Escolar Documentos

Profissional Documentos

Cultura Documentos

Government Expenditure and Budget

Enviado por

paramsnDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Government Expenditure and Budget

Enviado por

paramsnDireitos autorais:

Formatos disponíveis

1.

Government expenditure: For the year ending March 2013, the Indian government set a expenditure target of Rs 14,90,925 crore, according to budget estimates. The government expenditure falls into two categories: planexpenditure and non-plan expenditure. Plan expenditure is incurred according to the proposals put in the five-year plans. Non-plan expenditure is maintenance of existing assets, administrative services, interest payments, subsidies, among other things. The spending on defence is part of both plan and non-plan expenditure. less 2. Revenue and Capital expenditure: Both plan and non-plan expenditures include a revenue and capital expenditure component. Revenue expenditure is the money spent to run the day-to-day business of the government. Subsidies and interest payments are a key component of the revenue expenditure. Capital expenditure is the money spent for creating new infrastructure in the economy. So the government investment in education, roads, bridges, airports, urban infrastructure form a part of the capital expenditure. 3. What is the problem: India spends 65% of its total expenditure funds in a year on non-plan expenditure. This means two-thirds of the government revenue is spent on simply maintaining the day-to-day affairs of the government. Over a third of the government expenditure or over Rs 5,10,000 crore goes for repaying loans or paying interest on them

or subsidizing food, fuel and fertilizer for the poor. Experts say that it is essential for India to spend more on creating new assets to build the infrastructure in the economy.

3. Spending right: When governments spend on building a countrys infrastructure, it gives a push to the economic growth. However, the spending for growth in India actually fell over three months to December 2012. Total expenditure less subsidy and interest payments has decelerated to 3% in the Sep-Dec 2012 period from 11.4% in Apr-Aug 2012, said Morgan Stanley, a global bank in a note last week. This means Indias spending for creating new assets to stimulate growth has gone down.

What next: When the budget is presented, you need to watch out for the overall expenditure the government proposes to incur. It should relatively lower than the previous year. It is also important to see how the government proposes to allocate resources. If the government allocates more money to stimulate growth by increasing the spending on the infrastructure sector, that would be good news for the economy.

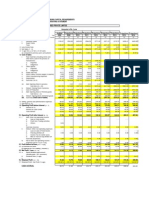

1. United States United States of America is the largest importer of goods and services and tops the list of countries for its highest budget. It has a mixed economy which is backed by natural resources and a very well developed infrastructure. Revenues (million USD): 2,303,000 Expenditures (million USD): 3,599,000

Deficit/Surplus (million USD): -1,296,000

2. 2. Japan Japan is one of the largest economies in the world and has a large industrial capacity. The country leads in scientific machinery, research and technology. It is also known as the most technologically advanced producers of machines in the world. Revenues (million USD): 1,971,000 Expenditures (million USD): 2,495,000 Deficit/Surplus (million USD): -524,000

2. 3. China China is the worlds fastest growing economy and has an upper hand in the in the manufacturing sector. Well known for its population growth, the country is the largest exporter and manufacturer of goods. The countrys rapid economic growth has led to severe consumer inflation. Revenues (million USD): 1,646,000 Expenditures (million USD): 1,729,000 Deficit/Surplus (million USD): -83,000

4. 4. Germany Germany is a major economic power in Europe and ranks number four for its government budget. The country has developed a very high standard of living and is recognized for its small and medium enterprises. The country boasts its highly skilled labour and its level of innovation. Revenues (million USD): 1,551,000 Expenditures (million USD): 1,588,000 Deficit/Surplus (million USD): -37,000

5. France France has a mixed economy in which banking, financial services and insurance are the key sectors of the countrys economy. France has been a major economic influence in Europe and also considered to be the wealthiest nation there. Revenues (million USD): 1,386,000 Expenditures (million USD): 1,535,000 Deficit/Surplus (million USD): -149,000

6. Italy Italy is a democratic republic and its economic influence makes it a major regional power. The nation rapidly transformed from agriculture based economy into one of the worlds most industrialized nations. Italy has a free market economy which focuses on exports of luxury products and niche market. Revenues (million USD): 1,025,100 Expenditures (million USD): 1,112,000 Deficit/Surplus (million USD): -86,900

7. United Kingdom United Kingdom is a partially regulated market economy, in which, the service sector makes up more than 70 percent of the countrys GDP. The automotive, pharmaceutical and aerospace industries are a significant part of the United Kingdoms economy. Revenues (million USD): 986,500 Expenditures (million USD): 1,188,000 Deficit/Surplus (million USD): -201,500

8. Brazil Brazil is the largest country in South America and is known as one of the fastest growing economies of the world. With new generation tycoons and booming exports, Brazil has a mixed economy. Since the nation has abundant natural resources, its economy is growing rapidly. Revenues (million USD): 978,300 Expenditures (million USD): 901,000 Deficit/Surplus (million USD): +77,300

9. Canada Canada has one of the most advanced economies in the world and is recognized as an economic power internationally. The nation ranks among the highest in economic freedom, quality of life and government transparency. Revenues (million USD): 660,200 Expenditures (million USD): 747,800 Deficit/Surplus (million USD): -87,600

10. Spain Spain has a capitalist mixed economy that has a strong economic growth. With a balanced government budget which got inflation under control, Spain was admitted into the Eurozone in 1999. Tourism in Spain plays a key role for the countrys economic health. Revenues (million USD): 545,200 Expenditures (million USD): 672,100 Deficit/Surplus (million USD): -126,900

11. Australia Australia is recognized as one of the wealthiest and highly developed countries in the world. The nation has a market economy which emphasizes on exporting commodities. Tourism, education and financial services account to more than 70 percent of the nations GDP. Revenues (million USD): 473,200 Expenditures (million USD): 521,800 Deficit/Surplus (million USD): -48,600

12. Russia Russia has one of the most powerful economies worldwide. Oil and gas is a major natural economy resource in Russias market economy. Apart from oil and gas, timber and metals make up for a major portion of the countrys exports. Revenues (million USD): 382,800 Expenditures (million USD): 376,200 Deficit/Surplus (million USD): +6,600

13. Netherlands Netherland is a constituent country which leads European nations in attracting foreign direct investment. This developed economy is one of the major investors in the United States of America. Trade, shipping, banking and fishing are the leading sectors of the Dutch economy. Revenues (million USD): 381,300 Expenditures (million USD): 420,400 Deficit/Surplus (million USD): -39,100

14. Norway Norway is categorized as one of the worlds wealthiest nations and is a perfect example of a mixed economy. The revenue that the nation receives from its natural resources adds to be a major contribution to the economic health. Revenues (million USD): 280,500 Expenditures (million USD): 209,500 Deficit/Surplus (million USD): +71,000

15. Sweden Sweden is ranked among other highly developed countries worldwide. This country is has a mixed economy that is export oriented. The nations engineering sector accounts for more than 50 percent of exports. Services and manufacturing industries dominate the Swedish economy. Revenues (million USD): 277,600 Expenditures (million USD): 277,100 Deficit/Surplus (million USD): +0,500

. South Korea South Korea is a developed country with a high standard of living. It has an export driven economy which mainly focuses on automobiles, electronics, machinery, ships and pharmaceuticals. The countrys credit rating suffers in times of military crisis with North Korea. Revenues (million USD): 267,900 Expenditures (million USD): 242,000 Deficit/Surplus (million USD): +25,900

17. Mexico Mexico is a regional power as a newly industrialized country. The country is known to produce some of the most complex components which are mostly engaged in research and development activities. According to Goldman Sachs, Mexico will have the fifth largest economy in the world by 2050. Revenues (million USD): 263,200 Expenditures (million USD): 292,200 Deficit/Surplus (million USD): -29,000

18. Belgium Belgium is a prosperous commerce and cultural hub. The nations strong globalized economy and transport infrastructure are integrated with the rest of Europe. It is a highly industrialized economy with a highly productive work force. Revenues (million USD): 249,600 Expenditures (million USD): 271,200 Deficit/Surplus (million USD): -21,600

19. Saudi Arabia Saudi Arabia is a wealthy nation with a concentration of large oil reserves. Oil accounts to more than 70 percent of government reserves and 95 percent of exports. The oil sector in the country has allowed the economy to grow at a rapid pace. Revenues (million USD): 221,100 Expenditures (million USD): 218,700 Deficit/Surplus (million USD): +2,400

20. Switzerland Switzerland is one of the worlds richest countries and largest exporters. Among other economies, its economy is considered to be the most competitive in the world. Switzerland is high-tech and prosperous economy. Revenues (million USD): 217,900 Expenditures (million USD): 214,500 Deficit/Surplus (million USD): +3,400

21. Austria Austria is a developed country with a high standard of living. It has a well developed social market economy that has a major influence on labour politics. Tourism plays an integral part in terms of the countrys economic revenues. Revenues (million USD): 202,600 Expenditures (million USD): 216,600 Deficit/Surplus (million USD): -14,000

22. India India is one of the fastest growing economies in the world and is considered to be a newly industrialized country. Textiles, telecommunications, chemicals, pharmaceuticals, transport, machinery and mining are among the major sectors of the Indian economy. Revenues (million USD): 196,400 Expenditures (million USD): 308,800 Deficit/Surplus (million USD): -112,400

23. Turkey Turkeys growing economy has given it recognition as a regional power. Tourism is a key industry that attracts revenue for the government and has experienced a rapid growth in the last two decades. The nations economy is becoming dependent on industries in major cities. Revenues (million USD): 176,700 Expenditures (million USD): 187,100 Deficit/Surplus (million USD): -10,400

24. Finland Finland is ranked among other wealthiest countries in the world despite it being a latecomer to industrialization. The economic development was rapid and is considered to be one of the most competitive nations in the world. It is also known to a have high quality of life. Revenues (million USD): 136,200 Expenditures (million USD): 137,600 Deficit/Surplus (million USD): -1,400

25. Indonesia Indonesia has a mixed economy and serves as the largest economy in Southeast Asia. The industry sector contributes the most for the countrys GDP. The rapidly developing export oriented sector attracts foreign investment for the nation. Revenues (million USD): 134,200 Expenditures (million USD): 144,100 Deficit/Surplus (million USD): -9,900

Measures taken positively by markets: - Measures to reduce fiscal deficit - Any increase in foreign investor participation - Thrust to infrastructure- Roads, Power etc. - Reduction in taxes Measures taken negatively by markets: Added pressure on fiscal deficit New tax measures, mostly higher taxes or change in tax policy

Policy measures that hinder investment climate Budget and market performance - Last 20 years, MSCI India outperformed MSCI EM (MSCI Emerging Markets Index) 8 out of 20 times in the month after budget - 20 year average shows Indian markets are down 2.3% in month after Budget underperforming EM by 1.5%, - MSCI India outperformed MSCI EM (years): 1997, 1999, 2001 , 2004 , 2005, 2006, 2010, 2011 1. Measures taken positively by markets: - Measures to reduce fiscal deficit - Any increase in foreign investor participation - Thrust to infrastructure- Roads, Power etc. - Reduction in taxes (AFP PHOTO/ Punit PARANJPE) 2. Measures taken negatively by markets: Added pressure on fiscal deficit New tax measures, mostly higher taxes or change in tax policy Policy measures that hinder investment climate (AFP PHOTO/Indranil MUKHERJEE)

3. Budget and market performance - Last 20 years, MSCI India outperformed MSCI EM (MSCI Emerging Markets Index) 8 out of 20 times in the month after budget - 20 year average shows Indian markets are down 2.3% in month after Budget underperforming EM by 1.5%, - MSCI India outperformed MSCI EM (years): 1997, 1999, 2001 , 2004 , 2005, 2006, 2010, 2011 (REUTERS/Ajay Verma) 4. 1. UNION BUDGET 1992-93 Finance Minister: Manmohan Singh Stock market reaction: Feb 29, 1992: Sensex up (+) 9.37% - Indian economy liberalized thorough reforms across the board - New import-export policy encouraged FDI - Foreign investment limit in high-priority industries was raised to 51% - Private sector expansion and participation encouraged - Licences and quotas were abolished - Interest rates were made flexible

- Banks got freedom to set lending rates according to risk profile 2. UNION BUDGET: 1997 -98 Finance Minister: P Chidambaram Stock market reaction: Feb 28, 1997: Sensex up (+) 6.54% - This Budget was called a Dream Budget - Budget presented a plan for economic reforms in India - Tax policy (Direct and indirect) was reormed - FII investment limit was raised from 24% to 30% - Maximum income tax rate for individuals was cut from 40% to 30% - Income tax rate for companies was decreased to 35% per from 40% - Peak customs duty was reduced to 40% from 50% - Dividend tax on individual investors was abolished - Budget launched Voluntary Disclosure of Income Scheme or VDS to recover of black money 3. UNION BUDGET: 1998 Finance Minister: Yashwant Sinha Stock market reaction: June 1, 1998: Sensex fell (-) 11%

- Budget after India conducted Nuclear tests and US sanctions - Defence spending was hiked - Allocation for Department of Atomic Energy was hiked by 68% - Import duties were increased 4. UNION BUDGET: 2002 Finance Minister: Yashwant Sinha Stock market reaction: Feb 28, 2002: Sensex fell (-) 3.87% - Dividend distribution tax was abolished: Dividends were to be taxed in the hands of the investors instead of taxing companies and mutual funds - Gujarat riots were an added pressure 5. UNION BUDGET 2012 Finance Minister: Pranab Mukherjee Stock market reaction: March 16, 2012: Sensex fell (-) 1.9% - Introduction of GAAR or General Anti Avoidance Rule - GAAR to counter aggressive tax avoidance sent markets into a tizzy - Budget sought to amend the Income Tax Act retrospectively from 1962

- Lack of clarity on retrospective tax on older deals further dipped market sentiment - A ballooning fiscal deficit at 5.1% of GDP further worried investors

Você também pode gostar

- Not Contactable Clients For Incentive Calculation - Sep'14Documento1.000 páginasNot Contactable Clients For Incentive Calculation - Sep'14paramsnAinda não há avaliações

- Particulars Opening Closing Balance Balance Rameswar Agro Industries Pvt. Ltd.-10-11Documento1 páginaParticulars Opening Closing Balance Balance Rameswar Agro Industries Pvt. Ltd.-10-11paramsnAinda não há avaliações

- Ffr-I 30.06.09Documento1 páginaFfr-I 30.06.09paramsnAinda não há avaliações

- Rice Milling Industry: Diagnostic Study ReportDocumento62 páginasRice Milling Industry: Diagnostic Study ReportVigneshwaran AiyappanAinda não há avaliações

- Bhagavad Gita SanskritDocumento108 páginasBhagavad Gita SanskritMaheshanand Mainali100% (1)

- Operational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedDocumento1 páginaOperational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedparamsnAinda não há avaliações

- Clarification 16.01.09Documento5 páginasClarification 16.01.09paramsnAinda não há avaliações

- Estimated Projected BS & PL09!10!11Documento21 páginasEstimated Projected BS & PL09!10!11paramsnAinda não há avaliações

- CMA2009Documento21 páginasCMA2009paramsn0% (1)

- SVP-Advances (Eastern Zone) : VP & Head (SME Centre-BBSR) : Rameswar Agro Industries PVT LTD Replies To Risk Department ObservationsDocumento8 páginasSVP-Advances (Eastern Zone) : VP & Head (SME Centre-BBSR) : Rameswar Agro Industries PVT LTD Replies To Risk Department ObservationsparamsnAinda não há avaliações

- Orissa Food and Procurement Policy for Kharif Marketing Season 2009-10Documento16 páginasOrissa Food and Procurement Policy for Kharif Marketing Season 2009-10paramsn0% (1)

- Milling Agreement FAQDocumento1 páginaMilling Agreement FAQparamsnAinda não há avaliações

- Iiiiiii II: OJ CDDocumento17 páginasIiiiiii II: OJ CDparamsnAinda não há avaliações

- SubhadraDocumento1 páginaSubhadraparamsnAinda não há avaliações

- FIGLDocumento58 páginasFIGLparamsnAinda não há avaliações

- Notification Chhattisgarh Gramin Bank Officers OfficeAsstDocumento10 páginasNotification Chhattisgarh Gramin Bank Officers OfficeAsstCareerNotifications.comAinda não há avaliações

- Syndicate DD CircularDocumento6 páginasSyndicate DD CircularparamsnAinda não há avaliações

- Sreeragam Exports Pvt. LTDDocumento8 páginasSreeragam Exports Pvt. LTDparamsnAinda não há avaliações

- North Orissa University: Vision of The UniversityDocumento36 páginasNorth Orissa University: Vision of The UniversityparamsnAinda não há avaliações

- Article of AssociationDocumento12 páginasArticle of AssociationparamsnAinda não há avaliações

- Revised NMFP GuidelinesDocumento98 páginasRevised NMFP GuidelinesparamsnAinda não há avaliações

- Mienral Based IndustriesDocumento11 páginasMienral Based IndustriesparamsnAinda não há avaliações

- To The President, Biju Janata Dal, Odisha, BhubaneswarDocumento1 páginaTo The President, Biju Janata Dal, Odisha, BhubaneswarparamsnAinda não há avaliações

- Trading Account Closure Request FormDocumento1 páginaTrading Account Closure Request FormparamsnAinda não há avaliações

- JAIIB LowDocumento10 páginasJAIIB LowVimal RamakrishnanAinda não há avaliações

- Help Line Numbers in OJEE Cell Ojee 2012 163Documento1 páginaHelp Line Numbers in OJEE Cell Ojee 2012 163Kanhu PadhiAinda não há avaliações

- United India InsuranceDocumento10 páginasUnited India Insurancegowtham19892003Ainda não há avaliações

- Expenditure Target of Rs 16,65,297 Crore in 2013-14. Plan Expenditure Is at Rs 5,55,320 Crore - Up 29 Per CentDocumento8 páginasExpenditure Target of Rs 16,65,297 Crore in 2013-14. Plan Expenditure Is at Rs 5,55,320 Crore - Up 29 Per CentparamsnAinda não há avaliações

- GanjamDocumento3 páginasGanjamparamsnAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- 2009 - Banca Mondiala - Analize Si Recomandari StrategiceDocumento92 páginas2009 - Banca Mondiala - Analize Si Recomandari StrategiceBalaniscu BogdanAinda não há avaliações

- COC Training ExcercisesDocumento8 páginasCOC Training ExcercisesGuddataa DheekkamaaAinda não há avaliações

- FICM ObsaaDocumento105 páginasFICM Obsaasamuel kebede100% (1)

- Economic Survey 2021-22Documento548 páginasEconomic Survey 2021-22Khawaja Burhan100% (12)

- Victoria Junior College Jc2 Preliminary Examination 2018 Higher 2Documento7 páginasVictoria Junior College Jc2 Preliminary Examination 2018 Higher 2trizillion12Ainda não há avaliações

- Assignment On Managerial EconomicsDocumento31 páginasAssignment On Managerial Economicsdiplococcous100% (7)

- Test BankDocumento22 páginasTest BankSHAMIT RASTOGI EPGP 2021-22Ainda não há avaliações

- League of Women Voter GuideDocumento24 páginasLeague of Women Voter GuideReporterJennaAinda não há avaliações

- SBI PO Prelims 2023 Memory Based Paper (6th Nov - Shift 1)Documento71 páginasSBI PO Prelims 2023 Memory Based Paper (6th Nov - Shift 1)SritharAinda não há avaliações

- Meaning, Definition and Principles of BudgetDocumento12 páginasMeaning, Definition and Principles of BudgetAngeii Campano100% (1)

- PNB Process NoteDocumento36 páginasPNB Process NotePawan BagrechaAinda não há avaliações

- 5 6271720118468739556Documento124 páginas5 6271720118468739556Sayan BiswasAinda não há avaliações

- LIC Assistant Mains GA Power Capsule 2019 PDFDocumento104 páginasLIC Assistant Mains GA Power Capsule 2019 PDFAbhilash GanjarapalliAinda não há avaliações

- Assam BudgetDocumento11 páginasAssam BudgetnazmulAinda não há avaliações

- McKinsey Report PDFDocumento38 páginasMcKinsey Report PDFRakibul IslamAinda não há avaliações

- FICHAM. Gerard Dumenil Dominique Levy The Crisis of NeoliberalismDocumento6 páginasFICHAM. Gerard Dumenil Dominique Levy The Crisis of NeoliberalismremobastosAinda não há avaliações

- Accounting Gov ReviewerDocumento20 páginasAccounting Gov ReviewerShane TorrieAinda não há avaliações

- Student Version Work MACC Unit 6 - Theatre Calgary ExcelDocumento6 páginasStudent Version Work MACC Unit 6 - Theatre Calgary ExcelVesela MihaylovaAinda não há avaliações

- Morrisons ReportDocumento100 páginasMorrisons ReportMihai BudaAinda não há avaliações

- The Mind of a Business Analyst: Lessons for Investment Bankers and Research AnalystsDocumento82 páginasThe Mind of a Business Analyst: Lessons for Investment Bankers and Research AnalystskessbrokerAinda não há avaliações

- Term - 1 2021-22 Study Support Material - EconomicsDocumento166 páginasTerm - 1 2021-22 Study Support Material - EconomicsAryaman RajputAinda não há avaliações

- Macro Econmic Dev 1988-1999Documento11 páginasMacro Econmic Dev 1988-1999asmaahmedAinda não há avaliações

- Greece KPMGDocumento124 páginasGreece KPMGVesna Simonovik PavicevicAinda não há avaliações

- Economics Quick Revision MatrialDocumento33 páginasEconomics Quick Revision MatrialSiddhi AgarwalAinda não há avaliações

- Excel Solutions - CasesDocumento25 páginasExcel Solutions - CasesJerry Ramos CasanaAinda não há avaliações

- Gregory Albo: Department of Political Science, York University CanadaDocumento19 páginasGregory Albo: Department of Political Science, York University CanadaMônica Di MasiAinda não há avaliações

- Soc Sci 4 ModuleDocumento25 páginasSoc Sci 4 ModuleYrram Esor SallinAinda não há avaliações

- Economic Survey English - 2016-17Documento426 páginasEconomic Survey English - 2016-17alicemuneroAinda não há avaliações

- Balance of Payments Recap Key RelationshipsDocumento14 páginasBalance of Payments Recap Key RelationshipsOisín Ó CionaoithAinda não há avaliações

- CAAP budgeting systems comparative studyDocumento14 páginasCAAP budgeting systems comparative studyJayBalaAinda não há avaliações