Escolar Documentos

Profissional Documentos

Cultura Documentos

Hoegh LNG 2012 Q3 Presentation

Enviado por

guzman87Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Hoegh LNG 2012 Q3 Presentation

Enviado por

guzman87Direitos autorais:

Formatos disponíveis

Hegh LNG The floating LNG services provider

Third Quarter 2012 Presentation of financial results

30 November 2012

Forward looking statements

This presentation contains forward-looking statements which reflects managements current expectations, estimates and projections about its operations. All statements, other than statements of historical facts, that address activities and events that will, should, could or may occur in the future are forward-looking statements. Words such as may, could, should, would, expect, plan, anticipate, intend, forecast, believe, estimate, predict, propose, potential, continue or the negative of these terms and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Unless legally required, Hegh LNG undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changes in LNG transportation and regasification market trends; changes in the supply and demand for LNG; changes in trading patterns; changes in applicable maintenance and regulatory standards; political events affecting production and consumption of LNG and Hegh LNGs ability to operate and control its vessels; change in the financial stability of clients of the Company; Hegh LNGs ability to win upcoming tenders and securing employment for the FSRUs on order; changes in Hegh LNGs ability to convert LNG carriers to FSRUs including the cost and time of completing such conversions; changes in Hegh LNGs ability to complete and deliver projects awarded; increases in the Companys cost base; changes in the availability of vessels to purchase; failure by yards to comply with delivery schedules; changes to vessels useful lives; changes in the ability of Hegh LNG to obtain additional financing, in particular, currently, in connection with the turmoil in financial markets; the success in achieving commercial success for the projects being developed by the Company; changes in applicable regulations and laws; and unpredictable or unknown factors herein also could have material adverse effects on forward-looking statements.

Agenda

Highlights Financials Operational review Market outlook

Summary

Highlights Q3 2012

Pre-tax profit USD 1.1 m (loss of USD 2.0 m 3Q11) EBITDA of USD 13.2 m (USD 8.6 m) Selected preferred bidder for FSRU project in Chile

Ordered a fourth new FSRU

Exercised option to purchase 50% of STX Frontier Took delivery of and started charter for LNG Libra Issued USD 130 m five year corporate bond Subsequent events Sold Port Meridian for USD 20 m Signed revised agreement for PGN FSRU

Signed USD 250 m loan facility for KN FSRU

Agenda

Highlights Financials

Operational review

Market outlook Summary

Income statement

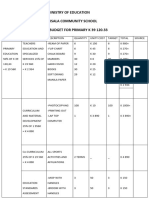

USD million

3Q2012

3Q2011

Jan Sep 2012

Jan Sep 2011

2011

TOTAL INCOME Charterhire expenses Operating expenses Administrative expenses Business dvelopment expenses EBITDA Depreciation and impairment EBIT Interest expenses Interest income Other financial items PROFIT OR (LOSS) BEFORE TAX Taxes NET PROFIT OR (LOSS)

38,0 (5,2) (7,8) (3,5) (8,2) 13,2 (6,2) 7,0 (6,1) 0,0 0,1 1,1 (0,2) 0,9

27,4 (5,1) (7,2) (3,0) (3,5) 8,6 (4,7) 3,9 (6,5) 0,1 0,4 (2,0) (2,0)

98,0 (15,5) (23,0) (10,1) (20,7) 28,8 (14,3) 14,5 (18,3) 0,1 1,5 (2,2) (0,2) (2,4)

79,8 (15,1) (21,8) (10,5) (9,9) 22,6 (13,7) 8,9 (18,9) 0,6 0,0 (9,4) 0,3 (9,1)

109,8 (20,1) (32,4) (17,0) (14,2) 26,1 (19,6) 6,5 (25,2) 0,7 0,2 (17,9) 0,2 (17,7)

Financial position

USD million

30.09.2012

30.06.2012

31.12.2011

Licences, design and other intangibles Vessels and newbuildings Other assets Current cash, s/t deposits, marketable securities TOTAL ASSETS Total equity Interest bearing debt MtM of interest rate swaps Other liabilities TOTAL EQUITY AND LIABILITIES Total equity adjusted for MtM of interest rate swaps Equity ratio adjusted for MtM of interest rate swaps Net interest bearing debt less cash, mark.securities and restricted cash

3Q2012 subsequent events USD 130 million in bond issue proceeds received in Q4 2012

74 685 41 133 932 328 430 137 37 932 465 50% 274

83 578 53 223 937 326 433 138 40 937 464 50% 187

83 502 33 127 745 133 439 132 41 745 265 36% 300

USD 20 million in Port Meridian sales proceeds received in Q4 2012 asset moved from licences to other assets (assets held for sale)

Cash flow statement

USD million

3Q2012

3Q2011

Jan Sep 2012

Jan Sep 2011

2011

Net profit or (loss) before tax Adjustments of non-cash P&L items Net changes in working capital, other Net cash flow from operating activities Proceeds from sale of marketable securities/receivables Investments in marketable securities Investments in vessels and newbuildings Investments in intangibles and equipment Net cash flow from/(used in) investing activities

1 12 4 17

(2) 11 (2) 7

(2) 32 (8) 22

(9) 32 (7) 15

(18) 44 (2) 25

81 (98) (1) (17)

(90) (30) (1) (121)

183 (155) (189) (2) (163)

52 (90) (56) (4) (99)

52 (90) (57) (7) (102)

Repayment of borrowings Interest paid Issue of share capital net of transaction cost Other financing activities Net cash flow from/(used in) financing activities TOTAL CASH FLOW -

(3) (6) (0) (10) (10) -

(3) (6) 126 117 3

(10) (18) 202 (0) 174 33

(9) (19) 126 0 99 16

(12) (25) 126 (4) 85 8

Agenda

Highlights Financials

Operational review

Market outlook Summary

Corporate matters

Bond issue Raised NOK 750 m in Norwegian bond market (USD 130 m) Proceeds to be used as substitute for equity

Swapped from NOK to USD and floating to fixed base rate resulting in a USD total fixed interest rate of 7.3% p.a.

Financing of KN FSRU for Lithuania Signed USD 250 million senior secured credit facility with DNB, Nordea, SEB and Swedbank K-Sure and GIEK guaranteeing 75% of the facility 7 year tenor door-to-door, 16 year profile, 12 year swap, 5.1% total fixed interest rate Sale of Port Meridian project Sold for USD 20 million with a profit of USD 10 million to be recorded in Q4 2012 Exclusive right to build, own and operate FSRU for the project

10

Funding of remaining capex

Pro forma as at 30 September 2012

Remaining capital expenditure Cash & cash equivalents* Committed financing (bridge loan + Klaipedos Nafta)

USD billion

USD billion

1.2

0.3 0.5

Incremental financing**

Mooring settlement Total funds Cash buffer

(*) Includes cash, marketable securities, proceeds from bond issue and Port Meridian sale (**) Assuming 75% leverage for FSRUs and 65% leverage for STX Frontier

0.5

0.1 1.4 0.2

11

FSRU Construction in progress

Double bottom block

Regas unit at Sinopacific Offshore & Engineering's yard in China

Stripe coat in water ballast tank

12

FSRU Newbuilding programme

2011

Q1 Q2 Q3 Q4

2012

Q1 Q2 Q3 Q4

2013

Q1 Q2 Q3 Q4

2014

Q1 Q2 Q3 Q4

2015

Q1

H2548 H2549 H2550

H2551

Today

Steel Cutting Keel Laying Launch

H2548: H2549: H2550: H2551:

Perusahaan Gas Negara Klaipdos Nafta Colbun / AES Uncommitted

13

FSRU Klaipedos Nafta - Lithuania

FSRU will provide a second import gate for natural gas to Lithuania and add to the domestic energy supply security Project on schedule for a planned start-up in Q3 2014. Client progress:

Environmental impact analysis approved for jetty and pipeline Multiple offers for LNG supply EPC contracts for jetty and pipeline in progress

Financing of FSRU secured through USD 250 million debt facility and paid-in equity

14

FSRU Perusahaan Gas Negara - Indonesia

FSRU will connect to Indonesia's existing main grid and supply gas to Sumatra and Jakarta Amended commercial agreement signed for the new location in Lampung signed 17 October 2012 PGN will take title to and reimburse Hegh LNG for investments in mooring upon completion

Delivery of FSRU from yard re-scheduled for April 2014. Planned start-up moved to June 2014. Hegh LNG receives full compensation for delayed start-up

Debt financing work with our advisors Standard Chartered and Bank of Tokyo Mitsubishi UFJ progressing well and scheduled to be completed by mid 2013

Regasification Module Jumper Hoses (gas & utilities)

Gas Export

15

FSRU Colbn / AES Gener - Chile

FSRU will be located in Quintero Bay close to Santiago, connect to the existing grid and provide natural gas to existing power plants in Chile Colbn S.A and AES Gener S.A among the largest power producers in Chile Chile rated A+, Colbn rated BBB- and AES Gener rated BBB- (Standard & Poor's) Contract length 10 + 5 years Scheduled start-up late 2014 Selected preferred bidder with exclusive contract negotiations on-going Financing will commence upon signing of contract and is expected to be completed during second half 2013

16

FSRU Contract award opportunities

Estimated timing of near-term FSRU project awards

Project Indonesia Uruguay Jordan Kuwait Lebanon England*

(*) Port Meridian

Prequalified Yes Yes Yes Yes Yes Exclusive

Bid Submitted Q1 2013 Q4 2012 Q1 2013 Q2 2013 N/A

Selection 2012/13 Q2 2013 Q1 2013 2013 Q3 2013 N/A

Contract 2013 Q3 2013 Q2 2013 2013 2013 Q4 2013

Official Start-up 2014 2015 2014 2014 2015 2016

Hegh LNG has one uncommitted FSRU on order for delivery in March 2015

17

Fleet and Operation

Existing fleet operated safely and without incidents Norman Lady time charter extended for 1+2 years at improved commercial terms LNG Libra delivered and commenced a six month charter to North West Shelf project in Australia in July. Vessel being marketed for chartering and/or sale Option to purchase 50% of STX Frontier exercised. Vessel being marketed for chartering with availability from second half 2013

LNG Libra

STX Frontier

Norman Lady

18

FLNG

Hegh FLNG Ltd. established as stand-alone organisation and all FLNG assets and resources transferred to new entity Discussions with potential partners/investors in progress, shortlist of 2-3 companies Detailed discussions on FEED contracts for projects in Israel and Asia

19

Agenda

Highlights Financials

Operational review

Market outlook Summary

20

Continued strong demand growth for LNG

Demand for FSRU services driven by incremental demand for natural gas to fuel power production

Fuel switch for existing plants

Main focus markets

New combined-cycle gas turbines

Natural gas projected to be the fastest growing major energy source globally LNG production in 2011 was 242 million tonnes - expected to reach 330 million tonnes p.a. by 2017 In main markets, such as Japan, Korea and Taiwan, LNG covers close to 100% of demand for natural gas

Source: Wood Mackenzie, BP Energy Outlook 2030

21

Around 30 FSRU regasification projects in pipeline

Owner Hegh LNG

Vessels 2+4

Customers* GDF Suez (2), Perusahaan Gas Negara, Klaipedos Nafta, Colbun/AES Gener Petrobras (2), Pertamina, Dubai Power Authority, GasAtacama YPF (2), Kuwait Oil Corporation, Petrobras, PREPA, Israel Electric Corporation

Golar LNG

4+2

Excelerate

8+1

* Projects in operation or awarded

Around 30 projects in pipeline

19 projects in Asia/Middle East 5 projects in South America

Existing Under construction / awarded Potential

8 projects in Europe/Africa HLNG has bids in process

22

Global LNG fleet overview

Type LNGC FLNG FSRU Total

Delivered 364 14* 378

Newbuildings on order 78 2 7** 87

Under conversion 1 1

Total 442 2 22 466

* 10 newbuildings and 4 conversions ** In additional to six firm FSRU orders globally, Golar LNG has options to convert two LNGC orders to FSRUs

LNGC fleet 364 LNG vessels in fleet

FSRU fleet 14 FSRUs in fleet

78 newbuildings on order (21%)

7 FSRU newbuildings on order plus 2 options to change from LNGC to FSRU

Source: Wood Mackenzie, LNG Unlimited, Fearnley LNG

23

Evolving FLNG project portfolio

Country

Australia

Location of field

Prelude

Main sponsors

Status

Under construction

Australia

Australia

Cash Maple

Sunrise

Pre-FEED done

Pending resolution with Timor Govt approval FID delayed until or post 2013 Under construction FEED on-going Pre-FEED done Under construction FEED on-going In approval process

Australia Brazil Colombia Indonesia Israel Malaysia Malaysia P. New Guinea

Bonaparte Santos Caribbean coast Abadi Tamar Sarawak Kanowit Sarawak Rotan Gulf of Papua

Under construction / awarded Potential

USA

Speculative

US Gulf

FEED on-going

Conversion

Source: Hegh LNG

24

Agenda

Highlights Financials

Operational review

Market outlook Summary

25

Summary of 3Q 2012 and subsequent events

Strong operating performance Selected preferred bidder for a FSRU project Signed revised agreement for PGN FSRU

Ordered a fourth new FSRU

Exercised option to purchase 50% of STX Frontier Sold Port Meridian Issued corporate bond Closed the KN FSRU debt financing Strong market prospects

26

Você também pode gostar

- Health Insurance in Switzerland ETHDocumento57 páginasHealth Insurance in Switzerland ETHguzman87Ainda não há avaliações

- Buchner Kaserer Wagner 2014Documento61 páginasBuchner Kaserer Wagner 2014guzman87Ainda não há avaliações

- CAPM Prof. Pasquale Della CorteDocumento46 páginasCAPM Prof. Pasquale Della Corteguzman87Ainda não há avaliações

- Hidden in Plain Sight The Hunt For Banking CapitalDocumento11 páginasHidden in Plain Sight The Hunt For Banking Capitalguzman87Ainda não há avaliações

- CAPM Prof. Pasquale Della CorteDocumento46 páginasCAPM Prof. Pasquale Della Corteguzman87Ainda não há avaliações

- Firm: A.T. Kearney Case Number: Case Setup (Facts Offered by Interviewer)Documento11 páginasFirm: A.T. Kearney Case Number: Case Setup (Facts Offered by Interviewer)guzman87Ainda não há avaliações

- MGI Financial Globalization Full Report Mar2013Documento92 páginasMGI Financial Globalization Full Report Mar2013guzman87Ainda não há avaliações

- McKinsey Handbook - How To Write A Business PlanDocumento116 páginasMcKinsey Handbook - How To Write A Business PlanFrankie Rossenberg95% (19)

- McKinsey ' Advanced Problem Solving SampleDocumento10 páginasMcKinsey ' Advanced Problem Solving SampleMikhail DomanovAinda não há avaliações

- CV Steven OngenaDocumento1 páginaCV Steven Ongenaguzman87Ainda não há avaliações

- Enkel Gassmann Chesbrough (2009) - R&D and Open InnovationDocumento6 páginasEnkel Gassmann Chesbrough (2009) - R&D and Open Innovationguzman87Ainda não há avaliações

- Von Hippel Von Krogh (2006) - Free Revealing and The Private-Collective Model For Innovation IncentivesDocumento12 páginasVon Hippel Von Krogh (2006) - Free Revealing and The Private-Collective Model For Innovation Incentivesguzman87Ainda não há avaliações

- Golar Q4 2011 ReportDocumento23 páginasGolar Q4 2011 Reportguzman87Ainda não há avaliações

- Bristish Airways Pp1 12 - CopieDocumento12 páginasBristish Airways Pp1 12 - Copieguzman87Ainda não há avaliações

- Intel Summary Decision C 22720090922en00130017Documento5 páginasIntel Summary Decision C 22720090922en00130017guzman87Ainda não há avaliações

- Critical Sales Loss Test (Nov 2002)Documento3 páginasCritical Sales Loss Test (Nov 2002)guzman87Ainda não há avaliações

- ATT TMobile Merger USDocumento25 páginasATT TMobile Merger USguzman87Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Ministry of Education Musala SCHDocumento5 páginasMinistry of Education Musala SCHlaonimosesAinda não há avaliações

- Interest Rates and Bond Valuation: All Rights ReservedDocumento22 páginasInterest Rates and Bond Valuation: All Rights ReservedAnonymous f7wV1lQKRAinda não há avaliações

- Danube Coin LaundryDocumento29 páginasDanube Coin LaundrymjgosslerAinda não há avaliações

- PartitionDocumento5 páginasPartitionKotagiri AravindAinda não há avaliações

- MOFPED STRATEGIC PLAN 2016 - 2021 PrintedDocumento102 páginasMOFPED STRATEGIC PLAN 2016 - 2021 PrintedRujumba DukeAinda não há avaliações

- Product Manual: Panel Mounted ControllerDocumento271 páginasProduct Manual: Panel Mounted ControllerLEONARDO FREITAS COSTAAinda não há avaliações

- HP Sustainability Impact Report 2018Documento147 páginasHP Sustainability Impact Report 2018Rinaldo loboAinda não há avaliações

- Practical GAD (1-32) Roll No.20IF227Documento97 páginasPractical GAD (1-32) Roll No.20IF22720IF135 Anant PatilAinda não há avaliações

- Creative Thinking (2) : Dr. Sarah Elsayed ElshazlyDocumento38 páginasCreative Thinking (2) : Dr. Sarah Elsayed ElshazlyNehal AbdellatifAinda não há avaliações

- VoLTE KPI Performance - E2EDocumento20 páginasVoLTE KPI Performance - E2EAnway Mohanty100% (1)

- Scope of Internet As A ICTDocumento10 páginasScope of Internet As A ICTJohnAinda não há avaliações

- Terms and Conditions 27 06 PDFDocumento4 páginasTerms and Conditions 27 06 PDFShreyash NaikwadiAinda não há avaliações

- Heat Exchanger Designing Using Aspen PlusDocumento6 páginasHeat Exchanger Designing Using Aspen PlusMeethiPotterAinda não há avaliações

- Copeland PresentationDocumento26 páginasCopeland Presentationjai soniAinda não há avaliações

- Study of Risk Perception and Potfolio Management of Equity InvestorsDocumento58 páginasStudy of Risk Perception and Potfolio Management of Equity InvestorsAqshay Bachhav100% (1)

- Ticket Udupi To MumbaiDocumento2 páginasTicket Udupi To MumbaikittushuklaAinda não há avaliações

- Is.14785.2000 - Coast Down Test PDFDocumento12 páginasIs.14785.2000 - Coast Down Test PDFVenkata NarayanaAinda não há avaliações

- Introduction To AirtelDocumento6 páginasIntroduction To AirtelPriya Gupta100% (1)

- Kompetensi Sumber Daya Manusia SDM Dalam Meningkatkan Kinerja Tenaga Kependidika PDFDocumento13 páginasKompetensi Sumber Daya Manusia SDM Dalam Meningkatkan Kinerja Tenaga Kependidika PDFEka IdrisAinda não há avaliações

- Random Variable N N Mean or Expected Value: Number of Ducks Type of Duck AmountDocumento2 páginasRandom Variable N N Mean or Expected Value: Number of Ducks Type of Duck AmountAngie PastorAinda não há avaliações

- CPE Cisco LTE Datasheet - c78-732744Documento17 páginasCPE Cisco LTE Datasheet - c78-732744abds7Ainda não há avaliações

- Pthread TutorialDocumento26 páginasPthread Tutorialapi-3754827Ainda não há avaliações

- Indictment - 17-Cr-00601-EnV Doc 1 Indictment 11-1-17Documento6 páginasIndictment - 17-Cr-00601-EnV Doc 1 Indictment 11-1-17C BealeAinda não há avaliações

- ACM2002D (Display 20x2)Documento12 páginasACM2002D (Display 20x2)Marcelo ArtolaAinda não há avaliações

- Project Job Number EngineerDocumento2 páginasProject Job Number Engineertekno plus banatAinda não há avaliações

- IP Based Fingerprint Access Control & Time Attendance: FeatureDocumento2 páginasIP Based Fingerprint Access Control & Time Attendance: FeaturenammarisAinda não há avaliações

- EW160 AlarmsDocumento12 páginasEW160 AlarmsIgor MaricAinda não há avaliações

- Vicente, Vieyah Angela A.-HG-G11-Q4-Mod-9Documento10 páginasVicente, Vieyah Angela A.-HG-G11-Q4-Mod-9Vieyah Angela VicenteAinda não há avaliações

- Acevac Catalogue VCD - R3Documento6 páginasAcevac Catalogue VCD - R3Santhosh KumarAinda não há avaliações

- Mpi Model QuestionsDocumento4 páginasMpi Model QuestionshemanthnagAinda não há avaliações