Escolar Documentos

Profissional Documentos

Cultura Documentos

Asia Strategy: Japanese Yen Weaker, Still Like Korean Won

Enviado por

SEB GroupTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Asia Strategy: Japanese Yen Weaker, Still Like Korean Won

Enviado por

SEB GroupDireitos autorais:

Formatos disponíveis

Trade Idea: Switch to JPY to fund KRW long

Trade Detail: Sell JPYKRW. Spot at entry 11.51. Target 10 with stop at 12.1 for a risk reward of 2.7:1. We are allocating 33% of our portfolio into this trade. We close our short USDKRW NDF position with a loss of 1%, to start this as a new trade even though we are just changing the funding side to JPY from USD. We have a wider stop since we are treating this as a 3 month trade leading to the July Upper House election in Japan. Still like KRW We still think KRW will do well from 1) export recovery from a stronger US economy 2) foreign bond inflows and 3) positioning is light (for details see Trade Idea: Long KRW vs USD 28 Jan 2013). In addition, Bank of Korea is keeping interest rates steady and the BoK is nudging the government to pursue fiscal policy to support growth rather than through cutting interest rates. This will support KRW. North Korea tensions have increased but we think it is mostly talk and North Koreas actions are to solidify domestic power base instead of starting international conflicts. Correlation to JPY weakness hurting KRW The KRW has been hurt by JPY weakness. The market thinking is that this is a zero sum game and JPY weakness will hurt Korean exporters and the overall economy. Our view is that over time, Japans monetary stimulus increases Japans demand and helps Korea. However, in the short term, we will not fight the markets thinking and limit this risk by switching to JPY funding instead of USD. We think JPY will continue weakening especially heading into the Upper House election in July where Abe and LDP will do whatever it takes to win and control both houses. In addition, we would like to be positioned before April, when the new BoJ Governor Kuroda takes over and installs new easing measures. Is it better to wait for a correction? Short term risks exist on JPY with March repatriation and high expectations for the BoJ meeting on th April 4 . However, we would see correction or disappointment as an opportunity to add to the position. For the BoJ meeting, we think a disappointment on April 4th will see a reaction by BoJ to implement stronger, redeeming easing measures in the April 26 policy meeting where they set the Economic Outlook for March 2015 (if March 2015 CPI forecast is under the 2% target, they would need to implement measures to reach the target). Risk to the trade is China The number one risk to the trade is if USDCNY fixing starts moving higher, which can be interpreted that China is joining the global currency depreciation game. We think China will continue appreciating its currency at a slow pace to continue the structural shift of moving up the value chain in exports. However, if our view does not unfold, we would exit this trade and revisit our general view on Asian currency appreciation for this year.

THURSDAY 14 MARCH 2013

EDITOR Sean Yokota

Head of Asia Strategy

sean.yokota@seb.se

+65 6505 0583

You can also find our research materials at our website: www.mb.seb.se. This report is produced by Skandinaviska Enskilda Banken AB (publ) for institutional investors only. Information and opinions contained within this document are given in good faith and are based on sources believed to be reliable, we do not represent that they are accurate or complete. No liability is accepted for any director consequential loss resulting from reliance on this document. Changes may be made to opinions or information contained herein without notice.

Asia Strategy Focus

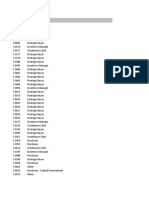

Open Trades Short JPYKRW

Date of Weight in Spot at Entry PF Entry 14-Mar-13 33% 11.532

Fwd at Entry

Target 10

Stop 12.1

Current Spot Price 11.52662

Price at Exit

Date of Exit

Profit* 0.05%

Weighted Profit** 0.02%

Closed Trades Long MYR vs USD 1M NDF 11-Jan-13 Long KRW vs USD 1M NDF 28-Jan-13 Year to Date Returns 2013

17% 33%

3.0165 3.021 1087.465 1089.00

2.94 1060

3.061 1098

3.06 28-Jan-13 -1.14% 1103.18 14-Mar-13 -0.99%

-0.19% -0.33% -0.50%

*Profit is calculated as spot at entry to current spot plus carry earned from date of entry. We are assuming that carry is earned evenly, every day for simplicity. ** Weighted Profit is the profit of the trade multiplied by the weight in the portfolio.

Asia Strategy Focus

DISCLAIMER

This communication is issued by a member of the Trading & Capital Markets department of Skandinaviska Enskilda Banken AB (publ), Singapore Branch (SEB). The information in this communication (the Communication) does not constitute independent, objective investment research, and is not therefore protected by the arrangements which SEB has put in place designed to prevent conflicts of interest from affecting the independence of its investment research. Unless otherwise indicated, any reference to a research report or research recommendation is not intended to represent that report/recommendation and is not in itself considered a recommendation or research report.

This Communication is exclusively intended for institutional investors only (CLIENT) and may not be distributed to any other parties without the prior written consent of SEB. This Communication is intended for informational purposes only. Nothing in this Communication shall constitute an offer or a solicitation of an offer to enter into any transaction, nor shall it form the basis of or be relied upon in connection with any contract or commitment whatsoever. Although SEB has used all reasonable endeavours to ensure that the information presented in this Communication is correct, no representation or warranty is made as to its accuracy, adequacy, completeness, fairness or timeliness of the contents. To the extent permitted by law, SEB accepts no liability whatsoever for any direct or consequential loss arising from use of this document or its contents. The information contained herein is subject to change without notice and may differ from the views, opinions and estimates held or expressed by other SEB personnel. Any forward-looking statements, opinions, and expectations are subject to risk, uncertainties and other factors that may cause actual results to differ materially from those set forth in any forward-looking statements herein. Past performance is no guarantee of future results. SEB does not express any opinion on legal, tax, accounting or similar consequences of the transactions contemplated by this Communication. CLIENT is strongly advised to inform themselves about, and retain separate expertise in respect of, such consequences. SEB, its affiliates or employees may, to the extent permitted by law, have positions in, buy/sell in any capacity, or otherwise participate in, any financial instrument referred to herein or related securities/futures/options or may from time to time perform or seek to perform investment banking or other services to the companies mentioned herein. SEB makes no warranty that the Communication will not be distorted as a result of technical or other malfunctions, including but not limited to incorrect transfer, technical inadequacies, disconnection, access, tampering and/or alteration by an unauthorised third party. The distribution of this document may be restricted in certain jurisdictions by law, and persons into whose possession this documents comes should inform themselves about, and observe, any such restrictions. Skandinaviska Enskilda Banken AB (publ) is incorporated in Sweden as a Limited Liability Company. It is regulated by Finansinspektionen, and by the local financial regulators in each of the jurisdictions in which it has branches or subsidiaries.

Você também pode gostar

- Insights From 2014 of Significance For 2015Documento5 páginasInsights From 2014 of Significance For 2015SEB GroupAinda não há avaliações

- Economic Insights: Riksbank To Lower Key Rate, While Seeking New RoleDocumento3 páginasEconomic Insights: Riksbank To Lower Key Rate, While Seeking New RoleSEB GroupAinda não há avaliações

- Economic Insights: The Middle East - Politically Hobbled But With Major PotentialDocumento5 páginasEconomic Insights: The Middle East - Politically Hobbled But With Major PotentialSEB GroupAinda não há avaliações

- Economic Insights: Subtle Signs of Firmer Momentum in NorwayDocumento4 páginasEconomic Insights: Subtle Signs of Firmer Momentum in NorwaySEB GroupAinda não há avaliações

- CFO Survey 1403: Improving Swedish Business Climate and HiringDocumento12 páginasCFO Survey 1403: Improving Swedish Business Climate and HiringSEB GroupAinda não há avaliações

- SE-Banken, Investment Outlook, Dec 2013, "Market Hopes Will Require Some Evidence"Documento35 páginasSE-Banken, Investment Outlook, Dec 2013, "Market Hopes Will Require Some Evidence"Glenn ViklundAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Chapter-14 Accounting For Not For Profit Organization PDFDocumento6 páginasChapter-14 Accounting For Not For Profit Organization PDFTarushi Yadav , 51BAinda não há avaliações

- Atty. Dionisio Calibo, vs. CA (Cred Trans)Documento2 páginasAtty. Dionisio Calibo, vs. CA (Cred Trans)JM CaupayanAinda não há avaliações

- Final Report - FM Project - HUL 2020Documento4 páginasFinal Report - FM Project - HUL 2020Barathy ArvindAinda não há avaliações

- This Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesDocumento2 páginasThis Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesArjay Dela PenaAinda não há avaliações

- Chap 009Documento20 páginasChap 009Qasih Izyan100% (2)

- Building Blocks For Community InvestmentsDocumento5 páginasBuilding Blocks For Community Investmentsnatasha mukukaAinda não há avaliações

- Mission Health-HCA Healthcare Inc. Asset Purchase Agreement, Aug. 30, 2018Documento147 páginasMission Health-HCA Healthcare Inc. Asset Purchase Agreement, Aug. 30, 2018Dillon DavisAinda não há avaliações

- Hedge Funds-Case StudyDocumento20 páginasHedge Funds-Case StudyRohan BurmanAinda não há avaliações

- JM Financial Asset Reconstruction Company Limited (JMFARC) : Corporate PresentationDocumento28 páginasJM Financial Asset Reconstruction Company Limited (JMFARC) : Corporate PresentationbestdealsAinda não há avaliações

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesDocumento16 páginasFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweAinda não há avaliações

- Can Iranians Get Residency in Portugal in 2022 - 2023 - HQA VisaDocumento2 páginasCan Iranians Get Residency in Portugal in 2022 - 2023 - HQA VisaRafael BaptistaAinda não há avaliações

- W07 Case Study Loan AssignmentDocumento66 páginasW07 Case Study Loan AssignmentArmando Aroni BacaAinda não há avaliações

- SME Products: Baroda Vidyasthali LoanDocumento17 páginasSME Products: Baroda Vidyasthali LoanRavi RanjanAinda não há avaliações

- Law of Agency CasesDocumento10 páginasLaw of Agency CasesAndrew Lawrie75% (4)

- Third Party FDDocumento4 páginasThird Party FDWali AshrafAinda não há avaliações

- All Fiori ApplicationDocumento49 páginasAll Fiori ApplicationRehan KhanAinda não há avaliações

- Doctrine of Restitution in India and EnglandDocumento15 páginasDoctrine of Restitution in India and EnglandBhart BhardwajAinda não há avaliações

- Anti ChresisDocumento21 páginasAnti ChresisKaren Sheila B. Mangusan - DegayAinda não há avaliações

- 03 Understanding Income Statements 2Documento36 páginas03 Understanding Income Statements 2Roy GSAinda não há avaliações

- Corruption in Japan - An Economist's PerspectiveDocumento19 páginasCorruption in Japan - An Economist's PerspectiveKarthikeyan ArumugathandavanAinda não há avaliações

- Paramaunt ViacomDocumento10 páginasParamaunt ViacomNatalia GastenAinda não há avaliações

- Testing Point FigureDocumento4 páginasTesting Point Figureshares_leoneAinda não há avaliações

- Unit - 4: Amalgamation and ReconstructionDocumento54 páginasUnit - 4: Amalgamation and ReconstructionAzad AboobackerAinda não há avaliações

- Income Taxation 2015 Edition Solman PDFDocumento53 páginasIncome Taxation 2015 Edition Solman PDFPrincess AlqueroAinda não há avaliações

- Qrrpa Report Sison Q3 2023Documento6 páginasQrrpa Report Sison Q3 2023MPDC SISONAinda não há avaliações

- Blaw Review QuizDocumento34 páginasBlaw Review QuizRichard de Leon100% (1)

- Cash and Proof of Cash ProblemsDocumento2 páginasCash and Proof of Cash ProblemsDivine MungcalAinda não há avaliações

- Financial Aid Reflection Lesson 14Documento2 páginasFinancial Aid Reflection Lesson 14api-287801256Ainda não há avaliações

- Tax - Dealings in PropertyDocumento18 páginasTax - Dealings in PropertyErik Paul PonceAinda não há avaliações

- HPPWD FORM No 7Documento2 páginasHPPWD FORM No 7Ankur SheelAinda não há avaliações