Escolar Documentos

Profissional Documentos

Cultura Documentos

Coa Circular No. 2000-001

Enviado por

安美仁Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Coa Circular No. 2000-001

Enviado por

安美仁Direitos autorais:

Formatos disponíveis

COMMISSION ON AUDIT CIRCULAR NO.

2000-001

April 4, 2000

TO

Heads and Concerned Officials of the Department of Agrarian Reform (DAR), Bureau of the Treasury (BTr), Land Bank of the Philippines (LBP), Asset Privatization Trust (APT) and Presidential Agrarian Reform Council (PARC) Secretariat; Heads of Financial Services/Controllership, Budget Officers, Chief Accountants/Heads of Accounting Units of the Agencies Concerned; COA Unit Auditors and All Others Concerned. ACCOUNTING GUIDELINES TO IMPLEMENT THE CREDIT MEMO ADVICE (CMA) SYSTEM AS PAYMENT SCHEME FOR THE TRANSFER OF LANDS BY THE ASSET PRIVATIZATION TRUST TO THE DEPARTMENT OF AGRARIAN REFORM PURSUANT TO EXECUTIVE ORDER (EO) No. 407

SUBJECT :

1.0 PURPOSE AND COVERAGE For the guidance of the DAR and other agencies concerned, this circular is issued to provide accounting guidelines and journal entries to implement the CMA System as payment scheme for the transfer of lands suitable for agriculture by the APT to the DAR pursuant to E.O. No. 407 and Department of Finance (DOF) and Department of Budget and Management (DBM) Joint Circular No.2-99 series of 1998. 2.0 GENERAL GUIDELINES 2.1 All accounts pertaining to lands suitable for agriculture which are for disposition by the APT shall be transferred from the BTr to the DAR books of accounts. 2.2 The valuation made by the LBP shall be the basis of amount or value of land to be recorded in the DAR books of accounts under the Agrarian Reform Fund (ARF)-Fund 158. 2.3 The Journal Voucher (JV) prepared by DAR to record in its books of accounts the lands transferred from BTr books shall also serve as Credit Memo Advice (CMA) to recognize the accomplishment/performance of APT in the Comprehensive Agrarian Reform Program (CARP) implementation. 2.4 Receivables from Agrarian Reform Beneficiaries (ARBs) shall be recorded in the DAR books of accounts based on Farmers Amortization Schedule (FAS) prepared by LBP.

2.5 All collections representing payments by ARBs for lands transferred by the APT shall be remitted to the BTr for credit to the ARF-Fund 158 of DAR. 2.6 The Monthly Report of Collections and Remittances by the LBP shall be the basis of recording land amortization collections and remittances to the BTr by the DAR. 2.7 The DARBureau of Land Acquisition and Distribution (BLAD) in coordination with PARC Secretariat, shall be responsible for providing the DAR Accounting Division with all documents necessary in recording the transactions in the books of accounts. 3.0 PROCEDURES FOR RECORDING OF LAND TRANSFER AND VALUATION 3.1 The LBP shall: a. Submit to DAR-BLAD, the List of APT Lands Valued For CARP Distribution (Annex A), for all APT lands valued in the past eight years, which were distributed/to be distributed to qualified ARBs under the CARP. The list referred to above shall not only contain lands valued which can be compensated but also those which can not be compensated from the Land Owners (LO) Compensation released for the purpose and deposited to LBP. Remit to BTr all amounts received as LO compensation for APT lands and accordingly effect the reversion/adjustment in its books of accounts. The remittance shall be supported by a Report of Application/Utilization of Funds to account for any difference in amounts of LO compensation received and remitted back to BTr. Likewise, effect the adjustment/reversion of all amounts recorded as Bonds Payable to APT, since lands transferred by APT are acquired assets of the National Government. Henceforth, submit to DAR-BLAD a similar list (Annex A) for subsequent valuation of lands for distribution to ARBs.

b.

c.

d.

3.2 The DAR-BLAD shall: a. Upon receipt of the List (Annex A), in coordination with the PARC Secretariat complete the data on the List re: acquisition/book value, date of distribution of lands, number of ARBs, etc. The names of ARBs shall be in the FAS. Request the BTr, through the PARC Secretariat, for the transfer of the lands for CARP distribution to the DAR books of accounts. The request to the BTr shall be supported by Annex A, Memorandum of Valuation (MOV) and Deed of Transfer (DOT).

b.

3.3 The DAR-Accounting Division shall: a. Based on the JV received from the BTr supported by Annex A, MOV and DOT, prepare JV to record in its books of accounts the value of the lands distributed or for distribution under the CARP. In recording the land transfer, the following shall be considered: The book value as recorded in BTr books shall be the value of the lands to be recorded in the books of accounts. The difference in book value as recorded in BTr books and the appraised value as determined by the LBP shall be taken up as "Invested Capital-Adjustments (Addition)", 0-94-170 or "Invested Capital-Adjustments (Reduction)", 0-94-270. The appraised value shall be shown under Particulars/Explanation portion of the JV. The subsidiary ledger (SL) to be maintained for lands transferred from APT, shall have separate money columns for book value and land appraisal increase. b. In coordination with the PARC Secretariat, furnish APT a copy of the JV taking up in its books the lands transferred by the BTr.

3.4 The BTr shall: a. Based on the request of DAR-BLAD supported by Annex A, MOV and DOT, prepare the JV to record the transfer of APT lands suitable for agriculture from the BTr to the DAR books of accounts. The value of the APT lands recorded in the BTr books shall accordingly be reduced by the corresponding book value of the transferred lands. Forward a copy of the JV with supporting documents to DAR-BLAD through the PARC Secretariat. Record the reversion to ARF-Fund 158/ARF Fund 101 of all remittances/refunds of LBP for LO compensation of APT lands. The difference between the amounts released to LBP and the amounts remitted back to BTr by LBP shall be accounted for accordingly. (Please see related provision under 3.1.b)

b. c.

3.5 The APT shall: a. Based on the JV furnished by DAR, prepare its Physical Accomplishment Report (PAR) as provided for in VII.2 of Joint DOFDBM Memorandum Circular No. 2-99 series of 1998. Consider the receipt of the JV as the conclusion of the transfer of the land to DAR and as the alternative memo advice system to recognize its performance in the implementation of the CARP.

b.

4.0 PROCEDURES FOR RECORDING DISTRIBUTION OF LANDS

4.1 The DAR-BLAD shall: a. Upon distribution of TCTs of lands to ARBs, forward to the DARAccounting Division a copy of the List of TCTs distributed to the beneficiaries and a copy of the FAS from LBP.

4.2 The DAR-Accounting Division shall: a. b. Based on the List (Annex A) and FAS, prepare a JV to drop from the books of accounts the lands distributed. Simultaneous with the dropping from the books of the lands distributed, record the Investment account for the distributed lands based on the FAS. Based on the FAS, record the receivable from ARBs by reclassifying the current portion of the Investment account.

c.

5.0 PROCEDURES FOR COLLECTION AND REMITTANCE OF ARB AMORTIZATION 5.1 The LBP shall: a. Submit to DAR-BLAD, copy furnished the PARC Secretariat, the following: Farmers Amortization Schedule (FAS) pursuant to Sec. 26 of R.A. No. 6657 and DAR Adm. Order No. 2, s.1998, and Monthly Report of Amortization Collections and Remittances Made to BTr. b. c. Collect the land amortization payments from ARBs. Remit to BTr all land amortization payments from ARBs for the account of ARF-Fund 158 of DAR. The remittance shall be disclosed as representing proceeds from the disposition of lands under the CARP. Record all LBPs remittances of ARBs land amortization payments and credit the amount to the ARF-Fund 158 of DAR. Revert to the General Fund all ARF-Fund 158 collections once the appropriation required under the law has been fully funded.

5.2 The BTr shall: a. b.

5.3 The DAR-Accounting Division shall: a. Record the collection of amortization from ARBs and the corresponding remittances to the BTr based on the Monthly Report of Collections and Remittances submitted by LBP. Prepare the adjusting journal entry to reduce deferred income and take

b.

up the appropriate income account upon recording of collections in the books of accounts. c. At the end of the year, prepare adjusting journal entry to reclassify the current portion of the Investment account to Receivable account.

6.0 ACCOUNTING ENTRIES The illustrative accounting entries attached as Annex B shall be used by the agencies concerned. 7.0 REPEALING CLAUSE The provisions of circulars/issuances which are inconsistent herewith are amended/modified/revoked accordingly. 8.0 EFFECTIVITY This circular shall take effect immediately.

(Sgd.) CELSO D. GAGAN Chairman (Sgd.) RAUL C. FLORES Commissioner (Sgd.) EMMANUEL M. DALMAN Commissioner

ATTACHMENTS:

(MS Excel, size: 39KB) ANNEXES A and B Annex A Sample Form - List of APT Lands Valued for CARP Distribution Annex B Illustrative Accounting Entries

Você também pode gostar

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsAinda não há avaliações

- Commission On Audit: 2t/rp:uhlir NFDocumento4 páginasCommission On Audit: 2t/rp:uhlir NFJuan Luis LusongAinda não há avaliações

- Wiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo EverandWiley GAAP for Governments 2018: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsAinda não há avaliações

- Commission On Audit: 2t/rp:uhlir NFDocumento4 páginasCommission On Audit: 2t/rp:uhlir NFKatherine PacenoAinda não há avaliações

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1No EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Ainda não há avaliações

- 34036rmo 2-2007Documento13 páginas34036rmo 2-2007toniAinda não há avaliações

- COA - Chart of AccountsDocumento54 páginasCOA - Chart of AccountsJeffrey Camiguing100% (1)

- Rmo No. 22 2016 PDFDocumento6 páginasRmo No. 22 2016 PDFjtf1898Ainda não há avaliações

- 01-CalapanCity2019 Transmittal LetterDocumento6 páginas01-CalapanCity2019 Transmittal LetterkQy267BdTKAinda não há avaliações

- DOF DBM COA Joint Circular 1 2000Documento7 páginasDOF DBM COA Joint Circular 1 2000fred_barillo09Ainda não há avaliações

- Manual of Standing Orders: (Accounts & Entitlements) Volume-IDocumento18 páginasManual of Standing Orders: (Accounts & Entitlements) Volume-IAtul SushantAinda não há avaliações

- Barangay Financial Transactions Recording Procedures PresentationDocumento20 páginasBarangay Financial Transactions Recording Procedures Presentationnelggkram82% (11)

- FSCS06A Rev Sop On Remitrance and Cash BalanceDocumento7 páginasFSCS06A Rev Sop On Remitrance and Cash BalancePauline Caceres AbayaAinda não há avaliações

- Civil Aviation Authority of The Philippines Executive Summary 2020Documento6 páginasCivil Aviation Authority of The Philippines Executive Summary 2020shiela.rebamonte20Ainda não há avaliações

- NGAS Manual For Local Government UnitsDocumento29 páginasNGAS Manual For Local Government UnitsChiyobels100% (5)

- COMMISSION ON AUDIT CIRCULAR NO. 84-89C January 25, 1984Documento15 páginasCOMMISSION ON AUDIT CIRCULAR NO. 84-89C January 25, 1984bolAinda não há avaliações

- COMMISSION ON AUDIT CIRCULAR NO. 84-89C January 25, 1984Documento15 páginasCOMMISSION ON AUDIT CIRCULAR NO. 84-89C January 25, 1984FLORENCIA alejandroAinda não há avaliações

- Aom No. 05 - (One Time Cleansing of Ppe)Documento8 páginasAom No. 05 - (One Time Cleansing of Ppe)Ragnar Lothbrok100% (7)

- Manual On Financial Management of Barangays MODULE 2Documento29 páginasManual On Financial Management of Barangays MODULE 2vicsAinda não há avaliações

- LGU NGAS Ch3 AcctgSystemVol1Documento46 páginasLGU NGAS Ch3 AcctgSystemVol1Pee-Jay Inigo UlitaAinda não há avaliações

- A Dilg Joincircular 2015212 - cf2966c253Documento12 páginasA Dilg Joincircular 2015212 - cf2966c253Erin CruzAinda não há avaliações

- AOM No. 03 - PPEDocumento3 páginasAOM No. 03 - PPERagnar LothbrokAinda não há avaliações

- Lifting of SuspensionDocumento20 páginasLifting of SuspensionPhilippe CamposanoAinda não há avaliações

- Philippine National Police Executive Summary 2020Documento11 páginasPhilippine National Police Executive Summary 2020Jeyn GreyAinda não há avaliações

- Bureau of Fire Protection Executive Summary 2011Documento6 páginasBureau of Fire Protection Executive Summary 2011Vin CentAinda não há avaliações

- DBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018Documento10 páginasDBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018barangay08 can-avidesamarAinda não há avaliações

- RMC No. 49-2020Documento4 páginasRMC No. 49-2020Juna May YanoyanAinda não há avaliações

- Circular Letter: Republic of The PhilippinesDocumento8 páginasCircular Letter: Republic of The PhilippinesanncelineAinda não há avaliações

- RR No. 02-2006Documento10 páginasRR No. 02-2006odessaAinda não há avaliações

- Commission On Audit Circular No. 2000-003Documento7 páginasCommission On Audit Circular No. 2000-003bolAinda não há avaliações

- Aparri Water District Cagayan Executive Summary 2020Documento5 páginasAparri Water District Cagayan Executive Summary 2020Franciz NasisAinda não há avaliações

- My LBC 126Documento10 páginasMy LBC 126Jean Kenneth AlontoAinda não há avaliações

- RMO No. 17-2016Documento7 páginasRMO No. 17-2016leeAinda não há avaliações

- Malabang Executive Summary 2018Documento5 páginasMalabang Executive Summary 2018Evan LoirtAinda não há avaliações

- RMO 11-2005 (Corrected Version)Documento12 páginasRMO 11-2005 (Corrected Version)simey_kizhie07Ainda não há avaliações

- BudgetingDocumento11 páginasBudgetingWinnie Ann Daquil LomosadAinda não há avaliações

- Republic of The Philippines Commission On AuditDocumento14 páginasRepublic of The Philippines Commission On AuditkQy267BdTKAinda não há avaliações

- Commission On Audit Circular No. 99-001: June 15, 1999Documento4 páginasCommission On Audit Circular No. 99-001: June 15, 1999Jhad DisamburunAinda não há avaliações

- Downloaded From WWW - Dbm.gov - PH WebsiteDocumento16 páginasDownloaded From WWW - Dbm.gov - PH WebsiteJean Monique Oabel-TolentinoAinda não há avaliações

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocumento7 páginasBureau of Internal Revenue: Republic of The Philippines Department of FinancejoanneAinda não há avaliações

- RMO - No. 33-2019 PDFDocumento7 páginasRMO - No. 33-2019 PDFRedbutterfly Del Mundo GalindoAinda não há avaliações

- 01-LBP2016 Transmittal LettersDocumento6 páginas01-LBP2016 Transmittal LettersADRIAN 18Ainda não há avaliações

- Roxas Executive Summary 2015Documento7 páginasRoxas Executive Summary 2015Virgo Philip Wasil ButconAinda não há avaliações

- Andhra Pradesh Agricultural Land (Conversion For Non-Agricultural Purposes) ACT, 2006Documento22 páginasAndhra Pradesh Agricultural Land (Conversion For Non-Agricultural Purposes) ACT, 2006Venkat Macharla100% (2)

- Carmen Executive Summary 2020Documento7 páginasCarmen Executive Summary 2020Feona TuraldeAinda não há avaliações

- 09-MalabonCity2018 - Part2-Observations - and - RecommDocumento45 páginas09-MalabonCity2018 - Part2-Observations - and - RecommJuan Uriel CruzAinda não há avaliações

- Recording Procedures-Barangay FundsDocumento21 páginasRecording Procedures-Barangay FundsMarliezel Sarda100% (1)

- SurigaoDelNorte ES2010Documento5 páginasSurigaoDelNorte ES2010J JaAinda não há avaliações

- Local Government UnitsDocumento14 páginasLocal Government UnitsJennybabe PetaAinda não há avaliações

- Appendix 4 (Cir1124 - 2021)Documento5 páginasAppendix 4 (Cir1124 - 2021)Kimberly Kaye QuibalAinda não há avaliações

- RMO NO. 17-2016 - DigestDocumento2 páginasRMO NO. 17-2016 - DigestMartha Jasmine BartiladAinda não há avaliações

- 10-Bacolor2017 Part2-Observations and RecommDocumento47 páginas10-Bacolor2017 Part2-Observations and RecommKatherine PacenoAinda não há avaliações

- Maramag Water District Bukidnon Executive Summary 2020Documento6 páginasMaramag Water District Bukidnon Executive Summary 2020cpa126235Ainda não há avaliações

- Executive Summary A. IntroductionDocumento6 páginasExecutive Summary A. IntroductionCatherine JoyceAinda não há avaliações

- Revenue Memorandum Order No. 4-2007: I. BackgroundDocumento7 páginasRevenue Memorandum Order No. 4-2007: I. BackgroundtoniAinda não há avaliações

- Afpces FinanceDocumento5 páginasAfpces FinanceKathy MercadoAinda não há avaliações

- Alegria Executive Summary 2019Documento6 páginasAlegria Executive Summary 2019Ronel CadelinoAinda não há avaliações

- 24B Fund Ledger and Ledger of Receipts 24A Ledger of Appropriations, Encumbrances, Disbursements and Balances 24C Detailed Ledger of DisbursementsDocumento43 páginas24B Fund Ledger and Ledger of Receipts 24A Ledger of Appropriations, Encumbrances, Disbursements and Balances 24C Detailed Ledger of DisbursementsJustine GuilingAinda não há avaliações

- Group-Government AccountingDocumento125 páginasGroup-Government AccountingaceAinda não há avaliações

- Part II Brgy. Inarado, Daraga - Findings and RecommendationsDocumento11 páginasPart II Brgy. Inarado, Daraga - Findings and RecommendationsBaby M FoodhubAinda não há avaliações

- 01-Manjuyod2014 Audit ReportDocumento57 páginas01-Manjuyod2014 Audit Report安美仁Ainda não há avaliações

- R A9372Documento14 páginasR A9372安美仁Ainda não há avaliações

- 01-SipalayCity08 Audit ReportDocumento53 páginas01-SipalayCity08 Audit Report安美仁Ainda não há avaliações

- Audit GuidanceDocumento16 páginasAudit Guidance安美仁Ainda não há avaliações

- 01-Manjuyod2013 Audit ReportDocumento71 páginas01-Manjuyod2013 Audit Report安美仁Ainda não há avaliações

- Coa M2015-007Documento12 páginasCoa M2015-007Abraham Junio80% (5)

- 9 Metro Mayors Ordered To Return P331-M PDAF - Inquirer NewsDocumento5 páginas9 Metro Mayors Ordered To Return P331-M PDAF - Inquirer News安美仁Ainda não há avaliações

- 40 Filipino Veterans ComplaintDocumento29 páginas40 Filipino Veterans Complaint安美仁Ainda não há avaliações

- COA of Cebu v. City of Cebu (2001)Documento8 páginasCOA of Cebu v. City of Cebu (2001)Carlo MercadoAinda não há avaliações

- PFRS or IFRS 9Documento11 páginasPFRS or IFRS 9安美仁Ainda não há avaliações

- Pretrial On DefenseupDocumento5 páginasPretrial On Defenseup安美仁Ainda não há avaliações

- 01-Binalonan2012 Audit ReportDocumento33 páginas01-Binalonan2012 Audit Report安美仁Ainda não há avaliações

- Answer To The Complaint (Final)Documento8 páginasAnswer To The Complaint (Final)安美仁Ainda não há avaliações

- Pre-Trial Brief: I. Brief Statement of The Case and Claims of The PartiesDocumento4 páginasPre-Trial Brief: I. Brief Statement of The Case and Claims of The Parties安美仁Ainda não há avaliações

- Pretrial On DefenseupDocumento5 páginasPretrial On Defenseup安美仁Ainda não há avaliações

- PFRS or IFRS 9Documento11 páginasPFRS or IFRS 9安美仁Ainda não há avaliações

- Plaintiff,: Pre-Trial BriefDocumento4 páginasPlaintiff,: Pre-Trial Brief安美仁Ainda não há avaliações

- 2014 Jurists Pre-Week Lectures101Documento1 página2014 Jurists Pre-Week Lectures101安美仁Ainda não há avaliações

- Pretrial On DefenseDocumento9 páginasPretrial On Defense安美仁Ainda não há avaliações

- Certificate of Filing of Amended AoiDocumento1 páginaCertificate of Filing of Amended Aoi安美仁Ainda não há avaliações

- Cem Rev2013Documento34 páginasCem Rev2013安美仁Ainda não há avaliações

- Cem Rev2013Documento34 páginasCem Rev2013安美仁Ainda não há avaliações

- Philippine Legal Citation Guide PDFDocumento17 páginasPhilippine Legal Citation Guide PDFMasterboleroAinda não há avaliações

- Outline LayoutDocumento1 páginaOutline Layout安美仁Ainda não há avaliações

- Philippine Legal Citation Guide PDFDocumento17 páginasPhilippine Legal Citation Guide PDFMasterboleroAinda não há avaliações

- Philippine Legal Citation Guide PDFDocumento17 páginasPhilippine Legal Citation Guide PDFMasterboleroAinda não há avaliações

- Cagayan Valley Inc VS Ca1 PDFDocumento12 páginasCagayan Valley Inc VS Ca1 PDF安美仁Ainda não há avaliações

- Philippine Legal Citation Guide PDFDocumento17 páginasPhilippine Legal Citation Guide PDFMasterboleroAinda não há avaliações

- Indeterminate Sentence Law123 PDFDocumento5 páginasIndeterminate Sentence Law123 PDF安美仁Ainda não há avaliações

- Internship Report - Consumer Credit Scheme, Customer Satisfaction and Customer Perception in The Context of Prime Bank LimitedDocumento80 páginasInternship Report - Consumer Credit Scheme, Customer Satisfaction and Customer Perception in The Context of Prime Bank LimitedSaikat DuttaAinda não há avaliações

- SAP MX Eletronic Accounting CustomizingDocumento12 páginasSAP MX Eletronic Accounting CustomizingFernando Zank Correa Evangelista0% (1)

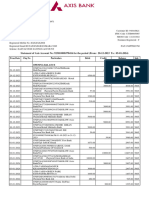

- BNI Mobile Banking: Histori TransaksiDocumento2 páginasBNI Mobile Banking: Histori TransaksiTegar THAinda não há avaliações

- PPT Presentation RbiDocumento10 páginasPPT Presentation RbiAayushAinda não há avaliações

- Political Factors of Retail SectorDocumento3 páginasPolitical Factors of Retail SectorSachin Kumar Bassi100% (1)

- Cash CE Bank Recon POC PCFDocumento8 páginasCash CE Bank Recon POC PCFemman neriAinda não há avaliações

- Aided SFS 1Documento95 páginasAided SFS 1Shankari.kAinda não há avaliações

- Contact Information (Responses)Documento9 páginasContact Information (Responses)Muhammad Faris GymnastiarAinda não há avaliações

- 300+ REAL TIME E-Banking Objective Questions & AnswersDocumento31 páginas300+ REAL TIME E-Banking Objective Questions & Answersbarun vishwakarmaAinda não há avaliações

- Sample Paper: Toles Advanced ExaminationDocumento20 páginasSample Paper: Toles Advanced ExaminationFLORETA100% (1)

- Liquidity Analysis of Nepal Investment Bank LTDDocumento39 páginasLiquidity Analysis of Nepal Investment Bank LTDsuraj banAinda não há avaliações

- Chapter 3 SolutionsDocumento3 páginasChapter 3 Solutionsriders29Ainda não há avaliações

- Loan PolicyDocumento5 páginasLoan PolicyAyesha FarooqAinda não há avaliações

- Revised Amlc TrancodesDocumento25 páginasRevised Amlc TrancodesGuevarraWellrhoAinda não há avaliações

- MCS Case StudyDocumento17 páginasMCS Case StudyPratik Tambe0% (1)

- Kalalo Vs LuzDocumento27 páginasKalalo Vs LuzRobertClosasAinda não há avaliações

- Union Bank vs. Sps Tiu DigestDocumento3 páginasUnion Bank vs. Sps Tiu DigestCaitlin KintanarAinda não há avaliações

- Seduction of ACSA SAA and TransnetDocumento8 páginasSeduction of ACSA SAA and TransnetPhilile NkwanyanaAinda não há avaliações

- Universidad Iberoamericana - Unibe-: Disbursement RecordDocumento2 páginasUniversidad Iberoamericana - Unibe-: Disbursement Recordodontologia unibeAinda não há avaliações

- Account STMTDocumento2 páginasAccount STMTnazim.civilengrAinda não há avaliações

- Comparative Analysis of Two Small Finance BanksDocumento19 páginasComparative Analysis of Two Small Finance BanksSneha SharmaAinda não há avaliações

- The Stamp ActDocumento28 páginasThe Stamp ActPrashant PatilAinda não há avaliações

- Profit Sharing PDFDocumento19 páginasProfit Sharing PDFGadisAinda não há avaliações

- ECONOMIC ROLES OF GovtDocumento12 páginasECONOMIC ROLES OF GovtLibrarian 1975Ainda não há avaliações

- Ramzan Ali PP ApoDocumento1 páginaRamzan Ali PP ApoAshok RauniarAinda não há avaliações

- Overview of Functions and Operations BSPDocumento2 páginasOverview of Functions and Operations BSPKarla GalvezAinda não há avaliações

- Paytm Payment Solutions Feb15 PDFDocumento30 páginasPaytm Payment Solutions Feb15 PDFRomeo MalikAinda não há avaliações

- Chapter 1Documento51 páginasChapter 1Kaishrie MisirAinda não há avaliações

- Nego 2nd WeekDocumento35 páginasNego 2nd WeekElyn ApiadoAinda não há avaliações

- National Internal Revenue Code of The Philippines (NIRC)Documento195 páginasNational Internal Revenue Code of The Philippines (NIRC)Jennybabe PetaAinda não há avaliações

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)No EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Nota: 4 de 5 estrelas4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InNo EverandGetting to Yes: How to Negotiate Agreement Without Giving InNota: 4 de 5 estrelas4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (13)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineAinda não há avaliações

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNo EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNota: 5 de 5 estrelas5/5 (13)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!No EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Nota: 4.5 de 5 estrelas4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNo EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNota: 4 de 5 estrelas4/5 (7)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessNo EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessNota: 4.5 de 5 estrelas4.5/5 (28)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNo EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNota: 5 de 5 estrelas5/5 (4)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)No EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Nota: 4.5 de 5 estrelas4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeNo EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeNota: 4 de 5 estrelas4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNo EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNota: 5 de 5 estrelas5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetAinda não há avaliações

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyNo EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyNota: 4.5 de 5 estrelas4.5/5 (37)

- Controllership: The Work of the Managerial AccountantNo EverandControllership: The Work of the Managerial AccountantAinda não há avaliações

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantNo EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantNota: 4.5 de 5 estrelas4.5/5 (146)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNo EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNota: 4.5 de 5 estrelas4.5/5 (760)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditNo EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditNota: 5 de 5 estrelas5/5 (1)