Escolar Documentos

Profissional Documentos

Cultura Documentos

Atif Bajwa Interview

Enviado por

trillion5Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Atif Bajwa Interview

Enviado por

trillion5Direitos autorais:

Formatos disponíveis

Exclusive Interview with Mr Atif Bajwa, CEO Bank Alfalah

By: Erum Zaidi From Print Edition

KARACHI: Atif Bajwa, CEO Bank Alfalah (BAFL) is a veteran banker with global professional experience of over three decades of serving several international as well as local banks. He started his career with the Citibank in 1982 and assumed various roles with the bank for 11 years across Karachi, Lahore, New York and Bahrain. He also worked in ABN AMRO and MCB Bank. Following are excerpts from an exclusive interview.

Q. What are the major challenges and opportunities confronting banking sector in Pakistan? A. The financial services sector has experienced a hard-hitting impact and there are several lessons to be learnt from the global meltdown. This backdrop coupled with the dismal local economic outlook exacerbates the challenges for the banking industry in Pakistan customers are not confident of countrys situation; foreign entities are apprehensive of the operating risk. Moreover, whilst banks (including Bank Alfalah) continue to report strong profits, there has been growing concern in the industrys rising trend of non-performing loans (NPLs), peaking at approximately 17 percent. Bank Alfalahs NPLs reflect a lower position vis--vis the industry, at less than 9 percent. However, greater focus and improvements in risk management are required to create discipline and tackle this issue. Second is the dependence of the sector on high spreads. Whilst the cause of significant spreads lies primarily in the countrys macroeconomic imbalances (manifested through a large fiscal deficit leading to high government borrowing), the banking sector is both

benefiting from it and being drugged into easy profits. This has created the industry into a profitable one but is really like a plane flying on one engine. It is critical that diversification of revenue sources is pursued. The good news is the creation of an ecosystem that supports innovation through technology, allowing for the banked and yet-to-be-banked to meet more of their payment/financial needs through a convenient set of products and services. As electronic solutions will encompass customer convenience and ubiquity, branchless, mobile, online and digital banking, both for corporate and retail banking, customers are also likely to revolutionise the financial services industry and Bank Alfalah aims to be amongst the leaders of this transformation. SME banking and agri-finance are also promising opportunities and address sectors that are the backbone of our economy. Bank Alfalah aims to continue investing in these areas through tailored solutions for each segment, whilst remaining cognisant of and appropriately managing the risks involved. One other area of focus for us is the nascent capital market in Pakistan. It is critical that a vibrant and broad based capital market be developed in order to support the financing needs of a growth economy. The existing short-term debt focused capital markets are woefully inadequate to meet the requirements of industry and infrastructure if our economy is to shift gear into higher growth rates. We believe we should be playing a leading role in helping to mobilise capital and to deploy it effectively. Q. What potential do you think the SME sector has to flourish in Pakistan? Can you describe BAFLs performance in this area? A. Today, in Pakistan, the SME sector contributes 30 percent towards the countrys GDP, employs more than 70 percent of the non-agricultural workforce, accounts for 35 percent of the value added in the manufacturing industry, and generates 25 percent of export earnings. However, SME lending constitutes only 16 percent of total lending and only 4 percent of total banking customers. The sector has huge potential to generate employment opportunities and play a role in alleviating poverty. The sustained and long-term growth of the SME sector in Pakistan faces several challenges on both the demand and supply side. Most SMEs are sole proprietorships or family businesses that are managed rather informally and therefore face issues such as lack of formal business management skills, poor maintenance of accounts and lack of business planning amongst others. They often do not have adequate collateral to meet the minimum criteria of banks and have little awareness about the financing options available. While access to capital is invariably an issue, more pressing needs are non-lending.

We are currently undertaking a pilot project, in collaboration with the International Finance Corporation (IFC), to remodel our SME strategy and better cater to this niche segment. We are optimistic that this endeavor will allow us to better assess and understand the specific needs of SME businesses and enable us to offer a holistic yet bespoke SME-centric business management platform. Such an offering shall not only support the borrowing requirements of SMEs but will also offer products and services to support their transactional and advisory requirements. Q. What product launches do you have in the pipeline? A. We see convenience and ubiquitous access to financial services as vital requirements today. To this end, we are investing in our technology platform and will be launching branchless banking, mobile and internet banking services in the near future this year. Through electronic solutions, clients will be able to make utility bill payments and fund transfers and buy airtime and conduct several financial transactions at their own time and convenience. On the deposits front, we hope to enhance our portfolio with segmented products for salaried individuals, kids, senior citizens and women. We are also looking to introduce a chip-based credit card soon. For protection products, we are linking up with more insurance partners to enhance our bancassurance suite with unique, customized offerings. We are also simultaneously working on developing a fully integrated cash management collection/payment suite for our institutional clients. Q. How did Bank Alfalah perform during 2012? A. The year 2012 has been an evolving, transformative but most importantly productive year for the bank. The bank has outpaced the industry in terms of private sector lending. As part of our branch expansion plan, we have added 65 new branches to our already vast branch network during 2012. This year, we intend to further expand our footprint in the country. We have also introduced relevant management changes and reassessed our operating priorities, while ensuring that our overall growth trajectory sustains its momentum. Due to the efforts of our entire team, I am pleased to report that our deposits, advances and profitability have all witnessed significant growth over 2012. Q. How does BAFL distinguish itself from its competitors? A. Bank Alfalah started out with a footprint of 3 branches. Over the last 15 years, our growth story in Pakistan has been significant. We have closed last year with a network spanning 471 branches across 163 cities and an overseas presence in Afghanistan, Bangladesh and Bahrain. We are well aware that a one-size fits all approach does not work effectively to this end we have segmented our product offering so as to ensure a unique strategy for each requirement.

We have implemented new procedures and systems at all our conventional branches and in the upcoming months. Our Islamic branches will follow suit. Transactional services will become faster as a consequence of this change and hence customer interface should be more efficient. Amongst other priorities, as mentioned above, we are also keen to work on developing need-based, customised financial solutions with a view to introducing a larger proportion of the unbanked population into the formal fold. Our bricks-and-mortar banking model coupled with our branchless banking services should bolster our efforts on this front. With the shift of wealth from big cities to smaller towns and rural areas, there is an appetite in these markets and so it makes sense to open smaller branches to tap the potential there. Moreover, our Islamic banking also sets us apart the banks Islamic arm is a vibrant identity offering an innovative range of Shariah compliant products and services customised to cater to the individual needs of our customers. We are the no.2 Islamic bank in Pakistan with new branches being added to our network of 86 Islamic banking branches as we speak. The bank aims to invest in its core strengths to provide best in class products and services on the consumer and corporate side, whilst also further exploring opportunities in SME and agri-finance.

Você também pode gostar

- Assignment #1 MarketingDocumento5 páginasAssignment #1 MarketingUsman SheikhAinda não há avaliações

- Swot AnalysisDocumento7 páginasSwot AnalysisSikandar AkramAinda não há avaliações

- Introduction Bop 2Documento10 páginasIntroduction Bop 2muhammad umairAinda não há avaliações

- Term End Project: G Siva Prasad 10MBA0105Documento10 páginasTerm End Project: G Siva Prasad 10MBA0105Johnson YathamAinda não há avaliações

- Research Paper On Indian Banking SectorDocumento7 páginasResearch Paper On Indian Banking Sectoriimytdcnd100% (1)

- ANNUAL REPORT 2009/10 Himalayan BankDocumento98 páginasANNUAL REPORT 2009/10 Himalayan Banknamru28Ainda não há avaliações

- Rural Banking in IndiaDocumento2 páginasRural Banking in IndiaAmit SinhaAinda não há avaliações

- Bank AlfahaDocumento94 páginasBank AlfahamcbAinda não há avaliações

- Assignment MKT Mba 1Documento6 páginasAssignment MKT Mba 1Nahid BhuiyanAinda não há avaliações

- Allied Bank LimitedDocumento6 páginasAllied Bank LimitedWafa AliAinda não há avaliações

- Indian Banking Sector Towards The Next OrbitDocumento17 páginasIndian Banking Sector Towards The Next OrbitKalyan Raman VadlamaniAinda não há avaliações

- Habib Bank Limited (HBL) : HBL Was The First Commercial Bank To Be Established in Pakistan in 1947Documento7 páginasHabib Bank Limited (HBL) : HBL Was The First Commercial Bank To Be Established in Pakistan in 1947Muhammad ShakeelAinda não há avaliações

- Introduction of BanksDocumento4 páginasIntroduction of BanksNoman AnsariAinda não há avaliações

- Background Vision MissionDocumento6 páginasBackground Vision MissionShimelis Tesema83% (6)

- Advanced Strategic Management Assignment IDocumento6 páginasAdvanced Strategic Management Assignment IBura Ze100% (4)

- NIB Bank Business Policy and StrategyDocumento29 páginasNIB Bank Business Policy and StrategyFaizan Tafzil100% (10)

- IFIC Bank's Business Ethics and SWOT AnalysisDocumento3 páginasIFIC Bank's Business Ethics and SWOT AnalysisShadman ShahadAinda não há avaliações

- Yes BankDocumento30 páginasYes BankVivek PrakashAinda não há avaliações

- Allied Bank Limited: DetailsDocumento11 páginasAllied Bank Limited: DetailsRida ZehraAinda não há avaliações

- SwotDocumento10 páginasSwotmubasharnauman22Ainda não há avaliações

- Prime BankDocumento24 páginasPrime BankNazmulHasanAinda não há avaliações

- Swot AnalysisDocumento3 páginasSwot AnalysisSayali DiwateAinda não há avaliações

- KPMG CII Indian BankingDocumento32 páginasKPMG CII Indian BankingMukesh Pareek100% (1)

- 3 Paper Agent BankDocumento9 páginas3 Paper Agent BankDr. Hemendra ShahAinda não há avaliações

- Research Paper On Banking ServicesDocumento8 páginasResearch Paper On Banking Servicesafedmdetx100% (1)

- HBL Strengths and Competitive Analysis in Pakistan BankingDocumento24 páginasHBL Strengths and Competitive Analysis in Pakistan BankingSarfraz AliAinda não há avaliações

- 2014 Annual ReportDocumento78 páginas2014 Annual ReportRia DumapiasAinda não há avaliações

- 2015iciee - India3 Challenges PDFDocumento7 páginas2015iciee - India3 Challenges PDFVishakha RathodAinda não há avaliações

- SIB Leverages Tech to Serve Customers BetterDocumento14 páginasSIB Leverages Tech to Serve Customers BetterAshish BnAinda não há avaliações

- Fi Case Study 2 NewDocumento9 páginasFi Case Study 2 NewKrutik ShahAinda não há avaliações

- Bank AlflahDocumento122 páginasBank AlflahM Waqar JavedAinda não há avaliações

- YES BANK'S FUTURE IN FINTECHDocumento5 páginasYES BANK'S FUTURE IN FINTECHDeepak BhatiaAinda não há avaliações

- City Bank Is One of BangladeshDocumento4 páginasCity Bank Is One of BangladeshFarhana Rashed 2035196660Ainda não há avaliações

- The Future of Microfinance in IndiaDocumento3 páginasThe Future of Microfinance in IndiaSurbhi AgarwalAinda não há avaliações

- HRM370-CASE 1-NCC BankDocumento16 páginasHRM370-CASE 1-NCC BankOishee AhmedAinda não há avaliações

- Assignment PointDocumento9 páginasAssignment PointAysha Begum ShantaAinda não há avaliações

- AcknowledgementDocumento12 páginasAcknowledgementPushpa BaruaAinda não há avaliações

- UBL Operations ManagementDocumento18 páginasUBL Operations ManagementSaad HamidAinda não há avaliações

- MCBDocumento84 páginasMCBTari Baba100% (2)

- Banking Sector Presentation HRMDocumento26 páginasBanking Sector Presentation HRMNoor Sadia MriduAinda não há avaliações

- Purpose of The InternshipDocumento9 páginasPurpose of The InternshipFaizan MalikAinda não há avaliações

- ICICI-Bank Strategic ImplementationDocumento52 páginasICICI-Bank Strategic ImplementationJazz KhannaAinda não há avaliações

- Research Paper On E-Banking in India PDFDocumento6 páginasResearch Paper On E-Banking in India PDFfvgr8hna100% (1)

- Faysal Bank SWOT AnalysisDocumento11 páginasFaysal Bank SWOT AnalysisMuhammadSufianAinda não há avaliações

- Banking & InsuranceDocumento35 páginasBanking & InsuranceBhaveen JoshiAinda não há avaliações

- Term Paper On Mobile Banking in BangladeshDocumento5 páginasTerm Paper On Mobile Banking in Bangladeshafmzodjhpxembt100% (1)

- Strategic Management Final Report Bank Al HabibDocumento20 páginasStrategic Management Final Report Bank Al HabibBrave Ali KhatriAinda não há avaliações

- Banking Sector in India - Challenges and OpportunitiesDocumento6 páginasBanking Sector in India - Challenges and OpportunitiesDeepika SanthanakrishnanAinda não há avaliações

- Term Paper On Brac BankDocumento5 páginasTerm Paper On Brac Bankafmzsprjlerxio100% (1)

- Project On Credit Appraisal For Sme SectorDocumento33 páginasProject On Credit Appraisal For Sme Sectoranish_10677953Ainda não há avaliações

- Success in SME FinancingDocumento33 páginasSuccess in SME FinancingSachin GuptaAinda não há avaliações

- SME Financing: Issues and Strategies: Ishrat HusainDocumento9 páginasSME Financing: Issues and Strategies: Ishrat HusainKhurram Ali SyedAinda não há avaliações

- SCB Jamal AlviDocumento3 páginasSCB Jamal AlviArun AshokAinda não há avaliações

- Unlocking the Potential of Islamic Finance for SME`sNo EverandUnlocking the Potential of Islamic Finance for SME`sAinda não há avaliações

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Ainda não há avaliações

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNo EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeAinda não há avaliações

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesAinda não há avaliações

- Banking 2020: Transform yourself in the new era of financial servicesNo EverandBanking 2020: Transform yourself in the new era of financial servicesAinda não há avaliações

- Compact: Uhf RadioDocumento12 páginasCompact: Uhf Radiotrillion5Ainda não há avaliações

- Bafwm1 - Lhe - 24092021082244Documento1 páginaBafwm1 - Lhe - 24092021082244trillion5Ainda não há avaliações

- Myeloma UK AL Amyloidosis Serum Free Light Chain Assay InfosheetDocumento8 páginasMyeloma UK AL Amyloidosis Serum Free Light Chain Assay Infosheettrillion5Ainda não há avaliações

- Understanding The Results of Your VAP Cholesterol TestVapDocumento4 páginasUnderstanding The Results of Your VAP Cholesterol TestVapcmdcscribdAinda não há avaliações

- Performance Electronics: 2018/2019 Master CatalogDocumento88 páginasPerformance Electronics: 2018/2019 Master Catalogtrillion5Ainda não há avaliações

- A Brief On Regulations For EMIsDocumento14 páginasA Brief On Regulations For EMIstrillion5Ainda não há avaliações

- Manual: Safety Warning 【Please read carefully.】Documento2 páginasManual: Safety Warning 【Please read carefully.】trillion5Ainda não há avaliações

- 表1:豪州E车主手册标题Documento361 páginas表1:豪州E车主手册标题djdr1100% (3)

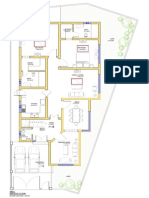

- Ground FloorDocumento1 páginaGround Floortrillion5Ainda não há avaliações

- 02 Foods You Should Never EatDocumento113 páginas02 Foods You Should Never EatmrsorenAinda não há avaliações

- Lucasdist 46 To 60Documento49 páginasLucasdist 46 To 60trillion5Ainda não há avaliações

- 02 Foods You Should Never EatDocumento113 páginas02 Foods You Should Never EatmrsorenAinda não há avaliações

- Cat 13 ELqdddDocumento14 páginasCat 13 ELqdddtrillion5Ainda não há avaliações

- Usws PricelistDocumento3 páginasUsws Pricelisttrillion5Ainda não há avaliações

- First FloorDocumento1 páginaFirst Floortrillion5Ainda não há avaliações

- Gpac Presentation November 2010 2Documento41 páginasGpac Presentation November 2010 2trillion5Ainda não há avaliações

- AKD Daily Sep 05 2013Documento5 páginasAKD Daily Sep 05 2013trillion5Ainda não há avaliações

- Organic Restaurant Business PlanDocumento71 páginasOrganic Restaurant Business Plantrillion5Ainda não há avaliações

- RPRDocumento20 páginasRPRtrillion5Ainda não há avaliações

- Rice BranDocumento19 páginasRice Brantrillion5Ainda não há avaliações

- ICI Paints Pakistan Internship Report on FinanceDocumento57 páginasICI Paints Pakistan Internship Report on Financetrillion5Ainda não há avaliações

- BAFL: Lower Provisions A Key Factor - Maintain Hold': Morning BriefingDocumento2 páginasBAFL: Lower Provisions A Key Factor - Maintain Hold': Morning Briefingtrillion5Ainda não há avaliações

- Guidelines For Rabies Prevention 1Documento40 páginasGuidelines For Rabies Prevention 1trillion5Ainda não há avaliações

- Solar DishDocumento17 páginasSolar DisharhlboyAinda não há avaliações

- OrnithopterDocumento10 páginasOrnithopterRicardo Luis Martin Sant'AnnaAinda não há avaliações

- Bank Alfalah Detail ReportDocumento17 páginasBank Alfalah Detail Reporttrillion5Ainda não há avaliações

- AKD Daily Sep 05 2013Documento5 páginasAKD Daily Sep 05 2013trillion5Ainda não há avaliações

- By Mge Ups Systems: Merlin GerinDocumento60 páginasBy Mge Ups Systems: Merlin GerinGhulam MustafaAinda não há avaliações

- Constitution of Pakistan 1973 PDFDocumento138 páginasConstitution of Pakistan 1973 PDFmrasadAinda não há avaliações

- Introduction to the Nature and Classification of LawDocumento1 páginaIntroduction to the Nature and Classification of Lawtrillion5Ainda não há avaliações

- Weekly Choice - Section B - April 05, 2012Documento6 páginasWeekly Choice - Section B - April 05, 2012Baragrey DaveAinda não há avaliações

- Hajj Rituals - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPDocumento140 páginasHajj Rituals - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPIslamicMobilityAinda não há avaliações

- Harvey and Annette Whittemore Sue The SeenosDocumento24 páginasHarvey and Annette Whittemore Sue The SeenossirjsslutAinda não há avaliações

- HTGC 2013 Annual ReportDocumento246 páginasHTGC 2013 Annual Reportemirav2Ainda não há avaliações

- Cost Accounting 1 8 FinalDocumento16 páginasCost Accounting 1 8 FinalAsdfghjkl LkjhgfdsaAinda não há avaliações

- Strategic Management Procter & Gamble 2011Documento10 páginasStrategic Management Procter & Gamble 2011Zadeexx50% (2)

- The Equity Implications of Taxation: Tax IncidenceDocumento21 páginasThe Equity Implications of Taxation: Tax IncidenceA. Rizki HimawanAinda não há avaliações

- Business Finance - ModuleDocumento33 páginasBusiness Finance - ModuleMark Laurence FernandoAinda não há avaliações

- Onion Cold StorageDocumento4 páginasOnion Cold StoragezhyhhAinda não há avaliações

- INTERNAL CONTROL SYSTEM GUIDEDocumento64 páginasINTERNAL CONTROL SYSTEM GUIDETeal JacobsAinda não há avaliações

- Open Banking Api Service FactsheetDocumento2 páginasOpen Banking Api Service FactsheetswiftcenterAinda não há avaliações

- PDF - Unpacking LRC and LIC Calculations For PC InsurersDocumento14 páginasPDF - Unpacking LRC and LIC Calculations For PC Insurersnod32_1206Ainda não há avaliações

- Perils of The Sea Perils of The ShipDocumento15 páginasPerils of The Sea Perils of The ShipEd Karell GamboaAinda não há avaliações

- Icwim PDFDocumento2 páginasIcwim PDFWolfgangAinda não há avaliações

- Controls in Revenue - Expenditure CycleDocumento28 páginasControls in Revenue - Expenditure CycleKhen CaballesAinda não há avaliações

- Equity analysis of auto stocksDocumento4 páginasEquity analysis of auto stocksYamunaAinda não há avaliações

- Solution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackDocumento5 páginasSolution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackMarjorie Rosales100% (39)

- Ibm - WK - Co-Om - IbmDocumento57 páginasIbm - WK - Co-Om - IbmAnonymous 0xdva5uN2Ainda não há avaliações

- Chinese Silver Standard EconomyDocumento24 páginasChinese Silver Standard Economyage0925Ainda não há avaliações

- Total Item Description Unit PriceDocumento3 páginasTotal Item Description Unit PriceMartin Kyuks100% (2)

- Presentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitDocumento14 páginasPresentation by Bikramjeet Singh ON Study On Working Capital Management On Iffco-Phulpur UnitPreetaman SinghAinda não há avaliações

- Nikon Annual ReportDocumento15 páginasNikon Annual Reportksushka89Ainda não há avaliações

- Case Studies On HR Best PracticesDocumento50 páginasCase Studies On HR Best PracticesAnkur SharmaAinda não há avaliações

- Meet Your Strawman: Let's Have A Little QuizDocumento50 páginasMeet Your Strawman: Let's Have A Little Quizwereld2all100% (3)

- No E-Mail Address Nationality Institution/Organization Position Country of Residence Parallel Session Full NameDocumento3 páginasNo E-Mail Address Nationality Institution/Organization Position Country of Residence Parallel Session Full Namesono_edogawaAinda não há avaliações

- 0 DTE MEIC - January 16, 2023 by Tammy ChamblessDocumento19 páginas0 DTE MEIC - January 16, 2023 by Tammy Chamblessben44Ainda não há avaliações

- 6 - Power of AttorneyDocumento2 páginas6 - Power of AttorneyJahi100% (4)

- CREDIT CARD STATEMENT SUMMARYDocumento4 páginasCREDIT CARD STATEMENT SUMMARYAravind SunithaAinda não há avaliações

- Basic Budgeting Tips Everyone Should KnowDocumento2 páginasBasic Budgeting Tips Everyone Should KnowharissonAinda não há avaliações

- The Following Information Is Available About The Capital Structure For PDFDocumento1 páginaThe Following Information Is Available About The Capital Structure For PDFLet's Talk With HassanAinda não há avaliações