Escolar Documentos

Profissional Documentos

Cultura Documentos

Business Plan - Typical Contents: Executive Summary

Enviado por

Wasiq KhanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Business Plan - Typical Contents: Executive Summary

Enviado por

Wasiq KhanDireitos autorais:

Formatos disponíveis

Business Plan - Typical Contents

Executive summary

What is the business? What is the market? What is the potential for the business? Forecast profit figures Funding requirements Prospects for the investor/ lender

Description of the business

What is the business?

A brief description of the business idea and why it should be a success History of the enterprise and its ownership Information about the entrepreneurs qualifications, experience and financial status Location

Products and services

A description of the product and what it does An explanation of ways in which the product is distinctive and unique Analysis of the competition How the product will be developed and what new products are being considered as replacements Intangible assets & protection (e.g. copyright, trade marks)

The market

Size and expected growth of the market Analysis of market by segments Identification of target segments Competitors - who they are, ownership, size, market share, likely response to the challenge Customers (existing & potential) - who they are, how they buy, why they buy Distribution channels

Situational audit (where are we now?) This involves data collection and analysis

Purpose of data collection and analysis:

Determine which opportunities to pursue Identify SWOT Identify competitive advantages Provide a background for the formulation of strategy

Main analytical techniques:

PEST/ PESTLE analysis SWOT analysis Competitor analysis Marketing audit

Statement of aims and objectives (where do we want to go?)

A statement of what the business should achieve over a five year period Aims should be expressed in terms of hierarchy of objectives becoming progressively more detailed and specific Vision - what the organisation will be like in the future Mission statement - a statement of the overall purpose and aims SMART Objectives - quantitative goals. Functional objectives - objectives for the functional areas

Strategy and tactics

How are we to get there? Strategy is the broad approach to the achievement of objectives Summarises how to fulfil the objectives Tactics refer to the details of the strategy e.g. the promotional mix The detail will be contained in programmes and budgets

Marketing: key questions to be answered

Who are our customers? Who are our competitors? What is the size and growth rate of the market?

How is the market segmented? What is special about our product or service? What are our competitive advantages? What is our marketing strategy?

Marketing plan

Market research Segmentation and targeting Detailed outline of the product or service Unique selling points Chosen pricing strategy Promotional plans Distribution strategy (including online) Customer service strategy

Operations plan

Physical location The production process Facilities Equipment Scale & location of operations Capacity - potential and effective ICT strategy Engineering and design support Materials required Inventory levels and stock control plans Purchasing arrangements Sources of supply of key resources Quality control plans Staffing requirements

Management and organisation

Organisational chart Details of senior management Corporate governance Staffing requirements Key personnel

Recruitment and selection Training Rewards (financial & non-financial) Labour relations Employment and related costs

Forecasts in the business plan

Sales forecast Forecast profit and loss account (income statement) Cash flow forecast (cash budget) In each case this should be a month by month forecast for a minimum of two years Forecast balance sheet for each of the first two years The assumptions behind the forecast should also be included

Financial data

Investment appraisal - payback and discounted cash flow Break even analysis Evaluation criteria for performance review Ratio analysis: net profit margin, Gross profit margin, return on capital employed, liquidity and solvency analysis

Financing required

Details of capital required and uses The plan must include details of the external finance required This will be equal to the finance required less finance raise internally from existing owners and from operations The plan will outline how it is proposed to raise the finance Sources of finance: Short, medium and long term; Debt v equity

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Strengths in The SWOT Analysis of Hero Moto CropDocumento4 páginasStrengths in The SWOT Analysis of Hero Moto CropMd aadab razaAinda não há avaliações

- Resource Based Theory (RBT) - AK S1Documento9 páginasResource Based Theory (RBT) - AK S1cholidAinda não há avaliações

- LICENSES Full Documentation STDDocumento511 páginasLICENSES Full Documentation STDffssdfdfsAinda não há avaliações

- Accounts ReceivableDocumento6 páginasAccounts ReceivableNerish PlazaAinda não há avaliações

- PC-13518 - Aquaflow BrochureDocumento8 páginasPC-13518 - Aquaflow Brochuremark nickeloAinda não há avaliações

- hrm4111 Recruitment and Selection Assignment Five Employment Contract Christina RanasinghebandaraDocumento3 páginashrm4111 Recruitment and Selection Assignment Five Employment Contract Christina Ranasinghebandaraapi-3245028090% (1)

- Textured Soy Protein ProductsDocumento13 páginasTextured Soy Protein ProductsAmit MishraAinda não há avaliações

- Capital One's Letter To The Federal ReserveDocumento15 páginasCapital One's Letter To The Federal ReserveDealBookAinda não há avaliações

- 15 Bankers and Manufacturers Vs CA DigestDocumento2 páginas15 Bankers and Manufacturers Vs CA DigestCharisseCastilloAinda não há avaliações

- Confirmation - Delta Air LinesDocumento5 páginasConfirmation - Delta Air LinesAkinoJohnkennedyAinda não há avaliações

- Security Analysis of Bharat Forge LTDDocumento38 páginasSecurity Analysis of Bharat Forge LTDRanjan Shetty100% (1)

- Test Pattern Changed For Promotion To MMGS-II & IIIDocumento3 páginasTest Pattern Changed For Promotion To MMGS-II & IIIsamuelkishAinda não há avaliações

- Structural Consultants Registered With Dda Sl. No. Name & Address of The Agency ValidityDocumento4 páginasStructural Consultants Registered With Dda Sl. No. Name & Address of The Agency ValidityRupali ChadhaAinda não há avaliações

- Feasibility and Business Planning: Back To Table of ContentsDocumento55 páginasFeasibility and Business Planning: Back To Table of ContentsJK 9752Ainda não há avaliações

- Certif I CteDocumento13 páginasCertif I CteJoielyn Dy DimaanoAinda não há avaliações

- Equity Research Report - CIMB 27 Sept 2016Documento14 páginasEquity Research Report - CIMB 27 Sept 2016Endi SingarimbunAinda não há avaliações

- ODI Administration and Development OutlineDocumento7 páginasODI Administration and Development OutlinerameshibmAinda não há avaliações

- International Business NotesDocumento28 páginasInternational Business NotesLewis McLeodAinda não há avaliações

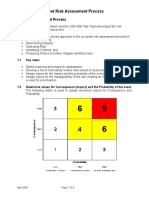

- 4 Fleet Risk Assessment ProcessDocumento4 páginas4 Fleet Risk Assessment ProcessHaymanAHMEDAinda não há avaliações

- TZINGADocumento15 páginasTZINGAMahvish RahmanAinda não há avaliações

- Republic Act No. 11057Documento9 páginasRepublic Act No. 11057FCAinda não há avaliações

- Republic Act No 1400Documento8 páginasRepublic Act No 1400anneAinda não há avaliações

- M310 11 ConstructionProgressScheduleDocumento10 páginasM310 11 ConstructionProgressScheduleIan DalisayAinda não há avaliações

- BGV Form - CrisilDocumento3 páginasBGV Form - CrisilAkshaya SwaminathanAinda não há avaliações

- Petitioner, Vs Respondent: Second DivisionDocumento8 páginasPetitioner, Vs Respondent: Second Divisiondenbar15Ainda não há avaliações

- The Shopping Mall As Consumer Habitat: Peter H. Bloch Nancy M. Ridgway Scott A. DawsonDocumento20 páginasThe Shopping Mall As Consumer Habitat: Peter H. Bloch Nancy M. Ridgway Scott A. Dawsonpasalperda100% (1)

- Airline Alliance PDFDocumento2 páginasAirline Alliance PDFSimran VermaAinda não há avaliações

- Primary and Secondary Data (UNIT III)Documento12 páginasPrimary and Secondary Data (UNIT III)shilpeekumariAinda não há avaliações

- H Paper EastWest Bank 2Documento4 páginasH Paper EastWest Bank 2Justin Dan A. OrculloAinda não há avaliações

- Walmart Analyst ReportDocumento29 páginasWalmart Analyst ReportAlexander Mauricio BarretoAinda não há avaliações