Escolar Documentos

Profissional Documentos

Cultura Documentos

Nov 2010 PDF

Enviado por

Naveed Mughal AcmaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Nov 2010 PDF

Enviado por

Naveed Mughal AcmaDireitos autorais:

Formatos disponíveis

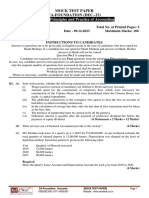

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN Fall (Winter) 2010 Examinations

Saturday, the 4th December 2010

FUNDAMENTALS OF FINANCIAL ACCOUNTING (S-101) STAGE - 1

Time Allowed 2 Hours 45 Minutes

(i) (ii) (iii) (iv) (v) (vi) (vii) Attempt ALL questions. Answers must be neat, relevant and brief.

Maximum Marks 90

In marking the question paper, the examiners take into account clarity of exposition, logic of arguments, effective presentation, language and use of clear diagram / chart, where appropriate. Read the instructions printed inside the top cover of answer script CAREFULLY before attempting the paper. Use of non-programmable scientific calculators of any model is allowed. DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script. Question No.1 Multiple Choice Question printed separately, is an integral part of this question paper.

Marks Q.2 (a) A comparison of cash book and bank statement of Afzal Traders for the month of March, 2010 revealed the following: Balance as per cash book Rs.24,720. Bank statement showed an overdraft of Rs.22,660. A cheque for Rs.14,400 deposited into the bank was shown in the debit column of the bank statement. A cheque for Rs.3,920 deposited into the bank was recorded in the bank statement as Rs.3,560. A cheque for Rs.1,600 received from Ameer Brothers and deposited into the bank was returned dishonoured by the bank. A cheque for Rs.14,000 issued to Saqib Traders has not so far been presented to bank for payment. The bank statement showed a debit of Rs.540 for bank charges and a credit of Rs. 840 for profit. Cash amounting to Rs.30,920 was deposited into the bank late in the evening on March 31, 2010, but it was recorded by the bank on April 1, 2010. Required: (i) (ii) (b) (i) Bank Reconciliation Statement as on March 31, 2010. Entries in the General Journal to adjust the cash record of the company. Nazim Company uses the periodic inventory system and reports the following information for the month ended January 31, 2010: Date January 1 12 15 18 25 Description Balance b/d Purchases Purchases Purchases Purchases Units 200 300 600 400 800 Cost per Unit Rs. 5 6 7 6 7 Total Cost Rs. 1,000 1,800 4,200 2,400 5,600 07 03

During the month ended January 31, 2010, two thousand units were sold. Required: Calculate the value of closing inventory and the value of cost of goods sold, assuming the company uses valuation method of weighted-average. 1 of 4

05 PTO

Marks (ii) Ahmed Brothers, a trader of household items, uses periodic inventory system. In the last week of June 2010, a theft took place in the shop and the thief succeeded in taking away most of the inventory with him. In order to make an insurance claim, Ahmed Brothers need an estimate of the stolen inventory. Following information is available: Rs. 255,250 Opening inventory (July 1, 2009) Purchases during the year Remaining inventory on June 30, 2010 Sales 1,590,500 25,750 2,090,200

Ahmed Brothers apply gross profit margin of 25%. Required: Make an estimate of the stolen inventory in the light of the above data. 05

Q. 3

(a)

Prepare adjusting and correcting journal entries for the year ended June 30, 2010 from the information given below: (i) Sales to Mr. Ali for Rs.25,600 was wrongly entered in the books as Rs.26,500. (ii) Unearned revenue account showed a credit balance of Rs.257,500 in the trial balance on June 30, 2010. An analysis revealed that 80% of this amount had been earned during the year. (iii) Sales proceeds amounting to Rs.35,500 (sold at book value) of a non-current asset were wrongly treated as sales of goods. (iv) Rent paid amounting to Rs. 55,000 in relation to the rented house of the proprietor was debited to the office rent expense account. (v) Insurance expired during the year Rs.6,500. Prepaid insurance at the beginning being Rs.15,000. (vi) Amount of repairs to building was debited to building account, Rs.25,500. (vii) Purchase of office equipment for Rs.15,520 was treated as purchases of inventory. (viii) Allowance for doubtful debts to be maintained at 2% on sales. Sales for the year amounted to Rs.2,850,500. (ix) Interest on a 10% loan of Rs.275,000 was outstanding . (x) Purchase of goods for Rs.6,500 from Mr. Ahmed was completely omitted from the books.

10

(b)

On January 1, 2007, A Limited purchased five machines for Rs.120,000. On June 30, 2008, it acquired another machine at a cost of Rs.20,000. On March 31, 2009, a machine, purchased on January 1, 2007 for Rs.25,000, was sold for Rs.10,000. It was replaced on the same day by a new machine costing Rs.8,000. Depreciation is to be provided at 20% per annum using straight-line method. Company charges full years depreciation in the year of purchase and no depreciation in the year of sale.

Required: Prepare the following accounts for three years to December 31, 2009: (i) Machine Account. (ii) Accumulated Depreciation Account. (iii) Machine Disposal Account. 2 of 4

04 04 02

Marks Q. 4 Yasir & Company deals in electronic items. Not only does it sell goods for cash, a big proportion of its sales consist of credit sales. Due to liberal credit policy, Yasir & Companys volume of sales has increased over the last few years; however, this policy has also resulted in additional bad debt expense. At July 1, 2008, Accounts Receivable and Allowance for Doubtful Debts accounts, showed balances of Rs.155,890 (debit) and Rs.9,350 (credit), respectively. Following transactions took place during two years to June 30, 2010: 2009 (Rs.) 1,154,300 1,075,250 15,350 13,250 2010 (Rs.) 1,210,750 1,255,280 15,350 14,180

Credit sales Receipts from customers Discount allowed Debts considered to be un-collectable

Yasir & Company makes allowance for doubtful debts @ 5% of the closing balance of accounts receivable. Required: For the years ended June 30, 2009 and 2010, prepare accounts of: (i) Accounts Receivable (ii) Allowance for Doubtful Debts Q. 5 Hammad drew a bill for Rs.3,000 and Khalid accepted the same for mutual accommodation of both of them to the extent of 2/3 to Hammad and 1/3 to Khalid. Hammad discounted the same for Rs.2,820 and remitted 1/3 of the proceeds to Khalid. Before due date Khalid drew another bill for Rs.4,200 on Hammad in order to provide funds to meet the first bill. The second bill was discounted for Rs.4,080 with the help of which the first bill was met and an amount of Rs.720 was remitted to Hammad. Before the due date of the second bill, Hammad became bankrupt and Khalid received a dividend of 50 paisa in the rupee in full satisfaction. 15 Balance of A. Rahman Cr. (Rs.) 06 04

Required: Pass the necessary journal entries in the books of Khalid. Q. 6 The following balances have been taken from the pre-closing Trial Traders prepared on June 30, 2010: Dr. (Rs.) Cash 30,000 Accounts receivable 45,000 Furniture & fixture 60,000 Office equipment 40,000 Inventory (1-7-2009) 35,000 Purchases 205,000 Carriage-in 5,500 Office supplies expense 2,500 Discount allowed 7,500 Allowance for doubtful debts 2,000 A. Rahmans drawing 15,000 Prepaid office rent expense 5,000 Prepaid insurance 2,500 Salaries expense 25,000 Accounts payable Sales revenues Purchase returns and allowances A. Rahman, Capital 480,000 3 of 4

22,500 327,500 10,000 120,000 480,000

PTO

Marks Supplementary data for adjustments on June 30, 2010: (i) (ii) (iii) (iv) (v) (vi) Required: (a) Income Statement for the year ended June 30, 2010. 12 13 Inventory was valued at Rs.15,000. Depreciation expenses for the year were Rs.12,000 for furniture & fixture and Rs.4,000 for office equipment. Insurance expired during the year, Rs.1,500. Amount of prepaid office rent was Rs.2,000. Accrued salaries amounted to Rs.10,000. Allowance for doubtful debts was to be raised to Rs.5,000.

(vii) Unused office supplies on hand amounted to Rs.1,000.

(b) Statement of Financial Position as at June 30, 2010. THE END

4 of 4

Você também pode gostar

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionAinda não há avaliações

- Test 5 Principles and Practice of AccountingDocumento6 páginasTest 5 Principles and Practice of Accountingshreya shettyAinda não há avaliações

- © The Institute of Chartered Accountants of India: TH ST THDocumento15 páginas© The Institute of Chartered Accountants of India: TH ST THGaurav KumarAinda não há avaliações

- CA Foundation MTP 2020 Paper 1 QuesDocumento6 páginasCA Foundation MTP 2020 Paper 1 QuesSaurabh Kumar MauryaAinda não há avaliações

- Fall 2009 Past PaperDocumento4 páginasFall 2009 Past PaperKhizra AliAinda não há avaliações

- Accounting: Required: Prepare Journal Entries To Record The Above TransactionsDocumento3 páginasAccounting: Required: Prepare Journal Entries To Record The Above TransactionsMahediAinda não há avaliações

- © The Institute of Chartered Accountants of India: TH ST THDocumento6 páginas© The Institute of Chartered Accountants of India: TH ST THomkar sawantAinda não há avaliações

- Acc Full Test 3Documento6 páginasAcc Full Test 3Periyanan VAinda não há avaliações

- Foundation Accounts Suggested Nov20Documento25 páginasFoundation Accounts Suggested Nov20dhanushd0613Ainda não há avaliações

- Spring 2009 Past PaperDocumento4 páginasSpring 2009 Past PaperKhizra AliAinda não há avaliações

- Introduction To Financial Accounting: The Institute of Chartered Accountants of PakistanDocumento4 páginasIntroduction To Financial Accounting: The Institute of Chartered Accountants of PakistanadnanAinda não há avaliações

- Sutlej Public SR Sec School Annual Examination (Session 2021-22) Class Xi Commerce Subject: Accountancy TIME: 2 Hours MM 40Documento4 páginasSutlej Public SR Sec School Annual Examination (Session 2021-22) Class Xi Commerce Subject: Accountancy TIME: 2 Hours MM 40mnmehta1990Ainda não há avaliações

- Accounts Specimen QP Class XiDocumento7 páginasAccounts Specimen QP Class XiAnju TomarAinda não há avaliações

- Introduction To Financial Accounting: T I C A PDocumento5 páginasIntroduction To Financial Accounting: T I C A PadnanAinda não há avaliações

- Accounts Suggested Ans CAF Nov 20Documento25 páginasAccounts Suggested Ans CAF Nov 20Anshu DasAinda não há avaliações

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocumento25 páginasPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainAinda não há avaliações

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocumento164 páginasPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaAinda não há avaliações

- T I C A P: Foundation Examinations Spring 2009Documento4 páginasT I C A P: Foundation Examinations Spring 2009Robert AngelioAinda não há avaliações

- Class Xi Acc QPDocumento7 páginasClass Xi Acc QP8201ayushAinda não há avaliações

- Accounting: Page 1 of 3Documento3 páginasAccounting: Page 1 of 3Laskar REAZAinda não há avaliações

- Class 11 Accountancy Worksheet - 2023-24Documento17 páginasClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarAinda não há avaliações

- Unsolved Paper Part IDocumento107 páginasUnsolved Paper Part IAdnan KazmiAinda não há avaliações

- Mock Paper - 2017-18 Class-Xi: General InstructionsDocumento6 páginasMock Paper - 2017-18 Class-Xi: General InstructionsMukul YadavAinda não há avaliações

- Test Paper Ca FoundDocumento5 páginasTest Paper Ca FoundSarangapani KaliyamoorthyAinda não há avaliações

- Class 11 Accounts SP 1Documento6 páginasClass 11 Accounts SP 1UdyamGAinda não há avaliações

- J.K Shah Full Course Practice Question PaperDocumento7 páginasJ.K Shah Full Course Practice Question PapermridulAinda não há avaliações

- UntitledDocumento269 páginasUntitledvijaypeketiAinda não há avaliações

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocumento5 páginasTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaAinda não há avaliações

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Documento5 páginasVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsAinda não há avaliações

- Revision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For DepartmentsDocumento153 páginasRevision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For Departmentsshankar k.c.Ainda não há avaliações

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocumento5 páginasTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDeepak YadavAinda não há avaliações

- Test Aldine FinalDocumento3 páginasTest Aldine FinalAkshay TulshyanAinda não há avaliações

- File 9563Documento29 páginasFile 9563dhananijeneelAinda não há avaliações

- Accounting Problems With SolutionsDocumento63 páginasAccounting Problems With Solutionssumit_sagar69% (13)

- CA Foundation AccountDocumento7 páginasCA Foundation Accountrishab kumarAinda não há avaliações

- MFAB Oct 2020-Practice Set 1-Isb-V1Documento2 páginasMFAB Oct 2020-Practice Set 1-Isb-V1Shashank GuptaAinda não há avaliações

- Class XI Practice PaperDocumento4 páginasClass XI Practice PaperAyush MathiyanAinda não há avaliações

- RTP June 2018 QnsDocumento14 páginasRTP June 2018 QnsbinuAinda não há avaliações

- AccountancyDocumento8 páginasAccountancyAnkit KumarAinda não há avaliações

- Model Paper, Accountancy, XIDocumento13 páginasModel Paper, Accountancy, XIanyaAinda não há avaliações

- 650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329Documento4 páginas650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329sushil262004Ainda não há avaliações

- SAMPLE PAPER - (Solved) : For Examination March 2017Documento13 páginasSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavAinda não há avaliações

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocumento25 páginasPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareAinda não há avaliações

- Accountancy: Class: XiDocumento8 páginasAccountancy: Class: XiSanskarAinda não há avaliações

- Fall 2008 Past PaperDocumento4 páginasFall 2008 Past PaperKhizra AliAinda não há avaliações

- Qus. MTP Accounts - 09.12.23Documento5 páginasQus. MTP Accounts - 09.12.23karann021003Ainda não há avaliações

- 2 Accounting PDFDocumento3 páginas2 Accounting PDFibrahimbdAinda não há avaliações

- Revision Test Paper: Cap Ii (June 2017)Documento12 páginasRevision Test Paper: Cap Ii (June 2017)binuAinda não há avaliações

- Revision - Test - Paper - CAP - II - June - 2017 9Documento181 páginasRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariAinda não há avaliações

- Accounts RTP Foundation Nov 2020Documento25 páginasAccounts RTP Foundation Nov 2020Jayasurya MuruganathanAinda não há avaliações

- Assignment IIDocumento4 páginasAssignment IIAfifa TonniAinda não há avaliações

- Session Ending Examination 2019Documento7 páginasSession Ending Examination 2019madhudevi06435Ainda não há avaliações

- Gujarat Technological UniversityDocumento4 páginasGujarat Technological UniversityAniket PatelAinda não há avaliações

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsAinda não há avaliações

- 21St Century Computer Solutions: A Manual Accounting SimulationNo Everand21St Century Computer Solutions: A Manual Accounting SimulationAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionAinda não há avaliações

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersNo EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersAinda não há avaliações