Escolar Documentos

Profissional Documentos

Cultura Documentos

Psi Report March 2013 Final

Enviado por

Belinda WinkelmanDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Psi Report March 2013 Final

Enviado por

Belinda WinkelmanDireitos autorais:

Formatos disponíveis

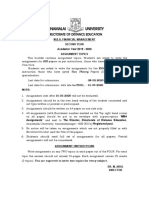

MARCH 2013

SERVICES SECTOR NUDGES GROWTH IN MARCH

The latest seasonally adjusted Australian Industry Group/ Commonwealth Bank of Australia Performance of Services Index (Australian PSI) rose to 49.6 in March, its highest level since January 2012. This months reading indicates that activity edged towards positive territory in the services sector during the month after being in decline since the start of 2012. The Australian PSI was supported in March by a rise in both sales and employment levels the first time this has been reported since August 2011. Rising activity levels were most commonly reported by businesses from the retail trade and hospitality sub-sectors that are directly exposed to household spending. The activity index of the property & business services sub-sector picked up further in March though remains in negative territory in the face of ongoing weakness in housing market conditions. Notwithstanding the stabilisation of the broader services sector, a growing number of businesses reported that activity levels are being hampered by uncertainty surrounding the upcoming federal budget and election.

MAR

65 60

AUSTRALIAN PSI

KEY FINDINGS

60

Increasing

49.6

55 50 45 40 35

55 50

Diffusion Index

AUST

45

Decreasing

FEB

30

40 35 30 25

EUROZONE SERVICES INDEX

FEB

65 60

June 10

Sep 10

Dec 10

Mar 11

June 11

Sept 11

Dec 11

Mar 12

June 12

Sept 12

Dec 12

Mar 13

Australian PSI

3 month moving average

47.9

55 50 45 40 35

EURO

SECTORS

The interest rate cuts seen over the past 18 months appear to be starting to support activity in service sub-sectors directly exposed to household spending, while businesses services such as transport & storage and communication services are yet to report any significant change in business conditions. In three-month-moving average (3mma) terms, activity has risen across the hospitality, health & community services, and personal & recreational service sub-sectors in both February and March. The 3mma activity index of the retail trade sub-sector has also picked up to its highest level since June 2011. On a less positive note, the 3mma activity index of the transport & storage sector is at its lowest level since the series started in 2003, underlying the weakness still present in large parts of the manufacturing and construction sectors. From this month, we are presenting the sub-sector indices in the Australian PSI as three-month moving averages, in order to more accurately identify the trends emerging from the monthly data, which are inherently volatile.

Decreasing Increasing

Wholesale trade Retail trade Accommodation, cafes and restaurants Transport and storage Communication services Finance and insurance

JAN

30

FEB

65 60

UK SERVICES INDEX

Property and business services Health and community services Personal and recreational services PSI

UK

0 10 20 30 40 50 60 70 80 90 100

Diffusion Index

(3 month moving average)

51.8

55 50 45 40 35

Feb 13

Mar 13

JAN

45 40 35 30 25

70 65 60 55

US

USA SERVICES INDEX

On a seasonally adjusted basis, sales levels rose in the services sector for the first time since June 2012. The sales component of the Australian PSI rose 3.1 points to 50.8 points. This was supported by sales growth in the property & business services and health & community services sub-sectors. On the other hand, sales continued to decline solidly in the wholesale trade and transport & storage sub-sectors. Capacity utilisation in the services sector (which is not seasonally adjusted) increased by 0.4 points to 76.7%, which is broadly in line with the average level recorded since the start of 2010.

80 75

Sales

Diffusion Index

55 50

Capacity Utilisation % (Unadj.)

SALES AND CAPACITY

65 60

Capacity Utilisation

85

30

FEB

65 60 55 50

56.0

45 40 35

June 10

Sep 10

Dec 10

Mar 11

June 11

Sept 11

Dec 11

Mar 12

June 12

Sept 12

Dec 12

Mar 13

Supported by:

JAN

30

On a seasonally adjusted basis, new orders fell again in March. The new orders sub-index rose by 0.1 points to 48.8 points. The fall in new orders was driven by especially weak activity in the

60 55

Diffusion Index

Increasing

NEW ORDERS

65

WHAT IS THE AUSTRALIAN PSI?

The Australian Industry Group Commonwealth Bank Australian Performance of Services Index (Australian PSI) is a seasonally adjusted national composite index based on the diffusion indexes for sales, orders/new business, deliveries, inventories and employment with varying weights. An Australian PSI reading above 50 points indicates services activity is generally expanding; below 50, that it is declining. The distance from 50 is indicative of the strength of the expansion or decline. More information can be obtained from the Ai Group website www.aigroup.com.au

transport & storage, wholesale trade and communication services sub-sectors. Falling new orders in these sub-sectors were partly offset by growth in the property & business services and health & community services sub-sectors. Businesses noted that falling new order levels stemmed from weakness in large parts of the manufacturing and construction sectors, as well as some moderation in mining sector activity.

50 45

Decreasing

40 35 30 25

June 10 Sep 10 Dec 10 Mar 11 June 11 Sept 11 Dec 11 Mar 12 June 12 Sept 12 Dec 12 Mar 13

20

EMPLOYMENT AND WAGES

On a seasonally adjusted basis, employment expanded in the services

70 65 60

Diffusion Index Average wages

Increasing

sector for the second consecutive month. The employment sub-index fell 1.5 points in March to 50.2. The rise in employment levels was strongest in the health & community services sub-sector. This was offset however by employment reductions in the wholesale trade and transport & storage sub-sectors. On a non-seasonally adjusted basis, the average wages sub-index fell by 6.6 points to 53.2 in March marking a rate of increase below the average level recorded since the start of 2010. The moderation of the average wages sub-index was largely due to wage declines in the transport & storage and property & business services sub-sectors.

55

Employment

50 45 40 35

June 10 Sep 10 Dec 10 Mar 11 June 11 Sept 11 Dec 11 Mar 12 June 12 Sept 12 Dec 12 Mar 13

Decreasing

SPONSOR STATEMENT

Commonwealth Bank is delighted to be the sponsor of the Australian PSI and is pleased to be able to provide the expertise of our Chief Economist Michael Blythe as the key spokesperson for the Performance of Services Index. The Commonwealth Bank is one of Australia's premier service organisations and with the majority of the Australian economy being services based we believe this important piece of research will add real value to the industry. It will provide insights and information that have not previously been available. We look forward to continuing to work with the Australian Industry Group to enhance and develop the Australian PSI.

30

On a seasonally adjusted basis, stock levels (or inventories) in the

55 50

Diffusion Index

Deliveries Stocks

services sector declined for a fifth consecutive month in March. The stocks sub-index of the Australian PSI rose by 1.4 points in the month to 46.4 points. The fall in inventories was driven by declining stock levels in the transport & storage and communication services sub-sectors. The supplier deliveries sub-index increased by 3.8 points this month to 49.9 points, its highest level since January 2012. The decline in deliveries to the services sector was driven by activity in the transport & storage and wholesale trade sub-sectors.

45

Decreasing

40 35 30 25

June 10

Sep 10

Dec 10

Mar 11

June 11

Dec 11

Mar 12

June 12

Dec 12

Sept 11

Sept 12

Mar 13

Increasing

STOCKS AND DELIVERIES

60

CONTACT

INPUT COSTS AND SELLING PRICES

On a non-seasonally adjusted basis, the input prices index fell 9.4

80 75

Input Prices

Increasing

points to 53.4 in March.

On a non-seasonally adjusted basis, the average selling prices index

70 65

Diffusion Index

Innes Willox Chief Executive Ai Group 03 9867 0111 John Peters Senior Economist Commonwealth Bank of Australia Mobile: 0410 482 500 Markit Economics www.markiteconomics.com

The Australian Industry Group, 2013 This publication is copyright. Apart from any fair dealing for the purposes of private study or research permitted under applicable copyright legislation, no part may be reproduced by any process or means without the prior written permission of The Australian Industry Group. Disclaimer The Australian Industry Group provides information services to its members and others, which include economic and industry policy and forecasting services. None of the information provided here is represented or implied to be legal, accounting, financial or investment advice and does not constitute financial product advice. The Australian Industry Group does not invite and does not expect any person to act or rely on any statement, opinion, representation or interference expressed or implied in this publication. All readers must make their own enquiries and obtain their own professional advice in relation to any issue or matter referred to herein before making any financial or other decision. The Australian Industry Group accepts no responsibility for any act or omission by any person relying in whole or in part upon the contents of this publication.

AIG12815

increased by 1.4 points to 45.7, remaining well below the critical 50point level separating expansion from contraction. The average selling price index for the retail trade sector was below the critical 50-point level separating expansion from contraction for the 16th consecutive month in March, as businesses continue to lower prices to help stimulate sales volumes. The low level of the average selling prices index is consistent with recent weakness in Australian inflation more generally, with headline inflation recording just 2.2% p.a. in the December quarter of 2012 (and with even smaller price changes for many foods and other consumer goods).

60 55 50

Selling Prices

40 35 30

June 10 Sep 10 Mar 11 June 11 Sept 11 Mar 12 June 12 Sept 12 Mar 13 Dec 10 Dec 11 Dec 12

25

AUSTRALIAN PSI*

March 2013 49.6 SALES 50.8 NEW ORDERS 48.8 EMPLOYMENT 50.2 SUPPLIER DELIVERIES 49.9 INVENTORIES 46.4 INPUT PRICES 53.4 SELLING PRICES 45.7 WAGES 53.2 CAPACITY UTILISATION (%) 76.7

AUSTRALIAN PSI

February 2013 48.5 47.7 48.7 51.7 46.1 45.0 62.8 44.3 59.8 76.3

Monthly Change 1.1 3.1 0.1 -1.5 3.8 1.4 -9.4 1.4 -6.6 0.4

Direction Rate of Change Contracting Slower Expanding From contracting Contracting Slower Expanding Slower Contracting Slower Contracting Slower Expanding Slower Contracting Slower Expanding Slower

Trend** (Months) 14 1 9 2 9 5 121 17 44

Results are based on the responses of around 150 companies. Forward seasonal factors were generated by the ABS in April 2012. * Australian PSI data is seasonally adjusted for sales, new orders, employment, supplier deliveries, inventories and input prices. ** Number of months moving in current direction.

If you would like to participate in this survey, please send your details to economics@aigroup.asn.au

Supported by:

Decreasing

45

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- June 2013 Pci ReportDocumento2 páginasJune 2013 Pci ReportBelinda WinkelmanAinda não há avaliações

- Pmi Report June 2013 FinalDocumento2 páginasPmi Report June 2013 FinalBelinda WinkelmanAinda não há avaliações

- Westpac Red Book May 2013Documento28 páginasWestpac Red Book May 2013Belinda Winkelman100% (1)

- View Press ReleaseDocumento3 páginasView Press ReleaseDavid4564654Ainda não há avaliações

- Pmi May13 FinalDocumento2 páginasPmi May13 FinalBelinda WinkelmanAinda não há avaliações

- HockeyDocumento12 páginasHockeyBelinda WinkelmanAinda não há avaliações

- Wbc-Mi Leading IndexDocumento3 páginasWbc-Mi Leading IndexBelinda WinkelmanAinda não há avaliações

- Commodity Call June13Documento20 páginasCommodity Call June13Belinda WinkelmanAinda não há avaliações

- 2013m05 Press ReleaseDocumento10 páginas2013m05 Press ReleaseBelinda WinkelmanAinda não há avaliações

- 2013-04 NHSS National Media ReleaseDocumento2 páginas2013-04 NHSS National Media ReleaseBelinda WinkelmanAinda não há avaliações

- ANZ Commodity Daily 830 240513Documento5 páginasANZ Commodity Daily 830 240513Belinda WinkelmanAinda não há avaliações

- Major Minerals Projects Update - May 2013Documento6 páginasMajor Minerals Projects Update - May 2013Belinda WinkelmanAinda não há avaliações

- .Gov - Au: Resources and Energy Major ProjectsDocumento44 páginas.Gov - Au: Resources and Energy Major ProjectsBelinda WinkelmanAinda não há avaliações

- Consumer Expectations: Inflation & Unemployment Expectation Chart PackDocumento24 páginasConsumer Expectations: Inflation & Unemployment Expectation Chart PackBelinda WinkelmanAinda não há avaliações

- Australian Economics Weekly 17-05-13Documento14 páginasAustralian Economics Weekly 17-05-13Belinda WinkelmanAinda não há avaliações

- ANZ Commodity Daily 827 200513Documento5 páginasANZ Commodity Daily 827 200513Belinda WinkelmanAinda não há avaliações

- Slide Presentation M To MR LaunchDocumento14 páginasSlide Presentation M To MR LaunchBelinda WinkelmanAinda não há avaliações

- Key Points: Trend Summary Seasonally Adjusted SummaryDocumento10 páginasKey Points: Trend Summary Seasonally Adjusted SummaryBelinda WinkelmanAinda não há avaliações

- Westpac Budget Report 2013Documento16 páginasWestpac Budget Report 2013Belinda WinkelmanAinda não há avaliações

- ANZ Greater China Economic Insight Incl Regional Chartbook - 14 May 2013Documento23 páginasANZ Greater China Economic Insight Incl Regional Chartbook - 14 May 2013Belinda WinkelmanAinda não há avaliações

- Australian Economics Comment - Lower AUD Would Help Rebalancing ActDocumento4 páginasAustralian Economics Comment - Lower AUD Would Help Rebalancing ActBelinda WinkelmanAinda não há avaliações

- ANZ Quick Reactions - China April Activity DataDocumento4 páginasANZ Quick Reactions - China April Activity DataBelinda WinkelmanAinda não há avaliações

- ANZ Quick Reaction - China April Trade DataDocumento5 páginasANZ Quick Reaction - China April Trade DataBelinda WinkelmanAinda não há avaliações

- Er 20130513 Bull Phat DragonDocumento3 páginasEr 20130513 Bull Phat DragonBelinda WinkelmanAinda não há avaliações

- Statement On Monetary PolicyDocumento68 páginasStatement On Monetary PolicyBelinda WinkelmanAinda não há avaliações

- Er 20130507 Bull Phat DragonDocumento3 páginasEr 20130507 Bull Phat DragonBelinda WinkelmanAinda não há avaliações

- NAB Business Survey AprilDocumento10 páginasNAB Business Survey AprilBelinda WinkelmanAinda não há avaliações

- Er 20130509 Bull Budget Preview 2013Documento5 páginasEr 20130509 Bull Budget Preview 2013Belinda WinkelmanAinda não há avaliações

- ANZ Commodity Daily 819 080513Documento5 páginasANZ Commodity Daily 819 080513Belinda WinkelmanAinda não há avaliações

- Er 20130608 Bull Rba Rate SaudDocumento4 páginasEr 20130608 Bull Rba Rate SaudBelinda WinkelmanAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Trial Balance December 2016Documento1 páginaTrial Balance December 2016Faie RifaiAinda não há avaliações

- SkodaDocumento29 páginasSkodaPratik Bhuptani75% (4)

- Economics of Strategy 6Th Edition PDF Full ChapterDocumento41 páginasEconomics of Strategy 6Th Edition PDF Full Chapterrosa.green630100% (27)

- What Is Modern Portfolio Theory (MPT) ?Documento6 páginasWhat Is Modern Portfolio Theory (MPT) ?nidamahAinda não há avaliações

- Chapter2 Exercise and TestDocumento22 páginasChapter2 Exercise and TestMichelle LamAinda não há avaliações

- bài tập ôn MA1Documento34 páginasbài tập ôn MA1Thái DươngAinda não há avaliações

- 06 Growth Rate of Potential GDPDocumento1 página06 Growth Rate of Potential GDPmiketolAinda não há avaliações

- Paper 1 Practice Questions For SL EconDocumento14 páginasPaper 1 Practice Questions For SL EconKazeAinda não há avaliações

- Phiếu Giao Bài Tập Số 3Documento3 páginasPhiếu Giao Bài Tập Số 3Phạm Thị Thúy HằngAinda não há avaliações

- Tata Corus AquisitionDocumento30 páginasTata Corus Aquisitionshreyas1111Ainda não há avaliações

- Annamalai University MBA Financial Management 2nd Year Assignments 2019-20Documento4 páginasAnnamalai University MBA Financial Management 2nd Year Assignments 2019-20Senthil KumarAinda não há avaliações

- PNR Pricing & Ticketing GuideDocumento6 páginasPNR Pricing & Ticketing GuideAdnan ChathaAinda não há avaliações

- 603 77210015-InsertDocumento4 páginas603 77210015-InsertTorus EngenhariaAinda não há avaliações

- Bond ValuationDocumento3 páginasBond ValuationGauravAinda não há avaliações

- Economics of Strategy: Fifth EditionDocumento44 páginasEconomics of Strategy: Fifth EditionSachin SoniAinda não há avaliações

- Marketing Management Syllabus BreakdownDocumento71 páginasMarketing Management Syllabus BreakdownDarshil GalaAinda não há avaliações

- Sample QuestionsDocumento1 páginaSample QuestionswghiAinda não há avaliações

- Edible OilDocumento51 páginasEdible Oilashish100% (3)

- q17 Iaetrfcnrfc AnsDocumento2 páginasq17 Iaetrfcnrfc AnsIan De DiosAinda não há avaliações

- 2nd Quarter First Assessment in Gen. MathDocumento3 páginas2nd Quarter First Assessment in Gen. MathglaizacoseAinda não há avaliações

- AssignmentDocumento2 páginasAssignmentnavneet26101988Ainda não há avaliações

- Inventory Management EssentialsDocumento57 páginasInventory Management EssentialsAlbert Wilson SmithAinda não há avaliações

- Distribution M1Documento22 páginasDistribution M1Charmie EmotinAinda não há avaliações

- SMC Guide BookDocumento15 páginasSMC Guide BookUsman Haider89% (9)

- HO Model Factor Intensity & Comparative Advantage (39Documento7 páginasHO Model Factor Intensity & Comparative Advantage (39ecsAinda não há avaliações

- Financial & Statement Analysis of National Tubes Ltd.Documento35 páginasFinancial & Statement Analysis of National Tubes Ltd.Aminul Karim Fahad0% (1)

- Deloitte NL Retail Analytics FrameworkDocumento44 páginasDeloitte NL Retail Analytics FrameworkTung NgoAinda não há avaliações

- SharingDocumento21 páginasSharingAmber ZahraAinda não há avaliações

- Understanding antitrust laws and how they protect consumersDocumento10 páginasUnderstanding antitrust laws and how they protect consumersselozok1Ainda não há avaliações

- Sainsburys - Profile SWAT AnalysisDocumento13 páginasSainsburys - Profile SWAT AnalysisMansoor Al KabiAinda não há avaliações