Escolar Documentos

Profissional Documentos

Cultura Documentos

3rd Global Islamic Microfinance Forum Profile

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

3rd Global Islamic Microfinance Forum Profile

Direitos autorais:

Formatos disponíveis

About AlHuda Centre of Islamic Banking and Economics

AlHuda Centre of Islamic Banking and Economics is a globally recognized name working in the areas of Islamic banking & finance and Microfinance in order to provide specialized Trainings, Advisory and Research for the last seven years with an aim to serve the community by providing state-of-the-art Advisory, Consultancy and Education to masses through various well recognized modes i.e. Distance learning programs, Trainings Workshops, Awareness Programs and Islamic Microfinance Products Development. Our specialized and research oriented publications are another source of knowledge delivery. For further details, please visit: www.alhudacibe.com

About Akhuwat

Akhuwat is dedicated to improve the lives of the poor, especially those who are financially abused, abandoned and disregarded by society. It was established with the objective of providing Qard-e-Hasn or interest free Microfinance to the poor so as to enhance their standard of living. Drawing on principles of social justice and brotherhood, Akhuwat strives to alleviate poverty by creating a system based on mutual support in the society. Akhuwats philosophy is based on the principle of Qard-e-Hasn, helping someone in need with an interest-free loan, has been favored over charity. From a first loan of Rs. 10,000, Akhuwats total disbursements have now become reached about Rs. 2 billion. For further details, please visit: www.akhuwat.org.pk

Islamic Microfinance An incredible tool for poverty alleviate

About Islamic Microfinance

Microfinance has emerged as an important instrument to help a large number of Unbankable members of society, as a tool to help reduce poverty and encourage economic growth in neglected parts of the world. However, time has proved that conventional microfinance is not fully reaching the poorest of the poor. During the latest research on Microfinance sector, it is evaluated that Islamic financial system provides the best solutions for Poverty alleviation and Social sustainability, it is not only providing opportunity to utilize a sustainable system but also offers good rate of return & ideal performance compare to conventional microfinance system. Islamic Microfinance is a sub-set of Islamic Economic & Financial System. The demand for Shariah complaints financial products and services is increasing with the rapid progress of Islamic finance industry. It is widely accepted that micro finance is the most effective tool for alleviation of poverty and uplift the living standards of poor through real economic activities in society, but as per market studies conventional micro financial system could not serve the potentially as should expectation due to the few deficiencies in the system. So, it is an immediate need to develop substitute financial products for microfinance institutions.

Need Assessment of Islamic Microfinance

We are in great need of Islamic microfinance to be implied due to the failure of microfinance structure all over the world and its most unprecedented example is India where microfinance companies had failed after a biggest clampdown due to exorbitant interest rates. Islamic microfinance has traits to provide a parallel support to the poorest of the poor and its imminent qualities leaves no room for structural devastation as emphasizes ethical, moral & social factors to promote equality and fairness for the good of the society. It is estimated that 3 billion people are living below the poverty line around the world among them approximately 44% conventional microfinance clients reside in Muslim countries. Almost one-half of the 56 IDB member countries in Asia and Africa are classed as United Nations Least Developed Countries (LDCs), so there is an immediate need to start Islamic Microfinance in Muslim Majority countries for financial inclusion. Right now, there are about 300 Islamic Microfinance Institution, working globally in 32 countries. Islamic Microfinance have proven track record that it deals with long lasting & complete solutions for Sustainability.

Islamic Microfinance An incredible tool for poverty alleviate

Event Summary

Last year, AlHuda CIBE has convened Global Islamic Microfinance Forum on December 8th, 2012 Dubai, U.A.E to expand the vision of microfinance all over the world. Supporters, sponsors and attendees admired the conference that served as a spokesman of the poor community to arouse rd the need of micro financing as a whole. AlHuda-CIBE is going to arrange 3 International Conference on Islamic Microfinance entitled as Global Islamic Microfinance Forum that will be th th held on October 6 at Dubai, U.A.E with Two Days Post Event Training Workshops on October 7 th and 8 , 2013. The main cause of the series of conferences is to increase the scope and trend of Islamic Micro Financing in the developing and under developed countries to open the horizon of helping the poor to survive to their best. We are quite hopeful that this forum will help to fairly and broadly distribute new opportunities and innovations across Microfinance field so as to build an even stronger movement to eliminate poverty. We intend to collate the manpower for a collective social movement to support Islamic microfinance as the best tool to eradicate poverty. The vision of this Islamic Microfinance Global Forum is to create a value in the line of Islamic microfinance for the benefit of human kind and motive to create awareness in the masses and International Market through this event. The core objectives of this Forum are: 4Promoting awareness of Islamic Microfinance among the masses, government and Non Governmental Sectors and Multilateral Donor agencies. Promote Islamic Microfinance Model which is compatible with the models being used in Conventional Microfinance. 4Create a more favorable environment for Islamic Microfinance at national and international level 4To promote Islamic microfinance as a social phenomenon instead of business oriented model 4Gain global practices on Islamic microfinance through learned national and international scholars and experts 4To recognize Islamic Microfinance as sustainable system worldwide 4Awareness of Islamic Microfinance system as sustainable and viable solution for poverty alleviation 4Buildup the recognition of Islamic Microfinance system, for the encouragement of practitioners/microfinance institutions/ donor agencies/ Government institutions 4To provide a Platform to start a dialogue with multilateral donor organizations and Microfinance Network 4Providing innovative knowledge of the various aspects of Islamic microfinance 4To provide the opportunities for collaborations/partnerships with donor agencies, Islamic banks and Islamic Microfinance Institutions/Networks. 4To ensure continued growth of Islamic Microfinance Institutes

Islamic Microfinance An incredible tool for poverty alleviate

2nd Global Islamic Microfinance Forum Speakers

December 08, 2012 - Dubai World Trade Centre - UAE.

Justice (R) Khalil Ur Rehman Shariah Advisor AlBaraka Islamic Bank Chairmen Punjab Halal Development Agency Govt. of Pakistan Dr. Amjad Saqib Executive Director Akhuwat Lahore, Pakistan Mr. Zubair Mughal Chief Executive Officer AlHuda Centre of Islamic Banking and Economics Lahore, Pakistan Mr. Mashesh Jayanarayan CEO and Director of Several Public and Private Companies Founder of UMEX Capital Markets Group UK Mr. Kavilash Chawla Managing Director Nur Global Strategies U.S.A Aziz Ur Rehman Manager-Shariah Mawarid Finance Dubai Zaigham Mehmood Rizvi Renowned International Expert Islamic Banking & Housing Finance Washington - U.S.A Mr. Pervez Nasim Managing Director & CEO Ansar Financial and Development Corporation Canada Mr. Abdul Samad Shairah Advisor Bank of Khyber Pakistan Syed Hussnain Haider Project Director of Akhuwat University Jamal D. Harwood Renowned Finance Expert Canada Abu Bakar Siddique Chief Coordinator -Akhuwat, Pakistan Junaid Farid Manager Consultant - Akhuwat Pakistan Mr. Jamal D. Harwood Renowned Finance Expert Canada Mr. Mamode Raffick Nabee Mohomed Founder/ Secretary Al Barakah Multi-purpose Co-operative Society Limited - Mauritius Mohamed El Mehdi Zidani Author -"An Islamic Analysis of the Grameen Bank" Director Baraka Editions Humayun Saeed Jamshed Senior Director Marketing SAB International FZ LLC UAE Ms. Gulnora Yakubova Operation Director LLCMDO ARVAND Tajikistan. Dr. Tariq Cheema Chief Executive Officer World Congress of Muslim Philanthropists U.S.A Mr. Hamad Rasool Director Research AlHuda Centre of Islamic Banking and Economics - Pakistan

For Speaking and Sponsorship please Contact: info@alhudacibe.com

Islamic Microfinance An incredible tool for poverty alleviate

Event Agenda

Inaugural Session

s Recitation from Holy Quran s Welcome Address s Inaugural & Key Note Address

Technical Session I: Conceptual Framework & Policies for Islamic Microfinance

s s s s s

Shari'ah foundation & Application of Islamic Microfinance Compatibility of Islamic Microfinance with other MF models Islamic Microfinance as an effective tool of poverty alleviation Donors reluctance towards Islamic Microfinance: Causes and Solutions Zakah, Waqf & Co-operative Models for Islamic Microfinance

Technical Session II: Qard-e-Hasn Model for Islamic Microfinance

s Akhuwat Model Adding new dimensions in Microfinance Salient Features s Linking Microfinance with business community s Replicating Akhuwat Model - Challenges & Benefits s Impact assement Impact assessment - A Case Study of Akhuwat

Session III: Power Table - Panel Discussion - Current Status, Strategies and Future Potential of Islamic Microfinance

s What are the Global efforts and Achievements in Islamic Microfinance? s What are the barriers to adoption of Islamic Microfinance globally? And how to resolve them? s What are the Potential Islamic Microfinance Instruments? Exploring The Islamic Microfinance

Models Available s Initiatives needed in designing a framework for policy making for the expansion of Islamic Microfinance s The key bottleneck in the strategies which constraints the growth of Islamic Microfinance

sTechnical Session IV: Outreach & Sustainability of Islamic Microfinance s Impact of Islamic Microfinance for Rural Development & Social Uplifting s Empowering Islamic Microfinance by fulfilling Social and Development expectations s MicroTakaful Shari'ah Compliant solution of Micro Insurance s I.T solutions to strengthened Islamic Microfinance Industry s Integration of Mobile Banking with Islamic Microfinance: Ensuring access to

finance for unbanked through. Declaration of the Conference

Islamic Microfinance An incredible tool for poverty alleviate

Two Days Post Event Workshop on

Shari'ah Principles, Operational Mechanism and Marketing Strategies of Islamic Microfinance October 07-08, 2013 development in Islamic microfinance. Shari'ah Principles and their Application in Innovation, Development & Opportunities in Microfinance Islamic Microfinance Conceptual Framework of Islamic Modernization in Microfinance Microfinance Alternative delivery channels Islamic principles of Micro financing, Role of I.T for the Development of needed to adhere to when operating Islamic Microfinance under Shari'ah law Need of Product Diversification in Compatibility of Microfinance Models Islamic Microfinance with Islamic Microfinance. Product innovation and product Mix of Islamic Microfinance as an effective tool Islamic Microfinance for sustainable development. Donors unwillingness towards Islamic Exploring the Islamic Microfinance Products: Microfinance: Causes and Solutions Murabaha, Salam, Istisna, Diminishing, Marketing Strategies of Islamic Microfinance. Mudarabahah, Musharakah and Ijarah How to market Islamic Microfinance Murabaha as Ideal financing mode in products? Micro/Rural finance sector How to ensure that your products are Salam: Its mechanism and practical authentically Islamic and how to implications for Microfinance Sector. convince your clients? Istisna: Shari'ah ruling and its Is Islamic Microfinance for Muslims ? A compliance with standards big Misconception Ijarah: As an alternative to conventional Effective donor strategies to support Micro leasing Islamic Microfinance Diminishing Musharaka A Shariah Islamic Insurance (MicroTakful ) & Risk Compliant Instrument for Micro Housing Management Techniques in Islamic Finance. Microfinance Deposit Management Techniques for Islamic Insurance ( MicroTakaful ) An Islamic Microfinance Banks/Institutions. effective tool for Sustainable ( Modarabah & Musharaka) Development. Use of Zakah and Establishment of Waqf for Risk Management Techniques for Islamic Building up the Islamic Microfinance Microfinance Institutions BancaTakaful Channelize the Use of Zakah, Waqf and Co-operative MicroTakaful Products with Islamic models in Islamic Microfinance. Microfinance Institution Utilization of Waqf concept for the Case Studies development of the development and Strengthened the Islamic Microfinance Extending the product line and product

Islamic Microfinance An incredible tool for poverty alleviate

Who should attend this Forum?

Institutions & Banks r Local and International Donors Agencies r Rural Support Programs r Islamic and conventional Banks r Insurance and Takaful Companies r SMEs & Corporative Societies r NGOs and NPOs r Microfinance Professionals and Experts r Academia r Philanthropist and Investors r Regulators and Govt. Officials r Shariah Scholars and Experts

r Microfinance

Promotional and Marketing Opportunities

No Company can afford to miss this Great Interactive Marketing Opportunity! Islamic Microfinance Global Forum is practice driven but interesting for senior level executives event, designed to explore and share strategies within Islamic microfinance industry. This platform is expected to provide a healthy liaison and calls for tremendous marketing and promotion opportunities for the following business and social segments: Microfinance Institutions & Banks Local and International Donors Agencies NGOs and NPOs Islamic and Conventional Banks IT Companies Rating Agencies Investment Banks Local and Multinational Companies REITs Financial Solutions Providers.

December 08, 2012 - Dubai World Trade Centre - UAE.

Islamic Microfinance An Incredible tool for poverty alleviation

Organized by

In Association with

Centre of Islamic Banking and Economics

June 13, 2011 at Faisal Mosque Auditorium, Islamabad - Pakistan

Shariah Compliant Solutions for Microfinance

Centre of Excellence in Islamic Microfinance

Our Services in Islamic Microfinance

Islamic Microfinance Product Development Training & Capacity Building Shariah Advisory Research and Innovation Publications & Reports Networking and Awareness

w w w. a l h u d a c i b e . c o m / i m h d

For Registration Please Contact

AlHuda Centre of Islamic Banking and Economics

192-Ahmed Block, New Garden Town, Lahore - Pakistan Ph: (+92-42) 35913096-98 Fax: (+92-42) 35913056 E-mail: info@alhudacibe.com Web: www.alhudacibe.com

Você também pode gostar

- Press Release - AlHuda CIBE Signed MOU With Uzbekistan Lessors AssociationDocumento2 páginasPress Release - AlHuda CIBE Signed MOU With Uzbekistan Lessors AssociationAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- Press Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalDocumento2 páginasPress Release - For The Promotion of Halal Industry, Islamic Finance Plays An Important Role: Zubair MughalAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- Two Days Specialized Training Workshop On Islamic Banking & Finance in Washington, DC. USADocumento8 páginasTwo Days Specialized Training Workshop On Islamic Banking & Finance in Washington, DC. USAAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- Islamic Banking, Takaful and Islamic Microfinance TrainingDocumento7 páginasIslamic Banking, Takaful and Islamic Microfinance TrainingAlHuda Centre of Islamic Banking & Economics (CIBE)0% (1)

- Press Release - African Interest-Free Banking and Finance AwardsDocumento3 páginasPress Release - African Interest-Free Banking and Finance AwardsAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- Islamic Banking & Finance Training Workshop - UKDocumento8 páginasIslamic Banking & Finance Training Workshop - UKAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- African Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaDocumento3 páginasAfrican Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- (ATMS) - Deployment PlanDocumento8 páginas(ATMS) - Deployment PlanAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- Two Days Specialized Training Workshop On Islamic Banking & Finance in CanadaDocumento7 páginasTwo Days Specialized Training Workshop On Islamic Banking & Finance in CanadaAlHuda Centre of Islamic Banking & Economics (CIBE)Ainda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Danske Bank - DenmarkDocumento6 páginasDanske Bank - DenmarkCatalin CalinAinda não há avaliações

- N.E. Essay Titles - 1603194822Documento3 páginasN.E. Essay Titles - 1603194822კობაAinda não há avaliações

- Ebau Exam 2020Documento4 páginasEbau Exam 2020lol dejame descargar estoAinda não há avaliações

- Gonzalez SanmamedDocumento14 páginasGonzalez SanmamedGuadalupe TenagliaAinda não há avaliações

- Global Economy and Market IntegrationDocumento6 páginasGlobal Economy and Market IntegrationJoy SanatnderAinda não há avaliações

- International Journal of Hospitality Management: Po-Tsang Chen, Hsin-Hui HuDocumento8 páginasInternational Journal of Hospitality Management: Po-Tsang Chen, Hsin-Hui HuNihat ÇeşmeciAinda não há avaliações

- Hawaii High School Hall of HonorDocumento1 páginaHawaii High School Hall of HonorHonolulu Star-AdvertiserAinda não há avaliações

- Presentation - Education in EmergenciesDocumento31 páginasPresentation - Education in EmergenciesCharlie ViadoAinda não há avaliações

- Best Practices (Sraes)Documento19 páginasBest Practices (Sraes)encarAinda não há avaliações

- Presentation SG9b The Concept of Number - Operations On Whole NumberDocumento30 páginasPresentation SG9b The Concept of Number - Operations On Whole NumberFaithAinda não há avaliações

- Jennifer Valencia Disciplinary Literacy PaperDocumento8 páginasJennifer Valencia Disciplinary Literacy Paperapi-487420741Ainda não há avaliações

- Modern ScotsDocumento266 páginasModern ScotsLuis ARJOL PUEYOAinda não há avaliações

- Shine Candidates 1669027750Documento20 páginasShine Candidates 1669027750Rohan DilawarAinda não há avaliações

- Principles & Procedures of Materials DevelopmentDocumento66 páginasPrinciples & Procedures of Materials DevelopmenteunsakuzAinda não há avaliações

- Notification AAI Manager Junior ExecutiveDocumento8 páginasNotification AAI Manager Junior ExecutivesreenuAinda não há avaliações

- SALMAN KHAN PRESENTATION-EmotionsDocumento11 páginasSALMAN KHAN PRESENTATION-EmotionsIrfan Hassan Irfan Hassan100% (1)

- DLL Sektor NG AgrikulturaDocumento7 páginasDLL Sektor NG AgrikulturaFredielyn Santos LuyamanAinda não há avaliações

- Psychology of Meditation by DR Siripala LeelaratnaDocumento14 páginasPsychology of Meditation by DR Siripala LeelaratnaVisita LeelaratnaAinda não há avaliações

- Curriculum Research in Nursing-Lesson PlanDocumento13 páginasCurriculum Research in Nursing-Lesson Planavinash dhameriyaAinda não há avaliações

- Laser Coaching: A Condensed 360 Coaching Experience To Increase Your Leaders' Confidence and ImpactDocumento3 páginasLaser Coaching: A Condensed 360 Coaching Experience To Increase Your Leaders' Confidence and ImpactPrune NivabeAinda não há avaliações

- Intellectual WellnessDocumento9 páginasIntellectual WellnessHania DollAinda não há avaliações

- Bauhaus Building, GropiusDocumento3 páginasBauhaus Building, Gropiusivicanikolic100% (2)

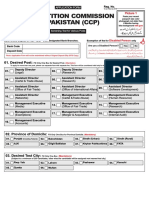

- Competition Commission of Pakistan (CCP) : S T NS T NDocumento4 páginasCompetition Commission of Pakistan (CCP) : S T NS T NMuhammad TuriAinda não há avaliações

- Quality Assurance in BacteriologyDocumento28 páginasQuality Assurance in BacteriologyAuguz Francis Acena50% (2)

- South African Book Fair Keynote AddressDocumento12 páginasSouth African Book Fair Keynote AddressCityPressAinda não há avaliações

- Virginia Spanish 2 SyllabusDocumento2 páginasVirginia Spanish 2 Syllabuskcoles1987Ainda não há avaliações

- 9th Math (Arts Group) Unit 5 Solved NotesDocumento26 páginas9th Math (Arts Group) Unit 5 Solved NotesAsad Ali MeharAinda não há avaliações

- IE468 Multi Criteria Decision MakingDocumento2 páginasIE468 Multi Criteria Decision MakingloshidhAinda não há avaliações

- ICT Curriculum For Lower Secondary 2Documento40 páginasICT Curriculum For Lower Secondary 2Basiima OgenzeAinda não há avaliações

- Certificate of AppreciationDocumento114 páginasCertificate of AppreciationSyrus Dwyane RamosAinda não há avaliações