Escolar Documentos

Profissional Documentos

Cultura Documentos

4-Vignali-Vignali-Pavicic (Credit To Authors Only)

Enviado por

akashniranjaneTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

4-Vignali-Vignali-Pavicic (Credit To Authors Only)

Enviado por

akashniranjaneDireitos autorais:

Formatos disponíveis

THE CONTRIBUTION OF OWN LABEL PRODUCTS TO A SUPERMARKET BRAND IN THE UK

Claudio Vignali1, Gianpaolo Vignali2, Jurica Pavii3 Recived: 24. 11. 2005. Accepted: 19. 3. 2006. Preliminary communication UDC: 658.626 (410)

In retailing, consumers are faced with an abundance of products and stores to choose from. Through own label products, supermarkets are attempting to differentiate their brand offering from their competitors. As a unique offering, own label brands are influential in attracting new customers and retaining current customers (Miranda and Joshi, 2003). Own label products have developed from an offering of low quality and low price products and are now a means of achieving store loyalty through a differentiated offering of high quality own label products (Corstjens, J. and Corstjens, M., 1999). This area of study was chosen due to the change in the marketing of own label products and to assess how important consumers perceive own label products in their choice of supermarket. Within the qualitative research, two supermarkets, ASDA and Sainsburys, were selected due to their similar market share yet difference in store and product offerings. The quantitative research does not focus on specific supermarkets but investigates respondents attitudes towards their reasons for choice of supermarket and the importance placed on own label products.

BRANDS IN RETAILING In retailing, a brand name can be more than a name or make of product, and is argued that it represents embodiments of special qualities, values and

1

2 3

Claudio Vignali, PhD, Professor, Leeds Metropolitan University The Arnold Zif, Chair in Retail Marketing Management Leslie Silver International Faculty, Leeds LS1 3HE, Civic Quarter Leeds LS1 3HE, Phone + 44 113 283 6722, E-mail: C.Vignali@leedsmet.ac.uk Gianpaolo Vignali, MSc, Lecturer Leeds Metropolitan University Leslie Silver International Faculty Jurica Pavii, PhD, Associate Professor, Zagreb, University Graduate School of Economics and Business

53

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

images (Gabriel and Lang, 1995, p.61). Klein (2000) further argues that brands are not products but are now ideas, attitudes, values and experiences. Grace and OCass (2002) argue that a brand name holds economic and symbolic values in consumers eyes. This is further argued by OCass and Frost (2002) who argue that a brand is more than a name and holds symbolic properties. It is these symbolic properties that make brands attractive and give them status in consumers eyes. Brands are important in retailing for both consumers and retailers as a brand name differentiates a product from its competitors. It is a name, symbol, design or some combination which identifies the product of a particular organisation as having a substantial differentiated advantage.(Omalley, 1991 p.107). This differentiation from competitors can be achieved through a fusion of product packaging, brand name, price, quality and promotion. A brand can be defined as an identifiable product, service, person or place, augmented in such a way that the buyer or user perceives relevant, unique added values, which match their needs most closely.(DeChernatony and McDonald, 1992 p. 237). It is these unique added values that transform a product into a brand name. For retailers, a brand provides identification of their products with unique associations to the store and legally protects unique features (OCass and Frost, 2002). For consumers, a brand can identify quality and a recognised brand can reduce search time in a buyers decision-making process. Corstjens, et al. (1999) argue that a brand name has three roles of identity, trust and images and associations. Randall (2000) expands on these three roles and identifies 5 main functions of a brand as a form of identity, a shorthand summary, security, differentiation and added value. Knee (2002) argues that consumers evaluate a brand through the recognisability, meaning, legitimacy and consistency of the offering. A strong brand contributes to the image of a product and aids repeat purchases, which consequently leads to brand loyalty. Rooney (1995) argues that brands attract and keep consumers through the attributes offered by the brand such as value, image, prestige or lifestyle. This is achieved as loyalty to a strong brand is often an aspirational act, enhancing self-image and self-esteem; it reinforces a sense of peer group membership, actual or desired; it reduces worry and uncertainty; and it simplifies choices and saves time (Wileham and Jary, 1997 p.17). A brand name enhances the success of establishing a new product as the association with a strong brand name reduces the risk of purchasing a product of which the consumer has little or no knowledge (Montgomery and Werkerfelt, 1992).

54

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

55

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

SUPERMARKETS AS A BRAND A study by Arnold et al. (1983) identifies the most important factors in supermarket choice as location, convenience, low price, fast check out, friendly courteous service, best weekly specials and shopping environment (Kahn and McAlister, 1997 p. 94). Supermarkets have further developed their offerings to meet and exceed these expectations of consumers and through developing their store as a brand have attempted to differentiate their offering in the market place. A stores position in the market is based on the relative aspects of customers and competitors, location, merchandise, atmosphere and marketing mix elements (Ness, Gorton, and Kuznesof, 2002, p. 509). Corstjens, et al. (1999) and Wileham et, al. (1997) argue that although location was once the only major differential in a stores offering, with the increase in mobility of shoppers, location no longer dominates consumers choice in supermarket. Wileham, et al. (1997) further this argument and contend that location holds no brand differentiation in the market place, and this differentiation can be achieved through range and price of products and service. Supermarkets have differentiated their store offerings to create loyalty among their shoppers. Once stores are differentiated one from another, retailers can improve their profits.(Corstjens, et al. 1999, p. 138.) Newman and Cullen (2002) expand on this argument and describe three methods a retailer can adopt in order to turn their store into a brand and thus create a differentiated advantage: develop a reputation for stocking quality branded product. brand its stores on their competitiveness and price. develop a range of own branded products. It is argued that there are actually seven key elements in a retail brand (Foxall, et al. 1994, Corstjens, 1995, Aaker, 1996, and Koskinene, 1999): the store itself, service, fresh produce, own label ranges, communication, price and quality positioning and access to the store, as cited in Landsverk, Hughes and Fearne (2003). Knee (2002) argues that a retailer must ensure that its brand offering must include the characteristics of brand value, a brand system and a brand structure. A retailer can achieve a brand offering through the long term investment in people and skills, in-store brand product development and quality control, in marketing, in consumer research, and in supplier relationships. (Wileham, et al. 1999, p.19). Newman, et al. (2002) support this argument and argue that

56

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

through these methods a retailer can maintain a differentiated position in the market place, which may consequently increase customer loyalty. Consumers evaluate a retailer on the attributes of store layout, fresh food, own label ranges, service, location and price positioning (Landsverk, Hughes, and Fearne, 2003). A retailers offering of a brand is the total service they offer through the range and assortment of goods, the layout of the store and the quality of the staff (Randall, 2000). Own Label Brands With the establishment of quality own label products, retailers are able to differentiate their stock from other retailers and manufacturer/ national brand products, while also holding a greater control over product quality, stock and price, (Uncles and Ellis, 1989, p. 57) and with an outcome of higher gross margins. Moore (1995), cited in Birtwistle and Freathy (1998) furthers this argument, maintaining that these attributes make own label brands an effective tool in gaining competitive advantage over other retailers as the own label products provide the retailer with intangible, symbolic and differential characteristics that a competitor can not imitate. Originally the low price, low quality products were supported by the stores turnover, however it was the introduction of higher quality, higher priced products which improved the stores appeal (Corstjens, et al. 1999). Key Note (2003) uphold this argument and that through the quality, guarantee of satisfaction and good value, own label products can hold the success for retailers. Own brands are influential in attracting new customers and retaining current customers as they add depth and breadth to the retailers existing ranges and provide a promotional pull(Miranda, et al. 2003 p. 44). Through offering products and ranges different to that of their competitors, retailers attempt to create a competitive advantage as exclusivity is built to the supermarket through its unique offering of quality own label brands. It is the high quality store brands that provide differentiation, store loyalty and profitability. In contrast, low quality store brands allow the supermarket to target the price sensitive segments (Corstjens and Lal 2000). Own Labels in the Grocery Sector The UK has one of the most developed own label markets. In the 1980s own label products were significantly brought into the forefront of grocery retailing with Marks and Spencer producing a higher quality of own label products. The new ranges were appealing to consumers and marked a change in

57

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

the way supermarkets were to compete on own label products. Waitrose arose as a competitor to Marks and Spencer, offering the consumers an alternative high quality of own label products (Key Note, 2001). Since then, all leading supermarkets have firmly established higher quality own label products. Sainsburys Taste the Difference, Tescos Finest, and ASDAs Extra Special have all proved to be successful ranges and are clearly marketed as a superior product range through quality, packaging and logos. Own label products have evolved from the simple cost cutting offers and supermarkets now offer a range of own label products to target different segments of the market. It became advantageous for retailers to offer products at different levels of quality and price to attract a broader spectrum of consumers since it was seen that price was important for a certain group of shoppers, but relatively less important to others. Since retailers must go for many segments, they must find benefits which motivate each type of shopper to become loyal to the store. (Corstjens, et al. 1999, p.139). For these reasons, Mintel (2003) identifies the three basic own label offerings and the segments they are aimed at as: ECONOMY: for consumers who perceive quantity to be more important than quality. STANDARD OWN LABEL: for consumers who believe the branded equivalent is not worth the premium price. PREMIUM: for consumers looking for added quality. The development of own-label ranges has grown into new ranges of healthy eating, organic and ranges specifically tailored to children's needs. Mintel (2003) argues that these ranges have contributed to the changing perceptions of own label products and that consumers now have considerable trust in leading grocery retailers and their own label product ranges.

Table 1: Increase of economy own label products

SUPERMARKET OWN LABEL ECONOMY RANGE ASDA:- Smart Price Tesco:- Value Sainsburys:- Economy Number of products in 2000 300 200 130 Number of products in 2002 640 400 140

Source: Mintel 2003.

Although own label products have enjoyed a growth in the market, this growth is not evenly spread across all product categories in the grocery sector. Mintel (2003) identifies the chilled packaged goods as a strong sector of penetration for own label products and claims that own label products even dominate some categories to the virtual exclusion of national brands in the

58

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

chilled foods sector.

59

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

Hypotheses As it was discussed earlier, there are many contributions to the image of a supermarket, including own label products, store aesthetics, assortment and variety of national product ranges, price of products, service and quality of experience in store. There has been a clear improvement in own label brands with the emphasis moving away from the economy ranges, therefore: H1: Consumers now look to quality as the most important factor in the choice of own label products. Consumers are still cautious in some areas, and look to familiarity and trust in national brands when a purchase is deemed risky, therefore: H2: Consumers are still unwilling to buy own label products in certain product categories. Supermarkets are developing their offering of a store into a brand offering. The leading four supermarkets are positioning themselves through differentiation in order to secure market share, therefore: H3: Consumers are looking to a supermarket brand as a whole in their choice of supermarket. Own label products are important to supermarkets in differentiating their brand offering from the competitors' and build brand loyalty, therefore: H4: Own label products are an important factor for consumers in their choice of supermarket. Methodology The research entailed in this article consisted of both primary and secondary research. Through the secondary research - conceptual framework of own label products in the grocery sector has been developed and through primary research methods the issues surrounding own label have been investigated. It was necessary to collect responses from a broad range of age groups, salary brackets and supermarkets visited, in order to gain a full understanding of the market. The aim was to, through gaining information regarding the respondents age group and salary bracket, gather the relevant information to analyse the influential factors against the data collected. A proposed figure of one hundred questionnaires to be collected was set in order to obtain a valid result.

60

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

The questionnaires were designed to fulfil the objective of analysing the perceptions of own label products through questions nine and ten. Question nine was asked in order to understand which product categories of own label products the respondents were willing to purchase. The question was constructed from the information gained from ASDAs and Sainsburys websites (www.asda.com and www.sainsburys.co.uk). In question ten, respondents were asked to rank each factor according to the degree of importance to them when purchasing own label products. A Likert scale was used with 1= very important, 2= important, 3= somewhat important, 4= neutral, 5= somewhat not important, 6=not important, 7= not at all important. A scale of seven points was chosen as it allowed for a broader range of respondents answers and therefore a clearer analysis of the importance placed on the attributes of own label products. To achieve the objective of determining the reasons for choice in supermarket, question six was constructed from the information collected from relevant literature (Kahn et al. 1997, Corstjens et al. 1999 and Newman et al. 2002). This information was converted into choices available for the respondents to choose from. One hundred questionnaires were administered and seventy questionnaires were collected and the results were entered into SPSS for analysis. This gave a response rate of 70%. Among the responses, 46 respondents were female and 24 male, which equates to 65.7% and 34.3% respectively. From the seventy completed questionnaires, there was a heavy percentage of 18-25 year olds. This was to be expected as many questionnaires were administered at Leeds Metropolitan University among students. The percentage of respondents in the 42-49 and 50+ brackets were exactly the same with 20% each. The age brackets that were not as evenly represented were 26-34 with 12.8% and 35-41 with 5.71%. There were no responses from the under 18 bracket. Responses were obtained from every age bracket in the targeted sample. The largest percentage in the salary bracket of respondents is the under 10,000 group with 41.43%. This may be due to the amount of 18-25 year old respondents, who were mainly students and therefore not in full time jobs. This segment will be compared against the price of own label products to analyse whether these respondents are price sensitive. In order to gain an understanding of the frequency of respondents supermarket visits and ensure that participants visit a supermarket, the

61

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

respondents were asked about the frequency of their visits. 91.43% of respondents visit a supermarket every two weeks or more frequently. Figure 1. illustrates that each major supermarket brand is represented by the respondents. This range of responses allows for an analysis of the market. Other supermarkets recorded as the main grocery shop included Marks and Spencer, CO-OP and Waitrose.

Location No. of respondents 80 60 40 20 0 Factors in choice of supermarke t Supermarket chain Price range Special offers Range of own brands Range of national brands Good service Good value Good quality of products Parking Figure 1: Factors in choice of supermarket

It is clear that respondents do consider more than one factor of a supermarket offering in their choice of patronage to a supermarket as supported by Kahn et al (1997), Randall (2000), Ness et al (2002). This question reveals which factors are influential to consumers in their choice of supermarket. However, it does not show the importance of these factors to consumers.

Table 2: Important factor in choice of supermarket (1)

Importance of factors in choice of supermarket Location Good value Good quality of products Price range Parking Special offers Own label range National brand ranges Count 35 9 8 7 4 3 2 1 Col % 50.7% 13.0% 11.6% 10.1% 5.8% 4.3% 2.9% 1.4%

In total, eight factors were selected as respondents' most important choice in supermarket. Location accounted for 50.7% of responses. Only supermarket chain and good service were not chosen as the first factor of choice in supermarket. This data illustrates that location is very important in choice of supermarket to respondents. However, just under 50% of respondents do not consider location as the most important factor, which supports Corstjens et al (1999) who argue that location is an important factor in consumers' choice of supermarket but it does not predominantly influence all consumers.

62

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

Table 3: Important factor in choice of supermarket (2)

Importance of factors in choice of supermarket Good value Price range Special offers Parking Good service Good quality of products Location National brand ranges Supermarket Chain Own label range Count 13 10 9 8 7 7 6 5 2 1 Col % 19.1% 14.7% 13.2% 11.8% 10.3% 10.3% 8.8% 7.4% 2.9% 1.5%

Ten factors were selected by respondents as their second most important choice in supermarket. The most frequent response in this category was good value with 19.1% of the share. Price range and special offers were claimed by 14.7% and 13.2% of respondents respectively. Good service accounted for 10.3% of respondents' second important factor, whereas it did not account for any responses in the most important factor. The factors selected show a more even spread of responses and do not illustrate a substantial preference for one factor. Therefore, respondents are more aware of different factors in their second factor of choice in supermarket.

Table 4: Important factor in choice of supermarket (3)

Importance of factors in choice of supermarket Parking Price range Good quality of products Special offers Location Good value Own label range National brand ranges Other Good service Count 11 9 9 8 6 6 5 5 2 1 Col % 17.7% 14.5% 14.5% 12.9% 9.7% 9.7% 8.1% 8.1% 3.2% 1.6%

In respondents' third most important factor of supermarket choice, parking accounted for the largest percentage share with 17.7%. Price range and good quality of products both had an equal response of 14.5% of the responses each. From these statistics it is clear that accessibility is an important factor in choice of supermarket. Supermarket chain did not feature as a factor, however of the two other factors selected, these included familiarity of supermarket layout which means the respondent visits the same store but not purely because of supermarket chain. The second other factor was the overall range of all products, which shows that equal importance was placed on national ranges and own label ranges.

63

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

Overall, the most important factor to respondents in choice of supermarket was location. The second most important factor was good value and the third was parking. Once location was accounted for, respondents considered a range of factors in choice of supermarket and in the offerings of a supermarket. Good value is clearly important to respondents but does not equate to purely low price. The range of both national brands and own label brands do not feature heavily as a factor in choice of supermarket. Therefore, it is clear that respondents do not look to the products on offer but to the offerings of the supermarket brand as a whole such as the value of shopping at a certain supermarket, or the overall price range, special offers and to the quality of products. Added values of service did feature as an important factor illustrating that respondents are considering their shopping experience as a whole and not purely basing their shopping location on the lowest price. Supermarket chain was only selected by one respondent. The second important factor in choice of supermarket however was selected by 15.7% of respondents in question six. This illustrates that consumers do not base their choice of supermarket on brand name alone but look to the brand offerings of the chain first. This data supports Kahn et al (1997) and Corstjens et al (1999) who both argue that location is the most important factor but following that other factors clearly are important in consumers 'choice of main grocery shopping. This clearly illustrates that retailers must do more than just find the right location as consumers look to the brand offering as a whole in their choice of supermarket

Baby Bakery & Cakes Beers, Wines & Spirits Biscuits Cereal Condiments Cooked Meats Dairy Frozen Fruit & Veg Laundry & Household Meat, poultry & fish Organic and 'Free From' Pet care Ready Meals Snacks & Crisps Soft Drinks Tinned & Packet Goods Toiletries & Pharmacy World Food Ranges Hot Drinks

45 40 35 No. of People 30 25 20 15 10 5 0 Categories of Ranges

Categories of Ranges

Figure 2: Categories of own label products purchased 64

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

This data does not support the argument that own label products are important in building loyalty to supermarkets, as argued by Kahn et al (1997) Corstjens et al (1999), Key Note (2003) and Miranda et al. (2003). Own label products only accounted for 15 responses, and was only selected by two respondents in the first most important factor, one respondent in the second important factor, and five respondents in third most important factor. This does illustrate that some consumers are looking to own label products in their choice of supermarket, but the majority are looking to the factors of location, value, parking, price and quality when choosing which supermarket to frequent. In order to provide an analysis of own label attributes it was necessary to asses whether respondents purchased own label products. Of the seventy respondents, 98.57% purchase own label products. Only one respondent did not purchase own label products. The most frequent response was Frozen Produce with 41 respondents claiming that here they were willing to purchase. Dairy had 40 responses and Bakery and Cakes had 39 responses. There was no clear outright product category which a strong majority of respondents would be willing to purchase. This illustrates that, although 98.57% of respondents do purchase own label products, there is no clear leadership of own label product ranges over national brands and there are categories in which respondents are not willing to purchase own label products. The categories with the lowest responses were Baby and Pet Care, with only 3 and 5 respondents respectively claiming they would be willing to buy own label products in these ranges. However these responses cannot be fully analysed due to the lack of knowledge regarding the respondents' background to ascertain whether they have a baby or pet. This is therefore an oversight in the collection method. Further investigation would be needed to find out the respondents' ownership of pets and parental status. The next lowest responses included Beers, Wines and Spirits and Hot Drinks, both with 13 responses. Therefore, 81.4% of respondents did not select these categories as the products they would be willing to purchase. This may be due to strong national brand loyalty in these categories or a perceived risk in the purchase in which the own label brand does not hold a strong perceived quality in the consumers' eyes and therefore make the purchase too risky to switch brands. Mintel (2003) identified alcoholic and carbonated drinks as categories where there was less own label penetration. This data to some extent supports these findings. However, carbonated drinks were not categorised as a single

65

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

category but were intended to fall within soft drinks. This error in results collection obstructs the support of carbonated drinks as a category of improvement for own label products. This data supports the hypothesis that consumers are still unwilling to purchase own label products in certain categories. This may be due to consumers not evaluating own label brands to be of comparable quality compared to the established national brands in these categories. Further investigation would need to look at the reasons for consumers not purchasing these categories.

Table 5: Percentage table of importance placed on attributes of own label products

Attribute Quality Freshness Value Price Quantity Loyalty Image Packaging Advertising Cum percent of importance 97.1 97.1 94.2 84.1 75.4 42.4 36.4 17.9 17.9 Neutral percent 1.4 1.4 0 2.9 15.4 21.2 19.7 22.4 14.9 Cum percent of not important 1.4 1.4 5.7 12.9 9.2 36.4 43.9 59.7 67.2

Table 3. illustrates the cumulative percentages of the differing degrees of importance placed on the attributes of own label products, along with the neutral percent and the cumulative percent of the differing degrees of unimportant responses. The two most important attributes were quality and freshness. These were followed by value, price and quantity. The least important factors to respondents included advertising, packaging and image of the own label brand. From this data it is clear that price is no longer the determining factor in choice of own label products for all consumers, which supports the arguments of Corstjens et al (1999) and Blythe (1997). This data supports the hypothesis that consumers look for quality in their purchase of own label products. With 84.1 percent of respondents claiming differing degrees of importance regarding price in their purchase decision on own label products, price is still an important factor. However, it is the attributes of quality and freshness which received the highest percent of respondents claiming a degree of importance,

66

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

both 97.1 percent. To further investigate the importance of price and quality, cross tabulation has been used against salary to assess whether salary bracket has an affect on the importance of these attributes. The row percentages show the responses for each salary bracket due to the uneven spread of results.

Table 6: Cross tabulation of importance of quality against salary bracket

Importance of quality of own label products somewhat very somewhat not important important important neutral important Row % Row % Row % Row % Row % under 10,000 31.0% 51.7% 13.8% 3.4% 10,001- 19,999 84.6% 7.7% 7.7% 20,000- 29,999 78.6% 21.4% 30,000- 39,999 85.7% 14.3% 40,000+ 66.7% 33.3%

Salary bracket of subject

Quality appears to have a degree of importance in all salary brackets. The highest percentage of respondents in all but under 10,000 bracket, claimed quality was very important In the under 10,000 bracket over half of these respondents claimed quality as important. The majority of all respondents in all salary brackets claimed quality was important and very important, this therefore supports the hypothesis that consumers do look for quality as an important factor in own label products. The importance of quality may explain respondents' unwillingness to purchase own label products in certain categories (Question nine). If consumers place such a high degree of importance on quality, own label brands may not hold the same weight in their brand name in comparison to national brands to overcome the risky purchase. As Batra et al. (2000) argue, consumers are purchasing own label products in low risk categories.

Table 7: Cross tabulation of importance of price against salary bracket

very important Row % Salary under 10,000 51.7% bracket of 10,001- 19,999 61.5% subject 20,000- 29,999 38.5% 30,000- 39,999 50.0% 40,000+ 16.7% Importance of price of own label products somewhat somewhat not not important important neutral important important Row % Row % Row % Row % Row % 34.5% 3.4% 10.3% 23.1% 15.4% 46.2% 7.7% 7.7% 12.5% 12.5% 50.0% 16.7% not at all important Row %

25.0% 16.7%

The cumulative percentages of respondents claiming a differing degree of importance in price clearly indicates that price sensitivity increases as salary bracket decreases. The highest cumulative percentage fell within the under

67

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

10,000 salary bracket with 89.6%, in the 10,001-19,999 and 20,00029,999 salary bracket cumulatively 84.6% and 84.7% respectively, claimed a differing degree of importance in the price of own label products. The lowest cumulative percentages fell with the 30,000-39,999 salary bracket in which 75% of respondents claimed price was to any degree important to them and the 40,000+ salary bracket in which 66.7% of respondents claimed that price was to any degree important to them. In comparison to the cumulative percentages of price as not important to any degree, 25% of the 30,000-39,999 salary bracket claimed price was not at all important. The highest cumulative percentage fell with the 40,000+ salary bracket with 33.4% of respondents claiming price was to differing degrees not important. This data illustrates that a higher importance is placed on price in the lower salary brackets. As Corstjens et al (1999) argue, price is only important to certain shoppers and is less important to others. This data suggests that the importance of price is dependent on respondents' salary bracket and the importance decreases as salary increases.

60 No. of responses Budget 40 20 0 Range Standard Premium Dieting Organic Dietary needs Childrens

Figure 3: Product ranges purchased

This question was asked to gain an understanding of which ranges of own label products respondents were willing to purchase. Initially as own label products were introduced as a budget economy option, the question was intended to evaluate the purchase of the Budget range in comparison to the other own label ranges now available. Both the Standard and Premium ranges have a higher share of responses. 48 respondents claimed they would purchase a standard own label product which was the highest response with 68.6%. 44 respondents claimed they would purchase a premium own label range which equalled 62.9% of the respondents. 27 respondents claimed they would purchase a Budget range product; lower than both the response for the Standard and Premium ranges.

68

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

The lowest response rate was the Dietary needs and Childrens ranges, with only six and seven respondents respectively claiming they would purchase these ranges. This data is not sufficient to claim that consumers are unwilling to purchase these own label products as there was no information gained about the respondents as to whether they had children or dietary needs. This oversight in collection precludes analysis of the purchase of these ranges and further investigation would be needed to ascertain whether respondents were purchasing for children or pets. The following cross tabulation results analyse the correlation between respondents' importance on quality and purchase of budget, standard and premium ranges in order to determine which ranges are purchased against the respondents needs for quality.

Table 6: Cross tabulation of importance of quality against purchase of budget own label ranges

Importance of quality of own label products somewhat very somewhat not important important important neutral important Col % Col % Col % Col % Col % 2.4% 68.3% 57.1% 20.0% 100.0% 29.3% 42.9% 80.0% 100.0%

Budget ranges

n y

(n= no, y= yes) From the above results it is shown that a higher percentage of consumers who claim quality is very important and important do not purchase budget own label ranges. A higher percentage of respondents who claim quality is somewhat important do purchase budget own label ranges. These respondents who place less emphasis on quality however did not indicate a degree of importance in desire for quality. This data indicates that the more quality sensitive respondents are, the less likely they are to purchase budget own label brands.

Table 7: Cross tabulation of importance of quantity against purchase of budget own label ranges

very important Col % 66.7% 33.3% Importance of quantity of own label products somewhat somewhat not not important important neutral important important Col % Col % Col % Col % Col % 61.1% 52.6% 50.0% 100.0% 38.9% 47.4% 50.0% 100.0% not at all important Col % 100.0%

Budget ranges

n y

Mintel (2003) argues that budget ranges are aimed at consumers who perceive quantity to be more important than quality. However, Table 10 does not support this as a lower percentage of respondents claiming quantity as

69

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

having a degree of importance to them claim to purchase budget own label compared to those that do not.

Table 8: Cross tabulation of importance of quality against purchase of standard own label ranges

Importance of quality of own label products somewhat very somewhat not important important important neutral important Col % Col % Col % Col % Col % 2.4% 31.7% 23.8% 40.0% 65.9% 76.2% 60.0% 100.0% 100.0%

Standard ranges

n y

Table 8. shows the column percentages of the cross tabulation results for the importance of quality against the purchase of own label products. A higher percentage of respondents who claim a differing degree of importance in quality, purchase standard own label ranges. All 100% of respondents who claimed they were neutral and perceived quality as somewhat not important, purchase standard own label products. This data indicates that quality sensitive respondents are likely to purchase standard own label ranges. Supermarkets have been trying to improve the quality of their standard own label ranges and this appears to be successful with the quality conscious respondents purchasing own label products.

Table 9: Cross tabulation of importance of quality against purchase of premium own label ranges

Importance of quality of own label products somewhat very somewhat not important important important neutral important Col % Col % Col % Col % Col % 2.4% 29.3% 28.6% 100.0% 100.0% 68.3% 71.4% 100.0%

Premium ranges

n y

Table 9. shows the column percentages from the cross tabulation of the purchase of premium own label ranges against the importance of quality. From this data it is clear that quality is important to respondents and a higher percentage of respondents who claim quality is very important and important purchase premium ranges than those who do not purchase premium ranges. Premium ranges are positioned as the highest quality of an own label offering and therefore cater for the quality conscious. From the three tables, it is clear how important quality is to consumers. It also shows an increase in the purchase of own label products against the

70

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

increase in quality of the ranges. The figures for standard and premium purchases are similar and indicate that supermarkets own label offerings are improving not only in premium ranges but also in the standard range offering. Even the budget ranges, originally seen purely a cheap and basic offering are purchased by the quality conscious respondents. Raju (1995) argued that own label products were purchased by price and value sensitive consumers, however this data illustrates that quality conscious consumers now purchase own label products.

Importance of own label products to choice of supermarket brand Frequency 6 5 16 17 6 8 12 70 Percent 8.6 7.1 22.9 24.3 8.6 11.4 17.1 100.0 Valid Percent 8.6 7.1 22.9 24.3 8.6 11.4 17.1 100.0 Cumulative Percent 8.6 15.7 38.6 62.9 71.4 82.9 100.0

Table 10: Importance of own label products

Valid

very important important somewhat important neutral somewhat not important not important not at all important Total

The highest response to this question fell with 24.3% of respondents claiming they were neutral. The cumulative percentage of respondents who claimed own label products were to any degree important was 38.6% compared to the cumulative percentage of respondents who claimed own label products were to any degree not important being 37.1%. This figure shows that there is a marginal preference for importance of own label products. This spread of figures illustrates that consumers, although purchasing own label products, still do not look to own label products as a predominant determinant factor in their choice of supermarket. This data does not allow for a complete justification of the hypothesis that own label products are an important factor to consumers in their choice of supermarket. Although a higher percentage of respondents fall into the important categories than the unimportant categories, the number of respondents who claim to be neutral diminishes from this figure. This is in comparison to question six where only 21.4% of respondents claimed that they considered own label products in their choice of supermarket. In this question, 38.6% claimed that own label products were to differing degrees important. This may be due to the wording of the question. In question six, respondents were given a list of options to choose from, whereas this question gave them the opportunity to rate the level of importance of own label products. This may be interpreted that consumers do consider the brand offering as a whole, but own label products are growing in importance with consumers.

71

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

It is argued that own label products build loyalty with consumers (Kahn et al 1997, Corstjens et al 1999, Miranda et al. 2003 and Key Note 2003). This data neither fully supports this argument nor does it support Richardson et al (1994) who argue that consumers do not distinguish among the different offerings of supermarkets. This data shows, with 38.6% of respondents claiming a degree of importance of own label products in their choice of supermarket, that there is still the potential of growth within this sector of supermarket retailing. CONCLUSION From the research conducted it was apparent that own label brands were not the only method of achieving a brand offering. Consumers are looking to a range of attributes and with the supermarket industry being so competitive, consumers are able to demand more from their supermarket. Own label products are growing in importance in consumers' choice of supermarket. However, they are not the sole determinant in choice of supermarket. This research has therefore highlighted that own label products are still growing in importance and retailers must continue to build their offering into a brand offering if they are to secure and increase their market share. Through the use of questionnaires, it became apparent that consumers are not as willing to purchase certain categories of own label products. This data therefore supports Batra et al. (2000) that consumers are prone to purchase own label products in low risk categories. It is within the high risk categories that supermarkets can continue their expansion of own label ranges. To do this, the retailer must build consumer confidence with the overall supermarket brand, therefore transferring confidence to the own label ranges. As Aaker (1996) argues, a strong brand name can aid consumers in their choice of brands. REFERENCES 1. 2. 3. 4. Aaker, D. A. (1996) Building Strong Brands, New York, Free Press. Barbour, S. & Kitzinger, J. (1999) Developing Focus Group Research: Politics, Theory, & Practice. London, Sage Publications Ltd. Batra, R. & Sinha, I. (2000) Consumer-level factors moderating the sources of private label brands across product categories: the role of perceived risk. Journal of Retailing. 76 (2) pp.175-191. Birtwistle, G. & Freathy, P. (1998) More than just a name above the shop: a comparison of the branding strategies of two UK fashion retailers. International Journal of Retail & Distribution Management, 26 (8), pp. 318-323.

72

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23.

Blaxter, L., Hughes, C. & Tight, M. (2001) How to Research. Second Edition. California, Sage Publications Inc. Blythe, J. (1997) The Essence of Consumer Behaviour. Hemel Hempstead, Prentice Hall. Burns, R. B., (2000) Introduction to Research Methods. Fourth Edition. London, Sage Publications Ltd. Corstjens, J., & Corstjens, M. (1999) Store Wars: The Battle for Mindspace and Shelfspace. Chichester, John Wiley & Sons Ltd. Corstjens, M. & Lal, R. (2000) Building Store Loyalty Through Store Brands. Journal of Marketing Research. 37 (3) August, pp.281-292. Chrzanowska, J. (2002) Interviewing Groups and Individuals in Qualitative Market Research. London, Sage Publications Ltd. De Chertony, L., & McDonald, M. H. B., (1992) Creating Powerful Brands. Oxford, Butterworth Heinemann. Denscombe, M. (1998) The Good Research Guide: for small-scale social research projects. Buckingham, Open University Press. Fowler, F. J. (1993) Survey Research Methods. Second Edition. London, Sage Publications Ltd. Gabriel, Y. & Lang, T. (1995) The unmanageable consumer: Contemporary Consumption and its Fragmentations. London, Sage Publications Ltd. Grace, D. & OCass, A. (2002) Brand associations: looking through the eye of the beholder. Qualitative Market Research: An International Journal, 5 (2), pp. 96-111. Hakim, C. (1987) Research Design: Strategies and choices in the design of social research. London, Routeledge. Hind, D. (1994) Transferable Personal Skills. UK, Business Educational Publishers Ltd. Kahn, B. E. & McAlister, L. (1997) Grocery Revolution: The New Focus on the Consumer. Reading, Addison-Wesley Educational Publishers Ltd. Key Note (2001) Own Brands. Ninth Edition. Hampton, Key Note Publications. Key Note (2003) Own Brands.[Internet] Tenth Edition. Hampton, Key Note Publications. Available from:<http/www.keynote.co.uk/kn2k1/>[Accessed 3 March 2004] Klein, N. (2000) No Logo. London, Harper Collins Publishers. Knee, C., (2002) Learning from experience: five challenges for retailers. Journal of Retail & Distribution Management, 30 (11) pp. 518-529. Krueger, R. A. & Casey, M. A. (2000) Focus Groups: A practical Guide for applied research. Third Edition. London, Sage Publications Ltd.

73

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

24. 25. 26. 27. 28. 29. 30. 31.

32. 33. 34. 35. 36. 37. 38. 39. 40.

Landsverk, O. B., Hughes, D., Fearne, A., (2003) Shopper Loyalty and Store Choice: Insights from a study of Norwegian supermarkets. European Retail Digest, 38, June. Mintel. (2003) Food Retailing. Available from:<http://www.reports. mintel.com>[Accessed 20 February, 2003] Mintel. (2003) Own Label Brand . Available from: <http://www.reports. mintel.com> [Accessed 5 December, 2003] Miranda, M. J., & Joshi, M. (2003) Australian retailers Need to Engage with Private Labels to achieve Competitive Difference. Asia Pacific Journal of Marketing and Logistics, 15 (5) pp. 34-47. Montgomery, C., & Werkfelt, B. (1992) Risk reduction and umbrella branding. Journal of Business. 65 pp. 31-50. Ness, M., Gorton, M., & Kuznesof, S.(2002) The Student Food Shopper: Segmentation on the basis of attitudes to store features and shopping behaviour. British Food Journal. Vol. 104, No. 7. pp. 506-525. Newmann, A.J. & Cullen, P. (2002) Retailing: Environment & Operations. Padstow, TJ International. OCass, A. & Frost, H.(2002) Status Brands: Examining the effects of non-product related brand associations on status and conspicious consumption. The Journal of Product and Brand management , 11 (2), pp. 67-88. Omar, O, (1999) Retail Marketing, London, Pitman. OMalley, D., (1991) Brand means business. Accountancy, 107, pp. 107108. Raju, J.S., Sethuraman, R., & Dhar, S. K, (1995) The introduction and performance of store brands. Management Science, 41 (6), pp. 957-978. Randall, G. (2000) Branding: A Practical Guide to Planning Your Strategy. Second Edition. UK, Kogan Page Ltd. Richardson, P. S., Dick, A. S., & Jain, A.K. (1994) Extrinsic and intrinsic cue effects on perceptions of store brand quality. Journal of Retailing. 58 (4) pp. 28-36. Rooney, J. A. (1995) Branding: a trend for today and tomorrow. Journal of Product and Brand Management, 4 (4), pp. 48-55. Saunders, M., Lewis, P,. & Thornhill, A. (2003) Research Methods for Business Students. Third Edition. Harlow, Pearson Education Ltd. Shimp, T. A., & Beardon, W. O., (1982) Warranty and other extrinsic cue effects on consumers risk perceptions. Journal of Consumer Research, 9, June, pp. 38-46. Sheinin, D. A., & Wagner, J. (2003) Pricing store brands across categories and retailers. The Journal of Product and Brand Management, 12 (4), pp. 201-219.

74

Management, Vol. 11, 2006, 1, pp. 53-73 C. Vignali, G. Vignali, J. Pavii: The contribution of own label products to a supermarket brand..

41. 42. 43. 44. 45. 46.

Tesch, R. (1990) Qualitative Research: Analysis Types and Software Tools. New York, Falmer. Uncles, M. & Ellis, K. (1989) The Buying of Own Labels. European Journal of Marketing, 23 (3), pp. 57-70. Walsh, M. (2001) Research Made Real: A guide for students . Cheltnam, Nelson Thornes Ltd. Wileham, A. & Jary, M. (1997) Retail Power Plays: From Trading to Brand Leadership. Basingstoke, Macmillan Press Ltd. www.asda.com[Internet] Available from: <http://www.asda.com> [Accessed 12 December, 2005] www.sainsburys.co.uk [Internet} Available from: <http://www. sainsburys.co.uk>[Accessed 12 December, 2005]

DOPRINOS VLASTITIH TRGOVAKIH MARKI RAZVOJU TRINE MARKE SUPERMARKETA U VELIKOJ BRITANIJI Saetak

Potroai se u maloprodaji suoavaju s obiljem proizvoda i maloprodajnih lokacija. Uz pomo vlastitih trgovakih marki, supermarketi pokuavaju diferencirati ponudu svoje trine marke u odnosu na konkurente. Kao jedinstveni oblik marketinke ponude, vlastite trgovake marke mogu posluiti kao uinkoviti oblik privlaenja novih, te zadravanja postojeih kupaca. Iako su se razvile iz ponuda niske kvalitete i niske cijene, danas trgovake marke predstavljaju nain zadravanja lojalnosti kupaca uz pomo diferencirane ponude visoke kvalitete. U ovom je radu izabrana opisana problematika istraivanja zbog promjena u marketingu proizvoda vlastitih trgovakih marki, kao i potrebe za procjenom koliko su kupcima vane vlastite trgovake marke u izboru supermarketa. Kvantitativna metodologija uz pomo koje je provedeno istraivanje ne usredotoava se na specifine supermarkete, ve utvruje stavove ispitanika povezane s izborom supermarketa i znaajem kojeg pridaju vlastitim trgovakim markama.

75

76

Você também pode gostar

- Mo Hinh MauDocumento35 páginasMo Hinh Mauhavy283Ainda não há avaliações

- Brand Awareness V1ycelq5Documento26 páginasBrand Awareness V1ycelq5anislaaghaAinda não há avaliações

- Chapter-VI Summary of Findings, Conclusion and Policy ImplicationsDocumento44 páginasChapter-VI Summary of Findings, Conclusion and Policy ImplicationsabhayAinda não há avaliações

- News of BrandsDocumento58 páginasNews of BrandsHari KrishnanAinda não há avaliações

- Consumer PerceptionsDocumento10 páginasConsumer PerceptionsSyahridzuel Ulquiorra SchifferAinda não há avaliações

- Factors Influencing Consumers' Purchase Decision of Private Label Brand ProductsDocumento10 páginasFactors Influencing Consumers' Purchase Decision of Private Label Brand ProductsRezkyAinda não há avaliações

- Branding An Invisible ProductDocumento14 páginasBranding An Invisible Productcongsang099970Ainda não há avaliações

- Brand Awareness-Brand Quality Inference and Consumer's Risk Perception in Store Brands of Food ProductsDocumento36 páginasBrand Awareness-Brand Quality Inference and Consumer's Risk Perception in Store Brands of Food ProductsYuresh NadishanAinda não há avaliações

- Literature Review GodrejDocumento6 páginasLiterature Review GodrejArchana Kalaiselvan100% (2)

- Disserr LitraDocumento17 páginasDisserr LitraDisha GangwaniAinda não há avaliações

- Unique Brand Extension ChallengesDocumento12 páginasUnique Brand Extension ChallengesDr. Firoze KhanAinda não há avaliações

- 2.1 The Brand: Literature ReviewDocumento58 páginas2.1 The Brand: Literature ReviewKarthi VijayAinda não há avaliações

- Brand LoyaltyDocumento25 páginasBrand LoyaltyParesh ShindeAinda não há avaliações

- Store Brands and Retail Differentiation PDFDocumento9 páginasStore Brands and Retail Differentiation PDFInvictus 13Ainda não há avaliações

- (2016) The Customers Satisfaction On Retailers' Brand ProductsDocumento10 páginas(2016) The Customers Satisfaction On Retailers' Brand ProductsWONG ZHI LIN MBS201232Ainda não há avaliações

- Effect of Advertising On The Brand Loyalty of Cosmetic Products Among College Students (#355868) - 367584Documento5 páginasEffect of Advertising On The Brand Loyalty of Cosmetic Products Among College Students (#355868) - 367584Neeraj KhanwaniAinda não há avaliações

- Critique PaperDocumento13 páginasCritique Paperankur29_ankurAinda não há avaliações

- Conditional Cross-Brand Learning: When Are Private Labels Really Private?Documento3 páginasConditional Cross-Brand Learning: When Are Private Labels Really Private?Iuliana ConstantinescuAinda não há avaliações

- Moderating Effect of The Relationship Between Private Label Share and Store Loyalty PDFDocumento15 páginasModerating Effect of The Relationship Between Private Label Share and Store Loyalty PDFKhushbooAinda não há avaliações

- Evaluations of Store Brands Effects of Store Image and Product AttributesDocumento12 páginasEvaluations of Store Brands Effects of Store Image and Product AttributesJasmin PlanicAinda não há avaliações

- Customer Perceptions On Private Label Brands in Indian Retail IndustryDocumento20 páginasCustomer Perceptions On Private Label Brands in Indian Retail IndustrySuresh UchihaAinda não há avaliações

- 03 - Review of LiteratureDocumento5 páginas03 - Review of Literatureyash sharmaAinda não há avaliações

- Secondary Objectives: Objectives of The Study Title of The StudyDocumento6 páginasSecondary Objectives: Objectives of The Study Title of The StudyAhamed HussainAinda não há avaliações

- The Influence of Customer Based Brand Equity On Consumer Responses-The Newly Opened West Hills Mall in GhanaDocumento11 páginasThe Influence of Customer Based Brand Equity On Consumer Responses-The Newly Opened West Hills Mall in Ghanau_mecrazyAinda não há avaliações

- Effect of Branding On Consumer Buying BehaviourDocumento15 páginasEffect of Branding On Consumer Buying BehaviourRishabh TiwariAinda não há avaliações

- Brand Equity, Brand Preference, and Purchase IntentDocumento17 páginasBrand Equity, Brand Preference, and Purchase IntentfutulashAinda não há avaliações

- Analisis Keputusan Pembelian Dan Tingkatan Loyalitas Merek Nasional Dan Merek TokoDocumento12 páginasAnalisis Keputusan Pembelian Dan Tingkatan Loyalitas Merek Nasional Dan Merek TokoMuhammadAgungPananrangAinda não há avaliações

- Literature Review On Brand EquityDocumento8 páginasLiterature Review On Brand EquityWaleed BashirAinda não há avaliações

- Extrinsic and Intrinsic Cue EffectsDocumento10 páginasExtrinsic and Intrinsic Cue Effectsroy royAinda não há avaliações

- Foods Product: A Strategic Brand Choice: Gatut L. BudionoDocumento10 páginasFoods Product: A Strategic Brand Choice: Gatut L. BudionoRizka Apriliani SAinda não há avaliações

- Impact OF Brand Image and Consumer Perception ON Brand Loyalty: A Study in Context of Patanjali Ayurveda Ltd. Among The People of DehradunDocumento36 páginasImpact OF Brand Image and Consumer Perception ON Brand Loyalty: A Study in Context of Patanjali Ayurveda Ltd. Among The People of DehradunSuraj NainwalAinda não há avaliações

- Brand Awareness 2Documento4 páginasBrand Awareness 2Martin MuleiAinda não há avaliações

- Brand AssociationsDocumento16 páginasBrand AssociationsAshish KulshresthAinda não há avaliações

- Book PublishingDocumento37 páginasBook PublishingTạ Lan KhanhAinda não há avaliações

- Cultural Branding RestaurantDocumento4 páginasCultural Branding RestaurantRusso Jossy100% (1)

- Consumer Perceptions of Private Label Products - An Empirical StudyDocumento16 páginasConsumer Perceptions of Private Label Products - An Empirical StudykocasAinda não há avaliações

- Dissertation ProposalDocumento20 páginasDissertation ProposalYashvardhan Kochar50% (2)

- The Effects of Selected MarketDocumento11 páginasThe Effects of Selected MarketFelisitas AgnesAinda não há avaliações

- Determinants of Brand Loyalty: A Study of Electronic Products Users in IndiaDocumento4 páginasDeterminants of Brand Loyalty: A Study of Electronic Products Users in IndiaDr-Vikas BhargawAinda não há avaliações

- Business Research QuarterlyDocumento16 páginasBusiness Research QuarterlyAllan AlvesAinda não há avaliações

- The Effects of Branding On Performance of Fast Moving Consumer Goods in GhanaDocumento6 páginasThe Effects of Branding On Performance of Fast Moving Consumer Goods in GhanaGeorge GrandyAinda não há avaliações

- Literature Review On Brand BuildingDocumento3 páginasLiterature Review On Brand BuildingNikhil Jain50% (2)

- Consumer Based Brand Equity and Brand PerformanceDocumento18 páginasConsumer Based Brand Equity and Brand PerformanceYaswanth R K SurapureddyAinda não há avaliações

- Brand Loyalty of Royal SuzukiDocumento16 páginasBrand Loyalty of Royal SuzukiSanthosh0% (1)

- Brand Loyalty Influence FactorsDocumento13 páginasBrand Loyalty Influence FactorsSafa Manala-oAinda não há avaliações

- Dipali Black BookDocumento75 páginasDipali Black Bookchaurasiyakhushboo845Ainda não há avaliações

- Brand Name and Consumer's Buying IntentionDocumento14 páginasBrand Name and Consumer's Buying IntentionQuynh Mai PhanAinda não há avaliações

- Capstone Project - Literature Review-PGDM16181414Documento16 páginasCapstone Project - Literature Review-PGDM16181414rishab sablokAinda não há avaliações

- Modeling Consumer AttitudesDocumento17 páginasModeling Consumer AttitudessahinchandaAinda não há avaliações

- KFC China Vs USADocumento15 páginasKFC China Vs USAnandinidhir22Ainda não há avaliações

- A Study The Analyzing of The Brand Equity and Resonance of Banking Services: PondicherryDocumento13 páginasA Study The Analyzing of The Brand Equity and Resonance of Banking Services: Pondicherryindex PubAinda não há avaliações

- Brand EquityDocumento13 páginasBrand EquityRitika GuptaAinda não há avaliações

- Brand Conceptual PaperDocumento14 páginasBrand Conceptual PaperMohd ZainiAinda não há avaliações

- Food Quality and Preference: Natalia Rubio, Javier Oubiña, Nieves VillaseñorDocumento10 páginasFood Quality and Preference: Natalia Rubio, Javier Oubiña, Nieves VillaseñorAbdurrohimnAinda não há avaliações

- Proposal Milk BrandDocumento12 páginasProposal Milk BrandSheikh Muhammad ShabbirAinda não há avaliações

- Drivers of Brand Commitment: A Cross-National Investigation: Andreas B. Eisingerich and Gaia RuberaDocumento16 páginasDrivers of Brand Commitment: A Cross-National Investigation: Andreas B. Eisingerich and Gaia RuberaFiaz MehmoodAinda não há avaliações

- An Empirical Model That Measures Brand Loyalty of Fast-Moving Consumer GoodsDocumento9 páginasAn Empirical Model That Measures Brand Loyalty of Fast-Moving Consumer GoodsBojanTopalovAinda não há avaliações

- Hierarchical Chain of Consumer-Based Brand Equity: Review From The Fast Food IndustryDocumento14 páginasHierarchical Chain of Consumer-Based Brand Equity: Review From The Fast Food IndustryMyra KiriyuuAinda não há avaliações

- Strategic Brand Management: Building and Sustaining BrandsNo EverandStrategic Brand Management: Building and Sustaining BrandsAinda não há avaliações

- Building Strong Brands (Review and Analysis of Aaker's Book)No EverandBuilding Strong Brands (Review and Analysis of Aaker's Book)Ainda não há avaliações

- Best DSLR CamerasDocumento1 páginaBest DSLR CamerasakashniranjaneAinda não há avaliações

- 28-7-15 MBA Calling DataDocumento6 páginas28-7-15 MBA Calling Dataakashniranjane0% (1)

- Best Mirrorless CamerasDocumento1 páginaBest Mirrorless CamerasakashniranjaneAinda não há avaliações

- Job Description PPC Executive: Roles & ResponsibilitiesDocumento2 páginasJob Description PPC Executive: Roles & ResponsibilitiesakashniranjaneAinda não há avaliações

- Google AdsDocumento1 páginaGoogle AdsakashniranjaneAinda não há avaliações

- Sagar Suresh Gupta: Career ObjectiveDocumento3 páginasSagar Suresh Gupta: Career ObjectiveakashniranjaneAinda não há avaliações

- (XYZ Provides Information On The Same) : XYZ! What About PlacementsDocumento1 página(XYZ Provides Information On The Same) : XYZ! What About PlacementsakashniranjaneAinda não há avaliações

- MBA Internal Exam Duty Chart MorningDocumento2 páginasMBA Internal Exam Duty Chart MorningakashniranjaneAinda não há avaliações

- Report Guidelines 20-5-15Documento17 páginasReport Guidelines 20-5-15akashniranjaneAinda não há avaliações

- A Session On: Digital Marketing With Google AdsDocumento18 páginasA Session On: Digital Marketing With Google AdsakashniranjaneAinda não há avaliações

- Library SoftwareDocumento5 páginasLibrary SoftwareakashniranjaneAinda não há avaliações

- Proposed Project Implementation Plan - HospitalDocumento1 páginaProposed Project Implementation Plan - HospitalakashniranjaneAinda não há avaliações

- Estimate Acceptance Form: Contract)Documento3 páginasEstimate Acceptance Form: Contract)akashniranjaneAinda não há avaliações

- Section 1.1 Adopt - Assess - Implementation of Systems - 1Documento8 páginasSection 1.1 Adopt - Assess - Implementation of Systems - 1akashniranjaneAinda não há avaliações

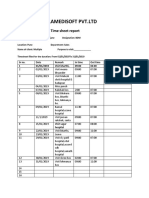

- Birlamedisoft PVT - LTD: Time Sheet ReportDocumento2 páginasBirlamedisoft PVT - LTD: Time Sheet ReportakashniranjaneAinda não há avaliações

- Birlamedisoft PVT - LTD: Time Sheet ReportDocumento1 páginaBirlamedisoft PVT - LTD: Time Sheet ReportakashniranjaneAinda não há avaliações

- Cancer Screening QuestionnaireDocumento3 páginasCancer Screening QuestionnaireakashniranjaneAinda não há avaliações

- 6 Maintenance Methodology & SLADocumento14 páginas6 Maintenance Methodology & SLAakashniranjaneAinda não há avaliações

- 2013 ITT Evaluation MatrixDocumento12 páginas2013 ITT Evaluation MatrixakashniranjaneAinda não há avaliações

- Training Strategy For ASHA Facilitators and ANMDocumento27 páginasTraining Strategy For ASHA Facilitators and ANMakashniranjaneAinda não há avaliações

- Training Strategy For ASHA Facilitators and ANMDocumento3 páginasTraining Strategy For ASHA Facilitators and ANMakashniranjaneAinda não há avaliações

- Training Strategy For ASHA Facilitators and ANMDocumento3 páginasTraining Strategy For ASHA Facilitators and ANMakashniranjaneAinda não há avaliações

- PACS QuestionnaireDocumento4 páginasPACS QuestionnaireakashniranjaneAinda não há avaliações

- System Development Life CycleDocumento22 páginasSystem Development Life CycleakashniranjaneAinda não há avaliações

- Teaching PlanDocumento3 páginasTeaching PlanakashniranjaneAinda não há avaliações

- Placement BrochureDocumento48 páginasPlacement BrochureakashniranjaneAinda não há avaliações

- Reasoning - : Topic Expected Number of SDocumento3 páginasReasoning - : Topic Expected Number of SakashniranjaneAinda não há avaliações

- Plant Tour Application Form: Sagar Suresh GuptaDocumento2 páginasPlant Tour Application Form: Sagar Suresh GuptaakashniranjaneAinda não há avaliações

- Mcdaniel Tanilla Civilian Resume Complete v1Documento3 páginasMcdaniel Tanilla Civilian Resume Complete v1api-246751844Ainda não há avaliações

- IM1 Calculus 2 Revised 2024 PUPSMBDocumento14 páginasIM1 Calculus 2 Revised 2024 PUPSMBEunice AlonzoAinda não há avaliações

- Caring For Women Experiencing Breast Engorgement A Case ReportDocumento6 páginasCaring For Women Experiencing Breast Engorgement A Case ReportHENIAinda não há avaliações

- BBL PR Centralizer Rig Crew Handout (R1.1 2-20-19)Documento2 páginasBBL PR Centralizer Rig Crew Handout (R1.1 2-20-19)NinaAinda não há avaliações

- CHARACTER FORMATION 1 PrelimDocumento15 páginasCHARACTER FORMATION 1 PrelimAiza Minalabag100% (1)

- Information Systems and Supply Chain ManagementDocumento2 páginasInformation Systems and Supply Chain Managementvipinkandpal86Ainda não há avaliações

- 19 Dark PPT TemplateDocumento15 páginas19 Dark PPT TemplateKurt W. DelleraAinda não há avaliações

- Existentialism in CinemaDocumento25 páginasExistentialism in CinemanormatthewAinda não há avaliações

- 7Documento6 páginas7Joenetha Ann Aparici100% (1)

- APA Vs Harvard Referencing - PDFDocumento4 páginasAPA Vs Harvard Referencing - PDFTalo Contajazz Chileshe50% (2)

- World War II D-Day Invasion by SlidesgoDocumento55 páginasWorld War II D-Day Invasion by SlidesgoPreston SandsAinda não há avaliações

- Pathogenic Escherichia Coli Associated With DiarrheaDocumento7 páginasPathogenic Escherichia Coli Associated With DiarrheaSiti Fatimah RadAinda não há avaliações

- Ej. 1 Fin CorpDocumento3 páginasEj. 1 Fin CorpChantal AvilesAinda não há avaliações

- Federalist Papers 10 51 ExcerptsDocumento2 páginasFederalist Papers 10 51 Excerptsapi-292351355Ainda não há avaliações

- Mfin 7002 Investment Analysis and Portfolio ManagementDocumento5 páginasMfin 7002 Investment Analysis and Portfolio ManagementjessieAinda não há avaliações

- The Checkmate Patterns Manual: The Ultimate Guide To Winning in ChessDocumento30 páginasThe Checkmate Patterns Manual: The Ultimate Guide To Winning in ChessDusen VanAinda não há avaliações

- Test Physics Chapter# 12,13,14 (2 Year) NameDocumento1 páginaTest Physics Chapter# 12,13,14 (2 Year) NameStay FocusedAinda não há avaliações

- Culture 2007 2013 Projects Overview 2018-03-18Documento133 páginasCulture 2007 2013 Projects Overview 2018-03-18PontesDeboraAinda não há avaliações

- The Ovation E-Amp: A 180 W High-Fidelity Audio Power AmplifierDocumento61 páginasThe Ovation E-Amp: A 180 W High-Fidelity Audio Power AmplifierNini Farribas100% (1)

- Common Core Content and Training Objectives For Basic AIS Training - Phase 2 - SpecialistDocumento82 páginasCommon Core Content and Training Objectives For Basic AIS Training - Phase 2 - SpecialistjlferreiraAinda não há avaliações

- Boundary Value Analysis 2Documento13 páginasBoundary Value Analysis 2Raheela NasimAinda não há avaliações

- ST Arduino Labs CombinedDocumento80 páginasST Arduino Labs CombineddevProAinda não há avaliações

- Praise and Worship Songs Volume 2 PDFDocumento92 páginasPraise and Worship Songs Volume 2 PDFDaniel AnayaAinda não há avaliações

- Very Narrow Aisle MTC Turret TruckDocumento6 páginasVery Narrow Aisle MTC Turret Truckfirdaushalam96Ainda não há avaliações

- Tutorial Chapter 5 - Power System ControlDocumento2 páginasTutorial Chapter 5 - Power System ControlsahibAinda não há avaliações

- DCS800ServiceManual RevADocumento96 páginasDCS800ServiceManual RevAElinplastAinda não há avaliações

- NAV SOLVING PROBLEM 3 (1-20) .PpsDocumento37 páginasNAV SOLVING PROBLEM 3 (1-20) .Ppsmsk5in100% (1)

- Acting White 2011 SohnDocumento18 páginasActing White 2011 SohnrceglieAinda não há avaliações

- A Content Analysis of SeabankDocumento13 páginasA Content Analysis of SeabankMarielet Dela PazAinda não há avaliações

- Hare and Hyena: Mutugi KamundiDocumento18 páginasHare and Hyena: Mutugi KamundiAndresileAinda não há avaliações