Escolar Documentos

Profissional Documentos

Cultura Documentos

Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ Date

Enviado por

thakurrobinTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ Date

Enviado por

thakurrobinDireitos autorais:

Formatos disponíveis

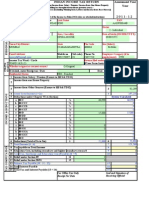

SAHAJ

FORM

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)] (Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

ITR-1

Assessment Year Year

2011-12

PAN CSIPS8961C

PERSONAL INFORMATION

First Name Robin Flat / Door / Building 6/5 Road / Street jak road Town/City/District ghaziabad

Middle Name

Last Name singh Status

I - Individual Area / Locallity shipra suncity Date of birth (DD/MM/YYYY) 13/05/1987

FILING STATUS

Email Address robin.sngh13@gmail.com Income Tax Ward / Circle RANGE-2 Whether original or revised return?

State Pin Code Sex (Select) 31-UTTAR 201014 M-Male PRADESH Mobile no (Std code) Phone No Employer Category (if in 9958592970 employment) OTH Return filed under section [Pl see Form Instruction] 11 - u/s 139(1) O-Original Date 1 2 3 4 153,980 0 5,850

If revised, enter Receipt no / Date RES - Resident Residential Status 1 Income from Salary / Pension (Ensure to fill Sch TDS1) Income from one House Property 2 3 Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2c) 5 Deductions under Chapter VI A (Section) 5a a 80 C 5b b 80 CCC 5c c 80 CCD 5d d 80 CCF 5e e 80 D 5f f 80 DD 5g g 80 DDB 5h h 80 E 5i i 80 G (Eligible Amount) 5j j 80 GG 5k k 80 GGA 5l l 80 GGC 5m m 80 U 6 6 Deductions (Total of 5a to 5m) 7 Total Income (4 - 6) 8 Tax payable on Total Income 9 Education Cess, including secondary and higher secondary cess on 8 10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9) 11 11 Relief under Section 89 12 12 Relief under Section 90/91 13 Balance Tax Payable (10 - 11 - 12) 14 Total Interest Payable 15 Total Tax and Interest Payable (13 + 14) For Office Use Only Receipt No/ Date

11,760 0 0 0 10,000 0 0 0 0 0 0 0 0 21,760

TAX COMPUTATION

159,830 System Calculated 11,760 0 0 0 10,000 0 0 0 0 0 0 0 0 21,760 6 138,070 7 0 8 0 9 0 10

INCOME & DEDUCTIONS

0 0 13 14 15 Seal and Signature of Receiving Official 0 0 0

23

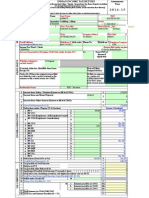

Details of Tax Deducted at Source from SALARY [As per FORM 16 issued by Employer(s)] Tax Deduction Income charg Name of the Total tax Account Number SI.No eable under the Employer Deducted (TAN) of the head Salaries Employer (3) (4) (5) (1) (2) DELC06827C CHINTELS 0 0 1 2 INDIA 3 (Click + to add more rows to 23) TDS on Salary above. Do not delete blank rows. )

24

Details of Tax Deducted at Source on Income OTHER THAN SALARY [As per FORM 16 A issued by Deductor(s)] Amount out Tax Deduction of Account Number Name of the Total tax SI.No (4) claimed (TAN) of the Deductor Deducted for Deductor this year (1) (2) (3) (4) (5) 1 2 3 4 (Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25 Sl No 1 2 3 4 5 6

Details of Advance Tax and Self Assessment Tax Payments Date of Deposit (DD/MM/YYYY) Serial Number of Challan

BSR Code

Amount (Rs)

(Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

TAXES PAID

16 Taxes Paid PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The taxes paid figures below will get filled up when the Schedules linked to them are filled. a Advance Tax (from item 25) b TDS (Total from item 23 + item 24) 16a 16b 0 0

0 c Self Assessment Tax (item 25) 16c 0 Total Taxes Paid (16a+16b+16c) 17 0 Tax Payable (15-17) (if 15 is greater than 17) 18 0 Refund (17-15) if 17 is greater than 15 19 52510623677 Enter your Bank Account number (Mandatory ) Yes Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque 22 In case of direct deposit to your bank account give additional details 110036011 Savings MICR Code Type of Account(As applicable) 26 Exempt income for reporting purposes only (from Dividends, Agri. income < 5000) VERIFICATION ROBIN SINGH I, (full name in block letters), son/daughter of MAHESH KR. SINGH solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2011-12 Place Date 02/01/2013 Sign here -> GHAZIABAD PAN CSIPS8961C 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP Counter Signature of TRP REFUND 17 18 19 20 21

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

Você também pode gostar

- IT Return 2011 2012Documento3 páginasIT Return 2011 2012swapnil6121986Ainda não há avaliações

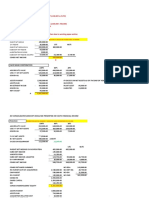

- Gross Total Income (1+2c) 4: Import Previous VersionDocumento4 páginasGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailAinda não há avaliações

- Gross Total Income (1+2c) 4: System CalculatedDocumento3 páginasGross Total Income (1+2c) 4: System CalculatedDHARAMSONIAinda não há avaliações

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Documento3 páginasSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarAinda não há avaliações

- 2011 ITR1 r2Documento3 páginas2011 ITR1 r2Zafar IqbalAinda não há avaliações

- Assessment Year Indian Income Tax Return SahajDocumento7 páginasAssessment Year Indian Income Tax Return SahajallipraAinda não há avaliações

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocumento11 páginasITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranAinda não há avaliações

- Form ITR-1Documento3 páginasForm ITR-1Rajeev PuthuparambilAinda não há avaliações

- Assessment Year Sahaj Indian Income Tax ReturnDocumento7 páginasAssessment Year Sahaj Indian Income Tax Returnrajshri58Ainda não há avaliações

- Income TaxDocumento6 páginasIncome TaxKuldeep HoodaAinda não há avaliações

- 2012 Itr1 Pr21Documento5 páginas2012 Itr1 Pr21MRLogan123Ainda não há avaliações

- 2015 Itr1 PR3Documento18 páginas2015 Itr1 PR3shubham sharmaAinda não há avaliações

- Gross Total Income (1+2+3) 4: System CalculatedDocumento8 páginasGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamAinda não há avaliações

- Assessment Year Indian Income Tax Return: I - IndividualDocumento6 páginasAssessment Year Indian Income Tax Return: I - IndividualManjunath YvAinda não há avaliações

- Indian Income Tax Return Assessment Year SahajDocumento7 páginasIndian Income Tax Return Assessment Year SahajSubrata BiswasAinda não há avaliações

- 2013 Itr1 PR11Documento9 páginas2013 Itr1 PR11Akshay Kumar SahooAinda não há avaliações

- ITR Form 1Documento7 páginasITR Form 1gj29hereAinda não há avaliações

- Sahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7Documento22 páginasSahaj Individual Income Tax Return Assessment Year 2 0 16 - 1 7rahul srivastavaAinda não há avaliações

- Enter Necessary Data For Income Tax CalculationDocumento15 páginasEnter Necessary Data For Income Tax Calculationsa_mishraAinda não há avaliações

- Bir Form 1701Documento12 páginasBir Form 1701miles1280Ainda não há avaliações

- Bir Forms PDFDocumento4 páginasBir Forms PDFgaryAinda não há avaliações

- ITR-3 Indian Income Tax Return: Part A-GENDocumento12 páginasITR-3 Indian Income Tax Return: Part A-GENmehtakvijayAinda não há avaliações

- 82255BIR Form 1701Documento12 páginas82255BIR Form 1701Leowell John G. RapaconAinda não há avaliações

- 1701 Bir FormDocumento12 páginas1701 Bir Formbertlaxina0% (1)

- ITR-2 Indian Income Tax Return: Part A-GENDocumento12 páginasITR-2 Indian Income Tax Return: Part A-GENMankamesachinAinda não há avaliações

- Indian Income Tax Challan Payment of Tds and TCS: Form by FinotaxDocumento2 páginasIndian Income Tax Challan Payment of Tds and TCS: Form by Finotaxbrayan uyAinda não há avaliações

- Improperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NoDocumento6 páginasImproperly Accumulated Earnings Tax Return: Kawanihan NG Rentas Internas For Corporations May 2001 BIR Form NofatmaaleahAinda não há avaliações

- Ahrpv0731f 2013-14Documento2 páginasAhrpv0731f 2013-14Shiva KumarAinda não há avaliações

- V. N. Hari,: Sudhakar & Kumar AssociatesDocumento28 páginasV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaAinda não há avaliações

- Tax Applicable (Tick One) 2 8 1Documento7 páginasTax Applicable (Tick One) 2 8 1Gaurav BajajAinda não há avaliações

- Form 16Documento4 páginasForm 16Aruna Kadge JhaAinda não há avaliações

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocumento2 páginasForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilAinda não há avaliações

- Assessment Year Sahaj Indian Income Tax ReturnDocumento1 páginaAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaAinda não há avaliações

- Bir Form 1702-RtDocumento8 páginasBir Form 1702-RtShiela PilarAinda não há avaliações

- Form 16 Word FormatDocumento4 páginasForm 16 Word FormatVenkee SaiAinda não há avaliações

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocumento6 páginasIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiAinda não há avaliações

- ITR-2 Indian Income Tax Return: Part A-GENDocumento10 páginasITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalAinda não há avaliações

- Indian Numbering SystemDocumento8 páginasIndian Numbering SystemelangomduAinda não há avaliações

- ITR-3 Indian Income Tax Return: Part A-GENDocumento7 páginasITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeAinda não há avaliações

- 1601 CDocumento16 páginas1601 CROGELIO QUIAZON100% (1)

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesAinda não há avaliações

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNo EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryAinda não há avaliações

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryNo EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Lines World Summary: Market Values & Financials by CountryAinda não há avaliações

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionAinda não há avaliações

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNo EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNota: 4 de 5 estrelas4/5 (5)

- Federal Income Tax: a QuickStudy Digital Law ReferenceNo EverandFederal Income Tax: a QuickStudy Digital Law ReferenceAinda não há avaliações

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchNo EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchNota: 5 de 5 estrelas5/5 (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionAinda não há avaliações

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1No EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Ainda não há avaliações

- Modernizing Local Government Taxation in IndonesiaNo EverandModernizing Local Government Taxation in IndonesiaAinda não há avaliações

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionAinda não há avaliações

- CPWD Par 2012Documento60 páginasCPWD Par 2012Babu SundararamanAinda não há avaliações

- Dariyaganj Store Evaluation: ConsultantsDocumento2 páginasDariyaganj Store Evaluation: ConsultantsthakurrobinAinda não há avaliações

- Mini Rice MillDocumento4 páginasMini Rice MillChris BarolasAinda não há avaliações

- Rice ExportersDocumento14 páginasRice ExportersthakurrobinAinda não há avaliações

- Project Vendor/Contractor Name Bill No AmountDocumento2 páginasProject Vendor/Contractor Name Bill No AmountthakurrobinAinda não há avaliações

- Hvac ComparisionDocumento19 páginasHvac ComparisionthakurrobinAinda não há avaliações

- Purchase Order: Connaught Plaza Restaurants Private LimitedDocumento1 páginaPurchase Order: Connaught Plaza Restaurants Private LimitedthakurrobinAinda não há avaliações

- Introduction To Probability and StatisticsDocumento21 páginasIntroduction To Probability and StatisticsimtiazbscAinda não há avaliações

- Book 1Documento1 páginaBook 1thakurrobinAinda não há avaliações

- Properties and Industrial Applications of Rice Husk: A ReviewDocumento5 páginasProperties and Industrial Applications of Rice Husk: A ReviewthakurrobinAinda não há avaliações

- Ajeet Pratap SinghDocumento3 páginasAjeet Pratap SinghthakurrobinAinda não há avaliações

- DSR 2012Documento448 páginasDSR 2012jagadees21100% (2)

- MCCAddDocumento8 páginasMCCAddforever2liveAinda não há avaliações

- G.F Civil Plan.Documento1 páginaG.F Civil Plan.thakurrobinAinda não há avaliações

- Day RDocumento2 páginasDay RthakurrobinAinda não há avaliações

- 14TH Annual Report: Year Ended - 3 (. O3.2Oo9Documento19 páginas14TH Annual Report: Year Ended - 3 (. O3.2Oo9ravalmunjAinda não há avaliações

- Unclaimed Balances Law: (Republic Act 3936 As Amended by Presidential Decree No. 679)Documento2 páginasUnclaimed Balances Law: (Republic Act 3936 As Amended by Presidential Decree No. 679)Jornel MandiaAinda não há avaliações

- 10 Musharka FinancingDocumento24 páginas10 Musharka FinancingFaheemullah HaddadAinda não há avaliações

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDocumento90 páginas35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Malaysian Government Budgeting MalaysianDocumento31 páginasMalaysian Government Budgeting MalaysianHanisah AbdulRahmanAinda não há avaliações

- Investment Wisdom From The Super AnalystsDocumento6 páginasInvestment Wisdom From The Super Analystsautostrada.scmhrdAinda não há avaliações

- Ecs Mandate Idbi1Documento4 páginasEcs Mandate Idbi1lotusnotesjct9497Ainda não há avaliações

- Lira District Report of The Auditor General 2015 PDFDocumento59 páginasLira District Report of The Auditor General 2015 PDFlutos2Ainda não há avaliações

- Business Studies Form Four NotesDocumento66 páginasBusiness Studies Form Four Notestimothy muyumbiAinda não há avaliações

- Direst Selling Agent Policy-Retail & Consumer LendingDocumento13 páginasDirest Selling Agent Policy-Retail & Consumer LendingVijay DubeyAinda não há avaliações

- 10.digest. NG Cho Cio VS NG DiogDocumento2 páginas10.digest. NG Cho Cio VS NG DiogXing Keet LuAinda não há avaliações

- Practica Del Modulo 2Documento5 páginasPractica Del Modulo 2Campusano MelanieAinda não há avaliações

- IA 3 MidtermDocumento9 páginasIA 3 MidtermMelanie Samsona100% (1)

- CA51024 - Quiz 2 (Solutions)Documento6 páginasCA51024 - Quiz 2 (Solutions)The Brain Dump PHAinda não há avaliações

- Hyperin Ation in Venezuela: Research Question, Aim and GoalDocumento2 páginasHyperin Ation in Venezuela: Research Question, Aim and GoalMilica NikolicAinda não há avaliações

- Engineering Econ - InterestDocumento37 páginasEngineering Econ - InterestNikolai VillegasAinda não há avaliações

- Company Name: Starting Date Cash Balance Alert MinimumDocumento3 páginasCompany Name: Starting Date Cash Balance Alert MinimumdantevariasAinda não há avaliações

- FTDocumentDocumento2 páginasFTDocumentGustavo UribeAinda não há avaliações

- AFM Assignment 3Documento6 páginasAFM Assignment 3Zuhair NasirAinda não há avaliações

- Bpo 102 Part 1Documento30 páginasBpo 102 Part 1Mary Lynn Dela PeñaAinda não há avaliações

- TBCH 13Documento43 páginasTBCH 13Tornike JashiAinda não há avaliações

- Satia Industry Training Report.Documento57 páginasSatia Industry Training Report.Deep zaildarAinda não há avaliações

- Collateral Document Delivery Request Form v2Documento1 páginaCollateral Document Delivery Request Form v2Teena BarrettoAinda não há avaliações

- BSE SME Exchange - BusinessDocumento53 páginasBSE SME Exchange - BusinessDeepak GajareAinda não há avaliações

- Strategy With MACD and ADX 21 5 2017Documento3 páginasStrategy With MACD and ADX 21 5 2017Anant MalaviyaAinda não há avaliações

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookDocumento8 páginas2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookChantelle IsaksAinda não há avaliações

- For Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEADocumento21 páginasFor Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEAFilip PopovicAinda não há avaliações

- Introduction To PPPDocumento25 páginasIntroduction To PPPswatiAinda não há avaliações

- Telegram Cloud Document 4 5774082087745225801 PDFDocumento75 páginasTelegram Cloud Document 4 5774082087745225801 PDFBen Willmott100% (2)

- Auditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHDocumento27 páginasAuditing Practice (AP) : #128 Maginhawa ST., Brgy. Teacher's Village East, Quezon City Pinnaclecpareview - PHWinnie ToribioAinda não há avaliações