Escolar Documentos

Profissional Documentos

Cultura Documentos

Credit and Debt Management Handbook

Enviado por

BONDCK88507Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Credit and Debt Management Handbook

Enviado por

BONDCK88507Direitos autorais:

Formatos disponíveis

4-1

Revised: 2/2007

CREDIT AND DEBT MANAGEMENT OPERATING STANDARDS AND PROCEDURES HANDBOOK CHAPTER 4. CREDIT MANAGEMENT AND DEBT COLLECTION PLAN AND ANNUAL BUDGET SUBMISSION Section 1.0 General Organization units shall develop a Credit Management and Debt Collection Plan (Plan) for effectively managing credit extension, account servicing and portfolio management, and delinquent debt collection. The Plan shall include program performance objectives, and will monitor actual results for each program against the Plan's objectives. The Plan will be used to identify, on a yearly basis, trends, which may adversely affect overall program objectives and agency budgets. As a function of portfolio management, the Plan shall consider the appropriateness of loan asset sales programs and prepayment programs. The full cost of credit programs, including anticipated losses, shall be included in the annual budget submission. Section 2.0 Credit Management and Debt Collection Plan (Plan) Pursuant to Office of Management and Budget (OMB) Circular A-129, Policies for Federal Credit Programs and Non-Tax Receivables organization units shall develop the Plan that describes their strategy for effectively managing all phases of the credit cycle--credit extension, account servicing and portfolio management, and delinquent debt collection. The Plan shall be developed with sections as indicated below: .01 Overview Describe each loan program in terms of: a. Characteristics of the debts and debtors involved; b. Historical experience of the program and other Government agencies and the private sector in collecting this type of debt; c. Trend analysis of delinquencies and defaults, including guaranteed loans;

d. Planned improvements in the organization unit's credit management and debt collection; and e. Statutory prohibitions enacted or pending that may impede implementation of the circular.

4-2

Revised: 2/2007

.02

Strategies Describe how loss prevention and debt collection will be improved in each element of the credit cycle--award, servicing, and collection. The strategy should indicate the program direction that will be required to accomplish the credit management objectives over the next five years. The strategy should link the objectives of credit management with the development of program accounting systems as proposed in accordance with OMB Circular A-127. The development of trends in receivables, delinquent debt collection and write-offs, as reflected in the annual budget submission in accordance with OMB Circular A11, Preparation, Submission and Execution of the Budget, Section 185, Federal credit data, should be reflected in the strategies and initiatives.

.03

Credit Management Initiatives The Plan shall describe each of the following areas, including associated milestones and time frames: a. Establishment of credit management and debt collection practices, procedures, and regulations that implement OMB Circular A-129;

b. How debt collection and credit management responsibilities will be defined and assigned for each program; c. Establishment of accounting practices and procedures and automated information systems to enable the production of accurate financial reports on those programs that generate receivables; and d. Evaluation of credit management and debt collection operations and systems in order to identify areas for improvement and to initiate actions to correct any problems identified. .04 Performance Goals The Plan shall include: a. Specific performance goals that the organization unit proposes to meet each fiscal year, and

b. Evaluations of performance goals previously established and reasons provided if the goals have not been met.

4-3

Revised: 2/2007

.05

Relationship to Other OMB Circulars The Plan shall include summaries of the relationship to the following OMB Circulars: a. b. Circular A-129, Policies for Federal Credit Programs and Non-Tax Receivables; Circular A-123, Management Accountability and Control. Credit management and debt collection functions identified as material weaknesses shall be reported along with corrective measures to eliminate the weaknesses; Circular A-127, Financial Management Systems; and Circular A-11, Preparation, Submission, and Execution of the Budget (Part 1).

c. d. .06

Appraisals of Property Organization units are required to conduct periodic reviews of appraisals of property serving as collateral for direct or guaranteed loans. Organization units shall provide an assessment of these reviews with their Plan(s).

.07

Financial Advisor A financial advisor shall be engaged by the agency to conduct a portfolio evaluation and compare pricing options for a prepayment program or loan asset sale as set forth in OMB Circular A-129, Policies for Federal Credit Programs and Non-Tax Receivables. Organizational units shall provide an assessment of the evaluation in the Plan.

.08

Risk Assessment and Loan Loss Estimates Organization units shall include in the Plan their established procedures for assessing the risk inherent in each loan in their portfolios as well as assessments of guaranteed loans by primary lenders. Organization units shall also include loan loss estimates for each loan program in their Plan.

Section 3.0 Annual Budget Submission In addition to the Credit Management and Debt Collection Plan, OMB Circular A-11, Section 185 identifies Federal credit data and loan program items that are to be included in support of the Department's annual budget submission to OMB.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Cal Judicial Changes-2012 SummaryDocumento64 páginasCal Judicial Changes-2012 SummaryBONDCK88507Ainda não há avaliações

- Commissioned Officer's HandbookDocumento133 páginasCommissioned Officer's HandbookBONDCK88507100% (2)

- Majority Action-Sb 1638 BillDocumento6 páginasMajority Action-Sb 1638 BillBONDCK88507Ainda não há avaliações

- California Probate Form - Claim - Declaration - English PDFDocumento1 páginaCalifornia Probate Form - Claim - Declaration - English PDFBONDCK88507Ainda não há avaliações

- Lic402. Surety BondDocumento1 páginaLic402. Surety BondBONDCK88507Ainda não há avaliações

- 2012 11 09 - Tribal Consumer Financial Services Regulatory Code - EnactedDocumento31 páginas2012 11 09 - Tribal Consumer Financial Services Regulatory Code - EnactedBONDCK88507Ainda não há avaliações

- For Recorder'S Use: (The Undersigned)Documento1 páginaFor Recorder'S Use: (The Undersigned)BONDCK88507Ainda não há avaliações

- DOJ Post Award Instructions SF-425Documento26 páginasDOJ Post Award Instructions SF-425BONDCK88507Ainda não há avaliações

- COUNTY of LOS ANGELES - Anticipation Note-Series A EtcDocumento212 páginasCOUNTY of LOS ANGELES - Anticipation Note-Series A EtcBONDCK88507Ainda não há avaliações

- California 'Quiet Title' Victory Paul Nguyen v. Chase Et AlDocumento4 páginasCalifornia 'Quiet Title' Victory Paul Nguyen v. Chase Et AlDinSFLAAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Hayman July 07Documento5 páginasHayman July 07grumpyfeckerAinda não há avaliações

- Bonollo Energia CaseDocumento10 páginasBonollo Energia CaseSam DhuriAinda não há avaliações

- P4 Chapter 11 Corporate ReconstructionDocumento29 páginasP4 Chapter 11 Corporate Reconstructionasim tariqAinda não há avaliações

- Oxford Brookes University Thesis SubmissionDocumento6 páginasOxford Brookes University Thesis Submissionafknfbdpv100% (2)

- Leverages ProblemsDocumento4 páginasLeverages Problemsk,hbibk,n0% (1)

- G.R. No. 193169 April 6, 2015 ROGELIO ROQUE, Petitioner, People of The Pidlippines, RespondentDocumento27 páginasG.R. No. 193169 April 6, 2015 ROGELIO ROQUE, Petitioner, People of The Pidlippines, RespondentAnonymous 7mfiDqaUvhAinda não há avaliações

- Analysis of Capital Structure and Dividend Policy Textile Industries in Bangladesh (Term Paper On Corporate Finance)Documento14 páginasAnalysis of Capital Structure and Dividend Policy Textile Industries in Bangladesh (Term Paper On Corporate Finance)mukulful2008Ainda não há avaliações

- North West Company: Analyzing Financial Performance: SolvencyDocumento5 páginasNorth West Company: Analyzing Financial Performance: SolvencyAbdullah QureshiAinda não há avaliações

- Financial FeasibilityDocumento53 páginasFinancial FeasibilityShyra MaximoAinda não há avaliações

- Fao Pertanian BerkelanjutanDocumento188 páginasFao Pertanian BerkelanjutanHaidar Fajar FirmansyahAinda não há avaliações

- BEGA ELECTROMOTOR SA Financial Condition Analysis PDFDocumento16 páginasBEGA ELECTROMOTOR SA Financial Condition Analysis PDFVirgo AeliusAinda não há avaliações

- TenStepsToIssueSecurityTokens AlphaPoint PDFDocumento30 páginasTenStepsToIssueSecurityTokens AlphaPoint PDFGorazd OcvirkAinda não há avaliações

- HSC Business Study NotesDocumento53 páginasHSC Business Study Notesmatt100% (2)

- Case Study of Tata MotorsDocumento6 páginasCase Study of Tata MotorsSoumendra RoyAinda não há avaliações

- Banking LawsDocumento26 páginasBanking LawsAnonymous X5ud3UAinda não há avaliações

- Drill Obligation 2 PDFDocumento2 páginasDrill Obligation 2 PDFMaeAinda não há avaliações

- URACDocumento30 páginasURACPatrich Jerome LeccioAinda não há avaliações

- All India Open Mock Clat 07 (Clat 46) 5753815Documento36 páginasAll India Open Mock Clat 07 (Clat 46) 5753815Likitha DashAinda não há avaliações

- Hotel Sample P&L and Bal SheetDocumento5 páginasHotel Sample P&L and Bal SheetRe Formity88% (8)

- Bad Debts ProcedureDocumento3 páginasBad Debts ProcedureCM_NguyenAinda não há avaliações

- Petronas Gas Berhad (Forex)Documento12 páginasPetronas Gas Berhad (Forex)KAR ENG QUAHAinda não há avaliações

- American Apparel Strategic Plan Spring 2015Documento39 páginasAmerican Apparel Strategic Plan Spring 2015Anonymous Hnv6u54H50% (2)

- Interest RatesDocumento8 páginasInterest RatesΆλεξ ΤριαντοAinda não há avaliações

- Affidavit of Merit: Republic of The Philippines) Marikina City, Metro Manila) S. SDocumento2 páginasAffidavit of Merit: Republic of The Philippines) Marikina City, Metro Manila) S. SVanAinda não há avaliações

- MF Cost of Capital - Practice QuestionsDocumento4 páginasMF Cost of Capital - Practice QuestionsSaad UsmanAinda não há avaliações

- Factoring, Forfaiting, DiscountingDocumento16 páginasFactoring, Forfaiting, DiscountingPooja balwaniAinda não há avaliações

- 4330 Lecture 27 Corporte Debt Valuation F10Documento25 páginas4330 Lecture 27 Corporte Debt Valuation F10EnnayojaravAinda não há avaliações

- Sample of Loan Agreement - ContractDocumento3 páginasSample of Loan Agreement - ContractYuriAinda não há avaliações

- 28 CREDTRANS Saludo Vs SCBDocumento1 página28 CREDTRANS Saludo Vs SCBJimenez LorenzAinda não há avaliações

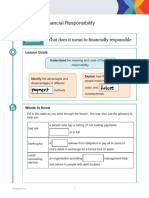

- 3108 13 06 FinancialResponsibility GN SEDocumento9 páginas3108 13 06 FinancialResponsibility GN SENEEVE SHETHAinda não há avaliações