Escolar Documentos

Profissional Documentos

Cultura Documentos

R PT Instruction Plan

Enviado por

Sk SharmaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

R PT Instruction Plan

Enviado por

Sk SharmaDireitos autorais:

Formatos disponíveis

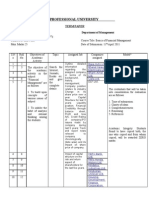

Lovely Professional University,Punjab

Format For Instruction Plan [for Courses with Lectures and Tutorials

Course No MGT333

Cours Title BASIC FINANCIAL MANAGEMENT

Course Planner 14723 :: Lalit Kumar Bhardwaj

Lectures Tutorial Practical Credits 3 1 0 4

Text Book:

1 Rajiv Shrivastava, Anil Mishra, Financial management, Oxford Publications, 3rd edition, 2009 edition

Other Specific Book:

2 Sharan Vyuptkesh, Fundamentals of financial Management, Pearson Education, 2009 edition 3 Reddy G. Sudarshana, Financial Management, Principles and Practice, Ist edition, Himalaya Publishing House, 2008 edition 4 Chandra, Prasana; Financial Management, Tata McGraw Hill, New Delhi (2008), 7th Edition 5 Pandey, I.M., Financial Management, Vikas Publishing, New Delhi, 9th Edition.

Other Reading Sr No Jouranls atricles as compulsary readings (specific articles, Complete reference) 6 Why Did the Crisis of 2008 Happen? By Nassim Nicholas Taleb, 3rd version August 2010: Source:http://papers.ssrn.com/sol3/papers.cfm? abstract_id=1666042 7 ) Value Maximization, Stakeholder Theory, and the Corporate Objective Function by Michael J. Hensen: Harvad Business school working paper no. 0058 8 A Note on Stakeholder Theory and Risk: Implications for Corporate cash holding and Dividend Policy: Frontiers in Finance and Economics vol 6, No 1, Pg 5172, 2009 9 Working Capital Management and Firm's profitability: An optimal cash conversion cycle By Haitham source:http://papers.ssrn.com/sol3/papers.cfm? abstract_id=1471230 10 Case study: Bharat Heavy Electricals: Source: Financial Management By I.M Pandey Pg 16, Ninth edition, Vikas Publications 11 Case study: Divya Handtools Private Limited( DHPL) Source: Financial Management By I.M Pandey Pg 40 Ninth edition, Vikas Publications 12 Case study: Hindustan Lever Limited Source: I.M Pandey Pg 192 13 Case study: Delite Furniture Company Limited: Source: I.M Pandey Pg 444, ninth edition, vikas Publications 1 Approved for Spring Session 2010-11

14 Case study: G.S. Petropull Company: Source: I.M Pandey pg 165, ninth edition, vikas Publications Relevant Websites Sr. No. (Web adress) (only if relevant to the courses) 15 http://businessfinancemag.com/corporate-finance Salient Features Articles related to Corporate Finance

16 http://economictimes.indiatimes.com/opinionshome/89722863 Insight into editorials, forums, interviews related to finance 9 17 http://www.youtube.com/watch?v=FNkFAUFxQIs 18 http://www.youtube.com/watch?v=FNkFAUFxQIs 19 http://www.youtube.com/watch?v=1_6MZA2KnEE 20 http://www.youtube.com/watch?v=f48Cb2kKhs0 Video on Financial management Video on Financial mgt: as strategic tool Accounting softwares and financial mgt solutions Strategies for business financial mgt

21 http://www.investopedia.com/articles/basics/06/capitalstructur Current Financial practice with capital structure e.asp?viewed=1 22 http://www.sagepub.com/upmdata/5005_Seidman_Chapter_5.pdf Working capital practices

23 http://unpan1.un.org/intradoc/groups/public/documents/APCIT Factors influencing dividend practices of the companies Y/UNPAN023819.pdf

Detailed Plan For Lectures

Week Number Lecture Number Lecture Topic Chapters/Sections of Homework to be Assigned Pedagogical tool Textbook/other to students Demonstration/case reference study/images/anmatio n ctc. planned

Part 1

Week 1 Lecture 1 Meaning of Financial Management, Profit Maximization objectives, Wealth Maximization Objective Scope of Financial Management: Traditional and modern Approach Finance Functions an overview: Investment decision, Financing Decision, Liquidity decisions Finance Functions: Dividend Decision, Risk and return Trade off in terms of finance functions Source of Finance: Long term sources Book :4,ch 1

Lecture 2 Lecture 3 Week 2 Lecture 4 Lecture 5

Book :5,ch1 Book :4,ch 1 Book :4,ch 1 Book :4,ch 3 HomeWork 1 Allocation Term Paper 1 Allocation

Ref 17: Video

Case study: Ref 13: Delite Furniture Limited

Approved for Spring Session 2010-11

Week 2 Week 3

Lecture 6 Lecture 7 Lecture 8 Lecture 9

Preference share capital as the source of finance Debentures & other long term source of finance Medium Term Sources of finance Short term Sources of finance Time Value of Money: Present Value (Basics using tables)

Book :4,ch 3 Book :4,ch 3 HomeWork 1 Submission

Week 4

Lecture 10

Book :1,ch 2

case study 3- ICICI Prudential retirement plan

Part 2

Week 4 Lecture 11 Lecture 12 Week 5 Lecture 13 Lecture 14 Lecture 15 Week 6 Lecture 16 Lecture 17 Lecture 18 Week 7 Lecture 19 Lecture 20 Lecture 21 Time Value of Money: Future Value, Net Present Value (Basics using tables) Time value of money: numerical based on net present value Other related aspects & application for time value Cost of Capital: Concept and its significance Cost of Capital: Cost of Debt & preference share capital Cost of Capital: Cost of Equity Cost of Capital: Weighted Average Cost of Capital Cost of Capital: numerical based upon WACOC Capital Structure Decision: Basics, significance etc. ->Reference :1,ch 14 ->Reference :2,ch 17 Understanding debt and equity and the factors affecting the debt and equity proportion Revision / test of the syllabus before MTE Quiz 1 ->Reference :1,ch 9 HomeWork 2 Submission ->Reference :1,ch 2 ->Reference :1,ch 2 ->Reference :1,ch 2 ->Reference :1,ch 9 HomeWork 2 Allocation excel templates Case study: Ref 12 Hindustan Lever Limited excel template

MID-TERM Part 3

Week 8 Lecture 22 Lecture 23 Capital Structure Decision: Concept of Financial Leverage, Effect on EPS Capital Structure Decision: Theories of Capital Structure (excluding the determination of value of firm numerically); Net Income Theory Capital Structure Decision: Traditional Theory HomeWork 3 Allocation ->Reference :1,ch 14 ->Reference :2,ch 17 Ref 18: Video excel templates

Lecture 24

Approved for Spring Session 2010-11

Week 9

Lecture 25 Lecture 26 Lecture 27

Capital Structure Theory: Irrelevance theory :Net Operating Income Capital Structure Theory: M&M Theory Capital Budgeting :Define, Type of Investment Projects, Importance Capital Budgeting :Analytical study of various methods : traditional methods: pay back period method Post pay back & accounting rate of return method

->Reference :1,ch 15 ->Reference :2,ch 17

->Reference :1,ch 8 ->Reference :1,ch 8 HomeWork 3 Submission Case: Ref 14: G.S Petropull Company

Week 10

Lecture 28

Lecture 29

Part 4

Week 10 Week 11 Lecture 30 Lecture 31 Lecture 32 Lecture 33 Week 12 Lecture 34 Lecture 35 Lecture 36 Week 13 Lecture 37 Lecture 38 Lecture 39 NPV method PI method & significance of capital budgeting decisions Working Capital : Concept, Types Determining working capital requirements i.e. factors affecting working capital decisions working capital and receivables management Inventory management, EOQ, Cash management theories of dividend Dividend Policy; Concept, Forms of dividend, Dividend Policy; Determinants of forming Dividend Policy, Theories of dividend: Walter Theory, Gorden & MM theory Break-Even Analysis ->Reference :1,Refrence 1; Ch 12 ->Reference :1,ch 18 ->Reference :2,ch 25 Quiz 2 HomeWork 4 Submission ->Reference :1,ch 27 ->Reference :1,ch 8 ->Reference :1,ch 8 ->Reference :1,ch 27 HomeWork 4 Allocation Term Paper 1 Submission

Spill Over

Week 14 Lecture 40 Lecture 41 Lecture 42 Week 15 Lecture 43 Current financial practices with regard to dividend Current financial practices with regard to capital structure Working capital practices International financial management ->Reference :17, ->Reference :15, ->Reference :16, ->Reference :1,ch 27

Approved for Spring Session 2010-11

Details of homework and case studies

Homework No. Homework 1 Topic of the Homework Media watch and analysis of the current financial movements in the business world for the better understanding of the financial world. students are required to collect articles, news. Instructor can check the scrapbook any time. 7 marks For scrapbook and 8 Marks for news Numerical Problems on time value of money. 5 Marks for submission 10 marks for test Numerical problems on capital structure. 5 marks for submission 10 marks for test Numerical Questions on working capital management. 5 marks for submission, 10 marks for test Nature of homework (group/individuals/field work Individual

Homework 2 Homework 3 Homework 4

Individual Individual Individual

Scheme for CA:out of 100*

Component Homework Term Paper Quiz Frequency 3 1 2 Total :Out Of 4 Each Marks Total Marks 15 25 15 55 45 25 30 100

* In ENG courses wherever the total exceeds 100, consider x best out of y components of CA, as explained in teacher's guide available on the UMS List of suggested topics for term paper[at least 15] (Student to spend about 15 hrs on any one specified term paper) Sr. No. Topic 1 Outline detailed information regarding the assigned company in terms of its background, history, management; Company position relative to industry Change in its share price over a year Capital Structure for last 3 years; Dividend Policy for last 5 years; Liquidity position; 2 A survey of corporate leasing analysis of any two companies 3 Dividend policy: its influence on the value of the enterprise for the last five years

4 Pre and post impact of dividend announcements on share price of any one company for the last five years 5 Impact of the difference and mix of current assets of two firms on their liquidity and profitability position

Approved for Spring Session 2010-11

6 Analysis of current asset composition of one company, each in Indian manufacturing, food products and electronics industry 7 Analysis of capital structure of a cement plant, software development firm and a call centre 8 Comparative analysis of cost of capital of two companies in the same industry for the last five years 9 Analysis of capital structure of a company over a period of ten years 10 Comparative analysis of Dividend policies of two companies in the same industry for the last three years 11 Analysis of Dividend policy of a company over a period of ten years

Plan for Tutorial: (Please do not use these time slots for syllabus coverage)

Tutorial No. Lecture Topic Type of pedagogical tool(s) planned (case analysis,problem solving test,role play,business game etc)

Tutorial 1 Tutorial 2 Tutorial 3 Tutorial 4 Tutorial 5 Tutorial 6 Tutorial 7

Discussion on the case study for the introduction of the Case analysis subject: Ref: 10 Discussion on "WHY DID THE CRISIS OF 2008 HAPPEN?" Ref: 6 Test of HW 1 VIVA & Doubt clearance session Case analysis,Problem solving Problem solving,Test

Practice of Numerical problems of Time value of Money Problem solving Discussion on " Value Maximization, Stakeholder Theory, and the Corporate Objective Function" Ref 7 Test of Hw-2 and Review of Term Paper Practice of Numericals Problems of Cost of capital & Doubt clearance session Case analysis Test Problem solving

After Mid-Term

Tutorial 8 Tutorial 9 Tutorial 10 Tutorial 11 Tutorial 12 6 Ref 8: "A note on stakeholders Theory & Risk" Ref: 11 Case Study " Divya handtools Private ltd" Test of HW 3 & discussion on the general topic of financial mgt Ref 9 " Working capital management and Firm's Profitability" and Review of term paper Test hw-4 Case analysis Case analysis,Problem solving Problem solving,Test Case analysis Test Approved for Spring Session 2010-11

Tutorial 13

Doubt clearance session

Problem solving

Approved for Spring Session 2010-11

Você também pode gostar

- MGT333Documento9 páginasMGT333nawabrpAinda não há avaliações

- MBA 1 Course Outline October 2010Documento67 páginasMBA 1 Course Outline October 2010Vu Hoang ThanhAinda não há avaliações

- MGT105Documento8 páginasMGT105shahnwazAinda não há avaliações

- FIN 400 Course SylDocumento4 páginasFIN 400 Course SylShebelle ColoradoAinda não há avaliações

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsAinda não há avaliações

- FIN501 Financial Management 14120::sumit Goyal 4.0 1.0 0.0 5.0 Courses With Numerical and Conceptual FocusDocumento10 páginasFIN501 Financial Management 14120::sumit Goyal 4.0 1.0 0.0 5.0 Courses With Numerical and Conceptual FocusSiddharth GautamAinda não há avaliações

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsNo EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsNota: 3 de 5 estrelas3/5 (1)

- FINN 200 - Intermediate Finance-Bushra NaqviDocumento4 páginasFINN 200 - Intermediate Finance-Bushra NaqviazizlumsAinda não há avaliações

- Syllabus2014 2015 PDFDocumento9 páginasSyllabus2014 2015 PDFartolas21Ainda não há avaliações

- Masters of Business Administration: (Financial Strategy and Policy)Documento12 páginasMasters of Business Administration: (Financial Strategy and Policy)Tanveer AhmedAinda não há avaliações

- 14 FRAV Prof Ramesh GuptaDocumento7 páginas14 FRAV Prof Ramesh GuptaSrinivaas GanesanAinda não há avaliações

- Financial Accounting TheoryDocumento8 páginasFinancial Accounting TheoryJustAHumanAinda não há avaliações

- Fundamentals of Finance SyllabusDocumento6 páginasFundamentals of Finance SyllabusVicky NguyenAinda não há avaliações

- Basic Business Finance 07Documento8 páginasBasic Business Finance 07knockdwnAinda não há avaliações

- RS Financial ManagementDocumento139 páginasRS Financial ManagementVishwas ShettyAinda não há avaliações

- Fin 202 ScheduleDocumento5 páginasFin 202 SchedulemadhuAinda não há avaliações

- The Future of Pension Management: Integrating Design, Governance, and InvestingNo EverandThe Future of Pension Management: Integrating Design, Governance, and InvestingAinda não há avaliações

- Financial Management PGDM 2013-14Documento32 páginasFinancial Management PGDM 2013-14Mahip Singh Pathania100% (2)

- A Project ProposalDocumento10 páginasA Project ProposalRam PandeyAinda não há avaliações

- Financial Accounting PGP 2015 Course OutlineDocumento7 páginasFinancial Accounting PGP 2015 Course OutlineNAinda não há avaliações

- Fin MGT Course Plan 012 FebDocumento7 páginasFin MGT Course Plan 012 FebOmkar PandeyAinda não há avaliações

- 186 Syllabus MCOM-1Documento30 páginas186 Syllabus MCOM-1Md Sharif HossainAinda não há avaliações

- Essentials of Corporate Financial Management 2ndDocumento99 páginasEssentials of Corporate Financial Management 2ndcharlisyuenAinda não há avaliações

- Finding Value in the Market - The Fundamentals of Fundamental AnalysisNo EverandFinding Value in the Market - The Fundamentals of Fundamental AnalysisAinda não há avaliações

- 01 Lesson Plan Financial AccountingDocumento14 páginas01 Lesson Plan Financial AccountingRajsha AliAinda não há avaliações

- Xavier Institute of Management and Research MMS-2020-2022 - Batch - II Semester Financial Management - Course OutlineDocumento4 páginasXavier Institute of Management and Research MMS-2020-2022 - Batch - II Semester Financial Management - Course OutlineNicole Ayesha D'SilvaAinda não há avaliações

- Instant Download Ebook PDF Finance For Managers Uk Higher Education Business Finance PDF ScribdDocumento52 páginasInstant Download Ebook PDF Finance For Managers Uk Higher Education Business Finance PDF Scribdmarian.hillis984100% (34)

- Lovely Professional University, Punjab: Course No Cours Title Course Planner Lectures Tutorial Practical CreditsDocumento7 páginasLovely Professional University, Punjab: Course No Cours Title Course Planner Lectures Tutorial Practical CreditsAmrish KumarAinda não há avaliações

- Full Download Book Financial Management Theory and Practice 10Th PDFDocumento41 páginasFull Download Book Financial Management Theory and Practice 10Th PDFcalvin.williams888100% (14)

- Post Graduate Programme in Management (PGP) AY: 2020-21 Term: Ii Title of The Course: Finance - I Credits: 3Documento6 páginasPost Graduate Programme in Management (PGP) AY: 2020-21 Term: Ii Title of The Course: Finance - I Credits: 3Rohit PanditAinda não há avaliações

- CCC C C! C"C! #CC % &#C"C C! #C C &C%Documento58 páginasCCC C C! C"C! #CC % &#C"C C! #C C &C%Chandra Sekhar JujjuvarapuAinda não há avaliações

- Maximizing the Value of Consulting: A Guide for Internal and External ConsultantsNo EverandMaximizing the Value of Consulting: A Guide for Internal and External ConsultantsAinda não há avaliações

- 8513-Financial ManagementDocumento7 páginas8513-Financial ManagementSulaman SadiqAinda não há avaliações

- M.B.A Sem I NewDocumento25 páginasM.B.A Sem I NewManish PariharAinda não há avaliações

- Financial Performance - VSPDocumento113 páginasFinancial Performance - VSPboidapu kanakarajuAinda não há avaliações

- Summer Internship Project ReportDocumento10 páginasSummer Internship Project ReportPraveen Sehgal0% (1)

- Basu DevDocumento8 páginasBasu Devbadaladhikari12345Ainda não há avaliações

- The Standard for Portfolio ManagementNo EverandThe Standard for Portfolio ManagementNota: 4.5 de 5 estrelas4.5/5 (3)

- FM Pgpwe 2024Documento4 páginasFM Pgpwe 2024ANKIT SHARMAAinda não há avaliações

- Performance Evaluation and Attribution of Security PortfoliosNo EverandPerformance Evaluation and Attribution of Security PortfoliosNota: 5 de 5 estrelas5/5 (1)

- FSA Course Outline 10-06-2016Documento6 páginasFSA Course Outline 10-06-2016Supreet NarangAinda não há avaliações

- Shree Theisi ProposalDocumento18 páginasShree Theisi ProposalHima RijalAinda não há avaliações

- The Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsNo EverandThe Complete Direct Investing Handbook: A Guide for Family Offices, Qualified Purchasers, and Accredited InvestorsAinda não há avaliações

- 1 .Background of Study: Diversity Advance What Is Trend of Deposit & InvestmentDocumento5 páginas1 .Background of Study: Diversity Advance What Is Trend of Deposit & Investmentdinesh khatriAinda não há avaliações

- Financial MGMT MBA 2nd SemDocumento188 páginasFinancial MGMT MBA 2nd Semnimala maniAinda não há avaliações

- MFMC0001: Business Environment and Management Practices: ObjectivesDocumento16 páginasMFMC0001: Business Environment and Management Practices: ObjectivesIshan SharmaAinda não há avaliações

- ACC501 AccountsDocumento15 páginasACC501 AccountsSandip KumarAinda não há avaliações

- BMS Sem1Documento14 páginasBMS Sem1Maunil Shah0% (1)

- BMS SyllabusDocumento14 páginasBMS SyllabusNavin SarafAinda não há avaliações

- Afsa IvDocumento7 páginasAfsa IvShivangi BhasinAinda não há avaliações

- Proposalof MachhapuchhreDocumento5 páginasProposalof Machhapuchhreprajwaldhakal2057Ainda não há avaliações

- Financial Planning & Analysis and Performance ManagementNo EverandFinancial Planning & Analysis and Performance ManagementNota: 3 de 5 estrelas3/5 (1)

- k4115 Syllabus Spring 2012Documento4 páginask4115 Syllabus Spring 2012api-22218014Ainda não há avaliações

- Guidelines On Process and Evaluation of Corporate Internship-2011-Suggestions IncorporatedDocumento5 páginasGuidelines On Process and Evaluation of Corporate Internship-2011-Suggestions IncorporatedSaurabh BansalAinda não há avaliações

- The Value of Innovation: Knowing, Proving, and Showing the Value of Innovation and CreativityNo EverandThe Value of Innovation: Knowing, Proving, and Showing the Value of Innovation and CreativityAinda não há avaliações

- HTMLDocumento1 páginaHTMLSk SharmaAinda não há avaliações

- Closing Account For Indusind AccountDocumento1 páginaClosing Account For Indusind AccountSk SharmaAinda não há avaliações

- Pangay Wali - SynopsisDocumento3 páginasPangay Wali - SynopsisSk SharmaAinda não há avaliações

- Product Name: HP Notebook - 14-Ac153tx Model Name: W6T25PA Serial Number: 5CG64204VMDocumento1 páginaProduct Name: HP Notebook - 14-Ac153tx Model Name: W6T25PA Serial Number: 5CG64204VMSk SharmaAinda não há avaliações

- Marriage Resume: For More Information, Please Contact The Dibble Institute 800-695-7975Documento5 páginasMarriage Resume: For More Information, Please Contact The Dibble Institute 800-695-7975Tusher SahaAinda não há avaliações

- Marriage ResumeDocumento2 páginasMarriage ResumeSk SharmaAinda não há avaliações

- Exercise 1.create A Navigation Bar in Tabular Format.: Year Length Day Length MercuryDocumento6 páginasExercise 1.create A Navigation Bar in Tabular Format.: Year Length Day Length MercurySk SharmaAinda não há avaliações

- Practical 1Documento4 páginasPractical 1Sk SharmaAinda não há avaliações

- Assingment Front PageDocumento1 páginaAssingment Front PageSk SharmaAinda não há avaliações

- CeaserDocumento1 páginaCeaserSk SharmaAinda não há avaliações

- Cap680 (Programming in Java-Laboratory)Documento3 páginasCap680 (Programming in Java-Laboratory)Sk SharmaAinda não há avaliações

- Crypto TPDocumento13 páginasCrypto TPSk SharmaAinda não há avaliações

- Cap615 (Programming in Java)Documento8 páginasCap615 (Programming in Java)Sk SharmaAinda não há avaliações

- CeaserDocumento1 páginaCeaserSk SharmaAinda não há avaliações

- Employee DetailsDocumento1 páginaEmployee DetailsSk SharmaAinda não há avaliações

- Curriculum VitaeDocumento3 páginasCurriculum VitaeSk SharmaAinda não há avaliações

- Assignment 4 E3001Documento3 páginasAssignment 4 E3001Sk SharmaAinda não há avaliações

- Lovely Professional University: Term PaperDocumento4 páginasLovely Professional University: Term PaperSk SharmaAinda não há avaliações

- Cap315 (Object Oriented Analysis and Design)Documento6 páginasCap315 (Object Oriented Analysis and Design)Sk SharmaAinda não há avaliações

- Home Work 3 of E3001Documento3 páginasHome Work 3 of E3001Sk SharmaAinda não há avaliações

- Imports Imports Public Class Dim As Dim As Private Sub Byval As Byval As Handles NewDocumento1 páginaImports Imports Public Class Dim As Dim As Private Sub Byval As Byval As Handles NewSk SharmaAinda não há avaliações

- Public NotInheritable Class SplashScreen1Documento12 páginasPublic NotInheritable Class SplashScreen1Sk SharmaAinda não há avaliações

- Imports Imports Public Class Dim As Dim As Private Sub Byval As Byval As Handles NewDocumento1 páginaImports Imports Public Class Dim As Dim As Private Sub Byval As Byval As Handles NewSk SharmaAinda não há avaliações

- Addison Wesley - Booch Et Al. - The Unified Modeling Language User GuideDocumento391 páginasAddison Wesley - Booch Et Al. - The Unified Modeling Language User GuideolusapAinda não há avaliações

- Data Flow Diagram ExerciseDocumento2 páginasData Flow Diagram ExerciseSk SharmaAinda não há avaliações

- Bresenhman AlgoDocumento1 páginaBresenhman AlgoSk SharmaAinda não há avaliações

- Guidelines For Change of Programme - 17th April 2012Documento3 páginasGuidelines For Change of Programme - 17th April 2012Sk SharmaAinda não há avaliações

- Lovely Professional University Application Form For Change of ProgrammeDocumento5 páginasLovely Professional University Application Form For Change of ProgrammeSk SharmaAinda não há avaliações

- HW1 (Networks)Documento10 páginasHW1 (Networks)Sk SharmaAinda não há avaliações

- Egyptian Processed Food Sector Development Strategy - ENDocumento442 páginasEgyptian Processed Food Sector Development Strategy - ENReyes Maria Kristina Victoria100% (1)

- Bank MaterialDocumento30 páginasBank Materialgaffar87mcaAinda não há avaliações

- Investment Analyst CV TemplateDocumento3 páginasInvestment Analyst CV TemplatenisteelroyAinda não há avaliações

- The Challenges and Opportunities For Sustainable BDocumento10 páginasThe Challenges and Opportunities For Sustainable BThabaswini SAinda não há avaliações

- Recruitment of A StarDocumento8 páginasRecruitment of A StarAshok Kumar VishnoiAinda não há avaliações

- Book CaseDocumento11 páginasBook CaseW HWAinda não há avaliações

- China Water Purifier Production: 4.2.2 by SegmentDocumento3 páginasChina Water Purifier Production: 4.2.2 by SegmentWendell MerrillAinda não há avaliações

- MCQs Unit 1 An Introduction To Labour Laws in IndiaDocumento9 páginasMCQs Unit 1 An Introduction To Labour Laws in IndiaRia Deshpande100% (1)

- Customer Relationship ManagementDocumento5 páginasCustomer Relationship ManagementAbhinandan JenaAinda não há avaliações

- Primus - Abap FactoryDocumento2 páginasPrimus - Abap FactorySambhajiAinda não há avaliações

- Biniam TassewDocumento74 páginasBiniam Tassewabel debebeAinda não há avaliações

- Homabay County Draft Strategic PlanDocumento107 páginasHomabay County Draft Strategic PlanCyprian Otieno Awiti86% (7)

- Ricardo Pangan ActivityDocumento1 páginaRicardo Pangan ActivityDanjie Barrios50% (2)

- Allwyn Nissan Group 8Documento58 páginasAllwyn Nissan Group 8Jayesh VasavaAinda não há avaliações

- Entreprunership Chapter 3Documento12 páginasEntreprunership Chapter 3fitsumAinda não há avaliações

- Applied of Commercial and Quality Principles in EngineeringDocumento5 páginasApplied of Commercial and Quality Principles in EngineeringCIYA ELIZAAinda não há avaliações

- New Issue MarketDocumento15 páginasNew Issue Marketshivakumar NAinda não há avaliações

- Why Did Subhiksha FailedDocumento11 páginasWhy Did Subhiksha Failedpujil2009Ainda não há avaliações

- Temporary Employment ContractDocumento2 páginasTemporary Employment ContractLancemachang Eugenio100% (2)

- Course Outline PDFDocumento2 páginasCourse Outline PDFSamiun TinyAinda não há avaliações

- What Is Talent ManagementDocumento8 páginasWhat Is Talent ManagementarturoceledonAinda não há avaliações

- Business Plan - Potato MilkDocumento29 páginasBusiness Plan - Potato MilkTania TahminAinda não há avaliações

- Ch. 1 Globalization IBDocumento18 páginasCh. 1 Globalization IBnikowawaAinda não há avaliações

- 000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocumento4 páginas000 Citibank Client Services 040 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AMónica M. RodríguezAinda não há avaliações

- Summer Training ReportDocumento54 páginasSummer Training ReportSyed Irfan Bin InayatAinda não há avaliações

- BCLTE Points To ReviewDocumento4 páginasBCLTE Points To Review•Kat Kat's Lifeu•Ainda não há avaliações

- Case Study - DaburDocumento1 páginaCase Study - DaburMonica PandeyAinda não há avaliações

- Manpower Supply Service Agreement-Security ServicesDocumento3 páginasManpower Supply Service Agreement-Security Servicesusaha sama workAinda não há avaliações

- Sukhwinder Kaur - Office ManagerDocumento4 páginasSukhwinder Kaur - Office ManagerAbhishek aby5Ainda não há avaliações

- Capacity Development AgendaDocumento7 páginasCapacity Development AgendaApple PoyeeAinda não há avaliações