Escolar Documentos

Profissional Documentos

Cultura Documentos

Importance of Ifm

Enviado por

Sonu JoiyaDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Importance of Ifm

Enviado por

Sonu JoiyaDireitos autorais:

Formatos disponíveis

Importance of finance cannot be over-emphasised. It is, indeed, the key to successful business operations.

Without proper administration of finance, no business enterprise can reach its full potentials for growth and success. Money is a universal lubricant which keeps the enterprise dynamic-develops product, keeps men and machines at work, encourages management to make progress and creates values. The importance of financial administration can be discussed under the following heads:(i) success of Promotion Depends on Financial Administration. One of the most important reasons of failures of business promotions is a defective financial plan. If the plan adopted fails to provide sufficient capital to meet the requirement of fixed and fluctuating capital an particularly, the latter, or it fails to assume the obligations by the corporations without establishing earning power, the business cannot be carried on successfully. Hence sound financial plan is very necessary for the success of business enterprise. (ii) Smooth Running of an Enterprise. Sound Financial planning is necessary for the smooth running of an enterprise. Money is to an enterprise, what oil is to an engine. As, Finance is required at each stage f an enterprise, i.e., promotion, incorporation, development, expansion and administration of day-to-day working etc., proper administration of finance is very necessary. Proper financial administration means the study, analysis and evaluation of all financial problems to be faced by the management and to take proper decision with reference to the present circumstances in regard to the procurement and utilisation of funds. (iii) Financial Administration Co-ordinates Various Functional Activities. Financial administration provides complete co-ordination between various functional areas such as marketing, production etc. to achieve the organisational goals. If financial management is defective, the efficiency of all other departments can, in no way, be maintained. For example, it is very necessary for the finance-department to provide finance for the purchase of raw materials and meting the other day-to-day expenses for the smooth running of the production unit. If financial department fails in its obligations, the Production and the sales will suffer and consequently, the income of the concern and the rate of profit on investment will also suffer. Thus Financial administration occupies a central place in the business organisation which controls and co-ordinates all other activities in the concern. (iv) Focal Point of Decision Making. Almost, every decision in the business is take in the light of its profitability. Financial administration provides scientific analysis of all facts and figures through various financial tools, such as different financial statements, budgets etc., which help in evaluating the profitability of the plan in the given circumstances, so that a proper decision can be taken to minimise the risk involved in the plan. (v) Determinant of Business Success. It has been recognised, even in India that the financial manger splay a very important role in the success of business organisation by advising the top management the solutions of the various financial

problems as experts. They present important facts and figures regarding financial position an the performance of various functions of the company in a given period before the top management in such a way so as to make it easier for the top management to evaluate the progress of the company to amend suitably the principles and policies of the company. The financial manges assist the top management in its decision making process by suggesting the best possible alternative out of the various alternatives of the problem available. Hence, financial management helps the management at different level in taking financial decisions. (vi) Measure of Performance. The performance of the firm can be measured by its financial results, i.e, by its size of earnings Riskiness and profitability are two major factors which jointly determine the value of the concern. Financial decisions which increase risks will decrease the value of the firm and on the to the hand, financial decisions which increase the profitability will increase value of the firm. Risk an profitability are two essential ingredients of a business concern.

Você também pode gostar

- 1.1 What Is Financial Management?: 1.1.1 Investment DecisionDocumento20 páginas1.1 What Is Financial Management?: 1.1.1 Investment DecisionTasmay EnterprisesAinda não há avaliações

- From Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1No EverandFrom Data to Decisions: Harnessing FP&A for Financial Leadership: FP&A Mastery Series, #1Ainda não há avaliações

- Financial ManagementDocumento16 páginasFinancial ManagementDijen ChingAinda não há avaliações

- Chapter 1 Introduction - Chapter 2 Industrial ProfileDocumento74 páginasChapter 1 Introduction - Chapter 2 Industrial Profilebalki123Ainda não há avaliações

- Financial Management: Ariel Dizon Pineda, CPADocumento88 páginasFinancial Management: Ariel Dizon Pineda, CPARenz Fernandez100% (7)

- AssignmentDocumento15 páginasAssignmentagrawal.sshivaniAinda não há avaliações

- Financial Management Class Notes For BBADocumento20 páginasFinancial Management Class Notes For BBASameel Rehman67% (3)

- Financial Management Lesson No. 1Documento4 páginasFinancial Management Lesson No. 1Geraldine MayoAinda não há avaliações

- FM Question Bank Answers by PKGDocumento14 páginasFM Question Bank Answers by PKGhimanshu shekharAinda não há avaliações

- Financial Management Lecture 101BDocumento5 páginasFinancial Management Lecture 101BDenied Stell100% (1)

- Financial Management ObjectivesDocumento5 páginasFinancial Management ObjectivesPinak DebAinda não há avaliações

- Business FinanceDocumento6 páginasBusiness FinanceAbhishek WadkarAinda não há avaliações

- Nature of Financial ManagementDocumento2 páginasNature of Financial ManagementRishikesh KumarAinda não há avaliações

- Financial Management GoalsDocumento4 páginasFinancial Management GoalsAkshay Pratap Singh ShekhawatAinda não há avaliações

- What Is Strategic Financial ManagementDocumento10 páginasWhat Is Strategic Financial Managementpra leshAinda não há avaliações

- Scope of Financial ManagementDocumento6 páginasScope of Financial ManagementMy thoughtAinda não há avaliações

- Financial Management CIA!Documento10 páginasFinancial Management CIA!TEJASWI K NAinda não há avaliações

- Lesson 1: Organize Plan Control DirectDocumento5 páginasLesson 1: Organize Plan Control DirectBeverly LaurinariaAinda não há avaliações

- Unit 1-Financial ManagementDocumento66 páginasUnit 1-Financial ManagementAshwini shenolkarAinda não há avaliações

- Manajemen Keuangan/ Financial Management: Endang Etty MerawatiDocumento41 páginasManajemen Keuangan/ Financial Management: Endang Etty MerawatiilaAinda não há avaliações

- Home Assignment on Financial Management Key IndicatorsDocumento12 páginasHome Assignment on Financial Management Key Indicatorshardik kabraAinda não há avaliações

- Financial ManagementDocumento18 páginasFinancial ManagementJohnykutty JosephAinda não há avaliações

- Module 1 - Nature, Basic Concepts and Scope of Financial ManagementDocumento11 páginasModule 1 - Nature, Basic Concepts and Scope of Financial ManagementMarjon DimafilisAinda não há avaliações

- Business Finance ConceptDocumento55 páginasBusiness Finance ConceptBir MallaAinda não há avaliações

- FM Module 1Documento9 páginasFM Module 1ZekiAinda não há avaliações

- 1. Finance FunctionDocumento6 páginas1. Finance FunctionPRATYUSH SINHAAinda não há avaliações

- Role of Financial Manager in The Changing ScenarioDocumento5 páginasRole of Financial Manager in The Changing ScenarioAnkit Arora71% (7)

- Introduction to Business Finance ConceptsDocumento10 páginasIntroduction to Business Finance Conceptsprasadnaidu00Ainda não há avaliações

- FM 1Documento7 páginasFM 1Rohini rs nairAinda não há avaliações

- Wipro ProjectDocumento91 páginasWipro ProjectDeepak DineshAinda não há avaliações

- Role of Financial MNGRDocumento1 páginaRole of Financial MNGRShum ShireAinda não há avaliações

- Module-1 Introduction To Finanaical ManagementDocumento79 páginasModule-1 Introduction To Finanaical ManagementRevathi RevathiAinda não há avaliações

- Financial ManagementDocumento51 páginasFinancial Managementarjunmba119624Ainda não há avaliações

- Financial Management: Financial Management Entails Planning For The Future of A Person orDocumento5 páginasFinancial Management: Financial Management Entails Planning For The Future of A Person orPriya PalAinda não há avaliações

- FINANCEDocumento7 páginasFINANCELynn GraceAinda não há avaliações

- FM assignmentDocumento8 páginasFM assignmentvidhipriyathakurAinda não há avaliações

- Financial Management GuideDocumento3 páginasFinancial Management GuideAszad RazaAinda não há avaliações

- Financial ObjectivesDocumento11 páginasFinancial ObjectivesLinda ZyongweAinda não há avaliações

- Assignment of Financial ManagementDocumento7 páginasAssignment of Financial Managementhyder imamAinda não há avaliações

- Financial Management Financing Decision Investment Decision Dividend DecisionDocumento5 páginasFinancial Management Financing Decision Investment Decision Dividend Decisionjagdish makwanaAinda não há avaliações

- FINANCIAL MANAGEMENT: OBJECTIVES AND DECISIONSDocumento8 páginasFINANCIAL MANAGEMENT: OBJECTIVES AND DECISIONSRizwana BegumAinda não há avaliações

- Introduction of FMDocumento11 páginasIntroduction of FMsonika7Ainda não há avaliações

- Financialmanagementpondicherry 140323121153 Phpapp01Documento70 páginasFinancialmanagementpondicherry 140323121153 Phpapp01Nguyen Dac ThichAinda não há avaliações

- Financial Management (TARUN PANT)Documento13 páginasFinancial Management (TARUN PANT)Tarun PantAinda não há avaliações

- SFBSGFDocumento1 páginaSFBSGFMuhibur's EntertainmentAinda não há avaliações

- Financial ManagementDocumento11 páginasFinancial ManagementWaseem KhanAinda não há avaliações

- DEF "Financial Management Is The Activity Conce-Rned With Planning, Raising, Controlling and Administering of Funds Used in The Business."Documento190 páginasDEF "Financial Management Is The Activity Conce-Rned With Planning, Raising, Controlling and Administering of Funds Used in The Business."katta swathi100% (1)

- WORKING CAPITAL MANAGEMENT: INDUSTRY PROFILEDocumento59 páginasWORKING CAPITAL MANAGEMENT: INDUSTRY PROFILERavi ShankarAinda não há avaliações

- ACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyDocumento3 páginasACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyAdrienne Nicole MercadoAinda não há avaliações

- Financial ManagementDocumento11 páginasFinancial ManagementTina KalitaAinda não há avaliações

- Finance Function ObjectivesDocumento7 páginasFinance Function ObjectivesanbuAinda não há avaliações

- Advanced Financial Managment FinalDocumento9 páginasAdvanced Financial Managment FinalMohit BAinda não há avaliações

- Introduction To Finance and AccountingDocumento38 páginasIntroduction To Finance and AccountingDr.Ashok Kumar PanigrahiAinda não há avaliações

- CF Final Guess-1Documento10 páginasCF Final Guess-1087-Md Arshad Danish KhanAinda não há avaliações

- Financial Management IntroductionDocumento28 páginasFinancial Management IntroductionAkash ArvikarAinda não há avaliações

- Role of A Financial ManagerDocumento2 páginasRole of A Financial ManagerANKITA JAISWALAinda não há avaliações

- Financial Management: Roles of CFODocumento6 páginasFinancial Management: Roles of CFOKhushal SainiAinda não há avaliações

- Chapter 1 - Financial Policy and Corporate StrategyDocumento12 páginasChapter 1 - Financial Policy and Corporate Strategysungate007100% (8)

- Financial Management NotesDocumento34 páginasFinancial Management NotesNalugo LeilahAinda não há avaliações

- Project OverviewDocumento9 páginasProject OverviewSonu JoiyaAinda não há avaliações

- Basic Accounting PrinciplesDocumento3 páginasBasic Accounting PrinciplesSonu JoiyaAinda não há avaliações

- Modified Grammar1Documento19 páginasModified Grammar1Sonu JoiyaAinda não há avaliações

- Essentials of Marketing Research: Kumar, Aaker, Day Instructor's Presentation SlidesDocumento16 páginasEssentials of Marketing Research: Kumar, Aaker, Day Instructor's Presentation SlidesSonu JoiyaAinda não há avaliações

- India Post Payments Bank PDFDocumento39 páginasIndia Post Payments Bank PDFnbprAinda não há avaliações

- Motilal Oswal Securities Ltd. Summer Internship ReportDocumento104 páginasMotilal Oswal Securities Ltd. Summer Internship ReportSathavara Ketul100% (2)

- Square RootsDocumento1 páginaSquare RootssalmanscribdAinda não há avaliações

- Square RootsDocumento1 páginaSquare RootssalmanscribdAinda não há avaliações

- Basic Accounting PrinciplesDocumento3 páginasBasic Accounting PrinciplesSonu JoiyaAinda não há avaliações

- Dissertation ReportDocumento22 páginasDissertation ReportSonu Joiya0% (1)

- Comparison Between Religare and Other FirmsDocumento91 páginasComparison Between Religare and Other FirmsAshish AryaAinda não há avaliações

- Essentials of Marketing Research: Kumar, Aaker, Day Instructor's Presentation SlidesDocumento16 páginasEssentials of Marketing Research: Kumar, Aaker, Day Instructor's Presentation SlidesSonu JoiyaAinda não há avaliações

- Project AppraisalDocumento27 páginasProject AppraisalSonu JoiyaAinda não há avaliações

- Out Sourcing Current and FutureDocumento22 páginasOut Sourcing Current and FutureSonu JoiyaAinda não há avaliações

- Spain GDP Growth RateDocumento26 páginasSpain GDP Growth RateSonu JoiyaAinda não há avaliações

- ReportDocumento30 páginasReportSonu JoiyaAinda não há avaliações

- South Korea2011... EconomicsDocumento71 páginasSouth Korea2011... EconomicsSonu JoiyaAinda não há avaliações

- International BusinessDocumento68 páginasInternational BusinessSonu JoiyaAinda não há avaliações

- SMFDocumento5 páginasSMFSonu JoiyaAinda não há avaliações

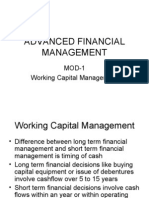

- Advanced Financial Management: MOD-1 Working Capital ManagementDocumento111 páginasAdvanced Financial Management: MOD-1 Working Capital ManagementSonu JoiyaAinda não há avaliações

- Human Resource Planning Concept and Need Factors Affecting HRP HRP Process L 3 1225376118868825 8Documento15 páginasHuman Resource Planning Concept and Need Factors Affecting HRP HRP Process L 3 1225376118868825 8navpreetlove100% (1)

- QQQ - Pureyr2 - Chapter 3 - Sequences & Series (V2) : Total Marks: 42Documento4 páginasQQQ - Pureyr2 - Chapter 3 - Sequences & Series (V2) : Total Marks: 42Medical ReviewAinda não há avaliações

- Manzano's and Kendall Taxonomy of Cognitive ProcessesDocumento5 páginasManzano's and Kendall Taxonomy of Cognitive ProcessesSheena BarulanAinda não há avaliações

- Moment Baseplate DesignDocumento10 páginasMoment Baseplate DesignNeil JonesAinda não há avaliações

- Develop Your Kuji In Ability in Body and MindDocumento7 páginasDevelop Your Kuji In Ability in Body and MindLenjivac100% (3)

- Mri 7 TeslaDocumento12 páginasMri 7 TeslaJEAN FELLIPE BARROSAinda não há avaliações

- The Effect of Reward Practices on Employee Performance in Ethio TelecomDocumento29 páginasThe Effect of Reward Practices on Employee Performance in Ethio TelecomZakki Hersi AbdiAinda não há avaliações

- Clinic Management System (24 PGS)Documento24 páginasClinic Management System (24 PGS)pranithAinda não há avaliações

- Elliptic Curve Cryptography and ApplicationsDocumento9 páginasElliptic Curve Cryptography and ApplicationssiddthesquidAinda não há avaliações

- CV Raman's Discovery of the Raman EffectDocumento10 páginasCV Raman's Discovery of the Raman EffectjaarthiAinda não há avaliações

- Grillage Method Applied to the Planning of Ship Docking 150-157 - JAROE - 2016-017 - JangHyunLee - - 최종Documento8 páginasGrillage Method Applied to the Planning of Ship Docking 150-157 - JAROE - 2016-017 - JangHyunLee - - 최종tyuAinda não há avaliações

- Perceptron Example (Practice Que)Documento26 páginasPerceptron Example (Practice Que)uijnAinda não há avaliações

- Policarpio 3 - Refresher GEODocumento2 páginasPolicarpio 3 - Refresher GEOJohn RoaAinda não há avaliações

- Capitalism Communism Socialism DebateDocumento28 páginasCapitalism Communism Socialism DebateMr. Graham Long100% (1)

- 4idealism Realism and Pragmatigsm in EducationDocumento41 páginas4idealism Realism and Pragmatigsm in EducationGaiLe Ann100% (1)

- MC145031 Encoder Manchester PDFDocumento10 páginasMC145031 Encoder Manchester PDFson_gotenAinda não há avaliações

- Charny - Mathematical Models of Bioheat TransferDocumento137 páginasCharny - Mathematical Models of Bioheat TransferMadalena PanAinda não há avaliações

- Menggambar Dengan Mode GrafikDocumento30 páginasMenggambar Dengan Mode GrafikkurniawanAinda não há avaliações

- DPCA OHE Notice of Appeal 4-11-2018 FinalDocumento22 páginasDPCA OHE Notice of Appeal 4-11-2018 Finalbranax2000Ainda não há avaliações

- Structural Testing Facilities at University of AlbertaDocumento10 páginasStructural Testing Facilities at University of AlbertaCarlos AcnAinda não há avaliações

- © Call Centre Helper: 171 Factorial #VALUE! This Will Cause Errors in Your CalculationsDocumento19 páginas© Call Centre Helper: 171 Factorial #VALUE! This Will Cause Errors in Your CalculationswircexdjAinda não há avaliações

- Db2 Compatibility PDFDocumento23 páginasDb2 Compatibility PDFMuhammed Abdul QaderAinda não há avaliações

- Time Series Data Analysis For Forecasting - A Literature ReviewDocumento5 páginasTime Series Data Analysis For Forecasting - A Literature ReviewIJMERAinda não há avaliações

- ME927 Energy Resources and Policy SyllabusDocumento5 páginasME927 Energy Resources and Policy SyllabusAditya Whisnu HeryudhantoAinda não há avaliações

- Literary Text Analysis WorksheetDocumento1 páginaLiterary Text Analysis Worksheetapi-403444340Ainda não há avaliações

- Neptune Sign House AspectDocumento80 páginasNeptune Sign House Aspectmesagirl94% (53)

- Rhythm Music and Education - Dalcroze PDFDocumento409 páginasRhythm Music and Education - Dalcroze PDFJhonatas Carmo100% (3)

- Learn Six Sigma Process and Methodology BasicsDocumento4 páginasLearn Six Sigma Process and Methodology BasicsGeorge MarkasAinda não há avaliações

- Mind MapDocumento1 páginaMind Mapjebzkiah productionAinda não há avaliações

- The History of American School Libraries: Presented By: Jacob Noodwang, Mary Othic and Noelle NightingaleDocumento21 páginasThe History of American School Libraries: Presented By: Jacob Noodwang, Mary Othic and Noelle Nightingaleapi-166902455Ainda não há avaliações

- Mosek UserguideDocumento81 páginasMosek UserguideadethroAinda não há avaliações

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNo EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeNota: 4.5 de 5 estrelas4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurNo Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurNota: 4 de 5 estrelas4/5 (2)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldNo Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldNota: 5 de 5 estrelas5/5 (19)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsNo EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsNota: 4 de 5 estrelas4/5 (6)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureNo EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureNota: 4.5 de 5 estrelas4.5/5 (100)

- Your Next Five Moves: Master the Art of Business StrategyNo EverandYour Next Five Moves: Master the Art of Business StrategyNota: 5 de 5 estrelas5/5 (794)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsNo EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsNota: 5 de 5 estrelas5/5 (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveAinda não há avaliações

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedNo EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedNota: 4.5 de 5 estrelas4.5/5 (38)

- Anything You Want: 40 lessons for a new kind of entrepreneurNo EverandAnything You Want: 40 lessons for a new kind of entrepreneurNota: 5 de 5 estrelas5/5 (46)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelNo EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelNota: 5 de 5 estrelas5/5 (51)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:No EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Nota: 5 de 5 estrelas5/5 (2)

- Without a Doubt: How to Go from Underrated to UnbeatableNo EverandWithout a Doubt: How to Go from Underrated to UnbeatableNota: 4 de 5 estrelas4/5 (23)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessNo EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessNota: 4.5 de 5 estrelas4.5/5 (24)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsNo EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsNota: 5 de 5 estrelas5/5 (48)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeNo EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeNota: 4.5 de 5 estrelas4.5/5 (30)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisNo EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisNota: 4.5 de 5 estrelas4.5/5 (3)

- Creative Personal Branding: The Strategy To Answer What's Next?No EverandCreative Personal Branding: The Strategy To Answer What's Next?Nota: 4.5 de 5 estrelas4.5/5 (3)

- Crushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooNo EverandCrushing It!: How Great Entrepreneurs Build Their Business and Influence-and How You Can, TooNota: 5 de 5 estrelas5/5 (887)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessNo EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessNota: 4.5 de 5 estrelas4.5/5 (407)

- AI Money Machine: Unlock the Secrets to Making Money Online with AINo EverandAI Money Machine: Unlock the Secrets to Making Money Online with AIAinda não há avaliações

- Becoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysNo EverandBecoming Trader Joe: How I Did Business My Way and Still Beat the Big GuysNota: 4.5 de 5 estrelas4.5/5 (17)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeNo EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeNota: 5 de 5 estrelas5/5 (23)

- Summary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesNo EverandSummary of The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric RiesNota: 4.5 de 5 estrelas4.5/5 (99)

- Entrepreneurial Leap, Updated and Expanded Edition: A Real-World Guide to Discovering What It Takes to Be an Entrepreneur and How You Can Build the Business of Your DreamsNo EverandEntrepreneurial Leap, Updated and Expanded Edition: A Real-World Guide to Discovering What It Takes to Be an Entrepreneur and How You Can Build the Business of Your DreamsNota: 5 de 5 estrelas5/5 (5)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesNo EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesNota: 5 de 5 estrelas5/5 (21)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeNo EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeNota: 5 de 5 estrelas5/5 (22)

- Summary of The 33 Strategies of War by Robert GreeneNo EverandSummary of The 33 Strategies of War by Robert GreeneNota: 3.5 de 5 estrelas3.5/5 (20)