Escolar Documentos

Profissional Documentos

Cultura Documentos

Want To Set Up Business in India

Enviado por

Sourav KumarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Want To Set Up Business in India

Enviado por

Sourav KumarDireitos autorais:

Formatos disponíveis

December 2009

Want to Set UP Business in India ?

Want to Set up Business in India?

Disclosure: This is not an exhaustive Study and Present only for the General Information of the intended user only.

K R A & Co.

KRA & CO.

Chartered Accountants

2

1

2009

Want to Set Up Business in India?

Regulatory & Tax Aspects Establishment of Business Entity in India

Structures Available in India to Set up a New Business:

for

Liaison Office

Subsidiary Company

Branch Office

KRA & CO.

Chartered Accountants

December 2009

Want to Set UP Business in India ?

Liaison Office:

Companies Incorporated Outside India can establish their Liaison Offices in India. Opening up of a Liaison Office (Also known as Representative Office) Require Prior Approval of Reserve Bank of India (RBI). Initial Permission was granted for Three Years which could be subsequently extend by the RBI. A Liaison office can not enter into any commercial or business activity in India and can undertake only Liaison and related activities on behalf of its parent company Like:

Representing the parent/ group companies in India. To Act as the channel of Communication between its Head Office and Parties in India. Collecting and/ or providing business information. Promoting export/ import from/ to India. Promoting Technical/ financial collaborations between parent/ group companies and Indian companies. Expenses of Liaison office are to be met entirely by inward remittances from the head office. As Liaison office is not allowed to undertake any profit making activities hence not liable to Income Tax. Liaison office is required to submit annual activity report from its Chartered Accountant/ CPA to RBI to ensure that it has undertaken only those activities that have been permitted by the RBI. A Liaison office is required to register itself with the Registrar of Companies (ROC) and to comply with certain procedural formalities, as prescribed under the Companies Act 1956. Foreign Insurance Companies can establish liaison offices in India after obtaining necessary approval from the Insurance Regulatory and Development Authority of India. Liaison Office has advantages like easy operations, less formalities and simple closer procedure. Operations of a Liaison office are limited to collection of market information on behalf of the company and providing information about the company and its products to existing/ potential customers. It takes 6-8 weeks to obtain all these approvals after receiving of all the necessary documents.

KRA & CO.

Chartered Accountants

2

3

2009

Want to Set Up Business in India?

Branch Offices:

Companies incorporated outside India and engaged in manufacturing or trading activities are allowed to set up a branch office in India with specific approval from Reserve Bank of India to undertake the permitted activities only. Branch Offices are permitted to represent parent/ group companies and undertake the following activities:

Export/ Import of goods. Procurement of Goods for export and sale of goods after import are allowed only on wholesale basis. Rendering of Professional or consultancy services. Carrying out of research work in the areas in which the parent company is engaged. Promoting technical and financial collaborations between Indian Companies and Parent Group Companies. To act as buying/ selling agent in India. Rendering of IT and Software Development Services in India. Rendering Technical Support to the products supplied by the parent/ group companies in India. Branches are not allowed to undertake retail trading activities in India of any nature. A Branch office can not carry out any manufacturing and processing activities in India. Branch Office is required to register itself with the Registrar of Companies and to comply with certain procedural formalities. Profits earned by the branches can be freely remitted to Head Office subject to payment of applicable taxes. Branch Offices are required to submit annual activity report from its CA/CPA to RBI. For income tax purposes branch is treated as extension of Foreign Company and on income attributable to business in India is taxable as same of a Foreign Company. Transactions between Branch and Head Office are subject to Transfer Pricing Regulations. Branch Office also has advantages like easy operations, less formalities & simple Exit Procedure. However its operations are restricted and may not provide flexibility in terms of expansion and diversification. Formation Time: 6 to 8 Weeks.

KRA & CO.

Chartered Accountants

2009

Want to Set Up Business in India?

Wholly Owned Subsidiary/Joint Venture

Foreign entity may set up subsidiary companies in India which can be private or public limited, with or without limited liability. In India companies are incorporated and regulated under the provisions of the companies Act, 1956 and are subjected to certain procedural formalities under the Act. The liability of the members can be limited by shares or guarantee. In the former, the personal liability of member is limited to the amount unpaid on their shares while in the latter; it is limited by a pre-decided amount. For companies with unlimited liability, the liability of its members is unlimited. Subsidiaries can either be wholly owned or in joint venture with some Indian partner, as per RBI (FDI) rules. Except in few sectors where foreign direct investment cap is applicable, foreign entity can have 100% subsidiary. It can undertake all types of business activities, as may be permitted by its charter, which may include marketing, manufacturing, providing services, etc. No RBI approval is needed where 100% direct investment is permissible. It is treated as domestic company under Indian tax law and is eligible for all the tax deductions and benefits as provided to any other Indian company. Individual director are required to obtain DIN (Director Unique Identification Number) from the Ministry of Company Affairs. Funding can be in the form of share capital, loans and business operations. Formation time: 3-4 weeks after receipt of the relevant information.

KRA & CO.

Chartered Accountants

2009

Want to Set Up Business in India?

PARTICULARS MINIMUM / MAXIMUM NUMBER OF SHAREHOLDERS MINIMUM DIRECTORS

Broad Comparison: Private and Public-Subsidiary PRIVATE LIMITED PUBLIC LIMITED

Two/Fifty Seven/Number of shares Two Three In both the cases, limited to the extent capitals unless LIBILITY OF SHAREHOLDERS agreed otherwise MINIMUM PAID-UP CAPITAL INR 100,000 INR 500,0000 -No offer can be made to public to subscription to its shares -Right to transfer shares is restricted -can not invite or accept deposits from public other than its No such restrictions but members, directors or their subject to some other BASIC FEATURES relatives compliances On obtaining certificates of commencement of business from ROC after WHEN IT CAN STARTS BUSINESS On incorporation incorporation. For widely held entity Closely held entity with minimum -If planning to go for a pulic procedural, reporting, issue. SUITABILITY compliances etc. -Listing of shares.

KRA & CO.

Chartered Accountants

2009

Want to Set Up Business in India?

General Provisions:

Partnership and proprietary concerns set up abroad are not allowed to open branch or liaison offices in India. Indian/domestic companies and foreign companies having offices in India are regulated under the companies Act, 1956. The law requires such entities to file their papers/forms/documents electronically. The directors or the authorized representatives, as the case may be, are required to obtain their digital signature to sign and file e-forms. Unlike subsidiaries others have simple exit route. Foreign entities are required to appoint their representatives in India to receive notices and other communications from the government and other agencies. Subsidiaries enjoy greater flexibility and operational freedom. Branch, liaison and project offices are allowed to open non-interest bearing current account in India. Transfer of assets by branch/liaison offices to subsidiaries or other liaison/branch offices are allowed subject to RBI prior approval. Inter project transfer of funds are allowed, subject to the rules.

KRA & CO.

Chartered Accountants

December 2009

Want to Set UP Business in India ?

Direct Taxes in General

General Union Government of India charges two types of taxes direct and indirect. There are few types of taxes which are the subject matter of State Government and are not material in nature. Direct Taxes are charged on the income or wealth and profits. Indirect Taxes are charged by Union Government on imports/production/sales/services. These are not items of expense but added to the cost of production and recovered from the customers. Indian tax (financial) year starts from 1st April and ends on 31st March of the subsequent year. All tax assesses are required to follow financial year as their tax year but may have different accounting year. All tax assesses are required to obtain unique tax identification number, called Permanent Account Number (PAN). All resident corporate tax assesses are supposed to file their tax returns by 31st September of every year even in the event of loss. Non-resident corporate are also required to file tax returns if they have business entity or office in India or have income from any Indian source, asset, business, etc. Tax rates in India are on the reducing trend. Corporate Tax It is charged on the net annual total taxable income which is computed under the provision of Income Tax Act, 1961. Depreciation is allowed as an expense at specified rates on tangible and intangible assets. Losses can be carried forward for set-off. Unabsorbed depreciation can be carried forward for set-off for indefinite period. Subsidiary of a foreign entity is treated as domestic company enjoys minimum corporate tax rates and all other tax exemptions and deductions like any Indian company. Branch/project offices are charged to tax on the profits attributable to it and is treated as an extension of a foreign company and taxed accordingly. Minimum Alteration Tax (MAT) It is an extension of Corporate/ Income tax. It intends to bring into tax net, the companies showing profits in their accounts but paying nil or little tax. It is levied if tax liability under the Income Tax Act (taxable profit x applicable tax rates) is lower than 10% of the book profits. Taxable profits means profits as computed under the Income tax Act after granting all eligible deductions and exemptions. Book profits mean (after few

KRA & CO.

Chartered Accountants

2

8

2009

Want to Set Up Business in India?

adjustments) as per accounts. Scheme of tax credit (MAT minus normal tax) is applicable in India as per the rules. Dividend Distribution Tax (DDT) It is levied on the amount paid, declared or distributed as dividend by a domestic company. It is not payable by Branch or Project office. Once domestic company has paid DDT, dividend received by the shareholders is totally tax free. Wealth Tax Wealth tax is payable on the market value of certain assets (basically guest house, motor cars, Boats, aircraft, jewellery, urban land etc.). Payable @1% (no surcharge and education cess) of the amount by which net wealth exceeds 3 Million INR. While computing net wealth, debts owned in connection with taxable assets are reduced.

KRA & CO.

Chartered Accountants

December 2009

Want to Set UP Business in India ?

Registrations Required:

Permanent Account Number (PAN): Income tax laws requires every assessee to apply and obtain PAN which is a unique tax identification number. Tax Deduction Account Number (TAN): India has tax deduction at source and withholding rules. Every Company, branch and Liaison office while making payments/ expenses is required to deduct tax and deposit it with the Govt. It is a unique tax identification number for withholding purposes. Service Tax Code (STC): It is a PAN based service tax code which every company providing taxable services is required to obtain. Value Added Tax (VAT): The entity is also required to get itself with the VAT Authorities having jurisdiction of premises from where company is making sale. Import Export Number (IEC): This unique number is require before entering into any import or export transactions. Shop and Establishment Act: In most part of the country all assesses engaged in commercial activities need to register themselves to open/ operate from a office.

KRA & CO.

Chartered Accountants

2

10

Você também pode gostar

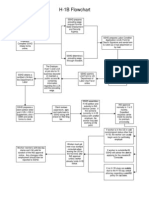

- H-1B Process FlowchartDocumento1 páginaH-1B Process FlowchartWilliam BaileyAinda não há avaliações

- Sample of Affidavit of UndertakingDocumento5 páginasSample of Affidavit of UndertakingLou Nonoi Tan100% (1)

- Ecb Fdi OdiDocumento11 páginasEcb Fdi Odishaunak goswamiAinda não há avaliações

- Fidic Contract Terms Glossary v1 PDFDocumento327 páginasFidic Contract Terms Glossary v1 PDFEhabSufyanAinda não há avaliações

- Admin Services Agreement SampleDocumento18 páginasAdmin Services Agreement SampleWayne B KademaungaAinda não há avaliações

- EMPLOYEE NDA - Raj Jewellers S. K. GroupDocumento4 páginasEMPLOYEE NDA - Raj Jewellers S. K. GroupVarinder DhimanAinda não há avaliações

- AML and KYC PDFDocumento36 páginasAML and KYC PDFNakul SehgalAinda não há avaliações

- Updates On Buyback Offer (Company Update)Documento56 páginasUpdates On Buyback Offer (Company Update)Shyam SunderAinda não há avaliações

- Consulting AgreementDocumento9 páginasConsulting AgreementHengky NoviyantoAinda não há avaliações

- Declaration of Good Faith - F WD 97 03Documento1 páginaDeclaration of Good Faith - F WD 97 03colimatrade100% (3)

- California Mutual Dispute Resolution AgreementDocumento9 páginasCalifornia Mutual Dispute Resolution AgreementSonia ValdiviaAinda não há avaliações

- FAQ On FDIDocumento14 páginasFAQ On FDIParas ShahAinda não há avaliações

- Appendix G - Elevator Maintenance - Scope of Work enDocumento42 páginasAppendix G - Elevator Maintenance - Scope of Work enNano SalamAinda não há avaliações

- NPA MGMTDocumento60 páginasNPA MGMTRajib Ranjan SamalAinda não há avaliações

- EthicsCanada E112 2016-11-3EDDocumento180 páginasEthicsCanada E112 2016-11-3EDthusi1Ainda não há avaliações

- How Foreign Companies Can Enter Into IndiaDocumento4 páginasHow Foreign Companies Can Enter Into Indiaad18111989Ainda não há avaliações

- Consulting Agreement Template SignaturelyDocumento4 páginasConsulting Agreement Template SignaturelyJimmy DanielAinda não há avaliações

- Founder Advisor MOUDocumento9 páginasFounder Advisor MOURavikant KAinda não há avaliações

- App Dev Contract SummaryDocumento6 páginasApp Dev Contract Summaryashutoshjha5290% (1)

- Master Services Agreement Between Sutherland Global Services, Inc. AND Borders, IncDocumento53 páginasMaster Services Agreement Between Sutherland Global Services, Inc. AND Borders, InccanninbrAinda não há avaliações

- Appointment LetterDocumento3 páginasAppointment LetterShubhamSauravAinda não há avaliações

- Investment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th SemesterDocumento20 páginasInvestment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th Semesterraj vardhan agarwalAinda não há avaliações

- Equity NSDL Individual FormDocumento28 páginasEquity NSDL Individual FormGovreAinda não há avaliações

- Setting Up Company in IndiaDocumento11 páginasSetting Up Company in IndiaPriya RaneAinda não há avaliações

- FEMA Rules & Policies: Government of India World Trade OrganisationDocumento2 páginasFEMA Rules & Policies: Government of India World Trade OrganisationPradeep KumarAinda não há avaliações

- TOPIC 3 Business EnvironmentDocumento20 páginasTOPIC 3 Business EnvironmentMalik Mohamed100% (1)

- Recruitment Consultancy Agreement For Rider - Zepto - Sourcing ModelDocumento14 páginasRecruitment Consultancy Agreement For Rider - Zepto - Sourcing ModelpavanAinda não há avaliações

- Commercial Banking Lending Policies of Banks and FisDocumento47 páginasCommercial Banking Lending Policies of Banks and Fisrahul8909Ainda não há avaliações

- RBI issues new format for Statutory Auditors' Certificate for NBFCsDocumento5 páginasRBI issues new format for Statutory Auditors' Certificate for NBFCsjayantgeeAinda não há avaliações

- Oftware Evelopment Greement: Ompany OmpanyDocumento7 páginasOftware Evelopment Greement: Ompany OmpanygabrielaAinda não há avaliações

- RBI requirements for foreign companies to open a branch in IndiaDocumento6 páginasRBI requirements for foreign companies to open a branch in Indiamsn_testAinda não há avaliações

- Statutory Audit ChecklistDocumento22 páginasStatutory Audit ChecklistRasik SinghaniaAinda não há avaliações

- Liquidation of assets before EOI or CIRP process allowedDocumento12 páginasLiquidation of assets before EOI or CIRP process allowedRomit ChandrakarAinda não há avaliações

- Employment contract and compensationDocumento9 páginasEmployment contract and compensationYolly DiazAinda não há avaliações

- GST Return Business Process For GSTDocumento72 páginasGST Return Business Process For GSTAccounting & Taxation100% (1)

- Master Services AgreementDocumento4 páginasMaster Services AgreementsudarshanAinda não há avaliações

- Checklist of Compliances For A Non-Deposit Taking NBFC With Reserve Bank of IndiaDocumento4 páginasChecklist of Compliances For A Non-Deposit Taking NBFC With Reserve Bank of IndiaIam MdsAinda não há avaliações

- NBFC Compliance Checklist for RBI and NSEDocumento5 páginasNBFC Compliance Checklist for RBI and NSEBravoboy Johny100% (1)

- RBI Master Circular on NBFC Factoring DirectionsDocumento6 páginasRBI Master Circular on NBFC Factoring DirectionshhhhhhhuuuuuyyuyyyyyAinda não há avaliações

- Restricted Options AgreementDocumento18 páginasRestricted Options AgreementAnonymous sIy4b6Ainda não há avaliações

- FAQ - Car Lease - Normal & RacerDocumento14 páginasFAQ - Car Lease - Normal & RacerSourav KumarAinda não há avaliações

- FAQ - Car Lease - Normal & RacerDocumento14 páginasFAQ - Car Lease - Normal & RacerSourav KumarAinda não há avaliações

- Grievance Redressal Policy For EmployeesDocumento4 páginasGrievance Redressal Policy For EmployeesKumar KishlayAinda não há avaliações

- Documents Required For Registration As Type I - NBFC-NDDocumento3 páginasDocuments Required For Registration As Type I - NBFC-NDvignesh ACSAinda não há avaliações

- BS 6375-2-2009 - (2015-05-18 - 09-56-05 PM)Documento18 páginasBS 6375-2-2009 - (2015-05-18 - 09-56-05 PM)MarcinAinda não há avaliações

- Artificial Intelligence - 101 Things You Must Know Today About Our Future PDFDocumento375 páginasArtificial Intelligence - 101 Things You Must Know Today About Our Future PDFSourav KumarAinda não há avaliações

- Artificial Intelligence - 101 Things You Must Know Today About Our Future PDFDocumento375 páginasArtificial Intelligence - 101 Things You Must Know Today About Our Future PDFSourav KumarAinda não há avaliações

- 163 PLDT vs. NTCDocumento2 páginas163 PLDT vs. NTCJulius Geoffrey Tangonan100% (1)

- Supreme Court Rules 20% FWT Forms Part of Gross Receipts for GRT CalculationDocumento2 páginasSupreme Court Rules 20% FWT Forms Part of Gross Receipts for GRT CalculationMarj CenAinda não há avaliações

- What You Must Know About Incorporate a Company in IndiaNo EverandWhat You Must Know About Incorporate a Company in IndiaAinda não há avaliações

- FanDuel/State of Georgia AgreementDocumento8 páginasFanDuel/State of Georgia AgreementJonathan RaymondAinda não há avaliações

- FanDuel/State of Georgia AgreementDocumento13 páginasFanDuel/State of Georgia AgreementJonathan RaymondAinda não há avaliações

- Final Handbook May 2013v1Documento42 páginasFinal Handbook May 2013v1Yokoyoko2011Ainda não há avaliações

- ESOP and Sweat EquityDocumento7 páginasESOP and Sweat EquityShehana RenjuAinda não há avaliações

- Documents required for NOC, transfer and subleasingDocumento3 páginasDocuments required for NOC, transfer and subleasingSathish JayaprakashAinda não há avaliações

- Payroll Setup ChecklistDocumento4 páginasPayroll Setup ChecklistcaliechAinda não há avaliações

- Memorandum of Understanding Cum AgreementDocumento6 páginasMemorandum of Understanding Cum AgreementRajesh ChauhanAinda não há avaliações

- NBFC FAQs on Registration, Deposits & RegulationsDocumento9 páginasNBFC FAQs on Registration, Deposits & RegulationsVipuljainyAinda não há avaliações

- Guide To Non Operative Financial Holding Companies For New Banks in India PDFDocumento32 páginasGuide To Non Operative Financial Holding Companies For New Banks in India PDFvishnu pAinda não há avaliações

- Consolidated GST Rate Chart For Goods 01122017 NewDocumento526 páginasConsolidated GST Rate Chart For Goods 01122017 NewJoby ThomasAinda não há avaliações

- CAT Technology Inc - Subcontract AgreementDocumento6 páginasCAT Technology Inc - Subcontract AgreementLokesh NKAinda não há avaliações

- Filing of GST ReturnsDocumento7 páginasFiling of GST ReturnsRabin DebnathAinda não há avaliações

- Avoidable Transactions Under IBCDocumento7 páginasAvoidable Transactions Under IBCDivija PiduguAinda não há avaliações

- XXXX XXXX Salesforce Developer/Administrator XXX-XXX-XXXXXXDocumento7 páginasXXXX XXXX Salesforce Developer/Administrator XXX-XXX-XXXXXXRaja GogineniAinda não há avaliações

- Impact of GST On Stock MarketDocumento14 páginasImpact of GST On Stock MarketSiddhartha0% (1)

- ESOP Scheme / Plan Setup FlowchartDocumento1 páginaESOP Scheme / Plan Setup FlowchartdinfotekAinda não há avaliações

- GST impact on Income TaxDocumento14 páginasGST impact on Income TaxNAMAN KANSALAinda não há avaliações

- 15 Key Developments in The Insolvency and Bankruptcy CodeDocumento19 páginas15 Key Developments in The Insolvency and Bankruptcy CodeAvtar singhAinda não há avaliações

- Employment Contracts in IndiaDocumento30 páginasEmployment Contracts in IndiaKunwarbir Singh lohatAinda não há avaliações

- Trademark RegistrationDocumento8 páginasTrademark RegistrationK RamanadhanAinda não há avaliações

- Karnataka Payment of Wages Act Form and Rules SummaryDocumento3 páginasKarnataka Payment of Wages Act Form and Rules SummaryShabir Tramboo100% (1)

- IND As Vs As ComparisonDocumento42 páginasIND As Vs As ComparisonGeetikaAinda não há avaliações

- NDA - FreelancerV2.0Documento3 páginasNDA - FreelancerV2.0Chatterjee KushalAinda não há avaliações

- Software Product Development A Complete Guide - 2020 EditionNo EverandSoftware Product Development A Complete Guide - 2020 EditionAinda não há avaliações

- Digital Economy and Development of E-CommerceDocumento4 páginasDigital Economy and Development of E-CommerceEditor IJTSRDAinda não há avaliações

- Olympicscarrentalsfinalexam Vjakm 131231084506 Phpapp01Documento26 páginasOlympicscarrentalsfinalexam Vjakm 131231084506 Phpapp01Juan BlazAinda não há avaliações

- Multibook Limited PDFDocumento1 páginaMultibook Limited PDFSourav KumarAinda não há avaliações

- SSRN Id974724 PDFDocumento65 páginasSSRN Id974724 PDFSourav KumarAinda não há avaliações

- Olympics JournalofEconomicPerspectives2016 PDFDocumento19 páginasOlympics JournalofEconomicPerspectives2016 PDFSourav KumarAinda não há avaliações

- Case Analysis Assignment PDFDocumento1 páginaCase Analysis Assignment PDFSourav KumarAinda não há avaliações

- Scenario Analysis of The COVID-19 Pandemic-Final PDFDocumento126 páginasScenario Analysis of The COVID-19 Pandemic-Final PDFSourav KumarAinda não há avaliações

- 2018 Co List en PRDocumento5 páginas2018 Co List en PROmkar BavageAinda não há avaliações

- Japanese Industrial Park in INdia PDFDocumento48 páginasJapanese Industrial Park in INdia PDFSourav KumarAinda não há avaliações

- Case Analysis Questions PDFDocumento1 páginaCase Analysis Questions PDFSourav KumarAinda não há avaliações

- RAHUL - The Jackal and The Sun ChildDocumento1 páginaRAHUL - The Jackal and The Sun ChildSourav KumarAinda não há avaliações

- TransCosmos GTM StrategyDocumento10 páginasTransCosmos GTM StrategySourav KumarAinda não há avaliações

- TransCosmos GTM StrategyDocumento10 páginasTransCosmos GTM StrategySourav KumarAinda não há avaliações

- Japanese Industrial Park in INdia PDFDocumento48 páginasJapanese Industrial Park in INdia PDFSourav KumarAinda não há avaliações

- 17 AprilDocumento1 página17 AprilSourav KumarAinda não há avaliações

- Rahul - Task 6 A Wise RatDocumento1 páginaRahul - Task 6 A Wise RatSourav KumarAinda não há avaliações

- Jackal meets rare sun child in forestDocumento1 páginaJackal meets rare sun child in forestSourav KumarAinda não há avaliações

- Relationship and Contact Details16042020143729628Documento8 páginasRelationship and Contact Details16042020143729628Sourav KumarAinda não há avaliações

- The Friendly GhostDocumento1 páginaThe Friendly GhostSourav KumarAinda não há avaliações

- 16 AprilDocumento1 página16 AprilSourav KumarAinda não há avaliações

- A A The Further Further Ing Er's To Then Ltels Speciaspeciallly Inger's ", ", TheDocumento1 páginaA A The Further Further Ing Er's To Then Ltels Speciaspeciallly Inger's ", ", TheSourav KumarAinda não há avaliações

- Tales of a Wise but Cruel Village GhostDocumento1 páginaTales of a Wise but Cruel Village GhostSourav KumarAinda não há avaliações

- Vijay Task 6Documento1 páginaVijay Task 6Sourav KumarAinda não há avaliações

- The Friendly GhostDocumento1 páginaThe Friendly GhostSourav KumarAinda não há avaliações

- Lenovo and IBMDocumento93 páginasLenovo and IBMPankaj GhevariyaAinda não há avaliações

- 17 AprilDocumento1 página17 AprilSourav KumarAinda não há avaliações

- AML Exam For Outsourcing Partners 2020Documento2 páginasAML Exam For Outsourcing Partners 2020Kat KatAinda não há avaliações

- CE Marking Information Sheet: A World Leader in CertificationDocumento4 páginasCE Marking Information Sheet: A World Leader in CertificationymagAinda não há avaliações

- Haryana Stamp AmendmentDocumento2 páginasHaryana Stamp AmendmentAnant GuptaAinda não há avaliações

- Your Current Account Statement: Miss Blessing Urhie 94 Tanners Hall Co CarlowDocumento2 páginasYour Current Account Statement: Miss Blessing Urhie 94 Tanners Hall Co CarlowPaula UrhieAinda não há avaliações

- 13.4 CR 10 (1) (A) Fall Protection Plan DeveloperDocumento2 páginas13.4 CR 10 (1) (A) Fall Protection Plan DeveloperPhanankosi DubeAinda não há avaliações

- Cernak Chaiken Most Favored Nation Clauses 20130311Documento7 páginasCernak Chaiken Most Favored Nation Clauses 20130311Celestino LawAinda não há avaliações

- Proposed Social Welfare and Development Agencies (Swdas) Bill Frequently Asked Questions (Faqs)Documento7 páginasProposed Social Welfare and Development Agencies (Swdas) Bill Frequently Asked Questions (Faqs)Jacob SantosAinda não há avaliações

- The Evolution of China's International Trade Policy: Development Through Protection and LiberalizationDocumento23 páginasThe Evolution of China's International Trade Policy: Development Through Protection and LiberalizationRoxana CristianaAinda não há avaliações

- Karnataka Cinemas (Regulation) Act, 1964Documento12 páginasKarnataka Cinemas (Regulation) Act, 1964Latest Laws TeamAinda não há avaliações

- Substance and ProcedureDocumento3 páginasSubstance and ProcedureHemant VermaAinda não há avaliações

- AFP Mutual Benefit Association vs NLRCDocumento5 páginasAFP Mutual Benefit Association vs NLRCKaryl Mae Bustamante OtazaAinda não há avaliações

- The Unified Accounts Code StructureDocumento36 páginasThe Unified Accounts Code StructureAzil Jane Protacio GasparAinda não há avaliações

- ISO 9001 Audit GuideDocumento12 páginasISO 9001 Audit Guidejonel.javierAinda não há avaliações

- Child Labor and Its MoralityDocumento18 páginasChild Labor and Its MoralityJulius BaldivinoAinda não há avaliações

- KNS 1472Documento15 páginasKNS 1472Anonymous 7oXNA46xiN100% (1)

- HMROA Bylaws (Abridged)Documento5 páginasHMROA Bylaws (Abridged)cab0rtzAinda não há avaliações

- Jobjob OfferDocumento12 páginasJobjob OfferjackAinda não há avaliações

- IRU Model Highway InitiativeDocumento24 páginasIRU Model Highway InitiativeIRUAinda não há avaliações

- Farouk Al KasimDocumento24 páginasFarouk Al KasimBarry HiiAinda não há avaliações

- 2002 - 169 Pressure Welders RegulationDocumento20 páginas2002 - 169 Pressure Welders RegulationGeorge SunAinda não há avaliações