Escolar Documentos

Profissional Documentos

Cultura Documentos

Etm 2013 4 14 13

Enviado por

Rajeev Singh BhandariDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Etm 2013 4 14 13

Enviado por

Rajeev Singh BhandariDireitos autorais:

Formatos disponíveis

cover story

APRIL 14-20, 2013

13

Total Debt

RCOM vs Bharti

Measured against each other, the Anil Ambani company is on a weaker wicket than Bharti. But with elder brother Mukeshs RIL on its side, RCOM is a more daunting challenger to Bharti

(`Crore)

36,917.8

Net Sales (`Crore)

FY12 FY13E FY14E

RCOM Bharti

Market Capitalisation

RCOM

1 9,677 71,450 20,797 21,926

(`Crore)

80,576

13,096.2

RCOM

Bharti

89,491

Bharti

69,000

Net Profit (`Crore)

FY12 FY13E FY14E

Figures are for fiscal year 2012

928 506.9 2,575 1,747.5

Source: Research Reports

4,257

1,06,711

*As of the first week of April, 2013

7,089

...RCOM + RIL vs Bharti

by RCOMs fibre optic network that connects buildings in big cities. Mahesh Uppal, a telecom consultant, says 4G promises greater bandwidths, almost comparable to current fixed broadband. This means it can be a versatile and cheap way for moving large chunks of data. Reliance with its nationwide licence can expect to exploit this in the coming years. Mukesh has also rebooted his IPTV, or Internet Protocol TV, dreams (IPTV was due to be launched in 2005). With one infrastructure-sharing deal with RCOM in place and more in the works, he is preparing for a sweeping data push. Voice might be bundled as minutes from other operators, particularly RCOM, says a RIL executive. As ET reported last week, RIL has also got Sanjay Mashruwala, a veteran insider to head Reliance Jio. The company is already packed with other telecom veterans. these deals, there will be reciprocal arrangements with them (RIL). For RIL, the towers of RCOM will not suffice, says this official. Bharti and Vodafone have about 90,000 towers. RCOM has half the footprint. For (Reliance) Jio to compete head on with Bharti and Vodafone, it has to build its own towers. We will share those towers, he says. So without spending a penny on capex, we will expand our footprint. What does that mean for Bharti? Today, it is saddled with borrowings of more than `70,000 crore (see RCOM vs Bharti). In recent times, a slew of top-level exits have weakened the company as have regulatory setbacks. Yet, many telecom analysts believe that the worst is behind Bharti due to rising tariffs and declining spectrum charges. Its relatively strong balance sheet too should bode well. A person familiar with Bhartis operations says there is no frantic activity in the company because of RILs proposed entry. The market is cutthroat. Bharti is already competing against the worlds largest telecom company (Vodafone) and one of the top performers (Idea Cellular). The penetration in cities like Mumbai and Delhi tops 150%. Can the market take another player? I would say no. A new player must offer something new, according to this person. Let RIL do that, then the market, including Bharti, can react. Uppal agrees. Incumbency is a huge advantage in telecom and acquiring subscribers is both expensive and time consuming. Reliance has limited experience in services, so the competition will not be a walkover. But Mukeshs first foray into tele-

Win-Win Deal

For RCOM, the deal with RIL is godsend. The Anil Ambani company is one of the most indebted Indian mobile operators, with a total debt of nearly `37,000 crore. Thats more than five times its annualised operating profit. Four more deals worth another `7,700 crore could be signed by the two brothers, according to a recent Morgan Stanley report. RCOM will surely use this money to free its debt. This will allow it to re-focus on its 3G and voice businesses afresh. The ADAG official was confident about more deals. The next deal would involve sharing intra-city network in about 100 cities, followed by a similar arrangement in telecom towers (RCOM owns nearly 45,000 towers), according to him. For all

1 2 3 4 5 6

Bharti will be fighting Ambanis on two fronts a cash-strapped RCOM in 2G and 3G and a cash-rich Reliance Jio on 4G and data

The deals between brothers will improve the debt on RCOMs books, making it more nimble RCOM is more focused on profitability than growth for two years. RIL on its side will allow it to push growth

Retail will continue to burn cash and Mukesh Ambani has `80,000 crore plus of cash for burning and can strain Bharti Reliance Jios pan India presence in 4G and access to fibre-to-home network of RCOM may obliterate Bhartis first-mover advantage Bharti will have to invest more to keep its lead in 2G and 3G services

com suggests that Bharti has its task cut out. That explains why he brought back Gopal Vittal from Hindustan Unilever almost a year ago to usher in a greater focus on the consumer in Bharti Airtel. Yet, it could be anybodys game. Currently, 4G has several disadvantages that reduce its attractiveness, according to Uppal. 3G band-

widths though lower than 4G, are still adequate for most people currently using them. 3G offers mobility as well. 3G devices are cheaper, lighter, more powerful and numerous making them far more attractive for the typical user. 4G has a long way to go in this regard. This presents a major risk to Reliance Jios long-term plans and is perhaps the reason why the company is yet to roll out 4G after paying several thousand crores spent in spectrum auctions of 2010, he says. All the same, Reliance Jio presents a formidable challenge to GSM incumbents such as Bharti, Vodafone and Idea, he says. Its nationwide cloud, regulatory savvy and nationwide are distinct advantages. A former employee of Bharti, who has since joined another telecom operator, says Mittal now has to tackle the combined might of the Ambanis. To fix a meeting with officials takes 3-4 days for us. The Ambanis can walk into meetings. The executive who worked in RCOM and Bharti says Mittal was forced to appear in court (for alleged corruption in allocation of spectrum). Anil bhai went nowhere near a court. The jousting continues unabated, meanwhile. Recently, the countrys GSM operators led by Bharti accused the telecom department of extending undue benefits to RIL by allowing it to offer voice services with 4G airwaves, which were originally planned to be used only for high-speed Internet services.

Fresh Salvos

A former associate of Radia says despite judicial and regulatory scrutiny, telecom rules are being rewritten again to benefit a select few.

RIL has again pulled off the Great Indian Rope Trick. Bharti couldnt have been more vulnerable, so its the perfect time for Reliance to reenter telecom. Can Indian telecom accommodate the ambitions of all the three companies? Romal Shetty, the head of telecom at KPMG, says while there is enough of a market, the key would be innovations. India is a huge country; a country-wide rollout means huge costs. However, there are encouraging signs. The data usage in India has gone up substantially in the last one year even in markets like UP and Bihar. The typical user of 3G services today is the rich, according to Shetty. However, to be successful, 4G will have to address the masses in villages too. Data including SMS accounts for only 20% of revenues for telecom operators in India compared with 60% (data excluding SMS) in more mature markets. English Premier League matches can be watched even on cellphones. The day we will be able to watch IPL on phones will mark the success of 4G in India, says Shetty. Affordable and versatile devices too will be a key challenge in 4G. Can you provide an app that offers an easy way to buy railway tickets? asks Shetty. Likewise, 3G services have been beset by cheap and quality smartphones. Taking these realities into context, the battle between the three telecom companies promises to be a rollercoaster. The former employee of Bharti says the fight between the Ambanis and Mittal has increasingly come out in the open. If in 2012, the biggest event for telecom was the cancellation of licences, in 2013, it will be this battle.

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hack Websites With MetasploitDocumento24 páginasHack Websites With Metasploityodresh50% (4)

- HEC-ResSim 30 UsersManual PDFDocumento512 páginasHEC-ResSim 30 UsersManual PDFvitensaAinda não há avaliações

- Switchyard Protection Equipment Technical Specification-Rev A2Documento17 páginasSwitchyard Protection Equipment Technical Specification-Rev A2meraatAinda não há avaliações

- PDF Transport Phenomena Bird Solutions Manual PDFDocumento2 páginasPDF Transport Phenomena Bird Solutions Manual PDFHamza Faheem0% (3)

- ISO 39001 Internal Audit - SafetyCultureDocumento12 páginasISO 39001 Internal Audit - SafetyCulturePesta ParulianAinda não há avaliações

- SpringBoot All ProgramsDocumento16 páginasSpringBoot All ProgramsHitesh WadhwaniAinda não há avaliações

- Library and Information Science MCQsDocumento28 páginasLibrary and Information Science MCQsDavid Stephan86% (29)

- E TicketDocumento1 páginaE Ticketمحمد يوسفAinda não há avaliações

- Which Is The Tata Group's Oldest Surviving Brand?: A. Tcs B. Tata Motors C. The Taj Palace and Tower D. Tata TetleyDocumento20 páginasWhich Is The Tata Group's Oldest Surviving Brand?: A. Tcs B. Tata Motors C. The Taj Palace and Tower D. Tata TetleyRajeev Singh BhandariAinda não há avaliações

- Annual Report 2011 12 EDocumento267 páginasAnnual Report 2011 12 ERajeev Singh BhandariAinda não há avaliações

- Etm 2013 4 14 10Documento1 páginaEtm 2013 4 14 10Rajeev Singh BhandariAinda não há avaliações

- Islamic Micro Finance ReportDocumento30 páginasIslamic Micro Finance ReportRajeev Singh BhandariAinda não há avaliações

- Structural Products & Systems: Toolkit 8 Design Software User Guide For The Republic of IrelandDocumento3 páginasStructural Products & Systems: Toolkit 8 Design Software User Guide For The Republic of IrelandDass DassAinda não há avaliações

- Industrial Control Systems (ICS) Security MarketDocumento3 páginasIndustrial Control Systems (ICS) Security Marketkk vkAinda não há avaliações

- Intra Web ManDocumento109 páginasIntra Web ManTheodor-Florin LefterAinda não há avaliações

- Chapter 8 Enterprise Data Models PDFDocumento40 páginasChapter 8 Enterprise Data Models PDFJaliya ThilakawardaneAinda não há avaliações

- Tender Document For O & M of AHS & AuxiliariesDocumento33 páginasTender Document For O & M of AHS & Auxiliariesvbmrvm100% (1)

- 802 - Information - Technology - MS (3) - 231223 - 091112Documento7 páginas802 - Information - Technology - MS (3) - 231223 - 091112manmarvellous1337Ainda não há avaliações

- Internet of Things Course OutlineDocumento3 páginasInternet of Things Course OutlinekanaiyaAinda não há avaliações

- Age of TalentDocumento28 páginasAge of TalentSri LakshmiAinda não há avaliações

- SCS135 SCS135SI SCS136SI SCS145.5S Service Manual: ModelsDocumento24 páginasSCS135 SCS135SI SCS136SI SCS145.5S Service Manual: ModelsMartina PetreskaAinda não há avaliações

- Special Recruitment Drive AdvDocumento3 páginasSpecial Recruitment Drive AdvEric MccartyAinda não há avaliações

- Field Interviewer Cover LetterDocumento7 páginasField Interviewer Cover Letterbcrqhr1n100% (2)

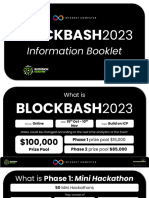

- Blockbash 2023 DocumentDocumento14 páginasBlockbash 2023 DocumentAinda não há avaliações

- OmniSwitch Configuring PIMDocumento34 páginasOmniSwitch Configuring PIMYong Lee TayAinda não há avaliações

- The Street, Apple, & General Systems TheoryDocumento4 páginasThe Street, Apple, & General Systems TheoryDavid SchneiderAinda não há avaliações

- 20Documento83 páginas20altaminAinda não há avaliações

- STR-A6100 Series Data Sheet: Off-Line PRC Controllers With Integrated Power MOSFETDocumento25 páginasSTR-A6100 Series Data Sheet: Off-Line PRC Controllers With Integrated Power MOSFETRaja RajaAinda não há avaliações

- Javascript Multiple Choice Questions and Answers-Sheet 1Documento276 páginasJavascript Multiple Choice Questions and Answers-Sheet 1mamidi sudeepAinda não há avaliações

- PTC TermistorDocumento9 páginasPTC TermistoretronictechAinda não há avaliações

- Pneumatic Forging MachineDocumento28 páginasPneumatic Forging MachineSaravanan Viswakarma83% (6)

- GSM DG11 4 5Documento833 páginasGSM DG11 4 5gustavomoritz.aircom100% (2)

- Globalization Syllabus S22Documento11 páginasGlobalization Syllabus S22Manit ShahAinda não há avaliações

- Arduino Project ReportDocumento16 páginasArduino Project ReportBroAmirAinda não há avaliações