Escolar Documentos

Profissional Documentos

Cultura Documentos

Accountants Vs Investment Bankers

Enviado por

Ebnu SuryadhiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Accountants Vs Investment Bankers

Enviado por

Ebnu SuryadhiDireitos autorais:

Formatos disponíveis

Accountants vs Investment Bankers creamgethamoney Member Join Date: Sep 2008 Posts: 582 Accountants vs Investment Bankers Accountant:

Oooo a bunch of d-bag bankers look. Shouldn't be ruining the economy with your pitchbooks (makes weird faces to camera and title with Big 4 accounti ng firms pops up) Banker: Some accountants ouch. Probably got no suits and they can't even afford Men's Warehouse (baller investment banking title with big name banks pops up) Music Interlude Auto-Tuned Hot Dog Vendor: Bankers and accountants its time to squash the beef. We're gonna settle this now, right here on the street oh oh oh oooooooh! Now, let's write the rest of the lyrics starting with accountants. Go! creamgethamoney is offline Reply Old 11-26-2010, 07:48 PM #2 spydersix Junior Member Join Date: Dec 2009 Posts: 220 consultants spydersix is offline Reply Old 11-27-2010, 01:32 AM MSFHQsite Junior Member Join Date: Oct 2010 Location: Philadelphia Posts: 290 Accounting is a fine career. It is also a great major for anyone wanting to get into banking. With that said the main difference between accounting and banking is salary. My friend just got a job with E&Y in NYC, will have his MAcc and his salary is 5 6K. My friends in banking are getting 70K base, 10K signing and probably 50% or more of salary as a bonus. MSFHQsite is offline Reply Old 11-27-2010, 03:05 AM #4 GamBino Junior Member Join Date: May 2010 Posts: 145 Honestly, most of the people that I've talked to in Big 4, getting a Master's in Accounting is simply worthless in terms of practicality. By the time that you'v e obtained a Master's in Accounting, you could have advanced at least a few step s in the hierarchy.

#3

Most of the knowledge obtained in a MAcc isn't applicable to what you really do in Big 4 firms. The opportunity cost of obtaining such a degree is too high. A b achelor's degree will suffice for the Big 4. GamBino is offline Reply Old 11-27-2010, 10:33 AM #5 MSFHQsite Junior Member Join Date: Oct 2010 Location: Philadelphia Posts: 290 The MAcc takes one year and helps you meet the 150 credit hour requirement for y our CPA. A lot of people get a MAcc (I know two people personally). One year in Big 4 is not going to progress you at all. Having your CPA sure as h ell will.

Regardless, accounting pays less and is relatively easy to get into. Banking pay s a lot and is relatively hard to get into. Banking is primarily focused on mode ling to come up with a value, creating pitch books to send to private equity or other potential investors/buyers, etc. Lot of long hours and tight deadlines. First year comp should be over 100K. It will also give you great exits to top B school or PE/VC/HF after 2-3 years. MSFHQsite is offline Reply Old 11-27-2010, 11:11 AM #6 Dawgie Senior Member Join Date: Jul 2006 Location: Massachusetts Posts: 1,518 The truth is, half you kids wouldn't succeed in accounting or IBank. So stop dis cussing it. MSFHQ, CPA is overrated (I passed it myself). Experience is king. Ho wever I agree a Top MSA program is worth it these days with the 150 credit hour rule. Dawgie is offline Reply Old 11-27-2010, 12:38 PM #7 GamBino Junior Member Join Date: May 2010 Posts: 145 Honestly, without the 150 hour requirement, the MAcc would be pretty pointless, like Dawgie said, experience is much better than that extra year in college. But given that you DO need the 150 hour requirement to sit the CPA, I guess ther e aren't many other alternatives. But it isn't really worth the time. GamBino is offline Reply Old 11-27-2010, 05:30 PM #8 MSFHQsite Junior Member Join Date: Oct 2010 Location: Philadelphia

Posts: 290 Agree. A masters in accounting is only in existence for the 150 credit hours. MSFHQsite is offline Reply Old 11-27-2010, 10:14 PM #9 jdnely Junior Member Join Date: Apr 2009 Posts: 112 This might have been a San Diego thing, but every large firm (Big 4 included) sh e interviewed at expects a Macc in Taxation if you want to work in tax. jdnely is offline Reply Old 11-27-2010, 11:20 PM #10 GamBino Junior Member Join Date: May 2010 Posts: 145 Then it's just a San Diego thing. GamBino is offline Reply Old 11-27-2010, 11:41 PM #11 morrismm Senior Member Join Date: Jun 2008 Posts: 1,443 Haha--There is no one vs the other! Very different jobs, very different requirem ents to get "in" and very different compensations. Let's just say it is much easier to become an accountant. morrismm is offline Reply Old 11-28-2010, 01:48 AM #12 MSFHQsite Junior Member Join Date: Oct 2010 Location: Philadelphia Posts: 290 Masters in tax is completely different from a Masters in Accounting. MSFHQsite is offline Reply Old 11-28-2010, 11:26 AM #13 CounterofBeans New Member Join Date: Nov 2010 Posts: 11 MSFHQSite provides great answers in this thread as usual. Investment banking VS Big4 Accounting is something that is commonly brought up in this forum, I will t hrow in my opinion as someone doing Accounting -Compensation: Investment banking compensation is better, especially at the entr y level. Big 4 compensation is great, and if you make partner at a Big 4 you wil l be upper middle class, but will not be living a Patrick Bateman lifestyle

-Hours: Investment banking hours are usually far worse (longer hours year round) . Accountants work hard in busy season, but even during busy season I have not h eard of accountants working as many hours as bankers. -Exit Opportunities: Investment banking exit opportunities are usually better th an Big 4 accountants, with Investment Bankers seen as being more likely to exit to roles in business development, etc at F500 while Accountants exit to Controll er (good job, but still accounting) -Stability: Investment banking employment is far less stable than a career in Bi g4 Accounting. If investment banks have a few bad earnings quarters they have no problem laying off huge amounts of people. Investment banks make more money tha n Accounting Firms in the long run, but the Big4 Accounting Firms have smoother earnings trends. This allows the Big4 to not lay off as many employees, because Accounting Firms bad years are better than Investment Banks' bad years. I think at the end of the day it comes down to one's appetite for risk/reward. T he investment banking career is more risky (may get laid off, etc. far more easi ly) but the financial rewards can be greater. What the starter of this thread as well as most high school students fail to realize is that there are far fewer i nvestment bankers (Front Office) than their accountants at the Big4. While I am in no way saying you can't be a banker, etc. it is far easier relatively to beco me a Big4 Accountant. http://talk.collegeconfidential.com/business-major/1038523-accountants-vs-invest ment-bankers.html

effofex Reputation: TSR Demigod Location: Noord Holland Posts: 5,665 Re: Accountant VS Investment Banker (Originally Posted by Ace) whats?? Please answer question. Which job is 'better' depends on the skillsket and priorities of the applica nt in question. Usually an investment bunker will need to work longer hours, though roles wi thin 'accountancy' vary in duration. From what I am aware, some auditors often w ork from 9am to 9pm, whilst people involved in tax may only need to remain in th e office until 6pm. Often people may get one day of leave per week to study for certifications (ACCA, ACA, CIMA etc.). Investment bankers tend to remain in the office after 9pm but their jobs are often not very stressful, apart from when they are hastily preparing a pitchboo k overnight. Often during the day they may be conducting 'research' which may si mply not contribute to whether or not a deal goes ahead. I am a trader - but I always like my work and decisions to have a clear impa ct and/or result. So investment bunking would not be ideal for me, even though t hese people have a similar basic pay as me. Likewise, some people prefer to rese arch companies, EV/EBIDTA ratios across sectors, debt/equity ratios, cashflow an alyses in depth as well as utilizing their presentation skills and dressing up i n suits - hence they may prefer banking to being a trader.

Often you will notice trends - for example, female people tend to be overrep resented in accountancy, and to a degree in investment banking - maybe they tend to really understand companies in detail and enjoy the presentation aspect of t heir work, whilst male people are often overrepresented in trading - maybe they tend to enjoy being able to see very clearly whether a decision they made was a good or bad one. simstar88's Avatar 13 12-10-2011 20:04 simstar88 Reputation: Exalted Member Location: London Posts: 273 Re: Accountant VS Investment Banker (Originally Posted by Annoying-Mouse) Accounting = more hours + better pay Investment banking = less hours + less pay (but still better than most other cooperate jobs) Investment banking = it depends on where your located. You could be at your local high street which means it would be around 12-20k. Or in the city which wo uld mean 30+K (starting). Accounting = same as above really. If local then 12-20k. If city, 40k (for t he Big 4). And in terms of prestige, accounting > investment banking. It has better exit opportunities and allows you to enter other fields like VC, PE, HF etc etc (can't be asked to explain those terms to you, google them). What has happened to the quality of TSR posts? This is wrong, simply wrong. Investment Banking = Far greater pay than accounting jobs. A real world example, I work for one of the big 4 in audit, I'm on 28k, just approaching completin g my first year. My housemate from uni went into investment banking for one of t he major UK banks, he earns 42k basic had a 5 figure bonus and had a 6k signing up bonus so that's about 60-70k in the first year. I work 9am - 8pm during busy season, and about 9-6 other times. He works fro m 6am - 8pm all year round. I know this is only one example but investment banking is known for its high pay and long hours. Accounting is the much more steady approach which could lea d you to a investment banking job, but only if you want. If you want money, at the expense of your time then investment banking is fo r you.

If you want a slightly more tame, but less hours, lower paid job then accoun ting is for you. http://www.thestudentroom.co.uk/showthread.php?t=1807859

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- GC-Case Description-En EN PDFDocumento4 páginasGC-Case Description-En EN PDFvlado2meAinda não há avaliações

- Prepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADDocumento29 páginasPrepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADBino JosephAinda não há avaliações

- SABIS Ventures Into AfricaDocumento1 páginaSABIS Ventures Into Africaawesley5844Ainda não há avaliações

- Homework Assignment 1 KeyDocumento6 páginasHomework Assignment 1 KeymetetezcanAinda não há avaliações

- Report On Hyundai I20Documento10 páginasReport On Hyundai I20Sandarbh AgarwalAinda não há avaliações

- Ratio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioDocumento7 páginasRatio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioizzhnsrAinda não há avaliações

- Company Overview Q3 2011 PDFDocumento27 páginasCompany Overview Q3 2011 PDFPiran UmrigarAinda não há avaliações

- Reviewer RebDocumento11 páginasReviewer RebKylie MayʚɞAinda não há avaliações

- Taxes: Part One: Obliged ToDocumento4 páginasTaxes: Part One: Obliged ToStaciaRevianyMegeAinda não há avaliações

- REFLECTION-PAPER-BA233N-forex MarketDocumento6 páginasREFLECTION-PAPER-BA233N-forex MarketJoya Labao Macario-BalquinAinda não há avaliações

- PT Aldenio: Memorial Journal (ADJUSTMENT)Documento7 páginasPT Aldenio: Memorial Journal (ADJUSTMENT)Laela LitaAinda não há avaliações

- Budget Literacy PDFDocumento233 páginasBudget Literacy PDFramAinda não há avaliações

- Women and Banks Are Female Customers Facing Discrimination?Documento29 páginasWomen and Banks Are Female Customers Facing Discrimination?Joaquín Vicente Ramos RodríguezAinda não há avaliações

- What Is A Zero-Coupon Treasury Bond: Guarantees The SecurityDocumento7 páginasWhat Is A Zero-Coupon Treasury Bond: Guarantees The Security88arjAinda não há avaliações

- Capital Budgeting Techniques IRRDocumento12 páginasCapital Budgeting Techniques IRRraza572hammadAinda não há avaliações

- Int MKT AssignmentDocumento66 páginasInt MKT AssignmentHafeez AfzalAinda não há avaliações

- 4AC0 01 Que 20150107Documento20 páginas4AC0 01 Que 20150107anupama dissanaykeAinda não há avaliações

- Alok Industries Final Report 2010-11.Documento117 páginasAlok Industries Final Report 2010-11.Ashish Navagamiya0% (1)

- ILO and Social Security (GROUP B)Documento13 páginasILO and Social Security (GROUP B)Dhiren VairagadeAinda não há avaliações

- 66 - 4 - 1 - Business StudiesDocumento23 páginas66 - 4 - 1 - Business StudiesbhaiyarakeshAinda não há avaliações

- Deloitte CN CSG Guide To Taxation in Se Asia 2019 Bilingual 190806 PDFDocumento228 páginasDeloitte CN CSG Guide To Taxation in Se Asia 2019 Bilingual 190806 PDFLevina WijayaAinda não há avaliações

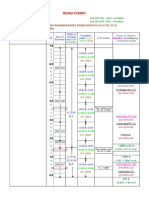

- Road Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Documento4 páginasRoad Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Phani PitchikaAinda não há avaliações

- Feasibility Analysis and Business Plan IntroDocumento41 páginasFeasibility Analysis and Business Plan IntroRicardo Oneil AfflickAinda não há avaliações

- Jun 2006 - Qns Mod ADocumento11 páginasJun 2006 - Qns Mod AHubbak Khan100% (2)

- Legal OpinionDocumento4 páginasLegal OpinionBaten KhanAinda não há avaliações

- The British Money MarketDocumento2 páginasThe British Money MarketAshis karmakarAinda não há avaliações

- Accounting: Definition, Scope, Nature, Objectives Accounting DefinedDocumento3 páginasAccounting: Definition, Scope, Nature, Objectives Accounting DefinedDeuter AbusoAinda não há avaliações

- Decisionth 1Documento66 páginasDecisionth 1Vijayant Panda100% (1)

- Solaria Cuentas enDocumento71 páginasSolaria Cuentas enElizabeth Sánchez LeónAinda não há avaliações

- Different Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4Documento17 páginasDifferent Forms of Business Organizations: By: Ma. Beatrix D. Sampang Bsa - 4anon_855990044Ainda não há avaliações