Escolar Documentos

Profissional Documentos

Cultura Documentos

Ficc Times // /: The Key Events of Last Week

Enviado por

r_squareTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ficc Times // /: The Key Events of Last Week

Enviado por

r_squareDireitos autorais:

Formatos disponíveis

FICC TIMES //

THE WEEK GONE BY AND THE WEEK AHEAD

April 27, 2013

Equities continued to do well last week, despite some slowing economic data. High Yield spreads have declined to their lowest levels in two years signalling a healthy appetite for risk. While weekly jobless claims fell, new Q1 GDP came in at +2.5% instead of the expected +3.0%. Euro zone saw an improvement in bond yields with many peripheral countries' spreads against German Bunds at their several month lows. Data from China was weak too, with flash PMI coming in at 50.50 instead of 51.50. While risk appetite for equities and bonds remained strong, there is definitely a risk that upcoming macro data defies market's expectations of a robust 2nd half leading to some profit-taking in equities. Trade Deficit numbers for the last quarter were a lot better than the previous quarters and hence, the INR should remain well supported.

The key events of last week:

Total existing home sales in US declined 0.6% to a seasonally adjusted annual rate of 4.92 million in March from a downwardly revised 4.95 million in February. Wall Street had been expecting sales to rise in the month, and the miss is a sign that it's been "overestimating the strength on the housing market recovery" The International Council of Shopping Centers and Goldman Sachs Retail Chain Store Sales Index edged up 0.8% in the week ended Saturday from the week before on a seasonally adjusted, comparable-store basis. The Mortgage Bankers Association said its seasonally adjusted index of mortgage application activity, which includes both refinancing and home purchase demand, rose 0.2 percent in the week ended April 19 as rates fell for the fifth week in a row. Claims for unemployment benefits fell more than expected last week, pointing to slight improvement in the US job market

108, Madhava, Bandra Family Court Lane, BKC, Bandra (E), Mumbai 51

Page 1

THE WEEK GONE BY AND THE WEEK AHEAD.

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.5 percent in the first quarter of 2013, below expectations for 3.0% growth , according to the "advance" estimate released by the Bureau of Economic Analysis. The Bank of Japan maintained its unprecedented plan to boost money supply at a policy meeting held on 26th of April, and predicted inflation will almost match its target in two years even after a report highlighted deflations grip. There is "limited but growing" evidence that Syrian government troops have used chemical weapons, U.S. intelligence and UK Prime Minister David Cameron says which cause crude oil price to spike sharply from 88 to 93 levels during the week ended on 27th of April.

And closer home.

Indian central bank says yield on 91-day treasury bills at 7.6435 pct vs. 7.7268 pct last week. Yield on 182-day treasury bills at 7.6406 pct vs. 7.7920 pct two weeks ago. India attracted INR 348.40 billion worth of bids for FII debt auction limits today against INR 291.08 billion on offer. These limits give foreign investors the right to invest in debt up to the limit bought. This is the first auction to be conducted after Sebi rationalized the various debt categories for FIIs.

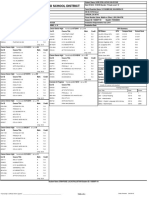

Category / Amount (INR Cr.) Government Debt Total Limit for Auction 29108 Total Bids Received 34840 Highest Bid (bps) 4 Cut off (bps) 1.50 Previous cut off(bps)

1st auction after government debt old and long term where combined this month

India's foreign exchange reserves including gold and Special Drawing Rights were down by $485.9 million to $294.761 billion in week to Apr 19, Reserve Bank of India's Weekly Statistical Supplement showed Friday. Foreign exchange reserves were down by $158.4 million from a year ago. Reserves held in the form of gold were at $25.692 billion, unchanged from previous week.

USD(Billion) Total reserves Forex assets* Gold SDRs Reserve position In IMF** Apr 19 294.761 262.410 25.692 434.7 2.311 week -0.485 -0.489 --0.002 0.001 end-Mar 2013 2.715 2.684 --0.019 0.010 year 0.158 2.192 -1.331 -0.110 -0.593

Page 2

THE WEEK GONE BY AND THE WEEK AHEAD.

Source : Tickerplant Dollar/rupee ended at two-week high Friday on month-end demand for the greenback from oil importers and tracking a fall in euro as repayment of European banks to the European Central Bank is set to fall sharply next week, dealers said.

SPOT Last Open High Low 54.3750-54.3850 54.1400-54.1500 54.4100-54.4200 54.1400-54.1500 1-YEAR FWD PREMIUM 6.49-6.54% 6.54-6.59% 6.56-6.61% 6.48-6.53% 1-MONTH FUTURES 54.5775-54.5800 54.3875-54.3900 54.6275-54.6300 54.3375-54.3400

Prev

54.2200-54.2300

6.51-6.56%

54.4050-54.4075

Important upcoming International events to be tracked:

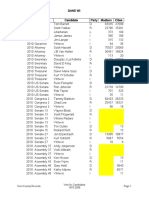

Date 29-04-2013 29-04-2013 30-04-2013 30-04-2013 30-04-2013 30-04-2013 30-04-2013 30-04-2013 30-04-2013 30-04-2013 30-04-2013 1/5/2013 1/5/2013 1/5/2013 Time 14:30 IST 19:30 IST 05:00 IST 05:20 IST 05:20 IST 14:30 IST 14:30 IST 17:15 IST 18:25 IST 19:15 IST 19:30 IST 00:30 IST 05:30 IST 13:30 IST Country European Monetary US Japan Japan Japan European Monetary European Monetary US US US US US US European Monetary Union Event EC Economic Sentiment Pending Home Sales Index Unemployment Rate Industrial Production Retail Sales (Year over Year) Unemployment Rate HICP Flash ICSC-Goldman Store Sales Redbook Chicago PMI Consumer Confidence Farm Prices (Farm Prices - m/m % change) Motor Vehicle Sales (Domestic Vehicle Sales) PMI Manufacturing Index

Union Union

Union

Page 3

THE WEEK GONE BY AND THE WEEK AHEAD.

1/5/2013 1/5/2013 1/5/2013 2/5/2013 2/5/2013 2/5/2013 2/5/2013 2/5/2013 2/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013

16:30 IST 20:00 IST 23:30 IST 05:20 17:15 18:00 18:00 19:15 19:15 02:00 02:00 18:00 IST IST IST IST IST IST IST IST IST

US US US Japan European Monetary Union US US US US US US US US US

19:30 IST 19:30 IST

MBA Purchase Applications EIA Petroleum Status Report FOMC Meeting Announcement (Federal Funds Rate - Target Level) BoJ MPB Minutes ECB Announcement (Change) Jobless Claims International Trade (Trade Balance Level) Bloomberg Consumer Comfort Index (Level) Bloomberg Consumer Comfort Index Money Supply Fed Balance Sheet Employment Situation (Nonfarm Payrolls M/M change) ISM Non-Mfg Index (Composite Index Level) Factory Orders (Factory Orders - M/M change)

Important upcoming Domestic Events

Date 26-04-2013 30-04-2013 30-04-2013 30-04-2013 30-04-2013 1/5/2013 1/5/2013 2/5/2013 2/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 3/5/2013 Time Country India India India India India India India India India India India India India India India India India India India India India Event IIP Core (YoY Chg) 91 day T- Bills auction of Rs 50 bn (cut-off yld) Government finances -fiscal deficit (pct of Budget Estimate) 364 day T- Bills auction of Rs 50 bn (cut-off yld) CPI-Industrial Workers Power generation HSBC India manufacturing PMI Reserve Money (change on wk) M3 (YoY Chg) HSBC India Services PMI HSBC India composite PMI Monetary Policy Statement WMA (ways and means advance) - to central govt WMA (ways and means advance) - to state govts FX reserve (change on wk) Bank Deposit (YoY Chg) Bank Credit (YoY Chg) Bank Investment (YoY Chg) Bank Cash Deposit Ratio Bank Investment Deposit Ratio Bank Credit Deposit Ratio

12:00 IST 10:30 IST

10:30 10:30 11:00 17:00 17:00 17:00 17:00 17:00 17:00 17:00 17:00 17:00

IST IST IST IST IST IST IST IST IST IST IST IST

TECHNICAL VIEW

USD/INR looks to be range bound between 54 and 55 and has not shown a large momentum on either side for a breakout On the daily chart USD/INR momentum indicators remain bearish while the short term technicals remain well supportive at around 54 levels

Page 4

THE WEEK GONE BY AND THE WEEK AHEAD.

r rupee bullish for the time being, also deriving our comfort from falling We remain commodity t prices internationally

USD/INR Daily Technicals

Disclaimer:

This document is copyrighted by R-Square and is intended solely for the use of the R-Square client, individual, or entity to which it is addressed. This document may not be reproduced in any manner or re-distributed by any means to any person outside of the recipient's organization without the express consent of R-Square. By accepting this document you agree to be bound by the foregoing limitations. This is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. R-Square may advise the issuers mentioned herein or deal as a principal in or own or act as a market maker for securities/instruments mentioned herein. The research and other information provided herein speaks only as of its date. We have not undertaken, and will not undertake any duty to update the research or information or otherwise advise you of changes in the research or information. This email message and any attachments are being sent by R-Square and may be confidential. If you are not the intended recipient, please notify the sender immediately by email and delete all copies of this message and any attachments.

R-Square Advisors LLP

108, Madhava, Bandra-Kurla Complex, Bandra (E), Mumbai 400051 Tel: +91 22 6111 9494

Email: info@rsquareadvisors.com Website: www.rsquareadvisors.com

Page 5

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Ficc Times HTML HTML: The Week Gone by and The Week AheadDocumento6 páginasFicc Times HTML HTML: The Week Gone by and The Week Aheadr_squareAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- FICC Times 12 April 2013Documento5 páginasFICC Times 12 April 2013r_squareAinda não há avaliações

- Ficc Times HTML HTML: April 5, 2013Documento5 páginasFicc Times HTML HTML: April 5, 2013r_squareAinda não há avaliações

- FICC Times 22 Mar 2013Documento6 páginasFICC Times 22 Mar 2013r_squareAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Ficc Times // /: The Week Gone by and The Week AheadDocumento6 páginasFicc Times // /: The Week Gone by and The Week Aheadr_squareAinda não há avaliações

- Ficc Times // /: The Week Gone by and The Week AheadDocumento5 páginasFicc Times // /: The Week Gone by and The Week Aheadr_squareAinda não há avaliações

- Ficc Times // /: The Week Gone by and The Week AheadDocumento5 páginasFicc Times // /: The Week Gone by and The Week Aheadr_squareAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Ficc Times: The Week Gone by and The Week AheadDocumento5 páginasFicc Times: The Week Gone by and The Week Aheadr_squareAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- FICC Times!Documento6 páginasFICC Times!r_squareAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Statement by Former Republican Officials Endorsing President Trump For ReelectionDocumento5 páginasStatement by Former Republican Officials Endorsing President Trump For ReelectionFox News100% (15)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Erin TranscriptDocumento1 páginaErin Transcriptapi-461228697Ainda não há avaliações

- Religion in American History by Amanda PorterfieldDocumento350 páginasReligion in American History by Amanda PorterfieldArqui de los SantosAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- John Rennie Short - CV - PDFDocumento57 páginasJohn Rennie Short - CV - PDFDavid del MaderoAinda não há avaliações

- 1970-2010 Madison WI Vote HistoryDocumento56 páginas1970-2010 Madison WI Vote HistoryJohn MAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Siegmeister Elie - Music and SocietyDocumento31 páginasSiegmeister Elie - Music and SocietyAlvar Xavier Rodriguez0% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- MDP Letter To The Office of Congressional Ethics Regarding Roscoe Bartlett and Alex MooneyDocumento2 páginasMDP Letter To The Office of Congressional Ethics Regarding Roscoe Bartlett and Alex MooneyMaryland Democratic PartyAinda não há avaliações

- Nero Hawley's Dream m04 - w02Documento8 páginasNero Hawley's Dream m04 - w02AlenJonotaCaldeo100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Corporation For Public Broadcasting: Chicago EventDocumento23 páginasCorporation For Public Broadcasting: Chicago Eventstallion229Ainda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- American Journal of International Law - American Society of ...Documento8 páginasAmerican Journal of International Law - American Society of ...Sovanrangsey KongAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Dilipkumar Dashrathbhai Patel, A200 939 111 (BIA June 6, 2014)Documento4 páginasDilipkumar Dashrathbhai Patel, A200 939 111 (BIA June 6, 2014)Immigrant & Refugee Appellate Center, LLCAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- MindWar (PDFDrive)Documento274 páginasMindWar (PDFDrive)WalterSobchakAinda não há avaliações

- Executive Order 11593 PDFDocumento2 páginasExecutive Order 11593 PDFJessieAinda não há avaliações

- Sanitation and Public Health Program in BatangasDocumento12 páginasSanitation and Public Health Program in BatangasGellie Lara BautistaAinda não há avaliações

- Texas: American Expeditions and SettlementDocumento3 páginasTexas: American Expeditions and Settlementnacho975Ainda não há avaliações

- Farr2012Using Systems PDFDocumento27 páginasFarr2012Using Systems PDFAnderson F Miranda SilvaAinda não há avaliações

- Printw2 PDFDocumento1 páginaPrintw2 PDFJhhghiAinda não há avaliações

- Super ValuDocumento11 páginasSuper ValuNazish SohailAinda não há avaliações

- AAI Fact Sheet 5Documento1 páginaAAI Fact Sheet 5UnitedWayChicagoAinda não há avaliações

- Powers of CongressDocumento32 páginasPowers of Congressapi-294843376Ainda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Introduction To Civil Engineering PDFDocumento6 páginasIntroduction To Civil Engineering PDFBarun SarangthemAinda não há avaliações

- Test Bank For Essentials of Statistics For The Behavioral Sciences, 9th Edition, Frederick J Gravetter, Larry B. Wallnau, Lori-Ann B. ForzanoDocumento32 páginasTest Bank For Essentials of Statistics For The Behavioral Sciences, 9th Edition, Frederick J Gravetter, Larry B. Wallnau, Lori-Ann B. Forzanopeterbrownedqykzfajw100% (9)

- 2019 IFA Annual Conference Montreal Fertilizer Outlook 2019-2023 SummaryDocumento14 páginas2019 IFA Annual Conference Montreal Fertilizer Outlook 2019-2023 Summaryvaratharajan g rAinda não há avaliações

- Brown V Board Research PaperDocumento7 páginasBrown V Board Research Paperafnlamxovhaexz100% (1)

- Immigration Crackdown Snares Arabs: Deportation Orders Jump 20% Critics Say Policies DiscriminateDocumento7 páginasImmigration Crackdown Snares Arabs: Deportation Orders Jump 20% Critics Say Policies Discriminateismailel1Ainda não há avaliações

- HIS 100 Historical Context and Introduction TemplateDocumento3 páginasHIS 100 Historical Context and Introduction TemplatePoppy0% (1)

- MHDC Self-Help Housing Fact SheetDocumento2 páginasMHDC Self-Help Housing Fact SheetMHDCHubAinda não há avaliações

- IB Case STUDYDocumento3 páginasIB Case STUDYMohit3107Ainda não há avaliações

- The Architecture of Modern Political PowerDocumento260 páginasThe Architecture of Modern Political Powermiha_anya100% (13)

- Friedman tHE RIGHT TO THE cITY PDFDocumento17 páginasFriedman tHE RIGHT TO THE cITY PDFcybermonchingAinda não há avaliações