Escolar Documentos

Profissional Documentos

Cultura Documentos

Paper Solution 2009

Enviado por

Sneha LeeTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Paper Solution 2009

Enviado por

Sneha LeeDireitos autorais:

Formatos disponíveis

Paper Solution 2009

Q1) Explain briefly the various stages of management control process citing salient features of each. Answer: 1). Programming Programming is defined as making programs by top/ senior management in terms of organizational goals and strategies and deciding the funds and resources needed to accomplish the programs. Programs can be made about development of new products, research and development of activities merger, takeover and other activities that are not related much with the existing product lines. In service organizations such as hotel chain management may draw programs for each hotel or each region where hotels are to be set up. Programming is long range plan, covering period of approximately five future years. The reason is that it programming is made for shorter period, the results and benefits of programming can not be realized within this period. some organization like public utilities prepare long range plans for even a period of twenty years .because of the relatively long time plan, only rough estimates are possible revenues ,expenses and capital expenditure. Programming is time consuming and expensive. The most significant expense is the time devoted to it by management, but it also involves a special programming staff and considerable paperwork. A formal programming process is not worthwhile in some organization. it is desirable in organization that have the following characteristics Its top management is convinced that programming is important .otherwise programming is likely to be or to become, a staff exercise that has little impact on actual decision making. It is relatively large and complex in small, simple organizations, an informal understanding of the organizations future directions for making decision about resource allocations, which is principal purpose of preparing programs. If the future is so uncertain that reasonably estimates cannot be made preparation of a formal program is a waste of time.

2). Budgeting Budget is formal financial plan for each year .a budget ,known as shorter angel plans ,is a technique of expressing revenues ,expenses ,physical targets like production and sales ,profit ,assets and liabilities usually for a period of one future year . 1. Budget has the functions of motivating managers, coordinating activities, communicating to persons within organization, providing standards for judging actual performance s and acting as control tool. 2. Budgeting involves operating managers as well as senior manager. Staff personnel have considerable input to the programming process, but relatively less input to the budgeting process 3. The program structure consists of program and major project. It includes both capital expenditure and operating items and it covers a period of several years. The budged is structured by responsibility centre (which may or may not cut across program) the focus is on operating revenues and expenses and it typically is for a single year. 4. Budget preparation is done under greater time pressure and is more hectic than programming 5. A program is abroad brush sketch of the future. A budget has more details both because it is a fairly specific guide to operating decisions and also because it will be used subsequently to evaluate the performance of individual manager. 6. Programming decision can have consequences of great magnitude. Budgeting decision are typically much less significant, because they are made within the context of the current level of operating activities, except as those activities will be affected by program decision. 7. Behavioral consideration is much more important in the budget preparation process than in the programming process. The approved project is a bilateral commitment; the program is not a commitment, because the budget will be used to evaluate performance. 3. Executing:After the budget preparation, budgeting is used as a tool for coordinating the actions of individual and department within the organization. In fact within the execution phase task control is done to ensure that actions and performance match with the planned or desired result. While performing the mangers goal is to achieve budgeted targets. However compliance to budget is not necessary if the plans given in the budget are found as not the best way of achieving the objective. After execution actual performance and result are compared with the budgeted plans and targets and variance reports are prepared which highlight the variance between the 2 and the causes for such variances. Variance reports should separate controllable item from non-controllable item, determine the effects of changes in volume on revenues and cost and if possible, should mention changes in other circumstances affecting the variances

4. Evaluation:Management control Process ends with the evaluation phase in which the performances of managers are evaluated. Since it is an after- event exercise, the evaluation does not affect what has happened. However, evaluation phase acts like a powerful stimulus as employees know that their performances will be subsequently evaluated. Also on the basis of performance evaluation, the future budget and plans are revised. Q2) What is Responsibility Centre? List and explain different types of responsibility centers with sketches. Answer:(A) Responsibility Centre An organization is composed of a number of financial responsibility centres. These responsibility centres are created by management based on the needs of the business enterprise. A responsibility centres may be define as an organizational unit which is headed by a responsible person namely a manager. He is responsible for the activities of the unit. The responsibility centres is responsible for performing some function which is its output. In performing these functions, it uses resources or inputs. The costs assigned to a responsibility centre are intended to measure the input that it consumes in a specific period of time, such as a week or a month. (B) Types of Responsibility Centres: (i) Expenses Centre (ii) Revenue Centre (iii) Profit Centre (iv) Investment Centre (i) Expenses Centre:Expense centers are responsibility centers whose inputs are measured in monetary terms, but whose outputs are not. There are two types of expense centers. A. Engineered Expense centers It has following characteristics a. Their inputs can be measured in monetary terms. b. Their output can be measured in physical terms. c. The optimum rupee value of input required to produce one unit of output can be determined.

Engineered Expense Centers Optimal relationship can be established

Inputs

Outputs

Rupees

PROCESS

Physical

B. Discretionary Expense center:- Where the output centres cannot be measured in terms of money, they are known as Discretionary Expense Centre. The word Discretionary must be properly understood. Example of such expenses centres are human resource department, accounting department, legal department, industrial relations department etc. in other words all administrative and support functions fall within the ambit of discretionary expense centres. In case of discretionary expense centre an optimal relationship cannot be established between inputs & output

Discretionary Expense Centers Optimal relationship cannot be established

Inputs

Outputs

Rupees

PROCESS

Physical

(ii) Revenue Centres: Revenue is a monetary measure of output. Where the output of responsibility centre is measured in terms of money, we have what is known as revenue centres. According to Anthony, in a revenue centre, outputs are measured in monetary terms, but no formal attempt is made to relate inputs (i.e. expense or cost) to outputs. Examples of revenue centres are marketing organization where no responsibility for profit exists. Orders booked and sales are compared with the budget to measures their performance. The primary yard stick for judging the efficency of revenue centres is revenue earned vis a vis the budget. However, the head of the revenue centre is held responsible for expenses incurred by his responsibility centre. Generally, revenue centre managers do not have responsibility for estabilishing selling prices. Thus, in a revenue centre, there is no relationship between inputs and outputs. Following figures shows the features of revenue centres.

Revenue Centers Input Not Related to Output

Inputs

Outputs

Rupees only for cost directly incurred

PROCESS

Rupee for revenue

(iii) Profit Centres: In the language of Anthony when financial performance in a responsibility centre is measured in terms of profit, which is the difference between the revenue and expenses, the responsibility centre is called a profit centre. Thus if the performance in a responsibility centre is measure in terms of both the revenue it earn and and the cost it incure, it is called as profit centre. Profit as measure of performance is especially useful since it enables senior management to use one comprehensive measure instead of several measures that points to different directions. The profit centre concept is powerful one.

Profit Centers Input are Related to Output

Inputs

Outputs

Rupees Cost

PROCESS

Rupee Profit

(IV) Investment Centre: An investment centre is a responsibility centre in which the manager is held responsible for the use of assets as well as for revenue & expenses. It is therefore the ultimate extension of the responsibility idea. The manager is expected to earn a satisfactory return on capital employed in the responsibility centre. Measurement of the investment base or capital employed gives rise to many difficult problems and the idea of the investment centre being new, there is considerable disagreement as to best solution of these problems.

Investment Centers Input are Related to Capital Employed

Inputs

Outputs

Rupees Cost

Capital Employed

Rupee Profit

Q.3

Every SBU is a profit center but every profit center is not a SBU? What are the conditions that

should be fulfilled for an organization unit to be converted into a profit center? What are the different ways to measure the performance of profit centers? Discuss their relative merit & demerits. Answer: (A) Every SBU is a profit centre but every profit centre is not a SBU Business units are suitable candidate for being establish as profit centres. Head of such units have control over production, marketing, development of new product etc and are in a position to exercise control over costs & revenues. However to gain maximum advantage from profit centre, the head of such a unit should have complete autonomy as the CEO of an independent ccompany. This is practically not feasiable as the organization would be losing the advantage of size and synergy, moreover, it would lead to the abdication of top management responsibility. Most business units are created as profit centers since managers in charge of such units typically control product development, manufacturing & marketing resources. these managers are in a position to influence revenues and costs and as such can be held accountable for the bottom line. However, a business unit managers authority may be constrained in various ways, which ought to be reflected in a profit centers design and operation. (B) Conditions that should be fulfilled for an organization to be converted into a profit centre Functional organization is one which each principal manufacturing or marketing function is performed by a separate organization unit. when such an organization is converted to one in which each major unit is responsible for both the manufacture and marketing ,the process is termed divisionalization. As a rule, companies create business units because they have decided to delegate more authority to operating managers. Although the degree of delegation may differ From company to company, complete authority for generating profits is never delegated to a single segment of the business. Many management decisions involve proposals to increase expenses with the expectation of am even greater increase in sales revenue. such decisions are said to involve expense/revenue trade offs .additional advertising expense is an example. However three condition given below must be fulfilled before such a trade off decision or decision involving specialized knowledge and skills can be delegated safely to a manager lower down in the organizational hierarchy: 1. Relevant information must be available with the manager for making trade-offs between expenses & revenue.

2. It is not possible to manufacture and market the product in the absence of specialized manufacturing aand marketing knowledge and skills and the knowledge & skills should be available with the manager. 3. It is possible to measure the effectiveness with which the manager is carrying out these Trade-offs and decision involving specialized knowledge and skills. A major step in creating profit centers is to determine the lowest point in an organization where these two conditions prevail. All responsibility centers fit into a continuum ranging from those that clearly should be profit centers to those that clearly should not ,management must decide whether the advantages of giving profit responsibility offset the disadvantages. (C) Different ways to measure the performance of profit centre and there relative merits & demerits (i) Direct Profit:- Direct profit is the excess of sales value over the marginal cost of sales and fixed cost attributable to the profit centre. Particulars Sales Less: Marginal cost Contribution Less: Fixed Cost Direct profit Amount (Rs.000) 500 200 300 100 200

The merits of the method are that it is simple, easy to understand, and conceptually sound. However, it has its weakness also. The technique fails to consider the motivation arising from the charging of costs of corporate headquarters. (ii) Contribution Margin:- Contribution margin is arrived at after deducting the marginal cost of sales from the sales value. It is the excess of sales value over the marginal cost of sales and shows the amount of money contributed by the organizational unit towards the recovery of fixed cost & generation of profit. Particulars Sales Less: Marginal cost Contribution that he should aim at ensuring spread between sales value and variable cost. Amount (Rs.000) 500 200 300

The logic underlying this method is that since fixed expenses cannot be controlled by the manager, it is vital

(iii) Income Before Income Tax:- income before tax represents the excess of sales revenue over the cost of Amount (Rs.000) sales. It is computed by deducting Particulars from the sales value the following expenses: Sales Less: Marginal cost Contribution Less: Fixed Cost ( Incurred in Profit centre) Direct profit Less: Controllable corporate charges Less: Other allocated corporate overheads Income Before Income Tax (a) Managerial cost of sales (c) Controllable corporate charges overheads Merits:(a) This act as a motivational tool for responsibility centre manager (b) It reflect as true performance of the entity and facilitate interfirm comparisons. (c) Allocation of corporate overheads helps to keep in check head office expenditure as they would be subject to question by profit centre managers. Demerits:(a) Suitable methods of allocating corporate overheads to profit centre are difficult to find. (b) It is not possible to control the costs incurred by corporate service entities like legal, human resource development, finance & accounts etc. (iv) Controllable Profit: Controllable profit is arrived after deducting following items of expenses from the Particulars Amount (Rs.000) sales revenue: Sales Less: Marginal cost Contribution Less: Fixed Cost ( Incurred in Profit centre) Direct profit Less: Controllable corporate charges Controllable Profit (a) Marginal cost of sales 500 200 300 100 200 50 150 (b) (d) 500 200 300 100 200 50 150 30 120 Fixed cost of the profit centre Other controllable allocated

(b) Fixed cost of the profit centre (c) Controllable corporate charges The expenses that are incurred by the corporate headquarter is of two types controllable and non controllable. The profit centre manager is in the position to control the first category of expenses if not fully to a great extant. The logic underlying this method is that the measurement system should include only those costs that can be influenced by the profit centre manager. The drawback of this method are that the profit derived under this method cannot be compared with date published by trade association or with published accounts (v) Net Income:- This technique uses the net income figure to measures the profitability of a responsibility centre. Net income is the surplus left after deducting all expenses, allocated corporate overheads, and income tax from sales revenue. Merits: (a) Decisions related to installment sales/hire purchase, acquisition of fixed assets and disposal of fixed assets are made by profit centre managers. These decision influence income tax. Consequently this leads to motivation of the manager to minimize income tax. (b) The effective rate of income tax is the same among all profit centres.

Demerits: (a) Corporate headquarters makes many decisions which have income tax implication and the performance of managers of profit centres should not be affected by such decision. (b) No advantage arises from the consideration of income tax as income tax as income after tax happens to be constant percentage of income before tax.

Particulars Sales Less: Marginal cost Contribution Less: Fixed Cost ( Incurred in Profit centre) Direct profit Less: Controllable corporate charges Controllable Profit Less: Other allocated corporate overheads Income Before Income Tax Less: Income tax @ 50% Net Income

Amount (Rs.000) 500 200 300 100 200 50 150 30 120 60 60

Q4) (a) Transfer Pricing is not an Accounting Tool. Comment with illustrations. Answer: 1. Some companies use the term TP to refer to the amount used in accounting , for transfer of goods & services between responsibility centres. But in MCS, TP is used to the value placed on transfer of goods and services in transaction where at least one of the two parties is a profit centre.

2. Transfer price involves a profit since an independent company would not transfer goods & services to another independent company at the cost or less, hence we exclude the mechanics of allocating cost in a cost accounting system since such costs do not include the profit element. 3. Transfer price in MCS is to be used in the same way as in transaction between independent companies. 4. The fundamental principal is that, the transfer price should be similar to the price that would be charged if the product was sold externally or purchase from outside vendors. 5. The profit included in transfer price is a notional profit, but in pure accounting it is a real profit since it includes transactions with external perties. 6. Transfer price is more of an internal mechanism of allocating profit as compared to accounting which is more of an external mechanism of real profit. 7. Transfer price depends upon the accounting profit sice all future decisions would be based on the current profit of the company. Hence Transfer pricing is not an Accounting Tool. Q4) (b) Market price is ideal transfer price even in limited market. Comment Answer:- Transfer price can be very simple or complex depending on the business. Ideally we need a proper negotiation system, a proper arbitration system, a proper conflict resolution system, a proper product classification system, competitive managers, good atmosphere, available market price, freedom to source and full information. All of these have to be present for a market price based transfer price system to induce goal congruence. Ideally, the buying and selling profit centre manager should be free to source but it may be unfeasible by company policy. Limited market: Market for buying & selling profit centres may be limited due to: (i) The existence of internal capacity might limit the development of external sales. Most of the large companies in an industry are highly integrated hence production capacity for an intermediate product is limited. These profit centres can handle only a limited amount of demand. When internal capacity become tight, the market is flooded with demand for the intermediate product. Even though outside capacity exists it may be unavailable to the integrated company unless used on a regular basis or it may have trouble getting it externally when capacity is limited. (ii) (iii) If the company is a sole producer of a differential product then no external source exists. If a comaapy has invested in facilities, it is likely to use external sources, unless the external selling price is equal to variable cost which is unusual. Hence the produced products are captive. Integrated Oil companies send crude oil from the production unit to the refining unit even if there is an external market for the crude oil. Even in the case of limited markets, the best transfer price satisfying all requirement of a profit centre is the Competitive Price. If internal capacity is unavailable the company will buy from outside at the

Competitive Price. The difference between the Competitive Price and the internal cost is money saved by producing rather then buying.

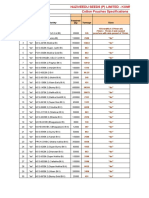

Q5) XYZ Ltd. has two division : A and B. Return on Investment for both divisions is 15%. There details are given below: Particulars Division A (Rs.) Division B (Rs.) Divisional Sales 40,00,000 96,00,000 Divisional Investment 20,00,000 32,00,000 Profit 3,00,000 4,80,000 Analyze and comment on divisional performance of each with respect to Operational Excellence & Marketing Effectiveness. Solution: Table showing evaluation of Divisional Performance Particulars Divisional Sales Divisional Investment Profit Profit Margin Assets Turnover ROI Comments: Division A 40,00,000 20,00,000 3,00,000 7.5% 2 times 15% Division B 96,00,000 32,00,000 4,80,000 5% 3 times 15%

(a) The ROI for both Divisions is the same at 15% (b) The profitability of Division A is higher at 7.5% with respect to the Profitability of Division B of 5%. (c) The assets turnover ratio of Division B is better at 3 times rather then Division A which is 2 times (d) Division B has earned greater profit of Rs. 480000 as compare to Division A which earned only Rs.300000. (e) Sales in absolute terms of Division B Rs.9600000 were greater then sales of Division A Rs.4000000. (f) Assets invested in Division B were Rs.3200000 as compared to Division A which had only Rs.2000000. (g) The division would be better evaluated if they were measured on the basis of EVA rather then ROI

Thus From the above Division A performance is good. As with same ROI i.e. 15% it provides high profit margin the Division B. The profit margin of division B is lower because any of the following reasons like: Due to inefficency Due to excess input cost.

This profit margin can be improved by following actions: Keeping same sales and reduce cost Increase sales keeping same cost Increase sales and reduce cost.

Q7) Organizations with Business Division format have observed that Divisional Controller experience divided loyalty in carrying out their functions, causing a possible dysfunction. How could such a situation be resolved? Define role of controller which suits your suggestion. Answer:- In a business unit form of organization, the finance and accounting function is headed by a business unit controller. The business unit controller reports to the business unit manager. He also reports to the corporate controller. This create what is known as divided loyalty. While dealing with organization structures we have come across what is known as dotted line relationships.

In some organization, business unit controller reports directly to corporate controller and have a dotted line relationship with business unit managers. This indicates that the corporate controller is the business unit controller immediate boss.

In sharp contrast to above, we have companies where business unit controller reports directly to business unit manager and have what is known as dotted line relationship with the corporate controller. In India, the business unit manager generally report directly to the business unit manager and has a dotted relationship with the corporate controller. The reporting relation described above has its own merits & demerits. In case the business unit controller reports directly to the corporate controller, the business unit manager may view him with suspicious and as a result may not repose his trust and confidence in him. On the contrary, if the business unit controller reports directly to the business unit manager, the former may not be in a position to discharge his responsibility in a faithful manner to the company. Q8) What you understand by Goal Congruence? What are the informal factors that influence the Goal Congruence? Answer:- This term is used when the same goals are shared by top managers and their subordinates. This is one of the many criteria used to judge the performance of an accounting system. The system can achieve its goal more effectively and perform better when organizational goals can be well aligned with the personal and group goals of subordinates and superiors. The goals of the company should be the same as the goals of the individual business segments. Corporate goals can be communicated by budgets, organization charts, and job descriptions.

Goal Congruence- Meaning Individuals work in different hierarchies and handle different

responsibilities & may have different goals. But they must come together as far as Companys Goal is concerned (there action must speak Cos language.)

Goal Congruence Example 1 The HR manager has devised a HR training program to enhance the skills of its sales personnel, with an objective to enhance their productivity But if company is in strategic need of attaining a certain sales volume in a given quarter, it can not do so on account of non availability of personnel. Example 2 The marketing department has planned an impressive advertising campaign, which promises good returns, But say due to cash crunch Companys current financial position may not let to lose the strings Example 3 Production Manager may get a good applause for reducing cycle time; But at what cost? Building up the high inventory i.e. higher investment in current assets. While doing so he just overlooked the financial interest of the company. After completing the given activity in more efficient manner the

concerned manager scores the point/s on his score card. Whether his actions are leading to scoring of points on the organizations score card too? if it is so then only one can say the organization is marching towards a common goal.

Every individual working in an organization has got his own motive to do the work. Individuals act in their own interest, based on their own motivations. And it is always not necessarily consistent with the Cos goal. In a goal congruence process, the actions the people are led to take in accordance with their perceived self interest are also in the best interest of the organization i.e. Goal congruence ensures that the action of manager taken in their best interest is also in the best interest of the organization.

Informal factors that influence goal congruence: External Factors External factors are norms of desirable behavior that exist in the society of which the organization is a part. These norms include a set of attitudes, often collectively referred to as the work ethic, which is manifested in employees' loyalty to the organization, their diligence, their spirit, and their pride in doing a good job (rather than just putting in time). Some of these attitudes are local that is, specific to the city or region in which the organization does its work. In encouraging companies to locate in their city or state, chambers of commerce and other promotional organizations often claim that their locality has a loyal, diligent workforce. Other attitudes and norms are industry-specific. Still others are national; some countries, such as Japan and Singapore, have a reputation for excellent work ethics. Internal Factors Culture

The most important internal factor is the organization's own culture-the common beliefs, shared values, norms of behavior and assumptions that are implicitly and explicitly manifested throughout the organization. Cultural norms are extremely important since they explain why two organizations with identical formal

management control systems, may vary in terms of actual control. A company's culture usually exists unchanged for many years. Certain practices become rituals, carried on almost automatically because "this is the way things are done here." Others are taboo ("we just don't do that here"), although no one may remember why. Organizational culture is also influenced strongly by the personality and policies of the CEO, and by those of lower-level managers with respect to the areas they control. If the organization is unionized, the rules and norms accepted by the union also have a major influence on the organization's culture. Attempts to change practices almost always meet with resistance, and the larger and more mature the organization, the greater the resistance is. Management Style

The internal factor that probably has the strongest impact on management control is management style. Usually, subordinates' attitudes reflect what they perceive their superiors' attitudes to be, and their superiors' attitudes ultimately stem from the CEO. Managers come in all shapes and sizes. Some are charismatic and outgoing; others are less ebullient. Some spend much time looking and talking to people (management by walking around); others rely more heavily on written reports.

The Informal Organization

The lines on an organization chart depict the formal relationships-that is, the official authority and responsibilities-of each manager. The chart may show, for example, that the production manager of Division A reports to the general manager of Division A. But in the course of fulfilling his or her responsibilities, the production manager of Division A actually communicates with many other people in the organization, as well as with other managers, support units, the headquarters staff, and people who are simply friends and acquaintances. In extreme situations, the production manager, with all these other communication sources available, may not pay adequate attention to messages received from the general manager; this is especially likely to occur when the production manager is evaluated on production efficiency rather than on overall performance. The realities of the management control process cannot be understood without recognizing the importance of the relationships that constitute the informal organization. Perception and Communication

In working toward the goals of the organization, operating managers must know what these goals are and what actions they are supposed to take in order to achieve them. They receive this information through various channels, both formal (e.g., budgets and other official documents) and informal (e.g., conversations).

Despite this range of channels, it is not always clear what senior management wants done. An organization is a complicated entity, and the actions that should be taken by anyone part to further the common goals cannot be stated with absolute clarity even in the best of circumstances. Moreover, the messages received from different sources may conflict with one another, or be subject to differing interpretations. For example, the budget mechanism may convey the impression that managers are supposed to aim for the highest profits possible in a given year, whereas senior management does not actually want them to skimp on maintenance or employee training since such actions, although increasing current profits, might reduce future profitability. Q9) Short Notes (i) Zero Based Budgeting:ZBB is an analytical approach to budgeting. It involves a method of budgeting where by all activities are duly reevaluated each time a budget is formulated. Each functional budget starts with the assumption that the function does not exist and is at zero cost. Generally, the conventional budgetary system uses the previous period actuals and budget as bases in order to set budget targets according to experience gained during the preceding period and expectation for the budget period. ZBB differs radically from conventional budgeting. It raises such questions as why. The concept does not give consideration to previous years actuals results and budget as base for planning in future. ZBB proceeds on the assumption that the functions does not exist and its cost is NIL or Zero. It reviews, critically analysis, and seeks justification for the aactivities and expenses of the preceding year and to put succinctly, commences planning from zero base. Hence, the name Zero Base Budgeting. Under this all the activities of organization are re-valued whenever a budget is prepared. It carries out an evaluation of both existing and new activities and tries to answer question such as: (a) Are existing activities justified? (b) What is the efficency & effectiveness of existing operation? (c) Should reduction need to be made in existing operation in order to finance new project of high priority. (ii) Free Cash Flow: A measure of financial performance calculated as operating cash flow minus capital expenditures. Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value. Without cash, it's tough to develop new products, make acquisitions, pay dividends and reduce debt. FCF is calculated as:

It can also be calculated by taking operating cash flow and subtracting capital expenditures. Free Cash Flow of the Firm is calculated as follows:A measure of financial performance that expresses the net amount of cash that is generated for the firm, consisting of expenses, taxes and changes in net working capital and investments. Calculated as:

This is a measurement of a company's profitability after all expenses and reinvestments. It's one of the many benchmarks used to compare and analyze financial health. A positive value would indicate that the firm has cash left after expenses. A negative value, on the other hand, would indicate that the firm has not generated enough revenue to cover its costs and investment activities. In that instance, an investor should dig deeper to assess why this is happening - it could be a sign that the company may have some deeper problems. (iii) MCS in the Matrix Organization: The matrix form of organization is a combination of the functional and divisional structures. While product lines are arranged along one arm of the matrix, across the other arm could be arranged either functional or geographical division. Matrix organizational structure assigns multiple responsibilities to the functional heads. Evaluation of performance of such organizational entities is very difficult. Though they offer economies of using scares functional staff, it poses problems of casting the individual responsibility. This form of organization is very complex, from the point of view of management control system. At the end we must not forget that the management control system is for the organization and not the organization exists for management control system. One has to mold and remold the management control system to suit the given organization structure

Usually in an advertisement agency, account supervisors are shifted from one account to another on periodic basis, this practice allows the agency to look at the account from the perspectives of different executives. However taking in to consideration the time lag of result realization in such services is quite large. And this may pose problem of performance assessment of a particular executive. This does not mean a control system designer should insist on abandoning the rotation system of the executives. Matrix structure offers advantages such as faster decision making process, efficiency and effectiveness but simultaneously it may pose problems such as added complexity in control function, assignment of responsibility and authority etc. The matrix form of organization have drawbacks too. It is difficult to manage the structure easily. The configuration dilutes priorities and creates conflicts product lines and functional lines over the allocation of resources. Firms that follow this structure are TCS, Shell etc.

Você também pode gostar

- Chapter Introduction:: Advantages of BudgetDocumento10 páginasChapter Introduction:: Advantages of BudgetreneeshrameshAinda não há avaliações

- Pre Joining Guidelines For InfosysDocumento21 páginasPre Joining Guidelines For InfosysGokul0% (2)

- Budgeting and Its TypesDocumento28 páginasBudgeting and Its Typesnitin0010Ainda não há avaliações

- Budgetary Control-HdfcDocumento66 páginasBudgetary Control-HdfcG.MANOHAR BABU100% (2)

- Perfomance BudjectingDocumento72 páginasPerfomance BudjectingAnithaAinda não há avaliações

- Coerver Sample Session Age 10 Age 12Documento5 páginasCoerver Sample Session Age 10 Age 12Moreno LuponiAinda não há avaliações

- 5 Point Scale PowerpointDocumento40 páginas5 Point Scale PowerpointMíchílín Ní Threasaigh100% (1)

- Paper Solution 2009Documento20 páginasPaper Solution 2009mukeshkumar91Ainda não há avaliações

- MA AssignmentDocumento11 páginasMA AssignmentGurung AnshuAinda não há avaliações

- MCS Qa 2009Documento14 páginasMCS Qa 2009Mayur GharatAinda não há avaliações

- Fikriyah Arinal Haq / 12010006/ Term 5/ Management Control Systems Resume Chapter 4 Responsibility Centers: Revenue and Expense CenterDocumento4 páginasFikriyah Arinal Haq / 12010006/ Term 5/ Management Control Systems Resume Chapter 4 Responsibility Centers: Revenue and Expense CenterVikri Al-hadiAinda não há avaliações

- Management Control System Unit-2Documento10 páginasManagement Control System Unit-2RenjiniChandranAinda não há avaliações

- 8 - Putu Nita WinidiantariDocumento9 páginas8 - Putu Nita WinidiantariyudaAinda não há avaliações

- Management Control SystemDocumento28 páginasManagement Control SystemLea WigiartiAinda não há avaliações

- What The Concept of Free Cash Flow?Documento36 páginasWhat The Concept of Free Cash Flow?Sanket DangiAinda não há avaliações

- Responsibility CentresDocumento9 páginasResponsibility Centresparminder261090Ainda não há avaliações

- Recent Trends in Management AccountingDocumento20 páginasRecent Trends in Management Accountingsanusahad123Ainda não há avaliações

- Budget in 1Documento9 páginasBudget in 1Tanwi Jain100% (1)

- Managerial Accounting IBPDocumento58 páginasManagerial Accounting IBPSaadat Ali100% (1)

- Management Accounting B. Com (P) Sem VIDocumento9 páginasManagement Accounting B. Com (P) Sem VIKopal GargAinda não há avaliações

- Summary Master BudgetingDocumento5 páginasSummary Master BudgetingliaAinda não há avaliações

- Chapter 4 PptsDocumento111 páginasChapter 4 PptsKimberly Quin Cañas100% (1)

- BUDGETORY CONTROL - Use of Budget For MaDocumento37 páginasBUDGETORY CONTROL - Use of Budget For MaSahil AggarwalAinda não há avaliações

- BudgetDocumento6 páginasBudgetKedar SonawaneAinda não há avaliações

- Pusat Tanggung Jawab: Pusat Pendapatan Dan Beban: Pertemuan 4Documento17 páginasPusat Tanggung Jawab: Pusat Pendapatan Dan Beban: Pertemuan 4Siti Rahmi HidayatullahAinda não há avaliações

- Budgetary ControlDocumento64 páginasBudgetary ControlTapaswini MohapatraAinda não há avaliações

- Budgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToDocumento6 páginasBudgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToJoy VAinda não há avaliações

- Chapter 15 - AnswerDocumento21 páginasChapter 15 - AnswerAgentSkySkyAinda não há avaliações

- Techniques For Financial ControlDocumento4 páginasTechniques For Financial ControlxonstanceAinda não há avaliações

- Name:-Yoseph Berhane Section: - ADocumento3 páginasName:-Yoseph Berhane Section: - Ayoseph berhaneAinda não há avaliações

- Activity 1 Introduction To Planning, Budgeting and ForecastingDocumento3 páginasActivity 1 Introduction To Planning, Budgeting and ForecastingMaya RivasAinda não há avaliações

- Budget:: Factors Affecting Budget PlanningDocumento5 páginasBudget:: Factors Affecting Budget Planningmadhu anvekarAinda não há avaliações

- BHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3Documento6 páginasBHMCT Sem VII Spl. Front Office Mgt. II CED 701 Chapter 3neelsequeira.9Ainda não há avaliações

- IUB-MA-Ch # 04Documento26 páginasIUB-MA-Ch # 04siam_ndc04Ainda não há avaliações

- BUDGETINGDocumento11 páginasBUDGETINGCeceil PajaronAinda não há avaliações

- Divine Word College of Vigan Vigan City, Ilocos Sur Graduate School of Business AdministrationDocumento7 páginasDivine Word College of Vigan Vigan City, Ilocos Sur Graduate School of Business AdministrationJoy VAinda não há avaliações

- CHAPTER 3 5 Contents ONLYDocumento18 páginasCHAPTER 3 5 Contents ONLYKimberly Quin CañasAinda não há avaliações

- Motivation, Budgets and Responsibility AccountingDocumento5 páginasMotivation, Budgets and Responsibility AccountingDesak Putu Kenanga PutriAinda não há avaliações

- Lecture 1 & 2Documento5 páginasLecture 1 & 2Syed Attique KazmiAinda não há avaliações

- Managerial Accounting: Summary: Chapter 10 - Master BudgetingDocumento6 páginasManagerial Accounting: Summary: Chapter 10 - Master BudgetingIra PutriAinda não há avaliações

- Budgetary ControlDocumento38 páginasBudgetary ControlraajnanjaiAinda não há avaliações

- Group 2 GroupDocumento11 páginasGroup 2 GroupRupeshri PawarAinda não há avaliações

- 2008 SolutionDocumento17 páginas2008 SolutionBook wormAinda não há avaliações

- BudgetingDocumento19 páginasBudgetingmaakkanAinda não há avaliações

- Mcs Safira Annisa RCDocumento9 páginasMcs Safira Annisa RCDasril ChaniagoAinda não há avaliações

- Unit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedDocumento13 páginasUnit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedArvind RayalwarAinda não há avaliações

- Budgeting As A Tool of ControlDocumento3 páginasBudgeting As A Tool of ControlAbdul WahabAinda não há avaliações

- CH 4 Responsibility CentersDocumento22 páginasCH 4 Responsibility CentersAurellia AngelineAinda não há avaliações

- BSBPMG514Documento21 páginasBSBPMG514tvatAinda não há avaliações

- Budgetary Control at Omaxe LimitedDocumento81 páginasBudgetary Control at Omaxe Limitedanshul5410100% (1)

- Overhead BudgetDocumento16 páginasOverhead BudgetRonak Singh67% (3)

- Cost CH 2Documento16 páginasCost CH 2Shimelis TesemaAinda não há avaliações

- ASP-Responsibility Center in Local GovernmentDocumento3 páginasASP-Responsibility Center in Local GovernmentmlinaaAinda não há avaliações

- Fiscal PlanningDocumento84 páginasFiscal PlanningMebin Ninan92% (26)

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Documento12 páginasSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarAinda não há avaliações

- Responsibility AccountingDocumento15 páginasResponsibility AccountingSudipto RoyAinda não há avaliações

- Seminar On: Budget Estimate, Revised Budget and Performance Budget)Documento12 páginasSeminar On: Budget Estimate, Revised Budget and Performance Budget)Reshma AnilkumarAinda não há avaliações

- BudgetDocumento18 páginasBudgetembiale ayalu100% (1)

- BudgetingDocumento20 páginasBudgetingSanjeevAinda não há avaliações

- Cost Ii CH 2Documento23 páginasCost Ii CH 2TESFAY GEBRECHERKOSAinda não há avaliações

- Responsbility AccountingDocumento2 páginasResponsbility Accountingsairajdash189Ainda não há avaliações

- Metalanguage: Big Picture in Focus: Ulod. Understand The Budgeting Framework and Develop A Master BudgetDocumento5 páginasMetalanguage: Big Picture in Focus: Ulod. Understand The Budgeting Framework and Develop A Master BudgetJeson MalinaoAinda não há avaliações

- Foreign Direct InvestmentDocumento8 páginasForeign Direct InvestmentSneha LeeAinda não há avaliações

- How European Crisis Could Impact India? Understanding The Linkages .Documento15 páginasHow European Crisis Could Impact India? Understanding The Linkages .Sneha LeeAinda não há avaliações

- Weather DerivativesDocumento19 páginasWeather DerivativesSneha Lee100% (1)

- MicroFinance PDFDocumento89 páginasMicroFinance PDFSneha Lee100% (2)

- Coping With Liquidity Management in India: A Practitioner's View Rakesh MohanDocumento18 páginasCoping With Liquidity Management in India: A Practitioner's View Rakesh MohanSneha LeeAinda não há avaliações

- Freelancer - Financial Content: Siteid Google&addunit Textad&keyword Banking - ServicesDocumento9 páginasFreelancer - Financial Content: Siteid Google&addunit Textad&keyword Banking - ServicesSneha LeeAinda não há avaliações

- Appendix I - Plant TissuesDocumento24 páginasAppendix I - Plant TissuesAmeera ChaitramAinda não há avaliações

- Lunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Documento2 páginasLunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Kiwanis Club of WaycrossAinda não há avaliações

- Design and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionDocumento11 páginasDesign and Experimental Performance Assessment of An Outer Rotor PM Assisted SynRM For The Electric Bike PropulsionTejas PanchalAinda não há avaliações

- SBP Notes-1 PDFDocumento7 páginasSBP Notes-1 PDFzeeshanAinda não há avaliações

- BROADCAST Visual CultureDocumento3 páginasBROADCAST Visual CultureDilgrace KaurAinda não há avaliações

- Komatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop ManualDocumento20 páginasKomatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop Manualmallory100% (47)

- 7 кмжDocumento6 páginas7 кмжGulzhaina KhabibovnaAinda não há avaliações

- Install GuideDocumento64 páginasInstall GuideJorge Luis Yaya Cruzado67% (3)

- Corelation & Multiple Regression AnalysisDocumento28 páginasCorelation & Multiple Regression AnalysisSaad Bin Tariq100% (1)

- RPS Manajemen Keuangan IIDocumento2 páginasRPS Manajemen Keuangan IIaulia endiniAinda não há avaliações

- Review of Related LiteratureDocumento9 páginasReview of Related LiteratureMarion Joy GanayoAinda não há avaliações

- Bimetallic ZN and HF On Silica Catalysts For The Conversion of Ethanol To 1,3-ButadieneDocumento10 páginasBimetallic ZN and HF On Silica Catalysts For The Conversion of Ethanol To 1,3-ButadieneTalitha AdhyaksantiAinda não há avaliações

- Horgolás Minta - PulcsiDocumento5 páginasHorgolás Minta - PulcsiCagey Ice-RoyAinda não há avaliações

- CA39BDocumento2 páginasCA39BWaheed Uddin Mohammed100% (2)

- Case 3 GROUP-6Documento3 páginasCase 3 GROUP-6Inieco RacheleAinda não há avaliações

- Lyndhurst OPRA Request FormDocumento4 páginasLyndhurst OPRA Request FormThe Citizens CampaignAinda não há avaliações

- Value Chain AnalaysisDocumento100 páginasValue Chain AnalaysisDaguale Melaku AyeleAinda não há avaliações

- Cotton Pouches SpecificationsDocumento2 páginasCotton Pouches SpecificationspunnareddytAinda não há avaliações

- How To Use The ActionDocumento3 páginasHow To Use The Actioncizgiaz cizgiAinda não há avaliações

- Channels of CommunicationDocumento3 páginasChannels of CommunicationIrin ChhinchaniAinda não há avaliações

- ANTH 222 Syllabus 2012Documento6 páginasANTH 222 Syllabus 2012Maythe S. HanAinda não há avaliações

- HelloDocumento31 páginasHelloShayne Dela DañosAinda não há avaliações

- CO-PO MappingDocumento6 páginasCO-PO MappingArun Kumar100% (1)

- Ancient Egyptian TimelineDocumento5 páginasAncient Egyptian TimelineMariz Miho100% (2)

- 03-Volume II-A The MIPS64 Instruction Set (MD00087)Documento793 páginas03-Volume II-A The MIPS64 Instruction Set (MD00087)miguel gonzalezAinda não há avaliações

- Bike Chasis DesignDocumento7 páginasBike Chasis Designparth sarthyAinda não há avaliações

- Robert FrostDocumento15 páginasRobert FrostRishi JainAinda não há avaliações