Escolar Documentos

Profissional Documentos

Cultura Documentos

Introduction

Enviado por

Tejas PatelDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Introduction

Enviado por

Tejas PatelDireitos autorais:

Formatos disponíveis

Introduction Mergers and acquisitions ("M&A") are strategic decisions taken for maximization of a company's growth by enhancing its

production and marketing operations. They are being used in a wide array of fields in order to gain strength, expand the customer base, cut competition or enter into a new market or product segment. Aviation sector is one of the least researched sectors in India as it has limited number of players. However, as the sector is growing rapidly, it becomes essential to have knowledge about the sector and the activities which are taking place in the sector. The aviation market and scenario in India has seen major developments in the last 5 years. Not merely has the market grown very rapidly, but the industry has seen, M&A, the entry of a number of new carriers with aggressive pricing policies and significant additions of capacity leading to cut- throat competition. This assignment makes an attempt to give a brief overview of the meaning of M&A, and the regulations dealing with the same in India.It then tries to comprehensively deal with the Aviation Industry in India and M&A in the aviation sector. Finally, it offers few important cases dealing with M&A in the said sector both at domestic and international front. Overview Merger A merger is a combination of two or more businesses into one business. Laws in India use the term 'amalgamation' for merger. It is a process where one company blends with another company (both being existing companies and carrying on business), provided that following conditions are met with: All properties are transferred to the amalgamated company. All liabilities are transferred to the amalgamated company. Shareholders holding at least 3/4th in the value of shares of the amalgamating company become shareholders of the amalgamated company.

Type of Mergers Horizontal Mergers : A Horizontal Mergers occurs when one firm combines with the other in the same line of business. This kind of merger takes place between entities engaged in competing businesses which are at the same stage of the industrial process. Vertical mergers : Vertical mergers refer to the combination of two entities at different stages of the industrial or production process. For example, the merger of a company engaged in the construction business with a company engaged in production of brick or steel would lead to vertical integration. Conglomerate Mergers : A conglomerate merger occurs when unrelated enterprises combine. The principal reason for a conglomerate merger is utilization of financial resources, enlargement of debt capacity, and increase in the value of outstanding shares by increased leverage and earnings per share, and by lowering the average cost of capital. Acquisition An acquisition or takeover is the purchase by one company of controlling interest in the share capital, or all or substantially all of the assets and/or liabilities, of another company. A takeover may be friendly or hostile.

Regulations governing M&A in India Before going into the issues pertaining to M&A of airlines, we will first have a look at the current policy framework for M&A in India. Regulations governing M&A in India may be divided in to the following categories: 1. National M&A transactions

Companies Act, 1956. Companies Court Rules, 1959. Income Tax Act, 1961. Central Sale Tax Act, 1956. Indian Stamp Act, 1899 Competition Act, 2002 (It has been enacted but is not yet fully enforced)

2. M&A transactions involving listed companies The Securities and Exchange Board of India (SEBI) Regulations The SEBI (Substantial Acquisition of Shares and Takeovers) Regulations,1997 The SEBI (Issue of Capital and Disclousre Requirements) Regulations, 2009 Listing Agreements 3. International M&A Transactions Foreign Exchange Management Act, 1999 Aviation Sector Aviation is, by its very nature, a critical part of the infrastructure of the country and has important ramifications for the development of tourism and trade, the opening up of inaccessible areas of the country and for providing stimulus to business activity and economic growth. The airline industry has to operate in a competitive world. Many airlines are unable to survive in their present set up and have to streamline their operations through cost cutting measures. Merging with another airline provides a possible method to improve airline operations and reduce costs by sharing the available resources and eliminating duplication of service. Aviation Industry in India The history of civil aviation of India may be traced back to the year 1933, when Tata Airlines was formed by Mr. JRD Tata. At the time of Independence nine airlines were operational in the Indian Territory. The number was then reduced to eight when Orient Airways shifted its base to Pakistan. The then operational airlines were the Tata Airlines, Indian National Airways, Air service of India, Deccan Airways, Ambica Airways, Bharat Airways and Mistry Airways. The era of private airlines came to an end on 28th May 1953 - with the enactment of the Air Corporations Act, 1953 - Government of India nationalised the airline industry. In accordance with this Act, two air corporations, viz. Indian Airlines Corporation and Air India International, were established and the assets of all the then existing nine air companies were transferred to the two new Corporations. The operation of scheduled air transport services was made a monopoly of these two Corporations and the Act prohibited any other person or their associates from operating any scheduled air transport services from/to/ or across India.

In the year 1990, open-sky policy was adopted by the government and it allowed air taxi- operators to decide their own flight schedules, cargo and passenger fares. On March 1, 1994 the Air Corporation Act, 1953 was repealed thereby ending the monopoly of the Corporations on scheduled air transport services. While the domestic air transport services were liberalised and private operators were permitted to provide scheduled air transport services, the Government had laid down a policy framework to ensure safety and security of operations as well as the orderly growth of air transport services keeping in view the infrastructure constraints at a number of airports. Aviation Industry in India is one of the fastest growing aviation industries in the world. With the liberalization of the Indian aviation sector, aviation industry in India has undergone a rapid transformation. From being primarily a government-owned industry, the Indian aviation industry is now dominated by privately owned full service airlines and low cost carrier. At present, private airlines account for around 75% portion of the domestic aviation market. The open sky policy of the government has helped a lot of overseas players entering the aviation market in India. Earlier air travel was a privilege only a few could afford, but today air travel has become much cheaper and can be afforded by a large number of people. The 9th largest aviation market in the world is India with a compound annual growth rate (CAGR) of 18 per cent. However, the Indian Aviation Industry is still in a very nascent stage. Indias air passenger per capita at 0.09 is still abysmally low as compared to 0.30 in China, 5.63 in Australia and 4.69 in US. Classification of Indian Aviation sector The Indian civil aviation can be broadly classified into the following categories:Scheduled Air Transport Service means an air transport service undertaken between the two or more places and operated according to a published time table or with flights so regular or frequent that they constitute a recognizably systematic series, each flight being open to use by members of the public. Non-Scheduled Operation means an air transport service other than scheduled air transport service and that may be on charter basis and/or non-scheduled basis. The operator is not permitted to publish time schedule and issue tickets to passengers. An air cargo service means air transportation of cargo and mail. Passengers are not permitted to be on these operations. It may be on scheduled or non-scheduled basis. These operations are to destinations within India. For operations outside India, the operator has to take specific permission of Directorate General of Civil Aviation demonstrating his capacity for conducting such operations. Major Players in aviation industry The players in aviation industry can be categorized in three groups: Public players : Air India, Indian Airlines and Alliance Air Private players : Jet Airways, Air Sahara, Kingfisher Airlines, Spice Jet, Air Deccan, Go Air lines, Paramount Airways Start-up players: Omega Air, Magic Air, Premier Star Air & MDLR Airlines.

Legal framework The important laws relevant to civil aviation are: a) The Aircraft Act, 1934 which controls the manufacture, possession, use, operation, sale, import and export of air craft. Also relevant is the Aircraft Rules, 1937. b) The Carriage by Air Act, 1972. c) The Air Corporations (Transfer of Undertakings and Repeal) Act, 1994. d) The Civil Aviation Policy. e) The Civil Aviation Requirements. Airline Mergers & Aquisitions Airline M&A are on the rise across the globe. These M&A are highly strategic involving several considerations. Airline M&A bear serious implications for travellers as well as airline employees. The airlines industry is abuzz with news of M&A. In the last few years airline M&A have been a growing trend in several countries across the globe. However, M&A in the aviation industry are highly strategic in nature and are undertaken after taking into consideration several important factors. Factors considered by airlines in taking M&A decisions Some of the important factors considered by airlines in taking merger and acquisition decisions are - The coverage area of the other airline. Strategically an airline would like to merge with or acquire an airline that operates in routes different from its own. This helps in expanding service coverage and avoiding overlapping of flight schedules. The quality of service and brand image of the other airline. If the other airline has any partnership with a rival group of airlines. From the point of view of customers M&A may lead to increased airfares. This is because M&A reduce the number of operators thereby reducing competition and pushing up prices in the aviation industry. Airline M&A also have important impacts on the employees of the participating airlines. Concerns that Airline employees face in case of M&A Some of the major concerns that airline employees face in case of M&A are Layoffs M&A in most cases are accompanied by layoffs. New job rules. Salary concerns - The new acquiring airline or the new group arising out of a merger may not pay the old salaries. Pensions and other benefits. Seniority - A senior employee of an airline that is acquired may find himself to be not considered senior by the new employer.

Some of the important issues related to Airline M&A Time - Airline M&A take much longer time to materialize than in other industries. This is due to the fact that a lot of considerations are involved from costs to operational issues which are generally large in magnitude and complex in nature. Approvals - Approvals are required from governments, often from different levels and different authorities to establish airline M&A. Efficiency- Airline M&A can lead to cost efficiency of the operators by the elimination of overlapping routes. For the travelers however, this often leads to lesser frequency of flights. Competition M&A in the airline industry help to reduce competition significantly. This helps airlines to achieve higher operating margins. On the other hand, passengers may face higher airfares. Passenger Benefits -Passengers, who are enlisted for frequent-travel schemes will have higher mileage pints. Strife - Airline M&A are often accompanied by strife related to seniority issues, new work rules, etc.

Basis of Domestic Air Transport Policy on M&A Consistent with the global trends in aviation, aviation sector in India has and is likely to witness more number of consolidations amongst airlines. The question regarding use of airport infrastructure in case of merger / takeover of airlines and sale / transfer of aircraft etc. had drawn attention of the Government for quite some time. In keeping with the spirit of consolidation the Aircraft Acquisition Committee of the Ministry of Civil Aviation considered the issue of policy on transfer of airport infrastructure in case of merger/take-over of airlines and sale/transfer of aircraft in 2006. Some of the general principles forming the basis for consideration of this policy are: The Government would adopt a non-discriminatory approach towards the acquiring entity. No public inconvenience should be caused by disrupting flight schedules. Policy should not be arbitrary and should not hamper growth and consolidation of the airline industry.

Policy Provisions After examining the pros and cons of the various alternatives particularly with reference to the position of the civil aviation sector in the Indian context, it was decided by the Government through the policy: The airline that takes over the aircraft (acquirer) pursuant to merger / takeover or sale / transfer of the aircraft may be allowed the use of airport infrastructure like parking bays, landing slots etc., which is allotted by Airport Operator without any payment. This was particularly necessary as the transferred aircraft is in operation in the country already availing the airport infrastructure. In terms of schedules / connectivity etc. it will be in public convenience if usage of such infrastructure is allowed to the airline that take over the aircraft provided the user rights are actually used by the airline. Only the user rights over such infrastructure that are given to an airline on non-payment basis e.g. parking bays, landing slots etc. may be allowed to be used by the airline that takes over the aircraft. For all other rights, the terms of lease / sale agreement between the airport operator and the airline may apply. The user rights belong to the Government / airport operator and therefore, cannot be transferred by one airline to the other airline in any event. The Government / airport operator shall allow the user rights to be availed by the airline that takes over the aircraft.

The user rights will be available with the airline that takes over the aircraft only in respect of those rights, which are actually under use by the airline that transfers the aircraft. All other rights will be taken over by the Government / airport operator. The user rights will be available with the airline that takes over the aircraft only till such time that the infrastructure concerned is under actual use. If the airline that takes over the aircraft does not use the concerned infrastructure, it will lose the user rights over the infrastructure.

The Competition Angle The substantive review of an airline merger by a competition authority now has a fairly well established methodology. The definition of a market in the airline industry is usually based on pairs of flight destinations that constitute a route (the Delhi-Mumbai route, for example, is one such pair). The competition in the market is accordingly analysed in terms of the level of competition in these city-pairs. The airline industry is normally seen as a network of such city-pairs. Quite often, the economic impact of airline mergers is, therefore, seen in terms of the nature of the merging networks. While the merger of non-overlapping networks may not raise serious competition issues when analysed market by market, the resultant larger network may attain dominance on the whole by virtue of increased coverage and the power of size. There are several advantages of operating a larger network. Loyalty schemes like frequent flier programmes for passengers and incentive schemes for travel agents are heavily loaded in favour of larger networks, which offer greater economies of scope and ease of customer attraction. Moreover, while analysing the effects of airline mergers, the competition concerns also relate to the effect of the merger on the control over complementary serviceslike take-off and landing slots at airports, gates, baggage handling and passenger handling facilities, and so on, for the merging parties and competitors. A merger between two large carriers can easily turn such access to ground facilities lopsided, to the detriment of competitors. Every industry has its peculiarities, aviation even more so. Yet, a competition policy must always use broad principles of application. Under Indias Competition Act, 2002, factors have been laid down to determine whether a merger would have an appreciable adverse effect on competition in the relevant market. The various factors to be considered include extent of barriers to entry, market share of enterprises, individually and as a combination, competition through imports, level of concentration in the market, degree of countervailing power, availability of substitutes, likelihood of significant and sustainable increase in prices and profit margins after merger, likelihood of removal of a vigorous and effective competitor, likelihood of sustainability of effective competition, nature and extent of vertical integration, possibility of a failing business, nature and extent of innovation, relative advantage by way of the contribution to the economic development and whether the benefits of combination or merger outweigh the adverse impact of the combination. However, the enforcement provisions of the Competition Act, 2002, including those relating to regulation of mergers and other forms of combinations, have not yet been notifiedand hence the Competition Commission of India cannot at this stage undertake inquiries under these provisions of the Act.

Cases of Airline M&A in India 1. Air India and Indian Airlines For long decades after its independence, India was served by two state run aviation companies Air India which served the international market and Indian Airlines which served the domestic market. Even though the two were started with a lot of capital and initial performance was nothing short of remarkable, it was not long that the two companies started to feel the restrictions and stress of a socialistic shackled system. In the recent years, the opening of Indian aviation sector for private players meant that the competition was getting too much for the two. The solution was found by the Indian government in the form of merger of both the entities. The Government of India, on March 1, 2007, approved the merger of Air India and Indian Airlines to improve operational synergy and increase productivity. Consequent to the above, a new Company viz National Aviation Company of India Limited was incorporated under the Companies Act, 1956 on March 30, 2007. The company became registered on March 30, 2010. The merger was to help the new entity compete with large global airlines. Following the merger of the two companies, it was decided that a combined identity should evolve. Since Air India was a globally and nationally recognized brand name, the operational brand name of the company remained Air India and the Maharaja continued to reign as the mascot of the new airline. The logo of the new airline was a flying swan with the Konark Chakra placed inside it.

Benefits The key benefits to Indian Airlines and Air India on account of this merger were as under: The merger had created a mega company with combined revenue of Rs. 15000 crores. The new entity had seen a number of changes in its operating model. It was much less restricted by government control and is therefore much more agile and could churn better returns than the two different entities. Since the two companies had come together, they had also been able to bring together their best practices and reduced the overall operational cost as well as administrative cost by a considerable margin. Air-India would have a combined fleet of 112 aircraft and would be among the top 10 airlines in Asia and among the leading 30 airlines globally.

Critical Analysis: Air India-Indian Merger: Nice idea, poor execution The merger between Air India and Indian Airlines made perfect sense on paper for over a decade. Their complementary networks, common ownership and need to generate greater efficiencies all pointed to the benefits of a merged entity. As it was, the merger coincided with a flurry of increased domestic and international competition, placing great pressure on management. Successful implementation required robust guidance and a capable execution team to handle such a complex undertaking. Instead, the process moved ahead without first strengthening the management and organisation structure. More attention was devoted to discussion around non-core issues such as long term fleet acquisitions and establishing subsidiaries for ground handling and maintenance, than to addressing the state of the flying business. Air India has continued to see its domestic market share decline. The situation was compounded by the cultural chasm between Air India and Indian Airlines, leading to an increase in internal politics, a potentially messy situation in an entity with 35,000 employees. A bloated workforce, unproductive work practices and political impediments to shedding staff made the creation of a viable business model extremely challenging. The situation calls for a depth of leadership across the organisation which still does not exist. There appears to be no clear business plan to revive the carrier and effecting a turnaround now appears to be a herculean task. 2. Jet Airways and Sahara Airlines The two carriers share the same history: both began their operations as air taxi operators and later became full service carriers. Jet and Sahara both used to compete on international routes prior to merger. Jet Airways, which commenced operations on May 5, 1993, has within a short span of 14 years established its position as a market leader. The airline has had the distinction of being repeatedly adjudged India's 'Best Domestic Airline' and has won several national and international awards. Background: Jet Airways and the Shareholders of Sahara Airlines Limited had concluded a Share Purchase Agreement on January 18, 2006 whereby Jet Airways was to acquire the 100% shares of Sahara Airlines Limited for a Total Consideration of Rs. 2,000 crores. The original 65 day Term of the Agreement expired in March 2006. This was mutually extended to 21st June 2006, at which time Jet Airways also paid an advance of Rs. 500 Crores. At the expiry of the extended period, disputes arose between the parties as to whether or not the agreement had terminated (for non fulfillment of some conditions). These disputes were referred for hearing to an Arbitral Tribunal. However, before the commencement of Arbitral Proceedings, the two parties successfully resolved their disputes and were able to draw up a Settlement Agreement and the Arbitral Proceedings were disposed off in terms of the same agreement. On 20th April, 2007, Jet acquired 100% stake in Air Sahara 15 months after signing the original purchase agreement. Jet purchased its arch rival for 1,450 crores which was 35 % less than the price agreed in 2006. Jet rebranded Sahara as Jetlite and announced that the new entity would offer reduced frills but would be over and above low cost carrier (LCC) in terms of service. The private sector Jet-Sahara

combine ended the dominating role of the public sector with the new corporate commanding as much as 32% of the domestic market space. Benefits Jet Airways firmly believed that the acquisition of Sahara Airlines Limited would enable it to derive significant commercial and economic benefits keeping in view the then state of the domestic aviation industry. The key benefits to Jet Airways on account of this acquisition were as under: A strong platform and a larger operational base for future growth. A wider and a more effective coverage of the Indian market and giving the two airlines a very strong position especially in the metro markets. Increased prime time departures and frequencies through a subsidiary. Obtain access to skilled personnel such as Pilots and Engineers, categories of which there was a significant shortage in India. Unit cost savings and improved levels of productivity due economies of scale and common utilization of facilities and resources, arising particularly from common maintenance and training facilities, airport handling facilities, enhanced purchasing power, finance and administrative set-ups, etc. Clear value proposition for the customers in the form of wider network coverage, enhanced and convenient connections and better service levels on a larger scale of operations. Increased availability of airport infrastructure facilities and availability of a larger operational base for future expansion. Since Sahara Airlines would operate as an independent carrier with its own Operating Permit, it would have access to available traffic rights for international operations. Another important benefit that Jet Airways derived from the acquisition of Sahara Airlines was that their order for the additional 10 B737NG aircraft which were scheduled for delivery between June 2009 and August 2011 thereby enabled Jet Airways to have access to additional aircraft to expand its fleet. This represented substantial additional intangible assets for Jet Airways since it had no aircraft on order and delivery positions were not available before 2011 or only available at a premium. The acquisition of Sahara Airlines gave Jet Airways the opportunity to reassess its strategy and use this carrier to provide an innovative service concept of higher quality than current no-frills carriers.

Critical Analysis: Jet Airways-Air Sahara: a strategic mistake Centre for Asia Pacific Aviation is of the view that the acquisition of Air Sahara by Jet Airways was maybe the carriers first major strategic error. Allowing Sahara to exit from the market would have resulted in a market correction that would have been to the benefit of all players. Jet incurred a high acquisition price and has been funding operating losses ever since. The process of integration has been difficult and costly and continues to negatively impact Jet Airways. It is reported that Jet Airways has yet to settle the full purchase price for the carrier, reflecting the state of its financial situation. Jet Airways bottom line has been further impacted by an aggressive international expansion which stretched the carriers resources and damaged investor confidence. The airline has since been forced to cut a number of existing routes and halt new services as it

consolidates its overseas network. To address the overcapacity in its long haul fleet, Jet Airways has leased a number of wide body aircraft to Gulf Air and Oman Air. 3. Kingfisher Airlines-Air Deccan Kingfisher Airlines, a premium Full-Service Carrier, is a private airline based in Bangalore, India. Currently, it holds the status of India's largest domestic airline, providing world-class facilities to its customers. Owned by Vijay Mallya of United Beverages Group, Kingfisher Airlines started its operations on May 9, 2005, with a fleet of 4 brand new Airbus - A320, a flight from Mumbai to Delhi to start with. The airline currently operates on domestic as well as international routes, covering a number of major cities, both in and outside India. Air Deccan is Indias first LCC. It was founded and operated by Deccan Aviation Ltd. By Captain Gopinath in 2003 with regular scheduled flights from Bangalore to Mangalore and Hubli. When it started its operations, Deccan was known popularly as the common man's airlines. Air Deccan triggered price wars in the Indian Skies which forced other players to match Air Deccans prices. The consumers benefited while carriers lost. Air Deccan gained market share but at the cost of profitability. In 2007, Kingfisher Airlines acquired a 26% equity stake in Air Deccan and became the largest single shareholder in Deccan Aviation Ltd. It was agreed that Kingfisher would continue to serve the corporate and business travel while Air Deccan would focus on serving the low fare segment but with improved financial prospects for both carriers. Kingfisher later increased its stake to 46%, and took control of the management of Air Deccan, upgrading it to a value-based airline with higher airfare and repositioned it as 'Simplifly Deccan'. Air Deccan airlines merged with Kingfisher Airlines and decided to operate as a single entity from April, 2008. Following the merger of Deccan with Kingfisher, in August 2008, Kingfisher renamed Deccan as Kingfisher Red. After the merger, the company has a combined fleet of 71 aircrafts, connects 70 destinations and operates 550 flights in a day. The combined entity has a market share of 33%. Benefits The key benefits to Kingfisher Airlines and Air Deccan on account of this were as under: Legally, if an airline wants to operate overseas it must have a domestic status of having operated for 5 yrs and therefore in case of kingfisher operating overseas became easier. Besides, operational synergies (engineering, inventory management and ground handling services, maintenance and overhaul), the management and staff of both the airlines would be integrated. They would be stronger vis-a-vis lessors, aircraft manufacturers, and will also spend less on training and employees. Costs would also reduce which is associated with maintenance of aircraft. The savings in cost would be lower by about 4-5% (Rs 300 crores). The merger would create a more competitive business in scale and there would be scope to emerge as market leader.

Critical Analysis: Kingfisher Airlines-Deccan: Not as easy as it sounded The Kingfisher Airlines acquisition of Air Deccan is another case of underestimating the challenges of merging two carriers. It is a venture that has proved to be costly. Removing Air Deccan as an independent operator took out the airline that was most responsible for the irrational fares in the market place and, to this extent, it restored some pricing discipline which advantaged the entire industry. Where did this consolidation leave Indian aviation? Air Sahara, which should ideally have been left to fail and exit, continues to create problems for Airways. The Air India merger has been a non-starter because of a lack of leadership, while Kingfisher is still digesting Air Deccan. For Jet Airways and Kingfisher, the key driver of their decisions to acquire Air Sahara and Air Deccan, was to establish market leadership in order to be able to influence the direction of the industry and achieve pricing power. Other anticipated benefits included network expansion, access to scarce airport slots and infrastructure, and costs savings through scale economies. At that time, the market was reporting growth of 25% yearon-year and the acquisition strategy appealed to investors. But this consolidation, aimed at creating a more viable business model, took place against the background of an industry that was beginning to exhibit the first signs of distress. The bullish fleet orders placed by Indian carriers saw capacity being introduced at the rate of 6 to 6.5 aircraft a month, whereas the actual growth in demand was closer to 3 aircraft equivalents; Aside from the mis-match between supply and demand, the rate of growth was simply too great for the industry to handle from a management and capital perspective. In a fragmented market, with multiple start-ups chasing market share, loss-leader pricing was widespread and Air Deccan in particular was responsible for setting fares well below cost as it fought to retain its first mover market share; The rapid increase in capacity at a time when the airport modernisation program was yet to deliver upgraded infrastructure, meant that airports and airways were highly congested, increasing airline operating costs; With the inadequate surface access and airport (and airways) infrastructure, airlines were unable to secure a significant competitive edge over other means of travel, thereby excluding huge parts of the still-untapped leisure market; In a period of global boom, demand for skilled personnel such as pilots and engineers also outstripped supply leading to a sharp escalation in wages, and in some cases grounding of aircraft due a shortage of staff; Balance sheets were stretched as a result of the aggressive fleet induction programs, combined with the mounting operational losses.

These early signs of growing pains were largely ignored and airlines continued to pursue aggressive but unachievable growth strategies. The flaws in this approach were exposed by the astronomical fuel prices in 2008 which created an impossible operating environment, not only for Indian airlines, but for the entire global industry. Conclusion Indian aviation is re-shaping itself for survival. The Indian Airlines-Air India merger, the KingfisherDeccan merger and the acquisition of Air Sahara by Jet airways has set the ball rolling for further M&A activities in this sector. LCCs such as IndiGo and SpiceJet have significant capital requirements and will need further flows of funding. The next round of consolidation is therefore most likely to occur in the LCC sector, especially as the full service carriers do not have the balance sheets to engage in further acquisitions. Foreign airlines appear unlikely to be able to participate in any consolidation opportunities in the short term though, as they are barred from holding in equity in Indian carriers.

Você também pode gostar

- An Industrial Report On On Mahesh TwistotechDocumento54 páginasAn Industrial Report On On Mahesh TwistotechTejas PatelAinda não há avaliações

- Library & Computers Laboratory: Ype The Company AddressDocumento2 páginasLibrary & Computers Laboratory: Ype The Company AddressTejas PatelAinda não há avaliações

- An Industrial Report On On Mahesh TwistotechDocumento54 páginasAn Industrial Report On On Mahesh TwistotechTejas PatelAinda não há avaliações

- Apple: Presented By: Tejas Patel (1159)Documento13 páginasApple: Presented By: Tejas Patel (1159)Tejas PatelAinda não há avaliações

- GSFC FY12-14Recruitment StrategyDocumento10 páginasGSFC FY12-14Recruitment StrategyTejas PatelAinda não há avaliações

- Loook EffectiveDocumento1 páginaLoook EffectiveTejas PatelAinda não há avaliações

- Gujarat Technological University: Mba 3'Rd Semester (Reg./Rem.) - Exam Time Table - Dec-Jan 2012-13Documento3 páginasGujarat Technological University: Mba 3'Rd Semester (Reg./Rem.) - Exam Time Table - Dec-Jan 2012-13Tejas PatelAinda não há avaliações

- Project of Marketing Plan For New Product LaunchDocumento16 páginasProject of Marketing Plan For New Product LaunchTejas Patel100% (2)

- QuestionerDocumento1 páginaQuestionerTejas PatelAinda não há avaliações

- Labour Management Cooperation RizDocumento16 páginasLabour Management Cooperation RizTejas PatelAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- DocumentDocumento1 páginaDocumentRowie Ann Arista SiribanAinda não há avaliações

- Trade Restrictions: TariffsDocumento22 páginasTrade Restrictions: TariffsVari GhumanAinda não há avaliações

- 900-kW Grid Connected Solar PV System: Technical and Commercial ProposalDocumento8 páginas900-kW Grid Connected Solar PV System: Technical and Commercial ProposalGulshana GajjuAinda não há avaliações

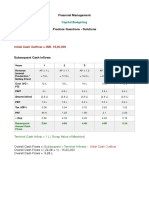

- Capital Budgeting - SolutionDocumento5 páginasCapital Budgeting - SolutionAnchit JassalAinda não há avaliações

- EconomicsDocumento3 páginasEconomicsnourjanati14% (7)

- Solution Manual For Microeconomics 4th Edition by BesankoDocumento21 páginasSolution Manual For Microeconomics 4th Edition by Besankoa28978213333% (3)

- Assignment Finalterm MbaDocumento2 páginasAssignment Finalterm MbaKazi Shafiqul AzamAinda não há avaliações

- Case Study 39 Airbus vs. Boeing: Prepared byDocumento13 páginasCase Study 39 Airbus vs. Boeing: Prepared byShakir EbrahimiAinda não há avaliações

- Statman - Behaviorial Finance Past Battles and Future EngagementsDocumento11 páginasStatman - Behaviorial Finance Past Battles and Future EngagementsFelipe Alejandro Torres CastroAinda não há avaliações

- Answer in BudgetingDocumento9 páginasAnswer in BudgetingkheymiAinda não há avaliações

- Mercurio LIBOR Market Models With Stochastic BasisDocumento39 páginasMercurio LIBOR Market Models With Stochastic BasisvferretAinda não há avaliações

- Marketing Plan Assignment - ArcX Sports Rings - Winter 2021Documento4 páginasMarketing Plan Assignment - ArcX Sports Rings - Winter 2021Sahiba MaingiAinda não há avaliações

- Case Study On Letter of CreditDocumento9 páginasCase Study On Letter of CreditPrahant KumarAinda não há avaliações

- Micromax Competitive Strategy Roll No.55 PDFDocumento24 páginasMicromax Competitive Strategy Roll No.55 PDFAnkur MakhijaAinda não há avaliações

- Annuity DueDocumento21 páginasAnnuity Duedame wayne100% (1)

- Brand Image ToyotaDocumento76 páginasBrand Image ToyotaNishant Salunkhe100% (1)

- Group Project FinalDocumento15 páginasGroup Project FinalmohamedAinda não há avaliações

- Gap Analysis of Services Provided by Real Estate Agents and Customer ExpectationDocumento66 páginasGap Analysis of Services Provided by Real Estate Agents and Customer ExpectationJanardhan ThokchomAinda não há avaliações

- Purchase Agreement: Contract Number: 004/BHS - SYRAKO/CPO/V/2017Documento4 páginasPurchase Agreement: Contract Number: 004/BHS - SYRAKO/CPO/V/2017Dian Pratama Putri100% (1)

- FinMan 12 IPO and Hybrid Financing 2015Documento50 páginasFinMan 12 IPO and Hybrid Financing 2015panjiAinda não há avaliações

- Time Value of Money (TVM)Documento58 páginasTime Value of Money (TVM)Nistha BishtAinda não há avaliações

- ECOS2001 Practice Exam No.3 1Documento5 páginasECOS2001 Practice Exam No.3 1Jingyu ShaoAinda não há avaliações

- Three D Integrated Solutions LTD V/s VerifoneDocumento31 páginasThree D Integrated Solutions LTD V/s VerifoneIndianAntitrustAinda não há avaliações

- Fundamental AnalysisDocumento23 páginasFundamental AnalysisAdarsh JainAinda não há avaliações

- Frederick Cooper - 1981 - Africa and The World EconomyDocumento87 páginasFrederick Cooper - 1981 - Africa and The World EconomyLeonardo MarquesAinda não há avaliações

- Complete Notes Principles of ManagementDocumento45 páginasComplete Notes Principles of ManagementamitAinda não há avaliações

- Managerial Economics: of Economics in The Business Decisions.' Decisions.Documento7 páginasManagerial Economics: of Economics in The Business Decisions.' Decisions.Raghu RallapalliAinda não há avaliações

- Lesson 10: Detailed Estimates (2) - Productivity: Labor Information in RS MeansDocumento8 páginasLesson 10: Detailed Estimates (2) - Productivity: Labor Information in RS MeansRyanAinda não há avaliações

- Quiz 2 - 22 - SolutionDocumento4 páginasQuiz 2 - 22 - SolutionJasmeetAinda não há avaliações

- The Supply of MoneyDocumento6 páginasThe Supply of MoneyRobertKimtaiAinda não há avaliações