Escolar Documentos

Profissional Documentos

Cultura Documentos

TAXCREDIT Form PDF

Enviado por

Duane ChunTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

TAXCREDIT Form PDF

Enviado por

Duane ChunDireitos autorais:

Formatos disponíveis

The Sierra Vista Public Schools Governing Board has established a fee schedule for extracurricular activities for

which taxpayer contributions may be accepted :

To fund supplemental travel costs for extracurricular activities including interscholastic competitions and field trips. To fund supplemental costs of equipment, services, and materials for extracurricular activities. To fund projects for which specific donations were received that are consistent with the extracurricular programs of the individual school.

Please contact the school listed below or the districts web site at for the approved list of extra curricular activities in the Sierra Vista Public Schools for which your tax credit contribution will benefit the students.

www.sierravistapublicschools.com

The Arizona School

Tax Credit

ELEMENTARY SCHOOLS

Please see district website (www.sierravistapublicschools.com) for school phone numbers and a detail listing of approved sub-categories.

Please apply the enclosed donation of $___________to the school and program identified below. Make check payable to the school of your choice below. Donor Name: __________________________________________________________ Address: _____________________________________________________________ _____________________________________________________________ Phone #: (______) _________-____________ General: ___________________________________________(specify subcategory) Athletics:________________________________________________(specify sport) Extracurricular/Scholastic Event or Competition:____________________________ Music/Fine Arts: ____________________________________(specify subcategory)

SIERRA VISTA UNIFIED SCHOOL DISTRICT NO. 68

BHS AMS JCMS BV CARM HM PDS T&C VM

Bella Vista - 515-2940 Carmichael - 515-2950 Huachuca Mountain - 515-2960 Pueblo del Sol - 515-2970 Town & Country - 515-2980 Village Meadows - 515-2990

Benefits for Both the Taxpayer and Sierra Vista Public Schools

MIDDLE SCHOOLS

Joyce Clark Middle School - 515-2930

HIGH SCHOOL

Buena High School Student Services - 515-2848

Revised 09/13/10

Sierra Vista Public Schools Unified District No. 68 3555 Fry Boulevard Sierra Vista, Arizona 85635

Telephone: (520) 515-2729 FAX : (520) 515-2744 www.sierravistapublicschools.com

The School Tax Credit

Arizona Revised Statute 43-1089.01 This statute allows a married couple filing a joint income tax return to receive a tax credit up to $400 and a single person up to $200 the amount of any fees or cash contributions made directly to school districts in Arizona for the support of extracurricular activities .

When can I make the payment to the school?

Answers to Common Questions

Must a taxpayer have a child enrolled in a public school in order to claim the tax credit? No. The statute defines a taxpayer as

any person subject to the tax and a person as an individual. Therefore, a taxpayer does not need to have a child enrolled in a public school in order to claim the credit.

To receive the tax credit, the payment must be made during the current tax year (Jan-Dec).

A contribution gets the money where it needs to go:

Is the credit available to corporations? No. The credit IS NOT available to

To the kids!

Extracurricular Activity

regular corporations and CANNOT be passed along to the partners, shareholders or members of Partnerships, S Corporations or Limited Liability Companies. However, contributions from businesses are welcome. SUCH CONTRIBUTIONS ARE DEDUCTIBLE, although they CANNOT be used to claim a tax credit.

Contributions that are eligible for a tax credit are donated directly to schools, not to the state and not even to the school district. The funds are not subject to the revenue control limit that prevents schools from spending more than a fixed amount for programs. Additional funding from tax credit contributions will allow more children to participate in activities.

An extracurricular activity is defined as any school sponsored activity that requires enrolled students to pay a fee in order to participate. Generally, all educational or recreational activities that are

OPTIONAL, NON-CREDIT, AND THAT SUPPLEMENT THE EDUCATIONAL PROGRAM OF THE SCHOOL are considered to be

the extent they reduce tax liability to zero. Any unused amounts may be carried forward for up to the next five taxable years.

May a taxpayer receive a refund of these credits? No. The credits may only be used to

Its this easy!

If you want to support one or more of the programs listed on the back of this brochure, simply: Write a check to the school or schools of your choice. Deliver or mail it to the school with your completed response card. Next spring, claim your tax credit if your filing single up to $200 or married filing jointly up to $400.

The school staff will provide you with a receipt verifying you have contributed to an eligible extracurricular activity.

extracurricular activities.

maximum for the credits for taxpayers choosing to file a joint return. Further, taxpayers who file married/separate returns may claim only one-half of the allowable credit on each return.

May two married taxpayers filing a joint return both be eligible to claim the maximum credit? No. The statute allows only the $400

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Dealings in PropertiesDocumento12 páginasDealings in PropertiesJane Tuazon50% (2)

- Euro500mn ProcedureDocumento10 páginasEuro500mn ProcedureShashikanth RamamurthyAinda não há avaliações

- City Union BankDocumento1 páginaCity Union BankRaja RajaAinda não há avaliações

- Final Draft - 1705 - Taxation Law IIDocumento17 páginasFinal Draft - 1705 - Taxation Law IIAditya BhardwajAinda não há avaliações

- Jodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08Documento2 páginasJodhpur Gstin/Uin: 08ABGPL3664C1ZS State Name: Rajasthan, Code: 08Hemlata LodhaAinda não há avaliações

- Hilton Garden InnDocumento2 páginasHilton Garden InnnormanwillowAinda não há avaliações

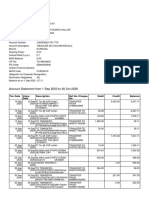

- Account Statement From 1 Sep 2020 To 30 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento3 páginasAccount Statement From 1 Sep 2020 To 30 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancebalajiAinda não há avaliações

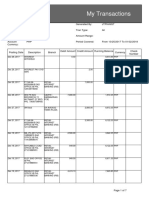

- Transaction Details - PayPalDocumento2 páginasTransaction Details - PayPalcmbbcorporAinda não há avaliações

- I Will Follow HimDocumento7 páginasI Will Follow HimTheo AmadeusAinda não há avaliações

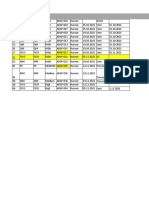

- Jan 2021 To March 2021Documento8 páginasJan 2021 To March 2021AKSHAY GHADGEAinda não há avaliações

- Wricefs Requirements (Workflows, Reports, Interfaces, Conversions, Enhancements, Forms)Documento6 páginasWricefs Requirements (Workflows, Reports, Interfaces, Conversions, Enhancements, Forms)aliAinda não há avaliações

- Taxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Documento2 páginasTaxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Ergel Mae Encarnacion RosalAinda não há avaliações

- General Principles Lecture Notes (1) TAXATION 1Documento9 páginasGeneral Principles Lecture Notes (1) TAXATION 1Angie Louh S. Dioso100% (4)

- SA106 NotesDocumento20 páginasSA106 Notesjacopo1967Ainda não há avaliações

- Course Outline Taxation PakistanDocumento4 páginasCourse Outline Taxation PakistanrehanshervaniAinda não há avaliações

- Form 16 FY 19-20Documento6 páginasForm 16 FY 19-20Anurag SharmaAinda não há avaliações

- Types of GST AssessmentDocumento19 páginasTypes of GST AssessmentAmit GuptaAinda não há avaliações

- 2 Obligation Request & StatusDocumento2 páginas2 Obligation Request & Statusjoan dalilisAinda não há avaliações

- Discussion Questions: True True True False True FalseDocumento7 páginasDiscussion Questions: True True True False True FalseJustin TempleAinda não há avaliações

- MBA Tuition Non Res FW 2022 2023Documento1 páginaMBA Tuition Non Res FW 2022 2023khabiranAinda não há avaliações

- Csem Sri Meru (Access Card Duplication Quotation)Documento1 páginaCsem Sri Meru (Access Card Duplication Quotation)syahir etAinda não há avaliações

- Seabank Statement GiselaDocumento4 páginasSeabank Statement Giseladeajohn093Ainda não há avaliações

- Microtek Microtek Line Interactive UPS Legend 650 Ups Legend 650 UpsDocumento1 páginaMicrotek Microtek Line Interactive UPS Legend 650 Ups Legend 650 UpsAriAinda não há avaliações

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento7 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceM ADITYA REDDYAinda não há avaliações

- Gmail - Expedia Travel Confirmation - Wed, Jul 19 - (Itinerary # 72593634072884)Documento4 páginasGmail - Expedia Travel Confirmation - Wed, Jul 19 - (Itinerary # 72593634072884)LUZ URREAAinda não há avaliações

- SOC DCB Privilege Savings AccountDocumento4 páginasSOC DCB Privilege Savings AccountBVS NAGABABUAinda não há avaliações

- Test On Cashbook and Petty CashbookDocumento5 páginasTest On Cashbook and Petty Cashbookshamawail hassanAinda não há avaliações

- Hyd To PuneDocumento2 páginasHyd To PuneSarathBattaAinda não há avaliações

- 2016 - Final Income Tax Ordinance, 2001 - 19.09.16 First & Second ScheduleDocumento148 páginas2016 - Final Income Tax Ordinance, 2001 - 19.09.16 First & Second ScheduletalalhaiderAinda não há avaliações

- Channel Access Request FormDocumento3 páginasChannel Access Request FormRavi RamrakhaniAinda não há avaliações