Escolar Documentos

Profissional Documentos

Cultura Documentos

Creation of Fir1

Enviado por

Helene Manyi-ArreyDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Creation of Fir1

Enviado por

Helene Manyi-ArreyDireitos autorais:

Formatos disponíveis

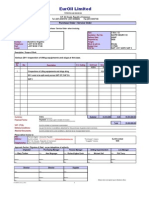

CREATION OF FIRM

INTRODUCTION

To create a firm it is to make it exist. The study of creation of a firm carries on ceremonies of creation of that on one hand and on the other hand the fiscal impact which are linked there. Throughout our account it will be a matter for us at first to see ceremonies and in second time fiscal impact linked to the constitution of firms. I-CEREMONY OF CONSTITUTION OF FIRMS Certain ceremonies must be respected so that the firm is legitimately constituted. The constituted society acquires the moral personality only when following conditions are fulfilled: - The writing of statutes or social alliance in a genuine manner or signature deprived. - The advertising of these statutes by insertion of an announcement in the thirds of the existence of the society and its conditions of functioning. - Statement to the court dealing with trade disputes with a store of a copy of these statutes. Registration in the register of trade and movable credit. - The statement of fiscal and social existence. II-INCIDENCES FISCALES LIEES IN THE CREATION OF FIRMS. In Cameroon, various levies and taxes are demanded in the constitution of the firm. 1-The Right of recording The general code of levies makes obligatory the recording of the acts of constitution of the society within fourteen days in month as from its constitution when this one is accomplished in front of a notary, and of one in three months in other cases. The rights of recording represent taxes to be paid according to the fiscal distribution of provisions. a -Request of certificate as submission in CNPS It is about a 6000-fr CFA +02 bill stamp 1000 f CFA =8000 f CFA b - Certificate of not use of wage-earning personnel in CNPS A 1500-fr CFA +01 bill stamps 1000 f CFA = 2500 f CFA c - Certificate of not exoneration in the licence. When you create your firm, you are exempted from the licence during the first two years. d - taxpayer's card It is free e - Recording of facultative lease Postponed by 03 months for a businessman tenant. 0.11 % of the value declared by the building, for a possessing businessman (Payment of the tax on piece of land.) f - Recording in the register of trade and movable credit. 53 000f CFA for a natural person + 1000F CFA of stamp at a request. 41 500f CFA for an artificial person. 2 - Graduated rights It was reckoned by application of the graduated rates on the value of the issued capital divided into edge. But for year 2010 this right was cancelled by the Cameroonian Inland Revenue to make easier the investment.

CONCLUSION Arrived at the end of our job, we note that the creation of a firm is fewer complexes contrary to it thinks of certain people; in seventy two hours it is possible to set up a firm because conditions are flexible and less constraining.

Você também pode gostar

- Landlord Tax Planning StrategiesNo EverandLandlord Tax Planning StrategiesAinda não há avaliações

- Barangay Micro Business EnterpriseDocumento16 páginasBarangay Micro Business EnterpriseGerson CastroAinda não há avaliações

- BLGF Opinion To Alsons Consolidated Resources Inc Dated 23 September 2009Documento4 páginasBLGF Opinion To Alsons Consolidated Resources Inc Dated 23 September 2009Chasmere MagloyuanAinda não há avaliações

- Deduction - Losses - CharitableDocumento12 páginasDeduction - Losses - CharitableVictor LimAinda não há avaliações

- DOF - Department Order No. 17 - 04Documento12 páginasDOF - Department Order No. 17 - 04jjvii8Ainda não há avaliações

- Update On RulingsDocumento154 páginasUpdate On RulingsKim-OAinda não há avaliações

- The SolopreneurDocumento6 páginasThe Solopreneurjun junAinda não há avaliações

- Tax Bar QsDocumento56 páginasTax Bar QsXyra BaldiviaAinda não há avaliações

- Republic Act 9178 or The Barangay Micro Business Enterprises Act of 2002Documento13 páginasRepublic Act 9178 or The Barangay Micro Business Enterprises Act of 2002tineponna051121Ainda não há avaliações

- GNotes Income Tax 100814 Part1Documento42 páginasGNotes Income Tax 100814 Part1Migz DimayacyacAinda não há avaliações

- CREBA vs. RomuloDocumento29 páginasCREBA vs. RomuloCharish DanaoAinda não há avaliações

- Tax Digests On Tax 2Documento25 páginasTax Digests On Tax 2John Roel S. VillaruzAinda não há avaliações

- Tax Final CasesDocumento14 páginasTax Final Casesjade123_129Ainda não há avaliações

- Tax Review DoctrinesDocumento18 páginasTax Review DoctrinesGrace Robes HicbanAinda não há avaliações

- 142 150Documento7 páginas142 150NikkandraAinda não há avaliações

- Tax DigestDocumento7 páginasTax DigestLeo Angelo LuyonAinda não há avaliações

- Chapter One Taxation of Legal Persons: - Limited Companies DefinitionsDocumento18 páginasChapter One Taxation of Legal Persons: - Limited Companies DefinitionsTriila manillaAinda não há avaliações

- Guide To Trinidad VATDocumento25 páginasGuide To Trinidad VATJerome DanielAinda não há avaliações

- Dof Order No. 17-04Documento10 páginasDof Order No. 17-04matinikkiAinda não há avaliações

- CIR vs. CA - G.R. No. 125355 (Digest)Documento7 páginasCIR vs. CA - G.R. No. 125355 (Digest)Karen Gina DupraAinda não há avaliações

- Corporate Regulations: Corporate Regulations - Chapter 3 - Legal Guide To Do Business in Colombia 2015Documento20 páginasCorporate Regulations: Corporate Regulations - Chapter 3 - Legal Guide To Do Business in Colombia 2015Andres MartinezAinda não há avaliações

- Allowable DeductionsDocumento18 páginasAllowable DeductionsZek AngelesAinda não há avaliações

- (CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000Documento3 páginas(CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000j guevarraAinda não há avaliações

- Module 3 Tax Preferences Available For Sole Proprietorship BusinessDocumento7 páginasModule 3 Tax Preferences Available For Sole Proprietorship Businessangclaire47Ainda não há avaliações

- Business Registration and Other Legal Requirements of Each Form of Business Organization in The Philippines 1. Sole ProprietorhsipDocumento5 páginasBusiness Registration and Other Legal Requirements of Each Form of Business Organization in The Philippines 1. Sole Proprietorhsipfrancis dungcaAinda não há avaliações

- Digested Cases RevisedDocumento13 páginasDigested Cases Revisedᜉᜂᜎᜊᜒᜀᜃ ᜎᜓᜌᜓᜎAinda não há avaliações

- Q. Deduction: in GeneralDocumento40 páginasQ. Deduction: in GeneralJen MoloAinda não há avaliações

- July 18 - SPIT NotesDocumento8 páginasJuly 18 - SPIT NotesMiggy CardenasAinda não há avaliações

- Tax Digest CompilationDocumento37 páginasTax Digest CompilationVerine SagunAinda não há avaliações

- Deductions and Exemptions DigestsDocumento16 páginasDeductions and Exemptions DigestsjmclacasAinda não há avaliações

- Barangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3Documento16 páginasBarangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3kim cheAinda não há avaliações

- Law Students Federation: LL.B. NotesDocumento13 páginasLaw Students Federation: LL.B. NotesNagesh ChAinda não há avaliações

- Business Income Calculation UdomDocumento23 páginasBusiness Income Calculation UdomMaster Kihimbwa100% (1)

- CIR Vs Commonwealth ManagementDocumento3 páginasCIR Vs Commonwealth ManagementGoody100% (1)

- Revised Chap 1 2Documento65 páginasRevised Chap 1 2Yolly DiazAinda não há avaliações

- Q. Deduction: in GeneralDocumento28 páginasQ. Deduction: in GeneralD Del SalAinda não há avaliações

- Chapter 4 Commercial and Industrial Activities - Part 2Documento37 páginasChapter 4 Commercial and Industrial Activities - Part 2sherygafaarAinda não há avaliações

- Taxation Case DigestDocumento25 páginasTaxation Case DigestHenrick YsonAinda não há avaliações

- How To Register As A Barangay Micro Business Enterprise BMBE in The Philippines Business Tips PhilippinesDocumento15 páginasHow To Register As A Barangay Micro Business Enterprise BMBE in The Philippines Business Tips PhilippinesJoana Rose DimacaliAinda não há avaliações

- Merchant Company and Enterprise in AndorraDocumento9 páginasMerchant Company and Enterprise in AndorraKai SanAinda não há avaliações

- Closure of Business With BirDocumento2 páginasClosure of Business With Birjohn allen MarillaAinda não há avaliações

- Ramo 01-86Documento2 páginasRamo 01-86saintkarriAinda não há avaliações

- Income Taxation Chapter 1 5f420b5e2c985Documento154 páginasIncome Taxation Chapter 1 5f420b5e2c985Kim DiezAinda não há avaliações

- Irui2ma: Otherwise Caled Tax ServesDocumento1 páginaIrui2ma: Otherwise Caled Tax ServesAmy Ruth LacsonAinda não há avaliações

- Republic of Philippines Court of Tax Appeals Quezon: THE CityDocumento26 páginasRepublic of Philippines Court of Tax Appeals Quezon: THE CityMarc Benedict TalamayanAinda não há avaliações

- Chapter 6 Accounting For PartnershipDocumento19 páginasChapter 6 Accounting For PartnershipBiru EsheteAinda não há avaliações

- Lyceum of The Philippines University Cavite Legal and Taxation Aspects 1.1 Legal AspectsDocumento14 páginasLyceum of The Philippines University Cavite Legal and Taxation Aspects 1.1 Legal AspectsYolly DiazAinda não há avaliações

- 128 - TaxDocumento2 páginas128 - TaxBrent Christian Taeza TorresAinda não há avaliações

- Allowable DeductionsDocumento7 páginasAllowable DeductionsCOLLET GAOLEBEAinda não há avaliações

- ARCH591 - 3. Where Do I Get Licenses and PermitsDocumento27 páginasARCH591 - 3. Where Do I Get Licenses and PermitsJahzeel CubillaAinda não há avaliações

- CH 16Documento36 páginasCH 16DrellyAinda não há avaliações

- Cir VS Estate of TodaDocumento3 páginasCir VS Estate of TodaGraziella AndayaAinda não há avaliações

- 2016 Bar Questions On Taxation Gen Pri and IncomeDocumento4 páginas2016 Bar Questions On Taxation Gen Pri and IncomeSheena PalmaresAinda não há avaliações

- I. J. Marshall and Claribel Marshall v. Commissioner of Internal Revenue, Flora H. Miller v. Commissioner of Internal Revenue, 510 F.2d 259, 10th Cir. (1975)Documento8 páginasI. J. Marshall and Claribel Marshall v. Commissioner of Internal Revenue, Flora H. Miller v. Commissioner of Internal Revenue, 510 F.2d 259, 10th Cir. (1975)Scribd Government DocsAinda não há avaliações

- Villanueva - Taxation and Regulatory ComplianceDocumento8 páginasVillanueva - Taxation and Regulatory ComplianceEDRICK ESPARRAGUERRAAinda não há avaliações

- Silkair Singapore V. CirDocumento6 páginasSilkair Singapore V. CirConie NovelaAinda não há avaliações

- BIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Documento5 páginasBIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Archie Guevarra100% (3)

- Cyanamid Phil. Inc. Vs CA (2000) FactsDocumento6 páginasCyanamid Phil. Inc. Vs CA (2000) FactsjeralyndionaldoAinda não há avaliações

- Week 2 - Tax AdministrationDocumento26 páginasWeek 2 - Tax AdministrationJuan FrivaldoAinda não há avaliações

- Business RegistrationDocumento26 páginasBusiness RegistrationAudrey Kwao100% (1)

- Assignment U1 E1 and 2 and 3Documento3 páginasAssignment U1 E1 and 2 and 3Helene Manyi-ArreyAinda não há avaliações

- Sponsorship Packages Intellect Annual Charity Ball Dec 2012 FINAL PDFDocumento4 páginasSponsorship Packages Intellect Annual Charity Ball Dec 2012 FINAL PDFHelene Manyi-ArreyAinda não há avaliações

- AbstractDocumento1 páginaAbstractHelene Manyi-ArreyAinda não há avaliações

- WelcomeDocumento5 páginasWelcomeCatAinda não há avaliações

- 2012 Master StatsDocumento9 páginas2012 Master StatsArmando Palma RosalesAinda não há avaliações

- Sample Contents of A Completed Feasibility StudyDocumento4 páginasSample Contents of A Completed Feasibility StudyMatthew DasigAinda não há avaliações

- Sample Sponsorship Request LetterDocumento2 páginasSample Sponsorship Request LetterHelene Manyi-ArreyAinda não há avaliações

- Performance Appraisal SampleDocumento10 páginasPerformance Appraisal SampleHelene Manyi-ArreyAinda não há avaliações

- Vocabulary For TOEFL iBTDocumento191 páginasVocabulary For TOEFL iBTquevinh94% (48)

- Sample Event Calendar FormDocumento1 páginaSample Event Calendar FormHelene Manyi-ArreyAinda não há avaliações

- Sample Sponsorship Request LetterDocumento2 páginasSample Sponsorship Request LetterHelene Manyi-ArreyAinda não há avaliações

- 2010-2011 Tuition and Fees Texas TechDocumento2 páginas2010-2011 Tuition and Fees Texas TechHelene Manyi-ArreyAinda não há avaliações

- SermonDocumento2 páginasSermonHelene Manyi-ArreyAinda não há avaliações

- StuffDocumento1 páginaStuffHelene Manyi-ArreyAinda não há avaliações

- StuffDocumento1 páginaStuffHelene Manyi-ArreyAinda não há avaliações

- Sample Sponsorship Request LetterDocumento2 páginasSample Sponsorship Request LetterHelene Manyi-ArreyAinda não há avaliações

- Austin CollegeDocumento5 páginasAustin CollegeHelene Manyi-ArreyAinda não há avaliações

- The Nervous SysDocumento32 páginasThe Nervous SysHelene Manyi-ArreyAinda não há avaliações

- C) Gaseous Exchange in MammalsDocumento49 páginasC) Gaseous Exchange in MammalsHelene Manyi-ArreyAinda não há avaliações

- M M M MMMMMMMMMMM MMMDocumento6 páginasM M M MMMMMMMMMMM MMMHelene Manyi-ArreyAinda não há avaliações

- Gst-Excus: Electronic Library For GST, Customs, Excise, Exim, Fema & Allied LawsDocumento2 páginasGst-Excus: Electronic Library For GST, Customs, Excise, Exim, Fema & Allied LawsAbhay DesaiAinda não há avaliações

- CandidateDocumento2 páginasCandidateSagar ChauhanAinda não há avaliações

- Introducing Law Uganda Christian University (BLAW 1101) LECTURER: Ms Winnifred Sarah Kwagala TUTORIAL ASSITANT: Ms Rose NamusokeDocumento17 páginasIntroducing Law Uganda Christian University (BLAW 1101) LECTURER: Ms Winnifred Sarah Kwagala TUTORIAL ASSITANT: Ms Rose NamusokeDerrick OketchoAinda não há avaliações

- TX Gang Threat AssessmentDocumento48 páginasTX Gang Threat AssessmentSteven HofferAinda não há avaliações

- Headout PP 209316Documento1 páginaHeadout PP 209316risingstar organizerAinda não há avaliações

- Consti Ra 7438Documento8 páginasConsti Ra 7438Dondi Meneses100% (1)

- Notice: in On ToDocumento12 páginasNotice: in On ToPratik kumar DashAinda não há avaliações

- Strong Ruling Deny TRODocumento12 páginasStrong Ruling Deny TRONews10NBCAinda não há avaliações

- Complaint For Declaratory and Injunctive ReliefDocumento46 páginasComplaint For Declaratory and Injunctive ReliefLaw&CrimeAinda não há avaliações

- Rule - 10 - 5 Diona C Balangue - DigestDocumento4 páginasRule - 10 - 5 Diona C Balangue - DigestNylaAinda não há avaliações

- Computer Misuseand Cybercrimes Act 5 of 2018Documento43 páginasComputer Misuseand Cybercrimes Act 5 of 2018Samantha KunguAinda não há avaliações

- Nature and Effects of ObligationsDocumento19 páginasNature and Effects of ObligationsAr-Reb AquinoAinda não há avaliações

- 02 Cruz Vs CabreraDocumento3 páginas02 Cruz Vs CabreraPaolo Miguel ArqueroAinda não há avaliações

- The Pinochet Case (1998)Documento19 páginasThe Pinochet Case (1998)Yza G.Ainda não há avaliações

- House RulesDocumento1 páginaHouse RulesJemmalyn Devis Fontanilla100% (1)

- Wage Code SummaryDocumento7 páginasWage Code Summaryqubrex1100% (1)

- 42nd Amendment Act UPSC NotesDocumento3 páginas42nd Amendment Act UPSC NotesJyotishna MahantaAinda não há avaliações

- Syllabus of 3 Years LLBDocumento72 páginasSyllabus of 3 Years LLBanniee1993Ainda não há avaliações

- Ignominy DigestsDocumento3 páginasIgnominy DigestsCharmaine Sales BumanglagAinda não há avaliações

- "I Am Data Subject. Data Privacy Is My Right": D P P R.A. 10173, K D P A 2012Documento24 páginas"I Am Data Subject. Data Privacy Is My Right": D P P R.A. 10173, K D P A 2012John J. MacasioAinda não há avaliações

- Cross Examination of Lara: (As To The JA of Reg)Documento3 páginasCross Examination of Lara: (As To The JA of Reg)Lara YuloAinda não há avaliações

- Llorente Vs Court of Appeals G.R. No. 124371 23 November 2000Documento1 páginaLlorente Vs Court of Appeals G.R. No. 124371 23 November 2000Samuel John CahimatAinda não há avaliações

- Bangsamoro Organic LawDocumento28 páginasBangsamoro Organic LawSalman Dimaporo RashidAinda não há avaliações

- Practice Exam 1 Real Estate Planning & DevelopmentDocumento5 páginasPractice Exam 1 Real Estate Planning & DevelopmentHELENAinda não há avaliações

- G.R. No. 203902 Spouses Estrada Vs Phil. Rabbit Bus Lines, Inc. July 19, 2017Documento14 páginasG.R. No. 203902 Spouses Estrada Vs Phil. Rabbit Bus Lines, Inc. July 19, 2017Javie DuranAinda não há avaliações

- Sc72 Application DeveloperDocumento434 páginasSc72 Application DeveloperVanchAlexCarrascoAinda não há avaliações

- Romero vs. Estrada DigestDocumento1 páginaRomero vs. Estrada DigestNa-eehs Noicpecnoc Namzug100% (3)

- Petitioner TC - 27Documento41 páginasPetitioner TC - 27pruthiraghav04Ainda não há avaliações

- UCPB v. Sps BelusoDocumento3 páginasUCPB v. Sps BelusoMasterboleroAinda não há avaliações

- Code of EthicsDocumento15 páginasCode of Ethicsrinabel asuguiAinda não há avaliações

- Why We Die: The New Science of Aging and the Quest for ImmortalityNo EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityNota: 4 de 5 estrelas4/5 (5)

- Dark Psychology & Manipulation: Discover How To Analyze People and Master Human Behaviour Using Emotional Influence Techniques, Body Language Secrets, Covert NLP, Speed Reading, and Hypnosis.No EverandDark Psychology & Manipulation: Discover How To Analyze People and Master Human Behaviour Using Emotional Influence Techniques, Body Language Secrets, Covert NLP, Speed Reading, and Hypnosis.Nota: 4.5 de 5 estrelas4.5/5 (110)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeNo EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeNota: 2 de 5 estrelas2/5 (1)

- Briefly Perfectly Human: Making an Authentic Life by Getting Real About the EndNo EverandBriefly Perfectly Human: Making an Authentic Life by Getting Real About the EndAinda não há avaliações

- 1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedNo Everand1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedNota: 4.5 de 5 estrelas4.5/5 (111)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansNo EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansNota: 4 de 5 estrelas4/5 (17)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessNo EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessNota: 4.5 de 5 estrelas4.5/5 (328)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldNo EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldNota: 4.5 de 5 estrelas4.5/5 (1145)

- The Other Significant Others: Reimagining Life with Friendship at the CenterNo EverandThe Other Significant Others: Reimagining Life with Friendship at the CenterNota: 4 de 5 estrelas4/5 (1)

- His Needs, Her Needs: Building a Marriage That LastsNo EverandHis Needs, Her Needs: Building a Marriage That LastsNota: 4.5 de 5 estrelas4.5/5 (100)

- Hey, Hun: Sales, Sisterhood, Supremacy, and the Other Lies Behind Multilevel MarketingNo EverandHey, Hun: Sales, Sisterhood, Supremacy, and the Other Lies Behind Multilevel MarketingNota: 4 de 5 estrelas4/5 (103)

- Troubled: A Memoir of Foster Care, Family, and Social ClassNo EverandTroubled: A Memoir of Foster Care, Family, and Social ClassNota: 4.5 de 5 estrelas4.5/5 (27)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenNo EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenNota: 3.5 de 5 estrelas3.5/5 (37)

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.No EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Nota: 5 de 5 estrelas5/5 (45)

- Cult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryNo EverandCult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryNota: 4 de 5 estrelas4/5 (45)

- The Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchNo EverandThe Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchNota: 4.5 de 5 estrelas4.5/5 (13)

- Summary: The Myth of Normal: Trauma, Illness, and Healing in a Toxic Culture By Gabor Maté MD & Daniel Maté: Key Takeaways, Summary & AnalysisNo EverandSummary: The Myth of Normal: Trauma, Illness, and Healing in a Toxic Culture By Gabor Maté MD & Daniel Maté: Key Takeaways, Summary & AnalysisNota: 4 de 5 estrelas4/5 (9)

- Troubled: The Failed Promise of America’s Behavioral Treatment ProgramsNo EverandTroubled: The Failed Promise of America’s Behavioral Treatment ProgramsNota: 5 de 5 estrelas5/5 (2)

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodNo EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodNota: 4.5 de 5 estrelas4.5/5 (1801)

- How Emotions Are Made: The Secret Life of the BrainNo EverandHow Emotions Are Made: The Secret Life of the BrainNota: 4.5 de 5 estrelas4.5/5 (440)

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryNo EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryNota: 2.5 de 5 estrelas2.5/5 (3)

- Saving Alex: When I Was Fifteen I Told My Mormon Parents I Was Gay, and That's When My Nightmare BeganNo EverandSaving Alex: When I Was Fifteen I Told My Mormon Parents I Was Gay, and That's When My Nightmare BeganNota: 4 de 5 estrelas4/5 (25)

- American Jezebel: The Uncommon Life of Anne Hutchinson, the Woman Who Defied the PuritansNo EverandAmerican Jezebel: The Uncommon Life of Anne Hutchinson, the Woman Who Defied the PuritansNota: 3.5 de 5 estrelas3.5/5 (66)

- Our Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownNo EverandOur Little Secret: The True Story of a Teenage Killer and the Silence of a Small New England TownNota: 4.5 de 5 estrelas4.5/5 (86)