Escolar Documentos

Profissional Documentos

Cultura Documentos

IPCE May 2013 Taxation Suggested Answer

Enviado por

Parasuram IyerTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IPCE May 2013 Taxation Suggested Answer

Enviado por

Parasuram IyerDireitos autorais:

Formatos disponíveis

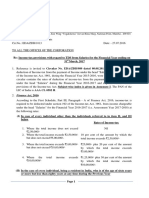

SUGGESTED ANSWER FOR IPCE MAY 2013 TAXATION

By CA Parasuram Iyer Contact: 9028518367 capkiyer@yahoo.com 1(a)

Computation of Income of Mrs Rani for the Assessment Year 2013-14 PARTICULAR Income Under the Head Salary Income Under the Head House Property Income Under the Head Profits & Gains from Business or Profession (W.N.1) Income Under the Head Capital Gain Income Under the Head Other Sources (W.N.2) GROSS TOTAL INCOME Deduction under Chapter VIA (W.N.3) TAXABLE INCOME(Round off U/s 288A) 3,21,000/34,000/3,55,000/30,000/3,25,000/AMOUNT

Computation of Tax Payable by Mrs Rani for the Assessment Year 2013-14 PARTICULAR Tax at Normal Rate (W.N. 4) Tax at Special Rate (W.N. 4)

Total tax Add: Education Cess 2% Add: SHEC 1% Tax including Cess Relief Tax Payable TDS/TCS/ Advance Tax Self Assessment Tax u/s 140A TAXABLE INCOME(Round off U/s 288A)

AMOUNT 11500/3000/14,500/290/145/14,935/0/14,935/3,000/11,935/11,940/-

W.N. 1 Computation of Income Under the Head Profits & Gains from Business or Profession: PARTICULAR

Income Over Expenditure Add: Medicines & needles (Personal use) Depreciation As per Books of Accounts Donation to Prime Minister Relief Fund Less: Depreciation U/s 32 Receipt from Valuation of Answer Book Dividend Lotteries Income Tax Refund Income Under the Head Profits & Gains from Business or Profession

AMOUNT AMOUNT

3,01,250/22,000/81,000/20,000/-

1,23,000/-

60,000/24,000/10,500/7,000/1,750/-

1,03,250/3,21,000/-

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com W.N. 2 Computation of Income Under the Head Other Sources: PARTICULAR Receipt from Valuation of Answer Book Dividend Less: Exempt u/s 10(34) Lottery Income Income Under the Head Other Sources W.N. 3 Computation of Deduction under Chapter VIA: PARTICULAR Section 80C: LIC Premium Paid Maximum Deduction Allowed 20% (since date of taking policy not given we are considering it as old policy but if someone considers it as policy taken after 1.04.12 then Max 10% deduction i.e. 5000 80G: Prime Minister National Relief Fund 100% deduction Total Deduction under Chapter VIA W.N. 4 Computation of Tax at Normal & Special Rate: Gross Total Income = 3,55,000/AMOUNT AMOUNT 12,000/10,000/AMOUNT AMOUNT 24,000/10,500/10,500/Nil 10,000/34,000/-

10,000/-

20,000/30,000/-

Income Taxable @ Special Rate i.e 30%

Income Taxable @ Normal Rate i.e Slab Rate Remaining Income =3,45,000/Less: Chapter VIA = 30,000/Balance income =3,15,000/Tax at Slab Rate = 11,500/-

10,000 X 30% 3,000/-

Note: 1. No Deduction of expense on Casual Income is allowed. 2. Income Tax Refund is not taxable under any head (Interest on IT Refund is taxable under Other Sources) 3. If we consider policy taken after 01.04.2012 then Maximum deduction = 5,000/4. It is assumed the Donation is made by any other mode than cash. 5. 57,860/- is maturity amount of LIC Policy it is exempt under section 10(10D) [assumed that Premium is less than 20% of sum assured].

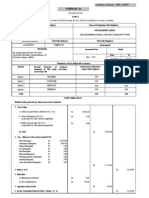

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com 1(b) Computation of Service tax payable by Q. Ltd. in the month of September 2012. Particular Amount Supply of Farm Labour (Covered in Negative List) Nil Service to People Free of Cost (Free of cost excluded from definition of service Nil under section 65B(44) Advance received from the client in September (Point of Taxation is date of receipt 85,000/of Advance) Nil Amount received for service rendered in June 2012(bills for same were issued on 25th June 2012) (Point of Taxation in June 2012 as date of completion of service was in June) Bill Raised for service rendered in the month of September no amount received 75,000 (Completion of service is Point of Taxation) Taxable Value of Service 1,60,000/Tax on Above 19,200/Education Cess @ 2% 384/SHEC @1% 192/Service Tax Payable for September 19,776/1(C) Computation of Taxable Turnover & VAT Payable By Mr Bansilal of Punjab: Sale Price of Total Goods (W.N.) =6,12,600 Taxable Turnover = Sale Price of Total Goods X 90% i.e. 5,67,600 X 90% =5,10,840/Vat Charged on Above Sale = 5,10,840/- X 12.50% = 63,855.00/Less: Input tax Credit of Current Period (W.N.) = 24,600.00/Less: Input tax Credit of Past Period (given) = 7,500.00/VAT Payable 31,755.00/W.N. Computation of Sale's Price & Input Tax Credit Available for the Current Period: Particular Cost of Goods Input Tax Credit Purchase from local Registered Dealer 1,15,000/4,600/Purchase from Local Dealer under Composition Scheme 2,20,000/Nil Depreciation on Capital Goods (Assumed that Consumption Variant 37,500/20,000/is VAT is followed) Other Direct & Indirect Expenses(115000+220000)X30% 1,00,500/Nil Total Cost/ Input Tax Credit 4,73,000/24,600/Profit Margin 20% of Cost 94,600/Total Sale Price 5,67,600/-

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com 2(a) Devesh is a Non- Resident since his stay is less than 182 day Whereas Siddhant is a Resident but Ordinarily Resident in India. Sr Particular No. 1 Interest on American Development Bond (50% Non- Indian & 50% Indian Income) 2 Dividend form Japanese Company received in America: It is not taxable in hands of Non Resident & Taxable in hands of resident & will not be exempt u/s 10(34) as DDT is not charged 3 Profit on Sale of Share of an Indian Company received in India (as it is received in India) 4 Profit from business in Mumbai, but directly Manage from America 5 Income from business in Mumbai 6 Fees for technical services rendered in America & Received in America but were utilised in India (Indian Income Section 9) 7 Interest on Saving Bank A/c SBI Mumbai 8 Rent Receiver From Property in Mumbai (W.N1) Gross Total Income Less: Deduction under Chapter VIA Section 80C:- LIC Premium Paid Section 80TTA:- Interest on Saving Bank A/c Total Income W.N. 1 Income Under the Head House Property: Particular

Devesh Siddhant Non-Resident R-OR 23,000/18,000/NIL 15,000/-

45,000/10,000/32,000/1,50,000/-

75,000/N.A. 28,000/-

4,500/67,200/3,31,700/Nil 4,500/3,27,200/-

12,000/38,500/1,86,500/25,000/10,000/1,51,500/-

Devesh Siddhant Non-Resident R-OR Rent Received 96,000/55,000/Deduction: Statutory @ 30% 28,800/16,500/House Property Income 67,200/38,500/Note: Interest From Saving Bank a/c is allowable as deduction u/s 80TTA maximum upto 10,000/2(b) As Per Section 65B(34) of Finance Act 1994 "Negative List" means the service which are listed in section 66D of the Finance Act 1994. This list got Importance due to Comprehensive coverage of service tax. Services by Government or a local authority which are excluded from the Negative List are (i) services by the Department of Posts by way of speed post, express parcel post, life insurance and agency services provided to a person other than Government; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com (iii) transport of goods or passengers; or (iv) support services, other than services covered under clauses (i) to (iii) above, provided to business entities 2(c) Neutrality:1. The greatest advantage of VAT system is that it does not interfere in the choice of decision for purchase. 2. This is because the system has anti-cascading effect. 3. How much value added & at what stage it is added in the system of production/distribution is of no consequence. 4. The system is neutral with regard to choice of production technique, as well as business organisation. 5. All other things remaining the same, the issues of tax liability does not vary the decision about the source of purchase. 3(a)(ii) Case 1: Calculation of Exemption in respect of LTC when Son's Age is 6 years & twin daughters age is 3 year: Exemption u/s 10(5) = 43,000/- + 15,000/- = 58,000/Reason: The age of Son is more than that of twin daughters, Mr. Rajesh can avail exemption of all his 3 children. The restriction of 2 children is not applicable to multiple birth after 1st Child. The holiday being in India & the journey performed by air & that to by Economy Class, the entire reimbursement by the employer will be exempt. Case 2: Calculation of Exemption in respect of LTC when Twin Daughters age is 6 year & Son's Age is 3 years: Exemption u/s 10(5) = 43,000/- + 15,000/-X2/3 = 53,000/Reason: The Age of Twins is more than that of Son, Mr. Rajesh cannot avail exemption of all his 3 Children. LTC exemption can be availed in respect of only 2 children. 3(a)(ii) Retrenchment Compensation Received Particular Retrenchment Compensation Received Less: Exempt under Section 10(10B) W.N. 1 Taxable Retrenchment compensation Amount 10,00,000/4,32,692/5,67,308/-

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com W.N. 1 Calculation of Exemption: Particular Retrenchment Compensation Received Statutory Limit Calculation as per Industrial Dispute Act, 1947 =15X(20,000/- x)+ (5,000/- x3)X30 years 3 Whichever is less Amount 10,00,000/5,00,000/4,32,692/-

4,32,692/-

3(b) EASIEST stands for Electronic Accounting System in Excise & Service Tax. It makes tax payment easy. This facility is available with 28 banks. The Benefits of EASIEST to the taxpayer are as follows:(a) Only 1 copy of the challan is to filled instead of 4 copies as required earlier. (b) EASIEST facilitates online verification of the status of tax payment using Challan Identification Number (CIN). 3(c) If a dealer wishes to opt for the composition scheme, he should not have any stock of goods which were brought from outside the State on the day he exercises the option to pay tax by way of composition. Hence, it is not possible for Seth Traders to opt for the composition scheme as it has a stock of goods costing 30,000/- purchased from outside the state on the day it wishes to opt for the composition scheme. Other Conditions to be satisfied by a dealer who wishes to opt for the composition scheme are as follows: (i) A dealer who wishes to avail the composition scheme has to exercise the option in writing for a year or a part of the year in which he gets himself registered. For this, the dealer has to intimate to the Commissioner. (ii). The dealer should also not claim input tax credit on the inventory available on the date on which he opts for composition scheme.

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com Q 4 a. Computation of Gross Total Income of Mr. A Particular Income Under the Head Salary: Income from House No. 1 Income from House No. 2 (Loss) Income Under the Profits & Gains from Business or Profession: Profit From Leather Business Less: Current Year Loss (Textile Business) Add: Bad Debts recovered u/s 41(1) Less: Brought forward Losses of textile business for A.Y. 2009-10 Income Under the Capital Gain: Short term Capital Gain Gross Total Income Deduction Under Chapter VI A Section 80C: LIC Premium Taxable Income Statement Showing Loss to be carried forward to A.Y. 2014-15 Particular Business Loss of A.Y. 2011-12 Long term Capital Loss of A.Y. 2013-14 Amount 50,000/35,000/Amount 80,000/(-)38,000/1,00,000/(-)40,000/60,000/35,000/95,000/95,000/Amount

42,000/-

NIL

60,000/1,02,000/10,000/92,000/-

Note: 1. Share of Profit from Firm16,550/- is exempt u/s 10(2A). 2. LTCL cannot be set-off against STCG. Therefore, it has to be carried forward to the next year to be set-off against LTCG of that Year. 4(b) (1) Incorrect: From 1st April 2012 there was a change in effective rate of tax i.e. it changed from 10.30% to 12.36% hence Point of Taxation Rule 4 is applicable. Date of payment in case when there is change in effective rate of tax is the date on which payment is credited in the bank Account if the same is not credited in bank account within 4 days. In the given case the Date of Payment is 15/04/2012 Assuming that the invoice is issued before 1st April 2012 we can say that the Point of taxation is on 30th March 2012 & in such Situation where Invoice is issued & service rendered before the both are before the date on which there is change in effective rate then old rate else new rate will apply.

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com (2) Incorrect: Above Statement is on Negative list of service which do not cover Mailing service by way of Speed Post but it do not mention that it will also not cover registered post. Hence considering the same we can say that the registered post is covered under Negative List & Not liable to Service Tax. (3) Incorrect: Service tax is Consumption base tax. i.e. the place of consumption of service is more important. Jammu & Kashmir are not a taxable territory hence service rendered there by any person is not liable to service tax. But when any person who is residing in Jammu and Kashmir & is providing tax in Taxable Territory is liable to Service Tax & Patna is a Taxable Territory. (4) Correct: As per Section 65B(44) i.e. Definition of Service "Service is an Activity Carried out by a Person for Another for Consideration" therefore atleast 2 person are necessary. Self service is not a service. In similar manner when a branch provides service to its other branch or Head office is service provided to self hence out of the preview of the definition of Service hence not liable to tax. 4 (c) 1. Stock transfer to branches or on consignment basis dose not amount to sale. 2. It is not subjected to CST or VAT. 3. If the goods sent outside State on stock transfer/ consignment basis, credit (set-off) of tax paid on the inputs purchased within the state is available only to the extent of tax paid in excess of 2% as 2% is retained by the State Government. 4. Eg. If the tax paid on input is 12.5%, input credit of 10.5% is available. 5. If the stock are transferred to the other branches within the same state 100% input credit is allowed. Q 5 (a.) Computation of Gross Total Income of Mr. A Particular Income Under the Head Salary: Salary from Larsen Ltd. (25,000 X 12) Salary of Mrs. A Clubbed (A holds Substantial Interest in Larsen Ltd.) (10,000X12) Income Under the Head Other Source: Interest on Security Total Income Before Clubbing Add: Income of Minor Child (W.N.1) (Note: since the head of income is not given hence it is treated separately) Gross Total Income Amount 3,00,000/1,20,000/Amount

4,20,000/-

30,000/4,50,000/1,000/-

4,51,000/-

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com Computation of Gross Total Income of Mrs. A Particular Income Under the Head House Property: Gross Annual Value (12,000 X 12) Less: Municipal Tax Net Annual Value Less: Statutory Deduction (30% x NAV) Gross Total Income Amount 1,44,000/Nil 1,44,000/43,200/Amount

1,00,800/1,00,800/-

W.N. 1 Computation of Income of Minor Particular Income of Twins: (2000X2) Less: (1500 x2) u/s 10(32) Income of Minor Son: (1,200X1) Less: (1200 ) u/s 10(32) Gross Total Income Amount 4000/3,000/1,200/1,200/Amount 1,000/Nil 1,000/-

5(b) Computation of Taxable Service & Service Tax payable of ABC & Co. for the Financial Year 2012-13 Particular Amount of Amount of Taxable Service Service Tax Amount Collected from Pre-recruitment screening 3,00,000/37,080/Amount Collected from Recruitment of Permanent Staff 1,80,000/22,248/Amount Collected from Recruitment of Temporary Staff 4,50,000/55,620/Advance receive from prospective employers for conducting 71,200/8,800/campus interviews Total Service /Service Tax Payable 10,01,200/1,23,748/Note: 1. Amount Received in Advance are also liable to Service Tax. Service Tax on advance has been calculated on the presumption that the same is inclusive of service tax (80,000X12.36/112.36 = 8,800) 2. Since the value of taxable service rendered in the preceding year is more than 10 Lakh (30 Lakh), the assessee is not a small service provider. Hence, it is not eligible for the exemption available to the small service provider.

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com 5(c): Computation of Vat Payable at each Stage Particular In the Hands of B of Delhi: Purchase from A a Manufacturer in CST Freight Expenses Total Cost / Sales Price In the Hands of C of Delhi: Purchase from B Sale to Consumer D Therefore VAT Payable: By B= 156.25/- & C = 31.25/-. Cost of Goods 1,040/(1,000/- +4% CST) 60 1,100/1,250/1,500/187.50-156.25= 31.25/Sales Price Vat Payable/ Credit

1,250/-

156.25 -0.00 =156.25/-

6 (a.) Computation of Capital Gains in the Hands of Mrs. Neelima Particular Sale Consideration (1100 x 240) Less: Cost of Acquisition: Share Purchased before 01.04.1981 (27500X852/100) Bonus Share Purchased in FY 1984-85 (0X852/125) Less: Cost of Transfer (2,64,000/- x 2%) Long Term Head Capital Gain Amount Amount 2,64,000/-

2,34,300/NIL 2,34,300/5280/24,420/-

Case 1: When A Ltd. is an unlisted company & Securities Transaction Tax was not applicable at the time of Sale : Ans: Entire LTCG = 24,420/- is fully taxable and rate of tax applicable is 20% Case 2: When A Ltd. is an Listed company & the share are sold in a recognised stock exchange & Securities Transaction Tax was Paid at the time of Sale : Ans: Entire LTCG = Fully Exempt u/s 10(38).

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com Note: 1. Cost of Acquisition of Bonus Share before 01.04.81 will be taken at F.M.V on 01.04.81 & of Share purchased in Feb 1979 will also be taken at the larger of 2 = 500X 30 = 15000/- + 1%x 15,000/- = 15,150/or 500 x 50= 25,000/i.e. 25,000/- + 50 x50 (cost of 50 Bonus Share) = 27500/2. Cost of Bonus Share after 01.04.1981 is zero. 3. Indexation is allowed on Share. 6.(b) Computation of Taxable Service & Service Tax payable of Mr. Rajesh for the Financial Year 2012-13 Particular Amount Advance received while signing the contract 1,25,000/Amount received by Pay Order 6,00,000/Amount Received through Credit Card. 5,25,000/Value of Taxable Service 12,50,000/Tax on above @ 12% 1,50,000/Education Cess @ 2% on above 3,000/SHEC @ 1% 1,500/Total Service Tax Payable 1,54,500/Note: 1. Money means legal tender, cheque, promissory note, bill of exchange, letter of credit, draft, pay order, traveller cheque, money order, postal or electronic remittance or any such similar instrument but shall not include any currency that is held for its numismatic value. 2. Gross amount charged includes payment by cheque, credit card, deduction from account and any form of payment by issue of credit notes or debit notes & book adjustment. 6(c) Gross Product Variant 1. No Input Tax Credit on Capital Goods 2. Input Tax Credit is Added to Cost of Capital Goods 3. VAT on Capital Goods is charged by way of depreciation on the final product every year & hence Increased Cost of the Product 4. Capital goods Carry heavy tax burden as they are taxed Twice 5. Modernization & Upgradation of Plant & Machinery is delayed due to Double tax treatment.

Consumption Variant 1. Input Tax credit is available on Capital Goods 2. It is not added to cost as Credit is available on that 3. Cost of Product is not effected as VAT is not Charged as cost of Product. 4. It does not carry heavy duty burden 5. It is decision Neutral.

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com 7. (a) (i) Advance Tax is payable by an assessee on his Total Income, which includes Capital Gains & Casual Income like Lotteries Income, Crossword Puzzles etc., As it is not possible for the assessee to estimate his Capital Gain, or Income from lotteries etc. well in advance, it has been provided that if any such income arises (i.e. not on estimate but on actual basis) after the due date for any installment, then, the entire amount of tax payable (after considering tax deducted at source) on such Capital Gain & Casual Income should be paid in the remaining Installments of advance tax, which are due after such date of arising of Income by way of Capital Gain or Casual Income. Where no such installment is due (i.e. Capital Gain or Casual Income arising after 15th March), the the entire tax should be paid by 31st March of the relevant Financial Year. If all the above procedure is followed then no interest liability on late payment would arise if the entire tax liability is so paid. (ii)For Income tax purpose Firm is Defined to include Limited Liability partnership as defined under Limited Liability Partnership Act 2008. It is also Said that the Partner shall include Partner of Limited Liability Partnership. It is also Said that the Partnership shall include Partner of Limited Liability Partnership. & It is also Said that the Firm shall include Partner of Limited Liability Partnership. Hence in view of all the above it is clear that the LLP is liable to tax at 30% as that of firm. And it has to also comply with provision laid down in 40(b). But LLP is kept out of the scope of Section 44AD. Return of LLP will be signed by Designated Partner under section 140 but in absence of designated partner any other partner. (iii) (A) Head of Income: Profits & Gains from Business or Profession Section 22 basis of charge of House Property says that property can be used for any purpose other than the business of the Assessee. When assessee carries on business in his own property it becomes property of business & section 32 on depreciation is also on Nature of use. Hence depreciation is applicable at appropriate rate. (B) Head of Income: B's Income - House Property & X's - Income Other Source Section 22 basis of charge of House Property put forth the most Important condition of Ownership of the property. Since B is the owner his Income shall be charged to House Property. But since X is not the owner his income can't be taxed under the head House Property. But Basis of Charge of Other Source Section 56(1) say that if the income is of revenue in nature & is not taxed under any head then it is taxed under the head other source. (C) Head of Income: B's Income - House Property Section 27 on deemed ownership says that if the lease period is more than 12 year it will be deemed that the lessee is the deemed owner of House Property. & Hence it will be charged to house property. But he has to compulsory avail 30% statutory deduction he cannot avail deduction on actual basis which is totalling to 40%.

Education Tree Nagpur

CA Parasuram Iyer 9028518367 capkiyer@yahoo.com 7. (b) Where the value of the service under service tax provision determined where such value is not ascertainable, the service provider shall determine the equivalent money value of such consideration. But in no case such value shall be less than the cost of provision of such taxable service. 7(c) 1. 2. 3. 4. Input Tax Credit on Capital Goods available to trader also. Tax Credit on Capital Goods may be adjusted over Maximum period of 36 Months. The state has an option to reduce this period. Maharashtra allows the Input tax credit in the month of purchase itself to the extent of full 100%. But it also States that the purchaser can claim maximum set-off to the extent of tax received by the treasury. i.e. if he wants to claim Set off then he has to make sure that the seller has deposited the tax with the Government Treasury. It is necessary to obtain the Tax invoice showing the bifurcation of purchase of capital goods eligible for set off & capital goods not eligible for set off (i.e. Negative list Capital Goods). And in absence of Tax Invoice no tax credit will be allowed. If the Dealer is entitled to Set-off he has to further comply with the relevant provision in respect of allowability. Eg. if the Government requires that the dealer should take prior approval before claiming Credit then he has to. However if the Capital Asset is sold before expiry of 36 months then proportionate credit will be withdrawn. There is a Negative List of Capital Goods (on the basis of principle already decided by the Empower Committee) not eligible for Input Tax Credit.

5.

6.

7. 8.

Education Tree Nagpur

Você também pode gostar

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionAinda não há avaliações

- Suggested Tax Paper May 2011Documento11 páginasSuggested Tax Paper May 2011Sudhir PanigrahiAinda não há avaliações

- N13 IPCC Tax Guideline Answers WebDocumento12 páginasN13 IPCC Tax Guideline Answers WebGeorge MooneyAinda não há avaliações

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocumento21 páginasFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezAinda não há avaliações

- Taxation Full Test 1 Unscheduled May 2023 Solution 1677483923Documento38 páginasTaxation Full Test 1 Unscheduled May 2023 Solution 1677483923Vinayak PoddarAinda não há avaliações

- Corporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalDocumento76 páginasCorporate Tax Planning AY 2020-21 Sem V B.ComH - Naveen MittalNidhi LathAinda não há avaliações

- Test 1 SolutionsDocumento20 páginasTest 1 SolutionssamanialenaAinda não há avaliações

- Drafting - Dec 2018Documento119 páginasDrafting - Dec 2018rk_19881425Ainda não há avaliações

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDocumento10 páginasNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaAinda não há avaliações

- Income Tax 2017 Edazdb1013Documento50 páginasIncome Tax 2017 Edazdb1013Pradeep PatilAinda não há avaliações

- Tax Final Book With Cover Page 4th Sem 2021Documento134 páginasTax Final Book With Cover Page 4th Sem 2021H 0140 sayan sahaAinda não há avaliações

- Solution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDocumento14 páginasSolution 1: Calculation of Total Assessable Income, Taxable Income, Tax LiabilityDevender SharmaAinda não há avaliações

- Taxation 2013 NovDocumento25 páginasTaxation 2013 NovAshok 'Maelk' RajpurohitAinda não há avaliações

- Individual-Txation-FY-2018-19-with - JJDocumento64 páginasIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYAinda não há avaliações

- 10-Practical Questions of Individuals (78-113)Documento38 páginas10-Practical Questions of Individuals (78-113)Sajid Saith0% (1)

- Income Tax Ready Reckoner 2011-12Documento28 páginasIncome Tax Ready Reckoner 2011-12kpksscribdAinda não há avaliações

- SalaryDocumento66 páginasSalaryFurqan AhmedAinda não há avaliações

- Deductions U/S 80C TO 80U: By: Sumit BediDocumento69 páginasDeductions U/S 80C TO 80U: By: Sumit BediKittu NemaniAinda não há avaliações

- Inctax 2Documento45 páginasInctax 2janeferrarin551Ainda não há avaliações

- GST 2018 Full Solved PaperDocumento15 páginasGST 2018 Full Solved PaperKomala100% (1)

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Documento5 páginas1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiAinda não há avaliações

- Tanzania Tax Guide 2016/2017Documento22 páginasTanzania Tax Guide 2016/2017Timothy Rogatus67% (3)

- IPCC Taxation Guideline Answer Nov 2015 ExamDocumento16 páginasIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaAinda não há avaliações

- ManagementDocumento6 páginasManagementranu jainAinda não há avaliações

- ALEKYA - Tax Saving SchemsDocumento14 páginasALEKYA - Tax Saving SchemsMOHAMMED KHAYYUMAinda não há avaliações

- Premium CertificateDocumento2 páginasPremium CertificateSowmalya Mandal100% (4)

- Annexure C ExamplesDocumento21 páginasAnnexure C ExamplesLee Ka FaiAinda não há avaliações

- Fifth PartDocumento17 páginasFifth PartMahsinur RahmanAinda não há avaliações

- 1 .Income Tax On Salaries - (01.06.2015)Documento57 páginas1 .Income Tax On Salaries - (01.06.2015)yvAinda não há avaliações

- Mock E Exam Pap ERDocumento19 páginasMock E Exam Pap ERtim_rattanaAinda não há avaliações

- TDS & TCSDocumento107 páginasTDS & TCSSANDEEP CHAUREAinda não há avaliações

- Tax Rates For MFs And Investors 2012-13Documento2 páginasTax Rates For MFs And Investors 2012-13mayankleo_1Ainda não há avaliações

- Tax Reckoner 2013-14: Snapshot of Tax Rates Specific To Mutual FundsDocumento2 páginasTax Reckoner 2013-14: Snapshot of Tax Rates Specific To Mutual FundsZia Ur RehmanAinda não há avaliações

- Tax Planning For Individuals Under Income TaxDocumento11 páginasTax Planning For Individuals Under Income TaxSIDDHESHAinda não há avaliações

- Tax XXXXDocumento60 páginasTax XXXXGerald Bowe ResuelloAinda não há avaliações

- Hussainkhawaja 1177 3641 2 LECTURE-10Documento51 páginasHussainkhawaja 1177 3641 2 LECTURE-10Hasnain BhuttoAinda não há avaliações

- GOLs e-Learning Portal: Salary Computation and Tax TreatmentDocumento24 páginasGOLs e-Learning Portal: Salary Computation and Tax TreatmentLokesh manglaAinda não há avaliações

- Income Tax Law & Practice Unit 4Documento8 páginasIncome Tax Law & Practice Unit 4MuskanAinda não há avaliações

- Tax Reckoner 2011 - 2012Documento2 páginasTax Reckoner 2011 - 2012pgshah79Ainda não há avaliações

- IT Assignment - MDocumento8 páginasIT Assignment - Mrushabh pareetAinda não há avaliações

- Ca Final VatDocumento34 páginasCa Final VatSuhag PatelAinda não há avaliações

- Statutory Income Assessable Income Chargeable IncomeDocumento4 páginasStatutory Income Assessable Income Chargeable IncomeKelvin Lim Wei LiangAinda não há avaliações

- ICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Documento150 páginasICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Optimal Management Solution91% (11)

- Chapter 12 TaxdeductionsDocumento16 páginasChapter 12 TaxdeductionsRiya SharmaAinda não há avaliações

- Notes To Investment Proof SubmissionDocumento10 páginasNotes To Investment Proof SubmissionVinayak DhotreAinda não há avaliações

- ItfjfygjDocumento3 páginasItfjfygjKrishna GAinda não há avaliações

- PracticeDocumento17 páginasPracticeSmarty ShivamAinda não há avaliações

- Determine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overDocumento46 páginasDetermine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overmicaella pasionAinda não há avaliações

- Form 16 Salary CertificateDocumento5 páginasForm 16 Salary CertificateAshok PuttaparthyAinda não há avaliações

- Examples Salary 2015Documento44 páginasExamples Salary 2015Farhan JanAinda não há avaliações

- Indian Institute of Technology Madras: CircularDocumento5 páginasIndian Institute of Technology Madras: CircularAravinthram R am18m002Ainda não há avaliações

- Assignment On TaxationDocumento13 páginasAssignment On TaxationRabiul Karim ShipluAinda não há avaliações

- Tax Planning For Salaried Employees - Taxguru - inDocumento5 páginasTax Planning For Salaried Employees - Taxguru - invthreefriendsAinda não há avaliações

- Exemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Documento5 páginasExemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Ramakoteswar NampalliAinda não há avaliações

- Rsm324 Week 1Documento18 páginasRsm324 Week 1Rudy GuAinda não há avaliações

- TDS (Tax Deducted at Source) : ST STDocumento6 páginasTDS (Tax Deducted at Source) : ST STRuchiRangariAinda não há avaliações

- Hemarus Industries Income Tax Declaration Form SummaryDocumento4 páginasHemarus Industries Income Tax Declaration Form SummaryShashi NaganurAinda não há avaliações

- Computation of Gross Taxable Income and Tax DueDocumento24 páginasComputation of Gross Taxable Income and Tax DueAlice HartAinda não há avaliações

- Paderes Vs CADocumento2 páginasPaderes Vs CAcmv mendozaAinda não há avaliações

- 61 - Wolf v. WELLS - Oral Deposition of Marie McDonnell October 2, 2012Documento59 páginas61 - Wolf v. WELLS - Oral Deposition of Marie McDonnell October 2, 2012mozart20Ainda não há avaliações

- Mallari V Ca: SUMMARY. One Morning, The Passenger Jeepney Driven by Mallari JR Collided With TheDocumento1 páginaMallari V Ca: SUMMARY. One Morning, The Passenger Jeepney Driven by Mallari JR Collided With TheJanlo FevidalAinda não há avaliações

- Updated Consulting Agreement ZenHR HR Letters TemplatesDocumento5 páginasUpdated Consulting Agreement ZenHR HR Letters TemplatesJoyceMendozaAinda não há avaliações

- Motion For Recon NavidadDocumento6 páginasMotion For Recon NavidadDence Cris RondonAinda não há avaliações

- Indian Contract Case Law HighlightsDocumento12 páginasIndian Contract Case Law HighlightsNitu sharmaAinda não há avaliações

- O o o O: Venancio Figueroa y Cervantes, Petitioner People of The Philippines, Respondent FactsDocumento10 páginasO o o O: Venancio Figueroa y Cervantes, Petitioner People of The Philippines, Respondent Factssally deeAinda não há avaliações

- Cline Dba Dark Monkey v. Etsy - Arbitration PDFDocumento14 páginasCline Dba Dark Monkey v. Etsy - Arbitration PDFMark JaffeAinda não há avaliações

- Water Prevention Act 1974Documento22 páginasWater Prevention Act 1974Tanmay TiwariAinda não há avaliações

- Philreca Vs DILGDocumento1 páginaPhilreca Vs DILGGilbertAinda não há avaliações

- SCOC 9677 2012 AramcoDocumento5 páginasSCOC 9677 2012 AramcoMohammed AnwerAinda não há avaliações

- Provisional Remedies TableDocumento6 páginasProvisional Remedies TableJovie Hernandez-MiraplesAinda não há avaliações

- Gozun vs. MercadoDocumento2 páginasGozun vs. Mercadopdalingay100% (1)

- Supreme Court upholds validity of lifetime transfers of properties by deceasedDocumento1 páginaSupreme Court upholds validity of lifetime transfers of properties by deceaseddaphvillegas100% (1)

- Jardine Davies Inc vs. JRB Realty Inc. 463 SCRA 555Documento6 páginasJardine Davies Inc vs. JRB Realty Inc. 463 SCRA 555morningmindsetAinda não há avaliações

- ST. AVIATION SERVICES CO., PTE., LTD., Petitioner, vs. Grand International Airways, Inc., RespondentDocumento6 páginasST. AVIATION SERVICES CO., PTE., LTD., Petitioner, vs. Grand International Airways, Inc., RespondentMary Licel RegalaAinda não há avaliações

- Past Year Qawaid FiqhiyyahDocumento5 páginasPast Year Qawaid FiqhiyyahNani HamidAinda não há avaliações

- Montoya vs. VarillaDocumento21 páginasMontoya vs. VarillaSharmen Dizon GalleneroAinda não há avaliações

- 8.lucman vs. MalawiDocumento1 página8.lucman vs. MalawiLance MorilloAinda não há avaliações

- Guide to Settling a Loved One's EstateDocumento12 páginasGuide to Settling a Loved One's EstateDee MicholeAinda não há avaliações

- 002 (PSI Vs AGANA (.G.R. No. 126297) (2008)Documento2 páginas002 (PSI Vs AGANA (.G.R. No. 126297) (2008)Henry L100% (1)

- RCBC vs Magwin dismissal without prejudice improperDocumento2 páginasRCBC vs Magwin dismissal without prejudice improperTheodore0176Ainda não há avaliações

- Pakdel v. City & County of San Francisco, No. 20-1212 (U.S. June 28, 2021) (Per Curiam)Documento7 páginasPakdel v. City & County of San Francisco, No. 20-1212 (U.S. June 28, 2021) (Per Curiam)RHTAinda não há avaliações

- Rights of Unpaid SalerDocumento32 páginasRights of Unpaid SalerJohn SmithAinda não há avaliações

- Privacy Rights UpheldDocumento6 páginasPrivacy Rights UpheldArlen Rojas100% (1)

- Chan Wan Vs Tan KimDocumento3 páginasChan Wan Vs Tan KimWilliam Christian Dela CruzAinda não há avaliações

- 21 Saludo Vs CADocumento5 páginas21 Saludo Vs CAEditha Santos Abalos CastilloAinda não há avaliações

- Roman v. USA - Document No. 1Documento5 páginasRoman v. USA - Document No. 1Justia.comAinda não há avaliações

- Total: (Personal Checks Are Not Accepted As Method of Payment)Documento4 páginasTotal: (Personal Checks Are Not Accepted As Method of Payment)KOLD News 13Ainda não há avaliações

- Riera Vs PalmaroliDocumento2 páginasRiera Vs PalmaroliJan Re Espina CadeleñaAinda não há avaliações