Escolar Documentos

Profissional Documentos

Cultura Documentos

Ir8a (M) 2010

Enviado por

gk9f5e6ho1owcldxDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ir8a (M) 2010

Enviado por

gk9f5e6ho1owcldxDireitos autorais:

Formatos disponíveis

2010

Employers Tax Ref. No. / RCB No. Full Name of Employee Residential Address

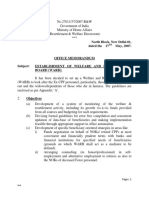

FORM IR8A

Return of Employees Remuneration for the year ended 31 Dec 2009 Fill in this form and give it to your employee/pensioner by 1 Mar 2010 for his submission together with his Income Tax Return

This Form will take about 10 minutes to complete. Please get ready the employees personal particulars and details of his/her employment income. Kindly read the explanatory notes when completing this form. Employees Tax Ref. No. : *NRIC / FIN (Foreign Identification No.) Date of Birth Designation Date of Commencement Date of Cessation $ Sex Marital Status

If employment commenced and/or ceased during the year, state: (See paragraph 7 of the Explanatory Notes) INCOME a) b) c) d) Gross Salary, Fees, Leave Pay, Wages and Overtime Pay: Bonus (non-contractual bonus declared on /

/ 2009 and / or contractual bonus for services rendered in 2009) / / 2009

Directors fees approved at the companys AGM/EGM on Others: 1. Gross Commission for the period 2. Pension $ 3. Allowances: (i) Transport $

to

* Monthly / other than monthly payment

(ii) Entertainment $

(iii) Others $ (See paragraph 12d (I) of the Explanatory Notes) Length of service:

4. Lump sum payment (See paragraph 12d (II) of the Explanatory Notes) Reason for payment: Basis of arriving at the payment: (Give details separately if space is insufficient) Gratuity $ Compensation for loss of office $ Notice Pay $ Ex-gratia payment $ Others (please state nature) $ 5. Retirement benefits including gratuities/pension/commutation of pension/lump sum payments, etc from Pension/Provident Fund: Name of Fund (Amount accrued up to 31 Dec 1992 $ ) Amount accrued from 1993: 6. Contributions made by employer to any Pension/Provident Fund constituted outside Singapore: (See paragraph 12d (III) of the Explanatory Notes. Give details separately if tax concession is applicable) 7. Excess/Voluntary contribution to CPF by employer (less amount refunded/to be refunded): (Please complete Form IR8S - see paragraph 12d (IV) of the Explanatory Notes) 8. Gains or profits from Employee Stock Option (ESOP) / other forms of Employee Share Ownership (ESOW) Plans: (Please complete Appendix 8B see paragraph 12d (V) of the Explanatory Notes) 9. Value of Benefits-in-kind (Please complete Appendix 8A): TOTAL (items d1 to d9) e) Employees Income Tax borne by employer: (Indicate YES or NO) .. If YES and partial, state items for which tax is borne DEDUCTIONS

EMPLOYEES COMPULSORY contribution to * CPF / Designated Pension or Provident Fund (less amount refunded/ to be refunded) Name of Fund : (Please adopt the appropriate CPF rates published by CPF Board on its website www.cpf.gov.sg and do not include excess/voluntary contributions to CPF, voluntary contributions to Medisave Account, voluntary contributions to CPF Minimum Sum Topping-up Scheme and SRS contributions in this item)

Donations deducted through salaries for:

*Yayasan Mendaki Fund/Community Chest of Singapore/SINDA/CDAC/ECF/Other tax exempt donations Contributions deducted through salaries for Mosque Building Fund : DECLARATION Name of Employer : Address of Employer : Name of authorised person making the declaration Designation Tel. No. Signature Date There are penalties for failing to give a return or furnishing an incorrect or late return. IR8A(1/2010) * Delete if not applicable

Você também pode gostar

- 1a. IR8A (M) - YA 2012 - v1Documento1 página1a. IR8A (M) - YA 2012 - v1freepublic9Ainda não há avaliações

- Form IR8A YA 2018Documento2 páginasForm IR8A YA 2018Sandeep KumarAinda não há avaliações

- Form Ir8a - Ya 2017Documento2 páginasForm Ir8a - Ya 2017Naga RajAinda não há avaliações

- Certificate of Collection or Deduction of Tax-2018-19Documento2 páginasCertificate of Collection or Deduction of Tax-2018-19Sarfraz Ali100% (1)

- CDAC Contributions - Opt-out-FormDocumento1 páginaCDAC Contributions - Opt-out-FormDesmond WeeAinda não há avaliações

- Overview of TDS: by C.A. Manish JathliyaDocumento21 páginasOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaAinda não há avaliações

- Short Fall in Qualifying Service For Pension To Be Taken From GDS ServiceDocumento5 páginasShort Fall in Qualifying Service For Pension To Be Taken From GDS ServiceK RAGAVENDRAN67% (3)

- Employees Provident Fund Organization: - Declaration FormDocumento1 páginaEmployees Provident Fund Organization: - Declaration FormRajeshAinda não há avaliações

- Nomination Form 1Documento2 páginasNomination Form 1KumarKd0% (1)

- Return For Provisional Tax PaymentDocumento2 páginasReturn For Provisional Tax PaymentByron KanengoniAinda não há avaliações

- FMLA-Absence Request0001Documento1 páginaFMLA-Absence Request0001Jose Nuñez100% (1)

- ITF 12C Income Tax Self Assessment ReturnDocumento4 páginasITF 12C Income Tax Self Assessment ReturnTavongasheMaddTMagwati100% (1)

- Annexure-IV Form For Furnishing Pensioner / Family Pensioner DetailsDocumento4 páginasAnnexure-IV Form For Furnishing Pensioner / Family Pensioner DetailsSrinivasavaradan EsAinda não há avaliações

- US Internal Revenue Service: I1065bsk - 2005Documento10 páginasUS Internal Revenue Service: I1065bsk - 2005IRSAinda não há avaliações

- Form 16Documento3 páginasForm 16Bijay TiwariAinda não há avaliações

- Form CDocumento2 páginasForm Cnimoakalanka100% (1)

- AF Form 40Documento2 páginasAF Form 40Julianna Stringfield Divett100% (2)

- LAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsDocumento2 páginasLAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsSyed Jalil abbasAinda não há avaliações

- Affidavit - Leave EncashmentDocumento1 páginaAffidavit - Leave EncashmentSAI ASSOCIATEAinda não há avaliações

- FORM R - Register of Wages - Tamilnadu Shops and Establishments Act-1456316704461Documento3 páginasFORM R - Register of Wages - Tamilnadu Shops and Establishments Act-1456316704461Anonymous oWzPuqFVh100% (4)

- A Small Briefing On CSI PayrollDocumento6 páginasA Small Briefing On CSI PayrollAjay PandeyAinda não há avaliações

- EPOnlineSvcAccessApplnForm CompileDocumento11 páginasEPOnlineSvcAccessApplnForm CompileRia ArguellesAinda não há avaliações

- National Cadet Corps: Appendix A' (Revised 2013) Form IDocumento8 páginasNational Cadet Corps: Appendix A' (Revised 2013) Form IAnkit AnandAinda não há avaliações

- Employees' Provident Fund Organization: Form No. 11 (New) Declaration FormDocumento3 páginasEmployees' Provident Fund Organization: Form No. 11 (New) Declaration FormDAAinda não há avaliações

- New Pension Proposal With Example PDFDocumento13 páginasNew Pension Proposal With Example PDFPavan Kumar100% (2)

- Pay Bill GazettedDocumento3 páginasPay Bill Gazettedibrahimshahghotki_20Ainda não há avaliações

- US Internal Revenue Service: I1065bsk - 2004Documento10 páginasUS Internal Revenue Service: I1065bsk - 2004IRSAinda não há avaliações

- (Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Documento13 páginas(Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Arslan Hafeez100% (1)

- Partner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceDocumento10 páginasPartner's Instructions For Schedule K-1 (Form 1065) : Internal Revenue ServiceIRSAinda não há avaliações

- GPaybillDocumento2 páginasGPaybillMumtaz Ali Soomro100% (1)

- Regular Employee Details FormDocumento4 páginasRegular Employee Details FormRajesh BabuAinda não há avaliações

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocumento11 páginasAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuAinda não há avaliações

- Form 300 - Feb 2021Documento13 páginasForm 300 - Feb 2021PREM MURUGANAinda não há avaliações

- No Dues FromDocumento3 páginasNo Dues FromBharathAinda não há avaliações

- Provident Fund Full DetailsDocumento5 páginasProvident Fund Full DetailsGaurav VijayAinda não há avaliações

- Application For Leave For Extension of Leave: FORM-1Documento3 páginasApplication For Leave For Extension of Leave: FORM-1Pinto DebnathAinda não há avaliações

- Statement of Transaction - Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or SnowmobileDocumento2 páginasStatement of Transaction - Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or SnowmobilePramedicaPerdanaPutra100% (1)

- Subscriber Registration Form: (Administered by Pension Fund Regulatory and Development Authority)Documento4 páginasSubscriber Registration Form: (Administered by Pension Fund Regulatory and Development Authority)Arun RockyAinda não há avaliações

- Joint Declaration Under para 26Documento1 páginaJoint Declaration Under para 26Yashika SalujaAinda não há avaliações

- Coe TemplateDocumento1 páginaCoe TemplateJulius AlcantaraAinda não há avaliações

- MorrisBreann Fall 2020 MGMT 343 Exam #1Documento4 páginasMorrisBreann Fall 2020 MGMT 343 Exam #1Breann MorrisAinda não há avaliações

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Documento1 páginaW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Adam AkbarAinda não há avaliações

- For Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearDocumento1 páginaFor Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearJazzy BadshahAinda não há avaliações

- Vetting of Pay Fixation of SchoolsDocumento5 páginasVetting of Pay Fixation of Schoolspinappu0% (1)

- Application Form For Earned Leave or Extension of LeaveDocumento1 páginaApplication Form For Earned Leave or Extension of LeaveTia Moore0% (1)

- Declaration Form PDFDocumento2 páginasDeclaration Form PDFBoopathi KalaiAinda não há avaliações

- Retirement Benefits TaxDocumento18 páginasRetirement Benefits TaxArpit GoyalAinda não há avaliações

- IHRM - Compensation ManagementDocumento36 páginasIHRM - Compensation ManagementVinay Krishna H VAinda não há avaliações

- Template - EPFS Form 13 (Revised)Documento3 páginasTemplate - EPFS Form 13 (Revised)Sugam KhetrapalAinda não há avaliações

- Annexure - Format For DeclarationDocumento1 páginaAnnexure - Format For DeclarationAhmed SaadAinda não há avaliações

- Metro Board of Directors Agenda, Feb. 2020Documento15 páginasMetro Board of Directors Agenda, Feb. 2020Metro Los AngelesAinda não há avaliações

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Documento3 páginasTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)RnnrohitAinda não há avaliações

- Bir Forms PDFDocumento4 páginasBir Forms PDFgaryAinda não há avaliações

- Single Comprehensive Form Automated) of Pension For W.b.govt EmployeesDocumento18 páginasSingle Comprehensive Form Automated) of Pension For W.b.govt Employeeskaka432167% (3)

- Employee Proof Submission Form - 2011-12Documento5 páginasEmployee Proof Submission Form - 2011-12aby_000Ainda não há avaliações

- IT Declaration Form 2011-2012Documento1 páginaIT Declaration Form 2011-2012Shishir RoyAinda não há avaliações

- IT Declaration FormatDocumento2 páginasIT Declaration FormatKamal VermaAinda não há avaliações

- Investment Declaration Form (Hemarus)Documento4 páginasInvestment Declaration Form (Hemarus)Shashi NaganurAinda não há avaliações

- Computation of Adjusted Profit For Self EmployedDocumento8 páginasComputation of Adjusted Profit For Self EmployedCindyAinda não há avaliações

- M5 Mock Exam 1Documento22 páginasM5 Mock Exam 1Eveleen Gan100% (4)

- Taxation - Singapore (TX - SGP) : Applied SkillsDocumento19 páginasTaxation - Singapore (TX - SGP) : Applied SkillsLee WendyAinda não há avaliações

- StatsT LabourDocumento18 páginasStatsT LabourKenny J. YueAinda não há avaliações

- BGVBF: (2007) SGCA 32Documento32 páginasBGVBF: (2007) SGCA 32lumin87Ainda não há avaliações

- Thu Ya Hein-GcDocumento16 páginasThu Ya Hein-GcAsia Shwe OhAinda não há avaliações

- Employment Pass / S Pass Application Form (Form 8)Documento12 páginasEmployment Pass / S Pass Application Form (Form 8)Nanda Hlaing MyintAinda não há avaliações

- MGCCT ProspectusDocumento700 páginasMGCCT ProspectusMarc EdwardsAinda não há avaliações

- Pru HI 6th Edition (4 Sets of Mock Combined)Documento51 páginasPru HI 6th Edition (4 Sets of Mock Combined)thth943Ainda não há avaliações

- WPDocumento12 páginasWPChen Zhi HanAinda não há avaliações

- Workright Guide Employment LawsDocumento19 páginasWorkright Guide Employment LawsquachtohoangAinda não há avaliações

- Application For Alteration Form 2-UpdateDocumento4 páginasApplication For Alteration Form 2-UpdateShareen TeoAinda não há avaliações

- Death Claim Procedure: Documents RequiredDocumento7 páginasDeath Claim Procedure: Documents RequiredMilanie NoriegaAinda não há avaliações

- Financial Lit QuizDocumento8 páginasFinancial Lit QuizLynnHanAinda não há avaliações

- The Complete Guide To Making Your WillDocumento16 páginasThe Complete Guide To Making Your WillshubhraAinda não há avaliações

- HDB SingaporeDocumento10 páginasHDB SingaporemsAinda não há avaliações

- Welfare Andre HB Il ItationDocumento45 páginasWelfare Andre HB Il ItationBanavaram UmapathiAinda não há avaliações

- Relocation Handbook For HR Practitioners in SingaporeDocumento94 páginasRelocation Handbook For HR Practitioners in Singaporegeorgemtchua4385100% (1)

- 1 2Documento4 páginas1 2Robin DeyAinda não há avaliações

- Income Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDocumento5 páginasIncome Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDaniel SohAinda não há avaliações

- Singapore As A Regional Financial Centre: Denis HewDocumento26 páginasSingapore As A Regional Financial Centre: Denis HewSanthiya MogenAinda não há avaliações

- Form Sol ControllerDocumento13 páginasForm Sol ControllerAnamul Haque SazzadAinda não há avaliações

- 10 Attchment - Memorandum of MortgageDocumento10 páginas10 Attchment - Memorandum of Mortgageapi-3803117Ainda não há avaliações

- Prudential M5 Mock PaperDocumento22 páginasPrudential M5 Mock PaperAshAinda não há avaliações

- Aberdeen Standard Indonesia Equity FundDocumento2 páginasAberdeen Standard Indonesia Equity FundAndison WinartoAinda não há avaliações

- Partial Prepayment Notice Form and NotesDocumento2 páginasPartial Prepayment Notice Form and Noteskei00Ainda não há avaliações

- CPF Contribution Rates For Jan 2016Documento5 páginasCPF Contribution Rates For Jan 2016Kayleen ChewAinda não há avaliações

- EP SPass Form8Documento12 páginasEP SPass Form8iambadass0% (1)

- OM Pat-V (2016 Edition)Documento205 páginasOM Pat-V (2016 Edition)DebashishAinda não há avaliações

- FSSA Dividend Advantage FundDocumento2 páginasFSSA Dividend Advantage FundMiknoos PutinAinda não há avaliações

- Form CPFLMDocumento4 páginasForm CPFLMKrishnan JayaramanAinda não há avaliações