Escolar Documentos

Profissional Documentos

Cultura Documentos

IRS For 501c4 Form14449

Enviado por

Lucy BernholzTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

IRS For 501c4 Form14449

Enviado por

Lucy BernholzDireitos autorais:

Formatos disponíveis

Form

14449

Department of the Treasury - Internal Revenue Service

(January 2013)

Self-Declarers Questionnaire IRC 501(c)(4), (5) and (6) Organizations

OMB Number 1545-2071

This questionnaire asks for information about your organization and how it operates. Answer the questions based on the most recent tax year for which your organization filed Form 990 (i.e., 2010 or 2011), unless otherwise indicated. Do not submit any books or records

Part I - Information About Your Organization

Name of your organization (enter the complete name) Your organizations website address Name of contact 1. 2. Title of contact Phone number of contact Employer Identification Number (EIN)

In what year was your organization formed What type of organizational structure does your organization operate under Corporation Trust Other (describe) Limited Liability Corporation Association Partnership Cooperative

3. 4.

In what year did your organization begin operating For which tax year did your organization file its most recent Form 990 a. What was the ending month of the tax year for this Form 990

5.

Has your organization ever had employees

Yes

No

a. If yes to question 5, in what year did your organization hire its first employee b. If yes to question 5, how many employees does your organization currently employ 6. An organization claiming exemption under Code Section 501(c)(4), (5) or (6) is not required to file an application (Form 1024) to be tax exempt. Briefly describe the reason(s) your organization chose not to apply for recognition of exemption

7. 8.

In what year did your organization begin claiming tax exemption Did your organization receive outside professional advice regarding its qualification for exemption Yes No

a. If yes to question 8, indicate who provided your organization advice. Check all that apply Accountant Other (describe) 9. Is your organization claiming tax exemption as described in Section 501(c)(4) Yes No Attorney Enrolled preparer

a. If yes to question 9, check the box that best describes your organization Ballot measure committee Educational organization Healthcare organization Police or firefighters relief association Veterans organization Other (describe)

Catalog Number 60996P www.irs.gov Form 14449 (1-2013)

Cultural organization Homeowners' association Recreation facility/activities Volunteer fire department

Economic development Local association of employees Religious organization

Financial, credit counseling, debt management

Page

10.

Is your organization claiming tax exemption as described in Section 501(c)(5) a. If yes to question 10, check the box that best describes your organization Agricultural Other (describe) Horticultural Labor

Yes

No

11.

Is your organization claiming tax exemption as described in Section 501(c)(6) a. If yes to question 11, check the box that best describes your organization Business league, trade association, professional association Real estate board Other (describe) Board of trade

Yes

No

Chamber of commerce Professional sports league

Part II Information About Your Activities and Related Organizations

12. Enter the percentage of your organizations revenue, expenses and staff/volunteer time dedicated to each of the following activities during the most recent tax year for which your organization filed Form 990. If your organization did not conduct a particular activity in that year, enter 0 for the percentages. For each activity, indicate whether all, some or none of the income from that activity was unrelated business income (UBI) Activity Attempting to influence legislation Conducting any gaming activities such as pull-tabs, bingo, raffles, etc Conducting trade shows Engaging in collective bargaining on behalf of members Promoting a single product brand, manufacturer or technology Providing or maintaining community property Providing and maintaining facilities available only to members (or guests of members) Providing other services to your organizations members Publishing (in print or online) a magazine, professional journal, newsletter or membership directory Publishing (either as part of another publication or separately) a catalog of your organizations members products or services Sale of advertising Supporting or opposing candidates for public office Percentage of Revenue Percentage of Expenses Percentage of Time Portion of Income from Activity that is UBI (All, Some, None)

Catalog Number 60996P

www.irs.gov

Form 14449 (1-2013)

Page

13.

During the most recent tax year for which your organization filed Form 990, did your organization conduct any activities not described in question 12

Yes

No

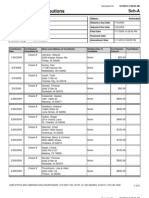

a. If yes to question 13, list each of those activities in order of percentage of time, starting with the most time devoted. Indicate the activity and the percentage of your organizations revenue, expenses and staff/volunteer time devoted to the activity during the most recent tax year for which your organization filed Form 990. For each activity, indicate whether all, some or none of the income from that activity was unrelated business income (UBI), as defined in the instructions for your most recently filed Form 990. Do not include as UBI income that is excluded from tax under Section 512, 513 or 514 of the Internal Revenue Code Activity 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. b. For each activity listed in question 13a, enter the name and line number of each followed by a detailed description of that activity. To the extent an activity is related to your organizations tax-exempt purposes, describe how it furthers those tax-exempt purposes Percentage of Revenue Percentage of Expenses Percentage of Time Portion of Income from Activity that is UBI (All, Some, None)

14.

During the most recent tax year for which your organization filed Form 990 (i.e., 2010 or 2011), did your organization participate or intervene in any political campaigns on behalf of or in opposition to any candidates for public office a. If yes to question 14, what dollar amount did your organization spend on political campaign intervention during that tax year b. If yes to question 14, how many volunteer hours did your organization use in political campaign intervention during that tax year c. If yes to question 14, how many paid staff hours did your organization use in political campaign intervention during that tax year

Yes

No

Catalog Number 60996P

www.irs.gov

Form 14449 (1-2013)

Page

15.

Between January 1, 2012, and December 31, 2012, did your organization participate or intervene in any political campaigns on behalf of or in opposition to any candidates for public office a. If yes to question 15, what dollar amount did your organization spend on political campaign intervention between January 1, 2012, and December 31, 2012 b. If yes to question 15, how many volunteer hours did your organization use in political campaign intervention between January 1, 2012, and December 31, 2012 c. If yes to question 15, how many paid staff hours did your organization use in political campaign intervention between January 1, 2012, and December 31, 2012

Yes

No

16.

Between January 1, 2012, and December 31, 2012, did your organization purchase any radio, TV, newspaper, or other advertisements, or other media time or space, to support or oppose candidates for public office a. If yes to question 16, what amount did your organization spend on these advertisements and media buys between January 1, 2012, and December 31, 2012

Yes

No

17

Between January 1, 2012, and December 31, 2012, did your organization purchase any radio, TV, newspaper, or other advertisements, or other media time or space, to influence legislation a. If yes to question 17, what amount did your organization spend on these advertisements and media buys between January 1, 2012, and December 31, 2012

Yes

No

18.

Between January 1, 2012, and December 31, 2012, did your organization purchase any radio, TV, newspaper, or other advertisements, or other media time or space, to engage in public advocacy not related to legislation or election of candidates a. If yes to question 18, what amount did your organization spend on these advertisements and media buys between January 1, 2012, and December 31, 2012

Yes

No

19.

Does your organization have any related organizations (as defined in the instructions for your most recently filed Form 990)

Yes

No

a. If Yes to question 19, list each of your related organizations (as defined in the instructions for your most recently filed Form 990) and provide the information requested below. If your organization does not have any ownership or control of a related organization, enter 0 in the last column Type of Organization Name of Related Organization 1. 2. 3. 4. 5. 6. 7. 8. 9. 10.

(Nonprofit Corporation, Stock Corporation, Partnership, LLC, Trust)

Primary Activity

Percent Ownership of Related Organization or Percent Control of Nonprofit Board, if any

Catalog Number 60996P

www.irs.gov

Form 14449 (1-2013)

Page

Part III Information About Your Revenue and Expenses

20. For each category below, list the total revenue your organization received during the most recent tax year for which your organization filed Form 990, and list the amount of total revenue that was unrelated business income (as defined in the instructions for your most recently filed Form 990, but not including income that is excluded from tax under Section 512, 513 or 514 of the Internal Revenue Code). Report gross rather than net revenue. Do not include an item of revenue in more than one line. If your organization did not have a particular type of revenue, enter 0 for that category Type of Revenue 1. Fundraising events 2. Noncash contributions 3. Membership dues (contributions) 4. Other contributions 5. Membership dues (payments for goods or services) 6. Program service revenue 7. Investment income 8. Rental income 9. Income from sale of assets 10. Income from gaming 11. Other revenue Total revenue (should equal sum of lines 1-11) 21. For each calendar year (January 1 through December 31) below, list the total amount of contributions over $50,000 your organization received during that year and the total number of donors of over $50,000 who were individuals, tax-exempt organizations, for-profit corporations and other entities Calendar Year 2010 2011 2012 22. During the most recent tax year for which your organization filed Form 990, did your organization receive outside professional advice on any of the following? Check all that apply Determining whether activities were unrelated or exempt Allocating expenses between unrelated and exempt activities Pricing between your organization and its related organizations for expenses incurred in unrelated activities Did not receive outside professional advice Other (describe) Total Amount of Contributions over $50,000 Number of Individual Donors Number of TaxExempt Organization Donors Number of For-Profit Corporation Donors Number of Other Donors Total Revenue Amount of Unrelated Business Income

Catalog Number 60996P

www.irs.gov

Form 14449 (1-2013)

Page

23.

During the most recent tax year for which your organization filed Form 990, did your organization have unrelated business income of more than $1,000 If no to question 23, skip to question 24 a. If yes to question 23, did your organization file a Form 990-T, Exempt Organization Business Income Tax Return, for the most recent tax year for which your organization filed Form 990

Yes

No

Yes

No

b. If yes to question 23a, using the total expenses reported for all activities on your organizations Form 990-T (Part II, line 29 Total Deductions), provide a percentage breakdown of direct v. indirect expenses. If Form 990-T, Part II, line 29 contains a number other than 0, the sum of the percentages below should be 100%. If Form 990-T, Part II, line 29 is 0, enter 0% on both lines below Direct expenses Indirect expenses % % Yes No

c. If yes to question 23a, did your organization have any unrelated business activities that resulted in losses during the most recent tax year for which your organization filed Form 990

d. If yes to question 23c, list the five unrelated business activities that resulted in the largest losses shown on line 30 of your organizations Form 990-T and complete the columns below for each activity using the numbers reported on your organizations Form 990-T Column Instructions: In 2nd column, enter the total income for the activity that was included on line 13, column A of Form 990-T In 3rd column, enter the unrelated business taxable income before net operating loss deduction for the activity that was included on line 30 of the Form 990-T In the 4th column, enter the direct expenses for the activity that were included on line 29 of Form 990-T In the last column, enter the indirect expenses for the activity that were included on line 29 of Form 990-T Line 13, column (A)

(Total UBI)

Line 30 (UBI Before

Net Operating Loss Deduction)

Unrelated Business Activity

Direct Expenses included in line 29

(Total Deductions)

Indirect Expenses included in line 29

(Total Deductions)

Catalog Number 60996P

www.irs.gov

Form 14449 (1-2013)

Page

24.

For each category below, list the total expenses your organization incurred during the most recent tax year for which your organization filed Form 990. Do not include an item of expense in more than one line. If your organization did not have a particular type of expense, enter 0 for that category Type of Expense 1. 2. 3. 4. 5. 6. 7. 8. 9. Grants and other assistance within the United States Grants and other assistance outside the United States Benefits paid to or for members Compensation and benefits paid to or for officers, directors, trustees and key employees (as

defined in the instructions for your most recently filed Form 990)

Amount of Expense

Compensation and benefits paid to or for other employees Fees for services (for management, legal, accounting, consulting, fundraising, investment

management and other services provided by non-employees)

Occupancy, rent, utilities and maintenance Advertising/promotion Office expenses

10. Lobbying 11. Supporting or opposing candidates for public office 12. Payments of travel or entertainment expenses for any public officials 13. Conferences/meetings/conventions 14. Payments to affiliates 15. Other expenses Total expenses (should equal sum of lines 1-15) 25. During your organizations most recent tax year for which it filed Form 990, did your organization pay a Section 527(f) tax on expenditures to influence the selection, nomination, election or appointment of any candidate for federal, state or local public office or office in a political organization, or the election of presidential or vice-presidential electors a. If yes to question 25, what dollar amount of section 527(f) tax did your organization pay Yes No

Catalog Number 60996P

www.irs.gov

Form 14449 (1-2013)

Page

Part IV Information About Compensation

For the remaining questions, answer each question based on the calendar year ending with or within the most recent tax year for which your organization filed Form 990. For instance, if your organizations most recently filed Form 990 was for tax year 2011, answer each question in Part IV based on the 2011 calendar year 26. Did your organization compensate any of its officers, directors, trustees or key employees If no to question 26, do NOT complete the remainder of the questionnaire. Refer to the instructions for returning the questionnaire 27. Complete this table for your organizations six most highly compensated officers, directors, trustees and key employees for the calendar year ending in the most recent tax year for which your organization filed Form 990. For purposes of this questionnaire, report key employees and other compensation as defined in the instructions for your most recently filed Form 990, Part VII, Section A. If your organization did not pay a certain type of compensation (e.g., other compensation, compensation from related organizations) to a person listed in this table, enter 0 in the box for that type of compensation Compensation from Estimated Amount of Related Other Compensation Organizations from your Average Hours (from Form W-2, box 5 (from Form W-2, box 5 Organization and Worked Per Week and Form 1099-MISC, and Form 1099-MISC, Related box 7) box 7) Organizations Compensation from Your Organization Yes No

Name and Position

28.

Check the appropriate box(es) if your organization provided any of the following to or for a person listed in question 27 First-class or charter travel Travel for companions Tax indemnification and gross-up payments Discretionary spending account None of the above Housing allowance or residence for personal use Payments for business use of personal residence Health or social club dues or initiation fees Personal services (e.g., maid, chauffer, chef)

a. If any of the items in question 28 (other than None of the above) are checked, did your organization follow a written policy regarding payment, reimbursement or provision of all of the items checked above b. If no to question 28a, provide an explanation

Yes

No

29.

Did your organizations Board of Directors or other authorized governing body approve the compensation of all, some or none of its officers, directors, trustees and key employees All Some None Yes No

30.

Did all of your organizations officers, directors, trustees and key employees recuse themselves from discussions of their own compensation or otherwise not participate in the discussions of their own compensation

www.irs.gov

Catalog Number 60996P

Form 14449 (1-2013)

Page

31. 32.

Did all of your organizations officers, directors, trustees and key employees recuse themselves from voting on their own compensation or otherwise not participate in the voting on their own compensation

Yes

No

Did your organization hire an outside compensation consultant to help determine the compensation of all, some or none of its officers, directors, trustees or key employees All Some None

33.

Did your organization use comparable compensation data to determine the compensation of all, some or none of its officers, directors, trustees or key employees All Some None

a. If all or some to question 33, describe how your organization used comparable compensation data to determine compensation

If none to question 33, do NOT complete the remainder of the questionnaire. Refer to the instructions for submitting the questionnaire 34. If all or some to question 33, did your organization establish compensation of all, some or none of its officers, directors, trustees and key employees at a specific percentile or percentiles from comparable compensation data All Some None

a. If all or some to question 34, at what percentile(s) from the comparable compensation data did your organization establish compensation? List all percentiles

b. If all or some to question 34, describe how your organization determined that the percentile(s) was (were) appropriate

35.

Select the sources used, including those used by outside compensation consultants retained by your organization, to obtain comparability data for compensation of your organizations officers, directors, trustees or key employees. Check all that apply Published surveys of compensation at similar organizations Phone surveys of compensation at similar organizations Forms 990 filed by similar organizations Other (describe) Internet research on compensation at similar organizations Written offers of employment from similar organizations

36.

Select the factors that were included in the comparability data and used by your organization, or by any outside compensation consultants retained by your organization. Check all that apply Compensation data of similar tax-exempt organizations Level of persons education and experience Previous salary or compensation package Similar services in the same geographic or metropolitan area Similar number of individuals served Other (describe) Annual budget and/or gross revenue/assets

www.irs.gov Form 14449 (1-2013)

Compensation data of similar taxable organizations Specific responsibilities of position Similar number of employees

Catalog Number 60996P

Você também pode gostar

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNo EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCNota: 4 de 5 estrelas4/5 (5)

- How to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateNo EverandHow to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateNota: 3.5 de 5 estrelas3.5/5 (9)

- Evaluating InnovationDocumento24 páginasEvaluating InnovationLucy Bernholz85% (127)

- Understanding Your EIN PUB 1635Documento44 páginasUnderstanding Your EIN PUB 1635company22100% (3)

- From Vision To Reality: A Guide To Launching A Successful Nonprofit OrganizationDocumento211 páginasFrom Vision To Reality: A Guide To Launching A Successful Nonprofit OrganizationNamibia Donadio100% (1)

- ss4 PDFDocumento4 páginasss4 PDFKeith Muhammad: Bey100% (2)

- Attention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business DayDocumento3 páginasAttention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business Daypreston_40200350% (2)

- Employer Identification Number (EIN) Application / RegistrationDocumento3 páginasEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- Publication 583 by My StyleDocumento39 páginasPublication 583 by My StyleNassif El DadaAinda não há avaliações

- Due Diligence Report TemplateDocumento18 páginasDue Diligence Report Templatequynhanhle85100% (7)

- Change To Domestic Employer Identification Number (EIN) Assignment by Toll-Free PhonesDocumento3 páginasChange To Domestic Employer Identification Number (EIN) Assignment by Toll-Free PhonespeteycostaAinda não há avaliações

- How Did The Income Tax Start?: Irs - GovDocumento6 páginasHow Did The Income Tax Start?: Irs - GovApurva BhargavaAinda não há avaliações

- IRS Publication 334 2010Documento55 páginasIRS Publication 334 2010mtn3077Ainda não há avaliações

- What Type of Information Is Necessary To Complete A Tax ReturnDocumento4 páginasWhat Type of Information Is Necessary To Complete A Tax ReturnDianna RabadonAinda não há avaliações

- 3.2. City of Manila Vs Chinese CemeteryDocumento1 página3.2. City of Manila Vs Chinese CemeteryRandy SiosonAinda não há avaliações

- Canada Cpat Lmia ApplicationDocumento14 páginasCanada Cpat Lmia ApplicationAdin burg100% (1)

- Income Tax Returns Guide for Common ManDocumento13 páginasIncome Tax Returns Guide for Common Mananandakumar2810100% (1)

- Form 1065 InstructionsDocumento45 páginasForm 1065 InstructionsWilliam BulshtAinda não há avaliações

- Form 990 HighlightsDocumento10 páginasForm 990 HighlightsValerie F. LeonardAinda não há avaliações

- Delhi HC Netflix Amazon Online Shows PetitionDocumento15 páginasDelhi HC Netflix Amazon Online Shows PetitionbhavanaAinda não há avaliações

- ContractsDocumento29 páginasContractsattyeram9199Ainda não há avaliações

- Labour Market Impact Assessment Application Higher-Skilled OccupationsDocumento13 páginasLabour Market Impact Assessment Application Higher-Skilled Occupationsyilongwei.comAinda não há avaliações

- Philippine Supreme Court upholds foreign will over legitime rightsDocumento2 páginasPhilippine Supreme Court upholds foreign will over legitime rightshistab33% (3)

- Legal Principle and Skills NotesDocumento35 páginasLegal Principle and Skills NotesZOzy Kitty LeowAinda não há avaliações

- CORPO - 96-105 Close CorporationDocumento9 páginasCORPO - 96-105 Close CorporationlaursAinda não há avaliações

- New Vendor Info FormDocumento11 páginasNew Vendor Info FormRoseNPrinceAinda não há avaliações

- Lonzanida Vs COMELECDocumento3 páginasLonzanida Vs COMELECCon PuAinda não há avaliações

- CASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CADocumento10 páginasCASE DIGESTS Selected Cases in Pub. Corp. Dela Cruz Vs Paras To Miaa Vs CAErica Dela Cruz100% (1)

- UNHCR Vendor FormDocumento6 páginasUNHCR Vendor FormZoya ShahidAinda não há avaliações

- Nejme Form For Disclosure of Potential Conflicts of InterestDocumento5 páginasNejme Form For Disclosure of Potential Conflicts of InterestYasser JayawinataAinda não há avaliações

- Charitable Obligations of The WalrusDocumento47 páginasCharitable Obligations of The WalrusCANADALANDAinda não há avaliações

- Sales Report Template 38Documento2 páginasSales Report Template 38Sara HussainAinda não há avaliações

- DB 2016 - ROM - Starting - Survey - en - Pop - ClaudiuDocumento14 páginasDB 2016 - ROM - Starting - Survey - en - Pop - ClaudiuCristi GaburAinda não há avaliações

- 501 (C) (4) Instructions For Set-UpDocumento4 páginas501 (C) (4) Instructions For Set-UpPratus WilliamsAinda não há avaliações

- Business organization types and tax calculationsDocumento4 páginasBusiness organization types and tax calculationsAwais AhmedAinda não há avaliações

- Clinton Foundation Revised Filing 2013Documento108 páginasClinton Foundation Revised Filing 2013Daily Caller News FoundationAinda não há avaliações

- Appendix 1: Questionnaire To Perform Legal Analysis To Determine Whether A BreachDocumento20 páginasAppendix 1: Questionnaire To Perform Legal Analysis To Determine Whether A BreachtlalovićAinda não há avaliações

- Pa Rev-72Documento12 páginasPa Rev-72Nick Rosati0% (1)

- Guide VAT VATG115 EnglishDocumento8 páginasGuide VAT VATG115 EnglishEdsel Castro Delos SantosAinda não há avaliações

- DISB Access To Capital Survey 2015 09Documento19 páginasDISB Access To Capital Survey 2015 09Scott RobertsAinda não há avaliações

- Nonprofit Insider: What Is Your Form 990 Telling The IRS?Documento2 páginasNonprofit Insider: What Is Your Form 990 Telling The IRS?UHYColumbiaMDAinda não há avaliações

- PQQ - Calderdale MBC - Integrated Sexual Health Services - PagesDocumento20 páginasPQQ - Calderdale MBC - Integrated Sexual Health Services - PagesJennyS19Ainda não há avaliações

- Fomtnp RRF 2015Documento2 páginasFomtnp RRF 2015L. A. PatersonAinda não há avaliações

- STEPSDocumento35 páginasSTEPSRochel HatagueAinda não há avaliações

- NCJC 561348186 - 201112 - 990Documento30 páginasNCJC 561348186 - 201112 - 990A.P. DillonAinda não há avaliações

- Welcome Letter Universal - 202357519087Documento3 páginasWelcome Letter Universal - 202357519087minhdang03062017Ainda não há avaliações

- Supplemental-Checklist-COVID-EIDL-intake Form-090821-508Documento7 páginasSupplemental-Checklist-COVID-EIDL-intake Form-090821-508Shashank SaxenaAinda não há avaliações

- Managing Profits and Losses On NonDocumento2 páginasManaging Profits and Losses On NonAmar narayanAinda não há avaliações

- Chap 7Documento18 páginasChap 7Quang HuyAinda não há avaliações

- TaxesdocumentDocumento2 páginasTaxesdocumentapi-301940147Ainda não há avaliações

- How To Start A BusinessDocumento8 páginasHow To Start A BusinessAnonymous I03Wesk92Ainda não há avaliações

- Business DataDocumento3 páginasBusiness DataYasir KhanAinda não há avaliações

- Business Plan QuestionnaireDocumento4 páginasBusiness Plan QuestionnaireamegahcharlesisaiahAinda não há avaliações

- ICMJE Form For Disclosure of Potential Conflicts of InterestDocumento24 páginasICMJE Form For Disclosure of Potential Conflicts of InterestPaola RodríguezAinda não há avaliações

- EN-AP1-Organization-ProfileDocumento4 páginasEN-AP1-Organization-ProfileIvan TaylorAinda não há avaliações

- C-22272-BSQ Section 2 Attachment 7 - DD QuestionnaireDocumento6 páginasC-22272-BSQ Section 2 Attachment 7 - DD QuestionnaireARF GoldenArmsAinda não há avaliações

- Tally Assignment BookDocumento76 páginasTally Assignment Bookvihanjangid223Ainda não há avaliações

- Occupational Tax and Registration Return For Wagering: Type or PrintDocumento6 páginasOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1Ainda não há avaliações

- How Do I Start Making My Business Legal?Documento17 páginasHow Do I Start Making My Business Legal?Rey Nerius CalooyAinda não há avaliações

- Plusius - Io - Airwallex EDD FormDocumento13 páginasPlusius - Io - Airwallex EDD FormRicha GujjarAinda não há avaliações

- VAT - Getting Started GuideDocumento6 páginasVAT - Getting Started GuideBlueLake InvestmentAinda não há avaliações

- 1 s2.0 S0168827821000866 mmc1Documento6 páginas1 s2.0 S0168827821000866 mmc1Thanet aramsangtheanchaiAinda não há avaliações

- FTG RRF 2006Documento1 páginaFTG RRF 2006L. A. PatersonAinda não há avaliações

- Business Taxation MeaningDocumento4 páginasBusiness Taxation MeaningSheila Mae AramanAinda não há avaliações

- Instructional Manual EnglishDocumento17 páginasInstructional Manual EnglishKhawaja Burhan80% (5)

- Aarm PSX Lesson 5Documento14 páginasAarm PSX Lesson 5mahboob_qayyumAinda não há avaliações

- 8 Condensed ARM Approach QuestionnaireDocumento48 páginas8 Condensed ARM Approach Questionnairepataa0Ainda não há avaliações

- Charitable organizations annual financial report instructionsDocumento9 páginasCharitable organizations annual financial report instructionsMary GallagherAinda não há avaliações

- EthicsofData FRAMINGDOCUMENTDocumento4 páginasEthicsofData FRAMINGDOCUMENTLucy BernholzAinda não há avaliações

- Several Examples of Digital Ethics and Proposed PracticesDocumento2 páginasSeveral Examples of Digital Ethics and Proposed PracticesLucy Bernholz100% (1)

- Cases For Discussion BigDataDocumento3 páginasCases For Discussion BigDataLucy BernholzAinda não há avaliações

- Digital Civil Society BIBLIOGRAPHY (In Process)Documento4 páginasDigital Civil Society BIBLIOGRAPHY (In Process)Lucy Bernholz100% (1)

- Questions To Ask When Funding Big DataDocumento1 páginaQuestions To Ask When Funding Big DataLucy BernholzAinda não há avaliações

- New Skills New Economy NMIDocumento12 páginasNew Skills New Economy NMILucy Bernholz100% (1)

- Social Economy Digital Civil Society - BernholzDocumento13 páginasSocial Economy Digital Civil Society - BernholzLucy BernholzAinda não há avaliações

- Data Examples and DCS GIFE 2014Documento14 páginasData Examples and DCS GIFE 2014Lucy BernholzAinda não há avaliações

- Alliance September 2012 DATADocumento26 páginasAlliance September 2012 DATALucy Bernholz0% (1)

- New Rules For New ToolsDocumento9 páginasNew Rules For New ToolsLucy BernholzAinda não há avaliações

- Digital Civil Society COF GPF 2013Documento28 páginasDigital Civil Society COF GPF 2013Lucy BernholzAinda não há avaliações

- Philanthropy and Social Investing: Blueprint 2010Documento44 páginasPhilanthropy and Social Investing: Blueprint 2010Lucy BernholzAinda não há avaliações

- Charrette Sharing 1.24.12Documento16 páginasCharrette Sharing 1.24.12Lucy BernholzAinda não há avaliações

- Online Platform Database (Core) - 2011Documento23 páginasOnline Platform Database (Core) - 2011Lucy Bernholz100% (1)

- Agenda 1.24.12 Recoding GoodDocumento1 páginaAgenda 1.24.12 Recoding GoodLucy BernholzAinda não há avaliações

- Onlinegivingdb HFDocumento20 páginasOnlinegivingdb HFLucy BernholzAinda não há avaliações

- PREVIEW Blueprint 2011 Reviewers 2Documento12 páginasPREVIEW Blueprint 2011 Reviewers 2Lucy BernholzAinda não há avaliações

- Charrette Sharing 1.24.12Documento16 páginasCharrette Sharing 1.24.12Lucy BernholzAinda não há avaliações

- Disrupting Philanthropy March 30 2011Documento18 páginasDisrupting Philanthropy March 30 2011Lucy BernholzAinda não há avaliações

- Navigating New Social EconomyDocumento14 páginasNavigating New Social EconomyLucy BernholzAinda não há avaliações

- Building Fields For Policy ChangeDocumento26 páginasBuilding Fields For Policy ChangeLucy Bernholz0% (1)

- Philanthropy and Social Investing: Blueprint 2011Documento45 páginasPhilanthropy and Social Investing: Blueprint 2011Lucy BernholzAinda não há avaliações

- Culture of Giving WorkshopDocumento1 páginaCulture of Giving WorkshopLucy BernholzAinda não há avaliações

- Disrupting Philanthropy: Technology and PolicyDocumento1 páginaDisrupting Philanthropy: Technology and PolicyLucy BernholzAinda não há avaliações

- Border CrossingDocumento15 páginasBorder CrossingLucy BernholzAinda não há avaliações

- Guidestar 10 For 10 - FINALDocumento28 páginasGuidestar 10 For 10 - FINALLucy BernholzAinda não há avaliações

- NTEN Data Monster (07/29/10)Documento27 páginasNTEN Data Monster (07/29/10)Lucy Bernholz100% (1)

- State Agencies PhilanthropyDocumento7 páginasState Agencies PhilanthropyLucy BernholzAinda não há avaliações

- North South DivideDocumento27 páginasNorth South DivideAelirab AnnaAinda não há avaliações

- Azimio Machibya Matonge Vs The Repub Crim Appea No.35 of 2016 Hon - Juma, CJDocumento19 páginasAzimio Machibya Matonge Vs The Repub Crim Appea No.35 of 2016 Hon - Juma, CJTawan SalimAinda não há avaliações

- Inz 1146 Form For Partners - April 2016 - Fa - Web PDFDocumento6 páginasInz 1146 Form For Partners - April 2016 - Fa - Web PDFAKo Si JAkeAinda não há avaliações

- Ethics in International Affairs, Theories and Cases Written by Andrew Valls (Book Review) Jad El Hajj INA 811 Professor Sami Baroudy 06/1/2011Documento8 páginasEthics in International Affairs, Theories and Cases Written by Andrew Valls (Book Review) Jad El Hajj INA 811 Professor Sami Baroudy 06/1/2011elhajj_jadAinda não há avaliações

- Succession: Chanrobles Law LibraryDocumento4 páginasSuccession: Chanrobles Law LibraryChristine Rose Bonilla LikiganAinda não há avaliações

- FROM MARX TO GRAMSCI AND BACK AGAINDocumento16 páginasFROM MARX TO GRAMSCI AND BACK AGAINzepapiAinda não há avaliações

- RMC 80-91Documento5 páginasRMC 80-91cool_peachAinda não há avaliações

- Foundations of American Democracy (GoPo Unit 1)Documento170 páginasFoundations of American Democracy (GoPo Unit 1)Yuvika ShendgeAinda não há avaliações

- Types of Companies in RomaniaDocumento7 páginasTypes of Companies in RomaniaGabrielAlexandruAinda não há avaliações

- Labour Law Internal AnswersDocumento7 páginasLabour Law Internal AnswersSrinivas NuthalapatiAinda não há avaliações

- Intosai-P: Principles of Transparency and AccountabilityDocumento11 páginasIntosai-P: Principles of Transparency and AccountabilityishtiaqAinda não há avaliações

- Bir Ruling No 263-13Documento3 páginasBir Ruling No 263-13Rafael JuicoAinda não há avaliações

- The Occulted Powers of The British ConstitutionDocumento14 páginasThe Occulted Powers of The British ConstitutionSteven HendryAinda não há avaliações

- Child Marriage in Equatorial GuineaDocumento8 páginasChild Marriage in Equatorial GuineaHannah AmitAinda não há avaliações

- Arrest and Attachment Before JudgementDocumento19 páginasArrest and Attachment Before Judgementmahnoor tariqAinda não há avaliações

- 17th City Council Accomp ReportDocumento37 páginas17th City Council Accomp Reportbubblingbrook100% (1)

- Chris Chapter 0ne To FourDocumento46 páginasChris Chapter 0ne To FourAmih JamesAinda não há avaliações

- GGVDocumento2 páginasGGVKarlene Nicole RamosAinda não há avaliações

- Role of UN in Bridging The Gap BetweenDocumento12 páginasRole of UN in Bridging The Gap BetweenDEEPAK GROVER100% (1)

- Migration Into The Cyprus Conflict and The Cypriot Citizenship Regime 2019Documento48 páginasMigration Into The Cyprus Conflict and The Cypriot Citizenship Regime 2019Александра ИвановаAinda não há avaliações

- The Reality of GlobalizationDocumento3 páginasThe Reality of GlobalizationIrene Pines GarmaAinda não há avaliações

- IWDA PAC - 9761 - A - ContributionsDocumento2 páginasIWDA PAC - 9761 - A - ContributionsZach EdwardsAinda não há avaliações