Escolar Documentos

Profissional Documentos

Cultura Documentos

2 - Adani Ports and SEZ - ICRAA

Enviado por

Carol ChiramelDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2 - Adani Ports and SEZ - ICRAA

Enviado por

Carol ChiramelDireitos autorais:

Formatos disponíveis

Adani Ports and Special Economic Zone Limited

Amount Term Loans Non Fund Based Bank Limits Reduced from Rs.3131.34 crore to Rs. 2209.96 crore Enhanced from Rs. 944.00 crore to Rs. 2620.00 crore Rating Action [ICRA]AA- (Stable) reaffirmed [ICRA]AA- (Stable) reaffirmed

The long term rating of [ICRA]AA- (pronounced ICRA double A minus) has been reaffirmed to the Rs. 4829.96 crore (enhanced from Rs. 4075.34 crore) bank limits of Adani Ports and Special Economic Zone Limited (APSEZL) [formerly Mundra Port and Special Economic Zone Limited]. The long term rating carries a Stable outlook. ICRA also has an [ICRA]AA- rating on the Rs. 1275 crore Non Convertible Debenture programme and [ICRA]A1+ rating on the Rs. 625 crore Commercial Paper programme/short term debt programme of APSEZL. The ratings continue to reflect the strong business profile of Mundra port which has been consistently registering cargo growth at rates superior to the industry trend driven by its favourable operating characteristics viz. location, deep draft, multi-modal connectivity, highly mechanised port facilities; diversified cargo profile and long term customer tie-ups. In ICRAs view the medium to long term demand-supply scenario in the Indian port sector is expected to remain favourable driven by the anticipated trade growth and persisting congestion and capacity constraints at existing ports; this would in turn point to a favourable operating environment for well established incumbent operators like APSEZL. The ratings also factor in the currently strong financial position of APSEZL (Standalone) as reflected in its robust profitability; cash flows and credit metrics. Further, the companys revenues and profitability have a strong upside potential from the expected increase in cargo volumes resulting from its newly commissioned facilities (60 million tonnes dry bulk cargo terminal and 25 million tonnes SPM facility for crude oil handling for HMEL); those proposed over the medium term (additional bulk cargo handling facilities under ASPEZL and addition of third container terminal of 1.5 million TEU capacity under a subsidiary) and upscaling of business at SEZ and SPV level, which are expected to result in a healthy cash accrual position on a projected basis. Being a non-major port entity, APSEZL currently enjoys flexibility in tariff determination; this could however be vulnerable to an event based risk arising from the proposed provisions of the Draft Port Regulatory Bill 2011 which inter alia seeks to bring the tariff setting of non major ports under regulatory jurisdiction. The ratings are however constrained by the risks emanating from the companys recent large sized debt funded overseas acquisition (in Australia) including its indirect exposure to part of the debt which has been mobilized for funding the acquisition (US$0.8 billion borrowing based on a Letter of Comfort supported by APSEZL) and possibility of further cash flow support being extended by APSEZL to the overseas SPV in the event of any financial stress due to the strategic nature of the acquisition. While the business risks of the acquisition are partly tempered by the fact that the acquired asset is an already operating port terminal with long term take or pay cargo arrangements which gives it assured revenue streams, ICRA believes that over the medium term the financial profile of the overseas SPV is likely to be moderate owing to the gestation period associated with ramp up of cargo volumes and cash flows on one hand and high interest servicing burden resulting from high indebtedness on the other. Any significant slippages in the operating and financial performance of the overseas SPV and/or substantial increase in APSEZLs direct/indirect exposure to the SPV from the envisaged levels would be a key rating sensitivity. For refinancing the US$2 billion bridge loan which was initially used to fund the acquisition, APSEZL has already tied up US$0.8 billion debt at Australian holding company level which is backed by a letter of comfort from APSEZL. The company is in the process of tying up the standalone asset level funding of US$1.2 billion at the Australian subsidiary level and expects to achieve financial closure shortly. Any significant variation in the terms of this asset level funding from the proposed structure would be a rating sensitivity. While evaluating the credit profile of APSEZL, ICRA has also taken comfort from the company managements stated intent that they are evaluating various options to reduce the stress on the companys capital structure caused by this acquisition a s

well as other capex activities; the ability to do so over the near term shall be another key rating sensitivity. Apart from the substantial overseas exposure, APSEZL is in the midst of a large scale capex programme for its domestic operations (executing projects worth Rs. 6500 crore over FY 12-FY15 at standalone and SPV levels); the most recent addition being a new BOT terminal development at Kandla port for which the LOI has been recently awarded to APSEZL. The high capex outgo is expected to have a moderating impact on the level of the companys surplus cash flows; credit and return metrics over the medium term. The fact that most of these projects are being executed through SPVs; are funded on a project recourse basis; the companys so far conservative bidding pattern and the Groups strong demonstrated project execution track record, are some of the risk mitigants. ICRA further notes that APSEZL has various other projects in planning stage including further expansion at Mundra and pan India expansion through BOT and/or greenfield port ventures. Pending finalisation, these capex plans have not been factored in the current ratings. They will continue to be event based risks, impact of which will be assessed as and when the concerned plans materialize. ICRA also notes that the company has been extending temporary financial support to some of the ventures which are being carried on by its subsidiaries, the quantum of which is not significant at present. However going forward any material increase in support to subsidiaries might impact the credit quality of APSEZL. Over the longer term, the ports operations could face an increase in competitive pressures from the proposed expansion projects and new port developments on the Western coast; however the growing trade volumes and the fact that most of the proposed projects are in fairly early stages of execution at present, are risk mitigants. The companys operations are also exposed to event based risks emanating from pending litigations on the container terminal operations and SEZ development and corporate governance concerns emanating from past litigations against lead promoters/promoter group companies.

About the Company APSEZL is the developer and operator of the Mundra port located in the Kutch district of Gujarat on the west coast of India, under a 30-year Concession Agreement with the Gujarat Maritime Board (GMB), valid till February 2031. Currently 77.5% of the companys equity is held by Adani Enterprises Limited (flagship of the promoter Adani Group) while the balance is with the public. APSEZL commenced trial operations at Mundra port in 1998 and commercial operations in 2001 and in a decades time the port has grown to become the largest port in the country by cargo handling capacity (current capacity of 165 million tonnes). The port offers handling services for all kinds of cargoes viz. bulk- dry and liquid, crude and containers. Apart from the port operations, APSEZL is also the approved developer of a multi-product SEZ at Mundra and its surrounding areas. Further through its majority/wholly owned SPVs, APSEZL has a presence in the logistics business (container trains and ICDs) and is associated with port/terminal developments in Dahej; Hazira; Mormugao and Vizag in India and an overseas port asset in Australia. With effect from January 6, 2012, the company has changed its name to 'Adani Ports and Special Economic Zone Limited from 'Mundra Port and Special Economic Zone Limited' in order to have common identity with the promoter Adani Group. Recent Results In 2010-11, APSEZL handled cargo volumes of 52 million tonnes at Mundra port and reported an operating income (OI) of Rs. 1887 crore with a net profit (PAT) of Rs. 986 crore at a standalone level. In 9M 2011-12, the company has handled 49 million tonnes of cargo at the port and has reported an OI of Rs. 1840 crore with a PAT of Rs. 838 crore.

For further details please contact: Analyst Contact: Mr. K. Ravichandran, (Tel. No. +91-44-45964301) ravichandran@icraindia.com Relationship Contact: Mr. L. Shivakumar, (Tel. No. +91-22-30470005) shivakumar@icraindia.com

Copyright, 2012, ICRA Limited. All Rights Reserved. Contents may be used freely with due acknowledgement to ICRA

ICRA r a t in gs shou ld not be tr eat ed a s recom m en da t ion to bu y, sell or h old th e r a ted debt inst ru m en t s. Th e ICRA r a t in gs a re su bject to a process of su rveilla nce wh ich m a y lea d t o a revision in r a t ings. P lea se visit ou r website (www.icr a.in ) or con t a ct a ny ICRA office for t h e la test in form a tion on ICRA r a t in gs ou t st a n ding. All in form a t ion con t a in ed herein h as been obt ain ed by ICRA fr om sou rces believed by it t o be a ccu r a te a n d relia ble. Alt h ou gh r ea son a ble ca re h a s been t a ken t o en sur e t h a t t he in form a t ion h erein is t r ue, su ch in form a t ion is pr ovided a s is wit h ou t a ny wa r r an t y of a n y kin d, a n d ICRA in pa r t icu la r , m a kes no repr esen t a t ion or war r a n t y, expr ess or im plied, a s to t he a ccu r acy, t im eliness or com pleteness of an y su ch in for m a t ion. All in for m a t ion con t a ined her ein m u st be const r ued solely a s st a tem en ts of opin ion a n d ICRA sh all n ot be lia ble for a n y losses in cu r red by u sers from a n y u se of th is pu blica t ion or it s con ten ts

Registered Office ICRA Limited 1105, Kailash Building, 11th Floor, 26, Kasturba Gandhi Marg, New Delhi 110001 Tel: +91-11-23357940-50, Fax: +91-11-23357014 Corporate Office Mr. Vivek Mathur Mobile: 9871221122 Email: vivek@icraindia.com Building No. 8, 2nd Floor, Tower A, DLF Cyber City, Phase II, Gurgaon 122002 Ph: +91-124-4545310 (D), 4545300 / 4545800 (B) Fax; +91-124-4545350 Mumbai Mr. L. Shivakumar Mobile: 91-22-30470005/9821086490 Email: shivakumar@icraindia.com 3rd Floor, Electric Mansion, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025 Ph : +91-22-2433 1046/ 1053/ 1062/ 1074/ 1086/ 1087 Fax : +91-22-2433 1390 Chennai Mr. Jayanta Chatterjee Mobile: 9845022459 Email: jayantac@icraindia.com 5th Floor, Karumuttu Centre, 498 Anna Salai, Nandanam, Chennai-600035. Tel: +91-44-2433 3293/ 94, 2434 0043/ 9659/ 8080, 2433 0724, Fax:91-44-24343663 Ahmedabad Mr. L. Shivakumar Mobile: 9821086490 Email: shivakumar@icraindia.com 907 & 908 Sakar -II, Ellisbridge, Ahmedabad- 380006 Tel: +91-79-26585494, 26582008,26585049, 26584924 TeleFax:+91-79- 2648 4924 Hyderabad Mr. M.S.K. Aditya Mobile: 9963253777 Email: adityamsk@icraindia.com 301, CONCOURSE, 3rd Floor, No. 7-1-58, Ameerpet, Hyderabad 500 016. Tel: +91-40-2373 5061 /7251 Fax: +91-40- 2373 5152 Kolkata Ms. Anuradha Ray Mobile: 91-33-22813158/9831086462 Email: anuradha@icraindia.com A-10 & 11, 3rd Floor, FMC Fortuna, 234/ 3A, A.J.C. Bose Road, Kolkata-700020. Tel: +91-33-2287 6617/ 8839/ 2280 0008 Fax: +91-33-2287 0728 Bangalore Mr. Jayanta Chatterjee Mobile: 9845022459 Email: jayantac@icraindia.com 2 nd Floor. ,Vayudhoot Chambers, Trinity Circle, 15-16 M.G.Road, Bangalore-560001. Tel:91-80-25597401/ 4049 Fax:91-80-25594065 Pune Mr. L. Shivakumar Mobile: 9821086490 Email: shivakumar@icraindia.com 5A, 5th Floor, Symphony, S.No. 210, CTS 3202, Range Hills Road, Shivajinagar,Pune-411 020 Tel : (91 20) 2556 1194 -96; Fax : (91 20) 2556 1231

Você também pode gostar

- 5 PCR Investments NCD 100CrDocumento2 páginas5 PCR Investments NCD 100CrCarol ChiramelAinda não há avaliações

- 3 IL&FS Transportation ICRA ADocumento3 páginas3 IL&FS Transportation ICRA ACarol ChiramelAinda não há avaliações

- 1 - HPCL-Mittal Energy LimitedDocumento3 páginas1 - HPCL-Mittal Energy LimitedCarol ChiramelAinda não há avaliações

- LowDocumento9 páginasLowCarol ChiramelAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Philippine Laws On WomenDocumento56 páginasPhilippine Laws On WomenElle BanigoosAinda não há avaliações

- Combinepdf PDFDocumento487 páginasCombinepdf PDFpiyushAinda não há avaliações

- ParlPro PDFDocumento24 páginasParlPro PDFMark Joseph SantiagoAinda não há avaliações

- FEE SCHEDULE 2017/2018: Cambridge IGCSE Curriculum Academic Year: August 2017 To July 2018Documento1 páginaFEE SCHEDULE 2017/2018: Cambridge IGCSE Curriculum Academic Year: August 2017 To July 2018anjanamenonAinda não há avaliações

- FortiClient EMSDocumento54 páginasFortiClient EMSada ymeriAinda não há avaliações

- Hydrostatic Testing of Control ValvesDocumento34 páginasHydrostatic Testing of Control ValvesMuhammad NaeemAinda não há avaliações

- NSF International / Nonfood Compounds Registration ProgramDocumento1 páginaNSF International / Nonfood Compounds Registration ProgramMichaelAinda não há avaliações

- Cambodia vs. RwandaDocumento2 páginasCambodia vs. RwandaSoksan HingAinda não há avaliações

- China National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseDocumento2 páginasChina National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseMd Abdur RahmanAinda não há avaliações

- Ultra 3000 Drive (2098-In003 - En-P)Documento180 páginasUltra 3000 Drive (2098-In003 - En-P)Robert BarnetteAinda não há avaliações

- Assembly ScriptDocumento3 páginasAssembly ScriptMary Ellen100% (1)

- HIRING OF VEHICLEsDocumento2 páginasHIRING OF VEHICLEsthummadharaniAinda não há avaliações

- MOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国Documento9 páginasMOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国qweku jayAinda não há avaliações

- Filipino ValuesDocumento26 páginasFilipino ValuesDan100% (14)

- Receivable Financing IllustrationDocumento3 páginasReceivable Financing IllustrationVatchdemonAinda não há avaliações

- Position Paper in Purposive CommunicationDocumento2 páginasPosition Paper in Purposive CommunicationKhynjoan AlfilerAinda não há avaliações

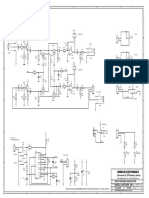

- Nobels Ab1 SwitcherDocumento1 páginaNobels Ab1 SwitcherJosé FranciscoAinda não há avaliações

- Document 5Documento6 páginasDocument 5Collins MainaAinda não há avaliações

- 18.2 Gargallo vs. DOHLE Seafront Crewing August 2016Documento10 páginas18.2 Gargallo vs. DOHLE Seafront Crewing August 2016French Vivienne TemplonuevoAinda não há avaliações

- Business Myth's About Ethics in BusinessDocumento4 páginasBusiness Myth's About Ethics in BusinessDoc Wad Negrete Divinaflor100% (1)

- Annual Report 17-18Documento96 páginasAnnual Report 17-18Sajib Chandra RoyAinda não há avaliações

- Henry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Documento7 páginasHenry E. Prunier v. Commissioner of Internal Revenue, 248 F.2d 818, 1st Cir. (1957)Scribd Government DocsAinda não há avaliações

- Kingsbridge Armory Request For Proposals 2011 FF 1 11 12Documento54 páginasKingsbridge Armory Request For Proposals 2011 FF 1 11 12xoneill7715Ainda não há avaliações

- Arbitration ClauseDocumento5 páginasArbitration ClauseAnupama MahajanAinda não há avaliações

- Tugas AKM II Minggu 9Documento2 páginasTugas AKM II Minggu 9Clarissa NastaniaAinda não há avaliações

- Muhammad Al-MahdiDocumento13 páginasMuhammad Al-MahdiAjay BharadvajAinda não há avaliações

- Case Report Cirilo Paredes V EspinoDocumento2 páginasCase Report Cirilo Paredes V EspinoJordan ProelAinda não há avaliações

- Practice in The Trial of Civil SuitsDocumento54 páginasPractice in The Trial of Civil SuitsCool dude 101Ainda não há avaliações

- The Procurement Law No. 26 (2005) PDFDocumento27 páginasThe Procurement Law No. 26 (2005) PDFAssouik NourddinAinda não há avaliações

- Introduction To The Study of RizalDocumento2 páginasIntroduction To The Study of RizalCherry Mae Luchavez FloresAinda não há avaliações