Escolar Documentos

Profissional Documentos

Cultura Documentos

ATM Management System

Enviado por

vijimudaliarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ATM Management System

Enviado por

vijimudaliarDireitos autorais:

Formatos disponíveis

Functionality

ATM management efficiency, reliability, and security play an important role in producing a positive bank's image. The WAY4 ATM Management module enables banks and processing companies to create a wide service line via ATM Network, from cash withdrawals and mini-statements to instant account top-up by cash and currency exchange. It uses communication and cryptography innovations, automates routine operations, and provides users with convenient ATM management facilities and monitoring tools. ATM Services Information services Balance inquiry / balance printing Credit limit and other account details Mini-statement (10 last transactions) Statements Account selection Cash functions Cash withdrawal Cash acceptance (envelope/deposit and note acceptance) Currency exchange Cash bill payments Cash prepaid services Cash by code Payments and transfers Account transfers P2P fund transfers Bill payments Prepaid services Self-service purchase (CAT/ADM) Account and profile management PIN change Block card Service activation Marketing Marketing messages Loyalty program support Protocols and Formats All major formats Diebold 912 (DDC) NDC/NDC+ ProCash

Transport protocols X.25 TCP/IP Other ATM Monitoring and Management Real-time ATM status management and monitoring Real-time cassettes monitoring Real-time hardware status monitoring Automatic real-time per-transaction balancing Dispense and Replenishment reconciliation and accounting Remote configuring, see: WAY4 NDC/DDC Configuration Builder Statistic analyser, see: WAY4 ATM/Kiosk Statistic Analyser Risk Management EMV smart cards and hybrid technologies ATM key management, dynamic key change MAC (Message Authentication Code) DES, 3DES Multi... Multiple currencies Multiple languages Multiple time zones

What's New

Cash by Code Cardholders sometimes need a reliable way to send money to relatives or friends. Even when recipients have their own card or bank account, it can get complicated how much more so, if they have no relationship with any bank! In this case, senders have to cash their funds and make a standard money transfer. This is inconvenient for two reasons: one, the cash withdrawal fees, and two, the money, time, and effort spent on the money transfer itself. This is why OpenWay is offering a new WAY4 functionality, Cash by Code. It allows cardholders to block the necessary amount in their account, which can later be withdrawn at an ATM through a cardless transaction. It's secure, because the transaction is only authorised through a secret code that the payee must know to receive funds. WAY4 Cash by Code enables bank customers to block funds in their card accounts and preauthorise another person to receive the blocked amount through an ATM without the card.

To authenticate the transfer recipient, a special code is used. The code is generated by WAY4 and sent to the cardholder. Next, the cardholder lets the recipient know of the code. Finally, the payee enters the code in an ATM and gets cash. The WAY4 Cash by Code service is normally used to process on-us transactions. The WAY4 Host System Interface module allows the service to process inter-bank transactions as well. In this case, the issuer and acquirer exchange information through a dedicated channel.

Benefits

Variety of ATM services All major ATM brands and protocols Comprehensive ATM monitoring Transaction security Proven EMV full grade/option, Pre-authorised technology Automatic ATM management rules and monitoring tools Load balancing Support for thousands of ATMs in standard configuration

ATM Management System

Speed and reliability in ATM management Banksoft ATM Management System offers uninterrupted, fast and reliable link with all banking systems to actively promote client satisfaction. Banksoft ATM Management System can be associated with an unlimited number of terminals in theory. The flexible solutions provided by the Banksoft ATM Management System enables Visa, Mastercard and private label cards to complete a variety of banking transactions on ATMs managed by the system. ATMs Supported

NCR Wincor Nixdorf Diebold Other brands

Features

ATM sharing with domestic and foreign banks In-depth and online tracking of ATM line and unit statuses Notification of ATM unit, line and system statuses to authorized personnel via text, email and other messaging media Online monitoring of system peripheral statuses Configuration transfer and version tracking by the center File distribution from the center to ATMs and uploading ATM files to the center Day-end transactions and ATM cash monitoring from the center A wide variety of tracking and reporting options End-to-end PIN security with HSM Remote Key Loading: Transfer of keys from the center to ATMs without physical key input on individual ATMs ATM Message Encryption for end-to-end ATM security E-Journal Management for offloading e-journal files on ATMs to the bank data center Foreign currency transactions on ATMs (ATM Exchange Office) High-performance solutions for Windows platforms (multitasking servers for NDC, NDC+, Aptra Advance NDC, IBM 912 and XFS-based special messages) Support for NCR, Wincor Nixdorf, Diebold, Bull and other brands of ATMs Support for leading ATM communication protocols (X25, TCP/IP, TTY, SNA, Wireless) Web-based branch application integration ATM EMV Card Acquiring function Integration with various banking systems (Windows, Unix, Mainframe)

Advantages to Banks Banksoft ATM Management System is designed to establish fast, reliable and uninterrupted links with all banking systems. A theoretically unlimited number of ATMs of all brands can operate within the Banksoft ATM Management System. Banksoft ATM Management System complies with banks, the Banking Regulation and Supervision Agency (BDDK) and PCI regulations.

Você também pode gostar

- Hacking Point of Sale: Payment Application Secrets, Threats, and SolutionsNo EverandHacking Point of Sale: Payment Application Secrets, Threats, and SolutionsNota: 5 de 5 estrelas5/5 (1)

- AtmDocumento75 páginasAtmahmedtani100% (1)

- Remote Key LoadDocumento8 páginasRemote Key LoadHafedh TrimecheAinda não há avaliações

- VISA CC Acceptance Device TestingDocumento36 páginasVISA CC Acceptance Device Testingqwerasdf100Ainda não há avaliações

- Electronic Financial Services: Technology and ManagementNo EverandElectronic Financial Services: Technology and ManagementNota: 5 de 5 estrelas5/5 (1)

- Quick Chip Emv SpecificationDocumento11 páginasQuick Chip Emv Specification1234567890Ainda não há avaliações

- Guide: ATM Cash Management 101Documento44 páginasGuide: ATM Cash Management 101abinash234Ainda não há avaliações

- Export Credit Insurance and Guarantees: A Practitioner's GuideNo EverandExport Credit Insurance and Guarantees: A Practitioner's GuideAinda não há avaliações

- EMV Testing Certification V1.0-080213 PDFDocumento31 páginasEMV Testing Certification V1.0-080213 PDFMaximo Decimo Fredwuardo MeridioAinda não há avaliações

- Commercial Banking APIs A Complete Guide - 2019 EditionNo EverandCommercial Banking APIs A Complete Guide - 2019 EditionAinda não há avaliações

- Ingenico EMV FAQ 07052012Documento36 páginasIngenico EMV FAQ 07052012Faizan Hussain100% (1)

- Credit Card Processing Srs - Google SearchDocumento2 páginasCredit Card Processing Srs - Google SearchSiva PemmasaniAinda não há avaliações

- Pin Managment For IC Card Member Implementation GuideDocumento66 páginasPin Managment For IC Card Member Implementation GuideWei JiannAinda não há avaliações

- 3D Secure 3Documento30 páginas3D Secure 3kominminAinda não há avaliações

- ECHO ISO 8583 Technical Specification V1.6.5Documento115 páginasECHO ISO 8583 Technical Specification V1.6.5Diego Alejandro Guzman BassAinda não há avaliações

- Smart card management system The Ultimate Step-By-Step GuideNo EverandSmart card management system The Ultimate Step-By-Step GuideAinda não há avaliações

- EMV Tokenization Encryption WP FINALDocumento34 páginasEMV Tokenization Encryption WP FINALSratixAinda não há avaliações

- Guidelines On Operations of Electronic Payment Channels in GhanaDocumento33 páginasGuidelines On Operations of Electronic Payment Channels in GhanashanrimazAinda não há avaliações

- HSM I&O Manual 1270A513-3 PDFDocumento202 páginasHSM I&O Manual 1270A513-3 PDFrzaidi921Ainda não há avaliações

- ISO 8583 - Card Message StandardsDocumento10 páginasISO 8583 - Card Message Standardsgupadhya68Ainda não há avaliações

- ATM Project Test Plan: Authors: Matthew Heusser Tabrez Sait Patrick M. BaileyDocumento32 páginasATM Project Test Plan: Authors: Matthew Heusser Tabrez Sait Patrick M. BaileyGopal YadavAinda não há avaliações

- Transaction Acceptance Device Guide TADG V3 May 2015 PDFDocumento273 páginasTransaction Acceptance Device Guide TADG V3 May 2015 PDFNirvana Munar MenesesAinda não há avaliações

- TechTrex Company & SecurePro Introduction V16Documento27 páginasTechTrex Company & SecurePro Introduction V16kab4kjdAinda não há avaliações

- Emv TVRDocumento19 páginasEmv TVRkeerthukanthAinda não há avaliações

- Merchant Fees Guide 1Documento8 páginasMerchant Fees Guide 1Winston BoonAinda não há avaliações

- ABc of Credit CardDocumento9 páginasABc of Credit CardamitrathaurAinda não há avaliações

- Credit Card System OOADDocumento27 páginasCredit Card System OOADArun Kumar63% (8)

- AcquirerMerchant 3DS QRG 9.06.18Documento2 páginasAcquirerMerchant 3DS QRG 9.06.18Rabih AbdoAinda não há avaliações

- Visa Smart Debit Credit Acquirer Device Validation ToolkitDocumento214 páginasVisa Smart Debit Credit Acquirer Device Validation Toolkitayanthak100% (2)

- Visa Smart Debit/ Credit Transaction Flow OverviewDocumento51 páginasVisa Smart Debit/ Credit Transaction Flow OverviewRabindranath Thanikaivelu100% (5)

- Automated Teller Machine TrainingDocumento91 páginasAutomated Teller Machine TrainingAmadasun Bigyouth Osayi100% (4)

- Software Requirement Specification For HDFC BankDocumento13 páginasSoftware Requirement Specification For HDFC BankVishal RajputAinda não há avaliações

- Credit Cards SO APIDocumento517 páginasCredit Cards SO APIMarcos PauloAinda não há avaliações

- 8 Credit Card System OOADDocumento29 páginas8 Credit Card System OOADMahesh WaraAinda não há avaliações

- AEPS Interface Specifications Version 5.2 - 20042018 PDFDocumento100 páginasAEPS Interface Specifications Version 5.2 - 20042018 PDFKiran Dummy100% (1)

- ATM Timeout or Command RejectDocumento21 páginasATM Timeout or Command RejectDass HariAinda não há avaliações

- Visa Money Transfer Clients Short Version 13 April 2010Documento21 páginasVisa Money Transfer Clients Short Version 13 April 2010rwilson66100% (1)

- Not To Be Confused With,, or - For More Information About Wikipedia-Related Phishing Attempts, SeeDocumento14 páginasNot To Be Confused With,, or - For More Information About Wikipedia-Related Phishing Attempts, SeeNanditha AithaAinda não há avaliações

- Online Payment Processing:: What You Need To KnowDocumento14 páginasOnline Payment Processing:: What You Need To KnowShop YourMedsAinda não há avaliações

- Visa International Operating Regulations MainDocumento1.218 páginasVisa International Operating Regulations Mainbcooper477100% (3)

- ATM Management SystemDocumento2 páginasATM Management SystemKanu Priya100% (1)

- Credit Card Management SystemDocumento2 páginasCredit Card Management Systemprathikfrndz50% (2)

- Atm Test ConditionsDocumento10 páginasAtm Test Conditionsneetu kalraAinda não há avaliações

- Chip Card Terminolgy Explained PDFDocumento15 páginasChip Card Terminolgy Explained PDFMuhammad Asad Bin Faruq100% (1)

- Cheque Management System FinalDocumento35 páginasCheque Management System FinalPrerna Sharma0% (1)

- Master Card Credit Authorization SimulatorDocumento220 páginasMaster Card Credit Authorization SimulatorСергій Глоба80% (5)

- Chip Card Acceptance Device Ref Guide 6 (1) .0Documento143 páginasChip Card Acceptance Device Ref Guide 6 (1) .0dovuducAinda não há avaliações

- Iso8583 UDF ManualDocumento2 páginasIso8583 UDF ManualsybondAinda não há avaliações

- Vis 131 ADocumento238 páginasVis 131 ADerek ChanAinda não há avaliações

- Policy and Procedure ManualDocumento117 páginasPolicy and Procedure ManualAnonymous kbmKQLe0J100% (2)

- Chapter10 Electronic Commerce Payment Systems 10Documento27 páginasChapter10 Electronic Commerce Payment Systems 10Cường NguyễnAinda não há avaliações

- EMV-L2 ST100 DraftDocumento72 páginasEMV-L2 ST100 DraftAndali AliAinda não há avaliações

- Pay Men Tech Response MessagesDocumento16 páginasPay Men Tech Response MessagesMahesh Nakhate100% (1)

- Login FormDocumento7 páginasLogin FormvijimudaliarAinda não há avaliações

- Chapter 3 Microsoft Word DocmentDocumento6 páginasChapter 3 Microsoft Word DocmentvijimudaliarAinda não há avaliações

- Consumers' Buying Behavior of Branded Apparel in Mall of Ahmedabad CityDocumento5 páginasConsumers' Buying Behavior of Branded Apparel in Mall of Ahmedabad CityvijimudaliarAinda não há avaliações

- In Law and PoliticsDocumento1 páginaIn Law and PoliticsvijimudaliarAinda não há avaliações

- Chapter - 1 Introduction To Consumer Behavior Towards Shopping MallDocumento32 páginasChapter - 1 Introduction To Consumer Behavior Towards Shopping MallvijimudaliarAinda não há avaliações

- Chapter - 1 Introduction To Consumer Behavior Towards Shopping MallDocumento32 páginasChapter - 1 Introduction To Consumer Behavior Towards Shopping MallvijimudaliarAinda não há avaliações

- BhoomikaDocumento1 páginaBhoomikavijimudaliarAinda não há avaliações

- Consumers' Buying Behavior of Branded Apparel in Mall of Ahmedabad CityDocumento7 páginasConsumers' Buying Behavior of Branded Apparel in Mall of Ahmedabad CityvijimudaliarAinda não há avaliações

- Visa Smart Debit/Credit Acquirer Device Validation Toolkit: User GuideDocumento163 páginasVisa Smart Debit/Credit Acquirer Device Validation Toolkit: User Guideart0928Ainda não há avaliações

- An Internship Report On "Financial Performance Analysis of Trust Bank LTDDocumento35 páginasAn Internship Report On "Financial Performance Analysis of Trust Bank LTDahsan habibAinda não há avaliações

- LKPD BAHASA INGGRIS (Kls 10)Documento10 páginasLKPD BAHASA INGGRIS (Kls 10)Intania AlifaAinda não há avaliações

- Card Issuer Response CodesDocumento3 páginasCard Issuer Response CodesDoutor NefariusAinda não há avaliações

- A Project On Banking SectorDocumento81 páginasA Project On Banking SectorAkbar SinghAinda não há avaliações

- English For IT StudentsDocumento527 páginasEnglish For IT StudentsGadkiy PonchikAinda não há avaliações

- Mis ReportDocumento33 páginasMis Reportginish12Ainda não há avaliações

- E-Banking Services and Performance of Top Performer Commercial Banks in EthiopiaDocumento63 páginasE-Banking Services and Performance of Top Performer Commercial Banks in EthiopiaTSEDEKE67% (3)

- DBSDocumento14 páginasDBSBenson ChooAinda não há avaliações

- A Technical Seminar ReportDocumento28 páginasA Technical Seminar Reportnishitha pachimatlaAinda não há avaliações

- Kotak Mahindra Project NewDocumento105 páginasKotak Mahindra Project NewPrgya SinghAinda não há avaliações

- Marketing Application in Banking and Insurance ServicesDocumento41 páginasMarketing Application in Banking and Insurance ServicesAshish DeoliAinda não há avaliações

- Delivery Channels in Retail BankingDocumento5 páginasDelivery Channels in Retail BankingSahibaAinda não há avaliações

- Bank Management System: International Journal of Engineering Research in Computer Science and Engineering (Ijercse)Documento6 páginasBank Management System: International Journal of Engineering Research in Computer Science and Engineering (Ijercse)Andenet TesfahunAinda não há avaliações

- E-Banking Facility Services in The Philippines: August 2020Documento14 páginasE-Banking Facility Services in The Philippines: August 2020SAIsanker DAivAMAinda não há avaliações

- Factores Affecting Custommers' Satisfaction Towards The Use of Automated Teller Machines (ATMS)Documento11 páginasFactores Affecting Custommers' Satisfaction Towards The Use of Automated Teller Machines (ATMS)anwar muhammedAinda não há avaliações

- CBQ Toc 05102016 enDocumento10 páginasCBQ Toc 05102016 ensyed muffassirAinda não há avaliações

- Acct Statement - XX9566 - 04012023Documento4 páginasAcct Statement - XX9566 - 04012023ANKIT SINGHAinda não há avaliações

- What Nigerians Think of The Cashless Economy PolicyDocumento1 páginaWhat Nigerians Think of The Cashless Economy PolicyObodo EjiroAinda não há avaliações

- ProjectDocumento29 páginasProjectSubhash BajajAinda não há avaliações

- LANDBANK New MBA FlyerDocumento2 páginasLANDBANK New MBA FlyerClinton M. AclibonAinda não há avaliações

- Retail Banking ChannelsDocumento6 páginasRetail Banking Channelsbeena antuAinda não há avaliações

- A Project Study On Banking at HDFC Bank LTDDocumento99 páginasA Project Study On Banking at HDFC Bank LTDManjeet SinghAinda não há avaliações

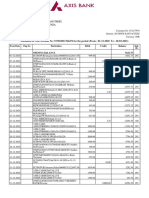

- Axis Bank Latest StatementDocumento4 páginasAxis Bank Latest StatementPrashant KumarAinda não há avaliações

- NCR Atm M Status Code Translator Atm M Status Code Translator Atm Error Code TranslatorDocumento4 páginasNCR Atm M Status Code Translator Atm M Status Code Translator Atm Error Code TranslatorNiko NikicAinda não há avaliações

- Anarchist Cookbook 2004 (Part-2)Documento2 páginasAnarchist Cookbook 2004 (Part-2)Jagmohan JagguAinda não há avaliações

- Card Member Declaration Form Final1Documento1 páginaCard Member Declaration Form Final1smsmbaAinda não há avaliações

- Indus Freedom February2017Documento1 páginaIndus Freedom February2017HeartKiller LaxmanAinda não há avaliações

- CIE A Level IT Sample 3rd-Proof Watermark.Documento78 páginasCIE A Level IT Sample 3rd-Proof Watermark.Win Yu KhineAinda não há avaliações

- BN203 PaymentsDocumento123 páginasBN203 PaymentsManish Grover100% (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InNo EverandGetting to Yes: How to Negotiate Agreement Without Giving InNota: 4 de 5 estrelas4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (13)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!No EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Nota: 4.5 de 5 estrelas4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessNo EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessNota: 4.5 de 5 estrelas4.5/5 (28)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)No EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Nota: 4 de 5 estrelas4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNo EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNota: 4 de 5 estrelas4/5 (7)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineAinda não há avaliações

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNo EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNota: 4.5 de 5 estrelas4.5/5 (14)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNo EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNota: 4.5 de 5 estrelas4.5/5 (14)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNo EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNota: 5 de 5 estrelas5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)No EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Nota: 4.5 de 5 estrelas4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeNo EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeNota: 4 de 5 estrelas4/5 (21)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNo EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNota: 4.5 de 5 estrelas4.5/5 (760)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNo EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookNota: 5 de 5 estrelas5/5 (4)

- Controllership: The Work of the Managerial AccountantNo EverandControllership: The Work of the Managerial AccountantAinda não há avaliações

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityNo EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityAinda não há avaliações

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookNo EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookAinda não há avaliações

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)No EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Nota: 4.5 de 5 estrelas4.5/5 (5)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditNo EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditNota: 5 de 5 estrelas5/5 (1)