Escolar Documentos

Profissional Documentos

Cultura Documentos

Tonnage Tax

Enviado por

karandeep89Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tonnage Tax

Enviado por

karandeep89Direitos autorais:

Formatos disponíveis

Tonnage tax: the cost-effective method for shipping industries

Mayank Chandrakar[1]

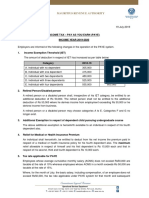

Shipping plays an important role in the transport sector of Indias economy. Approximately, 95% of the countrys merchandise trade by volume (70% in terms of value) is moved by sea. India has one of the largest merchant shipping fleet among the developing countries and is ranked 17th in the world. Indian maritime sector facilitates not only transportation of national and international cargoes but also provides a variety of other services such as cargo handling services, shipbuilding and ship repairing, freight forwarding, light house facilities, training of marine personnel, etc. This Part provides an alternative method (called tonnage tax) for calculating the shipping related profits of a company for corporation tax purposes. The term Tonnage Tax while standard in the various countries which have introduced similar measures is something of a misnomer. Tonnage Tax is not itself a tax, rather it is an alternative method by which shipping companies may calculate their shipping related profits for corporation tax purposes. The shipping related profits once calculated using the tonnage tax method are subject to the 12.5 per cent rate of corporation tax. The profits are calculated by reference to the tonnage of the ships used in a companys shipping trade and hence the title. Essentially, the tonnage profits replace the accounting profits of the shipping company for tax purposes.

2. Basic Feature of Tonnage Tax.

The shipping industry has demanded the levy of a tonnage tax to make it intentionally competitive. Tonnage tax will also induce more ships to fly the Indian flag. Consequently, the most of the shipping company withdrawn paying tax on shipping business income in a normal corporate tax[2] method and will now have only an option to pay the tonnage tax.[3] As Govt. of India has introduced tonnage tax in the Finance Bill, 2004, it has come into force w.e.f 1.4.2004.[4] The window period for existing qualifying companies exercising option for tonnage tax is available in terms of Income Tax Act, 1961[5] as amended by Finance Act, 2004. 2A. what is the alternative tonnage tax? Tonnage tax is a charge or impost for bringing a ship into port usually assessed on the basis of the ships weight.[6] The alternative tonnage tax is essentially a flat tax based on vessel tonnage and the number of days the vessel was operated in the international trades. If elected, the alternative tonnage tax is imposed in lieu of the normal corporate income tax with respect to the operation of the taxpayer qualifying vessels.[7] If the alternative tonnage tax is elected with respect to the taxpayer qualifying vessels, it is imposed in lieu of the normal corporate income tax. Therefore, all items of income, deduction (with limited exceptions), loss or credit associated with the taxpayer qualifying vessels are

excluded from the taxpayer normal corporate income tax return and are entirely replaced by the relatively simple tonnage tax. [8] 2B. who can elect the alternative tonnage tax? In general the alternative tonnage tax may be elected by qualifying shipping companies [9]. To be more specific, the tonnage tax regime may be elected by a qualifying vessel operator with respect to its qualifying vessels[10]. The election of the tonnage tax in lieu of the regular corporate income tax can be made with respect to a taxable year at any time before the due date (including extensions) for filing the tax return for that year. The election remains effective until revoked or until the taxpayer ceases to be a qualifying vessel operator, in which case revocation is automatic as of such date. 2C. Scope, Timing and Duration of the Election If the tonnage tax is elected by following the procedure[11], it replaces the standard corporate income tax with respect to income derived by the taxpayer from its qualifying shipping activities. In other words, if the tonnage tax is elected, any income earned by the taxpayer from qualifying shipping activities is excluded from the taxpayer gross income otherwise subject to the standard corporate income tax. Income from activities other than relevant shipping income (e.g. income from the operation of vessels in the domestic trades) remains subject to the normal income tax.[12] Complications may arise, however, with respect to the proper allocation of deductible overhead expenses to the portion of business not subject to the tonnage tax regime. For these purposes, tax deductions otherwise allowable that are attributable to qualifying vessels subject to the tonnage tax are effectively ignored. The definition of qualifying shipping activities encompasses more than just freight earned from the carriage of cargo in international trades. It is therefore important to carefully identify all income derived from qualifying shipping activities in order to obtain the greatest benefit from electing the alternative tonnage tax. Qualifying shipping activities are divided into three groups: (i) core qualifying activities, (ii) qualifying secondary activities, and (iii) qualifying incidental activities. Core qualifying activities involve the operation of qualifying vessels in international trades. Qualifying secondary activities include (among other things) managing and operating non-qualifying vessels in international trades, providing vessel, container and cargo-related services, and other activities of the taxpayer that are an integral part of its business of operating qualifying vessels in the international trades. It should be noted that gross income from qualifying secondary activities may be excluded from gross income otherwise subject to the standard corporate income tax only to the extent that gross income from qualifying secondary activities does not exceed 20 percent of gross income from core qualifying activities. Income from qualifying incidental activities (defined generally as activities that are incidental[13] to the taxpayer core qualifying activities but do not qualify as secondary qualifying activities) may also be excluded from gross income otherwise subject to the standard corporate income tax, but only to the extent that gross income from such activities does not exceed 0.1 percent of the taxpayer gross income from its core qualifying activities.

The purpose of Tonnage Tax is not specifically to provide a tax break for shipping. The intention behind tonnage tax is to provide a number of real advantages for all shipping companies which enter the regime. These include: A. Certainty, since the level of tax will be know and minimal. This reduces the need for a company to make provision in its accounts for deferred taxation, thereby increasing earnings per share. B. Flexibility, since companies will have more freedom to choose when to buy ships and how to finance them. These decisions will now largely be determined by commercial rather than tax considerations. C. Clarity, a companys tax position will now be more readily understood; consequently the company may become more attractive to investors and potential business partners. D. Compatibility and competitiveness, with the fiscal regimes of other countries. This is particularly important from the point of view of maintaining and developing our indigenous shipping industry.

3. Elective nature of Tonnage Tax

The tonnage tax scheme is elective, companies may choose whether to stay in the normal corporation tax system or move their shipping activities into tonnage tax. If a company enters tonnage tax it must stay in it for a minimum of 10 years.[14] The commitment to stay in for 10 years can be renewed at any time.[15] Companies have a period of 3 years beginning from the date the Minister for Finance makes the order commencing the scheme to make up their minds whether they want to enter the scheme. Where a qualifying ship is operated by two or more companies by way of joint interest in the ship or by way of an agreement for the use of the ship and their respective share and definite and ascertainable[16], the tonnage income of each such company shall be an amount equal to a share of income proportionate to its share of that interest.[17] This Part provides an alternative method (called tonnage tax) for calculating the shipping related profits of a company for corporation tax purposes. The term Tonnage Tax while standard in the various countries which have introduced similar measures is something of a misnomer. Tonnage Tax is not itself a tax, rather it is an alternative method by which shipping companies may calculate their shipping related profits for corporation tax purposes. The shipping related profits once calculated using the tonnage tax method are subject to the 12.5 per cent rate of corporation tax. The profits are calculated by reference to the tonnage of the ships used in a companys shipping trade and hence the title. Essentially, the tonnage profits replace the accounting profits of the shipping company for tax purposes.

4. The most important income sources which qualify for shelter under the tonnage tax are

Income from activities which are related to the actual operation of a qualifying ship (for example, profits from the carriage of cargo or passengers at sea). Income from activities carried out on board qualifying ships which are ancillary to these activities such as the operation of cinemas, bars, shops, restaurants, etc. where the goods and services provided are consumed on board a qualifying ship. Income from activities which are undertaken in order for these shipping operations to be undertaken (such as embarkation/disembarkation services, tickets sales, hire of containers, etc). Income from the provision of ship management services for qualifying ships.

Capital allowances, balancing charges and capital gains are not a part of the tonnage tax scheme once a company is established in tonnage tax. However, these matters do come into play in relation to certain transitional arrangements which may leave companies open to some balancing charges and some capital gains charges in relation to assets acquired before entry to tonnage tax. These charges, however, will not arise until a ship is sold and even then reliefs are available which will defer any balancing charge if there is re-investment in a new ship or reduce or eliminate any such charge by reference to either the time the company has been in tonnage tax or to unrelieved losses incurred before entry to tonnage tax. Income from ship related activities which are a necessary and integral part of the business of operating the companys qualifying ships. By necessary and integral is meant activities which are both required for the business of operating the companys qualifying ships and which enable the company to carry on its business of operating those ships. In cases of income of a non-qualifying ship to be computed as per normal provisions.[18]

5. Rakesh Mohan Committee on Tonnage Tax

The Ministry of Finance constituted an Expert Committee under the Chairmanship of Shri Rakesh Mohan, Adviser to Finance Minister to review the Indian Shipping and suggest measures to address its problems. The Committee in its report recommended introduction of tonnage tax as is followed by the leading Maritime Nations of the world. The report of the Committee and recommendations thereon have been accepted by this Ministry and referred to Ministry of Finance for implementation. [19] The Committee is of the view that that Shipping Industry can play important role in the development of national economy. Therefore, it is necessary to provide favorable fiscal regime to Indian Shipping Sector so that it can become internationally competitive. The Committee notes with some satisfaction the fiscal concessions given to the Indian Shipping Sector and measures taken by the Government of India recently towards growth of Indian Tonnage. The Committee, however, recommended that recommendations of the Rakesh Mohan Committee should be considered positively by the Government of India and further concessions necessary for the healthy Shipping Sector should be provided as early as possible. The Committee also reiterates its earlier recommendation that Government of India should not levy heavy taxation on

Shipping Sector. The Government should explore the possibility of Tonnage Tax rgime in the country as early as possible. 6. Problems facing by the Shipping companies A. Industry sources say the Ministry has adopted a hard stand on the implementation of the clause in the tonnage tax that makes it mandatory for every company under this regime to plough back 20 per cent of its profits to build up a reserve for fleet acquisition[20] and in case of noncompliance has to face consequences.[21] The Government had introduced this clause, while providing a level playing field to the domestic industry by introducing the tonnage tax, with the cardinal objective of ensuring that Indian tonnage gets a boost. It was thought that the tonnage tax clause relating to mandatory allocation of 20 per cent of profits for acquisition could go a long way in helping the industry mop up the requirement investment. B. After India introduced the tonnage tax regime which cut the tax incidence on investors in the shipping sector in 2004-05, the tonnage strength of Indias fleet rose sharply in comparison to the measly 7% growth recorded between 1992 and 2003. But in the last couple of years, no investments have come into the shipping sector despite the fact that the government has allowed 100% foreign direct investment (FDI). The fact is that the initial impact (of the tonnage tax regime) has tended to peter out and there have been no investments from foreign investors. This indicates that more needs to be done on the tax front. The shipping industry believes that the key reason investors are not evincing interest in the sector is the way direct and indirect taxes have evolved since the introduction of the tonnage tax system. For instance, the number of services covered by service tax has gone up from 76 to 107, taking the effective service tax rate for the shipping business from 8% to 12.36%. Indian shipping companies should be exempted from payment of dividend distribution tax on dividend declared/distributed to the shareholders. Indian shipping companies should not be subject to fringe benefit tax (FBT) on their major component of expenditure such as travel expenses, boarding and lodging expenses etc incurred for official purposes to ensure their competitiveness. [22] C. The shipping companies have to pay service tax at the rate of 12.36% on various services rendered to them such as cargo handling, clearing and forwarding, general insurance, clearing and forwarding agent service, port services, repair and maintenance, steamer agents, storage and warehousing, survey, manpower recruitment and professional services. The nature of some of these services like cargo handling and clearing; and forwarding is such that their suppliers have to be local and at the Indian end both Indian owned and foreign ships pay the same service tax. At the foreign end no service tax is levied on foreign ship owners as shipping services are either exempt or zero- rated worldwide. D. Indian shipping companies in terms of normal conditions of business, are obligated to obtain and consume outside India services (input services) like port services, repairs, dry-docking, cargo handling (loading/unloading), steamer agents services to name a few. But they have to pay service tax in India even on services provided from outside and received outside India unless they have been specifically exempted.

7. Profit to the government and shipping companies The new tax may not make much difference to big shipping companies that already take advantage of a tax exemption based on the amount they invest. The tonnage tax may benefit big companies if it allows them the option of choosing between the corporate tax and the tonnage tax. If the choice is not made optional, as suggested by the Rakesh Mohan committee report on the issue, big shipping companies may actually end up paying more tax.[23] Under the current tax law shipping companies are exempt from tax on their profits if they invest twice the value of their net worth and reserves in a fund for acquisition of new ships. This does not provide much relief for small companies since their reserves are small. Therefore, a tonnage tax will give small companies more incentives to add ships to their fleet. [24] After putting the new tonnage tax regime in place for the Indian shipping industry, it now seems to be payback time for the Ministry of Shipping. The Ministry has asked all shipping companies that adopted the new tax regime, which had drastically reduced their tax burden, to furnish details about their profits and the allocation made for ship acquisition. 8. International - Tonnage Tax

8A. Position in UK - In late 1997 it set up a Shipping Working Group, a body involving representatives from the industry, trades unions and Government departments. The Shipping Working Group reported in March 1998. It suggested that one of the key steps which Government could take to underpin a renaissance of the UK shipping industry would be to introduce a tonnage tax. The tonnage tax was introduced into the UK tax system as part of Finance Act 2000. The provisions implementing the regime form part of the Government's wider policy to bring about a reversal in the decline of the UK fleet and have been widely welcomed by the shipping industry. 8B. Position in USA - The American Jobs Creation Act of 2004, signed into law by President Bush in November 2004, includes two significant changes to the tax laws applicable to shipping income. As an initial matter, the reader should be informed that these new tax laws apply only to income from the operation of vessels in international trade. They do not apply to income generated from the operation of vessels in the domestic, or Jones Act, trades. However, U.S. companies that currently operate, or might be interested in operating, vessels in international trade should be aware of these new tax laws and the significant opportunities they create for more competitive and profitable operation of vessels in international trade. The two changes included in the Jobs Creation Act are (i) the creation of an alternative tonnage tax for income from the operation of certain U.S.-flag vessels in the international trades, and (ii) the removal of a foreign base company shipping income from subpart F of the Internal Revenue Code[25]. 9. Conclusion In the UK , Singapore, Ireland, Netherlands, Germany, Spain and Belgium the profit on sale of vessels is covered within the scope of tonnage tax regime. In light of the practice in these

important shipping nations it would be necessary to provide in our tax laws also that the surplus resulting from sale of vessels is covered within the scope of tonnage tax regime.

India is developing at a fast rate and expansion is taking place in sectors like cement, steel and others. India's demand for crude and petroleum product is rising, and to meet the demand there will be more imports, which means more growth in terms of tonnage. To sustain India's demand for import and export, more tonnage is required. With tonnage tax, there is shift in the taxation system for shipping companies: from revenuebased to asset-based. However, it's time to wait and see as tonnage tax has been in place only since the last three years and for reference there is not as such case law or dispute filed before the court of law.

[1] [2]

Student 4th Year, Hidayatullah National Law University, Raipur, Email mayank_hnlu@yahoo.co.in See Sec. 28 to 43C, IT Act, 1961 [3] See Sec. 115VA [4] Tonnage tax cell Circular No. 1 of 2004 [5] See Sec.115VP(2) [6] Garner, Brayan A., Blacks Law DictionaryI, 7th Edn. , West Group [7] Supra 2 [8] Brett M. Esber and Joseph T. Gulant, The Alternative Tonnage Tax, June 2006, Marine News [9] See Sec. 115VC, For the purposes of this Chapter, a company is a qualifying company if (a) it is an Indian company; (b) the place of effective management of the company is in India; (c) it owns at least one qualifying ship; and (d) the main object of the company is to carry on the business of operating ships. [10] See Sec. 115VD [11] See Sec. 115VP [12] Sec. 115VF read with Sec. 115VI [13] See Sec. 115VI(5) [14] See Sec. 115VQ (1) [15] See Sec. 115VR [16] Dr. Ahuja Girish, Dr. Ravi Gupta, Direct tax, Law and Practice, Bharat Publication, Vol.1, 18th Edn., 2008-09, p. 1047 [17] See Sec. 115VH [18] See Sec. 115VI(6)

[19]

Committee on Public Undertakings (2003 2004), (Thirteenth Lok Sabha), Forty - Seventh Study Tour Report, Shipping Corporation Of India Limited [20] See Sec. 115VT(1) [21] See Sec. 115VT(5)

[22]

Oineetom Ojah, Tonnage tax and Indian shipping industries, the financial express, Wednesday, June 18, 2008

[23]

Leach, Peter T., India commits to tonnage tax.(Rakesh Mohan committee), The Journal of Commerce Online, Publication Date: 09-JUL-04,

[24] [25]

ibid Brett M. Esber and Joseph T. Gulant, The Alternative Tonnage Tax, 14 June 2006, Marine News

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Lewis Corporation Case 6-2 - Group 5Documento8 páginasLewis Corporation Case 6-2 - Group 5Om Prakash100% (1)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Reward StrategiesDocumento35 páginasReward Strategiesamruta.salunke4786100% (6)

- Aquabest Fin StatementsDocumento27 páginasAquabest Fin StatementsJohn Kenneth BoholAinda não há avaliações

- Cost of Capital (AnkushaDocumento42 páginasCost of Capital (AnkushaPiyush ChauhanAinda não há avaliações

- Chanpreet SinghDocumento2 páginasChanpreet Singhkarandeep89Ainda não há avaliações

- Serial No.: 8001 M.B.B.S 1't Prof, 7062: Anatomy-ADocumento8 páginasSerial No.: 8001 M.B.B.S 1't Prof, 7062: Anatomy-Akarandeep89Ainda não há avaliações

- Professional Resume FormatsDocumento3 páginasProfessional Resume Formatskarandeep89Ainda não há avaliações

- June 2009 (A)Documento6 páginasJune 2009 (A)karandeep89Ainda não há avaliações

- Objective Professional QualificationDocumento2 páginasObjective Professional Qualificationkarandeep89Ainda não há avaliações

- Scliat No.: 8 0 0 2: I, R.RL L, R G (,: I Roll NuDocumento3 páginasScliat No.: 8 0 0 2: I, R.RL L, R G (,: I Roll Nukarandeep89Ainda não há avaliações

- Serialno.: 8 0 0 1: M.B.B.S. 1St Prof. 1 0 7 0Documento6 páginasSerialno.: 8 0 0 1: M.B.B.S. 1St Prof. 1 0 7 0karandeep89Ainda não há avaliações

- MBBS LST Prof. Examination 2068: - . (J R - T I - L, C e ?Documento4 páginasMBBS LST Prof. Examination 2068: - . (J R - T I - L, C e ?karandeep89Ainda não há avaliações

- Mbbs TST Prof. Examination 2068: Seriaino.: 1732Documento3 páginasMbbs TST Prof. Examination 2068: Seriaino.: 1732karandeep89Ainda não há avaliações

- Regional Anatomy of The Human ThoraxDocumento46 páginasRegional Anatomy of The Human Thoraxkarandeep89Ainda não há avaliações

- Logistics ManagementDocumento53 páginasLogistics Managementkarandeep89Ainda não há avaliações

- ON "Employee Perception Towards Work Life Balance": Final Research ProjectDocumento70 páginasON "Employee Perception Towards Work Life Balance": Final Research Projectkarandeep89Ainda não há avaliações

- St. John's Medical College, Bangalore: Source: Dept. of PhysiologyDocumento0 páginaSt. John's Medical College, Bangalore: Source: Dept. of Physiologykarandeep89Ainda não há avaliações

- Fii TLLS: Bms/M05 6904Documento4 páginasFii TLLS: Bms/M05 6904karandeep89Ainda não há avaliações

- HDFC Bank Limited, 6352/11, Shingar Palace Complex, Nichlson Road, Ambala Cantonment Haryana - 133001Documento1 páginaHDFC Bank Limited, 6352/11, Shingar Palace Complex, Nichlson Road, Ambala Cantonment Haryana - 133001karandeep89Ainda não há avaliações

- Bms Question PaperDocumento1 páginaBms Question Paperkarandeep89Ainda não há avaliações

- CP401 PDFDocumento1 páginaCP401 PDFkarandeep89Ainda não há avaliações

- Motia DevelopersDocumento80 páginasMotia Developerskarandeep89Ainda não há avaliações

- SCO 9,10-C, Green Park Avenue,, 141002 Canal Colony, Pakhowal Raod, Ludhiana, IndiaDocumento1 páginaSCO 9,10-C, Green Park Avenue,, 141002 Canal Colony, Pakhowal Raod, Ludhiana, Indiakarandeep89Ainda não há avaliações

- Professional Qualifying Examination PQE SyllabusDocumento101 páginasProfessional Qualifying Examination PQE Syllabuskarandeep89Ainda não há avaliações

- SCO 9,10-C, Green Park Avenue,, 141002 Canal Colony, Pakhowal Raod, Ludhiana, IndiaDocumento1 páginaSCO 9,10-C, Green Park Avenue,, 141002 Canal Colony, Pakhowal Raod, Ludhiana, Indiakarandeep89Ainda não há avaliações

- Financial Analysis of Crown CementDocumento20 páginasFinancial Analysis of Crown CementTareq RahmanAinda não há avaliações

- Kondratieff Cycles - The Long Waves in Economic Life (1935)Documento12 páginasKondratieff Cycles - The Long Waves in Economic Life (1935)Exopolitika MagyarországAinda não há avaliações

- Day1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCADocumento21 páginasDay1 - 06 - Ramona Volciuc-Ionescu - Volvic-Ionescu SCAaegean227Ainda não há avaliações

- Mauritius Revenue Authority: T: - F: - E: - WDocumento2 páginasMauritius Revenue Authority: T: - F: - E: - WAmrit ChutoorgoonAinda não há avaliações

- ERM Case Study - Enterprise Risk Management at ABN AMRODocumento20 páginasERM Case Study - Enterprise Risk Management at ABN AMROiam027Ainda não há avaliações

- Aircraft LeasingDocumento132 páginasAircraft LeasingBenchmarking84100% (1)

- The Fidelity Self-Employed 401 (K) Contribution W Worksheet For Unincorporated BusinessesDocumento2 páginasThe Fidelity Self-Employed 401 (K) Contribution W Worksheet For Unincorporated BusinessesokumurakozoAinda não há avaliações

- Group 8Documento31 páginasGroup 8Jessa E. FabilaneAinda não há avaliações

- Glomac Berhad (GLOMAC) - Company Profile and SWOT Analysis PDFDocumento38 páginasGlomac Berhad (GLOMAC) - Company Profile and SWOT Analysis PDFMuhammad Zaki0% (1)

- Don't Sweat The Interview: So, What's The Big Deal?Documento20 páginasDon't Sweat The Interview: So, What's The Big Deal?Peeyush WateAinda não há avaliações

- Merits and Demerits of The Different Types of Petroleum ContractsDocumento15 páginasMerits and Demerits of The Different Types of Petroleum ContractsZakaullah BabarAinda não há avaliações

- Cap Bud Ultratech 19Documento9 páginasCap Bud Ultratech 19feroz khanAinda não há avaliações

- Finance For Non Finance ExecutivesDocumento5 páginasFinance For Non Finance ExecutivesPahladsinghAinda não há avaliações

- Principles of Microeconomics (Chapter 12)Documento41 páginasPrinciples of Microeconomics (Chapter 12)Thanh-Phu TranAinda não há avaliações

- Nari Ekta Manch: Business PlanDocumento8 páginasNari Ekta Manch: Business PlanPATLIPUTRA EXPRESSAinda não há avaliações

- Assignment Unit 1Documento4 páginasAssignment Unit 1vsraviAinda não há avaliações

- Ko Tak Capital Multiplier PlanDocumento2 páginasKo Tak Capital Multiplier PlanemailtotesttestAinda não há avaliações

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocumento8 páginasJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganAinda não há avaliações

- Assignment 3 Prepare A Cash Budget KarununganDocumento3 páginasAssignment 3 Prepare A Cash Budget KarununganRenzo KarununganAinda não há avaliações

- Indian Gaap V/s Us GaapDocumento32 páginasIndian Gaap V/s Us GaapArun PandeyAinda não há avaliações

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsDocumento401 páginasFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Small 200 Index ComponentsQ.M.S Advisors LLCAinda não há avaliações

- Income From Other SourcesDocumento15 páginasIncome From Other SourcesBhuvaneswari karuturiAinda não há avaliações

- Taxation in Spanish Philippines: Evolution of Philippine TaxationDocumento16 páginasTaxation in Spanish Philippines: Evolution of Philippine TaxationC. I .AAinda não há avaliações

- SSPOFADVDocumento1 páginaSSPOFADVfreddieaddaeAinda não há avaliações

- Cary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunDocumento3 páginasCary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunthesacnewsAinda não há avaliações

- Accounting 2Documento3 páginasAccounting 2Minas SydAinda não há avaliações