Escolar Documentos

Profissional Documentos

Cultura Documentos

Madras Cements 4Q FY 2013

Enviado por

Angel BrokingDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Madras Cements 4Q FY 2013

Enviado por

Angel BrokingDireitos autorais:

Formatos disponíveis

4QFY2013 Result Update | Cement

June 4, 2013

Madras Cements

Performance Highlights

Quaterly results (Standalone)

Y/E Mar (` cr) Net Revenue Operating Profit OPM (%) Net Profit

Source: Company, Angel Research

NEUTRAL

CMP Target Price

Investment Period

% chg (qoq) 6.3 (30.4) (800)bp (23.6) 4QFY12 879 198 22.5 99 % chg (yoy) 5.5 (28.8) (732)bp (35.3)

`225 -

4QFY13 927 141 15.2 64

3QFY13 872 202 23.2 84

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Cement 5,347 2,366 0.8 269/136 47,938 1 19,546 5,919 MSCM.BO MC@IN

For 4QFY2013, Madras Cements (MC) posted a 35.3% yoy de-growth in its net profit to `64cr, impacted by weak cement prices, a surge in freight and raw material costs due to higher railway freight fares and higher diesel costs, and with volume growth being modest at just 3.7% yoy. We remain Neutral on the stock. OPM at 15.2%, down 732bp yoy: For 4QFY2013 MC posted a 5.5% yoy growth in net sales to `927cr. Top-line growth during the quarter was impacted by modest volume growth and weak realization. Further, change in accounting treatment for inter-segment revenue suppressed the overall revenue, although it didnt have any impact on the profit. The OPM for the quarter stood at 15.2%, down 732bp on a yoy basis, despite the higher realization, on account of increase in raw material, freight costs and other expenses. The EBITDA/tonne fell by 31.7% yoy and 39.2% qoq to `629. Outlook and valuation: Going ahead, we expect MC to post a 12.4% and 15.7% CAGR in its top-line and bottom-line respectively over FY2013-15. At the current market price, the stock is trading at a valuation of US$79/tonne on current capacity (US$59 on FY2015E capacity), which we believe is fair. We continue to maintain our Neutral recommendation on the stock.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 42.3 14.5 13.8 29.4

Abs. (%) Sensex MC

3m

1yr

3yr 8.8

(1.4) 16.4

(7.8) 65.5 121.3

Key financials (Standalone)

Y/E March (` cr) Net Sales % chg Net Profit % chg FDEPS (`) OPM (%) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/Tonne EV/EBITDA

Source: Company, Angel Research

FY2012 3,236 24.2 385 82.5 16.2 28.4 13.9 2.6 20.3 11.9 2.5 108 8.8

FY2013 3,788 17.1 404 5.0 17.0 25.4 13.2 2.3 18.3 12.2 2.0 79 7.8

FY2014E 4,234 11.8 440 8.8 18.5 23.9 12.2 1.9 17.2 13.0 1.7 66 7.0

FY2015E 4,788 13.1 541 23.1 22.8 24.0 9.9 1.7 18.2 15.1 1.3 59 5.6

V Srinivasan

022-39357800 v.srinivasan@angelbroking.com

Please refer to important disclosures at the end of this report

Madras Cements | 4QFY2013 Result Update

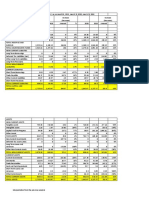

Exhibit 1: Quarterly performance (Standalone)

Y/E March (` cr) Net Sales Net Raw Material Costs (% of Sales) Power & Fuel (% of Sales) Staff Costs (% of Sales) Freight & Forwarding (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (excl. Extr. Items) Provision for Taxation (% of PBT) Reported PAT PATM EPS (`)

Source: Company, Angel Research

4QFY2013 927 153 16.5 194 20.9 51 5.5 224 24.2 164 17.7 787 141 15.2 31 58 34 86 22 25.1 64 6.9 2.7

3QFY2013 872 118 13.6 199 22.8 49 5.6 181 20.7 124 14.2 670 202 23.2 43 69 34 124 40 32.4 84 9.6 3.5

% Chg qoq 6.3 29.3 (2.5) 4.9 24.2 32.6 17.3 (30.4) (800)bp (28.4) (16.4) (1.7) (31.0) (46.4) (23.6) (23.6)

4QFY2012 879 142 16.2 174 19.9 44 5.0 186 21.1 135 15.4 681 198 22.5 31 66 33 134 35 26.1 99 11.3 4.2

% Chg yoy 5.5 7.8 11.1 17.1 20.9 21 15.5 (28.8) (732)bp (0.9) (11.9) 1.1 (123.1) (38.5) (35.3) (35.3)

FY2013 3,788 530 14.0 810 21.4 196 5.2 769 20.3 520 13.7 2,825 963 25.4 179 281 84 588 185 31.4 404 10.6 16.9

FY2012 3,203 437 13.6 699 21.8 171 5.3 561 17.5 418 13.1 2,287 916 28.6 158 254 54 557 172 30.9 385 12.0 16.2

% Chg 18.3 21.3 15.8 14.5 37.0 24.4 23.6 5.1 (319)bp 12.7 10.5 57.1 5.5 7.1 4.7 4.7

Exhibit 2: Operational highlights

(` cr) 1,000 32.6 750 28.0 22.5 500 31.0 31.4 23.2 15.2 123 133 (%) 35.0 30.0 25.0 20.0 15.0 10.0 872 84 927 64 5.0 0.0 2QFY12 3QFY12 4QFY12 Net Sales 1QFY13 2QFY13 Net Profit 3QFY13 4QFY13 OPM (RHS)

819 111

879 99

250

741 77

989

Source: Company, Angel Research

June 4, 2013

999

Madras Cements | 4QFY2013 Result Update

Exhibit 3: 4QFY2013 Actual vs Angel estimates

(` cr) Net Sales Operating Profit OPM (%) Net Profit

Source: Company, Angel Research

Actual 927 141 15.2 64

Estimates 1,086 248 22.8 93

Variation (%) (14.6) (43.3) (763)bp (30.9)

Operational performance

For 4QFY2013 MC has posted a 6.3% yoy growth in its net sales to `927cr. Top-line growth during the quarter was impacted by modest volume growth (3.7% yoy) and weak realization. Volume growth was disappointing considering the company had posted an impressive 13.4% volume growth in 9MFY2013. Further, change in accounting treatment for inter-segment revenue suppressed the overall revenue although it didnt have any impact on the profit. Earlier the companys net sales included power generated by windmill division which was consumed by the cement division. As per the new accounting treatment the value of power consumed at the cement division has been reduced from both the overall net sales and power and fuel costs. Thus `22.5cr of such inter-segment revenue pertaining to the entire year was adjusted during the quarter, thereby suppressing the revenue. The OPM for the quarter stood at 15.2%, down 732bp on a yoy basis, despite the higher realization, on account of increase in raw material costs, freight costs and other expenses. The EBITDA/tonne fell steeply by 31.7% yoy and 39.2% qoq to `629. Exhibit 4: Volume and realization trend

2.50 2.00 1.50 1.00 0.50 0.00 3QFY12 4QFY12 1QFY13

Dispatches

5,000 4,500 4,000 3,500 3,000 2,500 2,000 2QFY13 3QFY13 4QFY13

Realization (RHS)

(mn tonnes)

2.1 1.8

2.2

2.0

1.9

2.2

Source: Company, Angel Research

MCs per tonne raw material cost rose by 18.0% yoy to `711. The freight cost per tonne during the quarter increased by 16.6% yoy to `1,016 on account of higher diesel costs and railway freight charges.

June 4, 2013

(`/tonne)

Madras Cements | 4QFY2013 Result Update

Exhibit 5: Per tonne analysis

Particulars (`) Realization/tonne Raw material cost/tonne Power & fuel cost /tonne Freight cost/tonne Other costs/tonne Operating profit/tonne

Source: Company, Angel Research

4QFY13 4,465 711 878 1,016 743 629

3QFY13 4,548 689 1,047 952 651 1,035

4QFY12 4,354 602 819 872 635 922

% chg (yoy) 2.6 18.0 7.1 16.6 16.9 (31.7)

% chg (qoq) (1.8) 3.1 (16.2) 6.8 14.0 (39.2)

Exhibit 6: Segmental performance

(` cr) Revenue Cement Windmill Total EBIT Cement Windmill Total 236 (33) 203 180 (7) 173 30.8 0.0 17.2 234 (14) 219 1.0 134.1 (7.6) 880 22 902 799 827 10.2 9.1 28 (22.4) 886 6 892 864 9 872 2.6 (32.9) 2.3 927 7 934 (4.4) (12.8) (4.5) 3,744 110 3,853 3,162 96 3,258 18.4 13.9 18.3 4QFY13 3QFY13 chg % qoq 4QFY12 chg % yoy FY13 FYY12 chg %

Source: Company, Angel Research

Investment rationale

New CPPs to reduce power costs: MC, which currently has 112MW of captive power plants (CPPs), is currently in the process of adding another 45MW of CPPs, thereby taking its total CPP capacity to ~157MW. We expect the increase in CPPs to result in lower per-tonne power and fuel costs. The companys efficiency too has improved as indicated by reduction in the electricity consumption per tonne of cement from 83kwh in FY2011 to 78kwh in FY2012. Coal consumed per tonne of clinker too has reduced from 0.14/tonne to 0.12/tonne.

Outlook and valuation

Going ahead, we expect MC to post a 12.4% and 15.7% CAGR in its top-line and bottom-line respectively over FY2013-15. At the current market price, the stock is trading at a valuation of US$79/tonne on current capacity (US$59 on FY2015E capacity), which we believe is fair. We continue to maintain our Neutral recommendation on the stock.

June 4, 2013

Madras Cements | 4QFY2013 Result Update

Exhibit 7: One-year forward EV/tonne (US$)

120,000 100,000 80,000 EV (` mn) 60,000 40,000 20,000 0 May-13 Nov-05 Nov-06 Jan-04 Jul-10 Jun-11 Apr-01 Mar-02 Feb-03 Oct-07 Aug-09 Dec-04 Sep-08 Jun-12 EV/tonne $50 $70 $90 $110

Source: BSE, Company, Angel Research

Exhibit 8: Recommendation summary

Company ACC* Ambuja Cements* India Cements JK Lakshmi Madras Cement Shree Cements UltraTech Cements Reco Accum. Neutral Neutral Buy Neutral Neutral Neutral CMP (`) 1,218 175 68 106 225 4,777 1,861 Tgt. Price (`) 1,361 143 Upside (%) 11.7 34.3 FY2015E P/BV (x) 2.5 2.6 0.6 0.7 1.7 3.0 2.5 FY2015E P/E (x) 13.3 14.4 6.2 4.9 9.9 12.9 15.5 FY2013-15E EPS CAGR 10.6 9.1 35.1 15.6 15.7 15.2 9.3 FY2015E RoE (%) 20.0 18.6 9.0 16.3 18.2 25.4 17.3 EV/tonne^ US $ 116 157 59 38 77 164 191

Source: Company, Angel Research; Note: *Y/E December; ^ Computed on TTM basis

Company Background

Madras Cements is one of the largest cement players in southern India, with a capacity of 14.5mtpa (incl 1.95mtpa of split grinding capacities). The capacities are spread across TN (9.55mtpa), AP (3.7mtpa); and Karnataka (0.3mtpa). Apart from these, the company has a grinding plant at Kolaghat in West Bengal (1mtpa) and also a wind power generation capacity of ~112MW.

June 4, 2013

Madras Cements | 4QFY2013 Result Update

Profit and Loss Statement (Standalone)

Y/E March (` cr) Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY10

2,801 14.0 1,944 398 596 137 812 857 10.0 30.6 196 661 3.1 23.6 151 20 3.8 530 (2.9) (0) 531 177 33.3 354 (2.9) 12.6 14.9 14.9 (2.9)

FY11

2,605 (7.0) 1,987 391 661 154 782 617 (28.0) 23.7 221 397 (40.0) 15.2 139 40 13.4 297 (44.0) (0) 297 86 29.0 211 (40.4) 8.1 8.9 8.9 (40.4)

FY12

3,236 24.2 2,318 438 730 171 979 918 48.7 28.4 254 664 67.4 20.5 158 52 9.3 557 87.5 (0) 557 172 30.9 385 82.5 11.9 16.2 16.2 82.5

FY13

3,788 17.1 2,825 530 810 196 1,289 964 5.0 25.4 281 683 2.9 18.0 179 84 14.3 589 5.6 589 185 31.4 404 5.0 10.7 17.0 17.0 5.0

FY14E

4,234 11.8 3,224 649 894 216 1,465 1,011 4.9 23.9 296 714 4.6 16.9 143 85 12.9 656 11.5 656 217 33.0 440 8.8 10.4 18.5 18.5 8.8

FY15E

4,788 13.1 3,640 734 992 237 1,677 1,147 13.5 24.0 301 846 18.4 17.7 123 85 10.5 808 23.1 808 267 33.0 541 23.1 11.3 22.8 22.8 23.1

June 4, 2013

Madras Cements | 4QFY2013 Result Update

Balance Sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves& Surplus Shareholders Funds Total Loans Deferred Tax Liability Other long term laibilities Long term provisions Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Investments Long term loans and adv. Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets

1,135 35 532 568 546 589 21 4,710 4,811 1,119 3,693 318 89 5,110 1,318 3,793 546 267 166 933 40 325 567 290 642 5,415 5,670 1,555 4,115 528 267 110 1,039 47 292 699 296 743 5,763 6,170 1,836 4,335 416 266 110 1,345 54 393 898 1,032 313 5,440 6,270 2,132 4,138 566 266 110 1,551 87 431 1,033 1,088 463 5,543 6,370 2,433 3,937 766 266 110 1,761 147 444 1,169 1,156 605 5,684 4,710 24 1,534 1,558 2,567 585 24 1,711 1,735 2,791 589 287 12 5,415 24 2,027 2,050 2,710 649 320 33 5,763 24 2,347 2,371 2,000 716 320 33 5,440 24 2,725 2,749 1,725 716 320 33 5,543 24 3,191 3,215 1,400 716 320 33 5,684

FY10

FY11

FY12

FY13E

FY14E

FY15E

June 4, 2013

Madras Cements | 4QFY2013 Result Update

Cash flow statement (Standalone)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc)/ Decin Fixed Assets (Inc)/ Dec in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances

103 56 (7) 55 (3) 39 35 225 35 (137) 327 5 35 40 (81) 54 (137) 3 7 40 47 (711) 56 (40) (727) 7 47 54 (336) 33 54 87 (401) 60 87 147 (275) 61 (325) 76

FY10

531 196 (119) 20 89 498 (576) (0) 20 (556)

FY11

297 221 (49) 40 86 343 (527) (179) 40 (666)

FY12

557 254 (93) 52 172 494 (542) 1 52 (489)

FY13E

589 281 437 84 185 1,037 (388) 1 84 (303)

FY14E

656 296 (117) 85 217 535 (250) 85 (165)

FY15E

808 301 (82) 85 267 676 (300) 85 (215)

June 4, 2013

Madras Cements | 4QFY2013 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) FY10 FY11 FY12 FY13E FY14E FY15E

15.1 9.7 3.4 1.0 2.9 9.4 1.7 14.9 14.9 23.1 2.3 65.5 23.6 66.7 0.6 10.0 4.0 1.8 20.6 14.8 17.1 25.1 0.6 48 16 93 64 1.6 2.8 4.4

25.4 12.4 3.1 0.6 3.1 13.0 1.5 8.9 8.9 18.1 1.5 72.9 15.2 71.0 0.5 5.6 3.7 1.6 8.7 7.8 8.8 12.8 0.5 56 23 77 81 1.5 4.3 2.8

13.9 8.4 2.6 1.0 2.5 8.8 1.4 16.2 16.2 26.9 2.3 86.2 20.5 69.1 0.6 8.3 4.0 1.5 14.5 11.9 13.5 20.3 0.6 50 22 46 73 1.3 2.8 4.2

13.2 7.8 2.3 1.1 2.0 7.8 1.4 17.0 17.0 28.8 2.4 99.6 18.0 68.6 0.7 8.4 5.2 1.1 11.9 12.2 13.7 18.3 0.6 52 25 86 46 0.8 1.9 3.8

12.2 7.3 1.9 1.1 1.7 7.0 1.3 18.5 18.5 30.9 2.6 115.5 16.9 67.0 0.8 8.8 5.1 0.7 11.5 13.0 14.8 17.2 0.7 55 28 120 27 0.6 1.5 5.0

9.9 6.3 1.7 1.4 1.3 5.6 1.1 22.8 22.8 35.4 3.2 135.1 17.7 67.0 0.9 10.3 5.3 0.5 13.0 15.1 17.8 18.2 0.8 55 29 112 32 0.4 1.0 6.9

June 4, 2013

Madras Cements | 4QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Madras Cements No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

June 4, 2013

10

Você também pode gostar

- UBS HandbookDocumento152 páginasUBS HandbookcarecaAinda não há avaliações

- Partnership Agreement (Short Form)Documento2 páginasPartnership Agreement (Short Form)Legal Forms91% (11)

- Moa SK FundDocumento2 páginasMoa SK FundMelvyn Casuga100% (2)

- Madras Cements, 1Q FY 2014Documento10 páginasMadras Cements, 1Q FY 2014Angel BrokingAinda não há avaliações

- Madras Cements: Performance HighlightsDocumento10 páginasMadras Cements: Performance HighlightsAngel BrokingAinda não há avaliações

- Ultratech 4Q FY 2013Documento10 páginasUltratech 4Q FY 2013Angel BrokingAinda não há avaliações

- Acc 2Q Cy 2013Documento10 páginasAcc 2Q Cy 2013Angel BrokingAinda não há avaliações

- Shree Cement: Performance HighlightsDocumento10 páginasShree Cement: Performance HighlightsAngel BrokingAinda não há avaliações

- Acc 1Q CY 2013Documento10 páginasAcc 1Q CY 2013Angel BrokingAinda não há avaliações

- India Cements, 20th February, 2013Documento9 páginasIndia Cements, 20th February, 2013Angel BrokingAinda não há avaliações

- JK Lakshmi Cement, 12th February, 2013Documento10 páginasJK Lakshmi Cement, 12th February, 2013Angel BrokingAinda não há avaliações

- Ambuja, 15th February 2013Documento10 páginasAmbuja, 15th February 2013Angel BrokingAinda não há avaliações

- JK Lakshmi Cement: Performance HighlightsDocumento10 páginasJK Lakshmi Cement: Performance HighlightsAngel BrokingAinda não há avaliações

- JKLakshmi Cement, 1Q FY 2014Documento10 páginasJKLakshmi Cement, 1Q FY 2014Angel BrokingAinda não há avaliações

- Madras Cements Result UpdatedDocumento11 páginasMadras Cements Result UpdatedAngel BrokingAinda não há avaliações

- Gujarat State Petronet, 1Q FY 2014Documento9 páginasGujarat State Petronet, 1Q FY 2014Angel BrokingAinda não há avaliações

- Igl 4Q Fy 2013Documento10 páginasIgl 4Q Fy 2013Angel BrokingAinda não há avaliações

- Dishman, 12th February, 2013Documento10 páginasDishman, 12th February, 2013Angel BrokingAinda não há avaliações

- India Cements: Performance HighlightsDocumento10 páginasIndia Cements: Performance HighlightsAngel BrokingAinda não há avaliações

- JKLakshmi Cement 4Q FY 2013Documento10 páginasJKLakshmi Cement 4Q FY 2013Angel BrokingAinda não há avaliações

- Ultratech: Performance HighlightsDocumento10 páginasUltratech: Performance HighlightsAngel BrokingAinda não há avaliações

- Amara Raja 4Q FY 2013Documento11 páginasAmara Raja 4Q FY 2013Angel BrokingAinda não há avaliações

- NTPC 4Q Fy 2013Documento10 páginasNTPC 4Q Fy 2013Angel BrokingAinda não há avaliações

- Amara Raja Batteries: Performance HighlightsDocumento11 páginasAmara Raja Batteries: Performance HighlightsAngel BrokingAinda não há avaliações

- India Cements Result UpdatedDocumento10 páginasIndia Cements Result UpdatedAngel BrokingAinda não há avaliações

- TTMT, 15th February 2013Documento16 páginasTTMT, 15th February 2013Angel BrokingAinda não há avaliações

- Coal India, 15th February 2013Documento10 páginasCoal India, 15th February 2013Angel BrokingAinda não há avaliações

- India Cements, 1Q FY 2014Documento10 páginasIndia Cements, 1Q FY 2014Angel BrokingAinda não há avaliações

- MRF 1Q Fy2013Documento12 páginasMRF 1Q Fy2013Angel BrokingAinda não há avaliações

- Moil 1qfy2013ruDocumento10 páginasMoil 1qfy2013ruAngel BrokingAinda não há avaliações

- India Cements Result UpdatedDocumento12 páginasIndia Cements Result UpdatedAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento10 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- TCS, 1Q Fy 2014Documento14 páginasTCS, 1Q Fy 2014Angel BrokingAinda não há avaliações

- UltraTech Result UpdatedDocumento10 páginasUltraTech Result UpdatedAngel BrokingAinda não há avaliações

- Crompton Greaves: Performance HighlightsDocumento12 páginasCrompton Greaves: Performance HighlightsAngel BrokingAinda não há avaliações

- Acc 3qcy2012ruDocumento10 páginasAcc 3qcy2012ruAngel BrokingAinda não há avaliações

- Maruti Suzuki, 28th January, 2013Documento13 páginasMaruti Suzuki, 28th January, 2013Angel BrokingAinda não há avaliações

- GMDC 4Q Fy 2013Documento10 páginasGMDC 4Q Fy 2013Angel BrokingAinda não há avaliações

- Performance Highlights: Company Update - AutomobileDocumento13 páginasPerformance Highlights: Company Update - AutomobileZacharia VincentAinda não há avaliações

- Neutral: Performance HighlightsDocumento10 páginasNeutral: Performance HighlightsAngel BrokingAinda não há avaliações

- GAIL India, 1Q FY 2014Documento12 páginasGAIL India, 1Q FY 2014Angel BrokingAinda não há avaliações

- Apollo Tyre 4Q FY 2013Documento14 páginasApollo Tyre 4Q FY 2013Angel BrokingAinda não há avaliações

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDocumento10 páginasPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingAinda não há avaliações

- Exide Industries, 1Q FY 2014Documento12 páginasExide Industries, 1Q FY 2014Angel BrokingAinda não há avaliações

- Siyaram Silk Mills Result UpdatedDocumento9 páginasSiyaram Silk Mills Result UpdatedAngel BrokingAinda não há avaliações

- Rallis India 4Q FY 2013Documento10 páginasRallis India 4Q FY 2013Angel BrokingAinda não há avaliações

- Mahindra N Mahindra, 1Q FY 2014Documento14 páginasMahindra N Mahindra, 1Q FY 2014Angel BrokingAinda não há avaliações

- GSPL 4Q Fy 2013Documento10 páginasGSPL 4Q Fy 2013Angel BrokingAinda não há avaliações

- Ambuja Cements Result UpdatedDocumento11 páginasAmbuja Cements Result UpdatedAngel BrokingAinda não há avaliações

- MRF 2Q Sy 2013Documento12 páginasMRF 2Q Sy 2013Angel BrokingAinda não há avaliações

- ACC Result UpdatedDocumento10 páginasACC Result UpdatedAngel BrokingAinda não há avaliações

- Ambuja Cements Result UpdatedDocumento11 páginasAmbuja Cements Result UpdatedAngel BrokingAinda não há avaliações

- Asian Paints 4Q FY 2013Documento10 páginasAsian Paints 4Q FY 2013Angel BrokingAinda não há avaliações

- Gujarat Gas, 2Q CY 2013Documento10 páginasGujarat Gas, 2Q CY 2013Angel BrokingAinda não há avaliações

- Ambuja Cements Result UpdatedDocumento11 páginasAmbuja Cements Result UpdatedAngel BrokingAinda não há avaliações

- Amara Raja Batteries: Performance HighlightsDocumento11 páginasAmara Raja Batteries: Performance HighlightsAngel BrokingAinda não há avaliações

- Styrolution 1Q CY 2013Documento14 páginasStyrolution 1Q CY 2013Angel BrokingAinda não há avaliações

- GSPL, 11th February, 2013Documento10 páginasGSPL, 11th February, 2013Angel BrokingAinda não há avaliações

- Britannia, 18th February, 2013Documento10 páginasBritannia, 18th February, 2013Angel BrokingAinda não há avaliações

- JK Lakshmi Cement: Performance HighlightsDocumento10 páginasJK Lakshmi Cement: Performance HighlightsAngel BrokingAinda não há avaliações

- TVS Motor Company: Performance HighlightsDocumento12 páginasTVS Motor Company: Performance HighlightsAngel BrokingAinda não há avaliações

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosAinda não há avaliações

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAinda não há avaliações

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAinda não há avaliações

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAinda não há avaliações

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAinda não há avaliações

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAinda não há avaliações

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 12 2013Documento2 páginasDaily Agri Tech Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAinda não há avaliações

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAinda não há avaliações

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAinda não há avaliações

- Currency Daily Report September 13 2013Documento4 páginasCurrency Daily Report September 13 2013Angel BrokingAinda não há avaliações

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento12 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 12Documento2 páginasMetal and Energy Tech Report Sept 12Angel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 12 2013Documento6 páginasDaily Metals and Energy Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 12 2013Documento9 páginasDaily Agri Report September 12 2013Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Currency Daily Report September 12 2013Documento4 páginasCurrency Daily Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingAinda não há avaliações

- Irrevocable Master Fee Protection Agreement SampleDocumento3 páginasIrrevocable Master Fee Protection Agreement SampleFAHAMI HASHIMAinda não há avaliações

- Interview Questions and Answers For Freshers in Chemical EngineeringDocumento4 páginasInterview Questions and Answers For Freshers in Chemical EngineeringAkash BodekarAinda não há avaliações

- Vinati OrganicsDocumento6 páginasVinati OrganicsNeha NehaAinda não há avaliações

- Jurnalratna Haryo Soni2016Documento14 páginasJurnalratna Haryo Soni2016hafizhmmAinda não há avaliações

- Corporate Restructuring Short NotesDocumento31 páginasCorporate Restructuring Short NotesSatwik Jain57% (7)

- A Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga NagarDocumento12 páginasA Study On Financial Statement Analysis of Tata Steel Odisha Project, Kalinga Nagargmb117Ainda não há avaliações

- The Accounting Process: Name: Date: Professor: Section: Score: QuizDocumento6 páginasThe Accounting Process: Name: Date: Professor: Section: Score: QuizAllyna Jane Enriquez100% (1)

- Chapter 4 - 5 ActivitiesDocumento3 páginasChapter 4 - 5 ActivitiesJane Carla BorromeoAinda não há avaliações

- 21 VBHN-BTC 512873Documento78 páginas21 VBHN-BTC 512873LET LEARN ABCAinda não há avaliações

- Class TestDocumento6 páginasClass TestMayank kaushikAinda não há avaliações

- Urban Water Tariff GhanaDocumento15 páginasUrban Water Tariff GhanaBonzibit ZibitAinda não há avaliações

- Masaniello ProgressivoDocumento24 páginasMasaniello ProgressivoPavanAinda não há avaliações

- 12 Asian Cathay Finance V Sps Gravador and de VeraDocumento9 páginas12 Asian Cathay Finance V Sps Gravador and de VeraAnne VallaritAinda não há avaliações

- Strengths, Weaknesses, Opportunities, Threats The SWOT Analysis - KWHSDocumento1 páginaStrengths, Weaknesses, Opportunities, Threats The SWOT Analysis - KWHSAyushi AggarwalAinda não há avaliações

- AR 2009 EngDocumento252 páginasAR 2009 EngmorgunovaAinda não há avaliações

- Acctg7 - CH 2Documento33 páginasAcctg7 - CH 2Jao FloresAinda não há avaliações

- Tcs Report On Ratio AnalysisDocumento40 páginasTcs Report On Ratio Analysisami100% (1)

- UAE ConfDocumento20 páginasUAE ConfAkshata kaleAinda não há avaliações

- Resident Representative:: International Banking Section - A Introduction To International BankingDocumento3 páginasResident Representative:: International Banking Section - A Introduction To International BankingNimisha BhararaAinda não há avaliações

- 10 1 1 471 5234 PDFDocumento77 páginas10 1 1 471 5234 PDFLaxmiAinda não há avaliações

- Federal RetirementDocumento50 páginasFederal RetirementFedSmith Inc.100% (1)

- EPS Bootstrapping Bootstrap Earnings e EctDocumento2 páginasEPS Bootstrapping Bootstrap Earnings e Ecthyba ben helalAinda não há avaliações

- ISA-400-Audit Risk, ISA-550-Related Parties ISA-600-Groups Audit, and ISA-620-Using The Work of An Auditor's ExpertDocumento18 páginasISA-400-Audit Risk, ISA-550-Related Parties ISA-600-Groups Audit, and ISA-620-Using The Work of An Auditor's ExpertSohaib BilalAinda não há avaliações

- Meredith WhitneyDocumento13 páginasMeredith WhitneyFortuneAinda não há avaliações

- Bala Raksha Bhavan Rent Not File DT 07.02.2020Documento2 páginasBala Raksha Bhavan Rent Not File DT 07.02.2020District Child Protection Officer VikarabadAinda não há avaliações

- Subject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Documento4 páginasSubject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Rimpa SenapatiAinda não há avaliações