Escolar Documentos

Profissional Documentos

Cultura Documentos

Let's Go For Derivative 12 June 2013 by Mansukh Investment and Trading Solution

Enviado por

Mansukh Investment & Trading SolutionsTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Let's Go For Derivative 12 June 2013 by Mansukh Investment and Trading Solution

Enviado por

Mansukh Investment & Trading SolutionsDireitos autorais:

Formatos disponíveis

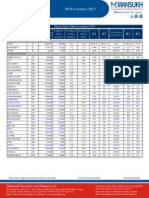

Daily Derivative Report

NIFTY FUTURE : 5788.80 -89.20

12 June 2013

-1.52%

NIFTY FUTURES HIGHLIGHTS

0.97 1.02

Nifty Sentiment Indicators

Put Call Ratio-Nifty Options Put Call Ratio-Bank Nifty Options

Product

Index Futures Stock Futures Index Options Stock Options Total F&O

10.06.13

317139 410129 2985579 224740 3937587

Volume 11.06.13

476818 586680 4311507 289021 5664026

% Chg

50.35% 43.05% 44.41% 28.60% 43.85%

Index

NIFTY BANK NIFTY CNXIT

Spot

5,788.80 11,820.50 6,550.95

Future

5,797.00 11,814.90 6,556.00

Basis

8 (6) 5

Nifty June 2013 futures closed at 5797.00 on Tuesday at a premium of 8.20 points over spot closing of 5788.80, while Nifty July 2013 futures ended at 5819.10, at a premium of 30.30 points over spot closing. Nifty June futures saw an addition of 1.39 million (mn) units taking the total outstanding open interest (OI) to 13.56 mn units. The near month June 2013 derivatives contract will expire on June 27, 2013. From the most active contracts, Reliance Communications June 2013 futures were trading at a premium of 0.05 points at 103.80 compared with spot closing of 103.75. The number of contracts traded was 24,002. Tata Motors June 2013 futures were at a premium of 1.65 points at 294.75 compared with spot closing of 293.10. The number of contracts traded was 13,852. DLF June 2013 futures were at a discount of 0.20 points at 187.50 compared with spot closing of 187.70. The number of contracts traded was 13,996. Reliance Industries June 2013 futures were trading at a premium of 3.50 points at 789.50 compared with spot closing of 786.00. The number of contracts traded was 14,147.

Increase in Open Interest with Increase in price Symbol BAJAJ-AUTO IDEA DABUR VOLTAS CIPLA Last price 1791.15 130.75 152.00 81.95 382.00 Chg (%) 0.7 0.69 0.3 2.57 1.85 Open Interest 1,340 6,498 2,612 4,478 9,322 11.58 7.8 3.73 2.1 2.02 Increase (%)

Increase in Open Interest with Decrease in price Symbol Last price Chg (%) Open Interest

ICICIBANK RCOM JINDALSTEL AXISBANK TATAMTRDVR 1082.05 103.3 227.3 1325 157.75 -3.82 -7.06 -15.19 -2.68 -3.01 8172.5 42352 11437 4915 8408

Increase (%)

26.3 21.83 19.11 19.06 15.65

CP

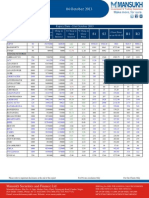

350000000 300000000 250000000 200000000 150000000 100000000 50000000 0

AU TO B NS AN TR K UC S TI FI O NA N NC E FM C HO G TE LS E T IT AL IL S & G PH AS AR M PO A W ER

SECTO R

A U TO BA N KS CO N STRU CTIO N FIN A N CE FM CG H O TELS IT M ETA LS O IL & GA S PH A RM A PO W ER

O .I.

37132750 152842750 295886000 47978500 27272000 9244000 16219750 121778000 49672500 34830500 86159500

% Change

3.57 1.31 0.12 1.51 1.54 2.21 2.71 0.15 -1.53 -0.08 1.78

For Private circulation Only

CO

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Daily Derivative Report

NIFTY OUTLOOK :

The Nifty dropped 89.20 points or 1.52% to 5788.20. On the National Stock Exchange (NSE), Bank Nifty down by266.55 points or 2.21% to 11820.05, CNX IT down by 53.75 points to 6550.95, while CNX mid-cap down by 142.95 points or 1.86% to 7758.35 and CNX Nifty Junior down by 227.30 points or 1.88% to 11890.00

MOST ACTIVE CALLS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY BANKNIFTY Expiry Date Strike Price 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 5900 6000 6100 5800 6200 6300 5700 6400 12500 Contracts Traded 26451950 26320550 16276800 12119850 7872650 4815350 1545050 1341750 508000 Open Interest 5181850 6882900 6924600 3228850 6388950 4380050 1031400 2049650 187875

MOST ACTIVE PUTS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY Expiry Date Strike Price 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 27-Jun-13 5800 5700 5600 5900 5500 6000 5400 5300 Contracts Traded 26552950 19795150 14246100 12222250 10872700 3575350 3085400 1150300 Open Interest 5740100 6465650 4525500 5062150 5573000 2794450 2012000 1084000

OPTION STRATEGY AS ON 7th JUNE 2013 UNDERLYING ASSET CMP STRATEGY MAX LOSS MAX PROFIT LOT SIZE NIFTY 5985.95 SELL NIFTY JUNE 6000 CA @ 63.90 SELL NIFTY JUNE 6000 PA @ 131.10 UNLIMITED 195 50

250 200 150 100 50 0 -50 -100 -150 1 2 3 4 5 6 7 NET INFLOW NET INFLOW

For any information or suggestion, please send your query at research@moneysukh.com

For Private circulation Only For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

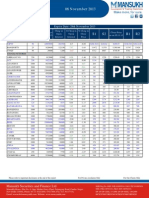

Daily Derivative Report

DATE OF STRATEGY

UNDERLYING ASSET

STRATEGY

IN/OUT FLOW

NET PROFIT/ LOSS AS ON 07/06/2013

REMARK

31/05/2013

NIFTY

SELL NIFTY JUNE 5700PUT@ 23.50 SELL NIFTY JUNE 6100CALL@ 56.95 SELL RELCAPITAL MAY 370 PUT@ 16.55 SELL RELCAPITAL MAY 370 CALL@ 11.55 SELL HINDALCO OCT 130 PUT@ 7.20 BUY TWO HINDALCO OCT 120 PUT@ 2.50 BUY BHEXAWARE OCT FUT@ 121 BHEXAWARE OCT 120 PUT@ 4.75 SELL BANK NIFTY SEP 11400 CALL@ 150 BUY TWO BANK NIFTY SEP 11600 CALL@ 68 BUY

80.45

22.15

BOOK FULL PROFIT

15/05/2013

RELCAPITAL

28.1

2.75

BOOK PARTIAL PROFIT AS ON 20..05.2013

8/9/2012

HINDALCO

2.2

0.35

HOLD

1/10/2012

HEXAWARE

-4.75

2.65

BOOK PARTIAL PROFIT AS ON 04.10.2012

24/9/2012

BANK NIFTY

14

(4.00)

CLOSED

NAME

Varun Gupta Mohit Taneja Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com mohit.t@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

For Private circulation Only

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Você também pode gostar

- Results Tracker 09.11.2013Documento3 páginasResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Results Tracker 08.11.2013Documento3 páginasResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Results Tracker 07.11.2013Documento3 páginasResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocumento3 páginasDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocumento5 páginasF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocumento3 páginasEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Lecture 1 - Foreign Exchange Markets and Exchange Rates IDocumento15 páginasLecture 1 - Foreign Exchange Markets and Exchange Rates Ijtt123100% (2)

- Introduction To Business and EconomicsDocumento41 páginasIntroduction To Business and EconomicsSahithi Reddy EtikalaAinda não há avaliações

- Senior High School - Grade 12Documento13 páginasSenior High School - Grade 12Jazy VillanuevaAinda não há avaliações

- ECO 101 QuizDocumento8 páginasECO 101 QuizMd. Thasin Hassan Shifat 2031495630Ainda não há avaliações

- TashtegoDocumento3 páginasTashtegoPhuong BograndAinda não há avaliações

- Macroecons ch1 Revision WorksheetDocumento4 páginasMacroecons ch1 Revision WorksheetChaerin LeeAinda não há avaliações

- Chapter 3 - National Income EquilibriumDocumento42 páginasChapter 3 - National Income EquilibriumRia AthirahAinda não há avaliações

- Financial ManagementDocumento9 páginasFinancial ManagementGogineni sai spandanaAinda não há avaliações

- One Economic Theory To Explain Everything - Bloomberg PDFDocumento6 páginasOne Economic Theory To Explain Everything - Bloomberg PDFMiguel VenturaAinda não há avaliações

- Scientific Research in Information Systems - A Beginner's GuideDocumento168 páginasScientific Research in Information Systems - A Beginner's GuideMIFTAHU RAHMATIKAAinda não há avaliações

- Production Possibilities and Opportunity CostsDocumento9 páginasProduction Possibilities and Opportunity CostsHealthyYOU100% (3)

- CH 6 Strategic Sourcing in The New Economy Harnessing T... - (PART II)Documento25 páginasCH 6 Strategic Sourcing in The New Economy Harnessing T... - (PART II)Aryan ChawlaAinda não há avaliações

- Tata Power - Competitive StrategyDocumento6 páginasTata Power - Competitive StrategyChiranjib DasAinda não há avaliações

- Underrepresentation of Developing Country Researchers in Development ResearchDocumento7 páginasUnderrepresentation of Developing Country Researchers in Development ResearchManuela Ospina GarcesAinda não há avaliações

- CH 20 Measuring GDPDocumento27 páginasCH 20 Measuring GDPايهاب غزالةAinda não há avaliações

- CH 09Documento27 páginasCH 09m48hjq4ymyAinda não há avaliações

- HW Microeconomics)Documento3 páginasHW Microeconomics)tutorsbizAinda não há avaliações

- Second Quarter: Module 2 Sum-Up Exercises in Applied EconomicsDocumento3 páginasSecond Quarter: Module 2 Sum-Up Exercises in Applied EconomicsRio Jaena DimayugaAinda não há avaliações

- GENEROSO PCDocumento5 páginasGENEROSO PCJar Jorquia100% (1)

- Internal Company AnalysisDocumento5 páginasInternal Company Analysislee jong sukAinda não há avaliações

- OligopolyDocumento5 páginasOligopolyFazil DamryAinda não há avaliações

- Dividend DecisionsDocumento40 páginasDividend DecisionsShivam GoelAinda não há avaliações

- Capital BudgetingDocumento3 páginasCapital BudgetingvimalaAinda não há avaliações

- MNC's Bane or BoonDocumento36 páginasMNC's Bane or BoonShoumi MahapatraAinda não há avaliações

- Chapter 3 Public GoodsDocumento29 páginasChapter 3 Public Goodsbest videosAinda não há avaliações

- LoiDocumento2 páginasLoiBayu SaputraAinda não há avaliações

- The North & South: Balance of PowerDocumento15 páginasThe North & South: Balance of PowerKim FloresAinda não há avaliações

- Document 2018 05 3 22427081 0 Prognoza PDFDocumento208 páginasDocument 2018 05 3 22427081 0 Prognoza PDFDan BAinda não há avaliações

- Customer Satisfaction: Review of Literature and Application To The Product-Service SystemsDocumento62 páginasCustomer Satisfaction: Review of Literature and Application To The Product-Service SystemsPunitha GAinda não há avaliações

- HBB 2403 Kakamega December 2016Documento2 páginasHBB 2403 Kakamega December 2016mimiAinda não há avaliações