Escolar Documentos

Profissional Documentos

Cultura Documentos

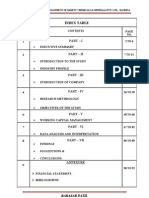

Capital Structure and Financial Statement Analysis: An Empirical Study of Petroleum Sector of Pakistan

Enviado por

0300MalikamirDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Capital Structure and Financial Statement Analysis: An Empirical Study of Petroleum Sector of Pakistan

Enviado por

0300MalikamirDireitos autorais:

Formatos disponíveis

Capital Structure and Financial Statement Analysis: An Empirical Study of Petroleum Sector of Pakistan

Abstract

Choosing vital, reliable and hustle free analysis is a bit difficult situation for most of the financiers and managers as there are so many analyses. This study focuses on most significant analyses to perform on financial statements. To accomplish this study, financial statements of three companies, Sh. Results show that vertical analysis can be a suspicious analysis as it total assets and sales fluctuate gradually. Horizontal analysis is somehow better analysis than vertical analysis as it shows negative or positive trend of variables. DuPont analysis is a reliable analysis but it taken into consideration only two years. However, ratio analysis is seems to be best analysis as it gives concise and paramount review of firms performance. According to these analyses, Shell Petroleum is the better corporate than other two corporations. Further results are discussed in the light of these analyses. Keywords: Vertical analysis, Horizontal analysis, DuPont analysis, Ratio analysis

a). Introduction

Pakistan Petroleum Limited is one of the oldest and largest E&P companies in the country. The primary activities of the company involve exploration, development and production of Pakistans natural reserves of oil and gas. It was incorporated on 5th June 1950 after the promulgation of the Pakistan Petroleum Production Rules in 1949. PPL inherited all the assets and liabilities of its parent company, the Burmah Oil Company (Pakistan Concessions) Limited and commenced business on 1st July 1952. The company remained under the management control of Burmah Castrol, UK till 1997. After that the government purchased the entire equity interest of Burmah Castrol PLC, formerly Burmah Oil Company. After June 2004, the Government of Pakistan disinvested around 15% of its equity in the company through an Initial Public Offering (IPO). The Government of Pakistan intends to privatize PPL and IPO was a significant step towards achieving this objective. As at June 2008, the government of Pakistan owned 78.4% stake of PPL, the International Finance Corporation (IFC) had 3.43% of shareholding and the rest 18.17% is free-float. The company is listed on all the three stock exchanges of Pakistan. Karachi Stock Exchange (KSE) rated the PPL as one of the top 25 companies for the two consecutive years 2006 and 2007. PPL is the second largest exploration and production (E&P) company, both, in terms of production and reserves. PPL has been playing a crucial role in augmenting hydrocarbon resources since 1955. Presently PPL contributes around 25% of the countrys total natural gas production. It is also one of the market leaders in terms of its holdings of exploration area. Out of 242,714sqkms area under exploration in Pakistan, PPL holds the second largest share, more than 22% in joint venture with partners.

PPL is aggressive in exploration but at the same time conservative in selecting drilling sites. It has discovered eight gas and three oil fields. PPL has working interest in 24 exploration blocks, of which eight are PPL operated and the other 14, including 4 off-shore are partner operated. Sui and Kandhkot gas fields are two of the major PPL operated fields where PPL has 100% ownership. In 1952 the company discovered the largest gas reserves at Sui. Within three years (1955) the supply of natural gas to Karachi for industrial and domestic use began through pipelines. Sui caters to about one-fifth of the total gas demand in the country. In 1959, vital discoveries at Kandhkot gas field and Mazarani fields were made. Crude oil was discovered at Adhi field in 1978 and in 1980 commercial production started at Adhi. In 1990, the Liquefied Petroleum Gas (LPG) and Natural Gas Liquid (NGL) Plan was installed and the production of LPG, NGL and gas from Adhi commenced. In the year 2007, PPL made oil and gas discovery at Mela-1 well (Nashpa Block) and two gas discoveries at Latif-1 (Latif Block) and Tajjal-1 (Gambat Block). In the same year, the first exploratory well Mela-1 at Nashpa Block was completed as oil and gas producer and the Extended Well Test production commenced. Bolan Mining Enterprises (BME) is a joint venture between PPL and the Government of Balochistan for the development, mining, grinding and marketing of barites mineral deposits found near Khuzdar and other minerals in the province of Balochistan. The Company operates a Baryte mine in the Balochistan province.

b). Literature Review

DuPont system performs an analysis that uses both income and balance sheet information to break the ROA and ROE ratios into component pieces. Return on common equity (ROE) is a measurement that captures the return earned on the common stockholders (owners) investment in a firm. Return on total assets (ROA) is a measurement of the overall effectiveness of management in generating returns to common stockholders with its available assets. (Smart et al., 2007) Saunders (2000) provides a model of financial analysis for financial institutions based on the Dupont system of financial analysis return on equity model. The return on equity model disaggregates performance into three components: net profit margin, total asset turnover, and the equity multiplier. The profit margin allows the financial analyst to evaluate the income statement and the components of the income statement. Total asset turnover allows the financial analyst to evaluate assets. The equity multiplier allows the financial analyst to liabilities and owners equity. Firms can be compared within an industry utilizing the DuPont analysiss financial ratios through a cross sectional analysis or a time series basis (Ou & Penman, 1989; Eisemann, 1997; Abarbanell & Bushee 1997; Fairfield & Yohn, 2001; Milbourn & Haight, 2005; Soliman, 2008). Nissim and Penman (2003) presents a financial statement analysis. That makes a distinction between leverage that arises in operations from leverage that arises in financing activities. Researchers also do financial statement analysis for use in equity valuation (Nissim & Penman, 2001). Ratio or financial analysis is the process of determining the significant operating and financial characteristics of a firm from accounting data and financial statements (Hampton, 2003).

Liquidity ratios measure a firms ability to satisfy its short-term obligations as they come due. Debt ratios measure the extent to which a firm uses money from creditors rather than stockholders to finance its operations. Profitability ratios are among the most closely watched and widely quoted financial ratios. Many firms link employee bonuses to profitability ratios and stock prices react sharply to unexpected changes in these measures. (Megginson et al., 2007) An analysis by which the trend of or changes in various dimensions of an economic unit over a number of years are examined is called horizontal analysis. Common-size analysis is also called vertical analysis because these statements are prepared in up and down form, and when one observes the statements, his observation moves from upwards to downwards. (Sinha, 2010) Concepts and Definitions A. Non-Current Assets 1. Capital work in progress: Work in process consists of the unfinished products in a production process which are not yet complete but either being fabricated or waiting in a queue or storage. They must be accounted for as funds (capital) that have been invested for future enhancement in production. 2. Operating fixed assets: These are owned by an enterprise engaged in production of items (directly or indirectly); which will be available for sale. These are not readily convertible into cash during the course of normal operations of an enterprise. These assets are not subject to periodical exchange through sales and purchases. Fixed assets are of permanent nature and are not normally liquidated or intended to turn into cash except in the form of depreciation, which is added to the cost of goods sold. The following balance sheet items are included in the category of fixed assets: (a) Real Estate (b) Plant, Machinery and Rolling Stock (i) All types of plant and machinery used for production and not for sale (ii) Crockery, cutlery, silverware and enamelware in hotels (c) Furniture, Fixtures, Fittings and Allied Equipment (i) Electric fans, refrigerators, air conditioners, electric heating, sanitary and other fittings. 3. Operating fixed assets after deducting accumulated depreciation Deducting the accumulated depreciation from the operating fixed assets of the company gives this item. 4. Depreciation for the year It includes all the depreciation charged to the profit and loss account. Owing to absence of uniform accounting standards, depreciation is a subjective item and varies from company to company. It is important for an analyst to know what effect such variation could have on the net profit. 5. Intangible Assets Intangible assets are defined as identifiable assets that cannot be seen, touched or physically measured, which are created through time and/or efforts and that are identifiable as a separate asset. The possible items are: 6. Long term investment Investment is acquisition of financial, physical or technology based assets by an investor for their potential future income, return, yield, profits, or capital gains. The long-term investments account differs largely from the short-term investments account in that the short-term

investments will most likely be sold, whereas the long-term investments may never be sold. They may include: 7. Other Non- current assets These include all residual non-current assets left from the above coverage, but remain in the balance sheet. Possible items may be: B. Current Assets: 1. Cash & bank balances Cash & bank balances is an integral part of a company's overall operations. It consists of: 2. Inventories It comprises of stocks of raw material in hand, work in progress and finished goods at the closing date. 3. Trade debt This refers to an entity from which amounts are due for goods sold or services rendered or in respect of contractual obligations and also termed: debtor, trade debtor, and account receivable. 4. Short term investments Unlike long term investments, short term investments have to be matured within the same accounting cycle. The basic motive of such an investment is to earn profits or capital gains for short term period. 5. Other current assets These are all remaining items of current assets left from the above coverage, but remained in the balance sheet. C. Current Liabilities: All liabilities, which are required to be discharged within one year, are termed as current liabilities. Alternatively, these cover those obligations whose liquidation is expected to be made out of current assets. They are usually incurred in the normal course of business and are required to be paid at fairly definite dates. 1. Short term secured loans These are loans which are to be matured within the year and have been obtained against secured collaterals. 2. Other current liabilities These are all remaining items of current liabilities left from the above coverage, but remained in the balance sheet. D. Non-Current Liabilities: 1. Long-term secured loan These are liabilities which are required to be discharged after a period of more than a year from the date of balance sheet and are obtained on the basis of secured collaterals. 2. Long-term unsecured loan These are liabilities which are required to be discharged after a period of more than a year from the date of balance sheet and are obtained without any secured collaterals. 3. Debentures/TFCs

These are bonds/certificates issued by a company to raise funds for long-term period (generally more than one year) for a specific purpose (usually for capital expenditures), sometimes convertible into stock. At present, debentures have been replaced by TFCs (Term Finance Certificates). Sukuk bonds. 4. Employees benefit obligations These include benefits provided either to employees or their dependants, and may be settled by payments (or the provision of goods or services) made either directly to the employees, their spouses, children, other dependants. 5. Other non-current liabilities These are residuals of non-current liabilities left from the above coverage, but remained in the balance sheet of the company. E. Shareholders equity: This item purports to represent the total stake of the shareholders in the business and is obtained by adding the ordinary share capital to the reserves and also surplus on revaluation of fixed assets. ix 1. Issued, subscribed & paid up capital This represents the total subscribed and paid-up capital against issue of ordinary shares. These are amounts of capital actually paid by the shareholders to the institution for acquiring its shares. It includes shares paid in cash (subscribed/right issued), issued as bonus shares and shares issued for considerations other than cash (e.g. for settlement of receivables/debts or debts redeemable into stock etc.). (i) Ordinary Shares Ordinary shares represent equity ownership in a company and entitle the owner to a vote in matters put before shareholders in proportion to their percentage ownership in the company. Ordinary shareholders are entitled to receive dividends if any are available after dividends on preferred shares are paid. They are also entitled to their share of the residual economic value of the company should the business unwind; however, they are last in line after bondholders and preferred shareholders for receiving business proceeds. As such, ordinary shareholders are considered unsecured creditors. (ii) Preference Shares Preferred Shares generally have dividends that must be paid out before dividends to common stockholders and the shares usually do not have voting rights. The precise details as to the structure of preferred stock are specific to each corporation. However, the best way to think of preferred stock is as a financial instrument that has characteristics of both debt (fixed dividends) and equity (potential appreciation). The difference between ordinary shares and preference shares is as follows: (a) Ordinary shareholder receive dividend, which varies according to the prosperity of the company but preference shareholder will receive a fixed amount dividend every year. (b) Ordinary shareholder has a right of voting in the companys annual general meeting while the preference shareholder has no voting right.

(c) Ordinary shareholders have a residual claim on the net assets of the company in case of liquidation, while the claim of the preference shareholders is paid earlier. 2. Reserves It is calculated by aggregating all kinds of reserves except depreciation reserve and reserve for bad and doubtful debts plus the balance of profit and loss account. (i) Capital Reserves These funds are allocated only to be spent on the capital expenditure projects/ future expansionary projects for which they were initially intended, excluding any unforeseen circumstances. 3. Surplus on revaluation of fixed assets Revaluation of fixed assets is a technique that may be required to accurately describe the true value of the capital goods that a business owns. The revaluation surplus has been included in equity because capital goods like property, plant and equipments participate directly in the revenue generation and transferred directly to retained earnings. F. Operation: 1. Sales This item represents the sale proceeds of the company netting off all components of expenses associated with sales. Sales revenue is classified as local sales and export sales. 2. Cost of sales Cost of sales includes the direct costs attributable to the production of the goods sold by a company. This amount includes the materials cost used in creating the goods along with the direct labor costs used to produce the good. (i) Cost of material This includes cost of all raw and other processing materials incurred in the production of finished goods, which are available for sale of the company. (ii) Other Input cost These are all remaining cost of sales excluding the cost of materials. 3. Gross Profit Gross profit is arrived at by subtracting cost of sales from sales revenue. 4. General, administrative and other expenses These expenses consist of the combined payroll costs (salaries, commissions, and travel expenses of executives, sales people and employees), and advertising expenses that a company incurs. This is usually understood as a major portion of non-production related costs. (i) Selling & distribution expenses These are non-production cost, but directly related with the revenue generation of saleable goods, i.e. cost incurred to mobilize goods from factory outlet to the market palace. (ii) Administrative and other expenses These expenses are also non-production costs and fixed in nature. The company is obliged to pay these expenses which are permanent in nature until the structure of the company is not affected. 5. Salary, wages and employees benefits These are salary; wages and employees benefit expenses that a company has borne in all stages to run the business activities. These covers the expenses to all employees (temporary, permanent) 6. Financial expenses These are expenses incurred due to borrowing of financial assets (short / long term loans) and acquisition of financial services by a company during an accounting period.

Of which: (i) Interest expenses These are interest expenses incurred on borrowing of long and short terms loans. 7. Net profit before taxes It is the profit earned by the company during the year before tax. 8. Tax provision It is provision of taxation made on current years profit. 9. Total amount of dividend It is the total dividend including interim dividend distributed or proposed to be distributed out of the current years profit 10. Total value of bonus shares issued This is the total amount of bonus shares issued to the shareholders as appropriation of net profit after tax of the company during the year. III. Performance Indicators: 1. Acid test or quick ratio The acid test or quick ratio is used to determine how quickly a company would be able to pay off its current liabilities if it needs to convert its quick assets into cash. Acid test or quick ratio = (Cash & bank balances + Trade debtors + Short term investments)/ Current Liabilities. The ideal quick ratio is 1:1, which measures the firms capacity to payoff claims of current creditors immediately. 2. Financial expenses to sales It shows the ratio of financial expenses to sales. Lowering the ratio indicates the financial discipline of the company and the increasing ratio indicates that the company is facing financial expenses burden out of its sales revenue Financial expense to sales = Financial expenses/ Sales 3. Trade debt to sales It is the ratio of outstanding credit (all sales receivables) to the total sale proceeds of the company. Higher the percentage, the company is increasing its debtors and credit risk and reducing its liquidity position. Trade debt to sales= Trade debt/ Sales 4. Assets turnover ratio It is the ratio of total sale proceeds to the total assets of the company. Higher the ratio, the company is sufficiently using its assets in generating revenues and lowers the ratio; the company is insufficient in generating revenues. Assets turnover ratio= Sales/ (Non-Current Assets + Current Assets) 5. Current ratio It is the ratio of total current assets to the total current liabilities. Higher current ratio shows that the company is in a well-off situation and lower current ratio shows the worsening situation. Current ratio= Current Assets/ Current Liabilities A rough guide for most companies exhibits 1.5:1 relationship between current assets and current liabilities as indication of ability to meet current obligation without recourse of special borrowings. 6. Cost of goods sold to sales

This ratio is derived by dividing cost of sales of goods to the total amount of sale proceeds. Higher the ratio, lower the gross profit margins and lower the ratio, higher the gross profit margins of the company. Cost of goods sold to sales= Cost of goods sold/ sales 7. Debt equity ratio This is a measure of companys financial leverage and calculated by dividing its total liabilities by stockholders' equity. It indicates what proportion of equity and debt the company is using to finance its assets. The higher ratio generally means that a company has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the additional interest expense. Debt equity ratio = (Current Liabilities + Non-Current Liabilities)/ Shareholders equity It provides a margin safety to creditors. The smaller the ratio, the more secured are the creditors. An appropriate debt to equity ratio is 0.33. A higher ratio than this is an indication of financial risk policy. 8. Return on assets (ROA) This is an indicator that reflects how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings. This is calculated by dividing a company's annual earnings by its total assets. The higher the ROA, the better, because the company earns more money on less investment. ROA = Net profit before taxes/ Average of (Non-Current Assets + Current Assets) 9. Return on equity (ROE) It measures a firm's efficiency at generating profits from every unit of shareholders' equity. It shows how well a company uses its resources to generate earnings growth. The ROE is useful for comparing the profitability of a company to that of other firms in the same industry. ROE = Net profit before taxes/ Average of Shareholders equity 10. Return on capital employed (ROCE) ROCE compares earnings with capital invested in the company. ROCE should always be higher than the rate at which the company borrows; otherwise any increase in borrowing will reduce shareholders' earnings. ROCE = Net profit before taxes/ Average of Total capital employed 11. Dividend cover ratio This measures the ability of a company to pay dividends to ordinary shareholders from after tax income and measured as: Dividend cover ratio= (Net profit before taxes - Tax provision)/ Total amount of dividend If a company is operating in a sector that is reasonably unaffected by economic downturns, such as food manufacturing and retailing, the lower dividend cover is more acceptable, because the risk is lower. 12. Inventory Turnover Ratio A ratio showing how many times a company's inventory is sold and replaced over a period. The inventory turnover ratio is calculated as Inventory Turnover Ratio = Sales / Inventory This ratio should be compared against industry averages. A low turnover implies poor sales and, therefore, excess inventory. A high ratio on the other hand implies strong sales. High inventory levels are unhealthy because they represent an investment with a rate of return of zero. It also opens the company up to trouble should prices begin to fall. 13. Interest cover ratio

This ratio measures the efficiency of a company for its ability to pay its interest-payment on its borrowing from operating profit and measured as Interest cover ratio = Net profit before interest and tax payment / Interest expenses = (Net profit before taxes+ Interest expenses) / Interest expenses The higher the figure, the safer is the company. The company with interest cover ratio 2 will suffer a 50% drop in the profit and a company with a ratio less than 1 would have to dip into cash reserve. 14. Net profit margin This ratio is achieved as a ratio of profit earned by a company from its sale proceeds. Net profit margin= Net profit before taxes/ sales 15. Operating cash flow to debt ratio This ratio is obtained by dividing the net cash flow balance from operating activities from total liabilities and mathematically it may be derived as: Operating cash flow to debt ratio =Cash flows from operations/ (Current Liabilities+ Non -Current Liabilities) This ratio measures the ability of the company's operating cash flow to meet its obligations. The operating cash flow is simply the amount of cash generated by the company from its main operations, which are used to keep the business funded. The higher the ratio, the safer the company. A minimum value of 0.2 is often used as guided level. 16. Earnings per share after tax (Rs./share) It is arrived at by dividing the net profit (after tax) by the number of ordinary shares. Earnings per share after tax (Rs.) = (Net profit before taxes - Tax provision)/ Number of ordinary shares 17. Break- up value shares (Rs./share) It is obtained by dividing the amount of shareholders equity by the number of ordinary shares. Break- up value shares (Rs. /share) = Shareholders equity/ Number of ordinary shares

c). Objectives

The core objective of this study was 1. To show unproblematic financial statement analysis 2. To verify the most significant and reliable analysis

d). Methodology

Methodology is based on Ratio Analysis, a powerful tool to analyze the financial statements of any company. Ratio analysis measures inter-relationship between different sections of the financial statements. Ratios are taken as guides that are useful in evaluating a companys financial position and operation and making comparison with results in previous years or with others in the same industry. The primary purpose of ratio analysis is to point out areas needing further investigation. All the ratios are calculated from the following financial statements and relevant notes to accounts.

Total shareholders equity is computed as the sum of ordinary share capital plus reserve and surplus plus un-appropriated profit/ (loss) and the revaluation. Analysis of Non-Financial sector used the following concepts and definitions as given below.

e). Empirical Results Pakistan Petroleum Overall

Financial Statement Analysis

Items A.Non-Current Assets (A1+A3+A5+A6+A7) 1.Capital work in progress 2.Operating fixed assets at cost 3.Operating fixed assets after deducting accumulated depreciation 4.Depreciation for the year 5.Intangible assets 6.Long term investments 7.Other non-current assets B.Current Assets (B1+B2+B3+B4+B5) 1 .Cash & bank balance 2.Inventories 3.Trade Debt 4.Short term investments 5.Other current assets C.Current Liabilities (C1+C2) 1.Short term Secured loans 2.Other current liabilities D.Non-Current Liabilities (D1+D2+D3+D4+D5) 1 .Long term secured loans 2.Long term unsecured loans 3.Debentures/TFCs 4.Employees benefit obligations 5.Other non-current liabilities 2006 43,353,483 75,019,518 43,025,889 4,413,841 327,594 203,019,21 0 46,757,220 56,037,533 43,809,138 22,826,355 33,588,964 139,908,82 4 15,885,426 124,023,39 8 6,117,223 535,698 5,581,525 2007 51,533,745 86,763,890 51,184,295 4,549,586 349,450 231,547,45 9 34,223,708 61,516,942 50,252,169 45,953,272 39,601,368 159,829,10 4 17,542,891 142,286,21 3 1,521,288 321,396 1,199,892 2008 62,476,965 106,336,73 9 62,141,118 5,285,961 335,847 365,829,23 9 66,825,396 110,890,57 2 90,711,066 55,532,698 41,869,507 274,564,73 6 26,543,107 248,021,62 9 1,013,258 107,094 906,164 2009 132,829,786 27,165,270 97,488,491 49,810,306 5,662,806 585,465 33,740,952 21,527,793 345,051,884 37,239,112 83,988,397 173,064,466 13,248,309 37,511,600 294,254,425 32,958,463 261,295,962 25,692,600 5,534,040 4,023,101 0 3,156,809 12,978,650 2010 144,406,13 9 25,301,531 117,578,19 6 63,435,599 7,266,862 2,130,061 35,948,361 17,590,587 442,772,41 5 39,387,296 102,761,11 9 230,217,26 3 30,410,502 39,996,235 368,372,13 6 26,312,262 342,059,87 4 28,905,869 3,378,332 5,000,944 3,513,495 17,013,098

20

177,8

14,7

150,6

88,3

8,7

1,8 53,2

19,5

517,7

30,6

161,9

228,7

25,0 71,3

421,4

34,1

387,2

27,7

1,6

4,1

21,9

E.Shareholders Equity (E1+E2+E3) 1.Issued, Subscribed & Paid up capital i).Ordinary Shares ii).Preference shares 2.Reserves i).Capital Reserve ii).Revenue Reserve 3.Surplus on revaluation of fixed assets F.Operation: 1.Sales i).Local sales (Net) ii).Export Sales (Net) 2.Cost of sales i).Cost of material ii).Other input cost 3.Gross Profit 4.General, administrative and other expenses i).Selling & distribution expenses ii).Administrative and other expenses 5.Salaries, wages and employee benefits 6.Financial expenses f which: (i) Interest expenses 7.Net profit before tax 8.Tax expense (current year) 9.Total amount of dividend 1 0.Total value of bonus shares issued 11 .Cash flows from operations G.Miscellaneous 1.Total capital employed (E+D) 2.Total fixed liabilities (D1+D3) 3.Retention in business (F7-F8-F9)

100,346,64 6 15,205,041 15,204,887 154 85,141,605 855,252,00 5 833,677,68 8 21,574,317 789,803,47 4 65,448,531 16,175,865 16,175,865 2,524,122 o 54,579,548 17,760,686 15,421,728 1,312,665 106,463,86 9 535,698 21,397,134

121,730,81 2 15,478,346 15,478,346 0 106,252,46 6 934,605,00 0 909,238,40 4 25,366,596 873,628,11 0 60,976,890 17,369,070 17,369,070 3,071,668 48,812,157 15,633,490 11,541,363 1,041,271 123,252,10 0 321,396 21,637,304

152,728,21 0 18,176,971 18,176,971 0 134,551,23 9 1,192,132,4 34 1,152,916,9 05 39,215,529 1,101,005,6 62 91,126,772 23,604,031 23,604,031 6,127,018 71,666,527 25,551,864 23,991,105 1,608,138 153,741,46 8 107,094 22,123,558

157,934,645 19,563,775 19,563,775 0 132,362,778 12,464,644 119,898,134 6,008,092 1,215,005,12 7 1,159,632,83 7 55,372,290 1,146,153,13 1 358,667,810 787,485,321 68,851,996 28,470,867 8,531,877 19,938,990 11,069,933 21,043,779 6,555,112 34,027,344 18,552,394 20,603,296 1,659,721 (6,220,935)

189,900,54 9 21,223,467 21,223,467 0 159,748,93 7 5,670,175 154,078,76 2 8,928,145 1,417,587,1 24 1,346,760,6 86 70,826,438 1,321,100,1 30 385,253,72 0 935,846,41 0 96,486,994 27,908,506 10,364,333 17,544,173 13,987,071 16,032,874 3,801,725 70,887,754 20,162,493 20,515,728 2,106,860 51,984,817 218,806,41 8 3,378,332 30,209,533

246,4

29,1

29,1

199,4

7,0

192,3

17,8

1,653,

1,568,

84,4 1,523,

497,2

1,026,

129,5

32,6

11,6

21,0

16,0

16,6

5,0

101,6

30,8

29,4

1,3

30,2

183,627,245 5,534,040 (5,128,346)

274,1

1,6

41,4

4.Contractual Liabilities (G2+C1) H.Key Performance Indicators 1 .Acid test or quick ratio[(B1 +B3+B4) to C] 2.Financial expenses as % of sales (F6 as % of F1) 3.Trade Debt as % of sales (B3 as % of F1) 4.Assets turnover ratio [F1 to (A+B)] 5.Current ratio (B to C) 6.Cost of goods sold to sales (F2 as % of F1) 7.Debt equity ratio [(C+D) to E] 8.Return on assets [F7 as % of avg.(A+B)] 9.Return of equity (F7 as % of avg. E) 10.Return on capital employed ( F7 as % of avg. G1) 11.Dividend cover ratio [(F7-F8) to F9] 12.Inventory Turnover Ratio (F1 to B2) 13.Interest cover ratio [(F7+ F6(i)) to F6(i)] 14.Net profit margin (F7 as % of F1) 15.Operating cash flow to debt ratio [F11 to (C+D)] 1 6.Earning per share after tax (Rs./share) [(F7F8)/No. of Ord. shares] 17.Break-up value shares (Rs./share) (E/No. of Ord. shares)

16,421,124

17,864,287

26,650,201

38,492,503

29,690,594

35,7

0.81 0.30 5.12 3.47 1.45 92.35 1.46 25.98 60.31 58.06 2.39 15.26 6.38 0.00 24.22 66.00

0.82 0.33 5.38 3.30 1.45 93.48 1.33 18.44 43.96 42.50 2.87 15.19 5.22 0.00 21.44 78.65

0.78 0.51 7.61 2.78 1.33 92.36 1.80 20.15 52.22 51.75 1.92 10.75 6.01 0.00 25.37 84.02

0.76 1.73 14.24 2.54 1.17 94.33 2.03 7.51 21.91 20.17 0.75 14.47 6.19 2.80 -0.02 7.91 80.73

0.81 1.13 16.24 2.41 1.20 93.19 2.09 13.31 40.76 35.23 2.47 13.79 19.65 5.00 0.13 23.90 89.48

Attock Petroleum Limited

Financial Statement Analysis

Items A.Non-Current Assets (A1+A3+A5+A6+A7) 1.Capital work in progress 2.Operating fixed assets at cost 2006 3,737, 018 4,390, 591 2007 6,401,691 7,275,720 2008 8,575,551 9,698,575 2009 14,874,321 4,297,952 12,091,616

3.Operating fixed assets after deducting accumulated depreciation 4.Depreciation for the year 5.Intangible assets 6.Long term investments 7.Other non-current assets B.Current Assets (B1+B2+B3+B4+B5) 1 .Cash & bank balance 2.Inventories 3.Trade Debt 4.Short term investments 5.Other current assets C.Current Liabilities (C1+C2) 1.Short term Secured loans 2.Other current liabilities D.Non-Current Liabilities (D1+D2+D3+D4+D5) 1 .Long term secured loans 2.Long term unsecured loans 3.Debentures/TFCs 4.Employees benefit obligations 5.Other non-current liabilities E.Shareholders Equity (E1+E2+E3) 1.Issued, Subscribed & Paid up capital i).Ordinary Shares ii).Preference shares 2.Reserves i).Capital Reserve ii).Revenue Reserve 3.Surplus on revaluation of fixed assets F.Operation: 1.Sales i).Local sales (Net) ii).Export Sales (Net)

3,719, 322 325,59 8 17,696 7,380, 583 2,189, 778 3,909, 395 1,106, 960 0 174,45 0 7,358, 405 890,10 1 6,468, 304 1,000, 605 535,69 8 464,90 7 2,758, 591 2,450, 652 2,450, 652 0 307,93 9 21,633 ,519 21,201 ,256 432,26 3

6,387,534 219,890 14,157 8,840,938 1,788,863 5,177,422 1,079,213 300,000 495,440 8,742,243 859,375 7,882,868 1,451,589 321,396 1,130,193 5,048,797 2,450,652 2,450,652 0 2,598,145 23,349,577 22,435,606 913,971

8,564,933 249,322 10,618 23,486,044 7,906,497 11,934,244 3,217,917 0 427,386 26,027,414 1,605,532 24,421,882 933,899 107,094 826,805 5,100,282 3,921,044 3,921,044 0 1,179,238 40,092,140 40,092,140 0

10,480,610 482,019 7,079 0 88,680 16,744,472 2,078,445 4,487,801 9,089,974 0 1,088,252 23,129,180 1,660,246 21,468,934 11,081,333 5,432,145 4,023,101 0 12,259 1,613,828 (2,591,720) 3,921,044 3,921,044 0 (10,597,517) 0 (10,597,517) 4,084,753 44,621,016 39,103,284 5,517,732

2.Cost of sales i).Cost of material ii).Other input cost 3.Gross Profit 4.General, administrative and other expenses i).Selling & distribution expenses ii).Administrative and other expenses 5.Salaries, wages and employee benefits 6.Financial expenses o f which: (i) Interest expenses 7.Net profit before tax 8.Tax expense (current year) 9.Total amount of dividend 1 0.Total value of bonus shares issued 11 .Cash flows from operations G.Miscellaneous 1.Total capital employed (E+D) 2.Total fixed liabilities (D1+D3) 3.Retention in business (F7-F8F9) 4.Contractual Liabilities (G2+C1) H.Key Performance Indicators 1 .Acid test or quick ratio[(B1 +B3+B4) to C] 2.Financial expenses as % of sales (F6 as % of F1) 3.Trade Debt as % of sales (B3 as % of F1) 4.Assets turnover ratio [F1 to (A+B)] 5.Current ratio (B to C) 6.Cost of goods sold to sales (F2 as % of F1) 7.Debt equity ratio [(C+D) to E] 8.Return on assets [F7 as % of avg.(A+B)] 9.Return of equity (F7 as % of avg. E) 10.Return on capital employed ( F7 as % of avg. G1) 11.Dividend cover ratio [(F7-F8) to F9]

21,008 ,890 624,62 9 138,57 8 138,57 8 285,56 6 301,36 1 89,645 0 0 3,759, 196 535,69 8 211,71 6 1,425, 799

23,422,062 (72,485) 196,142 196,142 405,647 (628,204) 96,859 0 0 6,500,386 321,396 (725,063) 1,180,771

37,950,232 2,141,908 1,647,747 1,647,747 497,179 183,981 179,031 0 0 6,034,181 107,094 4,950 1,712,626

48,530,050 46,184,170 2,345,880 (3,909,034) 595,161 192,809 402,352 365,632 6,431,727 1,989,011 (10,327,182) 55,177 0 0 (5,837,508) 8,489,613 5,432,145 (10,382,359) 7,092,391

0.45 1.32 5.12 1.95 1.00 97.11 3.03 3.35 11.33 8.44 -

0.36 1.74 4.62 1.53 1.01 100.31 2.02 -4.77 -16.09 -12.25 -

0.43 1.24 8.03 1.25 0.90 94.66 5.29 0.78 3.63 2.94 -

0.48 14.41 20.37 1.41 0.72 108.76 -13.20 -32.43 -823.35 -142.21 -

12.Inventory Turnover Ratio (F1 to B2) 13.Interest cover ratio [(F7+ F6(i)) to F6(i)] 14.Net profit margin (F7 as % of F1) 15.Operating cash flow to debt ratio [F11 to (C+D)] 1 6.Earning per share after tax (Rs./share) [(F7-F8)/No. of Ord. shares] 17.Break-up value shares (Rs./share) (E/No. of Ord. shares)

5.53 1.39 0.00 0.86 11.26

4.51 -2.69 0.00 -2.96 20.60

3.36 0.46 0.00 0.01 13.01

9.94 -4.19 -23.14 -0.17 -26.48 -6.61

Pakistan State Oil Co. Ltd.

Financial Statement Analysis

Items A.Non-Current Assets (A1+A3+A5+A6+A7) 1.Capital work in progress 2.Operating fixed assets at cost 3.Operating fixed assets after deducting accumulated depreciation 4.Depreciation for the year 5.Intangible assets 6.Long term investments 7.Other non-current assets B.Current Assets (B1+B2+B3+B4+B5) 1 .Cash & bank balance 2.Inventories 3.Trade Debt 4.Short term investments 5.Other current assets C.Current Liabilities (C1+C2) 1.Short term Secured loans 2.Other current liabilities D.Non-Current Liabilities (D1+D2+D3+D4+D5) 1 .Long term secured loans 2.Long term unsecured loans 3.Debentures/TFCs 4.Employees benefit obligations 5.Other non-current liabilities E.Shareholders Equity 2006 7,639,248 13,668,22 0 7,484,429 1,046,839 154,819 62,529,27 6 1,898,894 28,168,63 3 11,839,51 8 3,278,970 17,343,26 1 49,355,46 5 7,648,919 41,706,54 6 0 0 0 20,813,05 2007 8,138,529 16,244,045 8,012,317 1,098,157 126,212 66,598,786 1,522,276 29,562,055 13,599,966 2,990,591 18,923,898 53,798,098 9,064,781 44,733,317 0 0 0 20,939,217 2008 7,566,051 16,774,554 7,460,549 1,119,137 105,502 119,543,969 3,018,640 62,360,067 33,904,728 2,701,097 17,559,437 96,144,966 10,997,908 85,147,058 0 0 0 30,965,054

200

(E1+E2+E3) 1.Issued, Subscribed & Paid up capital i).Ordinary Shares ii).Preference shares 2.Reserves i).Capital Reserve ii).Revenue Reserve 3.Surplus on revaluation of fixed assets F.Operation: 1.Sales i).Local sales (Net) ii).Export Sales (Net) 2.Cost of sales i).Cost of material ii).Other input cost 3.Gross Profit 4.General, administrative and other expenses i).Selling & distribution expenses ii).Administrative and other expenses 5.Salaries, wages and employee benefits 6.Financial expenses o f which: (i) Interest expenses 7.Net profit before tax 8.Tax expense (current year) 9.Total amount of dividend 1 0.Total value of bonus shares issued 11 .Cash flows from operations G.Miscellaneous 1.Total capital employed (E+D) 2.Total fixed liabilities (D1+D3) 3.Retention in business (F7-F8F9) 4.Contractual Liabilities (G2+C1) H.Key Performance Indicators 1 .Acid test or quick ratio[(B1 +B3+B4) to C] 2.Financial expenses as % of sales (F6 as % of F1) 3.Trade Debt as % of sales (B3 as % of F1)

9 1,715,190 1,715,190 0 19,097,86 9 353,833,3 45 353,833,3 45 0 336,626,1 19 17,207,22 6 7,101,552 7,101,552 884,153 11,654,10 1 4,335,720 5,831,646 0 20,813,05 9 0 1,486,735 7,648,919 1,715,190 1,715,190 0 19,224,027 411,989,979 411,989,979 0 399,730,549 12,259,430 6,012,814 6,012,814 1,158,112 7,121,980 2,483,725 3,601,899 0 20,939,217 0 1,036,356 9,064,781 1,715,190 1,715,190 0 29,249,864 583,213,959 583,213,959 0 553,190,333 30,023,626 9,283,021 9,283,021 1,367,898 21,377,412 7,392,666 4,030,696 0 30,965,054 0 9,954,050 10,997,908

0.34 0.25 3.35

0.34 0.28 3.30

0.41 0.23 5.81

4.Assets turnover ratio [F1 to (A+B)] 5.Current ratio (B to C) 6.Cost of goods sold to sales (F2 as % of F1) 7.Debt equity ratio [(C+D) to E] 8.Return on assets [F7 as % of avg.(A+B)] 9.Return of equity (F7 as % of avg. E) 10.Return on capital employed ( F7 as % of avg. G1) 11.Dividend cover ratio [(F7-F8) to F9] 12.Inventory Turnover Ratio (F1 to B2) 13.Interest cover ratio [(F7+ F6(i)) to F6(i)] 14.Net profit margin (F7 as % of F1) 15.Operating cash flow to debt ratio [F11 to (C+D)] 1 6.Earning per share after tax (Rs./share) [(F7-F8)/No. of Ord. shares] 17.Break-up value shares (Rs./share) (E/No. of Ord. shares)

5.04 1.27 95.14 2.37 19.07 59.08 59.08 1.25 12.56 3.29 0.00 42.67 121.35

5.51 1.24 97.02 2.57 9.83 34.12 34.12 1.29 13.94 1.73 0.00 27.04 122.08

4.59 1.24 94.85 3.10 21.18 82.37 82.37 3.47 9.35 3.67 0.00 81.53 180.53

Shell Pakistan Ltd.

Financial Statement Analysis

Items A.Non-Current Assets (A1+A3+A5+A6+A7) 1.Capital work in progress 2.Operating fixed assets at cost 3.Operating fixed assets after deducting accumulated depreciation 4.Depreciation for the year 5.Intangible assets 6.Long term investments 7.Other non-current assets B.Current Assets (B1+B2+B3+B4+B5) 1 .Cash & bank balance 2.Inventories 3.Trade Debt 2006 7,639,248 13,668,22 0 7,484,429 1,046,839 154,819 62,529,27 6 1,898,894 28,168,63 3 11,839,51 2007 8,138,529 16,244,045 8,012,317 1,098,157 126,212 66,598,786 1,522,276 29,562,055 13,599,966 2008 7,566,051 16,774,554 7,460,549 1,119,137 105,502 119,543,969 3,018,640 62,360,067 33,904,728 2009 14,732,119 698,501 16,692,857 6,288,524 1,141,698 68,872 2,153,514 5,522,708 138,689,524 2,883,118 40,698,209 80,509,830

4.Short term investments 5.Other current assets C.Current Liabilities (C1+C2) 1.Short term Secured loans 2.Other current liabilities D.Non-Current Liabilities (D1+D2+D3+D4+D5) 1 .Long term secured loans 2.Long term unsecured loans 3.Debentures/TFCs 4.Employees benefit obligations 5.Other non-current liabilities E.Shareholders Equity (E1+E2+E3) 1.Issued, Subscribed & Paid up capital i).Ordinary Shares ii).Preference shares 2.Reserves i).Capital Reserve ii).Revenue Reserve 3.Surplus on revaluation of fixed assets F.Operation: 1.Sales i).Local sales (Net) ii).Export Sales (Net) 2.Cost of sales i).Cost of material ii).Other input cost 3.Gross Profit 4.General, administrative and other expenses i).Selling & distribution expenses ii).Administrative and other expenses 5.Salaries, wages and employee benefits

8 3,278,970 17,343,26 1 49,355,46 5 7,648,919 41,706,54 6 0 0 0 20,813,05 9 1,715,190 1,715,190 0 19,097,86 9 353,833,3 45 353,833,3 45 0 336,626,1 19 17,207,22 6 7,101,552 7,101,552 -

2,990,591 18,923,898 53,798,098 9,064,781 44,733,317 0 0 0 20,939,217 1,715,190 1,715,190 0 19,224,027 411,989,979 411,989,979 0 399,730,549 12,259,430 6,012,814 6,012,814 -

2,701,097 17,559,437 96,144,966 10,997,908 85,147,058 0 0 0 30,965,054 1,715,190 1,715,190 0 29,249,864 583,213,959 583,213,959 0 553,190,333 30,023,626 9,283,021 9,283,021 -

0 14,598,367 130,023,120 18,654,526 111,368,594 2,527,738 0 0 0 1,673,020 854,718 20,870,785 1,715,190 1,715,190 0 19,155,595 545,595 18,610,000 0 612,695,589 612,695,589 0 609,685,478 0 609,685,478 3,010,111 10,815,121 3,960,953 6,854,168 2,871,933

6.Financial expenses f which: (i) Interest expenses 7.Net profit before tax 8.Tax expense (current year) 9.Total amount of dividend 1 0.Total value of bonus shares issued 11 .Cash flows from operations G.Miscellaneous 1.Total capital employed (E+D) 2.Total fixed liabilities (D1+D3) 3.Retention in business (F7-F8-F9) 4.Contractual Liabilities (G2+C1) H.Key Performance Indicators 1 .Acid test or quick ratio[(B1 +B3+B4) to C] 2.Financial expenses as % of sales (F6 as % of F1) 3.Trade Debt as % of sales (B3 as % of F1) 4.Assets turnover ratio [F1 to (A+B)] 5.Current ratio (B to C) 6.Cost of goods sold to sales (F2 as % of F1) 7.Debt equity ratio [(C+D) to E] 8.Return on assets [F7 as % of avg.(A+B)] 9.Return of equity (F7 as % of avg. E) 10.Return on capital employed ( F7 as % of avg. G1) 11.Dividend cover ratio [(F7-F8) to F9] 12.Inventory Turnover Ratio (F1 to B2) 13.Interest cover ratio [(F7+ F6(i)) to F6(i)] 14.Net profit margin (F7

884,153 o 11,654,10 1 4,335,720 5,831,646 0 20,813,05 9 0 1,486,735 7,648,919

1,158,112 7,121,980 2,483,725 3,601,899 0 -

1,367,898 21,377,412 7,392,666 4,030,696 0 -

6,232,056 2,953,427 (11,356,864) 201,536 857,595 0 (4,828,554)

20,939,217 0 1,036,356 9,064,781

30,965,054 0 9,954,050 10,997,908

23,398,523 0 (12,415,995) 18,654,526

0.34 0.25 3.35 5.04 1.27 95.14 2.37 19.07 59.08 59.08 1.25 12.56 3.29

0.34 0.28 3.30 5.51 1.24 97.02 2.57 9.83 34.12 34.12 1.29 13.94 1.73

0.41 0.23 5.81 4.59 1.24 94.85 3.10 21.18 82.37 82.37 3.47 9.35 3.67

0.64 1.02 13.14 3.99 1.07 99.51 6.35 -8.10 -43.82 -41.78 -13.48 15.05 -2.85 -1.85

as % of F1) 15.Operating cash flow to debt ratio [F11 to (C+D)] 1 6.Earning per share after tax (Rs./share) [(F7F8)/No. of Ord. shares] 17.Break-up value shares (Rs./share) (E/No. of Ord. shares)

0.00 42.67 121.35

0.00 27.04 122.08

0.00 81.53 180.53

-0.04 -67.39 121.68

References Abarbanell, J., & Bushee, B. (1997). Fundamental analysis, future earnings and stock prices. Journal of Accounting Research, 35(1), 1-24. Eisemann, P. (1997). Return on equity and systematic ratio analysis. Commercial Lending Review, 12 (3), 51-57. Fairfield, P., & Yohn, T. (2001). Using asset turnover and profit margin to forecast changes in profitability. Review of Accounting Studies, 6, 371-385. Hampton, J. J. (2003). Financial Decision Making. New Delhi: PHI Learning Milbourn, G., & Haight, T. (2005). Providing students with an overview of financial statements using the Dupont analysis approach, Journal of American Academy of Business, 6(1), 46-50. Nissim, D. & Penman, S. H. (2003). Financial Statement Analysis of Leverage and How It Informs About Profitability and Price-to-Book Ratios. Review of Accounting Studies, 8, 531-560. Nissim, D. & Penman, S. H. (2001). Ratio Analysis and Equity Valuation: From Research to Practice. Review of Accounting Studies, 6, 109154. Ott, S., Riddiough, T., & Yi, H. (2005). Finance, investment and investment performance: Evidence from the REIT sector. Real Estate Economics, 33(1), 203-235. Saunders, A. (2000). Management of Financial Institutions. (3rd ed.). McGraw Hill. Research Journal of Finance and Accounting www.iiste.org Sinha, G. (2010). Financial Statement Analysis. New Delhi: PHI Learning Soliman, M. (2008). The use of Dupont analysis by market participants. The Accounting Review, 83(3), 823-853. Smart, S., Megginson, W., & Gitman, L. (2007). Corporate Finance. Mason, OH: Thomson South-Western.

Você também pode gostar

- Conrad Hilton: Business PersonalityDocumento16 páginasConrad Hilton: Business PersonalityjanmarcianoAinda não há avaliações

- Business Plan - PASS DMCCDocumento13 páginasBusiness Plan - PASS DMCCFarrukh Maqsood100% (1)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementAinda não há avaliações

- Business Development Strategy for the Upstream Oil and Gas IndustryNo EverandBusiness Development Strategy for the Upstream Oil and Gas IndustryNota: 5 de 5 estrelas5/5 (1)

- Financial Reporting under IFRS: A Topic Based ApproachNo EverandFinancial Reporting under IFRS: A Topic Based ApproachAinda não há avaliações

- FABM1 - 1st QuarterDocumento9 páginasFABM1 - 1st QuarterRaquel Sibal Rodriguez100% (2)

- Corporate Finance ProjectDocumento18 páginasCorporate Finance ProjectRohan SaxenaAinda não há avaliações

- Revised Proposal For Final Project FIn619Documento7 páginasRevised Proposal For Final Project FIn619AbdulRehman100% (5)

- C. Either A or B.: Discussion ProblemsDocumento8 páginasC. Either A or B.: Discussion ProblemsGlen JavellanaAinda não há avaliações

- Chapter-1: 1. Industry Scenario 1.1 Macro ProspectiveDocumento52 páginasChapter-1: 1. Industry Scenario 1.1 Macro Prospectivemubeen902Ainda não há avaliações

- Assurance Certificate LevelDocumento76 páginasAssurance Certificate Levelrubel khan100% (4)

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesNo EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesAinda não há avaliações

- A Study On Overall Financial Performance AnalysisDocumento104 páginasA Study On Overall Financial Performance Analysisaarasu007100% (2)

- Project Finance and Evaluation Report at IOCL Barauni RefineryDocumento57 páginasProject Finance and Evaluation Report at IOCL Barauni Refineryanshu276Ainda não há avaliações

- Working Capital Management PROJECT REPORT MBADocumento90 páginasWorking Capital Management PROJECT REPORT MBABabasab Patil (Karrisatte)100% (14)

- KPI Book Sample PDFDocumento90 páginasKPI Book Sample PDFAnonymous fZ93HP4UYg100% (3)

- IJRPR18248Documento5 páginasIJRPR18248mudrankiagrawalAinda não há avaliações

- I. Executive Summary: Oil India Limited (OIL)Documento5 páginasI. Executive Summary: Oil India Limited (OIL)pawan995470Ainda não há avaliações

- Introduction to Finance Functions and Decisions in BusinessDocumento64 páginasIntroduction to Finance Functions and Decisions in BusinessSathyaPriya RamasamyAinda não há avaliações

- Working Capital Management AbstractDocumento14 páginasWorking Capital Management AbstractPriyanka GuptaAinda não há avaliações

- Rehan Project FinancialAnalysis Ofdifferent CompaniesDocumento119 páginasRehan Project FinancialAnalysis Ofdifferent Companiesahmad frazAinda não há avaliações

- A Study On Financial Performance Analysis: 1. Short-Term SolvencyDocumento4 páginasA Study On Financial Performance Analysis: 1. Short-Term SolvencysujithvijiAinda não há avaliações

- Final SipDocumento42 páginasFinal Siphsaurav06Ainda não há avaliações

- Report 2009Documento72 páginasReport 2009coolatifAinda não há avaliações

- WCM @bahety Chemicals & Minerals PVT - LTDDocumento91 páginasWCM @bahety Chemicals & Minerals PVT - LTDmoula nawazAinda não há avaliações

- Financial Performance of HSLDocumento151 páginasFinancial Performance of HSLNareshkumar Koppala100% (2)

- Lalitha Financial ManagementDocumento69 páginasLalitha Financial ManagementChadra SekharAinda não há avaliações

- Chapter-I: Working CapitalDocumento46 páginasChapter-I: Working CapitalGou225Ainda não há avaliações

- Kiran Sir Financial Performance Sagar CementsDocumento72 páginasKiran Sir Financial Performance Sagar CementsPrem RajAinda não há avaliações

- Major Project 2Documento40 páginasMajor Project 2lordansarrii786Ainda não há avaliações

- Financial Statement Analysis (FIN AL)Documento32 páginasFinancial Statement Analysis (FIN AL)Abdullah RashidAinda não há avaliações

- 6 20 1 PBDocumento8 páginas6 20 1 PBduraiprakash83Ainda não há avaliações

- Working Capital Project 2Documento60 páginasWorking Capital Project 2cakotyAinda não há avaliações

- 1 - IntroductionDocumento8 páginas1 - IntroductionPraveen KamashettiAinda não há avaliações

- Financial Radio Analysis-AmbujaDocumento94 páginasFinancial Radio Analysis-Ambujak eswariAinda não há avaliações

- Ratio AnalysisDocumento64 páginasRatio AnalysisShams SAinda não há avaliações

- FFC - 2020 Fauji Fertilizer Company Limited - OpenDoors - PKDocumento32 páginasFFC - 2020 Fauji Fertilizer Company Limited - OpenDoors - PKMuhammad SalmanAinda não há avaliações

- Ratio Analysis 'Documento67 páginasRatio Analysis 'boidapu kanakarajuAinda não há avaliações

- Working Capital:: Long Term FundsDocumento78 páginasWorking Capital:: Long Term Fundssaran gokulAinda não há avaliações

- Du Pont AnalysisDocumento52 páginasDu Pont AnalysisNidhi GargAinda não há avaliações

- A Study On Working Capital Management With Special Reference To Tube Products of India Limited, ChennaiDocumento41 páginasA Study On Working Capital Management With Special Reference To Tube Products of India Limited, ChennaiBasant NagarAinda não há avaliações

- A Study On Funds Flow Analysis With Reference To GAIL (India) Limited, RajahmundryDocumento31 páginasA Study On Funds Flow Analysis With Reference To GAIL (India) Limited, RajahmundryZASXAAinda não há avaliações

- SynopsisDocumento11 páginasSynopsisDINESH RATHODAinda não há avaliações

- Working Capital and Fund Flow Statement of Modest Infrastucture LTDDocumento27 páginasWorking Capital and Fund Flow Statement of Modest Infrastucture LTDMegha HumbalAinda não há avaliações

- Abdlkerim Resarch Paper1Documento58 páginasAbdlkerim Resarch Paper1eferemAinda não há avaliações

- Working Capital Management of Bahety ChemicalsDocumento92 páginasWorking Capital Management of Bahety Chemicalsletter2lalAinda não há avaliações

- A Study On Financial Performance Analysis of Dabur India LimitedDocumento7 páginasA Study On Financial Performance Analysis of Dabur India Limitedutsav9maharjanAinda não há avaliações

- Sibar Funds Flow StateDocumento63 páginasSibar Funds Flow StateAnonymous 22GBLsme1100% (1)

- Fianl ProjectDocumento59 páginasFianl ProjectBilal GillaniAinda não há avaliações

- Operational Efficiency of Sakthi FinanceDocumento88 páginasOperational Efficiency of Sakthi FinancemaheswariAinda não há avaliações

- A Study On Financial Analysis of Maruthi Suzuki India Limited CompanyDocumento9 páginasA Study On Financial Analysis of Maruthi Suzuki India Limited CompanyVandanaAinda não há avaliações

- N19070293101 PDFDocumento9 páginasN19070293101 PDFOwais KadiriAinda não há avaliações

- Zuwari CementDocumento81 páginasZuwari Cementnightking_1Ainda não há avaliações

- Bharat Bohra ProjectDocumento10 páginasBharat Bohra ProjectManvendra AcharyaAinda não há avaliações

- Ministry of Petroleum and Natural Gas & Oidb: Energy Sector Structures, Policies and RegulationsDocumento7 páginasMinistry of Petroleum and Natural Gas & Oidb: Energy Sector Structures, Policies and RegulationsNikesh PullurAinda não há avaliações

- Financial Analysis of Coromandel FertilizersDocumento80 páginasFinancial Analysis of Coromandel Fertilizersboidapu kanakarajuAinda não há avaliações

- Punch MCPDocumento55 páginasPunch MCPmegha angadiAinda não há avaliações

- Funds Flow Analysis of GAIL (India) LimitedDocumento38 páginasFunds Flow Analysis of GAIL (India) LimitedZASXAAinda não há avaliações

- 17 Jul CilDocumento85 páginas17 Jul CilPritam BasuAinda não há avaliações

- The Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per ShareDocumento11 páginasThe Effect of Changes in Return On Assets, Return On Equity, and Economic Value Added To The Stock Price Changes and Its Impact On Earnings Per Sharegrizzly hereAinda não há avaliações

- WORKING CAPITAL ANALYSISDocumento83 páginasWORKING CAPITAL ANALYSISParveen NarwalAinda não há avaliações

- Market DevelopmentDocumento48 páginasMarket DevelopmentVandan SapariaAinda não há avaliações

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Ainda não há avaliações

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)No EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Ainda não há avaliações

- CH 07Documento49 páginasCH 07ChristyAinda não há avaliações

- Interamerican University of Puerto Rico: I. True or FalseDocumento13 páginasInteramerican University of Puerto Rico: I. True or FalsePatricia TorresAinda não há avaliações

- Chapter 3 (Accounting - What The Numbers Mean 10e)Documento17 páginasChapter 3 (Accounting - What The Numbers Mean 10e)Nguyen Dac ThichAinda não há avaliações

- Karnataka Urban Water Supply and Drainage Board Act, 1973Documento67 páginasKarnataka Urban Water Supply and Drainage Board Act, 1973Latest Laws TeamAinda não há avaliações

- Signed Off Entrepreneurship12q2 Mod7 Forecasting Revenues and Costs Department v3Documento26 páginasSigned Off Entrepreneurship12q2 Mod7 Forecasting Revenues and Costs Department v3Juliana Renz BlamAinda não há avaliações

- Fsav 5e - Errata 082718 PDFDocumento26 páginasFsav 5e - Errata 082718 PDFAbhi AbhiAinda não há avaliações

- PFRS 15Documento24 páginasPFRS 15Princess Jullyn ClaudioAinda não há avaliações

- Annual Report & Accounts Annual Report & Accounts: Document2 12/23/04 12:07 PM Page 1Documento92 páginasAnnual Report & Accounts Annual Report & Accounts: Document2 12/23/04 12:07 PM Page 1thestorydotieAinda não há avaliações

- Working Capital Management of Bisleri Pvt LtdDocumento82 páginasWorking Capital Management of Bisleri Pvt LtdVivek Haridas75% (4)

- Bank Financial Statements and CalculationsDocumento8 páginasBank Financial Statements and CalculationsĐặng Thị TrâmAinda não há avaliações

- Gillette CaseDocumento17 páginasGillette CaseNuman Ali100% (1)

- Management Compensation PlansDocumento41 páginasManagement Compensation PlansMichael JohnsonAinda não há avaliações

- Case Analysis For Culinarian CookwareDocumento23 páginasCase Analysis For Culinarian Cookwarevisakhboban100% (1)

- ch13 PDFDocumento83 páginasch13 PDFCoita DewiAinda não há avaliações

- VarianceDocumento5 páginasVarianceMuhammad Hussnain100% (1)

- Noida Toll BridgeDocumento6 páginasNoida Toll BridgePhani MkmsAinda não há avaliações

- Theory and Evidence For A Free LunchDocumento45 páginasTheory and Evidence For A Free LunchCsoregi NorbiAinda não há avaliações

- Cfap - 6: Audit, Assurance and Related ServicesDocumento83 páginasCfap - 6: Audit, Assurance and Related ServicesUmar FarooqAinda não há avaliações

- Unit 3 - Strategic Performance Measurement111Documento130 páginasUnit 3 - Strategic Performance Measurement111Art IslandAinda não há avaliações

- Accounting 1 2013Documento3 páginasAccounting 1 2013Qasim IbrarAinda não há avaliações

- Material CostingDocumento18 páginasMaterial CostingRaj KumarAinda não há avaliações

- Assignment For Finanacial Management IDocumento12 páginasAssignment For Finanacial Management IHailu DemekeAinda não há avaliações

- ACCT 1005 WorkSheet 1Documento5 páginasACCT 1005 WorkSheet 1Simone Bayne0% (1)

- Pableo Final DefenseDocumento97 páginasPableo Final DefenseDinalyn OfqueriaAinda não há avaliações