Escolar Documentos

Profissional Documentos

Cultura Documentos

Negotiable Instruments Law

Enviado por

Tacoy DolinaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Negotiable Instruments Law

Enviado por

Tacoy DolinaDireitos autorais:

Formatos disponíveis

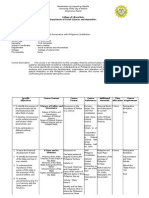

NEGOTIABLE INSTRUMENTS LAW

Prof. Ma. Ella Cecilia Dumlao-Escalante

Section 1. Form of Negotiable Instruments An instrument to be negotiable must conform to the following requirements: a. It must be in writing and signed by the maker or drawer; b. Must contain an unconditional promise or order to pay a sum certain in money; c. Must be payable on demand or at a fixed or determinable future time; d. Must be payable to order to bearer; and e. Where the instrument is addressed to a drawee, he must be named or otherwise indicated therein with reasonable certainty. Section 14. Blank, when may be filled Where the instrument is wanting in any material particular, the person in possession thereof has a prima facie authority to complete it by filling up the blanks therein. And a signature on a blank paper delivered by the person making the signature in order that the paper may be converted into a negotiable instrument operates as a prima facie authority to fill it up as such for any amount. In order, however, that any such instrument, when completed, may be enforced against any person who became a party thereto prior to its completion, it must be filled up strictly in accordance with the authority given and within a reasonable time. But if any such instrument, after completion is negotiated to a holder in due course, it is valid and effectual for all purposes in his hands, and he may enforced it as if it had been filled up strictly in accordance with authority given and within a reasonable time. Section 15. Incomplete instrument not delivered Where an incomplete instrument has not been delivered it will not, if completed and negotiated without authority, be a valid contract in the hands of any holder, as against any person whose signature was placed thereon before delivery.

Section 16. Delivery, when effectual, when presumed Every contract on a negotiable instrument is incomplete and revocable until delivery of the instrument for the purpose of giving effect thereto. As between immediate parties and as regards a remote party other than a holder in due course, the delivery in order to be effectual, must be made either by or under the authority, drawing, accepting or indorsing, as the case may be; and in such case, the delivery may be shown to have been conditional, or for a special purpose only, and not for the purpose of transferring the property in the instrument. But when the instrument is in the hands of a holder in due course, a valid delivery thereof by all parties prior to him so as to make them liable to him is conclusively presumed. And where the instrument is no longer in the possession of a party whose signature appears thereon, a valid and intentional delivery by him is presumed until the contrary is proved. Section 23. Forged signature; effect When a signature is forged or made without the authority of the person whose signature it purports to be, it is wholly inoperative, and no right to retain the instrument, or to give a discharge therefor, or to enforced payment thereof against any party thereto, can be acquired through or under such signature unless the party against whom it is sought to enforce such right is precluded from setting up the forgery or want of authority. Section 52. What constitutes a holder in due course A holder in due course is a holder who has taken the instrument under the following conditions: a. That it is complete and regular upon its face; b. That he became the holder of it before it was overdue, and without notice that it had been previously dishonoured, if such was the fact; c. That he took it in good faith and for value; d. That at the time it was negotiated to him he had no notice of any infirmity in the instrument or defect in the title of the person negotiating it.

Section 124. Alteration of instrument; effect of Where a negotiable instrument is materially altered without the assent of all parties liable thereon, it is avoided except as against a party who has himself made, authorized or assented to the alteration and subsequent indorsers. But when an instrument has been materially altered and is in the hands of a holder in due course not a party to the alteration, he may enforce payment thereof according to its original tenor.

NEGOTIABILITY is that quality or attribute of a bill or note whereby it may pass from one person to another similar to money, so as to give the holder in due course the right to collect on the instrument the sum payable for himself free from any defect in the title of any of the prior parties or defences available to them among themselves.

FORM AND INTERPRETATION I. Requisites of Negotiability NEGOTIABLE INSTRUMENT is a contractual obligation to pay money. COMMERCIAL PAPER refers to written promises or obligations that arise out of commercial transactions from the use of such instruments as promissory notes and bills of exchange. PROMISSORY NOTE is a written promise to pay a sum of money. Special: certificates of deposits, bank notes, due bills, bonds Parties: MAKER who makes the promise and signs the instrument, PAYEE to whom promise is made or instrument is payable BILLS OF EXCHANGE is essentially an order made by one person to another to pay money to a third person. Special: rafts, trade acceptances, bankers acceptances, CHECKS (order bill drawn on a bank and payable on demand) Parties: DRAWER who issues and draws the order bill, DRAWEE to whom the bill is addressed and who is ordered and expected to pay, PAYEE is the party in whose favour the bill is payable.

II. Doctrine of Substantial Compliance When negotiability is not affected III. Construction where instrument is ambiguous

Você também pode gostar

- NEGOTIABLE INSTRUMENTS LAwDocumento11 páginasNEGOTIABLE INSTRUMENTS LAwMorgana BlackhawkAinda não há avaliações

- Date, Presumption As ToDocumento6 páginasDate, Presumption As ToAbraham ChinAinda não há avaliações

- Negotiable Instruments RecitationDocumento10 páginasNegotiable Instruments RecitationMarkonitchee Semper FidelisAinda não há avaliações

- Iv. Negotiable Instruments Law Negotiable InstrumentDocumento13 páginasIv. Negotiable Instruments Law Negotiable InstrumentPaoloTrinidadAinda não há avaliações

- Negotiable Instruments Law ReviewerDocumento18 páginasNegotiable Instruments Law Reviewernoorlaw100% (2)

- NIL Important ProvisionsDocumento2 páginasNIL Important ProvisionsKrysha AlmazanAinda não há avaliações

- Iv. Negotiable Instruments Law Negotiable InstrumentDocumento23 páginasIv. Negotiable Instruments Law Negotiable InstrumentPaoloTrinidadAinda não há avaliações

- Section 1. Form of Negotiable Instruments. - AnDocumento1 páginaSection 1. Form of Negotiable Instruments. - AnBonn PustaAinda não há avaliações

- Negotiable InstrumentsDocumento6 páginasNegotiable Instrumentskero keropiAinda não há avaliações

- Real Defenses and Personal Defenses in Negotiable InstrumentsDocumento16 páginasReal Defenses and Personal Defenses in Negotiable Instrumentsmz rphAinda não há avaliações

- Concept of Negotiable InstrumentsDocumento6 páginasConcept of Negotiable InstrumentsJemmieAinda não há avaliações

- Negotiable instruments types and implicationsDocumento5 páginasNegotiable instruments types and implicationsAlexis KingAinda não há avaliações

- Vocabulary Negotiable InstrumentsDocumento6 páginasVocabulary Negotiable InstrumentsJan Joshua Paolo GarceAinda não há avaliações

- Negotiable Instruments LawDocumento23 páginasNegotiable Instruments LawPhilippe AmbasAinda não há avaliações

- Sec. 1. Form of Negotiable InstrumentDocumento24 páginasSec. 1. Form of Negotiable InstrumentLance MorilloAinda não há avaliações

- Negotiable InstrumentsDocumento12 páginasNegotiable Instrumentsjalilah guntiAinda não há avaliações

- Recitation For Negotiable Instruments: Mandatory SectionsDocumento11 páginasRecitation For Negotiable Instruments: Mandatory SectionsPaolo PacquiaoAinda não há avaliações

- Nego Handout 2Documento5 páginasNego Handout 2Cielo Mae ParungoAinda não há avaliações

- Negotiable Instruments Assigned ProvisionsDocumento32 páginasNegotiable Instruments Assigned ProvisionsRovi Kennth RamosAinda não há avaliações

- An Instrument To Be Negotiable Must Conform To The FollowingDocumento16 páginasAn Instrument To Be Negotiable Must Conform To The FollowingCecille TaguiamAinda não há avaliações

- LAW 123 Negotiable Instruments Finals ReviewerDocumento7 páginasLAW 123 Negotiable Instruments Finals ReviewerTrinca Diploma100% (1)

- The Negotiable Instruments LawDocumento5 páginasThe Negotiable Instruments LawLorelei B RecuencoAinda não há avaliações

- MBA 10-09 Assignment On Business Legislation TopicDocumento7 páginasMBA 10-09 Assignment On Business Legislation TopicKitdor HynniewtaAinda não há avaliações

- The Negotiable Instruments Law CodalDocumento12 páginasThe Negotiable Instruments Law CodalAleezah Gertrude RaymundoAinda não há avaliações

- NIL Compilation of ReviewersDocumento236 páginasNIL Compilation of ReviewerstowanAinda não há avaliações

- Nego Sec 1-23Documento4 páginasNego Sec 1-23Gracielle Falcasantos Dalaguit0% (1)

- NIL Finals Samplex AnswerDocumento5 páginasNIL Finals Samplex AnswerMark De JesusAinda não há avaliações

- The Negotiable Instruments LawDocumento3 páginasThe Negotiable Instruments LawTinny Flores-LlorenAinda não há avaliações

- Corporate legal environment study notesDocumento13 páginasCorporate legal environment study notesHardik KothiyalAinda não há avaliações

- The Negotiable Instruments LawDocumento26 páginasThe Negotiable Instruments LawOscar Ryan SantillanAinda não há avaliações

- Rights of Holders and Types of EndorsementsDocumento28 páginasRights of Holders and Types of EndorsementsNeenu VargheseAinda não há avaliações

- Negotiable Instruments Law Sections ExplainedDocumento5 páginasNegotiable Instruments Law Sections ExplainedMeme ToiAinda não há avaliações

- The Negotiable Instruments Law I. Form and InterpretationDocumento7 páginasThe Negotiable Instruments Law I. Form and Interpretationhigh protectorAinda não há avaliações

- Ni Act 2Documento15 páginasNi Act 2Shivangi ChandakAinda não há avaliações

- NIL CodalDocumento2 páginasNIL CodaljazzpianoAinda não há avaliações

- Business Law: Certificate LevelDocumento14 páginasBusiness Law: Certificate LevelRafidul IslamAinda não há avaliações

- NIL Sections 1-52Documento10 páginasNIL Sections 1-52RL N DeiparineAinda não há avaliações

- What Are Negotiable Instruement? Why Are Negotiable Instrument Important For Trade and Commerce?Documento5 páginasWhat Are Negotiable Instruement? Why Are Negotiable Instrument Important For Trade and Commerce?Ramsha ZahidAinda não há avaliações

- Payment in Due CourseDocumento5 páginasPayment in Due CourseKazi Shafiqul Azam0% (1)

- Form and InterpretationDocumento4 páginasForm and InterpretationRommel CruzAinda não há avaliações

- Characteristics and Elements of Negotiable InstrumentsDocumento13 páginasCharacteristics and Elements of Negotiable InstrumentsLorenz Reyes100% (2)

- Unit 6Documento5 páginasUnit 6rtrsujaladhikariAinda não há avaliações

- Philippine Negotiable Instruments Law of 1911Documento6 páginasPhilippine Negotiable Instruments Law of 1911Sanji VinsmokeAinda não há avaliações

- Negotiable InstrumentsDocumento3 páginasNegotiable InstrumentsHer SheAinda não há avaliações

- Negotiable Instruments LawDocumento11 páginasNegotiable Instruments LawMildred ZAinda não há avaliações

- Blaw Prefi NotesDocumento18 páginasBlaw Prefi NotesKyn RusselAinda não há avaliações

- Y N - Negotiable Instruments Law: Asay OtesDocumento6 páginasY N - Negotiable Instruments Law: Asay OtesBrandon BeachAinda não há avaliações

- Section 1. Form of Negotiable Instruments. - An Instrument To Be Negotiable MustDocumento11 páginasSection 1. Form of Negotiable Instruments. - An Instrument To Be Negotiable MustWarly PabloAinda não há avaliações

- Section 1. Form of Negotiable Instruments. - An Instrument To Be Negotiable MustDocumento11 páginasSection 1. Form of Negotiable Instruments. - An Instrument To Be Negotiable MustWarly PabloAinda não há avaliações

- College of Business Administration Business Law 4 - Negotiable InstrumentsDocumento4 páginasCollege of Business Administration Business Law 4 - Negotiable InstrumentsArimarc CodilloAinda não há avaliações

- Final Activity 2Documento5 páginasFinal Activity 2Thea BaruzoAinda não há avaliações

- History of Negotiable InstrumentDocumento23 páginasHistory of Negotiable InstrumentQuintos AssociatesAinda não há avaliações

- Negotiable Instruments Law Memory AidDocumento15 páginasNegotiable Instruments Law Memory AidMelvin Pernez100% (1)

- Negotiable Instruments Qanda NotesDocumento20 páginasNegotiable Instruments Qanda NotesRamon Joma BungabongAinda não há avaliações

- MBA TM III Legal Systems of Business Negotiable InstrumentsDocumento20 páginasMBA TM III Legal Systems of Business Negotiable InstrumentsVijaya BanuAinda não há avaliações

- Business Law 4: (Negotiable Instrument) MidtermDocumento14 páginasBusiness Law 4: (Negotiable Instrument) MidtermJayson ResurreccionAinda não há avaliações

- Nil 1Documento11 páginasNil 1Mark Joseph VirgilioAinda não há avaliações

- Convention on International Interests in Mobile Equipment - Cape Town TreatyNo EverandConvention on International Interests in Mobile Equipment - Cape Town TreatyAinda não há avaliações

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsAinda não há avaliações

- Introduction to Negotiable Instruments: As per Indian LawsNo EverandIntroduction to Negotiable Instruments: As per Indian LawsNota: 5 de 5 estrelas5/5 (1)

- Philippines Supreme Court Upholds Constitutionality of Archipelagic Baselines LawDocumento23 páginasPhilippines Supreme Court Upholds Constitutionality of Archipelagic Baselines LawTacoy DolinaAinda não há avaliações

- G. R. No. 195002 January 25, 2012 HECTOR TREÑAS, Petitioner, People of The PHILIPPINES, RespondentDocumento25 páginasG. R. No. 195002 January 25, 2012 HECTOR TREÑAS, Petitioner, People of The PHILIPPINES, RespondentTacoy DolinaAinda não há avaliações

- Republic Act No 10175Documento17 páginasRepublic Act No 10175Tacoy Dolina100% (1)

- The Quick Brown Fox Jumps Over The Lazy DogDocumento1 páginaThe Quick Brown Fox Jumps Over The Lazy DogTacoy DolinaAinda não há avaliações

- Ruby V CA PDFDocumento10 páginasRuby V CA PDFTacoy DolinaAinda não há avaliações

- Senator Angara: Superman-Lawyer' Doesn'T Fly AnymoreDocumento2 páginasSenator Angara: Superman-Lawyer' Doesn'T Fly AnymoreTacoy DolinaAinda não há avaliações

- Renato L. Cayetano For and in His Own Behalf. Sabina E. Acut, Jr. and Mylene Garcia-Albano Co-Counsel For PetitionerDocumento62 páginasRenato L. Cayetano For and in His Own Behalf. Sabina E. Acut, Jr. and Mylene Garcia-Albano Co-Counsel For PetitionerTacoy DolinaAinda não há avaliações

- Am NoDocumento6 páginasAm NoTacoy DolinaAinda não há avaliações

- Renato L. Cayetano For and in His Own Behalf. Sabina E. Acut, Jr. and Mylene Garcia-Albano Co-Counsel For PetitionerDocumento62 páginasRenato L. Cayetano For and in His Own Behalf. Sabina E. Acut, Jr. and Mylene Garcia-Albano Co-Counsel For PetitionerTacoy DolinaAinda não há avaliações

- Bulletin of InformationDocumento12 páginasBulletin of InformationTacoy DolinaAinda não há avaliações

- CasinasDocumento1 páginaCasinasTacoy DolinaAinda não há avaliações

- The Legal Counsel For Petitioner. CA. Ancheta & C.B. Banayos For Private RespondentsDocumento6 páginasThe Legal Counsel For Petitioner. CA. Ancheta & C.B. Banayos For Private RespondentsTacoy DolinaAinda não há avaliações

- People Vs Ramos, 39 SCRA 236Documento9 páginasPeople Vs Ramos, 39 SCRA 236Tacoy Dolina100% (1)

- CiriloDocumento2 páginasCiriloTacoy DolinaAinda não há avaliações

- CasinasDocumento1 páginaCasinasTacoy DolinaAinda não há avaliações

- Associated Bank Vs CADocumento4 páginasAssociated Bank Vs CATacoy DolinaAinda não há avaliações

- Taguig Branch: Polytechnic University of The PhilippinesDocumento1 páginaTaguig Branch: Polytechnic University of The PhilippinesTacoy DolinaAinda não há avaliações

- POLGOV - Course Syllabus (OBE) - June 7 2014Documento4 páginasPOLGOV - Course Syllabus (OBE) - June 7 2014Tacoy DolinaAinda não há avaliações

- Spouses Amparo, Et Al. Vs CaguiatDocumento1 páginaSpouses Amparo, Et Al. Vs CaguiatTacoy DolinaAinda não há avaliações

- Association of Small Landowners Vs Secretary of Agrarian Reform, 175 SCRA 343 (1989)Documento19 páginasAssociation of Small Landowners Vs Secretary of Agrarian Reform, 175 SCRA 343 (1989)Tacoy DolinaAinda não há avaliações

- Accounting12 3ed Ch12Documento23 páginasAccounting12 3ed Ch12rs8j4c4b5pAinda não há avaliações

- Session 1.3. Preparing Financial Statements Income Statement and Balance Sheet Part 2 Sync PDFDocumento57 páginasSession 1.3. Preparing Financial Statements Income Statement and Balance Sheet Part 2 Sync PDFSriAinda não há avaliações

- EPAF Sample Test PapersDocumento4 páginasEPAF Sample Test PapersmsmilansahuAinda não há avaliações

- PNB v. Sps Reblando, G.R. No. 194014, September 12, 2012Documento4 páginasPNB v. Sps Reblando, G.R. No. 194014, September 12, 2012SophiaFrancescaEspinosaAinda não há avaliações

- Paper 1 Practice Questions For SL EconDocumento14 páginasPaper 1 Practice Questions For SL EconKazeAinda não há avaliações

- Computer Advance Form IVDocumento2 páginasComputer Advance Form IVAbhishek Kumar SinghAinda não há avaliações

- Calax ItpbDocumento1 páginaCalax ItpbCharlon MayoAinda não há avaliações

- Capital Profile Weekly Report - 10.october.2014Documento7 páginasCapital Profile Weekly Report - 10.october.2014Anita KarlinaAinda não há avaliações

- CFAB - Accounting - QB - Chapter 10Documento14 páginasCFAB - Accounting - QB - Chapter 10Huy NguyenAinda não há avaliações

- Viceroy 2Documento18 páginasViceroy 2OinkAinda não há avaliações

- FCFF Valuation Model: Before You Start What The Model Inputs Master Inputs Page Earnings NormalizerDocumento64 páginasFCFF Valuation Model: Before You Start What The Model Inputs Master Inputs Page Earnings NormalizerUmangAinda não há avaliações

- Principles of Office ManagementDocumento21 páginasPrinciples of Office Managementsszma67% (9)

- Philippines Land Ownership Rules for ForeignersDocumento5 páginasPhilippines Land Ownership Rules for ForeignersLRMAinda não há avaliações

- Mergers and Acquisitions GuideDocumento12 páginasMergers and Acquisitions GuideAkshay DaveAinda não há avaliações

- 6.trial BalanceDocumento20 páginas6.trial BalanceChrisjin SujiAinda não há avaliações

- Think Twice Michael MauboussinDocumento5 páginasThink Twice Michael Mauboussindeepak aagareAinda não há avaliações

- Numberical Test (Đã S A CH A)Documento95 páginasNumberical Test (Đã S A CH A)beaml0% (1)

- Tutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Documento3 páginasTutorial - 1 - 2 - (06.10.2022, 13.10.22) TOPIC: Basic Cost Terms and Concepts, Cost Classification Ex. 1Tomas SanzAinda não há avaliações

- A Study On Difference in Gender Attitude in Investment Decision Making in IndiaDocumento17 páginasA Study On Difference in Gender Attitude in Investment Decision Making in IndiaAkit yadavAinda não há avaliações

- Bir Form 1903 - Registration Corp (Blank)Documento2 páginasBir Form 1903 - Registration Corp (Blank)Dennis Tolentino100% (3)

- 09 Section 9Documento6 páginas09 Section 9eyuelAinda não há avaliações

- Tender Document Warehouse (Financial)Documento518 páginasTender Document Warehouse (Financial)Aswad TonTong100% (3)

- The Reserve Bank of India: GovernorDocumento2 páginasThe Reserve Bank of India: GovernorIshanshu BajpaiAinda não há avaliações

- Attributes and Features of InvestmentDocumento5 páginasAttributes and Features of InvestmentAashutosh ChandraAinda não há avaliações

- Low-Cost Condominium Case StudyDocumento9 páginasLow-Cost Condominium Case StudygetAinda não há avaliações

- Assistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyDocumento2 páginasAssistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyKathrynJaneRipleyAinda não há avaliações

- Board StructureDocumento14 páginasBoard StructureJoeWai LeongAinda não há avaliações

- 616099155-Far-Fetch 2Documento1 página616099155-Far-Fetch 2Bajs MajaAinda não há avaliações

- FIS assignment bond payment schedulesDocumento2 páginasFIS assignment bond payment schedulesNIKITA JHA100% (1)

- Gill Wilkins Technology Transfer For Renewable Energy Overcoming Barriers in Developing CountriesDocumento256 páginasGill Wilkins Technology Transfer For Renewable Energy Overcoming Barriers in Developing CountriesmshameliAinda não há avaliações