Escolar Documentos

Profissional Documentos

Cultura Documentos

Acct 200 Chapter 6 Test

Enviado por

Big WillyDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Acct 200 Chapter 6 Test

Enviado por

Big WillyDireitos autorais:

Formatos disponíveis

ACCOUNTING 201

CHAPTER 6

TRUE-FALSE STATEMENTS

1. Transactions that affect inventories on hand have an effect on both the balance sheet and the income statement. The more inventory a company has in stock, the greater the company's profit. Raw materials inventories are the goods that a manufacturer has completed and are ready to be sold to customers. Goods that have been purchased FOB destination but are in transit, should be excluded from a physical count of goods. Consigned goods are goods held for sale by one party although ownership of the goods is retained by another party. The weighted average unit cost method of costing inventories tracks the actual physical flow of the goods available for sale. Management may choose any inventory costing method it desires as long as the cost flow assumption chosen is consistent with the physical movement of goods in the company. The First-in, First-out (FIFO) inventory method results in Cost of goods sold valued at the most recent cost. The matching principle requires that the cost of goods sold be matched against the ending merchandise inventory in order to determine income. The specific identification method of inventory valuation is desirable when a company sells a large number of low-unit cost items.

2. 3.

4.

5.

6.

7.

8.

9.

10.

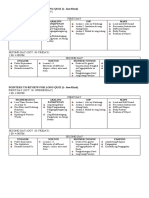

MULTIPLE CHOICE QUESTIONS

11. Inventories affect a. only the balance sheet. b. only the income statement. c. both the balance sheet and the income statement. d. neither the balance sheet nor the income statement. Merchandise inventory is a. reported under the classification of Property, Plant, and Equipment on the balance sheet. b. often reported as a miscellaneous expense on the income statement. c. reported as a current asset on the balance sheet. d. generally valued at the price for which the goods can be sold.

12.

Everett Community College Tutoring Center 1

13.

If goods in transit are shipped FOB destination a. the seller has legal title to the goods until they are delivered. b. the buyer has legal title to the goods until they are delivered. c. the transportation company has legal title to the goods while the goods are in transit. d. no one has legal title to the goods until they are delivered.

Use the following information for questions 14-17. A company just starting business made the following four inventory purchases in June: June June June June 1 10 15 28 150 units 200 units 200 units 150 units $ 780 1,170 1,260 990 $4,200

A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand.

14.

Using the LIFO inventory method, the value of the ending inventory on June 30 (rounded to the nearest dollar) is a. $1,073. b. $1,305. c. $2,895. d. $3,128. Using the FIFO inventory method, the amount allocated to cost of goods sold for June is a. $1,305. b. $2,545. c. $2,895. d. $3,128. Using the average cost method, the amount allocated to the ending inventory on June 30 is a. $4,200. b. $3,000. c. $1,150. d. $1,200. The inventory method which results in the highest gross profit for June is a. the FIFO method. b. the LIFO method. c. the weighted average unit cost method. d. not determinable.

15.

16.

17.

Everett Community College Tutoring Center 2

ANSWERS True and False 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. T F F T T F F F F F

Multiple Choice 11. 12. 13. 14. 15. 16. 17. C C A A C D A

Everett Community College Tutoring Center 3

Você também pode gostar

- Offshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfDocumento23 páginasOffshore banking_ financial secrecy, tax havens_ evasion, asset protection, tax efficient corporate structure, illegal reinvoicing, fraud concealment, black money _ Sanjeev Sabhlok's revolutionary blog.pdfVaibhav BanjanAinda não há avaliações

- Libby Financial Accounting Chapter7Documento10 páginasLibby Financial Accounting Chapter7Jie Bo Ti0% (2)

- 2.-A-Journal & Ledger - QuestionsDocumento3 páginas2.-A-Journal & Ledger - QuestionsLibrarian 19750% (1)

- Financial Accounting Chapter 6 QuizDocumento7 páginasFinancial Accounting Chapter 6 QuizZenni T Xin100% (1)

- Inventory 2 (Theories & Problems) With AnswersDocumento11 páginasInventory 2 (Theories & Problems) With AnswersUzziehllah Ratuita100% (3)

- Affidavit of Consent To Travel A MinorDocumento3 páginasAffidavit of Consent To Travel A Minormagiting mabayogAinda não há avaliações

- CH 8 - Intermediate Accounting Test BankDocumento53 páginasCH 8 - Intermediate Accounting Test BankCorliss Ko100% (3)

- Portable IT Equipment PolicyDocumento3 páginasPortable IT Equipment PolicyAiddie GhazlanAinda não há avaliações

- CH 06Documento65 páginasCH 06Chang Chan Chong0% (1)

- Fifo MethodDocumento36 páginasFifo Methodabhisheksachan10Ainda não há avaliações

- Inventories Valuation ConceptDocumento13 páginasInventories Valuation ConceptSumit SahuAinda não há avaliações

- CH 04 Personal Safety and Social ResponsibilityDocumento41 páginasCH 04 Personal Safety and Social ResponsibilityFirdauz RahmatAinda não há avaliações

- Seventeenth Edition: Business Vision and MissionDocumento28 páginasSeventeenth Edition: Business Vision and MissionMahmud TazinAinda não há avaliações

- Hip Self Assessment Tool & Calculator For AnalysisDocumento14 páginasHip Self Assessment Tool & Calculator For AnalysisNur Azreena Basir100% (9)

- Govt Influence On Exchange RateDocumento40 páginasGovt Influence On Exchange Rategautisingh100% (3)

- 09 Chapter # 9 - InventoriesDocumento29 páginas09 Chapter # 9 - InventoriesNiña Yna Franchesca PantallaAinda não há avaliações

- Fair Value. ACCA. Paper P2. Students notes.: ACCA studiesNo EverandFair Value. ACCA. Paper P2. Students notes.: ACCA studiesAinda não há avaliações

- DocxDocumento11 páginasDocx?????Ainda não há avaliações

- Quiz 1 - InventoryDocumento4 páginasQuiz 1 - InventoryRocel DomingoAinda não há avaliações

- MTE CostDocumento19 páginasMTE CostMarjhon TubillaAinda não há avaliações

- CH 6 (WWW - Jamaa Bzu - Com)Documento8 páginasCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- 06 InventoriesDocumento3 páginas06 InventoriesCy MiolataAinda não há avaliações

- Quiz 1 Midterm InventoriesDocumento6 páginasQuiz 1 Midterm InventoriesSophia TenorioAinda não há avaliações

- Inventories QuestionnaireDocumento9 páginasInventories QuestionnaireKristine JavierAinda não há avaliações

- Practice Quiz 07 - ACTG240 - Q2202122Documento11 páginasPractice Quiz 07 - ACTG240 - Q2202122Đinh Ngọc Minh ChâuAinda não há avaliações

- Final Chapter 6Documento8 páginasFinal Chapter 6Đặng Ngọc Thu HiềnAinda não há avaliações

- Accounting Principles 7Th Canadian Edition Volume 1 by Jerry J. Weygandt, Test BankDocumento95 páginasAccounting Principles 7Th Canadian Edition Volume 1 by Jerry J. Weygandt, Test BankakasagillAinda não há avaliações

- Chapter 8 Quiz Answer KeyDocumento3 páginasChapter 8 Quiz Answer KeySarah Marie LaytonAinda não há avaliações

- Financial Accounting Practice and Review InventoryDocumento3 páginasFinancial Accounting Practice and Review Inventoryukandi rukmanaAinda não há avaliações

- Act512 - Assignment Chapter - 06Documento9 páginasAct512 - Assignment Chapter - 06Rafin MahmudAinda não há avaliações

- Accounting Assignment 3Documento4 páginasAccounting Assignment 3Fariha pervaiz FarihaAinda não há avaliações

- A201 Ch6 Fall 2013Documento44 páginasA201 Ch6 Fall 2013Set LuAinda não há avaliações

- Merchandizing OperationDocumento2 páginasMerchandizing OperationMd. Sazzad HossenAinda não há avaliações

- Chang Converted MergedDocumento8 páginasChang Converted MergedEbAd ZuberiAinda não há avaliações

- Chapter 9-10 QuestionsDocumento10 páginasChapter 9-10 QuestionsMya B. WalkerAinda não há avaliações

- Fundamentals of Accounting II, Chapter 1Documento51 páginasFundamentals of Accounting II, Chapter 1negussie birieAinda não há avaliações

- Fundamentals of Financial Accounting Canadian 5th Edition Phillips Solutions ManualDocumento38 páginasFundamentals of Financial Accounting Canadian 5th Edition Phillips Solutions Manualjeanbarnettxv9v100% (18)

- Inventories: Purchaser SellerDocumento23 páginasInventories: Purchaser SellerBrylle TamanoAinda não há avaliações

- 08 Inventory Cost MeasurementDocumento34 páginas08 Inventory Cost MeasurementLeonilaEnriquezAinda não há avaliações

- Accounting For InventoriesDocumento12 páginasAccounting For InventoriesNoor AlSabbaghAinda não há avaliações

- More Concepts - InventoryDocumento22 páginasMore Concepts - InventoryGurkirat SinghAinda não há avaliações

- Mother Class Intermediate Accounting 1: Item 1Documento18 páginasMother Class Intermediate Accounting 1: Item 1Denise Margaret CabaguiAinda não há avaliações

- Ebook Cornerstones of Financial Accounting 4Th Edition Rich Solutions Manual Full Chapter PDFDocumento67 páginasEbook Cornerstones of Financial Accounting 4Th Edition Rich Solutions Manual Full Chapter PDFfreyahypatias7j100% (12)

- Taller Seis Acco 111Documento44 páginasTaller Seis Acco 111api-274120622Ainda não há avaliações

- Chapter 3. Inventories PDFDocumento27 páginasChapter 3. Inventories PDFifa_hasanAinda não há avaliações

- Libby 4ce Solutions Manual - Ch08Documento66 páginasLibby 4ce Solutions Manual - Ch087595522Ainda não há avaliações

- Chapter 6 PowerpointDocumento34 páginasChapter 6 Powerpointapi-248607804Ainda não há avaliações

- Chapter 5 - Inventories: Revised EditionDocumento7 páginasChapter 5 - Inventories: Revised EditionMelyssa Dawn Gullon0% (1)

- Costing Inventory Through FIFODocumento6 páginasCosting Inventory Through FIFOJosh LeBlancAinda não há avaliações

- Chap 008Documento69 páginasChap 008dbjnAinda não há avaliações

- Chapter 8 PDFDocumento6 páginasChapter 8 PDFMAMTA KHARISMAAinda não há avaliações

- Valuation of InventoriesDocumento7 páginasValuation of InventoriesBarbie BleuAinda não há avaliações

- IFA-I ch-3 Investories NewDocumento59 páginasIFA-I ch-3 Investories Newhasenabdi30Ainda não há avaliações

- Inter-Acct1Documento6 páginasInter-Acct1.Ainda não há avaliações

- INTACC DQsDocumento9 páginasINTACC DQsMa. Alessandra BautistaAinda não há avaliações

- Valuation of Inventories: A Cost-Basis Approach: Chapter Learning ObjectivesDocumento38 páginasValuation of Inventories: A Cost-Basis Approach: Chapter Learning ObjectivesmicahventuresAinda não há avaliações

- Module 4 Valuation of InventoryDocumento6 páginasModule 4 Valuation of Inventorykaushalrajsinhjanvar427Ainda não há avaliações

- Intacc Q2Documento4 páginasIntacc Q2Juliana Reign RuedaAinda não há avaliações

- Horngren Fin7 Inppt 06 InventoryDocumento62 páginasHorngren Fin7 Inppt 06 Inventoryhassaanaslam2003Ainda não há avaliações

- Principles of Acc. II Lecture NoteDocumento54 páginasPrinciples of Acc. II Lecture NoteJemal Musa83% (6)

- Text5-Accounting For Materials-Student ResourceDocumento10 páginasText5-Accounting For Materials-Student Resourcekinai williamAinda não há avaliações

- Transcript For Lecture Video 1Documento5 páginasTranscript For Lecture Video 1StaygoldAinda não há avaliações

- Kelompok 6 Chapter 6Documento11 páginasKelompok 6 Chapter 6leoni pannaAinda não há avaliações

- Inventories 1Documento32 páginasInventories 1Summer Star100% (1)

- Inventory: Key Topics To KnowDocumento9 páginasInventory: Key Topics To KnowYaregal YeshiwasAinda não há avaliações

- CH 6Documento51 páginasCH 6anjo hosmerAinda não há avaliações

- Acct 200 ChaptDocumento4 páginasAcct 200 ChaptBig WillyAinda não há avaliações

- Acct 200 Chapter 7Documento4 páginasAcct 200 Chapter 7Big WillyAinda não há avaliações

- Home Sales Year Month Median MonthDocumento4 páginasHome Sales Year Month Median MonthBig WillyAinda não há avaliações

- HousingDocumento4 páginasHousingBig WillyAinda não há avaliações

- Read MeDocumento21 páginasRead MeSyafaruddin BachrisyahAinda não há avaliações

- O.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BDocumento3 páginasO.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BRavvoAinda não há avaliações

- HR 2977 - Space Preservation Act of 2001Documento6 páginasHR 2977 - Space Preservation Act of 2001Georg ElserAinda não há avaliações

- Steinmann 2016Documento22 páginasSteinmann 2016sofyanAinda não há avaliações

- TKAM ch1-5 Discussion QuestionsDocumento14 páginasTKAM ch1-5 Discussion QuestionsJacqueline KennedyAinda não há avaliações

- Tutorial LawDocumento5 páginasTutorial LawsyafiqahAinda não há avaliações

- T Proc Notices Notices 035 K Notice Doc 30556 921021241Documento14 páginasT Proc Notices Notices 035 K Notice Doc 30556 921021241Bwanika MarkAinda não há avaliações

- Office of The Divisional Forest Officer, Durgapur DivisionDocumento30 páginasOffice of The Divisional Forest Officer, Durgapur Divisionrchowdhury_10Ainda não há avaliações

- Pointers To Review For Long QuizDocumento1 páginaPointers To Review For Long QuizJoice Ann PolinarAinda não há avaliações

- Andres Felipe Mendez Vargas: The Elves and The ShoemakerDocumento1 páginaAndres Felipe Mendez Vargas: The Elves and The ShoemakerAndres MendezAinda não há avaliações

- Home / Publications / Questions and AnswersDocumento81 páginasHome / Publications / Questions and AnswersMahmoudAinda não há avaliações

- Mitigate DoS Attack Using TCP Intercept On Cisco RouterDocumento4 páginasMitigate DoS Attack Using TCP Intercept On Cisco RouterAKUEAinda não há avaliações

- Retail Price List WEF August 1, 2016: BMW IndiaDocumento1 páginaRetail Price List WEF August 1, 2016: BMW IndiaManga DeviAinda não há avaliações

- Nepotism in NigeriaDocumento3 páginasNepotism in NigeriaUgoStan100% (2)

- 131.3 Visa Requirements General 2016 10 PDFDocumento2 páginas131.3 Visa Requirements General 2016 10 PDFDilek YILMAZAinda não há avaliações

- OJT Research Bam!Documento14 páginasOJT Research Bam!mrmakuleetAinda não há avaliações

- 7759 Cad-1Documento2 páginas7759 Cad-1Samir JainAinda não há avaliações

- FloridaDocumento2 páginasFloridaAbhay KhannaAinda não há avaliações

- Motion To Voluntarily DismissDocumento6 páginasMotion To Voluntarily DismissChicagoCitizens EmpowermentGroupAinda não há avaliações

- Ilm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabDocumento5 páginasIlm-e-Hadees Sikhne Wale Ke Liye Kuch AadaabSalman KhanAinda não há avaliações

- Land Use Management (LUMDocumento25 páginasLand Use Management (LUMgopumgAinda não há avaliações

- Shailendra Education Society's Arts, Commerce & Science College Shailendra Nagar, Dahisar (E), Mumbai-68Documento3 páginasShailendra Education Society's Arts, Commerce & Science College Shailendra Nagar, Dahisar (E), Mumbai-68rupalAinda não há avaliações