Escolar Documentos

Profissional Documentos

Cultura Documentos

ECO 444 Investments Test Bank-No Answers

Enviado por

Allan Genesis RomblonDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ECO 444 Investments Test Bank-No Answers

Enviado por

Allan Genesis RomblonDireitos autorais:

Formatos disponíveis

INVESTMENTS

MULTIPLE CHOICEConceptual

1. Which of the following is not a debt security? a. Convertible bonds b. Commercial paper c. Loans receivable d. All of these are debt securities. A correct valuation is a. available-for-sale at amortized cost. b. held-to-maturity at amortized cost. c. held-to-maturity at fair value. d. none of these. Securities which could be classified as held-to-maturity are a. redeemable preferred stock. b. warrants. c. municipal bonds. d. treasury stock. A requirement for a security to be classified as held-to-maturity is a. ability to hold the security to maturity. b. positive intent. c. the security must be a debt security. d. All of these are required. Held-to-maturity securities are reported at a. acquisition cost. b. acquisition cost plus amortization of a discount. c. acquisition cost plus amortization of a premium. d. fair value. Solo Co. purchased $300,000 of bonds for $315,000. If Solo intends to hold the securities to maturity, the entry to record the investment includes a. a debit to Held-to-Maturity Securities at $300,000. b. a credit to Premium on Investments of $15,000. c. a debit to Held-to-Maturity Securities at $315,000. d. none of these. Which of the following is not correct in regard to trading securities? a. They are held with the intention of selling them in a short period of time. b. Unrealized holding gains and losses are reported as part of net income. c. Any discount or premium is not amortized. d. All of these are correct.

2.

3.

4.

5.

6.

7.

17 - 2 8.

Test Bank for Intermediate Accounting, Eleventh Edition Unrealized holding gains or losses which are recognized in income are from securities classified as a. held-to-maturity. b. available-for-sale. c. trading. d. none of these. An unrealized holding loss on a company's available-for-sale securities should be reflected in the current financial statements as a. an extraordinary item shown as a direct reduction from retained earnings. b. a current loss resulting from holding securities. c. a note or parenthetical disclosure only. d. other comprehensive income and deducted in the equity section of the balance sheet. An unrealized holding gain on a company's available-for-sale securities should be reflected in the current financial statements as a. an extraordinary item shown as a direct increase to retained earnings. b. a current gain resulting from holding securities. c. a note or parenthetical disclosure only. d. other comprehensive income and included in the equity section of the balance sheet. When an investment in a held-to-maturity security is transferred to an available-for-sale security, the carrying value assigned to the available-for-sale security should be a. its original cost. b. its fair value at the date of the transfer. c. the lower of its original cost or its fair value at the date of the transfer. d. the higher of its original cost or its fair value at the date of the transfer. When an investment in an available-for-sale security is transferred to trading because the company anticipates selling the stock in the near future, the carrying value assigned to the investment upon entering it in the trading portfolio should be a. its original cost. b. its fair value at the date of the transfer. c. the higher of its original cost or its fair value at the date of the transfer. d. the lower of its original cost or its fair value at the date of the transfer. In accounting for investments in debt securities that are classified as trading securities, a. a discount is reported separately. b. a premium is reported separately. c. any discount or premium is not amortized. d. none of these. Investments in debt securities are generally recorded at a. cost including accrued interest. b. maturity value. c. cost including brokerage and other fees. d. maturity value with a separate discount or premium account. Pippen Co. purchased ten-year, 10% bonds that pay interest semiannually. The bonds are sold to yield 8%. One step in calculating the issue price of the bonds is to multiply the principal by the table value for a. 10 periods and 10% from the present value of 1 table. b. 10 periods and 8% from the present value of 1 table.

9.

10.

11.

12.

13.

14.

15.

Investments c. 20 periods and 5% from the present value of 1 table. d. 20 periods and 4% from the present value of 1 table. 16. Investments in debt securities should be recorded on the date of acquisition at a. lower of cost or market. b. market value. c. market value plus brokerage fees and other costs incident to the purchase. d. face value plus brokerage fees and other costs incident to the purchase.

17 - 3

17.

An available-for-sale debt security is purchased at a discount. The entry to record the amortization of the discount includes a a. debit to Available-for-Sale Securities. b. debit to the discount account. c. debit to Interest Revenue. d. none of these. APB Opinion No. 21 specifies that, regarding the amortization of a premium or discount on a debt security, the a. effective interest method of allocation must be used. b. straight-line method of allocation must be used. c. effective interest method of allocation should be used but other methods can be applied if there is no material difference in the results obtained. d. par value method must be used and therefore no allocation is necessary. Which of the following is correct about the effective interest method of amortization? a. The effective interest method applied to investments in debt securities is different from that applied to bonds payable. b. Amortization of a discount decreases from period to period. c. Amortization of a premium decreases from period to period. d. The effective interest method produces a constant rate of return on the book value of the investment from period to period. When investments in debt securities are purchased between interest payment dates, preferably the a. securities account should include accrued interest. b. accrued interest is debited to Interest Expense. c. accrued interest is debited to Interest Revenue. d. accrued interest is debited to Interest Receivable. Which of the following is not generally correct about recording a sale of a debt security before maturity date? a. Accrued interest will be received by the seller even though it is not an interest payment date. b. An entry must be made to amortize a discount to the date of sale. c. The entry to amortize a premium to the date of sale includes a credit to the Premium on Investments in Debt Securities. d. A gain or loss on the sale is not extraordinary. When a company holds between 20% and 50% of the outstanding stock of an investee, which of the following statements applies? a. The investor should always use the equity method to account for its investment. b. The investor should use the equity method to account for its investment unless circumstances indicate that it is unable to exercise "significant influence" over the investee.

18.

19.

20.

21.

22.

17 - 4

Test Bank for Intermediate Accounting, Eleventh Edition c. The investor must use the fair value method unless it can clearly demonstrate the ability to exercise "significant influence" over the investee. d. The investor should always use the fair value method to account for its investment. A reclassification adjustment is reported in the a. income statement as an Other Revenue or Expense. b. stockholders equity section of the balance sheet. c. statement of comprehensive income as other comprehensive income. d. statement of stockholders equity. If the parent company owns 90% of the subsidiary company's outstanding common stock, the company should generally account for the income of the subsidiary under the a. cost method. b. fair value method. c. divesture method. d. equity method. Byner Corporation accounts for its investment in the common stock of Yount Company under the equity method. Byner Corporation should ordinarily record a cash dividend received from Yount as a. a reduction of the carrying value of the investment. b. additional paid-in capital. c. an addition to the carrying value of the investment. d. dividend income. Under the equity method of accounting for investments, an investor recognizes its share of the earnings in the period in which the a. investor sells the investment. b. investee declares a dividend. c. investee pays a dividend. d. earnings are reported by the investee in its financial statements. Dane, Inc., owns 35% of Marin Corporation. During the calendar year 2004, Marin had net earnings of $300,000 and paid dividends of $30,000. Dane mistakenly recorded these transactions using the fair value method rather than the equity method of accounting. What effect would this have on the investment account, net income, and retained earnings, respectively? a. Understate, overstate, overstate b. Overstate, understate, understate c. Overstate, overstate, overstate d. Understate, understate, understate All of the following statements regarding accounting for derivatives are correct except that a. they should be recognized in the financial statements as assets and liabilities. b. they should be reported at fair value. c. gains and losses resulting from speculation should be deferred. d. gains and losses resulting from hedge transactions are reported in different ways, depending upon the type of hedge. All of the following are characteristics of a derivative financial instrument except the instrument a. has one or more underlyings and an identified payment provision. b. requires a large investment at the inception of the contract.

23.

24.

25.

26.

27.

*28.

*29.

Investments c. requires or permits net settlement. d. All of these are characteristics. *30.

17 - 5

Companies that attempt to exploit inefficiencies in various derivative markets by attempting to lock in profits by simultaneously entering into transactions in two or more markets are called a. arbitrageurs. b. gamblers. c. hedgers. d. speculators. The accounting for fair value hedges records the derivative at its a. amortized cost. b. carrying value. c. fair value. d. historical cost. Gains or losses on cash flow hedges are a. ignored completely. b. recorded in equity, as part of other comprehensive income. c. reported directly in net income. d. reported directly in retained earnings. An option to convert a convertible bond into shares of common stock is a(n) a. embedded derivative. b. host security. c. hybrid security. d. fair value hedge. All of the following are requirements for disclosures related to financial instruments except a. disclosing the fair value and related carrying value of the instruments. b. distinguishing between financial instruments held or issued for purposes other than trading. c. combining or netting the fair value of separate financial instruments. d. displaying as a separate classification of other comprehensive income the net gain/loss on derivative instruments designated in cash flow hedges.

*31.

*32.

*33.

*34.

17 - 6

Test Bank for Intermediate Accounting, Eleventh Edition

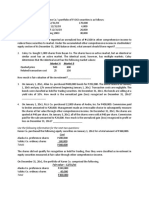

MULTIPLE CHOICEComputational

35. Redman Company's trading securities portfolio which is appropriately included in current assets is as follows: December 31, 2004 Fair Unrealized Cost Value Gain (Loss) Arlington Corp. 260,000 200,000 $(60,000) Downs, Inc. 245,000 265,000 20,000 $505,000 $465,000 $(40,000) Ignoring income taxes, what amount should be reported as a charge against income in Redman's 2004 income statement if 2004 is Redman's first year of operation? a. $0. b. $20,000. c. $40,000. d. $60,000. 36. On its December 31, 2003, balance sheet, Quinn Co. reported its investment in availablefor-sale securities, which had cost $360,000, at fair value of $330,000. At December 31, 2004, the fair value of the securities was $355,000. What should Quinn report on its 2004 income statement as a result of the increase in fair value of the investments in 2004? a. $0. b. Unrealized loss of $5,000. c. Realized gain of $25,000. d. Unrealized gain of $25,000. On August 1, 2004, Bettis Company acquired $120,000 face value 10% bonds of Hanson Corporation at 104 plus accrued interest. The bonds were dated May 1, 2004, and mature on April 30, 2009, with interest payable each October 31 and April 30. The bonds will be held to maturity. What entry should Bettis make to record the purchase of the bonds on August 1, 2004? a. Held-to-Maturity Securities .................................................. 124,800 Interest Revenue ................................................................ 3,000 Cash ........................................................................ 127,800 b. Held-to-Maturity Securities .................................................. Cash ........................................................................ c. Held-to-Maturity Securities .................................................. Interest Revenue ..................................................... Cash ........................................................................ d. Held-to-Maturity Securities .................................................. Premium on Bonds ............................................................. Cash ........................................................................ 127,800 127,800 127,800 3,000 124,800 120,000 7,800 127,800

37.

Investments 38.

17 - 7

On August 1, 2004, Witten Co. acquired 80, $1,000, 9% bonds at 97 plus accrued interest. The bonds were dated May 1, 2004, and mature on April 30, 2010, with interest paid each October 31 and April 30. The bonds will be added to Wittens available-for-sale portfolio. The preferred entry to record the purchase of the bonds on August 1, 2004 is a. Available-for-Sale Securities ............................................... 79,400 Cash ........................................................................ 79,400 b. Available-for-Sale Securities ............................................... Interest Receivable ............................................................. Cash ........................................................................ c. Available-for-Sale Securities ............................................... Interest Revenue ................................................................ Cash ........................................................................ d. Available-for-Sale Securities ............................................... Interest Revenue ................................................................ Discount on Debt Securities .................................... Cash ........................................................................ 77,600 1,800 79,400 77,600 1,800 79,400 80,000 1,800 2,400 79,400

39.

On October 1, 2004, Porter Co. purchased to hold to maturity, 1,200, $1,000, 9% bonds for $1,188,000 which includes $18,000 accrued interest. The bonds, which mature on February 1, 2013, pay interest semiannually on February 1 and August 1. Porter uses the straight-line method of amortization. The bonds should be reported in the December 31, 2004 balance sheet at a carrying value of a. $1,170,000. b. $1,170,900. c. $1,188,000. d. $1,188,360. On November 1, 2004, Little Company purchased 1,200 of the $1,000 face value, 9% bonds of Player, Incorporated, for $1,264,000, which includes accrued interest of $18,000. The bonds, which mature on January 1, 2009, pay interest semiannually on March 1 and September 1. Assuming that Little uses the straight-line method of amortization and that the bonds are appropriately classified as available-for-sale, the net carrying value of the bonds should be shown on Little's December 31, 2004, balance sheet at a. $1,200,000. b. $1,246,000. c. $1,244,160. d. $1,264,000. On November 1, 2004, Morton Co. purchased Gomez, Inc., 10-year, 9%, bonds with a face value of $150,000, for $135,000. An additional $4,500 was paid for the accrued interest. Interest is payable semiannually on January 1 and July 1. The bonds mature on July 1, 2011. Morton uses the straight-line method of amortization. Ignoring income taxes, the amount reported in Morton's 2004 income statement as a result of Morton's availablefor-sale investment in Gomez was a. $2,625. b. $2,500. c. $2,250. d. $2,000.

40.

41.

17 - 8 42.

Test Bank for Intermediate Accounting, Eleventh Edition On October 1, 2004, Lyman Co. purchased to hold to maturity, 300, $1,000, 9% bonds for $312,000. An additional $19,000 was paid for accrued interest. Interest is paid semiannually on December 1 and June 1 and the bonds mature on December 1, 2008. Lyman uses straight-line amortization. Ignoring income taxes, the amount reported in Lyman's 2004 income statement from this investment should be a. $6,750. b. $6,030. c. $7,470. d. $8,190. During 2002, Plano Co. purchased 500, $1,000, 9% bonds. The carrying value of the bonds at December 31, 2004 was $490,000. The bonds mature on March 1, 2009, and pay interest on March 1 and September 1. Plano sells 250 bonds on September 1, 2005, for $247,000, after the interest has been received. Plano uses straight-line amortization. The gain on the sale is a. $0. b. $1,200. c. $2,000. d. $2,800.

43.

Use the following information for questions 44 through 47. The summarized balance sheets of Elston Company and Alley Company as of December 31, 2004 are as follows: Elston Company Balance Sheet December 31, 2004 Assets $800,000 Liabilities Capital stock Retained earnings Total equities Alley Company Balance Sheet December 31, 2004 Assets Liabilities Capital stock Retained earnings Total equities 44. $600,000 $150,000 370,000 80,000 $600,000 $100,000 400,000 300,000 $800,000

If Elston Company acquired a 20% interest in Alley Company on December 31, 2004 for $130,000 and the fair value method of accounting for the investment were used, the amount of the debit to Investment in Alley Company Stock would have been a. $90,000. b. $74,000. c. $130,000. d. $120,000.

Investments 45.

17 - 9

If Elston Company acquired a 30% interest in Alley Company on December 31, 2004 for $150,000 and the equity method of accounting for the investment were used, the amount of the debit to Investment in Alley Company Stock would have been a. $190,000. b. $150,000. c. $120,000. d. $135,000. If Elston Company acquired a 20% interest in Alley Company on December 31, 2003 for $90,000 and during 2005 Barnes Company had net income of $50,000 and paid a cash dividend of $20,000, applying the fair value method would give a debit balance in the Investment in Alley Company Stock account at the end of 2005 of a. $74,000. b. $90,000. c. $100,000. d. $96,000. If Elston Company acquired a 30% interest in Alley Company on December 31, 2004 for $135,000 and during 2005 Alley Company had net income of $50,000 and paid a cash dividend of $20,000, applying the equity method would give a debit balance in the Investment in Alley Company Stock account at the end of 2005 of a. $135,000. b. $144,000. c. $150,000. d. $145,000.

46.

47.

Use the following information for questions 48 and 49. Karter Company purchased 200 of the 1,000 outstanding shares of Flynn Company's common stock for $180,000 on January 2, 2004. During 2004, Flynn Company declared dividends of $30,000 and reported earnings for the year of $120,000. 48. If Karter Company used the fair value method of accounting for its investment in Flynn Company, its Investment in Flynn Company account on December 31, 2004 should be a. $174,000. b. $198,000. c. $180,000. d. $204,000. If Karter Company uses the equity method of accounting for its investment in Flynn Company, its Investment in Flynn Company account at December 31, 2004 should be a. $174,000. b. $180,000. c. $198,000. d. $204,000.

49.

Use the following information for questions 50 and 51. Barry Corporation earns $180,000 and pays cash dividends of $60,000 during 2004. Glenon Corporation owns 3,000 of the 10,000 outstanding shares of Barry.

17 - 10 Test Bank for Intermediate Accounting, Eleventh Edition 50. What amount should Glenon show in the investment account at December 31, 2004 if the beginning of the year balance in the account was $240,000? a. $294,000. b. $240,000. c. $276,000. d. $360,000. How much investment income should Glenon report in 2004? a. $60,000. b. $54,000. c. $36,000. d. $180,000. Young Co. acquired a 60% interest in Tomlin Corp. on December 31, 2003 for $630,000. During 2004, Tomlin had net income of $400,000 and paid cash dividends of $100,000. At December 31, 2004, the balance in the investment account should be a. $630,000. b. $870,000. c. $810,000. d. $930,000.

51.

52.

Use the following information for questions 53 and 54. Stone Co. owns 3,000 of the 10,000 outstanding shares of Maye Corp. common stock. During 2004, Maye earns $180,000 and pays cash dividends of $50,000. 53. If the beginning balance in the investment account was $270,000, the balance at December 31, 2004 should be a. $270,000. b. $306,000. c. $324,000. d. $360,000. Stone should report investment revenue for 2004 of a. $18,000. b. $36,000. c. $45,000. d. $54,000. The following information relates to Vernon Company for 2004: Realized gain on sale of available-for-sale securities Unrealized holding gains arising during the period on available-for-sale securities Reclassification adjustment for gains included in net income Vernons 2004 other comprehensive income is a. $15,000. b. $24,000. c. $30,000. d. $36,000.

54.

55.

$ 9,000 21,000 6,000

Investments

17 - 11

MULTIPLE CHOICECPA Adapted

56. Unruh Corp. began operations in 2004. An analysis of Unruhs equity securities portfolio acquired in 2004 shows the following totals at December 31, 2004 for trading and available-for-sale securities: Trading Available-for-Sale Securities Securities Aggregate cost $98,000 $130,000 Aggregate fair value 78,000 114,000 What amount should Unruh report in its 2004 income statement for unrealized holding loss? a. $36,000. b. $30,000. c. $16,000. d. $20,000. 57. At December 31, 2004, Malle Corp. had the following equity securities that were purchased during 2004, its first year of operation: Fair Unrealized Cost Value Gain (Loss) Trading Securities: Security A $100,000 $ 60,000 $(40,000) B 15,000 20,000 5,000 Totals $115,000 $ 80,000 $(35,000) Available-for-Sale Securities: Security Y Z Totals $ 70,000 85,000 $155,000 $ 80,000 55,000 $135,000 $ 10,000 (30,000) $(20,000)

All market declines are considered temporary. Fair value adjustments at December 31, 2004 should be established with a corresponding charge against Income Stockholders Equity a. $55,000 $ 0 b. $40,000 $30,000 c. $35,000 $20,000 d. $35,000 $ 0

17 - 12 Test Bank for Intermediate Accounting, Eleventh Edition 58. On December 29, 2005, Greer Co. sold an equity security that had been purchased on January 4, 2004. Greer owned no other equity securities. An unrealized holding loss was reported in the 2004 income statement. A realized gain was reported in the 2005 income statement. Was the equity security classified as available-for-sale and did its 2004 market price decline exceed its 2005 market price recovery? 2004 Market Price Decline Exceeded 2005 Available-for-Sale Market Price Recovery a. Yes Yes b. Yes No c. No Yes d. No No On December 31, 2003, Nance Co. purchased equity securities as trading securities. Pertinent data are as follows: Fair Value Security Cost At 12/31/04 A $ 88,000 $ 78,000 B 112,000 124,000 C 192,000 172,000 On December 31, 2004, Nance transferred its investment in security C from trading to available-for-sale because Nance intends to retain security C as a long-term investment. What total amount of gain or loss on its securities should be included in Nance's income statement for the year ended December 31, 2004? a. $2,000 gain. b. $18,000 loss. c. $20,000 loss. d. $30,000 loss. 60. On October 1, 2003, Ming Co. purchased 800 of the $1,000 face value, 8% bonds of Loy, Inc., for $936,000, including accrued interest of $16,000. The bonds, which mature on January 1, 2010, pay interest semiannually on January 1 and July 1. Ming used the straight-line method of amortization and appropriately recorded the bonds as available-forsale. On Ming's December 31, 2004 balance sheet, the carrying value of the bonds is a. $920,000. b. $912,000. c. $908,800. d. $896,000.

59.

Use the following information for questions 61 through 63. Kimm, Inc. acquired 30% of Carne Corp.'s voting stock on January 1, 2004 for $360,000. During 2004, Carne earned $150,000 and paid dividends of $90,000. Kimm's 30% interest in Carne gives Kimm the ability to exercise significant influence over Carne's operating and financial policies. During 2005, Carne earned $180,000 and paid dividends of $60,000 on April 1 and $60,000 on October 1. On July 1, 2005, Kimm sold half of its stock in Carne for $237,000 cash.

Investments 61.

17 - 13

Before income taxes, what amount should Kimm include in its 2004 income statement as a result of the investment? a. $150,000. b. $90,000. c. $45,000. d. $27,000. The carrying amount of this investment in Kimm's December 31, 2004 balance sheet should be a. $360,000. b. $378,000. c. $405,000. d. $333,000. What should be the gain on sale of this investment in Kimm's 2005 income statement? a. $57,000. b. $52,500. c. $43,500. d. $34,500. On January 1, 2004, Sloane Co. purchased 25% of Orr Corp.'s common stock; no goodwill resulted from the purchase. Sloane appropriately carries this investment at equity and the balance in Sloanes investment account was $480,000 at December 31, 2004. Orr reported net income of $300,000 for the year ended December 31, 2004, and paid common stock dividends totaling $120,000 during 2004. How much did Sloane pay for its 25% interest in Orr? a. $435,000. b. $510,000. c. $525,000. d. $585,000.

62.

63.

64.

17 - 14 Test Bank for Intermediate Accounting, Eleventh Edition

PROBLEMS

Pr. 17-74Trading equity securities. Gordon Company has the following securities in its portfolio of trading equity securities on December 31, 2003: Cost Fair Value 5,000 shares of Milner Corp., Common $160,000 $139,000 10,000 shares of Eddy, Common 182,000 190,000 $342,000 $329,000 All of the securities had been purchased in 2003. In 2004, Gordon completed the following securities transactions: March 1 April 1 Sold 5,000 shares of Milner Corp., Common @ $31 less fees of $1,500. Bought 600 shares of Yount Stores, Common @ $50 plus fees of $550.

The Gordon Company portfolio of trading equity securities appeared as follows on December 31, 2004: Cost Fair Value 10,000 shares of Eddy, Common $182,000 $195,500 600 shares of Yount Stores, Common 30,550 25,500 $212,550 $221,000 Instructions Prepare the general journal entries for Gordon Company for: (a) (b) (c) (d) the 2003 adjusting entry. the sale of the Milner Corp. stock. the purchase of the Yount Stores' stock. the 2004 adjusting entry.

Pr. 17-75Trading equity securities. Garcia Company began operations in 2002. Since then, it has reported the following gains and losses for its investments in trading securities on the income statement: Gains (losses) from sale of trading securities Unrealized holding losses on valuation of trading securities Unrealized holding gain on valuation of trading securities 2002 $ 15,000 (25,000) 2003 $(20,000) 10,000 2004 $ 14,000 (40,000)

At January 1, 2005, Garcia owned the following trading securities:

Investments AGH Common (10,000 shares) DEL Preferred (2,000 shares) Pratt Convertible bonds (200 bonds) Cost $300,000 210,000 230,000

17 - 15

During 2005, the following events occurred: 1. Sold 5,000 shares of AGH for $170,000. 2. Acquired 1,000 shares of Norton Common for $45 per share. Brokerage commissions totaled $1,000. At 12/31/05, the fair values for Garcia's trading securities were: AGH Common, $28 per share DEL Preferred, $110 per share Pratt Bonds, $1,020 per bond Norton Common, $42 per share

Instructions (a) Prepare a schedule which shows the balance in the Securities Fair Value Adjustment (Trading) at December 31, 2004 (after the adjusting entry for 2004 is made). (b) Prepare a schedule which shows the aggregate cost and fair values for Garcia's trading securities portfolio at 12/31/05. (c) Prepare the necessary adjusting entry based upon your analysis in (b) above.

17 - 16 Test Bank for Intermediate Accounting, Eleventh Edition Pr. 17-76Available-for-sale equity securities. During the course of your examination of the financial statements of Simpson Corporation for the year ended December 31, 2004, you found a new account, "Investments." Your examination revealed that during 2004, Simpson began a program of investments, and all investment-related transactions were entered in this account. Your analysis of this account for 2004 follows: Simpson Corporation Analysis of Investments For the Year Ended December 31, 2004 Date2004 (a) Pinson Company Common Stock Feb. 14 Purchased 1,000 shares @ $55 per share. July 26 Received 100 shares of Pinson Company common stock as a stock dividend. (Memorandum entry in general ledger.) Sept. 28 Sold the 100 shares of Pinson Company common stock received July 26 @ $70 per share. $55,000 Debit Credit

$7,000

(b) Debit Apr. Oct. Watts Inc., Common Stock 30 Purchased 5,000 shares @ $40 per share. 28 Received dividend of $1.20 per share. $200,000 $6,000 Credit

Additional information: 1. The fair value for each security as of the 2004 date of each transaction follow: Security Feb. 14 Apr. 30 July 26 Sept. 28 Pinson Co. $55 $62 $70 Watts Inc. $40 Simpson Corp. 25 28 30 33

Dec. 31 $72 32 35

2. All of the investments of Simpson are nominal in respect to percentage of ownership (5% or less). 3. Each investment is considered by Simpsons management to be available-for-sale. Instructions (1) Prepare any necessary correcting journal entries related to investments (a) and (b). (2) Prepare the entry, if necessary, to record the proper valuation of the available-for-sale equity security portfolio as of December 31, 2004.

Investments

17 - 17

*Pr. 17-77Derivative financial instrument. Kelley Co. purchased a put option on Flynn common shares on July 7, 2004, for $170. The put option is for 200 shares, and the strike price is $50. The option expires on January 31, 2005. The following data are available with respect to the put option: Date September 30, 2004 December 31, 2004 January 31, 2005 Market Price of Flynn Shares $54 per share $52 per share $55 per share Time Value of Put Option $88 35 0

Instructions Prepare the journal entries for Kelley Co. for the following dates: (a) (b) (c) (d) July 7, 2004Investment in put option on Flynn shares. September 30, 2004Kelley prepares financial statements. December 31, 2004Kelley prepares financial statements. January 31, 2005Put option expires.

*Pr. 17-78Free-standing derivative. Yates Co. purchased a put option on Dixon common shares on July 7, 2004, for $270. The put option is for 300 shares, and the strike price is $64. The option expires on July 31, 2004. The following data are available with respect to the put option: Date March 31, 2004 June 31, 2004 July 6, 2004 Market Price of Dixon Shares $60 per share $62 per share $58 per share Time Value of Put Option $150 68 20

Instructions Prepare the journal entries for Yates Co. for the following dates: (a) (c) (d) (e) January 7, 2004Investment in put option on Dixon shares. March 31, 2004Yates prepares financial statements. June 30, 2004Yates prepares financial statements. July 6, 2004Yates settles the call option on the Dixon shares.

Você também pode gostar

- ACCOUNTING 3A HomeworkDocumento12 páginasACCOUNTING 3A HomeworkDarynn Linggon0% (1)

- Chapter 20 - Teacher's Manual - Far Part 1BDocumento8 páginasChapter 20 - Teacher's Manual - Far Part 1BPacifico HernandezAinda não há avaliações

- GROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALDocumento5 páginasGROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALREMBRANDT KEN LEDESMAAinda não há avaliações

- Chapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceDocumento32 páginasChapter 7-The Revenue/Receivables/Cash Cycle: Multiple ChoiceLeonardoAinda não há avaliações

- Final Drill No. 2Documento8 páginasFinal Drill No. 2anon_492858278Ainda não há avaliações

- Income Taxes Problem SolvingDocumento3 páginasIncome Taxes Problem SolvingLara FloresAinda não há avaliações

- Investments in Debt and Equity SecuritiesDocumento41 páginasInvestments in Debt and Equity SecuritiesMonica Monica0% (1)

- Incremental AnalysisDocumento28 páginasIncremental AnalysisMaricar Tarun100% (1)

- Pisodira PDFDocumento46 páginasPisodira PDFjhouvanAinda não há avaliações

- ACG3141 Chap 14 PDFDocumento35 páginasACG3141 Chap 14 PDFLexter Dave C EstoqueAinda não há avaliações

- Chapter 22 - Teacher's Manual - Far Part 1bDocumento13 páginasChapter 22 - Teacher's Manual - Far Part 1bPacifico HernandezAinda não há avaliações

- A7 Topic 10 - Gross Profit Variance AnalysisDocumento1 páginaA7 Topic 10 - Gross Profit Variance AnalysisAnna CharlotteAinda não há avaliações

- Jamolod - Unit 1 - General Features of Financial StatementDocumento8 páginasJamolod - Unit 1 - General Features of Financial StatementJatha JamolodAinda não há avaliações

- 2016 Vol 1 CH 8 Answers - Fin Acc SolManDocumento7 páginas2016 Vol 1 CH 8 Answers - Fin Acc SolManPamela Cruz100% (1)

- CH BsaDocumento1 páginaCH BsaLovErsMaeBasergoAinda não há avaliações

- Cbactg01 Complete ModuleDocumento181 páginasCbactg01 Complete ModuleAllyn Kaye PornosdoroAinda não há avaliações

- File 4795281140322753513Documento10 páginasFile 4795281140322753513Akako MatsumotoAinda não há avaliações

- Exam For Business TaxDocumento3 páginasExam For Business TaxJenyll MabborangAinda não há avaliações

- Name: - Section: - Schedule: - Class Number: - DateDocumento5 páginasName: - Section: - Schedule: - Class Number: - Datechristine_pineda_2Ainda não há avaliações

- Finacc 3Documento12 páginasFinacc 3jano_art21Ainda não há avaliações

- Lease ProblemsDocumento15 páginasLease ProblemsArvigne DorenAinda não há avaliações

- Activity - Chapter 6 - Statement of Cash FlowsDocumento4 páginasActivity - Chapter 6 - Statement of Cash FlowsKaren RiraoAinda não há avaliações

- MAS Review CVP and Variable CostingDocumento7 páginasMAS Review CVP and Variable CostingAizzy ManioAinda não há avaliações

- BLT 2012 First Pre-Board July 28Documento14 páginasBLT 2012 First Pre-Board July 28Lester AguinaldoAinda não há avaliações

- Comprehensive Income & Discontinued Oper PDFDocumento8 páginasComprehensive Income & Discontinued Oper PDFDarwin Competente Lagran0% (1)

- Bowen Built, Inc.Documento13 páginasBowen Built, Inc.Nikki D. ChavezAinda não há avaliações

- This Study Resource Was: Cash Out Lear Flows FlowsDocumento7 páginasThis Study Resource Was: Cash Out Lear Flows FlowsLayAinda não há avaliações

- Name: - Section: - Schedule: - Class Number: - DateDocumento6 páginasName: - Section: - Schedule: - Class Number: - Datechristine_pineda_2Ainda não há avaliações

- Quiz - Chapter 11 - Pfrs For SmesDocumento5 páginasQuiz - Chapter 11 - Pfrs For SmesJosh BustamanteAinda não há avaliações

- Assign. 2 Module 2Documento9 páginasAssign. 2 Module 2Kristine VertucioAinda não há avaliações

- ReviewerDocumento5 páginasReviewermaricielaAinda não há avaliações

- PDF Acc 109 Intermediate Accounting 4 Mock Phinma Exam 2s1920 Key Answer - CompressDocumento19 páginasPDF Acc 109 Intermediate Accounting 4 Mock Phinma Exam 2s1920 Key Answer - CompressGeraldine Martinez DonaireAinda não há avaliações

- National Mock Board Examination 2017 Financial Accounting and ReportingDocumento9 páginasNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Cpa Review School of The Philippines ManilaDocumento5 páginasCpa Review School of The Philippines ManilaAljur SalamedaAinda não há avaliações

- First Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Documento6 páginasFirst Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Febby Grace Villaceran Sabino0% (1)

- Cfas Quizzes FinalsDocumento10 páginasCfas Quizzes FinalsSaeym SegoviaAinda não há avaliações

- Quiz On InvestmentDocumento3 páginasQuiz On InvestmentDan Andrei BongoAinda não há avaliações

- Investments: IFRS Questions Are Available at The End of This ChapterDocumento44 páginasInvestments: IFRS Questions Are Available at The End of This Chapteralexstets4553Ainda não há avaliações

- UCU Audit ProblemsDocumento9 páginasUCU Audit ProblemsTCC FreezeAinda não há avaliações

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocumento7 páginasSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Attachment-Inventory Valuation ProblemsDocumento33 páginasAttachment-Inventory Valuation ProblemsNile Alric AlladoAinda não há avaliações

- Accrev1 FINAL EXAM 19 20 NO ANSWERSDocumento15 páginasAccrev1 FINAL EXAM 19 20 NO ANSWERSGray JavierAinda não há avaliações

- Use The Following Information For The Next Two QuestionsDocumento7 páginasUse The Following Information For The Next Two QuestionsJohn Carlo Aquino0% (1)

- 4 InventoriesDocumento5 páginas4 InventoriesandreamrieAinda não há avaliações

- MSQ-03 - Working Capital FinanceDocumento11 páginasMSQ-03 - Working Capital FinanceJade RamosAinda não há avaliações

- Chapter 10-Investments in Noncurrent Operating Assets-AcquisitionDocumento34 páginasChapter 10-Investments in Noncurrent Operating Assets-AcquisitionYukiAinda não há avaliações

- ZMSQ 12 Activity Based CostingDocumento9 páginasZMSQ 12 Activity Based CostingMonica MonicaAinda não há avaliações

- Quiz (Relevant - Costing) - MT - ContDocumento3 páginasQuiz (Relevant - Costing) - MT - ContExequielCamisaCrusperoAinda não há avaliações

- Property, Plant and Equipment Problems 5-1 (Uy Company)Documento14 páginasProperty, Plant and Equipment Problems 5-1 (Uy Company)NaSheeng100% (1)

- AnswerQuiz - Module 6Documento4 páginasAnswerQuiz - Module 6Alyanna Alcantara100% (1)

- Investment Intangible Wasting Assets 1 PDFDocumento8 páginasInvestment Intangible Wasting Assets 1 PDFMeldwin C. Gutierrez50% (2)

- 25 Profit-Performance Measurements & Intracompany Transfer PricingDocumento13 páginas25 Profit-Performance Measurements & Intracompany Transfer PricingLaurenz Simon ManaliliAinda não há avaliações

- CH 17 JWBDocumento38 páginasCH 17 JWBFarisa MachmudAinda não há avaliações

- ACT112 Final Exam Set 1 QuestionnaireDocumento10 páginasACT112 Final Exam Set 1 QuestionnaireBashayer M. Sultan100% (1)

- Multiple ChoiceDocumento9 páginasMultiple ChoiceCj SernaAinda não há avaliações

- Chapter 17 Flashcards - QuizletDocumento34 páginasChapter 17 Flashcards - QuizletAlucard77777Ainda não há avaliações

- Debt Securities ReviewerDocumento30 páginasDebt Securities Reviewerjhie boterAinda não há avaliações

- Investments 2Documento2 páginasInvestments 2Alora Eu100% (1)

- Chap 17Documento24 páginasChap 17alice123h210% (1)

- TFAR2304 - Investment in Equity SecuritiesDocumento3 páginasTFAR2304 - Investment in Equity SecuritiesBea GarciaAinda não há avaliações

- Abaqus Example Using Beam ElementsDocumento18 páginasAbaqus Example Using Beam ElementsŞener KılıçAinda não há avaliações

- Ideco E-2100 Parts List-OcrDocumento48 páginasIdeco E-2100 Parts List-OcrMarcelino Payro TorreAinda não há avaliações

- Flsmidth Private Limited: Quality Assurance Plan of Exciter CasingDocumento5 páginasFlsmidth Private Limited: Quality Assurance Plan of Exciter CasingMohammad AdilAinda não há avaliações

- MGM College of Engineering and Pharmaceutical Sciences: First Internal ExaminationDocumento2 páginasMGM College of Engineering and Pharmaceutical Sciences: First Internal ExaminationNandagopan GAinda não há avaliações

- Expectation-Maximization AlgorithmDocumento13 páginasExpectation-Maximization AlgorithmSaviourAinda não há avaliações

- Method Statement Riyadh School Project Fire Fighting SystemDocumento3 páginasMethod Statement Riyadh School Project Fire Fighting Systemkhantoseef84Ainda não há avaliações

- Combustion and Flame: Victor Chernov, Qingan Zhang, Murray John Thomson, Seth Benjamin DworkinDocumento10 páginasCombustion and Flame: Victor Chernov, Qingan Zhang, Murray John Thomson, Seth Benjamin DworkinVictor ChernovAinda não há avaliações

- Architecture As SpaceDocumento31 páginasArchitecture As Spaceazimkhtr50% (4)

- Grounding-101 IEEE IAS PDFDocumento81 páginasGrounding-101 IEEE IAS PDFRoySnk100% (2)

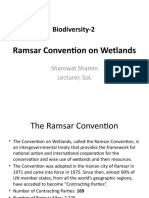

- Biodiversity-2: Ramsar Convention On WetlandsDocumento9 páginasBiodiversity-2: Ramsar Convention On WetlandsAhmad NawazAinda não há avaliações

- University of Calicut: Examination ResultsDocumento1 páginaUniversity of Calicut: Examination ResultsArun Saji Josz RbzAinda não há avaliações

- Rooftop Package Air Conditioner: Installation ManualDocumento32 páginasRooftop Package Air Conditioner: Installation Manualyusuf mohd sallehAinda não há avaliações

- Lesson Plan Template 2017 7 3Documento4 páginasLesson Plan Template 2017 7 3api-424474395Ainda não há avaliações

- Atomic Physics Exam Qs StudentDocumento7 páginasAtomic Physics Exam Qs StudentfitzttAinda não há avaliações

- Agesitab OP850: Electronic Operating TableDocumento4 páginasAgesitab OP850: Electronic Operating TableMuhammad NaomanAinda não há avaliações

- Single and Multistage Steam Jet Ejectors: TorinoDocumento12 páginasSingle and Multistage Steam Jet Ejectors: TorinoSuman SenapatiAinda não há avaliações

- NCP On Mental RetardationDocumento20 páginasNCP On Mental RetardationSARITA SHARMAAinda não há avaliações

- P3A Taking Order BeveragesDocumento2 páginasP3A Taking Order BeveragesRavi KshirsagerAinda não há avaliações

- Core Beliefs EssayDocumento7 páginasCore Beliefs Essayapi-291353846Ainda não há avaliações

- Cisco Wireless LAN Controller - Configuration Guide PDFDocumento696 páginasCisco Wireless LAN Controller - Configuration Guide PDFMiguel MazaAinda não há avaliações

- Crossroads #10 - Roger Zelazny's Amber - Seven No-TrumpDocumento254 páginasCrossroads #10 - Roger Zelazny's Amber - Seven No-TrumplerainlawlietAinda não há avaliações

- Goodman and Gilman's Sample ChapterDocumento17 páginasGoodman and Gilman's Sample Chapteradnankhan20221984Ainda não há avaliações

- Atma Rama Anandha Ramana - Scenes PDFDocumento2 páginasAtma Rama Anandha Ramana - Scenes PDFKoushik KattaAinda não há avaliações

- Aim Efi Euro1 100 EngDocumento8 páginasAim Efi Euro1 100 EngManuel RodriguezAinda não há avaliações

- Algorithm and FlowchartsDocumento9 páginasAlgorithm and FlowchartsNambashisha RyngksaiAinda não há avaliações

- Chapter 9 - Worksheet1finalDocumento27 páginasChapter 9 - Worksheet1finalTansu Erin ŞarlakAinda não há avaliações

- Enron Case StudyDocumento23 páginasEnron Case StudyJayesh Dubey100% (1)

- Examination of Foot and Ankle JointDocumento58 páginasExamination of Foot and Ankle JointSantosh KumarAinda não há avaliações

- Assignment 1Documento2 páginasAssignment 1Nayyar AbbasiAinda não há avaliações

- Gallipoli Diary, Volume 2 by Hamilton, Ian, 1853-1947Documento191 páginasGallipoli Diary, Volume 2 by Hamilton, Ian, 1853-1947Gutenberg.orgAinda não há avaliações