Escolar Documentos

Profissional Documentos

Cultura Documentos

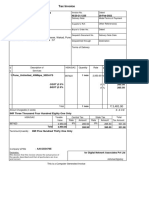

Vat

Enviado por

vb_krishnaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Vat

Enviado por

vb_krishnaDireitos autorais:

Formatos disponíveis

ALL INDIA VALUE ADDED TAX STATE-WISE BUDGET HIGHLIGHTS - 2013-14

A) MAHARASHTRA

1. Changes in VAT rates retail price less than Rs 500 to Rs 3 per bulk litre from Re 1 per bulk litre. Export fee on IMFL having maximum retail price of Rs 500 or more to increase from Rs 5 per bulk litre to Rs 10 per bulk litre. Existing Proposed

Commodity

B) GOA

1. To raise the rate of WCT TDS from 2% to 5% 2. Provision to streamline refund process (by amending Section 9) 3. To amend the Net Present Value Compulsory Payment Scheme to introduce the Restrictive Tax Invoices which are pre-authenticated by the units under deferment 4. To introduce provisions of remission of interest and penalty not exceeding 50% of the amount involved for payment of VAT by the defaulters 5. To raise the limitation period of passing order for Revision/Review from 3 years to 5 years by the Commissioner 6. To amend the provisions where appeal shall be admitted by the Administrative Tribunal only after 50% payment of the disputed dues 7. To reduce the penalty to Rs. 500 from Rs. 1000 for non-filing of returns. 8. Failure to file 3 consecutive quarterly returns would result in automatic cancellation of registration certificate. 9. Authority to the Commissioner for levying spot penalty of Rs.1000/on each incident where sales bills are not issued by the dealers, nonmaintenance of proper books of accounts and stock details. 10.Introduction of one-time settlement scheme, where the dealer will have to pay 50% of the disputed amount and withdraw the appeals so filed. This scheme will be announced in April, 2013 and those who file application within a period of three months will be considered for the benefit on case-to-case basis. Cases involving non-payment of tax will not be covered. 11. To introduce a unique scheme for foreign tourists, visiting Goa, who will be entitled for refund of VAT paid against purchases made in the state of Goa. 12.Reduction in VAT rate on Aviation Turbine Fuel (ATF) from 12.5% to 5% 13.To levy a tax on consideration received or receivable by the builder or developer by way of agreement to sale the flats or housing project or dwelling units or row houses and the like (where agreement value is Rs. 10 lakhs or more), which are under construction or development. Rate of tax as under:

Gold, Silver & their jewellery Textile for industrial use Sugarcane Purchase Tax Powder, Cubes & Tablets from which Non Alcoholic Beverages are prepared Bidi Cigarettes

1% 0% 3% 5% 5% 20%

1.10% 5% 5% 12.5% 12.5% 25%

2. To allow dealers to file single revised return instead of multiple returns for entire year if any discrepancy is pointed out in the audit by the Accountant or in the business audit conducted by the Sales Tax Department. 3. To recover, by directly serving a demand notice, additional tax liability pointed out by the Chartered Accountant or Cost Accountant in the audit report accepted by the dealer. 4. To allow adjustment of refund claim upto Rs. 5 lakh in the subsequent year; the admissible part of refund as per applications shall be granted within three months of the due date for filing of Audit Report. 5. To enable early grant of refund to Mega projects eligible for Industrial Promotion Subsidy and to dealers whose turnover of inter-State sales in previous year is in excess of 50% of their total turnover. 6. No set-off of input tax paid on purchases of passenger vehicles used for the purpose of leasing by a leasing company. 7. Provision for impounding of the existing instrument where the concerned financial institutions where proper stamp duty is not paid upto 30th September 2013. Penal Country Liquor - From Rs 95 per proof litre to Rs 110 per proof litre Indian Made Foreign Liquor From Rs 240 per proof litre to Rs 300 per proof litre Fragmented strong beer - From Rs 42 per bulk litre or 175% of manufacturing cost whichever is higher to Rs 60 per bulk litre or 200% per cent of the manufacturing cost whichever is higher. Indian Made Foreign Liquor - Increase in export fee having maximum

Value between Rs. 10 lakhs to Rs.100 lakhs 1% of the agreement value Value exceeding Rs. 100 lakhs - 2% of the agreement value 14. To levy VAT & Entry Tax on empty glass bottles at the rate of 12.5% which are used for beer and other like products. 15. To reduce the rates of VAT as well as Entry Tax from 15% to 12.5% on luxury cars costing above Rs. 15 lakhs and two wheelers costing above Rs. 2.5 lakhs 16. To levy VAT on Lubricating Oil at the rate of 15% and to exempt its subsequent sales thereof, subject to certain conditions to be notified

D) GUJARAT

1. To increase the total turnover-limit for applicability of provisions for payment of lump-sum tax from Rs. 50 lakhs to Rs. 75 lakhs. 2. To revise rates of certain commodities as tabulated below: Commodity Schedule entry reference II - 1 Existing Rate (incl. Additional tax) 5% Proposed Rate Exempt

C) KARNATAKA

a. Goods & Service Tax (GST) 1. Urge to the Government of India for the following: = To ensure that the compensation package provided and the final Revenue Neutral Rate fixed for the State would not compromise our high tax effort = GST Council should be empowered to recommend floor rates of GST within a band giving certain fiscal autonomy to States to raise additional resources a. Value Added Tax (VAT) 1. Increased peak VAT rates from 5% to 5.50% and 14% to 14.50% for a period of one year from August 2012 to August 2013, this rate to be reduced from August, 2013 to the earlier levels as per notification issued. 2. Reduction of VAT rates on certain products as under:

Micro irrigation system equipments Educational items for study of students Newar made of plastic Agarbatti dust Carbon credit change of schedule entry from II-87 to Cigarette made from tobacco

II - 56

5%

Exempt

5%

Exempt

II - 87 II - 41

15% 15%

Exempt 5%

II 76A

25%

30%

Commodity Arecanut dehusking machine Cocoa Husk Domestic containers Refractory Monolithic Powder

Existing 14.5% 14.5% 14.5% 14.5%

Proposed 5.5% 5.5% 5.5% 5.5%

3. To levy tax on the sale of second hand (used) two wheelers second hand (used) medium and heavy duty commercial vehicles as under: Second hand two wheelers - 1% (subject to maximum Rs. 500) Second hand medium and heavy duty commercial vehicles - 1% (subject to maximum Rs. 5,000) made by a registered dealer. 4. To allow payment of lump-sum entertainment tax under the provisions of the Gujarat Entertainment Tax Act, 1977 only to videos houses fulfilling the following conditions: (I) The rate of entry into the place of entertainment shall not be more than Rs.30/- per person. (ii) Entertainment (showing of films) can be provided using any kind of technology. (iii) The maximum number of seats in the entertainment place shall not be more than 125. (iv) There shall not be more than one screen in the premises. 5. To allow payment of lump-sum entertainment tax under the provisions of the Gujarat Entertainment Tax Act, 1977 only to videos houses fulfilling the following conditions:

3. Payment required to be made by the dealers for filing appeals against orders demanding tax in excess of the amounts declared by them and for obtaining stay for its recovery to be reduced from 50% to 30% of disputed amount. 4. Time limit for payment of additional tax demanded on assessment and reassessments to be increased from ten days to thirty days. 5. Threshold limit for registration under the Entry Tax Act from Rs. 2 lakhs to Rs. 5 lakhs to bring it at par with the threshold under the VAT Act. 6. It is proposed to provide for filing of an appeal even against best judgement assessment order under Profession Tax Act.

E)

1.

WEST BENGAL

Changes in VAT rates:Particulars Existing 4% 13.5% 20% Proposed 5% 14.5% 25%

Lower VAT rate Upper VAT rate VAT rate on Tobacco

2. Introduction of system assigning a 'Sahara Star Status' to dealers on the simple basis of the degree of accuracy of their refund claims submitted in the earlier periods 3. To restrict the assessment process only in very specific cases like defaulters in returns or evasion; in other cases, the assessment process to be eliminated 4. To introduce a scheme of 'Tatkhanik Registration' for dealers.

10. Stock Transfer by Automobile Industry outside the state attracts reversal of input tax rebate by 4%. Further, in textile industry, the produced cloth being tax free, ITR shall be reversed by 4%. The rate of reversal for both the industries is proposed to be revised to 2%. 11. VAT rate of components used in production of automobiles to change to 5% by categorizing as industrial inputs. 12. Rate of Entry Tax on Plant & Machinery to be reduced from 2% to 1%

5. To exempt such small resellers and works contractors having annual turnover of sale of less than Rs. 50 lakh from payment of purchase tax. 6. To completely dispense with the requirement of maintenance of stock registers for the purpose of availing Input Tax Credit. 7. To raise the ceiling of self Audit from Rs. 3 Crore to Rs. 5 Crore. 8. To eliminate the system of compulsory assessment and introduction of amnesty scheme for those registered employers and persons who have defaulted in the payment of Profession Tax. 9. To raise the lower rate of VAT from 4% to 5%. 10. To raise the profession tax exemption limit to Rs. 7000 per month from Rs 5000 per month.

13. Components which get consumed in manufacturing of Engineering goods are made tax free 14. Iron used in manufacturing purchased from 'Rashtriya Laghu Udhyog Nigam' is also proposed to make tax free. 15. In view of the increase in the prices of Domestic L.P.G., entry tax rate on the same to be reduced from 6.47% to 2%.

G) HIMACHAL PRADESH

1. Changes in CST Rates:

F) MADHYA PRADESH

a. Goods & Service Tax (GST) 1. Request to Central Government for the system to empower the State Government for service tax collection under 88th Constitution (amendment) Act, 2004 at par with European Union. 2. Centre should not intervene in activities on which the State Government have right to impose taxes in the service sector. a. Value Added Tax (VAT) 1. The limit of annual turnover for filing e-returns is to be reduced to Rs. 1 crore from existing limit of Rs. 2 crores 2. In case of filing return with digital signature, there will be no need to submit 'Return Verification Form' separately. 3. Increase the time limit for deposition of tax and furnishing of Ereturns for small dealers having annual turnover upto Rs. 2 crores by 20 days 4. The dealers, instead of providing the list of purchases of more than Rs. 25,000 in a quarter along with return, now has to provide the list of purchases and sales of more than Rs. 40,000 in a quarter 5. Turnover limit of annual turnover for availing the composition scheme to be increased to Rs. 1 crore as compared to Rs. 60 lakhs 6. To levy VAT on sale of all types of liquor as against sale of liquor from bars. 7. Full ITR to be made available on Natural Gas used as fuel in manufacturing as compared to availability of ITR in excess of 5%. 8. Rebate is now proposed to tax paid on sand and other similar products. 9. In cases of manufacturing units, due to inter-state sales, VAT paid on inputs does not get fully set off against the liability & the remaining ITR gets liable to be refunded. It is proposed to refund 75% of the excess ITR against the bank guarantee.

Particulars Existing industrial units New industrial units set up in the State and also carrying out substantial expansion work

Existing 2.00% 2.00%

Proposed 1.5% 1%

The benefit shall be extended for period of 5 years or till date of implementation of GST whichever is earlier. Changes in VAT Rates: Particulars On Footwear On Aviation turbine fuel On Cigarette, cigar & other smoking stuff On bidis Existing 5% & 13.75%. 5%. 18%. Proposed 9%. 1%. 36%

11%.

22%.

3. E-Service : Extension of facility of filing e-returns, e-declaration, e-tax payment and issue of C&F forms online to; Before 1/4/2013 From 1/4/2013

Dealers having Rs. 1 crore turnover & above.

Dealers having Rs.40 lakhs turnover & above

From 1st April 2013, the requirement of filing hard copies of monthly/quarterly returns filed online have been dispensed with except annual returns. 4. Registration fees under the H.P. VAT Act, CST Act, Passenger & Good Tax Act and Luxury Tax Act to be abolished for the new dealers to facilitate early registration. 5. From 1st April, 2013, commodities under various schedules appended to the Himachal Pradesh VAT Act, 2005 will be assigned commodity codes in line with Central Excise Tariff codes. 6 In current scenario where lots of cases are pending for assessment, select cases shall be selected for assessment on random basis. Cases where returns have been filed/taxes paid shall be considered for deemed assessment & closed.

2. To increase the threshold limit for registration from Rs.10 lakhs to Rs. 20 lakhs. 3. Facility of online registration to be introduced. 4. Periodicity of tax returns shall be changed from existing quarterly & monthly to quarterly only. 5. Dealers to file hard copies of only acknowledgement of returns e filed by them instead of filing hard copies of the entire VAT returns. 6. In order to encourage the dealers to voluntarily admit tax payable, it is proposed to mitigate penalty of 80% of tax admitted subject to tax having been deposited. 7. In order to enable the Works Contract dealers to discharge their tax liability in a simplified and hassle-free manner, it is proposed to introduce a new composition scheme where dealers will pay tax based on their overall turnover. There will be options available to dealers to procure materials against declaration forms (C forms), import as well as purchases from unregistered dealers.

H) DELHI

1. Changes in VAT rates:

Commodity

Schedule entry reference Section 4(1)(e)

Existing Rate Proposed (incl. Additional tax) Rate 12.5% Exempt

I) JAMMU & KASHMIR

1. Changes in VAT Rates:

Refuse Derived Fuel (RDF)

Commodity 12.5% Exempt Cooked food items sold by the hotels, restaurants, food joints, dhabas etc 12.5% 5% Saffron Honey The skills of our craftsmen in creating very attractive made ups like bags, purses, tea cozies etc All electrical goods including CFLs Items like durries, quilt & blanket covers, table cloth & table covers, mufflers, bed spreads, pillow case & pillow slips Pashmina wool Idols made of stone (other than precious stones) or any type of clay Cigarettes & Other related products Section 4(1)(e) Section 4(1)(e) 12.5% 12.5% 5% Exempt

Existing Rate (incl. Additional tax) 13.5%

Proposed Rate 5%

Tiles and kerbstones Section 4(1)(e) made from malba (i.e. construction debris) Light Emitting Diodes (LED) lights Section 4(1)(e)

13.5% 5% 13.5%

5% Exempt Exempt

Chilli Spray used for Section 4(1)(e) self defence Singhara, kuttu and their atta and sendha namak Empty pencil/ geometry box Charki and manza used for flying kites All types of footwear having MRP up to Rs. 500, provided that the MRP is indelibly marked or embossed on the footwear itself (other than those covered under schedule I 69) Desi ghee Organic gulal and organic colours III 81

12.5%

Exempt

5%

Exempt

Section 4(1)(e)

12.5%

Exempt

13.5%

5%

Section 4(1)(e)

12.5%

Exempt

13.5%

5%

III 51

5%

Exempt

13.5% 13.5%

Exempt Exempt

30%

40%

2. Benefit of certain exemptions/concessions outlined further extended upto March 31, 2014; =VAT relief on basic food items: like Atta, maida, suji, besan, pulses, paddy and rice =VAT relief to Industrial units =Vat relief on Hotels =VAT relief to farmers -wholly exempt small tractors, power tillers and other agricultural implements and attachments from the levy of VAT 3. To encourage farming sector it is proposed to wholly exempt subsidized small tractors, power tillers and other agricultural implements and attachments from the levy of VAT. 4. To change the requirement of obtaining reference from an existing

Specified goods

Old Rate

New Rate

HSN Code

Cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes Disposable plates, cups and leaves, made of plastic

15%

20%

2402

20%

*****

J) ASSAM

Commodity Gur, jaggery and edible variety of rub gur Stone chips and boulders CFL bulb & Generator set Cigarette, Bidi, Cheroots, Cigar, smoking mixture Existing 5% Proposed Exempt 2. Cooked food and beverages served in the house-boat paying compounded tax under the Kerala Tax on Luxuries Act, shall be exempt from paying tax 01.04.2006 3. Sale of Cardamom to be taxed at 2% at the point of auction, conducted at the auction centre, holding a valid license issued by the Spices Board under the Cardamom (Licensing and Marketing) Rules, 1987. 4. For Cigarettes it is proposed that any dealer, who is an importer or manufacturer of cigarettes and the similar products, may at his option, pay tax @ 20% on MRP of such goods. 5. The turnover limit for taking registration for dealers, other than dealers specified in Section 15(2) (casual dealer, bullion dealer etc.) is enhanced to Rs. 10 lakhs from Rs. 5 lakhs. 6. The department has come out with a one-time incentive to new registrants. The dealers may voluntarily get themselves registered under the KVAT Act between 1st April, 2013 and 30th September, 2013. These dealers shall not be liable to tax or penalties, with respect to the transactions prior to 1st April, 2013. However, this special provision shall not apply to the transactions of dealers who werea) importers; b) works contractors; c) manufacturers, but excluding dealers coming under sub-clause (i) of clause (c) of section 8; d) dealers against whom penal proceedings were initiated for nonregistration and non-payment of tax under this Act, before 1st April, 2013 7. Hospitals run by charitable institutions, which avail exemption under the Income Tax Act, 1961 and who purchases medicines from compounded dealer after paying tax, shall be exempt from tax on sale of laboratory store items and consumables to their patients for the period prior to 1st April, 2013, as may be notified by Government. This exemption is available only if the hospitals get themselves registered under this Act on or before 30th June, 2013. 8. The time limit for completion of assessments upto 2007-08 for audit assessments and assessments of escaped turnover are now extended upto 31st March, 2014. 9. Provision for Extension of period of limitation for assessments in certain cases.

13.5% 13.5% 20%

5% 5% 25%

2. To increase the exemption limit for levy of VAT from existing Rs.4 lakh to Rs.6 lakh. 3. To increase the turnover limit for retail dealers for discharging tax under Composition Scheme from existing Rs.40 lakh to Rs.60 lakh. 4. To fix the rate of tax at 5% on some electrical goods like sockets of all type, regulators, modular plate, MS Board, Casing and capping.

5. To reduce the rate of entry tax on plastic granules from existing 2% to 1% to give a boost to plastic industries. To increase rate of entry tax on marble, granite and other decorative slabs, furniture and fixtures, sanitary wares and bathroom fitting of all types from 4% to 6%. 6. To increase the rates under Composition Scheme for brick field, marble dealers & dealers dealing in cooked food, sweet meat. New composition scheme for catering dealers is also proposed.

K) KERALA

1. Changes in VAT rates: Goods coming under Schedule 1 Schedule 2 Schedule 3 Others Works Contract- where the transfer is not in the form of goods but in some other form Existing 0% 1% 5% 13.50% 13.50% Proposed 0% 1% 5% 14.5% 14.5%

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Procedure For MV Cable Termination and TestingDocumento8 páginasProcedure For MV Cable Termination and TestingAtlas Dammam100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Sample Revenue PolicyDocumento6 páginasSample Revenue Policyvb_krishnaAinda não há avaliações

- Epayslip 2023-07-27 31173270Documento1 páginaEpayslip 2023-07-27 31173270ryan robert mercadoAinda não há avaliações

- EQUI Marginal Concept-WordDocumento4 páginasEQUI Marginal Concept-Wordnithinsdn100% (2)

- Microsoft Dynamics CRM 2016 User Guide PDFDocumento882 páginasMicrosoft Dynamics CRM 2016 User Guide PDFDjord AndraAinda não há avaliações

- Ul AppletonDocumento2 páginasUl AppletonDIEGO SANCHEZ100% (1)

- Kick Off Meeting Cum Awareness Session DMW PatialaDocumento97 páginasKick Off Meeting Cum Awareness Session DMW PatialaAnkurAinda não há avaliações

- Treasury Report: INR (Crores) INR (Crores) INR (Crores)Documento1 páginaTreasury Report: INR (Crores) INR (Crores) INR (Crores)vb_krishnaAinda não há avaliações

- 51 Excel TutorDocumento210 páginas51 Excel TutorAbhinav GuptaAinda não há avaliações

- Whether The Assessing Officer IsDocumento2 páginasWhether The Assessing Officer Isvb_krishnaAinda não há avaliações

- AS 19 - LeasesDocumento23 páginasAS 19 - LeasesMurali Krishna ChakralaAinda não há avaliações

- Word Meaning Related To Ethics & CommunicationDocumento3 páginasWord Meaning Related To Ethics & Communicationvb_krishnaAinda não há avaliações

- Sample Internal Audit RisksDocumento6 páginasSample Internal Audit RisksKarl NeoAinda não há avaliações

- As9 RevenueDocumento63 páginasAs9 RevenueRahul KhoslaAinda não há avaliações

- Calculation of Hosue Rent Allowance (HRA) U/s 10 (13 A) and Rule 2ADocumento1 páginaCalculation of Hosue Rent Allowance (HRA) U/s 10 (13 A) and Rule 2Avb_krishnaAinda não há avaliações

- Accounting Standard 17 Segment ReportingDocumento37 páginasAccounting Standard 17 Segment ReportingYasir AhmedAinda não há avaliações

- 10essential ForcastudentsDocumento1 página10essential Forcastudentsvb_krishnaAinda não há avaliações

- AS28Documento70 páginasAS28Sujit ChakrabortyAinda não há avaliações

- Word Meaning Related To Ethics & CommunicationDocumento3 páginasWord Meaning Related To Ethics & Communicationvb_krishnaAinda não há avaliações

- Diabetes Center: Home Articles Tips CalculatorsDocumento3 páginasDiabetes Center: Home Articles Tips Calculatorsvb_krishnaAinda não há avaliações

- Whether The Assessing Officer IsDocumento2 páginasWhether The Assessing Officer Isvb_krishnaAinda não há avaliações

- Whether The Assessing Officer IsDocumento2 páginasWhether The Assessing Officer Isvb_krishnaAinda não há avaliações

- As InventoryDocumento4 páginasAs Inventoryvb_krishnaAinda não há avaliações

- New Master3cd 13 14Documento22 páginasNew Master3cd 13 14vb_krishnaAinda não há avaliações

- AS28Documento70 páginasAS28Sujit ChakrabortyAinda não há avaliações

- Companies (Auditor's Report) Order, 2003Documento6 páginasCompanies (Auditor's Report) Order, 2003vb_krishnaAinda não há avaliações

- 23 - Check List For Audit ProgrammeDocumento18 páginas23 - Check List For Audit Programmenilesh_v12Ainda não há avaliações

- Limited Revision To Accounting Standard (As) 15, Employee Benefits (Revised 2005)Documento4 páginasLimited Revision To Accounting Standard (As) 15, Employee Benefits (Revised 2005)Vivek ReddyAinda não há avaliações

- Information Required From Supplier OthersDocumento1 páginaInformation Required From Supplier Othersvb_krishnaAinda não há avaliações

- Dipifr 2013Documento10 páginasDipifr 2013vb_krishnaAinda não há avaliações

- As26Documento9 páginasAs26vb_krishnaAinda não há avaliações

- Recent Changes in ST Law 2013 14Documento14 páginasRecent Changes in ST Law 2013 14vb_krishnaAinda não há avaliações

- Tax Connect May 2014Documento7 páginasTax Connect May 2014vb_krishnaAinda não há avaliações

- Standard Costing: Material Cost VarianceDocumento4 páginasStandard Costing: Material Cost Variancevb_krishnaAinda não há avaliações

- Calculation of Fees: Authorised Capital Additional A.C. Add. FeesDocumento2 páginasCalculation of Fees: Authorised Capital Additional A.C. Add. Feesvb_krishnaAinda não há avaliações

- Ratio Calculation in An Easiest WayDocumento1 páginaRatio Calculation in An Easiest WayrajdeeppawarAinda não há avaliações

- SCMactivity 1Documento8 páginasSCMactivity 1Jasmin NoblezaAinda não há avaliações

- Contractual Agreements in Ghana's OilDocumento23 páginasContractual Agreements in Ghana's OilAaron Gbogbo MorthyAinda não há avaliações

- Grain and Feed Annual Jakarta Indonesia 03-27-2021Documento22 páginasGrain and Feed Annual Jakarta Indonesia 03-27-2021Fauzan LukmanAinda não há avaliações

- Financial ManagementDocumento2 páginasFinancial ManagementArun ReddyAinda não há avaliações

- Solution Manual For International Financial Management Eun Resnick 6th EditionDocumento36 páginasSolution Manual For International Financial Management Eun Resnick 6th Editionoleooilbarouche2uv2y100% (47)

- Gsma 2024Documento12 páginasGsma 2024Sabrine BelgaiedAinda não há avaliações

- FINAL-thesis-writing SampleDocumento48 páginasFINAL-thesis-writing SampleGwen-Evelyn GallosaAinda não há avaliações

- Daily Report Smu Ods Sap-Ho Mei 2023Documento40 páginasDaily Report Smu Ods Sap-Ho Mei 2023FEBRYAN RAMADHANAinda não há avaliações

- Piecing Together The Supply Chain ConceptDocumento7 páginasPiecing Together The Supply Chain ConceptSolange TCAinda não há avaliações

- ACC 203 Taxation in NepalDocumento9 páginasACC 203 Taxation in NepalSophiya PrabinAinda não há avaliações

- Accounting Theory ReviewerDocumento4 páginasAccounting Theory ReviewerAlbert Sean LocsinAinda não há avaliações

- Bangalore University BBM 5th Semester Core SubjectsDocumento7 páginasBangalore University BBM 5th Semester Core SubjectsHarsha Shivanna0% (1)

- Vaishali Dna Wifi 2022Documento1 páginaVaishali Dna Wifi 2022AbhijeetAinda não há avaliações

- Double Irish Dutch Sandwich and The Indian Transfer Pricing LawDocumento20 páginasDouble Irish Dutch Sandwich and The Indian Transfer Pricing LawRahaMan ShaikAinda não há avaliações

- Pall Mall Gazette: Evening EditionDocumento2 páginasPall Mall Gazette: Evening EditionÁlvaro Martínez FernándezAinda não há avaliações

- YB Tripartite Engagement AgreementDocumento6 páginasYB Tripartite Engagement AgreementYesBroker InAinda não há avaliações

- E-Agribusiness ModelDocumento14 páginasE-Agribusiness ModelShailendra PratapAinda não há avaliações

- Gutenberg and The Social Media RevolutionDocumento13 páginasGutenberg and The Social Media RevolutionAi Ram0% (1)

- Content SMM Assessment Task 2 - Project Template 2018 (T4-20)Documento7 páginasContent SMM Assessment Task 2 - Project Template 2018 (T4-20)elenay0418Ainda não há avaliações

- Us Quote 3000146608300.1Documento4 páginasUs Quote 3000146608300.1Crazy programmingAinda não há avaliações

- Multiple Choice Questions: Introduction To Business ProcessesDocumento10 páginasMultiple Choice Questions: Introduction To Business ProcessesTiên Nguyễn ThủyAinda não há avaliações

- Tax SOLVINGDocumento3 páginasTax SOLVINGjr centenoAinda não há avaliações

- Thesis Statement Shopping MallDocumento5 páginasThesis Statement Shopping Mallsamantharandallomaha100% (1)

- Atty Pat Tab C Drug Free Workplace Program LectureDocumento20 páginasAtty Pat Tab C Drug Free Workplace Program LectureLPS CMAinda não há avaliações