Escolar Documentos

Profissional Documentos

Cultura Documentos

02

Enviado por

Nitish KhuranaTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

02

Enviado por

Nitish KhuranaDireitos autorais:

Formatos disponíveis

FIGURING OUT CONTROL

As mergers and acquisitions become more complex and multi-layered, requiring multiple regulatory clearances and compliances, the understanding of the C word has become more crucial than ever

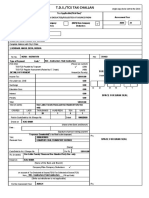

Definitions of control under different Indian laws

>

Differences between control as seen byCCI and Sebi: | CCI approaches it from business sense, Sebi looks at it from the stock market perspective > ACCOUNTING STANDARD 21 * | CCI looks through multiple | The ownership, directly or indirectly through subsidiary(ies), of more layers. Sebi usually stops at than half of the voting power of an enterprise; or one layer above for | Control of the composition of the board of directors to obtain determining voting rights. economic benefits from its activities But, control is decided on a case-to-case basis > COMPANIES ACT | CCI sees convertible No direct definition. But defines holding company and subsidiary. securities as shares from day Accordingly, a company shall be deemed to be a subsidiary of another one, Sebi sees those taking if, and only if, effect on the day of | The other controls the composition of its board of directors; conversion | Holds more than half in nominal value of its equity share capital; | The first-mentioned company is a subsidiary of any company of which | CCI says control can be exercised either jointly or its holding company is a subsidiary singly, Sebi sees control > SEBI TAKEOVER REGULATIONS being exercised individually or in concert, directly or Includes the right to appoint a majority of the directors, or to control the indirectly management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly. This could be by | Sebi rules apply only to listed virtue of their shareholding or management rights or shareholders firms. CCI covers both listed agreements or voting agreements, or in any other manner and unlisted companies Includes controlling the affairs or management by: | One or more enterprises, either jointly or singly, over another enterprise or group; | One or more groups, jointly or singly, over another group or enterprise

COMPETITION ACT

> Definition of control under the International Takeover Laws UK

An interest, or interests, in shares carrying 30% or more of the voting rights in aggregate

Hong Kong & Singapore

Control shall be deemed to mean a holding, or aggregate holdings, of 30% or more of the voting rights

US

Takeovers in the United States are governed by a combination of state laws and case laws in the Delaware court of Chancery

Australia

An entity controls another if it has the capacity to determine the decisions about financial & operating policies of the other

> How Achuthan committee on takeover regulations saw control

| Control can differ, depending on facts, circumstances and nature of each company | The existence or non-existence ofcontrol would be a question of fact, or at best a mixed question of fact and law, to be answered on a case-to-case basis. Any blanket provision may be liable to misuse | It is desirable to underline and emphasise that acquisition of de facto control, and not just de jure control, should expressly trigger an open offer obligation | The panel recommended inclusion of ability in addition to right to appoint a majority of the directors or to control the management or policy decisions in definition. But, this change was not made law

*An accounting standard issued and enforced by Institute of Chartered Accountants of India Achuthan committee: Formed by Sebi in 2009 to rewrite takeover law. Its recommendations formed the basis of the new takeover code that took effect in October 2011. Source: takeovercode.com, Achuthan panel report & News reports; CCI: Competition Commission of India; Sebi: Securities & Exchange Board of India

ILLUSTRATION: AJAY MOHANTY

Você também pode gostar

- Deloitte Me Tax Handbook 2013Documento188 páginasDeloitte Me Tax Handbook 2013Nitish KhuranaAinda não há avaliações

- Press Notes CSM2012Documento2 páginasPress Notes CSM2012Nitish KhuranaAinda não há avaliações

- Triangular Arbitrage Calculation Using Bid AskDocumento10 páginasTriangular Arbitrage Calculation Using Bid AskAlrick Barwa100% (1)

- Application For Visitor'S Card (Public Gallery) : HE Ecretary Eneral OK AbhaDocumento1 páginaApplication For Visitor'S Card (Public Gallery) : HE Ecretary Eneral OK AbhaNitish KhuranaAinda não há avaliações

- 3 Press NoteDocumento1 página3 Press Noteniksheth257Ainda não há avaliações

- Programmedetails 2Documento39 páginasProgrammedetails 2Nitish KhuranaAinda não há avaliações

- Weekly 10 June To 16 June 2013Documento26 páginasWeekly 10 June To 16 June 2013Nitish KhuranaAinda não há avaliações

- INST 275 Lecture1Documento32 páginasINST 275 Lecture1Nitish KhuranaAinda não há avaliações

- Admission Schedule (PCM June 2013) For Waitlisted Token NoDocumento1 páginaAdmission Schedule (PCM June 2013) For Waitlisted Token NoNitish KhuranaAinda não há avaliações

- (A Government of India Undertaking) Administrative Building, Chembur, Mumbai 400 074Documento3 páginas(A Government of India Undertaking) Administrative Building, Chembur, Mumbai 400 074Nitish KhuranaAinda não há avaliações

- (A Government of India Undertaking) Administrative Building, Chembur, Mumbai 400 074Documento3 páginas(A Government of India Undertaking) Administrative Building, Chembur, Mumbai 400 074Nitish KhuranaAinda não há avaliações

- SamsamyikiDocumento34 páginasSamsamyikiNitish KhuranaAinda não há avaliações

- 83765mba Gen I SemesterDocumento1 página83765mba Gen I SemesterNitish KhuranaAinda não há avaliações

- Syllabus For 2011 UPSC Preliminary ExaminationDocumento2 páginasSyllabus For 2011 UPSC Preliminary ExaminationDeepak KumarAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Registration Application Form Uk PDFDocumento15 páginasRegistration Application Form Uk PDFAnis AtmjAinda não há avaliações

- (11a) NOTICE TO VACATE ORDER OF DEFAULTDocumento9 páginas(11a) NOTICE TO VACATE ORDER OF DEFAULTDavid Dienamik100% (7)

- Pavlovich v. Superior Court, 29 Cal.4th 262 (2002) PDFDocumento8 páginasPavlovich v. Superior Court, 29 Cal.4th 262 (2002) PDFJoeAinda não há avaliações

- FGU Insurance Vs CA G.R. No. 137775 March 31, 2005Documento3 páginasFGU Insurance Vs CA G.R. No. 137775 March 31, 2005Pam Otic-ReyesAinda não há avaliações

- Written Statement On Behalf of The Respondent Under Order VIII (Rule 1)Documento3 páginasWritten Statement On Behalf of The Respondent Under Order VIII (Rule 1)noor aroraAinda não há avaliações

- Comparative Political Studies: Interests, Inequality, and Illusion in The Choice For Fair ElectionsDocumento30 páginasComparative Political Studies: Interests, Inequality, and Illusion in The Choice For Fair ElectionsAna Maria Ungureanu-IlincaAinda não há avaliações

- Jury Misconduct - MotionDocumento3 páginasJury Misconduct - MotionObservererAinda não há avaliações

- Flanges (Amendments/Supplements To Asme B16.5) : Technical SpecificationDocumento6 páginasFlanges (Amendments/Supplements To Asme B16.5) : Technical SpecificationmanuneedhiAinda não há avaliações

- TIMTA Annex A Instructional Guide-Feb. 17, 2021Documento7 páginasTIMTA Annex A Instructional Guide-Feb. 17, 2021Jeanette LampitocAinda não há avaliações

- What Is Uniform Civil Code in India - Article 44 (UPSC Notes)Documento13 páginasWhat Is Uniform Civil Code in India - Article 44 (UPSC Notes)Vinod PawarAinda não há avaliações

- ABYIP ResolutionDocumento3 páginasABYIP Resolutionmichelle100% (5)

- SARITA vs. CANDIADocumento2 páginasSARITA vs. CANDIALyn Jeen BinuaAinda não há avaliações

- Philippine Registered Electrical Practitioners, Inc. V Julio Francia, Jr. G.R. No. 87134Documento2 páginasPhilippine Registered Electrical Practitioners, Inc. V Julio Francia, Jr. G.R. No. 87134Monica MoranteAinda não há avaliações

- Expanded Media Coverage RE: Bahena RiveraDocumento4 páginasExpanded Media Coverage RE: Bahena RiveraLocal 5 News (WOI-TV)Ainda não há avaliações

- Application Form For New Students Bursary SchemeDocumento8 páginasApplication Form For New Students Bursary SchemeLahiru WijethungaAinda não há avaliações

- Texas V JohnsonDocumento3 páginasTexas V JohnsonTyler ChildsAinda não há avaliações

- Ganapati TDS ChalanDocumento3 páginasGanapati TDS ChalanPruthiv RajAinda não há avaliações

- 08 ESCORPIZO v. UNIVERSITY OF BAGUIODocumento6 páginas08 ESCORPIZO v. UNIVERSITY OF BAGUIOMCAinda não há avaliações

- Massachusetts Supreme Judicial Court Denies New Trial For Murderer of Amanda PlasseDocumento41 páginasMassachusetts Supreme Judicial Court Denies New Trial For Murderer of Amanda PlassePatrick JohnsonAinda não há avaliações

- Contract Assingment2 Samprity Kar Bba LLBDocumento8 páginasContract Assingment2 Samprity Kar Bba LLBOpen Sea Ever CapturedAinda não há avaliações

- Cable 504: US and Honduras Negotiate Intelligence Sharing and The Cerro La Mole Radar SystemDocumento7 páginasCable 504: US and Honduras Negotiate Intelligence Sharing and The Cerro La Mole Radar SystemAndresAinda não há avaliações

- The FederalistDocumento656 páginasThe FederalistMLSBU11Ainda não há avaliações

- Appendices To Substantive Defenses To Consumer Debt Collection Suits TDocumento59 páginasAppendices To Substantive Defenses To Consumer Debt Collection Suits TCairo Anubiss100% (2)

- City Government of Quezon City v. ErictaDocumento2 páginasCity Government of Quezon City v. ErictaNoreenesse SantosAinda não há avaliações

- Position PaperDocumento2 páginasPosition PaperAndrew AndrewAinda não há avaliações

- CIR Vs United Salvage and Towage - Case DigestDocumento2 páginasCIR Vs United Salvage and Towage - Case DigestKaren Mae ServanAinda não há avaliações

- Reaction Paper Miracle in Cell No 7Documento2 páginasReaction Paper Miracle in Cell No 7Joshua AmistaAinda não há avaliações

- Sweet Precious LawsuitDocumento11 páginasSweet Precious Lawsuitthe kingfishAinda não há avaliações

- Sarmiento, J.Documento11 páginasSarmiento, J.innabAinda não há avaliações

- Ward Brief Warje Ward No. 4 1Documento41 páginasWard Brief Warje Ward No. 4 1Pushkaraj KshirsagarAinda não há avaliações