Escolar Documentos

Profissional Documentos

Cultura Documentos

Asian Paints

Enviado por

Rahul GandhiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Asian Paints

Enviado por

Rahul GandhiDireitos autorais:

Formatos disponíveis

Asian paints

Company background Sectors of operations Decorative paints Ancilliaries Automotive paints Industrial Paints

Main Products and Brand Names

Ancilaries Asian Paints Decoprime Wall Primer WT Asian Paints Decoprime Wall Primer ST Asian Paints Acrylic Wall Putty Asian Paints Exterior Wall Putty Asian Paints Wood Primer Asian Paints Exterior Wall Primer

Automobile Aquabase plus Deltron Enviro base Aspa Enza 2k nexa auto colour Bilux

Eexterior walls Berger Apco Scib Ace Apex Apex Ultima Apex Duracast

Industrial Albi inducement coating

Market Share 45% Asian paints 20% Nerolac 17% Berger 11% ICI 4% J&N 3% Shalminar

Geographies of operations Caribbean Islands Trinidad & Tobago, Barbados, Jamica South Pacific- Fiji, Tonga, Vanuatu South Asia India, Srilanka, Nepal, Bangladesh South east Asia- China, Thailand, Malaysia, Singapore Middle east- UAE, Bahrain, Egypt, Oman

Main competitors Goodlass Nerolac Berger Paints ICI Jenson and Nicholson Shalminar New Developments Developed self healing coatings for wood substrates. Developed Touchwood Exterior Gloss and Silk Matt for wood surfaces Irridescent Special Effects finishes developed. Productivity improvement achieved in manufacture of select machine colorants. Stress intensity calculations done on colorant manufacturing process. Premium Satin Enamel range improved for anti-fungal performance. Developed high performance metal primer for harsh coastal weather conditions in Decorative applications. Developed entire range of machine colorants with lower volatile organic components. Advanced analytical technique developed to map select paint ingredients across the paint film. Productivity improvement achieved in the manufacture of variety of Resins. Developed specialty Polymers for high performance coatings. Developed Heat Resistant Coating System. Developed Range of Primers for Auto Refinish market. Board Size and Composition ASHWIN CHOKSI Chairman ASHWIN DANI Vice Chairman ABHAY VAKIL P.M. MURTY Managing Director & CEO (upto 31st March, 2012) K.B.S. ANAND Managing Director & CEO (w.e.f. 1st April, 2012) MAHENDRA CHOKSI AMAR VAKIL Mrs. INA DANI Ms. TARJANI VAKIL DIPANKAR BASU MAHENDRA SHAH DEEPAK SATWALEKAR R.A. SHAH DR. S. SIVARAM S. RAMADORAI

Compensation to directors Managing Director: Currently, Asian Paints Board consists of only one Executive Director namely Mr. K. B. S. Anand, Managing Director & CEO. Mr. K. B. S. Anand, a Mechanical Engineer with Post Graduation in Management from IIM Calcutta and a veteran with 33 years of experience with the Company, has been appointed as an Additional Director with effect from 1st April, 2012 and as Managing Director & CEO of the Company from 1st April, 2012 to 31st March, 2015 as approved by the Board of Directors at its meeting held on 29th March, 2012, subject to the approval of the shareholders at the ensuing Annual General Meeting. Mr. K. B. S. Anand has taken over the day to day affairs of the Company from 1st April, 2012 after Mr. P. M. Murty ceased to be the Managing Director & CEO of the Company on 31st March, 2012. The remuneration payable to him has been approved by the Remuneration Committee of the Board of Directors of the Company, comprising of Independent Directors, at its meeting held on 23rd March, 2012 and recommended to the Board. The remuneration payable to him is commensurate with the responsibility conferred upon him by the Board, the size of the Company and scope of its operations as well as taking into account external benchmarks. The remuneration structure comprises of salary, house rent allowance, superannuation, perquisites, commission, etc. No severance fee is payable to him on his termination of employment. For the financial year 2011-12, the remuneration payable to Mr. P. M. Murty is reviewed by the Remuneration Committee. The remuneration payable to Mr. P. M. Murty is in accordance with the terms and conditions mentioned in the contract and as approved by the shareholders at the Annual General Meeting held on 26th June, 2009. The remuneration payable to Mr. P. M. Murty is based on the performance of the Company, his contribution and industry standards. No severance fee has been paid on termination of employment. Non-Executive Directors: The Non-Executive Directors play a pivotal role in safeguarding the interests of the investors at large by playing an appropriate control role. Their contribution to the Board processes and valuable strategic insights from time to time; their active involvement and engagement with the Companys business as well as independent views ensure the highest level of governance. The Non-Executive Directors bring in their invaluable experience and expertise which help deliberations at Asian Paints Board. The Non-Executive Directors are paid remuneration by way of commission and sitting fees. The Company pays sitting fees of ` 15,000 (Rupees Fifteen Thousand Only) per meeting to the NonExecutive Directors for attending the meetings of the Board and Committees (except Share Transfer Committee Meeting). The commission is paid as per limits approved by the shareholders, subject to a limit not exceeding 1% p.a. of the profits of the Company (computed in accordance with Section 309(5) of the Companies Act, 1956). The commission payable to Non-Executive Directors is distributed broadly on the basis of their attendance and contributions at the Board and the Committee meetings; and Chairmanship of Committees of the Board.

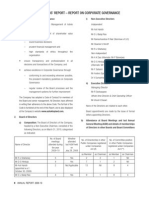

Details about Remuneration paid to the Directors in 2011-12 are as follows: (Figures in Rs`)

Notes: * Perquisites for Mr. P. M. Murty include Companys contribution to provident fund, medical and leave travel allowance, special allowance etc., as well as monetary value of perquisites as per Income Tax rules in accordance with Mr. P. M. Murtys contract with the Company. Perquisites in case of Mr. Ashwin Choksi, Mr. Ashwin Dani and Mr. Abhay Vakil, Non-Executive Directors include retiral benefits like pension and medical reimbursement as per their contracts entered with the Company in their erstwhile capacity as Executive Directors which ended on 31st March, 2009. # The term of Mr. P. M. Murty as the Managing Director & CEO of the Company expired on 31st March, 2012 and consequently he ceased to be a Director on the Board of your Company. The Company has not granted any Stock Options to any of its Directors.

Directors with materially significant, pecuniary or business relationship with the Company: Notes to the Financial Statements furnishes the transactions with related parties, as stipulated under Accounting Standard 18 (AS-18). Apart from the aforesaid related party transactions, there are no transactions of material nature with the Directors or their relatives, etc., which may have a potential conflict with the interest of the Company. Disclosures to this effect have also been received from the Directors and the Senior Managerial Personnel of the Company. There is no pecuniary or business relationship between the Non-Executive Directors and the Company, except for the commission payable to them annually. Mr. R. A. Shah, Independent Director of the Company, is a senior partner ofM/s. Crawford Bayley & Co., Solicitors & Advocates, of the Company, which renders professional services to the Company. The quantum of fees paid to M/s. Crawford Bayley & Co., is an insignificant portion of their total revenue, thus, M/s.Crawford Bayley & Co., is not to be construed to have any material association with the Company.

Employees holding an office or place of profit in the Company pursuant to Section 314 of the Companies Act, 1956, who are relatives of the Directors: Mr. Jalaj Dani, President International Business Unit, son of Mr. Ashwin Dani, Vice Chairman and Mrs. Ina Dani, Director, had earned gross remuneration of ` 1,53,40,628 (Rupees One Crore Fifty Three Lacs Forty Thousand Six Hundred andTwenty Eight only) during the FY 2011-12. Mr. Manish Choksi, Chief Corporate Strategy and CIO, son of Mr. Mahendra Choksi, Director and nephew of Mr. AshwinChoksi, Chairman, had drawn a gross remuneration of ` 1,68,81,516 (Rupees One Crore Sixty Eight Lacs Eighty One Thousand Five Hundred and Sixteen only) during the FY 201112. Mr. Varun Vakil, Manager Market Development, son of Mr. Amar Vakil, Director and nephew of Mr. Abhay Vakil, Director had drawn a gross remuneration of ` 14,06,329 (Rupees Fourteen Lacs Six Thousand Three Hundred and Twenty Nine only), during the FY 2011-12. The appointment and the terms and conditions including remuneration of Mr. Jalaj Dani, Mr. Manish Choksi, and Mr. VarunVakil have been approved by the shareholders and the Central Government/Ministry of Corporate Affairs. Mr. Jigish Choksi son of Mr. Shailesh Choksi (brother of Mr. Ashwin Choksi, Chairman and Mr. Mahendra Choksi, Director),holds the position of Marketing Executive and had drawn a gross remuneration of ` 7,20,207 (Rupees Seven Lacs TwentyThousand Two Hundred and Seven only), during the FY 2011-12. The appointment of Mr. Jigish Choksi and the terms and conditions including remuneration was approved by the shareholders at the Annual General Meeting held on 16th July, 2010. The Ministry of Corporate Affairs by a notification dated 2nd May, 2011, issued Directors Relatives (Office or Place of Profit) Rules, 2011. The revised rules increased the remuneration payable to the employees holding office or place of profit in the Company in accordance with Section 314 of the Companies Act, 1956 and rules thereunder, to ` 2,50,000 per month from ` 50,000 per month. The shareholding of the Non-Executive/ Independent Directors of the Company as on 31st March, 2012 is as follows:

* As per the declarations made to the Company by the Directors as to the shares held in their own name or held jointly as the first holder or held on beneficial basis as the first holder. Mr. P. M. Murty held 2,877 equity shares of the Company as on 31st March, 2012. Mr. K. B. S. Anand, Managing Director & CEO holds 27 equity shares of the Company.

Board meetings held During the financial year ended 31st March, 2012, ten (10) meetings of the Board of Directors were held and the maximumtime gap between two (2) meetings did not exceed four (4) months. The dates on which the Board Meetings were heldwere as follows: Date(s) on which meeting(s) were held 10th May, 2011 7th November, 2011 26th July, 2011 21st January, 2012 31st August, 2011 17th February, 2012 21st September, 2011 20th March, 2012 21st October, 2011 29th March, 2012 The Board meets atleast once in a quarter to review the quarterly financial results and operations of the Company As on date, the Board of Directors of your Company comprises of fourteen (14) Directors of which six (6) are Non-Executive Directors, seven (7) are Non-Executive/Independent Directors and one is Managing Director & CEO of the Company. The composition of the Board is in conformity with Clause 49 of the Listing Agreement. The term of Mr. P. M. Murty as the Managing Director & CEO expired on 31st March, 2012 and consequently he ceased to be a Director on the Board of your Company. The Board of Directors at their meeting held on 29th March, 2012, appointed Mr. K. B. S. Anand as an Additional Director and Managing Director & CEO of your Company with effect from 1st April, 2012. The details of the Directors being re-appointed on retirement by rotation at the ensuing Annual General Meeting, as required pursuant to Clause 49(IV)(G) of the Listing Agreement, are mentioned in the Notice to the Annual General Meeting. The Board meets atleast once in a quarter to review the quarterly financial results and operations of the Company. In addition to the above, the Board also meets as and when necessary to address specific issues relating to the business.The tentative annual calendar of Board Meetings for approving the accounts for the ensuing year is decided well in advance by the Board and is published as part of the Annual Report. All the Directors have informed your Company periodically about their Directorship and Membership on the Board Committees of other companies. As per disclosure received from Director(s), none of the Directors holds Membership in more than ten (10) Committees and Chairmanship in more than five (5) Committees.

The details of the composition, nature of Directorship, the number of meetings attended and the directorships in othercompanies of the Directors of the Company are detailed below. This table also signifies the relationship of the Directors with each other as required to be disclosed in terms of Clause 49 of the Listing Agreement:

Você também pode gostar

- MCS of ITCDocumento20 páginasMCS of ITCAbhay Singh ChandelAinda não há avaliações

- Voltas LTDDocumento13 páginasVoltas LTDVishal ShahAinda não há avaliações

- UNISEM FinStatementDocumento32 páginasUNISEM FinStatementDeepak GhugardareAinda não há avaliações

- Kohat Cement Annual Report 30th June 2013Documento68 páginasKohat Cement Annual Report 30th June 2013junaid_256Ainda não há avaliações

- ShalimarDocumento109 páginasShalimarvinodAinda não há avaliações

- Cybermate Infotek Limited: Board of DirectorsDocumento40 páginasCybermate Infotek Limited: Board of DirectorsSatyabrataNayakAinda não há avaliações

- Meghna Cement Mills 2009Documento50 páginasMeghna Cement Mills 2009panna000% (1)

- Annual ReportDocumento82 páginasAnnual ReportArvinda KumarAinda não há avaliações

- Report On Square Textile LimitedDocumento95 páginasReport On Square Textile LimitedNocturnal Bee100% (1)

- Corporate-Governance 2020 2021Documento43 páginasCorporate-Governance 2020 2021M. Sandhiya Tally proAinda não há avaliações

- Idea BecgDocumento4 páginasIdea BecggargprateekAinda não há avaliações

- BHEL - JugalDocumento19 páginasBHEL - JugalHitendra ChauhanAinda não há avaliações

- Ashokleyland Corp GovernanceDocumento10 páginasAshokleyland Corp GovernanceSaman NaqviAinda não há avaliações

- Corporate Governance of Three Listed CompaniesDocumento8 páginasCorporate Governance of Three Listed CompaniesALI0911Ainda não há avaliações

- GovernanceDocumento35 páginasGovernanceMd MajidAinda não há avaliações

- Corporate Governancereport: Tata Motors HUL ITCDocumento23 páginasCorporate Governancereport: Tata Motors HUL ITCSwapnil KulkarniAinda não há avaliações

- Descon Oxychem Limited Annual Report 2010Documento24 páginasDescon Oxychem Limited Annual Report 2010amirAinda não há avaliações

- HDB Annual Report11 12Documento49 páginasHDB Annual Report11 12Hariharasudan HariAinda não há avaliações

- Mahindra & Mahindra Financial Services LTD.: Team 28Documento8 páginasMahindra & Mahindra Financial Services LTD.: Team 28roller worldAinda não há avaliações

- Independent Directors Appointment LetterDocumento6 páginasIndependent Directors Appointment LetteranupamAinda não há avaliações

- Dr. Richa BaghelDocumento14 páginasDr. Richa BaghelRamani RanjanAinda não há avaliações

- Role - Board of DirectorsDocumento5 páginasRole - Board of DirectorsAtif RehmanAinda não há avaliações

- PEIL Annual Report 201011Documento52 páginasPEIL Annual Report 201011ashparboAinda não há avaliações

- Company PresentationDocumento5 páginasCompany PresentationTsering AngmoAinda não há avaliações

- Corporate Governance ReportDocumento19 páginasCorporate Governance ReportElena IonAinda não há avaliações

- Independent DirectorDocumento28 páginasIndependent DirectorVasvi Aren100% (1)

- Summit BankDocumento12 páginasSummit BankMian Muhammad HaseebAinda não há avaliações

- Cooper Energy Limited: and Its Controlled EntitiesDocumento65 páginasCooper Energy Limited: and Its Controlled EntitiesGregory EismanAinda não há avaliações

- Oilcorp FinancialStatement ShareStats Properties NoticeAGM (490KB)Documento65 páginasOilcorp FinancialStatement ShareStats Properties NoticeAGM (490KB)James WarrenAinda não há avaliações

- Detailed Annual Report 2010-2011Documento44 páginasDetailed Annual Report 2010-2011Nandu KonatAinda não há avaliações

- 56 PDFDocumento80 páginas56 PDFHarpreet ShergillAinda não há avaliações

- Case Study 2Documento8 páginasCase Study 2Dsp VarmaAinda não há avaliações

- Plugin Ar2011Documento104 páginasPlugin Ar2011Norfatihah OthmanAinda não há avaliações

- Vision: "To Become The Leading Total Beverage Company in Malaysia and The Region" Mission: "To Be A World-Class Multinational Enterprise Providing Superior Returns To OurDocumento7 páginasVision: "To Become The Leading Total Beverage Company in Malaysia and The Region" Mission: "To Be A World-Class Multinational Enterprise Providing Superior Returns To OurAmirah Rifin75% (4)

- EY Corporate Governance ReportDocumento46 páginasEY Corporate Governance ReportTanya DewaniAinda não há avaliações

- Dunlop India Limited 2012 PDFDocumento10 páginasDunlop India Limited 2012 PDFdidwaniasAinda não há avaliações

- Code of Corporate Governance For Public Sector OrganisationDocumento6 páginasCode of Corporate Governance For Public Sector OrganisationDanish SarwarAinda não há avaliações

- Chapter 2 - Corporate GovernanceDocumento34 páginasChapter 2 - Corporate GovernancebkamithAinda não há avaliações

- NTPC Corporate GovernanceDocumento9 páginasNTPC Corporate GovernancevisezaAinda não há avaliações

- Annual Report - SKNL - SmallDocumento164 páginasAnnual Report - SKNL - SmallShashikanth Ramamurthy100% (1)

- Annual Report (2010-11) HCLDocumento154 páginasAnnual Report (2010-11) HCLKarthik MudirajAinda não há avaliações

- The Presentation Is About Corporate Governance of SQUARE - Remodified NewDocumento19 páginasThe Presentation Is About Corporate Governance of SQUARE - Remodified NewShelveyElmoDiasAinda não há avaliações

- Hallmark Company Limited: Annual ReportDocumento35 páginasHallmark Company Limited: Annual ReportDanial RizviAinda não há avaliações

- Corporate GovernanceDocumento32 páginasCorporate Governancechandchand89100% (1)

- 1415 PDFDocumento77 páginas1415 PDFSai Venkatesh RamanujamAinda não há avaliações

- Atlas Battery PDFDocumento80 páginasAtlas Battery PDFJaleel Sherazi100% (1)

- Annualreport06 07 PDFDocumento40 páginasAnnualreport06 07 PDFrabitha07541Ainda não há avaliações

- Corporate GovernanceDocumento32 páginasCorporate GovernanceummarimtiyazAinda não há avaliações

- Report CF - Confidence CementDocumento59 páginasReport CF - Confidence CementKoaolAinda não há avaliações

- Governance NintendoDocumento18 páginasGovernance NintendoPranjal JaiswalAinda não há avaliações

- Coromandel International Ltd. 2008-09Documento90 páginasCoromandel International Ltd. 2008-09samknight2009100% (1)

- AGM Notice 2019Documento13 páginasAGM Notice 2019SuhasAinda não há avaliações

- Intertec Technologies Annual Report - 2012Documento85 páginasIntertec Technologies Annual Report - 2012DeepakGarudAinda não há avaliações

- Corporate Governance of HulDocumento13 páginasCorporate Governance of Hulanushree_mohta_10% (1)

- Annual 2012Documento56 páginasAnnual 2012Wasif Pervaiz DarAinda não há avaliações

- Corporate Governance Assignment by Sajal Kumar BiswasDocumento11 páginasCorporate Governance Assignment by Sajal Kumar BiswasRony GhoshAinda não há avaliações

- Action Construction Equipment Annual Report 2009Documento64 páginasAction Construction Equipment Annual Report 2009susegaadAinda não há avaliações

- Corporate Finance: A Beginner's Guide: Investment series, #1No EverandCorporate Finance: A Beginner's Guide: Investment series, #1Ainda não há avaliações

- HOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”No EverandHOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”Ainda não há avaliações

- 5 Chapter 5Documento39 páginas5 Chapter 5Rahul GandhiAinda não há avaliações

- PKCLDocumento32.767 páginasPKCLRahul GandhiAinda não há avaliações

- Pashu Khadya Company Limited (PKCL)Documento6 páginasPashu Khadya Company Limited (PKCL)Rahul GandhiAinda não há avaliações

- Warehouse Location Problem: From BranchDocumento8 páginasWarehouse Location Problem: From BranchRahul GandhiAinda não há avaliações

- 2009 1 Adani Wilmar Limited (AWL)Documento22 páginas2009 1 Adani Wilmar Limited (AWL)arulesAinda não há avaliações

- Branch Operating Costs: Items Rs/month Utility 2000 Rent 4000 Salary 4000 Inventory 11000 Total 21000Documento4 páginasBranch Operating Costs: Items Rs/month Utility 2000 Rent 4000 Salary 4000 Inventory 11000 Total 21000Rahul GandhiAinda não há avaliações

- Curled Metal Inc.: By: Sheetal Gwoala Jisun Hong Jacquiline Njiraine Gabriela Silva Betel SolomonDocumento12 páginasCurled Metal Inc.: By: Sheetal Gwoala Jisun Hong Jacquiline Njiraine Gabriela Silva Betel SolomonRahul GandhiAinda não há avaliações

- Q Paper End Term S4 Oct 05 2011Documento10 páginasQ Paper End Term S4 Oct 05 2011Rahul GandhiAinda não há avaliações

- Group A9 - SoslpDocumento10 páginasGroup A9 - SoslpRahul GandhiAinda não há avaliações

- P&L 11346 PDFDocumento1 páginaP&L 11346 PDFRahul GandhiAinda não há avaliações

- CH01Documento6 páginasCH01Rahul GandhiAinda não há avaliações

- How To Write Programs That Will Last Forever: Future Proofing Your ApplicationsDocumento8 páginasHow To Write Programs That Will Last Forever: Future Proofing Your ApplicationsRahul GandhiAinda não há avaliações

- Group C - PJMT Project PlanDocumento3 páginasGroup C - PJMT Project PlanRahul GandhiAinda não há avaliações

- Assignment 1: Operations Management IDocumento10 páginasAssignment 1: Operations Management IRahul GandhiAinda não há avaliações

- Company LawsDocumento31 páginasCompany LawsRahul GandhiAinda não há avaliações

- Business Letter F2Documento1 páginaBusiness Letter F2Rahul GandhiAinda não há avaliações

- Management AccountingDocumento2 páginasManagement AccountingVampire0% (1)

- David Anton Febrianto - CVDocumento5 páginasDavid Anton Febrianto - CVYordan GardiaAinda não há avaliações

- Financial Accounting Problems: Problem I (Current Assets)Documento21 páginasFinancial Accounting Problems: Problem I (Current Assets)Fery AnnAinda não há avaliações

- ACT1202.Case Study No. 3 Answer SheetDocumento6 páginasACT1202.Case Study No. 3 Answer SheetDonise Ronadel SantosAinda não há avaliações

- Africa Enterprise Challenge Fund (AECF) - Gender and Social Inclusion Analysis of The Solar Home SystemsDocumento2 páginasAfrica Enterprise Challenge Fund (AECF) - Gender and Social Inclusion Analysis of The Solar Home SystemsWallaceAceyClarkAinda não há avaliações

- Marketing Management Term PaperDocumento18 páginasMarketing Management Term PaperSamiraAinda não há avaliações

- ContractDocumento20 páginasContractgur0% (1)

- RAD TorqueDocumento16 páginasRAD TorqueRaziel Postigo MezaAinda não há avaliações

- A Medium For Male Escort Jobs in MumbaiDocumento5 páginasA Medium For Male Escort Jobs in MumbaiBombay HotboysAinda não há avaliações

- Presented By: Saleena.M S4 MbaDocumento21 páginasPresented By: Saleena.M S4 MbaSaleena Moothedath MAinda não há avaliações

- U H "Eƒ ¡I" Beha Construction Y Ƒ° SÓKÝ TD Má Pî& Job Description Notes FormDocumento2 páginasU H "Eƒ ¡I" Beha Construction Y Ƒ° SÓKÝ TD Má Pî& Job Description Notes FormAbrsh AbrshAinda não há avaliações

- Management of Finacial MarketDocumento3 páginasManagement of Finacial MarketDHAIRYA MARADIYAAinda não há avaliações

- Staff-Car-Rules-1980-amended-October, 2020Documento19 páginasStaff-Car-Rules-1980-amended-October, 2020Waqar AhmadAinda não há avaliações

- NATO STO CPoW 2021Documento71 páginasNATO STO CPoW 2021iagaruAinda não há avaliações

- CM1 PAS1 Presentation of Financial StatementsDocumento16 páginasCM1 PAS1 Presentation of Financial StatementsMark GerwinAinda não há avaliações

- Chapter # 12 Exercise - Problems - AnswersDocumento5 páginasChapter # 12 Exercise - Problems - AnswersZia UddinAinda não há avaliações

- Reasons For Not Getting A COVID-19 Vaccine.Documento536 páginasReasons For Not Getting A COVID-19 Vaccine.Frank MaradiagaAinda não há avaliações

- DPWH Related CircularsDocumento31 páginasDPWH Related CircularsCarina Jane TolentinoAinda não há avaliações

- Coffee Shop Co CaseDocumento3 páginasCoffee Shop Co Caserashmi shrivastavaAinda não há avaliações

- UnSigned TVSCS PL ApplicationDocumento13 páginasUnSigned TVSCS PL ApplicationArman TamboliAinda não há avaliações

- SWOT AnalysisDocumento33 páginasSWOT Analysism MajumderAinda não há avaliações

- Cover LetterDocumento1 páginaCover LetterSanjida Rahman EshaAinda não há avaliações

- CAD 6010 Ground Handling GH ISS02 - REV01Documento50 páginasCAD 6010 Ground Handling GH ISS02 - REV01IIA BangaloreAinda não há avaliações

- Annual Report On Bangladesh Mobile Industry 2018.v3.09.04.2019Documento4 páginasAnnual Report On Bangladesh Mobile Industry 2018.v3.09.04.2019Ayan MitraAinda não há avaliações

- D Hinges Section 2019 WebDocumento214 páginasD Hinges Section 2019 Webcontact2webAinda não há avaliações

- DocxDocumento9 páginasDocxHarold Cossío100% (1)

- Evidencia 19.7Documento11 páginasEvidencia 19.7lorenaAinda não há avaliações

- Ch02 Recording Business Transactions SVDocumento28 páginasCh02 Recording Business Transactions SVBảo DươngAinda não há avaliações

- Tvlrcai Bot Meeting FTM January 2024Documento83 páginasTvlrcai Bot Meeting FTM January 2024Keds MikaelaAinda não há avaliações

- RFP For Solar Photovoltaic Microgrid Project, City of GoletaDocumento53 páginasRFP For Solar Photovoltaic Microgrid Project, City of GoletaNhacaAinda não há avaliações