Escolar Documentos

Profissional Documentos

Cultura Documentos

Tax 2 (Remedies & CTA Jurisdiction)

Enviado por

Monice RiveraDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Tax 2 (Remedies & CTA Jurisdiction)

Enviado por

Monice RiveraDireitos autorais:

Formatos disponíveis

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P.

Quibod

Tax Final Exam Coverage: NIRC Remedies (government & taxpayer) & CTA Jurisdiction Excluded: Real Property Tax, Customs and Local Taxes (sa pagkarinig ko ha )

February 10, 2009 REMEDIES From the point of view of assessments, taxes are classified into: a. Self-assessing taxes - where the taxpayer himself determines his own tax liability. Example: 1. NIRC Taxes Most or all of the taxes in the NIRC income, donors, estate, VAT, percentage, excise, documentary stamps are self-assessing taxes. The taxpayer files a return and pays the tax on the basis of the return. But it does not follow that the returns filed and the taxes paid are correct. These returns are subject to an assessment. It will be subject to an inspection for purposes of determining whether the return is accurate. If it is not accurate, the taxpayer is informed that there is a deficiency. The taxpayer will be informed and notified and given a notice of assessment. Taxes are assessed because the taxes are the lifeblood of the government. The government must see to it that taxes are properly and honestly paid. Filing of Tax Return & Payment CIR 3 years to make assessment Sec 203 (Period) Exception: Sec 222 (falsity/fraud 10 yrs) Sec 223 (imprescriptibility) b. Non-self-assessing taxes where the taxpayer is unable to determine on his own his tax liability. Example: 1. Real Property Taxes there is an assessment and appraisal process. There is a tax declaration. The taxpayer has no capacity to determine the market value or assessed value of the property. There is the intervention of the office of assessor who does the fair market value or assessed value of the property. The local treasurer will determine the tax due. 2. Customs Duties importer is unable to determinet the dutiable value of the article. The imported articles have to be examined and appraised for purposes of coming up with the dutiable value. You have the customs examiner or customs appraiser who has the responsibility to come up with the dutiable value of the item. From that, they will be able to assess the duties that will be subject to an ad valorem rate or a specific rate of duties.

-oOoTaxpayer Remedy: Protest Assessment OR Opt to Pay the Tax

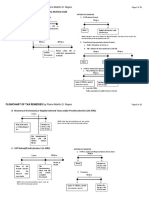

Notice Final of Notice Assessment of 1. Notice of Assessment Informal Sec 228 Conference - Jeopardy 2. Pre-Assessment Assessment Notice Rev Reg 12-99 CTA (en banc)

CIR

Grant Appeal to the CTA Division Deny

SC 1. Filing of Tax Return & Payment 2. General rule: CIR has 3 years to make an assessment (Section 203) Exceptions: a. Falsity or Fraud = 10 years (Section 222) b. Imprescriptibility = (Section 223) 3. Before the 3-year period will expire, the taxpayer is given a Notice of Assessment. a. Initially, it would in a form of notice of informal conference b. If you would not respond to the notice of informal conference, a Pre-Assessment Notice or Preliminary Assessment Notice (PAN) will be sent to you. (See Rev. Regulation 12-99) 4. Final Notice of Assessment Section 228 provides for the remedy that the taxpayer would resort to in the event he receives a final notice of assessment

Inaction 7. The decision of the CIR is either to grant, deny or not act on the protest 8. In case of denial, the remedy is to appeal to the CTA (division) In case of inaction, the Commissioner is given 180 days from the submission of documents to make a decision. The taxpayer has 30 days from receipt of assessment to file a protest. Protest may be: a. Reconsideration b. Reinvestigation In case of inaction, the taxpayer is given 30 days from the lapse of 180-day period to appeal to the CTA. Under the CTA rules (Rules of Procedure for the Court of Tax Appeals), the taxpayer can wait for the decision. It is not in the law but is in the said rules. Appeal to the CTA (en banc) Appeal to the Supreme Court

9. 10.

Another assessment he may have in the course of the examination made by the examiner is the jeopardy assessment. This is a notice to the taxpayer brought about by the setting in of the prescriptive period and the examiner is unable to complete the examination for the delay caused by the taxpayer. Since the prescriptive period is about to set in and the taxpayer will not agree to an extension or a waiver, the examiner will come up with this jeopardy assessment. Failure to send a notice of assessment within 3 years from the last day of filing a return, that assessment has prescribed and is null and void. 5. Taxpayer Remedy: Opt to Pay the Tax Protest the Assessment or the

Statutory Provisions: SECTION 203. Period of Limitation Upon Assessment and Collection. Except as provided in Section 222, internal revenue taxes shall be assessed within three (3) years after the last day prescribed by law for the filing of the return, and no proceeding in court without assessment for the collection of such taxes shall be begun after the expiration of such period: Provided, That in a case where a return is filed beyond the period prescribed by law, the three (3)-year period shall be counted from the day the return was filed. For purposes of this Section, a return filed before the last day prescribed by law for the filing thereof shall be considered as filed on such last day.

6. Assessments are protested before Commissioner of Internal Revenue (CIR)

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

You could not collect a tax unless there is a prior assessment, unless you pursue a criminal action where there is no need for prior assessment. If you failed to send a notice of assessment within the prescriptive period, there is nothing to collect. The 3-year period is the time for the examiners to ask, aside from the returns they have already received and its attachments. On the basis of a letter of authority signed by the CIR, which authorizes the examination of the returns of the taxpayer on a particular tax year, the examineris given the power to ask for books of accounts, business records, invoices and receipts of the taxpayer. The examination includes not only documents but also verification from suppliers and customers as to whether the purchases of the taxpayer are reflected, as to whether there is correct disclosure and accounting of sales. When there are preliminary findings made by the examiner, he would initially send a notice of informal conference. (Revenue Regulations 12-99). The taxpayer is given an opportunity to refute the preliminary findings. If the taxpayer opts to ignore a notice of informal conference, a preliminary notice of assessment is sent to the taxpayer. If that is still ignored, there will a final notice of assessment.

(c) Any internal revenue tax which has been assessed within the period of limitation as prescribed in paragraph (a) hereof may be collected by distraint or levy or by a proceeding in court within five (5) years following the assessment of the tax. (d) Any internal revenue tax, which has been assessed within the period agreed upon as provided in paragraph (b) hereinabove, may be collected by distraint or levy or by a proceeding in court within the period agreed upon in writing before the expiration of the five (5)-year period. The period so agreed upon may be extended by subsequent written agreements made before the expiration of the period previously agreed upon. SECTION 223. Suspension of Running of Statute of Limitations. The running of the Statute of Limitations provided in Sections 203 and 222 on the making of assessment and the beginning of distraint or levy or a proceeding in court for collection, in respect of any deficiency, shall be suspended for the period during which the Commissioner is prohibited from making the assessment or beginning distraint or levy or a proceeding in court and for sixty (60) days thereafter; when the taxpayer requests for a reinvestigation which is granted by the Commissioner; when the taxpayer cannot be located in the address given by him in the return filed upon which a tax is being assessed or collected: Provided, That, if the taxpayer informs the Commissioner of any change in address, the running of the Statute of Limitations will not be suspended; when the warrant of distraint or levy is duly served upon the taxpayer, his authorized representative, or a member of his household with sufficient discretion, and no property could be located; and when the taxpayer is out of the Philippines . SECTION 228. Protesting of Assessment. When the Commissioner or his duly authorized representative finds that proper taxes should be assessed, he shall first notify the taxpayer of his findings:1 Provided, however, That a preassessment notice shall not be required in the following cases:2 (a) When the finding for any deficiency tax is the result of mathematical error in the computation of the tax as appearing on the face of the return; or (b) When a discrepancy has been determined between the tax withheld and the amount actually remitted by the withholding agent; or (c) When a taxpayer who opted to claim a refund or tax credit of excess creditable withholding tax for a taxable period was determined to have carried over and automatically applied the same amount claimed against the estimated tax liabilities for the taxable quarter or quarters of the succeeding taxable year; or (d) When the excise tax due on excisable articles has not been paid; or (e) When an article locally purchased or imported by an exempt person, such as, but not limited to, vehicles, capital equipment, machineries and spare parts, has been sold, traded or transferred to non-exempt persons. The taxpayers shall be informed in writing of the law and the facts on which the assessment is made; otherwise, the assessment shall be void. Within a period to be prescribed by the implementing rules and regulations, the taxpayers shall be required to respond to said notice. If the taxpayer fails to respond, the Commissioner or his duly authorized representative shall issue an assessment based on his findings. Such assessment may be protested administratively by filing a request for reconsideration or reinvestigation within thirty (30) days from receipt of the assessment in such form and manner as may be prescribed by implementing rules and regulations. Within sixty (60) days from filing of the protest, all relevant supporting documents shall have been submitted; otherwise, the assessment shall become final. If the protest is denied in whole or in part, or is not acted upon within one hundred eighty (180) days from submission of documents, the taxpayer adversely affected by the decision or inaction may appeal to the Court of Tax Appeals within thirty (30) days from receipt of the said decision, or from the lapse of the one hundred eighty (180)-day period; otherwise, the decision shall become final, executory and demandable.

SECTION 222. Exceptions as to Period of Limitation of Assessment and Collection of Taxes. (a) In the case of a false or fraudulent return with intent to evade tax or of failure to file a return, the tax may be assessed, or a proceeding in court for the collection of such tax may be filed without assessment, at any time within ten (10) years after the discovery of the falsity, fraud or omission: Provided, That in a fraud assessment which has become final and executory, the fact of fraud shall be judicially taken cognizance of in the civil or criminal action for the collection thereof. In the general prescriptive period of 3 years, there can be an extension of the prescriptive period:

(b) If before the expiration of the time prescribed in Section 203 for the assessment of the tax, both the Commissioner and the taxpayer have agreed in writing to its assessment after such time, the tax may be assessed within the period agreed upon. The period so agreed upon may be extended by subsequent written agreement made before the expiration of the period previously agreed upon. Requirements for extension: 1. The extension or the waiver must be in writing 2. It must be with the consent and signed by the Commissioner AND the taxpayer 3. It shall provide the period within which to extend. Case: CARNATION vs. CIR The BIR asked for an extension. It was signed by Carnation (the taxpayer). The extension period lapsed and another extension was made. The taxpayer signed it. A third extension was made and signed by the taxpayer. Later, a notice of assessment was sent. The taxpayer questioned it. The SC held that while the extension was in writing and there was an agreement of the period they fixed within which to extend, it was not signed by Commissioner. So, it is therefore required that it is an agreement agreed in writing both by the Commissioner and the taxpayer. The law did not say to be signed by the taxpayer. It must be agreed by both. In other words, it is a bilateral and not a unilateral agreement. Case: PHILIPPINE JOURNALISTS ASSOCIATION The taxpayer was made to sign a waiver of the statutory period of assessment. The SC disallowed such waiver because the legal requirement is that there must be an agreement of extension. There must be a time certain. That waiver is not effective because there is no period within which you set up and define and determine the extension. When you required the taxpayer to sign a waiver of the prescriptive period, the waiver should provide a period up to when.

That is the requirement of due process notify (notice of informal conference, Preliminary Notice of Assessment) 2 In these following cases, wala ng PAN na pinapadala dito. Only a final notice.

2

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

The CTA rules provide waiting for the decision because what decision will become final and executory if there is no decision.

February 17, 2009 Assessment Period General rule: - 3 years Exceptions: (a) 10 years (b) Imprescribtible Government is given 5 years to pursue collection proceedings

Courts have no authority to grant any injunction to restrain the collection of taxes Perhaps by way of exception or under meritorious cases (no example given ) But the general rule is NO COURT SHALL ISSUE ANY INJUNCTION TO RESTRAIN THE COLLECTION OF TAXES on the basis of the principle that taxes are the lifeblood of the government Q: In the pursuit of these collection remedies, when the government would pursue a collection remedy (example: by distraint) where the government will run after your property, is the government precluded already from pursuing any other mode of remedy? Is the government barred from filing a civil suit before the regular court to collect the unpaid taxes? A: NO

SECTION 222. Exceptions as to Period of Limitation of Assessment and Collection of Taxes. xxx (c) Any internal revenue tax which has been assessed within the period of limitation as prescribed in paragraph (a) hereof may be collected by distraint or levy or by a proceeding in court within five (5) years following the assessment of the tax. (d) Any internal revenue tax, which has been assessed within the period agreed upon as provided in paragraph (b) hereinabove, may be collected by distraint or levy or by a proceeding in court within the period agreed upon in writing before the expiration of the five (5)-year period. The period so agreed upon may be extended by subsequent written agreements made before the expiration of the period previously agreed upon. xxx In case a notice of assessment of received, the remedy is to file a protest before the Commissioner of Internal Revenue (CIR) The CIR will either grant or deny the protest In case of denial, you can appeal to the Court of Tax Appeals (CTA) In case of inaction, within 30 days from the lapse of the 180-day period to decide, you can appeal to the CTA In the Rules of the CTA, the taxpayer will wait for the decision of the Commissioner. Once the decision is received, you may appeal to the CTA. From the CTA division, it is brought to the CTA en banc and then it is appealed to the Supreme Court

SECTION 205. Remedies for the Collection of Delinquent Taxes. xxx Either of these remedies or both simultaneously may be pursued in the discretion of the authorities charged with the collection of such taxes: Provided, however, that the remedies of distraint and levy shall not be availed of where the amount of tax involved is not more than One hundred pesos (P100). xxx Civil Remedies for Collection of Taxes SECTION 205. Remedies for the Collection of Delinquent Taxes. The civil remedies for the collection of internal revenue taxes, fees, or charges, and any increment thereto resulting from delinquency shall be: (a) By distraint of goods, chattels, or effects, and other personal property of whatever character, including stocks and other securities, debts, credits, bank accounts, and interest in and rights to personal property, and by levy upon real property and interest in or rights to real property; and (b) By civil or criminal action. xxx Administrative Remedies A. 1. Distraint Of Personal Property Sections 206-212. Actual Distraint there is an actual seizure or confiscation of the personal property

Collection Remedies The collection remedies of the government are classified as: 1. ADMINISTRATIVE A. Distraint Of Personal Property Sections 206212. B. Levy of Real Property Sections 207(b), 213, 214, 202, and 215 C. Forfeiture Sections 224 225 D. Enforcement of Tax Lien Section 219 E. Entering into a Compromise of Tax Cases Section 204 F. Giving Informers Reward Section 282 G. Arrest, Search and Seizure Section 15 (Title I) H. Power of the Commissioner to Obtain Information Section 5 I. Power of the Commissioner to Make Assessments, etc Section 6 J. Inspection of Books of Accounts Section 232 235 K. Filing of Bonds L. Imposition of Statutory Offenses and Penalties M. Requiring of Proof of Filing Income Tax Returns N. Deportation of Aliens JUDICIAL A. Civil Action B. Criminal Action

There is physical taking of the property. Distraint does not only involve the physical taking of the personal property but also includes garnishments proceedings on your bank accounts/deposits wherein a notice is served to the bank. It will indicate if you have a deposit there or not and a return is made by the bank and then, the bank will release so much amount as to cover the delinquency. The excess will remain. If cash is not subject of the garnishment but other personal properties, the properties shall be sold at a public auction. The proceeds will be applied to the delinquency. Excess will be returned to the taxpayer. If it is not sufficient, there will be further distraint and seizure of other personal properties of the taxpayer. 2. Constructive Distraint similar to a preliminary attachment where pending litigation, properties are already attached to protect the interest of the judgment creditor because the debtor is already concealing or hiding properties that they may not be enough property at the end of the litigation. SECTION 206. Constructive Distraint of the Property of a Taxpayer. To safeguard the interest of the Government, the Commissioner may place under constructive distraint the property of a delinquent taxpayer or any taxpayer who, in his opinion, is retiring from any business subject to tax, or is intending to leave the Philippines or to remove his property therefrom or to hide or conceal his property or to perform any act tending to obstruct the proceedings for collecting the tax due or which may be due from him. The constructive distraint of personal property shall be effected by requiring the taxpayer or any person having possession or control of such property to sign a receipt covering the property distrained and obligate himself to preserve the same intact and unaltered and not to dispose of 3

2.

SECTION 218. Injunction not Available to Restrain Collection of Tax No court shall have the authority to grant an injunction to restrain the collection of any national internal revenue tax, fee or charge imposed by this Code.

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

the same in any manner whatever, without the express authority of the Commissioner. In case the taxpayer or the person having the possession and control of the property sought to be placed under constructive distraint refuses or fails to sign the receipt herein referred to, the revenue officer effecting the constructive distraint shall proceed to prepare a list of such property and, in the presence of two (2) witnesses, leave a copy thereof in the premises where the property distrained is located, after which the said property shall be deemed to have been placed under constructive distraint. It is done by serving a notice to the taxpayer or the person in possession or who has control over that property and to sign a receipt covering that property distraint with an obligation to preserve it intact and unaltered and not to dispose that property In the event the assessment comes out and becomes final and collection proceedings are pursued, actual seizure will be done on the said personal property. B. Levy of Real Property Sections 207(b), 213, 214, 202, and 215 Levy seizure of real property Like the proceedings in Rule 39 of the Rules of Court or the extrajudicial foreclosure of a Real Estate Mortgage, the sheriff or the warrant officer or the BIR will go to the Register of Deeds to find whether the taxpayer has a property or none. If there is one, then, there will be annotations made to the title in connection with the delinquency claim by the BIR. After the annotation of the title, a notice of sale will be issued containing therein the auction sale. There will be publication and notice to the taxpayer in connection with the auction sale. On the auction date, the property will be sold to the highest bidder. The highest bidder will be issued a certificate of sale. The certificate of sale is annotated and registered with the Register of Deeds for the purpose of counting the redemption period. If there is no redemption, then, a final deed will be issued to the highest bidder. There will be issuance of a new title in favor of the highest bidder. Proceeds from the sale will be applied to the delinquency. Excess will be returned to the taxpayer. If not sufficient, then, further levy from other real properties of the taxpayer. C. Forfeiture Sections 224 225

there is a prior assessment and the assessment has become final. In forfeiture, there is a violation made and the item is seized. SECTION 225. When Property to be Sold or Destroyed. Sales of forfeited chattels and removable fixtures shall be effected, so far as practicable, in the same manner and under the same conditions as the public notice and the time and manner of sale as are prescribed for sales of personal property distrained for the non-payment of taxes. Distilled spirits, liquors, cigars, cigarettes, other manufactured products of tobacco, and all apparatus used in or about the illicit production of such articles may, upon forfeiture, be destroyed by order of the Commissioner, when the sale of the same for consumption or use would be injurious to public health or prejudicial to the enforcement of the law. All other articles subject to excise tax, which have been manufactured or removed in violation of this Code, as well as dies for the printing or making of internal revenue stamps and labels which are in imitation of or purport to be lawful stamps, or labels may, upon forfeiture, be sold or destroyed in the discretion of the Commissioner. Forfeited property shall not be destroyed until at least twenty (20) days after seizure. D. Enforcement of Tax Lien Section 219

A TAX LIEN is a legal claim or charge of the government against the property of the taxpayer. It is a legal claim or charge on property, whether real or personal, established by law as a security in the default of the payment of taxes. There is no such thing as an automatic operation of a tax lien under NIRC The Commissioner of the BIR has to annotate and enforce the tax lien against the property of the taxpayer. The office of the CIR must go to the ROD and annotate the tax lien. If there is already an existing encumbrance or an existing real estate mortgage, then the claim of the government will become inferior.

SECTION 224. Remedy for Enforcement of Forfeitures. - The forfeiture of chattels and removable fixtures of any sort shall be enforced by the seizure and sale, or destruction, of the specific forfeited property. The forfeiture of real property shall be enforced by a judgment of condemnation and sale in a legal action or proceeding , civil or criminal, as the case may require. Forfeiture proceedings are proceedings in rem. They are directed on the property subject of the forfeiture. Like in customs, the defense of lack of knowledge that the vessel, motor vehicle or the aircraft has been used for smuggling or the vessel, motor vehicle or aircraft has been used to bring in untaxed items is not a valid defense in forfeiture proceedings. That is a defense available in a criminal action that may be separately instituted agains the owner of the vessel, motor vehicle or the aircraft. The purpose of forfeiture is to take control and custody of the seized items in favor of the state Once the state has custody and control over the seized items, the personal property may either be sold or destroyed. In case of real property, they will be sold. In forfeiture proceedings, all the proceeds will go to the government. Nothing will be returned to the taxpayer or the owner of the seized items or properties. There is no such thing as to apply the proceeds to the delinquency. That is only done in case

In real property taxation or the Tariff and Customs Code, there is an automatic operation of a tax lien. When a delinquency arises on real property tax, a tax lien arises also and a claim arises on the real property by the local government. Such that the lien of the government there is superior to all other claims or charges. In real property taxation, even if there is an existing encumbrance or mortgage annotated on the title of the property, if there is a delinquency that arises, that property can be sold at a public auction. The same way in Tariff and Customs Code when the importer would not pay the duties, taxes and other charges on account of the importation, a tax lien on the imported articles arises. These articles are now in the custody of Customs. The government will dispose the articles and the proceeds will be applied to the unpaid duties and taxes of the imported. In the NIRC, the operation of the tax lien is not automatic. It must be enforced by registering the claim over the properties of the taxpayer. If there is an existing claim or encumbrance, the claim of the government becomes inferior. E. Entering into a Compromise of Tax Cases Section 204 SECTION 204. Authority of the Commissioner to Compromise, Abate and Refund or Credit Taxes. - The Commissioner may (A) Compromise the payment of any internal revenue tax, when: (1) A reasonable doubt as to the validity of the claim against the taxpayer exists; or (2) The financial position of the taxpayer demonstrates a clear inability to pay the assessed tax. The compromise settlement of any tax liability shall be subject to the following minimum amounts: For cases of financial incapacity, a minimum compromise rate equivalent to ten percent (10%) of the basic assessed tax; and 4

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

For other cases, a minimum compromise rate equivalent to forty percent (40%) of the basic assessed tax. Where the basic tax involved exceeds One million pesos (P1,000.000) or where the settlement offered is less than the prescribed minimum rates, the compromise shall be subject to the approval of the Evaluation Board which shall be composed of the Commissioner and the four (4) Deputy Commissioners. (B) Abate or cancel a tax liability, when: (1) The tax or any portion thereof appears to be unjustly or excessively assessed; or (2) The administration and collection costs involved do not justify the collection of the amount due. 3 All criminal violations may be compromised except: (a) those already filed in court, or (b) those involving fraud. xxx The compromise is bilateral. It must be accepted by the Commissioner. In compromise on the ground of financial incapacity, there is a requirement under Section 6 (F) of the NIRC that you have to show your bank accounts. You must execute a waiver of the Secrecy of Bank Deposits Law. SECTION 6. Power of the Commissioner to Make Assessments and Prescribe Additional Requirements for Tax Administration and Enforcement xxx (F) Authority of the Commissioner to inquire into Bank Deposit Accounts. - Notwithstanding any contrary provision of Republic Act No. 1405 and other general or special laws, the Commissioner is hereby authorized to inquire into the bank deposits of: (1) a decedent to determine his gross estate; and (2) any taxpayer who has filed an application for compromise of his tax liability under Sec. 204 (A) (2) of this Code by reason of financial incapacity to pay his tax liability. In case a taxpayer files an application to compromise the payment of his tax liabilities on his claim that his financial position demonstrates a clear inability to pay the tax assessed, his application shall not be considered unless and until he waives in writing his privilege under Republic act NO. 1405 or under other general or special laws, and such waiver shall constitute the authority of the Commissioner to inquire into the bank deposits of the taxpayer. F. informers For purposes of this reward, the information given to the Bureau is one that is not yet known or not under any investigation by the Bureau Giving Informers Reward Section 282 This refers to giving of incentives to

resulting in the recovery of revenues, surcharges and fees and/or the conviction of the guilty party and/or the imposition of any fine or penalty, shall be rewarded in a sum equivalent to ten percent (10%) of the revenues, surcharges or fees recovered and/or fine or penalty imposed and collected or One million pesos (P 1,000,000) per case, whichever is lower. The same amount of reward shall also be given to an informer where the offender has offered to compromise the violation of law committed by him and his offer has been accepted by the Commissioner and collected from the offender: Provided, That should no revenue, surcharges or fees be actually recovered or collected, such person shall not be entitled to a reward: Provided, further, That the information mentioned herein shall not refer to a case already pending or previously investigated or examined by the Commissioner or any of his deputies, agents or examiners, or the Secretary of Finance or any of his deputies or agents: Provided, finally, That the reward provided herein shall be paid under rules and regulations issued by the Secretary of Finance, upon recommendation of the Commissioner. (B) For Discovery and Seizure of Smuggled Goods To encourage the public to extend full cooperation in eradicating smuggling, a cash reward equivalent to ten percent (10%) of the fair market value of the smuggled and confiscated goods or One million pesos (P 1,000,000) per case whichever is lower, shall be given to persons instrumental in the discovery and seizure of such smuggled goods. The cash rewards of informers shall be subject to income tax, collected as a final withholding tax, at the rate of ten percent (10%). The provisions of the foregoing Subsections notwithstanding, all public officials, whether incumbent or retired, who acquired the information in the course of the performance of their duties during their incumbency, are prohibited form claiming informers reward. G. Arrest, Search and Seizure Section 15 (Title I)

In making arrests for violation of the NIRC, you cannot arrest without a warrant of arrest, unless covered by valid warrantless arrests. You cannot conduct a search and seizure unless on plain view or you have a search warrant. In the conduct of an arrest and there are untaxed items, that would be subject of seizure. But for purposes of conducting search and seizure, you must have a search warrant. H. Power of the Commissioner to Obtain Information Section 5

I. Power of the Commissioner to Make Assessments, etc Section 6 Includes conduct of inventory-taking and surveillance, prescribing presumptive gross sales and receipt, authority to terminate taxable period, inquiring into bank deposits (see provision for more details ) Inspection of Books of Accounts Section 232 235 (not cited in the 4th year lecture but was cited in 3rd year

Under Section 282 (A) - For violations of the NIRC, an informers reward will be given, except to Internal Revenue personnel and law enforcers, on a sworn information not yet in possession of the Bureau, leading to the discovery of frauds upon internal revenue laws or violations resulting in the recovery of revenues, surcharges and fees. The informant will be given a reward in the sum of 10% of the revenues surcharges or fee recovered and/or fine or penalty imposed and collected for P 1,000,000 per case, whichever is lower. SECTION 282. Informers Reward to Persons Instrumental in the Discovery of Violations of the National Internal Revenue Code and in the Discovery and Seizure of Smuggled Goods (A) For Violations of the National Internal Revenue Code. Any person, except an internal revenue official or employee, or other public official or employee, or his relative within the sixth degree of consanguinity, who voluntarily gives definite and sworn information, not yet in the possession of the Bureau of Internal Revenue, leading to the discovery of frauds upon the internal revenue laws or violations of any of the provisions thereof, thereby

J. )

Additional remedies provided by other authors: K. L. M. N. Filing of Bonds Imposition of Statutory Offenses and Penalties Requiring of Proof of Filing Income Tax Returns Deportation of Aliens Judicial Remedies A. Civil Action collection for sum of money

This is filed before the regular courts, depending on the jurisdictional amount When we go to the jurisdiction of the CTA, tax collection cases may be filed directly with the CTA when the amount exceeds P 1,000,000 Lower than that, you can file the collection case before the regular courts, depending on the jurisdictional amounts 3 In the filing of a collection case (civil action), If the cost of the administration and collection is more than the amount there is no more reopening of the assessment. The to be collected, the government will abate or cancel the liability. Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) 5

References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

assessment has become final and executory. The taxpayer cannot question there (in the civil action) the legality or the validity of the assessment. That should have been done administratively when the taxpayer received the notice of assessment. The assessment cannot be questioned on the civil action. B. Criminal Action -

CTA was originally created under RA 1125 way back in June 16, 1954 Amendment was made by RA 9282, which became effective in April 2004 In the set-up in the CTA, under RA 1125, the adjudicators were known as magistrates. These magistrates were called judges (CFI/RTC). In RA 9282, the major amendment that was introduced was the expansion of the CTA jurisdiction. Under RA 1125, the CTA only had exclusive appellate jurisdiction. Under RA 9282, Congress expanded the jurisdiction of the CTA. The CTA was now treated as an equivalent of the Court of Appelas. So, now, the members of the CTA are now called justices. The judges then were no called justices. Under RA 9282, there are 6 justicies 1 Presiding Justice and 5 Associate Justices with 2 divisions

In connection with the filing of a criminal case, you have the principle in criminal procedure and criminal law that in the criminal action, the civil action is deemed instituted (arising from the offense ) In that criminal action, the accused will either be convicted or acquitted in that tax case It is required that since the filing of a criminal case is a collection remedy, whether there is a judgment of conviction or acquittal, there must be an adjudication of a civil liability where the accused is made to pay the tax or not. SECTION 205. Remedies for the Collection of Delinquent Taxes. xxx The judgment in the criminal case shall not only impose the penalty but shall also order payment of the taxes subject of the criminal case as finally decided by the Commissioner. The Bureau of Internal Revenue shall advance the amounts needed to defray costs of collection by means of civil or criminal action, including the preservation or transportation of personal property distrained and the advertisement and sale thereof, as well as of real property and improvements thereon. In the criminal action, you have the provision in Sections 248-281.

An amendment came under RA 9503 (came out in 2008) which increased the number of justices. This time, they added 3 more justices. Right now, you have 1 Presiding Justice plus 8 associate justices with 3 divisions The CTA may sit en banc or in 3 divisions, each division consisting of 3 justices As amended uner RA 9503: SECTION 1. Court; Justices, Qualifications; Salary; Tenure. - There is hereby created a Court of Tax Appeals (CTA) which shall be of the same level as the Court of Appeals, possessing all the inherent powers of a Court of Justice, and shall consist of a Presiding Justice and eight (8) Associate Justices. The incumbent Presiding Judge and Associate Judges shall continue in office and bear the new titles of Presiding Justice and Associate Justices. The Presiding Justices and the two (2) most Senior Associate Justices, all of whom are incumbent, shall serve as chairmen of the three (3) Divisions. The other three (3) incumbent Associate Justices and the three (3) additional Associate Justices shall serve as members of the Divisions. The additional three (3) Justices as provided herein and the succeeding members of the Court shall be appointed by the President upon nomination by the Judicial and Bar Council. The Presiding Justice shall be so designated in his appointment, and the Associate Justices shall have precedence according to the date of their respective appointment or when the appointments of two (2) or more of them shall bear the same date, according to the order in which their appointments were issued by the President. They shall have the same qualifications, rank, category, salary, emoluments and other privileges, be subject to the same inhibitions and disqualifications, and enjoy the same retirement and other benefits as those provided for under existing laws for the Presiding Justice and Associate Justices of the Court of Appeals. Whenever the salaries of the Presiding Justice and the Associate Justices of the Court of Appeals are increased, such increases in salaries shall be deemed correspondingly extended to and enjoyed by the Presiding Justice and Associate Justices of the CTA. The Presiding Justice and Associate Justices shall hold office during good behavior, until they reach the age of seventy (70), or become incapacitated to discharge the duties of their office, unless sooner removed for the same causes and in the same manner provided by law for members of the judiciary of equivalent rank. SEC. 2. Sitting En Banc or Division; Quorum; Proceedings. - The CTA may sit en banc or in three (3) Divisions, each Division consisting of three (3) Justices. Five (5) Justices shall constitute a quorum for sessions en banc and two (2) Justices for sessions of a Division. Provided, That when the required quorum cannot be constituted due to any vacancy, disqualification, inhibition, disability, or any other lawful cause, the Presiding Justice shall designate any Justice of other Divisions of the Court to sit temporarily therein. The affirmative votes of five (5) members of the Court en banc shall be necessary to reverse a decision of a Division but a simple majority of the Justices present necessary to promulgate a resolution or decision in all other cases or two (2) members of a Division, as the case may be, shall be 6

SECTION 281. Prescription for Violations of any Provision of this Code All violations of any provision of this Code shall prescribe after five (5) years. Prescription shall begin to run from the day of the commission of the violation of the law, and if the same be not known at the time, from the discovery thereof and the institution of judicial proceedings for its investigation and punishment. The prescription shall be interrupted when proceedings are instituted against the guilty persons and shall begin to run again if the proceedings are dismissed for reasons not constituting jeopardy. The term of prescription shall not run when the offender is absent from the Philippines. Important and basic in criminal actions: it requires no prior assessment! In the pursuit of collection remedies administratively, by distraint or levy or a civil action, these collection remedies cannot be pursued without a prior assessment. You could not collect on the taxpayer unless there is a prior assessment, but not in a criminal action. This has been the ruling in the case of UNGAB vs. QC (97 SCRA 877) no need or prior assessment for purposes of criminal action In the institution of the criminal action, the judgment should include the adjudication of the civil liability the payment of taxes, fees and other charges. February 24, 2009 JURISDICTION OF COURT OF TAX APPEALS (CTA)

(Unless otherwise provided, the provisions (sections) are from RA 9282)

CTA was originally created under RA 1125 way back in June 16, 1954

The objectives of the creation of the court are: 1) to entrust tax cases to a specialize court composed of men technically qualified in the field of taxation and to develop expertise on the subject; 2) to expedite the disposition of tax cases and collection of taxes and provide adequate and speedy remedy to the taxpayers. It is in the second objective wherein 2 amendments were made to the CTA

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

necessary for the rendition of a decision or resolution in the Division Level. Jurisdiction of the CTA: a. Exclusive Original Jurisdiction b. Exclusive Appellate Jurisdiction EXCLUSIVE ORIGINAL JURISDICTION 1. Tax collection cases on final and executory assessments where the principal amount of taxes and fess is P 1,000,000 or more SECTION 7. Jurisdiction xxx (c) Jurisdiction over tax collection cases as herein provided: (1) Exclusive original jurisdiction in tax collection cases involving final and executory assessments for taxes, fees, charges and penalties : Provided, however, That collection cases where the principal amount of taxes and fees, exclusive of charges and penalties, claimed is less than One million pesos (P1,000,000.00) shall be tried by the proper Municipal Trial Court, Metropolitan Trial Court and Regional Trial Court. xxx 2. Criminal offenses for violation of the NIRC or the Tariff and Customs Code and other laws administered by the BIR/BoC where the principal amount of taxes and fees is more than P1 Million or more SECTION 7. Jurisdiction xxx (b) Jurisdiction over cases involving criminal offenses as herein provided: (1) Exclusive original jurisdiction over all criminal offenses arising from violations of the National Internal Revenue Code or Tariff and Customs Code and other laws administered by the Bureau of Internal Revenue or the Bureau of Customs: Provided, however, That offenses or felonies mentioned in this paragraph where the principal amount of taxes and fees, exclusive of charges and penalties, claimed is less than One million pesos (P1,000,000.00) or where there is no specified amount claimed shall be tried by the regular Courts and the jurisdiction of the CTA shall be appellate. Any provision of law or the Rules of Court to the contrary notwithstanding, the criminal action and the corresponding civil action for the recovery of civil liability for taxes and penalties shall at all times be simultaneously instituted with, and jointly determined in the same proceeding by the CTA, the filing of the criminal action being deemed to necessarily carry with it the filing of the civil action, and no right to reserve the filling of such civil action separately from the criminal action will be recognized. xxx In the criminal cases, it will go through the regular criminal procedure the filing of a complaint for the purpose of determining probable cause. As provided in the NIRC, there is no need of an assessment for the purpose of filing the criminal case. When there is a finding of probable cause, an information will be filed. If the claim in that criminal offense is P 1 Million or more (taxes and fees, exclusive of charges and penalties), then, the information is filed with the CTA If it is less than P 1 Million, you file it with the MTC or RTC Supreme Court

EXCLUSIVE APPELLATE JURISDICTION 1. Decisions of the Commissioner of Internal Revenue involving disputed assessment, refunds and all other matters arising under the NIRC or other laws administered by the BIR Sec. 7. Jurisdiction. The CTA shall exercise: (a) Exclusive appellate jurisdiction to review by appeal , as herein provided: (1) Decisions of the Commissioner of Internal Revenue in cases involving disputed assessments, refunds of internal revenue taxes, fees or other charges, penalties in relation thereto, or other matters arising under the National Internal Revenue or other laws administered by the Bureau of Internal Revenue; 2. Inaction by the Commissioner of Internal Revenue in cases involving disputed assessments, refunds, etc. (2) Inaction by the Commissioner of Internal Revenue in cases involving disputed assessments, refunds of internal revenue taxes, fees or other charges, penalties in relations thereto, or other matters arising under the National Internal Revenue Code or other laws administered by the Bureau of Internal Revenue, where the National Internal Revenue Code provides a specific period of action, in which case the inaction shall be deemed a denial; Example: In the case of disputed assessments, the Commissioner fails to decide within 180 days from the submission of documents. Then, you are given 30 days to appeal to the CTA. Example: In refund cases, you are made to file a claim for refund 2 years from payment and no suit or action shall be filed before the court after that period. When a claim is made before the Commissioner and the 2-year period from payment is about to prescribe, do not wait for it to lapse. There should be a reasonable time before the 2year period expires to bring the claim before the CTA. 3. Decisions, orders, or resolutions of the RTC in local tax cases originally decided or resolved in its appellate jurisdiction. (3) Decisions, orders or resolutions of the Regional Trial Courts in local tax cases originally decided or resolved by them in the exercise of their original or appellate jurisdiction; The decision of the RTC may be in its original or appellate jurisdiction Where the RTC decides on local taxes, whether in its original or appellate jurisdiction, that decision is appealed to the CTA Local Tax Cases: i. Legality of an ordinance - It is filed with the DOJ. From the decision or inaction of the DOJ, you should now bring the action before the RTC for questioning the legality or the validity of the ordinance. The decision is original in jurisdiction. The appeal is before the CTA. Protest local tax assessments - Your local treasurer will send you a notice of deficiency of local tax. The remedy is protest. If your protest is denied, then, you appeal to the regular courts depending on the jurisdictional amount, either MTC or RTC. If it is within the original jurisdiction of the MTC, then, you file the appeal with the RTC, where the RTC will exercise its appellate jurisdiction. From the appellate decision of the RTC, it is appealed to the CTA in its exclusive appellate jurisdiction. If the jurisdictional amount is with the RTC, the decision of the RTC in its original jurisdiction, will be appealed to the CTA. Refund in local taxes - When the local treasurer will deny your claim, the next step is to go to the regular courts to convert it into a court action. The court will either be MTC or RTC, depending on the jurisdictional amount. iii. ii.

P 1 Million or more : CTA division CTA en banc

Less than P 1 Million: RTC Court ` MTC Court CTA division RTC CTA en banc CTA en banc Supreme Supreme

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

4. Decisions of the Commissioner of Customs on protest cases, seizure and forfeiture, and other matters arising under the Tariff and Customs Code and other laws administered by the Bureau of Customs (4) Decisions of the Commissioner of Customs in cases involving liability for customs duties, fees or other money charges, seizure, detention or release of property affected, fines, forfeitures or other penalties in relation thereto, or other matters arising under the Customs Law or other laws administered by the Bureau of Customs; 5. Decisions of the Central Board of Assessment Appeals (CBAA) (5) Decisions of the Central Board of Assessment Appeals in the exercise of its appellate jurisdiction over cases involving the assessment and taxation of real property originally decided by the provincial or city board 4 of assessment appeals; i. Property Assessments This involves real property taxation If you would challenge or question the assessment of the local assessor, the remedy of the property owner is to file a petition before the Local Board of Assessment Appeals. From the Local Board, it is appealed to the Central Board ii. Special Levy The special levy being challenged is brought before the Local Board and then appealed to the Central Board.

(c) Jurisdiction over tax collection cases as herein provided: (2) Exclusive appellate jurisdiction in tax collection cases: (a) Over appeals from the judgments, resolutions or orders of the Regional Trial Courts in tax collection cases originally decided by them, in their respective territorial jurisdiction. (b) Over petitions for review of the judgments, resolutions or orders of the Regional Trial Courts in the Exercise of their appellate jurisdiction over tax collection cases originally decided by the Metropolitan Trial Courts, Municipal Trial Courts and Municipal Circuit Trial Courts, in their respective jurisdiction." The tax collection cases decided by the RTC, whether in its original or appellate jurisdiction, are also appealed to the CTA

9. Decisions of the RTC in the criminal offenses or violations (b) Jurisdiction over cases involving criminal offenses as herein provided: (2) Exclusive appellate jurisdiction in criminal offenses: (a) Over appeals from the judgments, resolutions or orders of the Regional Trial Courts in tax cases originally decided by them, in their respected territorial jurisdiction. (b) Over petitions for review of the judgments, resolutions or orders of the Regional Trial Courts in the exercise of their appellate jurisdiction over tax cases originally decided by the Metropolitan Trial Courts, Municipal Trial Courts and Municipal Circuit Trial Courts in their respective jurisdiction. As to criminal offenses, whether it is brought originally or decided by the RTC in its appellate jurisdiction, it is appealed to the CTA

iii. Protesting payments of the real property tax If your local treasurer determines real property tax liability and you challenge or question that computation, your remedy is to protest. But you have to first pay under protest. After paying it under protest, you can now bring your protest to the local treasurer. If the local treasurer will deny your protest, you now go to the Local Board and you bring it before the Central Board iv. Refunds on Real Property Tax Refund on Real Property Tax is first brought to the local treasurer. If the local treasurer will deny, you now bring it to the Local Board and then to the Central Board. Decisions of the Central Board, in these cases, are brought before the Court of Tax Appeals, in its exclusive appellate jurisdiction.

Cases brought to the CTA SECTION 11. Who May Appeal; Mode of Appeal; Effect of Appeal. Any party adversely affected by a decision, ruling or inaction of the Commissioner of Internal Revenue, the Commissioner of Customs, the Secretary of Finance, the Secretary of Trade and Industry or the Secretary of Agriculture or the Central Board of Assessment Appeals or the Regional Trial Courts may file an appeal with the CTA within thirty (30) days after the receipt of such decision or ruling or after the expiration of the period fixed by law for action as referred to in Section 7(a)(2) herein. Appeal shall be made by filing a petition for review under a procedure analogous to that provided for under Rule 42 of the 1997 Rules of Civil Procedure with the CTA within thirty (30) days from the receipt of the decision or ruling or in the case of inaction as herein provided, from the expiration of the period fixed by law to act thereon. A Division of the CTA shall hear the appeal: Provided, however, That with respect to decisions or rulings of the Central Board of Assessment Appeals and the Regional Trial Court in the exercise of its appellate jurisdiction, appeal shall be made by filing a petition for review under a procedure analogous to that provided for under Rule 43 of the 1997 Rules of Civil Procedure with the CTA, which shall hear the case en banc. Only 2 Cases where the appeal to the CTA is EN BANC (the rest is by division): 1. Decision of the Central Board of Assessment Appeals CBAA It is brought to the CTA en banc under Rule 43 CTA en banc (Rule 43) Supreme Court

6. Decisions of the Secretary of Finance on customs cases elevated by automatic review from the decisions of the Commissioner of Customs adverse to the government. (6) Decisions of the Secretary of Finance on customs cases elevated to him automatically for review from decisions of the Commissioner of Customs which are adverse to the Government under Section 2315 of the Tariff and Customs Code; 7. Decisions of the DTI or DA on cases involving dumping duty and countervailing or safeguard measure (7) Decisions of the Secretary of Trade and Industry, in the case of non-agricultural product, commodity or article, and the Secretary of Agriculture in the case of agricultural product, commodity or article, involving dumping and countervailing duties under Section 301 and 302, respectively, of the Tariff and Customs Code, and safeguard measures under Republic Act No. 8800, where either party may appeal the decision to impose or not to impose said duties. 8.

4

2. Decisions of the RTC in its appellate jurisdiction RTC CTA en banc (Rule 43) Supreme Court

Decisions of RTC in tax collection cases

ALL OTHERS: Decision, ruling or inaction of the Commissioner of Internal Revenue, the Commissioner of Customs, the Secretary of Finance, the Secretary of Trade and Industry or the Secretary of Agriculture or the Central Board of Assessment Appeals (original jurisdiction) or the Regional 8

Or what we call the local board of assessment appeals

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

Trial Courts (original jurisdiction) may file an appeal with the CTA division CTA division (Rule 42) CTA en banc SC

within which to file a suit or proceeding in Court under Section 229 of the National Internal Revenue Code. This means that in disputed assessments, under Section 228 wherein the Commissioner has to make a decision within 180 days, according to the Rules, that 180day period to decide is only for the purpose of having the taxpayer to appeal its case and does not constitute a formal decision of the Commissioner. In other words, the taxpayer can opt to wait for the decision of the Commissioner. Under Section 228, it is the decision of the Commissioner that is appealed to the CTA. But what will you appeal to the CTA if there is no decision? So, therefore, you are given an option to wait. If you will wait, that will not be taken against you. If you opt to wait and you received the decision after the 180-day period, then, you still have 30 days to appeal to the CTA in case of an adverse decision. That is not in the law. It is found in the Rules. This has not yet been tested where there is a case bringing it to the SC for a ruling if the internal rules are valid. That is another story. The procedure allows you to wait. But the law does not allow you to wait. That is still to be tested The SC has to decide if that issue is brought up.

All other cases involving rulings, orders or decisions filed with the CTA as provided for in Section 7 shall be raffled to its Divisions. A party adversely affected by a ruling, order or decision of a Division of the CTA may file a motion for reconsideration of new trial before the same Division of the CTA within fifteen (15) days from notice thereof: Provide, however, That in criminal cases, the general rule applicable in regular Courts on matters of prosecution and appeal shall likewise apply. No appeal taken to the CTA from the decision of the Commissioner of Internal Revenue or the Commissioner of Customs or the Regional Trial Court, provincial, city or municipal treasurer or the Secretary of Finance, the Secretary of Trade and Industry or the Secretary of Agriculture, as the case may be, shall suspend the payment, levy, distraint, and/or sale of any property of the taxpayer for the satisfaction of his tax liability as provided by existing law: Provided, however, That when in the opinion of the Court the collection by the aforementioned government agencies may jeopardize the interest of the Government and/or the taxpayer the Court any stage of the proceeding may suspend the said collection and require the taxpayer either to deposit the amount claimed or to file a surety bond for not more than double the amount with the Court. SECTION 18. Appeal to the Court of Tax Appeals En Banc No civil proceeding involving matters arising under the National Internal Revenue code, the Tariff and Customs code or the Local Government Code shall be maintained, except as herein provided, until and unless an appeal has been previously filed with the CTA and disposed of in accordance with the provisions of this Act. A party adversely affected by a resolution of a Division of the CTA on a motion for reconsideration or new trial, may file a petition for review with the CTA en banc. SECTION 19. Review by Certiorari A party adversely affected by a decision or ruling of the CTA en banc may file with the Supreme Court a verified petition for review on certiorari pursuant to Rule 45 of the 1997 Rules of Civil Procedure. 2004 Rules of the Court of Tax Appeals: In case of protest or cases involving disputed assessment, Section 228 provides that in case of inaction, you are given 30 days from the lapse of 180day period to bring it to the Court of Tax Appeals Under the Rules of the CTA: RULE 5 THE COURT, ITS ORGANIZATION & FUNCTIONS SECTION 6. Jurisdiction of the Division A Division of the Court shall exercise: (a) Exclusive appellate jurisdiction to review by appeal, as herein provided: xxx (2) Inaction by the Commissioner of Internal Revenue in cases involving disputed assessments, refunds of internal revenue taxes, fees or other charges, penalties in relation thereto, or other matters arising under the National Internal Revenue Code or other laws administered by the Bureau of Internal Revenue, where the National Internal Revenue Code provides a specific period for action: Provided, that in case of disputed assessments, the inaction of the Commissioner of Internal Revenue within the specific period of action under Section 228 of the National Internal Revenue Code shall be deemed a denial only for purposes of allowing the taxpayer to appeal his case before the Court and does not constitute a formal decision of the Commissioner of Internal Revenue on the tax case: Provided, further, that should the taxpayer opt to await the final decision of the Commissioner of Internal Revenue on the disputed assessments beyond the specific period for action under the National Internal Revenue Code, the taxpayer shall not be precluded from appealing such decision to the Court under Section 6 (a) (1) of this Rule, and Provided still further, that in the case of claims refund of taxes erroneously or illegally collected, the taxpayer files suit for recovery prior to the expiration of the two (2)-year period

March 3, 2009 CASES (This includes all cases discussed in class, although not necessarily part of the coverage for our final exam. The notes on these case are based on the class lectures Read the cases ) PILIPINAS SHELL vs. REPUBLIC (March 6, 2008) FACTS: Pilipinas Shell paid duties and taxes through tax credit certificates. It was found out later by the Department of Finance that the payment made by Pilipinas Shell through tax credit certificates where fraudulently issued. The Department of Finance ordered Shell to pay the Bureau of Customs and the BIR the value of the cancelled tax credit certificates. That was contested by Pilipinas Shell. It went up to the CTA. While this case was on-going, the Bureau of Customs went to the RTC to file a collection case against Pilipinas Shell. In this case, Pilipinas Shell filed a motion to dismiss with the RTC on the ground of lack of jurisdiction of RTC because there is already a case of the same issue with the CTA. It contended that the collection case could be consolidated with the case before the CTA. ISSUES: Whether or not RTC has jurisdiction over the collection case Whether or not the tax collection case can still be pursued while the issue on the fraudulent tax credit certificates is pending with the CTA HELD: YES, it can be done. The RTC has jurisdiction and can proceed hearing the tax collection case pursued by the Bureau of Customs. What if Shell wins in the CTA, wherein the CTA rules that the tax credit certificates are valid? The SC said that in that case, there will be a refund. That is the context of the decision. The RTC has jurisdiction because under the Judiciary Reorganization Act of 1980, RTC has jurisdiction over all cases not within the exclusive jurisdiction of any court, tribunal, person or body exercising judicial or quasi-judicial functions. In the event that there will be a favorable decision in favor of Shell in the case before the CTA, the law affords adequate remedy for Shell to seek for a refund. Thus, the RTC was ordered to proceed with the collection case. In the context of this decision, there is no prejudicial question. The collection case can proceed independently. PROTON PILIPINAS vs. REPUBLIC 504 S 528 (October 16, 2006) FACTS: Proton sold 13 vehicles to Devmark Textile which were paid in tax credit certificates and also acquired other tax credit certificates of Devmark with a total of P 30 M. Proton used the tax credit certificates for payment of customs, duties and taxes to the Bureau of Customs. 9

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

Later on, it was discovered that the tax credit certificates were found to be fake and spurious. The finance officials and officers of Devmark were sued for Anti-Graft before the Sandiganbayan. Since the tax credit certificates were found to be fake and spurious, the Bureau filed a collection case against Proton before the RTC and pursued a criminal case for estafa against Devmark. In the collection case, Proton refused payment since the tax collection should be with the Sandiganbayan, being a civil aspect of the criminal case, and not with the RTC and that the collection case in the RTC is a prejudicial question. HELD: The SC ruled that the tax collection case is separate and distinct from the Sandiganbayan case and is not a prejudicial question. It could proceed independently of each other. The government is not precluded from pursuing the collection of unpaid customs duties and taxes. ERICSSON TELECOMMUNICATIONS vs. CITY OF PASIG (November 22, 2007) FACTS: The issue here is on the local tax assessed on Ericson. In your Local Government Code, the basis for the assessment of the business tax is your gross receipts, not your gross revenue. Ericson paid the local business tax to the City of Pasig on the basis of its gross receipts. The City of Pasig assessed Ericson anew of its business tax on the basis of its gross revenue. ISSUE: Whether or not the Local Government of Pasig correct in assessing the business tax on the basis of gross revenue HELD: NO, the local business tax should be assessed on the basis of gross receipts, not on the basis of the gross revenue. There is a distinction between gross receipts and gross revenue. Gross receipts, as defined under Section 131 of the Local Government Code: xxxx (n) "Gross Sales or Receipts" include the total amount of money or its equivalent representing the contract price, compensation or service fee, including the amount charged or materials supplied with the services and the deposits or advance payments actually or constructively received during the taxable quarter for the services performed or to be performed for another person excluding discounts if determinable at the time of sales, sales return, excise tax, and value-added tax (VAT); xxxx Gross receipts include money or its equivalent actually or constructively received in consideration of services rendered or articles sold, exchanged or leased, whether actual or constructive. Gross revenue covers money or its equivalent actually or constructively received, including the value of services rendered or articles sold, exchanged or leased, the payment of which is yet to be received. This is in consonance with the International Financial Reporting Standards, which defines revenue as the gross inflow of economic benefits (cash, receivables, and other assets) arising from the ordinary operating activities of an enterprise (such as sales of goods, sales of services, interest, royalties, and dividends), which is measured at the fair value of the consideration received or receivable. Revenue from services rendered is recognized when services have been performed and are billable. It is recorded at the amount received or expected to be received. PHIL. FISHERIES DEVT AUTH (PFDA) vs. CA 534 SCRA 490 (October 2, 2007) FACTS: PFDA was assessed of real property taxes within the Municipality of Navotas on its properties under its jurisdiction, management and operation located inside the Navotas Fishing Port Complex. PFDA claimed that it was exempted, being a government instrumentality under Section 234 (A) of the Local Government Code

ISSUE: Whether or not PFDA, which operates the Navotas Fishing Port Complex, is subject to real property tax HELD: YES, PFDA is exempted. PFDA is an instrumentality of the national government and therefore, exempted from the real property tax. Section 234 (A) of the Local Government Code states that real properties owned by the Republic or any of its political subdivisions are exempted from the payment of real property tax except when the beneficial use thereof has been granted, for consideration or otherwise, to a taxable person. CIR vs. PRIMETOWN PROPERTY 531 SCRA 436 FACTS: This is about the counting of the prescriptive period for the claiming of refund. Primetown filed its Annual Income Tax Return for 1997 on April 14, 1998, with a net loss. On March 11, 1999, Primetown filed a claim for refund with the BIR for the excess creditable withholding tax since it incurred a net loss in 1997. BIR failed to resolve the claim and the 2-year prescriptive period was about to lapse. Primetown went to the CTA on April 14, 2000. The 1997 Income Tax Return was filed on April 14, 1998. The 2-year prescriptive period for the claim for refund is reckoned on the actual date of the filing of the return and the claim must be pursued to the Commissioner. When you bring it to the CTA, it should still be within the 2-year period. Since the claim for the refund is pending with the Commissioner and the 2-year period from the date of filing was about to end, Primetown went to the CTA and filed the case on April 14, 2000. CTA denied the claim on the ground that it has prescribed because year 2000 is a leap year. The claim should have been filed on April 13, 2000. ISSUE: Whether or not the additional day in a leap year is counted for the purpose of counting the prescriptive period HELD: NO, the additional day in a leap year is excluded for purposes of counting the prescriptive period. The claim for refund was correctly filed within the reglementary period before the CTA. The rule is that the 2-year period is reckoned from the filing of the final adjusted return. But how should the 2-year prescriptive period be counted? As already quoted under Article 13 of the Civil Code, it provides that when a law speaks of a year, it is understood to be equivalent to 365 days. In the case of NATIONAL MARKETING, CORP vs. TECSON 29 SCRA 70, the SC ruled that a year is equivalent to 365 days, regardless of whether it is a regular year or a leap year. FILINVEST DEVELOPMENT vs. CIR 529 SCRA 605 HELD: The claim for refund is to be filed within 2 years as prescribed in Section 229 of the NIRC. CIR vs. ACOSTA 529 SCRA 177 HELD: The same ruling 2-year prescriptive period applies in filing a claim for refund. Even before the 1997 NIRC, that has been the prescriptive period within which to file a claim for refund within 2 years from the date of payment of the tax or penalty, regardless of any supervening cause. BERDIN vs. MASCARIAS 526 SCRA 592 (July 6, 2007) FACTS: It is mandatory in local tax that when you have an ordinance, it requires publication. In this case, the Municipality of Tubigon, Bohol, the Sangguniang Bayan came up with this municipal revenue ordinance but failed to publish. ISSUE: Whether or not the failure of publication make the ordinance null and void HELD: NO, publication is a condition precedent for the effectivity and enforceability of an ordinance, the purpose of which is to inform the public of the ordinance contents before rights are affected by the same. Lack of publication does not render a tax ordinance null and void. The requirement of publication must still be complied to stop abuses in the exercise of taxing powers and to prevent protest from the people adversely affected. 10

Notes prepared by: Jazzie M. Sarona (4-Manresa 2008-2009) References: 2008 3rd Year Lectures of Atty. Quibod as transcribed by Jo Anne Beltran & Jazzie Sarona

Tax Review (Remedies & CTA Jurisdiction) Based on the 4 th Year 2009 Lectures of Atty. Manuel P. Quibod

If the ordinance approved by the Sanggunian was not published, it will not be null and void. The LGU will still be compelled and required to publish for the purpose of its effectivity and enforceability. In the meantime that it is not published, it will not be enfored. But it will not make the ordinance null and void. CITY ASSESSOR OF CEBU vs. ASSOCIATION OF BENEVOLA DE CEBU, INC. 524 SCRA 128 (June 8, 2007) FACTS: This involves real property tax. The assessment of hospitals, the land and its improvements, are treated as special classes of property. Under Section 216 (LGC), the special classes of real properties are those which are used for hospitals, cultural and scientific purposes and those owned and used by local water districts and government-owned or controlled corporations rendering essential public services in the supply and distribution of water and/or generation and transmission of electric power. As special classes, their assement level under Section 218 (LGC) is at 15%. If they do not belong to such special class, they become commercial, which has an assessment level of 50%. In this case, the Association is a corporate entity operating a Chong Hua hospital in Cebu. This Chong Hua Hospital in 1990 constructed a 5storey Chong Hua Hospital Medical Arts Center about 100 meters away from the hospital. The City Assessor of Cebu assessed the Medical Arts Center as commercial since it is a separate building being used as clinics, rooms, and spaces rented to physicians. The Chong Hua Hospital contends that the Medical Arts Center is an integral part of the hospital as some of the departments of the hospital are found there. It should be subject to a special assessment of 15%. ISSUE: Whether or not the Medical Arts Center built by the hospital to house its doctors a separate commercial establishment or is it an integral part of the hospital HELD: The Supreme Court ruled that the Medical Arts Center is an appurtenant or an integral part of the hospital and therefore, subject to the special assessment under Section 216 (LGC) as a special class of real property subject to the assessment level of 15%. It is undisputed that the doctors and medical specialists holding clinics are those accredited by the Chong Hua Hospital. They are consultants of the hospital and the ones who treat the patients found in the hospital. This fact alone takes away the Medical Arts Center from being categorized as commercial since a tertiary hospital like Chong Hua is required by law to have a pool of physicians who comprise the required medical departments and various medical clinics. The fact that the physicians are holding office in a separate building does not take away the essence and nature of their services vis-vis the over-all operation of the hospital and the benefits to the hospitals patients. It is clear that the Medical Arts Center is an integral part of the hospital. FELS ENERGY vs. PROVINCE OF BATANGAS NPC vs. LOCAL BOARD OF ASSESSMENT APPEALS OF BATANGAS 516 SCRA 186 (February 16, 2007) FACTS: This involves real property tax. When the assessor gives you an assessment in connection with your real properties and you will disagree with the finding of your local assessor, the remedy is to appeal and file a petition before the Local Board of Assessment Appeals (LBAA). What happened here is that they filed a Motion for Reconsideration before the Assessor. The other issue is with regard to the power barges which supply the electricity or the power requirements. In this case, NPC leased power barges from Polar Energy. These barges were moored at Balayan Bay in Calaca, Batangas. Polar Energy, in its lease contract with NPC, had its rights assigned to Fels Energy. The Province of Batangas assessed the power company, Fels Energy, for real property taxes of the power barges. Fels Energy, being the assignee only to that lease agreement, sent the assessment to NPC since NPC is the one who leased the property and thus, should pay the real property tax. NPC filed a Motion for Reconsideration to the assessment made by the local assessor.