Escolar Documentos

Profissional Documentos

Cultura Documentos

TT22 - Lease Versus Buy Analysis

Enviado por

iese027Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

TT22 - Lease Versus Buy Analysis

Enviado por

iese027Direitos autorais:

Formatos disponíveis

TT 22 - Lease versus Buy Analysis Personal Finance: Another Perspective Purpose: The purpose of this spreadsheet is to give an Excel

template for calculating the cost of leasing versus buying. The lease cost is an approximation only, and is close but not exact. This spreadsheet is only a help in discussing the financial aspects as part of the lease versus buy analysis, and assumes you can sell the vehicle at the end of the term for the pre-determined residual value. Disclosure: The purpose of this spreadsheet and this class is to help you get your financial house in order and to help you on your road to financial self-reliance. If there are mistakes in this spreadsheet, please bring them to our attention and we will correct them in upcoming versions. The teacher, and BYU, specifically disclaim any liability, or responsibility for claims, loss, or risk incurred, directly or indirectly, from using this material.

TT 22 - Lease versus Buy Analysis

Personal Finance: Another Perspective

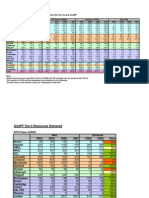

This tool helps to compare leasing versus buying as a potential method of acquiring a vehicle. It is for educational purposes only. The lease close approximation. Please note that this example assumes that taxes are paid outside of the monthly lease payments and that the taxes on do outside the monthly lease or loan payments as well. Costs Finance Charges and Residual MSRP 25,000.00 Interest Rate (rent charge) 8.35% Capitalized or Negotiated Cost 22,000.00 Sales Tax 6.25% Cap. Cost Reduction (Down Payment) 2,000.00 Lease Period (months) 36 Cap. Cost Reduction (Trade in) Residual Value in % 55% Remaining Amount (Net Capitalized Cost) 20,000.00 Residual Value in $ 13,750.00 Trade In Allowance Balance Owed on Trade In Lease Analysis (Fees paid separately) Buy Analysis (Down Payment paid separately) Overall Monthly Overall Monthly Costs: Cost Payments Costs: Cost Payments Capitalized Cost $ 22,000.00 Negotiated Cost $ 22,000.00 Down payment 2,000.00 Down payment 2,000.00 Net Balance on Trade-In Net Balance on Trade-In Taxable Fees/Options Taxable Fees/Options Net Taxable Amount 20,000.00 Tax on Down Payment 125.00 Tax on Down Payment 125.00 Fees: Acquisition 500.00 Termination 300.00 Documentation/Inspection 200.00 License & Registration 185.00 Property Assessment /State Fees Other Fees Total Paid Outside Lease 3,310.00 Total Amount to Finance: 20,000.00 Fees: Acquisition Termination Documentation/Inspection 200.00 License & Registration 185.00 Property Assessment /State Fees Total Paid Outside Loan Total Amount to Finance: Taxes on Net Amount Total Amount to Finance Loan Payments: PV = 21250., I = 6.25% N = 36 PMT = ? 2,510.00 20,000.00 1,250.00 21,250.00

Lease Payments: Depreciation: (NCC-RV) Interest (NCC+RV)*MF Taxes Total Lease Costs Total Costs Less Residual Value Total Lease Payments:

6,250.00 4,227.19 654.82 11,132.01 14,442.01

173.61 117.42 18.19

24,096.03

669.33

Total Costs Less Residual Value 309.22 Total Payments:

26,606.03 (13,750.00) $ 12,856.03 669.33

$ 14,442.01

1. Interest charges are calculated by adding the capitalized cost plus residual value times the money factor, which is the interest rate in decim It can also be thought of as the average amount outstanding, or (remaining amount + residual value) / 2 times the average interest rate of A it is the remaining amount plus residual value * APR / 24 or the Money Factor. Amount from Lease Contract APR

Actual Monthly Rent Charge in Dollars Actual Annual Rent Charge in Dollars

212.77 7,659.90

15.13% 15.13%

Analysis

spective

or educational purposes only. The lease interest charge is a y lease payments and that the taxes on down payment are paid Fees Acquisition 500.00 Termination 300.00 Documentation/Inspection 200.00 License & Registration 185.00 Property Assessment /State Fees Taxable Fees Other Taxable Fees/Options Buy Analysis (Downpayment & Fees Paid Separately) Overall Monthly Costs: Cost Payments Negotiated Cost $ 22,000.00 Total Payment 2,000.00 Net Balance on Trade-In Taxable Fees/Options Net Taxable Amount 20,000.00 Tax on Vehicle 1,250.00 Fees: Acquisition Termination Documentation/Inspection 200.00 License & Registration 185.00 Property Assessment /State Fees Total Paid Outside Loan Total Amount to Finance: Total Credits Total Amount to Finance Loan Payments: PV = 21250., I = 6.25% N = 36 PMT = ? 2,385.00 21,250.00 21,250.00

24,096.03

669.33

Total Costs Less Residual Value Total Payments:

26,481.03 (13,750.00) $ 12,731.03 669.33

actor, which is the interest rate in decimal form divided by 24. e) / 2 times the average interest rate of APR / 12. Multiplied out,

Você também pode gostar

- Updates in Win7 and WS08R2 SP1Documento80 páginasUpdates in Win7 and WS08R2 SP1Lee GalligAinda não há avaliações

- OR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007Documento2 páginasOR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007iese027Ainda não há avaliações

- Instructions For AuthorsDocumento25 páginasInstructions For Authorsiese027Ainda não há avaliações

- Imm5669e PDFDocumento4 páginasImm5669e PDFSampathAinda não há avaliações

- Paris MOU Calculator - LDocumento4 páginasParis MOU Calculator - Liese027Ainda não há avaliações

- Series 6 Part 2Documento8 páginasSeries 6 Part 2iese027Ainda não há avaliações

- Tier-2 MoU ResourcesDocumento2 páginasTier-2 MoU Resourcesiese027Ainda não há avaliações

- MOUrev 072011Documento1 páginaMOUrev 072011iese027Ainda não há avaliações

- BPE Pricing Structures Shared 2-20 Lines - VOICE ONLYDocumento2 páginasBPE Pricing Structures Shared 2-20 Lines - VOICE ONLYiese027Ainda não há avaliações

- Checklist For Club Qualification For 2013 2014Documento1 páginaChecklist For Club Qualification For 2013 2014iese027Ainda não há avaliações

- Manpower 2010Documento7 páginasManpower 2010iese027Ainda não há avaliações

- Memo of UnderstandingDocumento1 páginaMemo of Understandingiese027Ainda não há avaliações

- BPE Pricing Structures Shared 2-20 Lines - VOICE ONLYDocumento2 páginasBPE Pricing Structures Shared 2-20 Lines - VOICE ONLYiese027Ainda não há avaliações

- VA MOU Template Rev.2013!3!21Documento2 páginasVA MOU Template Rev.2013!3!21iese027Ainda não há avaliações

- Series 6 Part 2Documento8 páginasSeries 6 Part 2iese027Ainda não há avaliações

- Singapore ISCED MappingDocumento1 páginaSingapore ISCED Mappingiese027Ainda não há avaliações

- BIBIndexesACCdev18 Details.6 1Documento7 páginasBIBIndexesACCdev18 Details.6 1iese027Ainda não há avaliações

- ARTF Key DocumentsDocumento2 páginasARTF Key Documentsiese027Ainda não há avaliações

- Quarterly Report20 GenericlinksDocumento1 páginaQuarterly Report20 Genericlinksiese027Ainda não há avaliações

- Singapore ISCED MappingDocumento1 páginaSingapore ISCED Mappingiese027Ainda não há avaliações

- Uploads Resources 2112 Capital Lease Determination Revised July 09Documento11 páginasUploads Resources 2112 Capital Lease Determination Revised July 09iese027Ainda não há avaliações

- Student or General Public Injury and Property Damage Report: University of MissouriDocumento2 páginasStudent or General Public Injury and Property Damage Report: University of Missouriiese027Ainda não há avaliações

- Uploads Resources 2112 Capital Lease Determination Revised July 09Documento11 páginasUploads Resources 2112 Capital Lease Determination Revised July 09iese027Ainda não há avaliações

- Wait or Buy CondoDocumento5 páginasWait or Buy CondoNeedster100% (3)

- TT22 - Lease Versus Buy AnalysisDocumento5 páginasTT22 - Lease Versus Buy Analysisiese027Ainda não há avaliações

- Use of Quitting Advice or Products Maori and NonmaoriDocumento4 páginasUse of Quitting Advice or Products Maori and Nonmaoriiese027Ainda não há avaliações

- Friday DB JHI SER BH: JHI Repaid On 1st Dec SER Extra Repaid 23rd SeptDocumento5 páginasFriday DB JHI SER BH: JHI Repaid On 1st Dec SER Extra Repaid 23rd Septiese027Ainda não há avaliações

- OR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007Documento2 páginasOR-FY07 Allocations: KEY CNSRT Sta Name CDBG FY2007 HOME FY2007 ADDI FY2007iese027Ainda não há avaliações

- People Aged From 16 To 24 Not in Education, Employment or Training ('NEET')Documento6 páginasPeople Aged From 16 To 24 Not in Education, Employment or Training ('NEET')iese027Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- International Business Law 6th Edition August Test BankDocumento21 páginasInternational Business Law 6th Edition August Test Bankchristabeldienj30da100% (33)

- Holiday Homework 2023-24 (Class Xi)Documento5 páginasHoliday Homework 2023-24 (Class Xi)Sukhpreet KaurAinda não há avaliações

- 3.1 Leverage and Capital StructureDocumento50 páginas3.1 Leverage and Capital StructureLou Brad Nazareno IgnacioAinda não há avaliações

- Accounting P1 May-June 2023 EngDocumento12 páginasAccounting P1 May-June 2023 EngKaren ErasmusAinda não há avaliações

- Aud ProbDocumento8 páginasAud ProbYaj CruzadaAinda não há avaliações

- 1559051463267lQpqLbRWjUIPzaEz PDFDocumento8 páginas1559051463267lQpqLbRWjUIPzaEz PDFSibu SorenAinda não há avaliações

- Chapter 7 - 18may 2022Documento51 páginasChapter 7 - 18may 2022Hazlina HusseinAinda não há avaliações

- GOLD BrochureDocumento8 páginasGOLD BrochurelaxmiccAinda não há avaliações

- Quiz On MacroDocumento4 páginasQuiz On MacroAlexandria EvangelistaAinda não há avaliações

- Macroeconomics: Case Fair OsterDocumento26 páginasMacroeconomics: Case Fair OsterMikhel BeltranAinda não há avaliações

- ASSESSMENT Two ContempoDocumento7 páginasASSESSMENT Two ContempoJackie Lou RomeroAinda não há avaliações

- Function of Commercial Banks in IndonesiaDocumento4 páginasFunction of Commercial Banks in IndonesiaAbahLatifCanvasmasAinda não há avaliações

- Sharif Hassan Presidency Manifesto Final VersionDocumento28 páginasSharif Hassan Presidency Manifesto Final VersionShariff-HassanSheikh-Adan100% (1)

- Business Research Methods ReportDocumento5 páginasBusiness Research Methods Reportvijay choudhariAinda não há avaliações

- App Form Personal Account Application Form 103 v4Documento11 páginasApp Form Personal Account Application Form 103 v4Shaliena LeeAinda não há avaliações

- Financial Statements-Schedule-III - Companies Act, 2013 PDFDocumento13 páginasFinancial Statements-Schedule-III - Companies Act, 2013 PDFCA Ujjwal KumarAinda não há avaliações

- " Money and Its History": AboutDocumento13 páginas" Money and Its History": AboutHarsha ShivannaAinda não há avaliações

- Any Need For Naira Re Denomination NowDocumento10 páginasAny Need For Naira Re Denomination NowUtri DianniarAinda não há avaliações

- DM DCFDocumento2 páginasDM DCFAJAY GOYALAinda não há avaliações

- Dynamic Asset Allocation in A Changing WorldDocumento3 páginasDynamic Asset Allocation in A Changing WorldAnna WheelerAinda não há avaliações

- Business Finance Chapter 1 DLLDocumento7 páginasBusiness Finance Chapter 1 DLLVictorino Pinawin100% (1)

- Allied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionDocumento23 páginasAllied Food Products Capital Budgeting and Cash Flow Estimation Case SolutionAsad Sheikh89% (18)

- Capital Investment Analysis For Engineering and ManagementDocumento316 páginasCapital Investment Analysis For Engineering and ManagementCFA100% (2)

- What If We Were Like Our Neighbors?: Welcome Guests!Documento8 páginasWhat If We Were Like Our Neighbors?: Welcome Guests!John C StarkAinda não há avaliações

- Banking Amendment Act 2012Documento26 páginasBanking Amendment Act 2012jaspreet444Ainda não há avaliações

- Lecture 7 Company AccountingDocumento25 páginasLecture 7 Company AccountingSalah MobarakAinda não há avaliações

- 203 Final Fall 2010 Answers POSTDocumento15 páginas203 Final Fall 2010 Answers POSTJonathan RuizAinda não há avaliações

- Credit Card HSBCDocumento74 páginasCredit Card HSBClove_3080160% (5)

- Absa Group Limited Is One of South AfricaDocumento11 páginasAbsa Group Limited Is One of South AfricaCody EcAinda não há avaliações

- The HistoricalEvolutionofCentral BankingDocumento25 páginasThe HistoricalEvolutionofCentral Bankingmansavi bihaniAinda não há avaliações