Escolar Documentos

Profissional Documentos

Cultura Documentos

Wipro, 1Q FY 2014

Enviado por

Angel BrokingDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Wipro, 1Q FY 2014

Enviado por

Angel BrokingDireitos autorais:

Formatos disponíveis

1QFY2014 Result Update | IT

July 29, 2013

Wipro

Performance Highlights

(` cr) Net revenue EBITDA EBITDA margin (%) PAT 1QFY14 9,735 2,020 20.8 1,632 4QFY13 9,643 2,122 22.0 1,606 % chg (qoq) 0.9 (4.8) (125)bp 1.6 1QFY13 9,284 2,019 21.7 1,457 % chg (yoy) 4.8 0.1 (99)bp 12.0

ACCUMULATE

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code IT 93,920 (9,965) 0.6 418/290 163,184 2 19,748 5,886 WIPR.BO WPRO@IN

`383 `435

12 Months

Source: Company, Angel Research

For 1QFY2014, Wipros results were broadly in line with our estimates except in terms of USD revenue. The IT services revenue came in at US$1,588mn, up just 0.2% qoq vs our expectation of ~1.0% qoq growth; though in constant currency terms revenues grew by 1.2%. Going forward, for 2QFY2014, the Management has given a USD revenue guidance of US$1,620mn-1,640mn, which translates into a qoq growth of 2-4%, which is above our expectation of 1.5-3.0% qoq growth. We believe that the restructuring initiatives have not yet started showing the expected results and will start reflecting in the financials of the company in due course. We recommend an Accumulate rating on the stock. Quarterly highlights: For 1QFY2014, Wipros consolidated revenues came in at `9,735cr, up 0.9% qoq. The companys consolidated EBITDA margin declined by 125bp qoq to 20.8% while the EBIT margin grew by 49bp qoq to 18.2%. The IT services segments EBIT margin was at 20.0%, down ~20bp qoq, impacted by one month wage hikes given to employees (effective 1 June 2013). The PAT came in line with our expectations at `1,632cr, up 1.6% qoq. Outlook and valuation: For 2QFY2014, the Management has given a USD revenue guidance of US$1,620mn-1,640mn, which translates into a qoq growth of 2-4%. The Management remains confident of the revenue growth pick-up sustaining, citing a pick-up in large deal closures and win rates, uptick in discretionary spending, a strong business pipeline and momentum in demand from the US sustaining. Though the deal pipeline has remained largely unchanged over the past few months, deal closures and win ratios were on the up, reflecting both an improving environment (leading to faster decision-making) and execution (higher win ratios). We expect USD and INR revenue CAGR for IT services to be at 7.2% and 10.7%, respectively over FY2013-15. We expect an EBIT margin of 18.2% and 18.8% for FY2014 and FY2015, respectively. The stock is currently trading at 13.5x FY2014E and 12.3x FY2015E EPS. We value the stock at 14x FY2015E EPS of `31.2, which gives a target price of `435. We recommend Accumulate rating on the stock.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 73.5 4.6 7.3 14.6

Abs. (%) Sensex Wipro

3m 2.4 16.0

1yr 18.7 16.0

3yr 9.6 (7.3)

Key financials (Consolidated, IFRS)

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA margin (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) FY2011 31,099 14.7 5,297 15.3 21.2 21.7 17.7 3.9 22.0 15.5 2.7 12.9 FY2012 37,525 20.7 5,573 5.2 19.8 22.7 16.9 3.3 19.5 14.7 2.2 11.4 FY2013 37,823 0.8 6,130 10.0 21.7 24.8 15.4 3.3 21.5 15.9 2.1 9.6 FY2014E 42,196 11.6 6,991 14.1 21.0 28.3 13.5 2.8 20.7 15.3 1.8 8.4 FY2015E 45,890 8.8 7,705 10.2 21.6 31.2 12.3 2.4 19.4 15.1 1.5 6.8

Ankita Somani

+91 22-39357800 Ext: 6819 ankita.somani@angelbroking.com

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

Wipro | 1QFY2014 Result Update

Exhibit 1: 1QFY2014 performance (Consolidated, IFRS)

Y/E March (` cr) Net revenue Cost of revenue Gross profit SG&A expense EBITDA Dep. and amortization EBIT Other inc., net of finance chgs. PBT Income tax PAT Minority interest Adj. PAT Diluted EPS (`) Gross margin (%) EBITDA margin (%) EBIT margin (%) PAT margin (%)

Source: Company, Angel Research

1QFY14 9,735 6,472 3,263 1,243 2,020 250 1,770 287 2,057 425 1,632 1,632 6.6 33.5 20.8 18.2 19.7

4QFY13 9,643 6,318 3,325 1,204 2,122 415 1,706 328 2,044 438 1,606 1,606 6.5 34.5 22.0 17.7 20.1

% chg (qoq) 0.9 2.4 (1.9) 3.3 (4.8) (39.8) 3.7 0.6 (2.9) 1.6 1.6 1.6 (96)bp (125)bp 49bp (35)bp

1QFY13 9,284 6,132 3,152 1,133 2,019 270 1,749 133 1,871 405 1,466 10 1,457 5.9 34.0 21.7 18.8 15.8

% chg (yoy) 4.8 5.5 3.5 9.7 0.1 (7.5) 1.2 9.9 5.1 11.3 (100.0) 12.0 12.0 (43)bp (99)bp (65)bp 391bp

FY2013 37,823 26,203 11,619 4,635 8,222 1,237 6,984 990 7,974 1,835 6,139 10 6,130 24.8 30.7 21.7 18.5 18.8

FY2012 37,525 26,317 11,207 4,806 7,414 1,013 6,401 574 6,975 1,376 5,599 26 5,573 22.7 29.9 19.8 17.1 16.4

% chg (yoy) 0.8 (0.4) 3.7 (3.6) 10.9 22.2 9.1 14.3 33.3 9.7 (62.1) 10.0 9.3 85bp 198bp 141bp 244bp

Exhibit 2: 1QFY2014 Actual vs Angel estimates

(` cr) Net revenue EBITDA margin (%) PAT

Source: Company, Angel Research

Actual 9,735 20.8 1,632

Estimate 10,186 21.1 1,633

Variation (%) (4.4) (34)bp (0.1)

In-line performance, guidance positive

For 1QFY2014, Wipros IT services revenue came in at US$1,588mn, up merely 0.2% qoq and below our estimate of ~1.0% qoq growth. In CC terms, the revenue growth was of 1.2% qoq, which is at the higher end of Wipros guided range. In INR terms, the revenue from the IT services segment came in at `8,936cr, up 4.5% qoq.

July 29, 2013

Wipro | 1QFY2014 Result Update

Exhibit 3: Trend in IT services revenue growth (qoq)

1,610 1,590 1,570 1.7 1,577 1,585 0.5 0.2 2.4 1,588 3 2 1 0 (1) (2) 1QFY13 2QFY13 IT products

Source: Company, Angel Research

(USD mn)

1,550 1,530 1,510 1,490 1,470 1,450 3QFY13 (1.4) 1,515 1,541

4QFY13 yoy growth (%)

1QFY14

Industry wise, Wipros growth was once again led by energy & utilities industry vertical, the revenue from which grew by 5.0% qoq in CC terms. The company posted a 1.7% and 1.0% qoq revenue growth (in CC terms) in retail & transportation and financial solutions industry verticals, respectively, during the quarter. For FY2013, energy & utilities was the only vertical that grew in double digits (ie by ~19% yoy), aided by the acquisition of SAIC. The Management indicated that Wipro is participating in large deals in both energy & utilities and financial solutions industry verticals with noticeable traction in discretionary spends in these verticals as well. The Management indicated that revenue growth from the telecom industry is expected to remain sluggish over the next few quarters.

Exhibit 4: Revenue growth (Service wise CC basis)

% to revenue Global media and telecom Financial solutions Manufacturing and hi-tech Healthcare, life sciences and services Retail and transportation Energy and utilities

Source: Company, Angel Research

% growth (qoq) 0.1 1.7 (1.7) 1.0 5.0

% growth (yoy) (3.3) 6.9 3.0 3.2 6.2 19.9

13.6 26.5 19.1 9.8 15.1 15.9

Service wise, Wipros anchor service lines - business application services (contributed 31.3% to revenue) and technology infrastructure services (contributed 24.2% to revenue) - posted a marginal decline of 0.1% and 0.9% qoq in revenues, respectively. Revenues from application development and maintenance (ADM) segment (contributed 20.7% to revenue) also declined by 0.2% qoq. Growth during the quarter was led by analytics & information management services and consulting services, revenues from which grew by 6.5% and 3.5% qoq, respectively. The Management indicated that the company continues to see good traction in advanced technologies like mobility and cloud where the company witnessed a 9% qoq growth in 1QFY2014. The Management indicated that analytics, mobility and data will be the next growth drivers for the overall IT industry, and that the company is making continuous investments in these areas.

July 29, 2013

(%)

Wipro | 1QFY2014 Result Update

The company is seeing bottoming out of weakness in multiple segments, such as the IMS business out of India, and product engineering.

Exhibit 5: Revenue growth (Service wise)

Service verticals Technology infrastructure services Analytics and information management Business application services BPO Product engineering and mobility ADM R&D business Consulting

Source: Company, Angel Research

% to revenue 24.2 7.5 31.3 8.8 7.5 20.7 10.2 2.5

% growth (qoq) % growth (yoy) (0.9) 6.5 (0.1) 0.5 (0.2) (0.2) (2.5) 3.5 11.3 10.6 6.9 9.8 (6.8) (3.8) (11.5) 6.0

Geography wise, Wipros primary revenue growth came in from APAC and other emerging markets, which cumulatively grew by 9.9% qoq, while revenues from Europe grew by 1.5% qoq in CC terms. Revenues from India were down 1.5% qoq in CC terms (6.7% decline in USD terms) while that from the US were down 0.6% qoq in CC terms. However, prospectively, the Management is more sanguine on the US geography where both deal wins and the deal pipeline have improved meaningfully in the recent past.

Exhibit 6: Revenue growth (Geography wise, CC basis)

% to revenue America Europe India and Middle East APAC and other emerging markets

Source: Company, Angel Research

% growth (qoq) (0.6) 1.5 (1.5) 9.9

% growth (yoy) 1.1 8.4 9.3 19.2

49.7 29.0 8.8 12.5

Segmental performance

During the quarter, the IT services segments revenue came in at US$1,588mn, up merely 0.2% qoq, with India and the Middle East geographies being the major revenue draggers, with revenue declining by 6% qoq.

July 29, 2013

Wipro | 1QFY2014 Result Update

Exhibit 7: IT services Revenue growth (qoq)

6 4 2 1.1 1QFY13 (0.9) (1.4) 1.5 1.7 0.9 5.3 2.8 3.5 2.4 0.5 0.5 (0.3) 4QFY13 1.5 0.2 0.2 4.7

(0.5) 3QFY13

(%)

0 2QFY13 (2) (4) (6) (8) Global IT India and Middle East (4.8)

1QFY14

(6.0) BPO IT services

Source: Company, Angel Research

The IT products segment reported a 14.3% yoy decline in its revenue to `817cr during the quarter, as majority of business in this segment comes from India and the Middle East regions which were soft during the quarter.

Exhibit 8: IT products Revenue growth (yoy)

1,100 1,075 1,000 15 953 899 800 (5.2) (10.2) 700 1QFY13 2QFY13 IT products

Source: Company, Angel Research

25

997 10.8

14.7

(` cr)

817 (14.3) 3QFY13 4QFY13 yoy growth (%) 1QFY14

(5)

(15)

On a consolidated level, Wipros revenue came in at `9,735cr, up 0.9% qoq.

Hiring and utilization

Wipro reported a net addition of 1,469 employees in its IT services employee base, which now stands at 147,281 headcounts. Voluntary attritions (annualized) in the global IT business inched up to 13.0% in 1QFY2014 from 12.5% in 4QFY2012. The utilization rate of the global IT business remained almost flat qoq at 64.7%, which is at low levels for the company on an historical basis. The Management indicated that this is because of the following factors: 1) hyper automation process being implemented in the run services, resulting in higher productivity; 2) freshers added into the system. Going ahead, increased utilization level will be an important margin lever.

July 29, 2013

(%)

900

Wipro | 1QFY2014 Result Update

Exhibit 9: Employee pyramid

Employee pyramid Utilization Global IT (%) Attrition (%) Global IT BPO Net additions

Source: Company, Angel Research

1QFY13 68.3 15.2 13.4 2,632

2QFY13 66.8 14.4 14.4 2,017

3QFY13 64.8 12.9 12.5 2,336

4QFY13 64.9 12.5 12.8 2,907

1QFY14 64.7 13.0 12.3 1,469

Margins mixed

During 1QFY2014, Wipros consolidated EBITDA margin declined by 125bp qoq to 20.8% while EBIT margin grew by 49bp qoq to 18.2%, as there was a one-time depreciation cost last quarter which was not present during 1QFY2014. The IT services segments EBIT margin was at 20.0%, down ~20bp qoq, impacted by one month wage hikes given to employees (effective June 1, 2013). The EBIT margin of the IT products business segment declined by 90bp qoq to 1.6%, negatively impacted due to INR depreciation.

Exhibit 10: Segment-wise EBIT margin trend

25 20 15 21.0 18.8 20.7 18.6 20.8 18.7 20.2 17.7 20.0 18.2

(%)

10 5 0 1QFY13 IT services

Source: Company, Angel Research

2.2

3.0

2.4 3QFY13 IT products

2.5 4QFY13

1.6 1QFY14

2QFY13

Consolidated

July 29, 2013

Wipro | 1QFY2014 Result Update

Client pyramid

Wipro added 28 new clients in 1QFY2014, lowest since 1QFY2011, with its active client base standing at 946 from 978 in 4QFY2013. Overall, two clients were added in the US$1mn+ revenue brackets. The companys focus on account mining continues to yield results with top clients driving growth The companys revenue from its top clients grew by 3% qoq, while revenues from the top 5/10 clients increased by 4.8%/2.9% qoq.

Exhibit 11: Client metrics

Particulars US$100mn plus US$75mn$100mn US$50mn$75mn US$20mn$50mn US$10mn$20mn US$5mn$10mn US$3mn$5mn US$1mn$3mn New clients Active customers 1QFY13 8 6 11 48 58 82 89 176 37 919 2QFY13 9 7 9 46 62 62 85 182 53 939 3QFY13 10 6 10 47 59 82 79 191 50 966 4QFY13 10 6 10 50 57 80 78 199 52 978 1QFY14 10 5 12 49 57 85 63 211 28 946

Source: Company, Angel Research

Outlook and valuation

For 2QFY2014, the Management has given a USD revenue guidance of US$1,620mn-1,640mn, which translates into a qoq growth of 2-4%, well above our expectation of 1.5-3.0% qoq growth. The Management remains confident of the revenue growth pick-up sustaining, citing a pick-up in large deal closures and win rates, uptick in discretionary spending, strong business pipeline and momentum in demand from US sustaining. The Management indicated that CY2013 IT budgets are expected to remain stable and anticipates a positive demand environment ahead. Though the deal pipeline has remained largely unchanged over the past few months, deal closures and win ratios were on the up, reflecting both an improving environment (leading to faster decision-making) and execution (higher win ratios). The company sees itself better placed than this time last year, to latch on to opportunities in the market. We believe that the restructuring initiatives have not yet started showing the expected results and will start reflecting in the financials of the company in due course. We expect Wipros volume growth to continue to lag from some of its peer companies in the near term. Wipro has chosen a growth strategy of focusing on a selected few segments in terms of industry verticals and services. We are modeling in an ~1.8% revenue CQGR over 2Q-4QFY2014. We expect USD and INR revenue CAGR for IT services to be at 7.2% and 10.7%, respectively over FY2013-15. Wipro has been showing a decent performance in the past five quarters by rationalizing costs. The Management has given wage hikes from June 1, 2013 (average of ~8.5% to offshore employees and ~3% to onsite employees), which will impact operating margins in 2QFY2014. We expect an EBIT margin of 18.2% and 18.8% for FY2014 and FY2015, respectively. The stock is currently trading at 13.5x FY2014E and 12.3x FY2015E EPS. We value the stock at 14x FY2015E EPS

July 29, 2013

Wipro | 1QFY2014 Result Update

of `31.2, which is still at a reasonable discount to our target multiple for TCS. The discounted valuation for Wipro vis-a-vis TCS is fair in our view given several years of revenue underperformance at Wipro, while several quarters of sustained performance will be required for Wipro to narrow the valuation multiples. We recommend an Accumulate rating on the stock with a target price of `435.

Exhibit 12: Key assumptions

FY2014 Revenue growth IT services (USD) USD-INR rate (realized) Revenue growth Consolidated (`) EBITDA margin (%) Tax rate (%) EPS growth (%)

Source: Company, Angel Research

FY2015 8.5 58.0 8.8 21.6 18.8 10.2

6.0 57.9 11.6 21.0 18.2 14.1

Exhibit 13: One-year forward PE chart

950 800 650

(`)

500 350 200 50

Oct-06

Oct-07

Oct-08

Oct-09

Oct-10

Oct-11

Oct-12

Apr-06

Apr-07

Apr-08

Apr-09

Apr-10

Apr-11

Apr-12

Price

Source: Company, Angel Research

27x

22x

17x

12x

July 29, 2013

Apr-13

7x

Wipro | 1QFY2014 Result Update

Exhibit 14: Recommendation summary

Company HCL Tech Hexaware Infosys Infotech Enterprises KPIT Cummins MindTree MphasiS NIIT Persistent TCS Tech Mahindra Wipro Reco. Neutral Accumulate Neutral Accumulate Accumulate Accumulate Neutral Neutral Buy Buy Accumulate Accumulate CMP (`) 904 114 2,916 176 132 963 400 17 53 1,772 1,217 383 190 144 1050 595 2,060 1,390 435 Tgt. price (`) 123 Upside (%) 8.4 7.9 9.0 9.1 1,024.8 16.2 14.2 13.6 FY2015E EBITDA (%) 22.0 20.5 26.4 17.6 16.7 19.9 18.2 9.1 26.2 30.0 19.1 21.6 FY2015E P/E (x) 14.3 8.8 15.4 7.8 9.2 9.1 9.2 3.1 0.9 17.2 10.4 12.3 FY2012-15E EPS CAGR (%) 20.7 13.1 9.2 15.7 21.6 25.1 4.9 (7.1) 19.0 23.8 11.4 11.2 FY2015E RoCE (%) 1.7 1.2 2.5 0.5 0.7 0.9 0.6 (0.0) (0.3) 3.5 1.7 1.5 FY2015E RoE (%) 21.7 23.5 19.3 14.0 16.7 20.3 14.2 11.9 16.7 29.2 18.9 19.4

Source: Company, Angel Research

Company background

Wipro is among leading Indian companies, majorly offering IT services. The company is also engaged in IT hardware (11% of sales) and consumer care and lighting (10% of sales) businesses. Wipro's IT arm is India's fourth largest IT firm, employing more than 1,47,000 professionals, offering a wide portfolio of services such as ADM, consulting and package implementation, and servicing more than 950 clients.

July 29, 2013

Wipro | 1QFY2014 Result Update

Profit & Loss account (Consolidated, IFRS)

Y/E March (` cr) Net revenue Cost of revenues Gross profit % of net sales Selling and mktg exp. % of net sales General and admin exp. % of net sales Depreciation and amortization % of net sales EBIT % of net sales Other income, net Share in profits of eq. acc. ass. Profit before tax Provision for tax % of PBT PAT Share in earnings of associate Minority interest Adj. PAT Diluted EPS (`) FY2011 31,099 21,285 9,814 31.6 2,218 7.1 1,829 5.9 821 2.6 5,767 18.5 472 64.8 6,303 971 15.4 5,332 35 5,297 21.7 FY2012 37,525 26,317 11,207 29.9 2,778 7.4 2,029 5.4 1,013 2.7 6,401 17.1 541 33.3 6,975 1,376 19.7 5,599 26 5,573 22.7 FY2013 37,823 26,203 11,619 30.7 2,425 6.4 2,211 5.8 1,237 3.3 6,984 18.5 1,001 -10.5 7,974 1,835 23.0 6,139 10 6,130 24.8 FY2014E 42,196 29,179 13,017 30.8 2,903 6.9 2,424 5.7 1,159 2.7 7,690 18.2 1,238 0 8,928 1,937 21.7 6,991 6,991 28.3 FY2015E 45,890 31,685 14,206 31.0 3,042 6.6 2,519 5.5 1,285 2.8 8,644 18.8 1,630 0 10,274 2,568 25.0 7,705 1 7,705 31.2

July 29, 2013

10

Wipro | 1QFY2014 Result Update

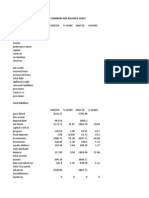

Balance sheet (Consolidated, IFRS)

Y/E March (` cr) Assets Goodwill Intangible assets Property, plant & equipment Investment in equ. acc. investees Derivative assets Non-current tax assets Deferred tax assets Other non-current assets Total non-current assets Inventories Trade receivables Other current assets Unbilled revenues Available for sale investments Current tax assets Derivative assets Cash and cash equivalents Total current assets Total assets Equity Share capital Share premium Retained earnings Share based payment reserve Other components of equity Shares held by controlled trust Equity attrib. to shareholders of Co. Minority interest Total equity Liabilities Long term loans and borrowings Deferred tax liability Derivative liabilities Non-current tax liability Other non-current liabilities Provisions Total non-current liabilities Loans and bank overdraft Trade payables Unearned revenues Current tax liabilities Derivative liabilities Other current liabilities Provisions Total current liabilities Total liabilities Total equity and liabilities 1,976 30 259 502 271 8 3045 3,304 4,405 660 734 136 591 232 10,062 13,107 37,144 2,251 35 31 540 352 6 3215 3,645 4,726 957 723 635 970 112 11,769 14,984 43,600 85 85 12 479 339 1 1001 6,296 4,807 1,035 1,023 98 1,099 117 14,474 15,475 43,973 185 85 12 529 450 1 1262 6,496 4,797 1,173 1,223 98 1,299 167 15,252 16,514 50,268 235 85 12 579 450 1 1362 6,646 5,208 1,168 1,373 98 1,499 187 16,179 17,541 57,264 491 3,012 20,325 136 58 (54) 23,968 69 24,037 492 3,046 24,191 198 659 (54) 28,531 85 28,616 493 1,176 25,918 132 717 (54) 28,381 117 28,498 493 1,176 31,173 132 717 (54) 33,637 117 33,754 493 1,176 37,143 132 717 (54) 39,606 117 39,724 5,482 355 5,509 299 298 924 147 898 13,913 971 6,163 1,974 2,415 4,928 496 171 6,114 23,231 37,144 6,794 423 5,899 323 346 1,029 260 1,178 16,251 1,066 8,033 2,574 3,003 4,196 564 147 7,767 27,349 43,600 5,476 171 5,053 5 1,031 424 1,074 13,233 326 7,664 3,107 3,199 6,917 741 303 8,484 30,740 43,973 5,476 171 5,093 5 1,231 574 1,074 13,624 694 8,030 3,107 3,464 10,831 850 350 9,319 36,644 50,268 5,476 171 5,009 5 1,431 724 1,074 13,889 754 8,298 3,107 3,632 13,589 900 400 12,695 43,376 57,264 FY2011 FY2012 FY2013 FY2014E FY20115E

July 29, 2013

11

Wipro | 1QFY2014 Result Update

Cash flow statement (Consolidated, IFRS)

Y/E March (` cr) Pre tax profit from operations Depreciation Expenses (deferred)/written off Pre tax cash from operations Other income/prior period ad Net cash from operations Tax Cash profits (Inc)/dec in current assets Inc/(dec) in current liab. Net trade working capital Cashflow from oper. actv. (Inc)/dec in fixed assets (Inc)/dec in intangibles (Inc)/dec in investments (Inc)/dec in net def. tax assets (Inc)/dec in derivative assets (Inc)/dec in non-current tax asset (Inc)/dec in minority interest Inc/(dec) in other non-current liab (Inc)/dec in other non-current ast. Cashflow from investing activities Inc/(dec) in debt Inc/(dec) in equity/premium Dividends Cashflow from financing activities Cash generated/(utilized) Cash at start of the year Cash at end of the year FY2011 5,832 821 (35) 6,618 472 7,090 (971) 6,119 (1,601) (499) (2,101) 4,018 (985) (56) (1,951) 22 (178) (578) 25 103 (20) (3,616) 165 617 (1,558) (775) (374) 6,488 6,114 FY2012 6,434 1,013 (26) 7,422 541 7,962 (1,376) 6,586 (3,197) 1,707 (1,490) 5,096 (1,402) (1,380) 708 (113) (48) (105) 16 (105) (280) (2,709) 275 713 (1,723) (735) 1,653 6,114 7,767 FY2013 FY2014E FY2015E 6,974 1,237 (10) 8,201 1,001 9,202 (1,835) 7,367 47 2,706 2,752 10,119 (391) 1,570 (2,398) (164) 341 (2) 32 (49) 104 (957) (2,166) (4,544) (1,736) (8,446) 717 7,767 8,484 7,690 1,159 8,849 1,238 10,087 (1,937) 8,150 (1,155) 778 (377) 7,773 (1,200) (3,914) (150) (200) 161 (5,303) 100 0 (1,736) (1,636) 835 8,484 9,319 8,644 1,285 9,929 1,630 11,559 (2,568) 8,990 (597) 927 330 9,320 (1,200) (2,758) (150) (200) 50 (4,258) 50 (0) (1,736) (1,686) 3,377 9,319 12,695

July 29, 2013

12

Wipro | 1QFY2014 Result Update

Key Ratios

Y/E March Valuation ratio(x) P/E (on FDEPS) P/CEPS P/BVPS Dividend yield (%) EV/Sales EV/EBITDA EV/Total assets Per share data (`) EPS (Fully diluted) Cash EPS Dividend Book value DuPont analysis Tax retention ratio (PAT/PBT) Cost of debt (PBT/EBIT) EBIT margin (EBIT/Sales) Asset turnover ratio (Sales/Assets) Leverage ratio (Assets/Equity) Operating ROE Return ratios (%) RoCE (pre-tax) Angel RoIC RoE Turnover ratios (x) Asset turnover(fixed assets) Receivables days Payable days 0.9 66 71 0.9 69 63 0.9 76 66 0.9 68 66 0.9 69 66 15.5 28.0 22.0 14.7 25.8 19.5 15.9 30.2 21.5 15.3 31.2 20.7 15.1 33.9 19.4 0.8 7.7 0.0 0.8 1.5 22.2 0.8 6.9 0.0 0.9 1.5 19.6 0.8 6.4 0.0 0.9 1.5 21.6 0.8 7.7 0.0 0.8 1.5 20.8 0.8 8.0 0.0 0.8 1.4 19.5 21.7 45.1 6.0 98.0 22.7 48.8 6.0 116.6 24.8 53.0 6.0 115.3 28.3 59.4 6.0 136.5 31.2 66.1 6.0 160.7 17.7 8.5 3.9 1.6 2.7 12.9 2.3 16.9 7.8 3.3 1.6 2.2 11.4 1.9 15.4 7.2 3.3 1.6 2.1 9.6 1.8 13.5 6.4 2.8 1.6 1.8 8.4 1.5 12.3 5.8 2.4 1.6 1.5 6.8 1.2 FY2011 FY2012 FY2013 FY2014E FY2015E

July 29, 2013

13

Wipro | 1QFY2014 Result Update

Research Team Tel: 022 - 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Ltd., its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Ltd. or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Ltd. has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Ltd. endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Ltd. and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Ltd., nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Ltd. and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Wipro No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

July 29, 2013

14

Você também pode gostar

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAinda não há avaliações

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAinda não há avaliações

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAinda não há avaliações

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAinda não há avaliações

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAinda não há avaliações

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 12 2013Documento2 páginasDaily Agri Tech Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAinda não há avaliações

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAinda não há avaliações

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAinda não há avaliações

- Currency Daily Report September 13 2013Documento4 páginasCurrency Daily Report September 13 2013Angel BrokingAinda não há avaliações

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento12 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 12Documento2 páginasMetal and Energy Tech Report Sept 12Angel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 12 2013Documento6 páginasDaily Metals and Energy Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 12 2013Documento9 páginasDaily Agri Report September 12 2013Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Currency Daily Report September 12 2013Documento4 páginasCurrency Daily Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Microsoft Intuit Case SolutionDocumento22 páginasMicrosoft Intuit Case SolutionHamid S. ParwaniAinda não há avaliações

- Common Size Balance SheetDocumento9 páginasCommon Size Balance SheetAditya ChauhanAinda não há avaliações

- Ipca Laboratories (IPCLAB) : Weak Formulation Exports Drag NumbersDocumento14 páginasIpca Laboratories (IPCLAB) : Weak Formulation Exports Drag NumbersManu GuptaAinda não há avaliações

- Equity TrainingDocumento224 páginasEquity TrainingSang Huynh100% (3)

- Understanding The FSDocumento21 páginasUnderstanding The FSDivina Gammoot100% (1)

- Siemens Ar 2011Documento388 páginasSiemens Ar 2011Karol MisztalAinda não há avaliações

- Foxconn Technology Group: Acquiring Sharp To Move Up The Value ChainDocumento12 páginasFoxconn Technology Group: Acquiring Sharp To Move Up The Value ChainnazmiAinda não há avaliações

- European Health Care Corporate Securitisation Undergoing Structural ChangeDocumento8 páginasEuropean Health Care Corporate Securitisation Undergoing Structural ChangejckhouryAinda não há avaliações

- Damodaran - Value CreationDocumento27 páginasDamodaran - Value Creationishuch24Ainda não há avaliações

- QS MbaDocumento222 páginasQS MbaAmaranath MedavarapuAinda não há avaliações

- Roaring Out of RecessionDocumento14 páginasRoaring Out of RecessionJack HuseynliAinda não há avaliações

- Capital Structure Analysis of Indian Oil Corporation Limited Iocl ConverteDocumento25 páginasCapital Structure Analysis of Indian Oil Corporation Limited Iocl ConverteAyush BishtAinda não há avaliações

- Valvoline's 2018 Annual Report PDFDocumento129 páginasValvoline's 2018 Annual Report PDFNeeta SharmaAinda não há avaliações

- KSB Pumps (KSBPUM) : Resounding Topline Growth Instils ConfidenceDocumento11 páginasKSB Pumps (KSBPUM) : Resounding Topline Growth Instils ConfidencedarshanmadeAinda não há avaliações

- BCG (Task 2 Additional Data) - VIPULDocumento13 páginasBCG (Task 2 Additional Data) - VIPULvipul tutejaAinda não há avaliações

- Valuation ALLDocumento107 páginasValuation ALLAman jhaAinda não há avaliações

- Uflex Research ReportDocumento4 páginasUflex Research ReportshahavAinda não há avaliações

- Sensitivity AnalysisDocumento25 páginasSensitivity AnalysisStevenTsaiAinda não há avaliações

- MCQ Test BankDocumento815 páginasMCQ Test Banklorna100% (1)

- Vodafone Annual Report 2019 PDFDocumento256 páginasVodafone Annual Report 2019 PDFMartinaAinda não há avaliações

- PATRIZIA Annual Report EN 2008 PDFDocumento116 páginasPATRIZIA Annual Report EN 2008 PDFRochelle GabianoAinda não há avaliações

- Baskin RobbinsDocumento15 páginasBaskin RobbinsNashrah RafiqueAinda não há avaliações

- How To Hack The StockmarketDocumento56 páginasHow To Hack The Stockmarketgritchard3Ainda não há avaliações

- 2018 Annual Report - Web Version PDFDocumento215 páginas2018 Annual Report - Web Version PDFManoj KumarAinda não há avaliações

- Technip DDR Va Bat Web PDFDocumento266 páginasTechnip DDR Va Bat Web PDFMukhlesur RahmanAinda não há avaliações

- Chapter 2 Financial Statement and Cash Flow AnalysisDocumento15 páginasChapter 2 Financial Statement and Cash Flow AnalysisKapil Singh RautelaAinda não há avaliações

- IATA Economic Performance of The Industry End Year 2017 ReportDocumento6 páginasIATA Economic Performance of The Industry End Year 2017 ReportMae SampangAinda não há avaliações

- Research Report Maruti Suzuki Ltd.Documento8 páginasResearch Report Maruti Suzuki Ltd.Harshavardhan pasupuletiAinda não há avaliações

- Financial Modeling by Corporate BriddgeDocumento55 páginasFinancial Modeling by Corporate BriddgecorporatebridgeAinda não há avaliações

- Clique Pens: The Writing Implements Division of Us HomeDocumento6 páginasClique Pens: The Writing Implements Division of Us HomeDaniel Hanry SitompulAinda não há avaliações