Escolar Documentos

Profissional Documentos

Cultura Documentos

Form 29B - MAT Report Under Sec 115J

Enviado por

Chethan VenkateshTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Form 29B - MAT Report Under Sec 115J

Enviado por

Chethan VenkateshDireitos autorais:

Formatos disponíveis

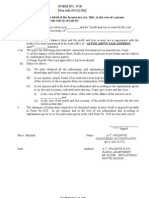

FORM NO.

29B

(See Rule 40B)

Report under section 115JB of the Income-tax Act, 1961 for computing the book profit of the Company 1. We have examined the accounts and records of _______________________ ___________________________________________ (Name and Address of the Assessee with PAN) engaged in the business of _________________ (Nature of Business) in order to arrive at the book profits during the year ended on the 31st March ,___________. (a) *I/We certify that the book profit has been computed in accordance with the provisions of this section. The tax payable under section 115JB of the Income-tax Act in respect of the assessment year ________ is Rs._____________, which has been determined on the basis of the details in Annexure A to this Form.

3. In my/our* opinion and to the best of my/our* knowledge and according to the explanations given to me/us* the particulars given in Annexure A are true and correct. For Chartered Accountants

Date:

PARTNER MM NO.

Notes: 1. *Delete whichever is not applicable 2. 2. This report is to be given by i) a Chartered Accountant within the meaning of the Chartered Accountants Act, 1949 (38 of 1949); or ii) any person, who in relation to any State is, by virtue of the provisions in sub-section (2) of section 226 of the Companies Act, 1956 (1 of 1956), entitled to be appointed to act as an Auditor of Companies registered in that State. 3. Where any of the matter in this report is answered in the negative or with a qualification, the report shall state the reasons therefor.

ANNEXURE A

Details relating to the computation of book profit for the purposes of

section 115JB of the Income

Tax Act, 1961 1. 2. 3. 4. 5. 6. 7. Name of the Assessee Particulars of Address Permanent Account No. Assessment Year Total Income of the Company under Income Tax, Act, 1961 Income Tax payable on total income Whether Profit and Loss Account is prepared in accordance with the provisions of Part II and III of Schedule VI of the Companies Act, 1956 (1 of 1956) Whether the Profit and Loss Account referred to in column 7 above has followed the same accounting policies, accounting standards for preparing the profit and loss account and the same method of rates for calculating depreciation as have been adopted for preparing accounts laid before the Company at its annual general body meeting? If not, the extent and nature of variation be specified : : : : : : :

8.

9. 10.

11.

12.

Net Profit according to Profit & Loss Account referred to in (7) above Amount of net profit as shown in Profit & Loss Account as increased by the amounts referred to in clauses (a)to(f) of Explanation of sub-section (2) of this section (file working separately, where required) The amount as referred to in item 10 as reduced by the amounts referred to in clauses (i) to (vii) of Explanation of subsection(2) of this section (file working separately, where required) Book profit as computed according to Explanation given in sub-section (2) 7.5% of "Book Profit" as computed in 12 above In case of income-tax payable by the Company referred to at Sl.No.6 is less than seven and one-half percent of its book profits shown in column 12, the amount of income-tax payable by the company would be 7.5% of column 12, i.e., as per (13)"

: :

13. 14.

: :

Você também pode gostar

- Income-Tax Rules, 1962: Form No.29BDocumento5 páginasIncome-Tax Rules, 1962: Form No.29Bjack sonAinda não há avaliações

- GN On 115JBDocumento40 páginasGN On 115JBapi-3828505100% (1)

- Minimum Alternate TaxDocumento8 páginasMinimum Alternate Taxjainrahul234Ainda não há avaliações

- Payment of Bonus RulesDocumento7 páginasPayment of Bonus RulesvkpamulapatiAinda não há avaliações

- FORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1Documento26 páginasFORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1S Kumar SharmaAinda não há avaliações

- Sales Tax Special Withholding Rules 2010Documento9 páginasSales Tax Special Withholding Rules 2010Shayan Ahmad QureshiAinda não há avaliações

- Form 3cb ExcelDocumento4 páginasForm 3cb ExcelRashmeet Kaur BangaAinda não há avaliações

- Form No. 10ccaa: (Now Redundant) Audit Report Under Section 80HHBA of The Income-Tax Act, 1961Documento1 páginaForm No. 10ccaa: (Now Redundant) Audit Report Under Section 80HHBA of The Income-Tax Act, 1961busuuuAinda não há avaliações

- Supplementary Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961Documento38 páginasSupplementary Guidance Note On Tax Audit Under Section 44AB of The Income-Tax Act, 1961Honey AgarwalAinda não há avaliações

- Sales Tax Special Procedure (Withholding) Rules, PDFDocumento6 páginasSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasAinda não há avaliações

- Finance Act, 2010 Effective From 1-4-2010Documento29 páginasFinance Act, 2010 Effective From 1-4-2010Nilu AhujaAinda não há avaliações

- Finance Act 2012Documento98 páginasFinance Act 2012Rishav SinghAinda não há avaliações

- Created By-Linesh Patil: Rates of Income-Tax Income-Tax. 2Documento13 páginasCreated By-Linesh Patil: Rates of Income-Tax Income-Tax. 2aman_aroraAinda não há avaliações

- SEMINAR ON TAX AUDITDocumento59 páginasSEMINAR ON TAX AUDITMahendra Kumar SoniAinda não há avaliações

- Finance ActDocumento56 páginasFinance ActRajesh MittalAinda não há avaliações

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocumento4 páginasForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdAinda não há avaliações

- Financeact 2009Documento44 páginasFinanceact 2009Sanjay AjudiaAinda não há avaliações

- Ruling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentDocumento31 páginasRuling: Before The Authority For Advance Rulings (Income Tax) New Delhi PresentSushil GuptaAinda não há avaliações

- Tax Audit - Sec.44abDocumento82 páginasTax Audit - Sec.44absathya300Ainda não há avaliações

- Finance Act 2013Documento63 páginasFinance Act 2013sdaac1Ainda não há avaliações

- 3CD Ready ReckonerDocumento39 páginas3CD Ready ReckonerTaxation TaxAinda não há avaliações

- New Form 15G Form 15H PDFDocumento6 páginasNew Form 15G Form 15H PDFdevender143Ainda não há avaliações

- WH Rules ST 1990Documento8 páginasWH Rules ST 1990arslan0989Ainda não há avaliações

- Income Tax Amendment Draft Bill 2016Documento10 páginasIncome Tax Amendment Draft Bill 2016Muhammad KashifAinda não há avaliações

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Documento6 páginasGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuAinda não há avaliações

- Form No. 3CD Format in ExcelDocumento41 páginasForm No. 3CD Format in ExcelranjitAinda não há avaliações

- Form 10 CDocumento1 páginaForm 10 CPulkit DhingraAinda não há avaliações

- Income Tax Cia 2 Differences in Financial Bill of 2009 and 2011Documento7 páginasIncome Tax Cia 2 Differences in Financial Bill of 2009 and 2011karandutt69Ainda não há avaliações

- InformationBookletonAIR 11072008Documento13 páginasInformationBookletonAIR 11072008Santhosh Kumar BaswaAinda não há avaliações

- Allocable Surplus and Available SurplusDocumento1 páginaAllocable Surplus and Available SurplusRukhsar Khatun0% (1)

- 2007 Sro 660Documento5 páginas2007 Sro 660Haseeb JavidAinda não há avaliações

- All About GST Annual ReturnsDocumento9 páginasAll About GST Annual ReturnsinfoAinda não há avaliações

- Chapter 2Documento9 páginasChapter 2Paym entAinda não há avaliações

- Sample SMRDocumento3 páginasSample SMRArjam B. BonsucanAinda não há avaliações

- ESI Form 5 - Half Yearly ReturnDocumento6 páginasESI Form 5 - Half Yearly ReturnAshim Agarwal100% (1)

- The Finance Bill, 2013Documento5 páginasThe Finance Bill, 2013vickytatkareAinda não há avaliações

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Documento3 páginasLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Ainda não há avaliações

- Reply For Hashim KhanDocumento2 páginasReply For Hashim Khanhamza awan0% (1)

- Finance Bill 2013Documento45 páginasFinance Bill 2013hit2011Ainda não há avaliações

- Creating Tax InvoicesDocumento29 páginasCreating Tax Invoicesvenkat chowdary bikkiAinda não há avaliações

- National Assembly passes tax amendment billDocumento11 páginasNational Assembly passes tax amendment billMuhammad Hassan AliAinda não há avaliações

- Audit under Fiscal Laws: Key SectionsDocumento17 páginasAudit under Fiscal Laws: Key SectionsabhiAinda não há avaliações

- Minimum Alternate Tax (MAT) - Section 115JB - Income Tax Act 1961 - Taxguru - inDocumento6 páginasMinimum Alternate Tax (MAT) - Section 115JB - Income Tax Act 1961 - Taxguru - inRohit SinghAinda não há avaliações

- PASEO REALTY Vs CA Part 4Documento3 páginasPASEO REALTY Vs CA Part 4SabjornAinda não há avaliações

- AY 2005-06 Saral Form 2DDocumento2 páginasAY 2005-06 Saral Form 2DVinod VarmaAinda não há avaliações

- New VAT Audit FormatDocumento12 páginasNew VAT Audit FormatparulshinyAinda não há avaliações

- Form No. 3Cb (See Rule 6G (1) (B) )Documento12 páginasForm No. 3Cb (See Rule 6G (1) (B) )Jay MogradiaAinda não há avaliações

- How To Prepare Final Accounts of Public Limited CompaniesDocumento37 páginasHow To Prepare Final Accounts of Public Limited CompaniesKNOWLEDGE CREATORSAinda não há avaliações

- Income Not Part of Total Income Full NotesDocumento93 páginasIncome Not Part of Total Income Full NotesCA Rishabh DaiyaAinda não há avaliações

- Guidance Note On Tax Audit-Exposure DraftDocumento248 páginasGuidance Note On Tax Audit-Exposure DraftPiyush KumarAinda não há avaliações

- Form No. 10da: Report Under Section 80JJAA of The Income-Tax Act, 1961Documento2 páginasForm No. 10da: Report Under Section 80JJAA of The Income-Tax Act, 1961rajdeeppawarAinda não há avaliações

- Income Tax Refund RulesDocumento2 páginasIncome Tax Refund RulesAvinash KumarAinda não há avaliações

- Audit Project TAX AUDITDocumento34 páginasAudit Project TAX AUDITkhairejoAinda não há avaliações

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24No EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24Ainda não há avaliações

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23Ainda não há avaliações

- Salient Features of GNDocumento10 páginasSalient Features of GNChethan VenkateshAinda não há avaliações

- TDS ProceduresDocumento3 páginasTDS ProceduresChethan VenkateshAinda não há avaliações

- Interview ImpDocumento2 páginasInterview ImpChethan VenkateshAinda não há avaliações

- NWCDocumento2 páginasNWCChethan VenkateshAinda não há avaliações

- Interview ImpDocumento2 páginasInterview ImpChethan VenkateshAinda não há avaliações

- NWCDocumento2 páginasNWCChethan VenkateshAinda não há avaliações

- Professional Opportunities For CAsDocumento14 páginasProfessional Opportunities For CAsChethan VenkateshAinda não há avaliações

- Bangalore Vat OfficesDocumento5 páginasBangalore Vat OfficesChethan VenkateshAinda não há avaliações

- Project Report and AppraisalDocumento26 páginasProject Report and AppraisalChethan VenkateshAinda não há avaliações

- Notes On Accounts: The Braithwaite Burn and Jessop Construction Co. LTDDocumento3 páginasNotes On Accounts: The Braithwaite Burn and Jessop Construction Co. LTDChethan VenkateshAinda não há avaliações

- 06 MPBF PDFDocumento3 páginas06 MPBF PDFMayank JainAinda não há avaliações

- 21 04 10Documento17 páginas21 04 10Chethan VenkateshAinda não há avaliações

- Caro - IcaiDocumento202 páginasCaro - IcaiChethan VenkateshAinda não há avaliações

- Itx 12 2013Documento3 páginasItx 12 2013Chethan VenkateshAinda não há avaliações

- Finance Syllabus Includes Accounting, Tax, Costing, ManagementDocumento1 páginaFinance Syllabus Includes Accounting, Tax, Costing, ManagementChethan VenkateshAinda não há avaliações

- Form 10GDocumento3 páginasForm 10GChethan VenkateshAinda não há avaliações

- Official BSNL Landline Closure FormDocumento1 páginaOfficial BSNL Landline Closure FormShashank Kumar75% (4)

- Candidate Application Form - KPMGDocumento6 páginasCandidate Application Form - KPMGChethan VenkateshAinda não há avaliações

- 50 Common Interview Questions and Answers: 1. Tell Me About YourselfDocumento7 páginas50 Common Interview Questions and Answers: 1. Tell Me About YourselfChethan VenkateshAinda não há avaliações

- AOA FOrmat - Public Limited CompanyDocumento10 páginasAOA FOrmat - Public Limited CompanyChethan VenkateshAinda não há avaliações

- Service Tax AmendmentDocumento3 páginasService Tax AmendmentChethan VenkateshAinda não há avaliações

- Issues in Tax AuditDocumento15 páginasIssues in Tax AuditChethan VenkateshAinda não há avaliações

- Service Tax AmendmentDocumento3 páginasService Tax AmendmentChethan VenkateshAinda não há avaliações

- RD Financial Audit RepresentationDocumento5 páginasRD Financial Audit RepresentationChethan VenkateshAinda não há avaliações

- 35 SampleDocumento13 páginas35 SampleChethan VenkateshAinda não há avaliações

- Form 29B - MAT Report Under Sec 115JDocumento4 páginasForm 29B - MAT Report Under Sec 115JChethan VenkateshAinda não há avaliações

- BdlogDocumento1 páginaBdlogChethan VenkateshAinda não há avaliações

- 1 Accounting For Mutual FundDocumento1 página1 Accounting For Mutual FundChethan Venkatesh100% (1)

- Variance AnalysisDocumento13 páginasVariance AnalysisRatnesh Singh100% (1)

- Daily Trading Stance - 2010-01-11Documento3 páginasDaily Trading Stance - 2010-01-11Trading FloorAinda não há avaliações

- National Bank of Romania Versus European Central Bank: Popescu IonuțDocumento9 páginasNational Bank of Romania Versus European Central Bank: Popescu IonuțAdina Cosmina PopescuAinda não há avaliações

- Understanding Tax Credit CommunitiesDocumento3 páginasUnderstanding Tax Credit CommunitiesJosh KwonAinda não há avaliações

- Fin542 Myr Againts Eur (Group 6 Ba2423d)Documento9 páginasFin542 Myr Againts Eur (Group 6 Ba2423d)NAJWA SYAKIRAH MOHD SHAMSUDDINAinda não há avaliações

- Account Activity SummaryDocumento141 páginasAccount Activity SummaryMOHAMAD IKSAN ABIDINAinda não há avaliações

- Risk and Return - PresentationDocumento75 páginasRisk and Return - PresentationMosezandroAinda não há avaliações

- Apple Inc. 2021 Financial ResultsDocumento2 páginasApple Inc. 2021 Financial ResultsJodie NguyễnAinda não há avaliações

- A Sum of Money Allocated For A Particular Purpose A Summary ofDocumento12 páginasA Sum of Money Allocated For A Particular Purpose A Summary ofsaneshonlineAinda não há avaliações

- Master Budgeting For Bhelpuri - 2019 & 2020: Spring 2021Documento12 páginasMaster Budgeting For Bhelpuri - 2019 & 2020: Spring 2021Amira KarimAinda não há avaliações

- Managerial Accounting II Case Study Analysis Harsh ElectricalsDocumento7 páginasManagerial Accounting II Case Study Analysis Harsh ElectricalsSiddharth GargAinda não há avaliações

- Income Tax Payment Challan: PSID #: 34336315Documento1 páginaIncome Tax Payment Challan: PSID #: 34336315kashif shahzadAinda não há avaliações

- Cash and AccrualDocumento3 páginasCash and AccrualHarvey Dienne Quiambao100% (2)

- Select City Walk (Tarun)Documento15 páginasSelect City Walk (Tarun)Tarun BatraAinda não há avaliações

- AarthiDocumento15 páginasAarthiilkdkAinda não há avaliações

- Asset Liability Management in Banks: Components, Evolution, and Risk ManagementDocumento29 páginasAsset Liability Management in Banks: Components, Evolution, and Risk Managementeknath2000Ainda não há avaliações

- Comparative Study of Non Interest Income of The Indian Banking SectorDocumento30 páginasComparative Study of Non Interest Income of The Indian Banking SectorGaurav Sharma100% (3)

- Sudhanshu IB AssignmentDocumento10 páginasSudhanshu IB AssignmentDevanand PandeyAinda não há avaliações

- Acf305: International Financial and Risk ManagementDocumento22 páginasAcf305: International Financial and Risk ManagementSimon GathuAinda não há avaliações

- Chap 21 - Leasing (PSAK 73) - E12-12Documento27 páginasChap 21 - Leasing (PSAK 73) - E12-12Happy MichaelAinda não há avaliações

- PM Sect B Test 5Documento3 páginasPM Sect B Test 5FarahAin FainAinda não há avaliações

- Annual Report KIJA 2015 56 - 63Documento210 páginasAnnual Report KIJA 2015 56 - 63David Susilo NugrohoAinda não há avaliações

- Final Report Allied BankDocumento70 páginasFinal Report Allied BankIfzal Ahmad100% (6)

- Accounting Notes On LedgersDocumento3 páginasAccounting Notes On LedgersAlisha shenazAinda não há avaliações

- Basic Economics and Indian Economy For Ias Pre ExamDocumento381 páginasBasic Economics and Indian Economy For Ias Pre ExamAshutosh Rai100% (1)

- AKPPJ9368KDocumento2 páginasAKPPJ9368Kvirat kumarAinda não há avaliações

- Accounting CycleDocumento10 páginasAccounting CycleJane VillanuevaAinda não há avaliações

- JPM - Emerging - Markets - Equ - 2021-01-13 - Dividend Plays 2021Documento18 páginasJPM - Emerging - Markets - Equ - 2021-01-13 - Dividend Plays 2021Joyce Dick Lam PoonAinda não há avaliações

- Og 23 1701 1802 00242559Documento7 páginasOg 23 1701 1802 00242559tushar gargAinda não há avaliações

- Capital GainsDocumento25 páginasCapital GainsanonymousAinda não há avaliações