Escolar Documentos

Profissional Documentos

Cultura Documentos

3-Filing of Returns

Enviado por

Imran MemonDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

3-Filing of Returns

Enviado por

Imran MemonDireitos autorais:

Formatos disponíveis

GOVERNMENT OF PUNJAB PUNJAB REVENUE AUTHORITY August 1, 2012 NOTIFICATION (Sales Tax on Services) No. PRA/Orders.

06/2012 (2) In exercise of the powers conferred under section 76 of the Punjab Sales Tax on Services Act 2012 (XLIII of 2012), the Punjab Revenue Authority, with the approval of the Government, is pleased to make the following rules: CHAPTER I PRELIMINARY 1. Short title and commencement. (1) These rules may be cited as the Punjab Sales Tax on Services (Filing of Returns) Rules 2012. (2) They shall come into force at once. CHAPTER II FILING OF RETURNS 2. Filing of return. (1) Every registered person shall file the return as specified in Form PST04, along with all its annexures in accordance with the instructions given in respect thereof. 3. Manual filing of return. (1) The Authority may, in case of any registered person or class of registered persons or in case of any taxable service or services or class of taxable service or services, subject to conditions or otherwise allow manual filing of return. (2) Where the Authority has allowed manual filing of return, it may be delivered either the PRALs counter in the bank or through courier addressed to the Chairperson of the Authority with a clear indication on the right corner of the envelop Punjab Sales Tax on Services Return for the Month of _____, 2012 (year may be changed as and when needed). 4. Electronic filing of return. (1) Unless manual filing of return has been allowed under rule 3, every registered person required to file return, shall file such return along with its annexures electronically in the manner given in these rules. (2) A registered person shall obtain a unique User-ID and password by eenrolling with the Authoritys web portal and electronically file a return (available on the website) from the web portal. (3) The return data shall be filled in a web form and shall be submitted online to the Authority by using e-PRA web portal at https://pra.punjab.gov.pk, where the Authority has provided instructions on how to fill the e-return. (3) The electronic return can be filed by a registered person himself or through an e-intermediary licensed by the Authority. 5. Procedure for e-filing. While filing the return, the registered user shall log on to e-portal of the Authority at https://e.pra.punjab.gov.pk using the assigned user ID and password and follow the stepwise procedure as follows:

select sales tax on services return from declaration menu, select the tax period, month, quarter from the drop down list and click the monthly or quarterly return link to open the return form; (b) return form shall be displayed which shall be filled in accordance with the instructions provided; the taxpayer shall fill out the relevant annexures of the return form by providing the details of invoices, value and the tax charged (the uploading facility for data files is available for all annexures) ; (c) based on the details entered in the relevant annexures of the return, the total values of the main return form shall be auto calculated; the payable tax column shall be showing the tax payable by the registered person; and the registered person shall verify all the details displayed in the prepared return form; and (d) the e-payment challan form PST05 shall be generated automatically from the system after verification of the return prepared by the registered person. 6. Completion of e-filing. E-filing can be completed in the following manner: (a) the user shall fill in all the relevant fields of the return (the return may be saved at any time during preparation process to avoid data loss); (b) the return may be verified by the person to press the Verify button given at the bottom of form; (c) if the registered person needs any alteration in the verified return, user shall press the Un-Verify button given at the bottom of the form having access to Personal Identification Number (PIN) code to make the required changes, and the user shall again press the Verify button given at the bottom of the form for fresh verification; (d) after verifying the return, the registered person shall generate Payment Slip Identifier (PSID) by clicking e-Payment button; (e) the registered person shall present PSID along with payable amount in the designated branch of the National Bank of Pakistan which shall accept the payment and provide Computerized Payment Receipt (CPR) as an acknowledgement; and (f) the CPR data shall be automatically updated within stipulated period in the registered persons e-filing portal and the registered person shall have to press the Confirm button for automatic confirmed addition of the CPR in the system. 7. E-submission of return. After confirmation of CPR under rule 6, the Submit button on return shall be enabled and the registered person shall click the submit button, the system shall require PIN code which shall be entered by the registered person, where after a message shall appear at the top of the screen that your return has been submitted. 8. Amendment in CPR. (1) Where due to any bonafide mistake, any change is required to be made in CPR, the registered person shall apply for correction in CPR to the relevant Commissioner along with following documents: (a) written request on letter head; (b) copy of CNIC;

(a)

(c) copy of TPR (Tax Payment Receipt), if any, and CPR; (d) in case of banks mistake, letter from the bank and affidavit from the person on whose name the payment has been deposited; and (e) for correction of national tax number on CPR, affidavit from the person on whose name the payment has been deposited. (2) The Commissioner shall convey his approval to the authorized functionary of PRAL, who shall: (a) update changes as per approval; (b) maintain record of changes; (c) intimate the applicant and relevant Commissioner; and (d) send summary report to the Authority on monthly basis. 9. Acknowledgment of e-filing. (1) Acknowledgement shall be printed by clicking the Print Acknowledgement button. (2) The submitted return shall also be printed and saved on users computer in PDF format. (3) The registered person shall quote the computer generated number of the e-filing acknowledgement in all his future correspondence with Authority. 10. Security of User ID and password. (1) The responsibility for filing the returns and all the information contained therein is that of the registered person. (2) The registered person shall keep his user ID and Password allotted by the Authority strictly confidential. (3) The electronic tax return and its relevant annexures shall be kept in electronic record of the registered person and shall be produced to the competent authority or officer of the Authority on demand along with supporting documents. 11. Payment of tax. (1) A registered person filing return electronically or otherwise shall make payment of the amount of tax due, if any, in any of the designated branches of the National Bank of Pakistan or any other designated Bank on the prescribed payment challan as specified in Form PST05 or through electronic payment system devised for the purpose. (2) In cases where due date has been prescribed as 15th of a month, the tax due shall be deposited by the 15th and the return may be submitted by 18th of the same month. (3) The registered person having the status of individual or proprietor shall mention his computerized national identity card number in the relevant column of the return. 12. Evidence of input tax invoices or bills. Where the Authority has allowed input tax adjustment in respect of any taxable goods used, utilized or consumed for providing taxable service or services, the registered person shall require to keep record of all relevant invoices or bills as evidence to be produced to the competent officer of the Authority on demand for the purpose of reconciliation or audit to verify the adequacy of the adjustment availed by the registered person. CHAPTER III REVISION OF RETURNS 13. Revised return. Where a registered person needs to revise his return, resulting in payment of tax over the tax already paid on the original return, he

may, without any permission from the Authority or any officer of the Authority, file his revised return and pay the differential amount of tax along with the default surcharge as applicable. 14. Permission for revision of return. The Commissioner shall be competent to allow revision of return not covered under rule 13 and all such permissions for revision of return shall be reported to the Authority on monthly basis in the format showing the name, registration number of the registered person, relevant tax period, revenue (including adjustment) effect of revision and principal reason or reasons of revision. 15. Substitution of return. (1) Where in case of any return or class of returns, the Authority or the Commissioner is of the view that a return has not been filed properly, accurately or completely, the concerned registered person or persons may be called upon and such person or persons shall file a new return in lieu of the return filed previously in such manner and subject to such conditions as it or he may specify in this behalf. (2) Where a new return has been filed under sub-rule (1), the original return shall be deemed to have never been filed except to the extent to which any tax has been paid thereon. (3) Where a new return has been filed under sub-rule (1), no action shall be taken against a registered person on the basis of the previous return for any of the purposes of the Act or rules made thereunder.

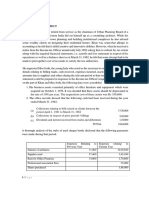

Government of Punjab Punjab Revenue Authority

PST - 04

Rule 2 Name Tax Period

Normal / Amended Submission Date

Sales Tax on Services Return

PSTN

P

Registry

CNIC in case of Individual

COY / AOP / IND

Service Category

Tax Office

Principal Service

Service Code

Description

1 Domestic Purchases excluding fixed assets for providing of service 2 Imports excluding fixed assets (includes value addition tax on commercial imports)

Sales Tax Credits

Value

Annex-A Annex-B

Sales Tax

3 Capital / Fixed Assets (Domestic Purchases & Imports) 4 (-) Non creditable inputs (relating to exempt, non-taxed supplies / rendering of services and relating to services provided in the other jurisdiction and taxed there) Formula : [(1 + 2 + 3) - 4]

5 Input Tax for the month

6 Credit carried forward from previous tax period(s) (determined by the Department where applicable) 7 Sales Tax withheld by the buyer as withholding agent 8 Accumulated Credit

Sales Tax Debits

Formula : (5 + 6 + 7)

Annex-C

9 Services provided / rendered 10 Services Exported 11 Output Tax for the month = (9) 12 Input for the month (admissible under the Rules) 13 Available Balance (Cr or Dr)

Formula : [3+6+[admissible inputs of 1 & 2]-4] (See Notes in Annex-A)

Annex-C Annex-D

Formula : [11-(7 + 12)]

14 Do you want to Carry Forward the Inputs of Capital / Fixed Assets declared at Sr-3 above 15 Sales Tax withheld by the return filer as withholding agent 16 Tax Reverse Charged 17 Sales Tax Payable 18 Refund Claim on Capital / Fixed Assets

Payable / Refundable

Formula : [if 13 > 0 then 13 + 15 otherwise 15]

Yes

No

Annex-A Annex-A

&

Annex-C

Formula : [if 14 = "No" then "Minimum of Fixed Assets and Available Balance" otherwise zero] Formula : [if 13 < 0 and (13 + 18) < 0 then -(13 + 18) otherwise zero] Formula : [if Tax Month = "JUN" and 19 > 0 then 19 otherwise zero] Formula : [if Tax Month = "JUN" then zero otherwise 19]

19 Credit to be carried forward 20 End-of-Year Refund Claim (as determined periodically) 21 Net Credit carried forward 22 Fine / Penalty / Default Surcharge [23 + 24 + 25] 23 24 25 a) Default Surcharge / Others b) Arrears c) Penalty / Fine

26 Total Amount to be Paid

Formula : (17 + 22)

27 Tax paid on normal / previous return (applicable in case of amended return) 28 Balance Tax Payable / (Refundable) 29 Select bank account for receipt of refund

Formula : (26 - 27)

I,

Declaration

, holder of CNIC No.

in my capacity as authorized person do solemnly declare that to the best of my knowledge and belief the information given in this return is / are correct and complete in all respects in accordance with the provisions of applicable law.

Submitted electronically by using User-ID, Password and PIN as electronic signature. Date Head of Account

Headwise Payable

Amount

Paid Amounts

CPR No.

Amount

B - 02382 - Sales Tax on Services B - 02382 - Surcharge / Others B - 02382 - Arrears B - 02382 - Penalty / Fine Total Amount Payable Total Amount Paid (in words):

Total Amount Paid (in figures)

DOMESTIC PURCHASE INVOICES

NTN XXXXXXXX Name of Taxpayer XXXXXXXX Tax Period MMM - YYYY

Annex - A

Sr. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Particulars of Supplier NTN CNIC Name

District of Supplier Typ *

Number

Document Date

HS Code *

Purchase Type

Rate

Value of Purchases Excluding Sales Tax

Sales Tax Involved

ST Withheld as WH Agent

Tax Revenue Charged u/s 4

Summary

Type Taxable Exempt Zero Rate Gross Total Typ => Type of Document Pl = Purchase Invoice CN = Credit Note DN = Debit Note Note : 1) All Purchases shall be recorded by providing either CNIC or NTN 2) Credit of Inputs will only be allowed where purchases are made from sales tax registered person 3) Sales Tax withheld is also made part of this annexure, therefore registered persons are not required to file ST withholding Statement seperately 4) If an invoice contains items pertaining to multiple rates or multiple types / HS-Codes, then multiple rows with same Invoice Type, No. & Date should be written by the taxpayer in this Annexure by providing sales type, rate, value, sales tax and tax withheld seperately 5) If an invoice contains items pertaining to goods and services both, then two separate rows should be used giving details seperately where possible as explained in (4) above otherwise if mixture of goods and services can not be determined then use the type as mixed. 6) Rate wise summary is computed automatically by the system, therefore it is not required to be entered by the taxpayer Value Sales Tax ST Withheld

DETAILS OF IMPORTS

NTN

99999999-9 XXXXXXXX Name of Taxpayer XXXXXXXX

Annex - B

Tax Period

Value Addition Tax on Commercial Imports

MMM - YYYY

Sr.

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Particulars of GD Imports (Found in Customs Data)

Collectorate GD Type GD Number GD Date

Type

Sales Tax Rate

Sales Taxable Value of Imports

Sales Tax Paid at Import Stage

FED Paid at Import Stage

Total Summary

Type Taxable (Excluding Fixed Assets) Fixed Assets Commercial Exempt Sales Taxable Value Sales Tax at Import Stage Value Addition Tax FED Paid at Import Stage

Note

1) Summary is automatically computed by the system, therefore the taxpayer is not required to prepare it

DOMESTIC SALE INVOICES (DSI)

NTN 999999999-9 XXXXXXXX Name of Taxpayer XXXXXXXX Tax Period MMM - YYYY

Annex - C

Particulars of Buyer Sr. NTN 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 CNIC Name

District of Buyer

Buyer Type

Document / Invoice Sale Type Typ * Number Date HS Code * Rate

Value of Sales Excluding Sales Tax

Extra Tax (Under Chapter Sales Tax Involved

XIII of Sales Tax Special Procedures Rules, 2007 of FBR)

ST Withheld at Source

Tax Revenue Charged u/s 4

Summary

1. Buyer Type : End consumer, Intermediary (intermediary is the registered buyer who may take input credit) SI = Sale Invoice, DN = Debit Note, CN = Credit Note Type Sales Made to End Consumers Sales Made to Intermediary Gross Total Value Sales Tax Extra Tax ST Withheld

2. Document Type : 3. HS-Code 4. Sale Type : :

8 - Digits HS-Code as per Pakistan Customs tariff Goods or services

Typ => Type of Document Note :

SI = Sale Invoice

CN = Credit Note

DN = Debit Note

1) All sales shall be recorded by providing either CNIC or NTN of the buyer irrespective of whether sold to a registered person or un-registered person. However, where invoices are issued to an un-registered end-consumers, all the invoices may be grouped by sales type and tax rate and declared in one line with NTN as 9999998-1 2) If an invoice contains items pertaining to multiple rates or multiple types / HS-Codes, then multiple rows with same Invoice Type, No. & Date should be written by the taxpayer in this Annexure by providing sales type, rate, value, sales tax and tax withheld seperately 3) If an invoice contains items pertaining to goods and services both, then two separate rows should be used giving details seperately 4) Rate wise summary is computed automatically by the system, therefore it is not required to be entered by the registered person

EXPORTS DETAILS

NTN

99999999-9 XXXXXXXX Name of Taxpayer XXXXXXXX

Annex - D

Tax Period

Value of Goods Admissible for Refund MATE Receipt No., where applicable

MMM - YYYY

Sr.

Particulars of GD EXPORT (Machine Number)

Collectorate GD Type GD Number GD Date

Value of Exports in Value of Goods Pak Rupees Actually Shipped

Value of Short Shipment

MATE Receipt Date

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Total

Government of Punjab Punjab Revenue Authority Tax Payment Challan Form

Month

PST - 05

Rule 5 (d)

Year

NTN

PSTN P

Tax Period

2 0

Name Address

Service TAX PAYMENTS Head of Account

Service Code

B - 0 2 3 8 2

Sr. 1 2 3 4

Punjab Sales Tax on Services

Amount in Pak Rs.

Description of payment, whichever is applicable Sales tax on services Default Surcharge / Others Arrears Penalty / Fine TOTAL Amount of Payment

Amount in Words Mode & Particulars of Payment Mode of Payment Cheque/Pay Order/Draft No. Bank/Branch Name/City/Br-Code Cash Cheque Pay Order Date Demand Draft

DECLARATION OF DEPOSITOR

I hereby declare that the particulars mentioned in this tax payment challan are correct to the best of my knowledge and belief.

CNIC Name

Date

(DD-MM-YYYY)

Signature of Depositor

Note:

This is an input form and should not be signed/stamped by the Bank. A Computerized Payment Receipt (CPR) should be issued after receipt of payment by the Bank

CHAIRPERSON PUNJAB REVENUE AUTHORITY

Você também pode gostar

- CGT Presentation Updated March 4 2015 WebsiteDocumento27 páginasCGT Presentation Updated March 4 2015 WebsiteImran MemonAinda não há avaliações

- NTN Application1Documento1 páginaNTN Application1Imran MemonAinda não há avaliações

- 2011 PTD (Trib) 1306Documento22 páginas2011 PTD (Trib) 1306Imran Memon100% (1)

- Second ScheduleDocumento7 páginasSecond ScheduleImran MemonAinda não há avaliações

- Annual Employer Statement Import TemplateDocumento6 páginasAnnual Employer Statement Import TemplateTanzeel Ur Rahman GazdarAinda não há avaliações

- The Sindh Finance Bill 2013Documento32 páginasThe Sindh Finance Bill 2013Imran MemonAinda não há avaliações

- The Sindh Finance Bill 2013Documento32 páginasThe Sindh Finance Bill 2013Imran MemonAinda não há avaliações

- XyzDocumento10 páginasXyzImran MemonAinda não há avaliações

- Richard FoltzDocumento2 páginasRichard FoltzImran MemonAinda não há avaliações

- The Butterfly MosqueDocumento3 páginasThe Butterfly MosqueImran MemonAinda não há avaliações

- Winter Clearance 2013Documento18 páginasWinter Clearance 2013Imran MemonAinda não há avaliações

- Owais Ali Khan: Career ObjectiveDocumento2 páginasOwais Ali Khan: Career ObjectiveImran MemonAinda não há avaliações

- Fed CorporateDocumento1 páginaFed CorporateImran MemonAinda não há avaliações

- Bypass Surgery Guide-Final For PrintingDocumento21 páginasBypass Surgery Guide-Final For PrintingImran MemonAinda não há avaliações

- Sorath - Rai - Diyach: Page 1 of 3Documento3 páginasSorath - Rai - Diyach: Page 1 of 3Imran MemonAinda não há avaliações

- CV - Chartered Accountant (Word 2007)Documento2 páginasCV - Chartered Accountant (Word 2007)Imran MemonAinda não há avaliações

- PTCL City Wise Contact Detail For EVO USBDocumento1 páginaPTCL City Wise Contact Detail For EVO USBSandeep Kumar MugriaAinda não há avaliações

- SRB 3 4 15 2011Documento2 páginasSRB 3 4 15 2011Imran MemonAinda não há avaliações

- SRB 3 4 5 471 2011Documento2 páginasSRB 3 4 5 471 2011Imran MemonAinda não há avaliações

- Fasle Ase B Honge by Adem HashmiDocumento63 páginasFasle Ase B Honge by Adem HashmiImran MemonAinda não há avaliações

- 11-Withholding Rules 2012Documento5 páginas11-Withholding Rules 2012Imran MemonAinda não há avaliações

- Restaurant Services Rules 09-10-2012Documento4 páginasRestaurant Services Rules 09-10-2012Imran MemonAinda não há avaliações

- 10-Alternative Dispute ResolutionDocumento3 páginas10-Alternative Dispute ResolutionImran MemonAinda não há avaliações

- 6 Computerized SystemDocumento4 páginas6 Computerized SystemImran MemonAinda não há avaliações

- Government of Punjab Lahore, Dated 2012Documento8 páginasGovernment of Punjab Lahore, Dated 2012Imran MemonAinda não há avaliações

- 7 Authorized RepresentativeDocumento3 páginas7 Authorized RepresentativeImran MemonAinda não há avaliações

- 5 Specific ProvisionsDocumento11 páginas5 Specific ProvisionsImran MemonAinda não há avaliações

- 8 AuditDocumento4 páginas8 AuditImran MemonAinda não há avaliações

- 2 Registration & de RegDocumento8 páginas2 Registration & de RegImran MemonAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- SWOT AnalysisDocumento3 páginasSWOT AnalysisGlydel ReyesAinda não há avaliações

- Gold Mastercard Titanium Mastercard Platinum MastercardDocumento3 páginasGold Mastercard Titanium Mastercard Platinum MastercardRoseyy GalitAinda não há avaliações

- Performance MeasurementDocumento42 páginasPerformance MeasurementSanam Chouhan50% (2)

- Short Term Trading StrategiesDocumento9 páginasShort Term Trading StrategiesMikhail Harris80% (5)

- Introduction To Forex - Forex Made Easy PDFDocumento33 páginasIntroduction To Forex - Forex Made Easy PDFKundan Kadam100% (1)

- Unit 3Documento328 páginasUnit 35pkw48m27cAinda não há avaliações

- Learning Objective 25-1: Chapter 25 Short-Term Business DecisionsDocumento93 páginasLearning Objective 25-1: Chapter 25 Short-Term Business DecisionsMarqaz Marqaz0% (2)

- D081 and C714V2 CASE STUDYDocumento2 páginasD081 and C714V2 CASE STUDYsteve mwasAinda não há avaliações

- Forms and Activities of BusinessDocumento45 páginasForms and Activities of Businessandrea jane hinaAinda não há avaliações

- Management In: Verification NeededDocumento12 páginasManagement In: Verification NeededLakshanmayaAinda não há avaliações

- Journalizing TransactionsDocumento38 páginasJournalizing TransactionsPratyush mishraAinda não há avaliações

- Introduction To BankDocumento10 páginasIntroduction To BankRavi Kashyap506100% (3)

- Week 4 - Module (Trade Discount)Documento8 páginasWeek 4 - Module (Trade Discount)Angelica perezAinda não há avaliações

- Banking Project (Section-2) Jhanvi Kankaliya AU1712050 Topic-2 Types of Deposits With FeaturesDocumento4 páginasBanking Project (Section-2) Jhanvi Kankaliya AU1712050 Topic-2 Types of Deposits With FeaturesJhanvi KankaliyaAinda não há avaliações

- Latif Khan PDFDocumento2 páginasLatif Khan PDFGaurav AroraAinda não há avaliações

- Tom Brass Unfree Labour As Primitive AcumulationDocumento16 páginasTom Brass Unfree Labour As Primitive AcumulationMauro FazziniAinda não há avaliações

- Standard Project Execution Plan PEP TemplateDocumento35 páginasStandard Project Execution Plan PEP TemplateecaterinaAinda não há avaliações

- Ipo DocumentDocumento16 páginasIpo Documentalan ruzarioAinda não há avaliações

- Universal Life Loans and SurrendersDocumento12 páginasUniversal Life Loans and SurrendersZaher RedaAinda não há avaliações

- IPR FormDocumento1 páginaIPR FormJyoti PrakashAinda não há avaliações

- TCS-Recruitment and SelectionDocumento17 páginasTCS-Recruitment and SelectionChirag PatelAinda não há avaliações

- Congruence Model: Submitted By-SyndicateDocumento9 páginasCongruence Model: Submitted By-SyndicateKrishnakant NeekhraAinda não há avaliações

- SM - Competitive StrategyDocumento31 páginasSM - Competitive StrategygaganAinda não há avaliações

- Foreign Exchange Rate MarketDocumento92 páginasForeign Exchange Rate Marketamubine100% (1)

- (Reyes) Portal of Installment LiquidationDocumento16 páginas(Reyes) Portal of Installment LiquidationChe NelynAinda não há avaliações

- Capacity Development AgendaDocumento7 páginasCapacity Development AgendaApple PoyeeAinda não há avaliações

- Dr. Reddy CaseDocumento1 páginaDr. Reddy Caseyogesh jangaliAinda não há avaliações

- Development AdministrationDocumento3 páginasDevelopment AdministrationJean Aspiras WongAinda não há avaliações

- KudumbashreeDocumento12 páginasKudumbashreeamarsxcran100% (1)

- Mah Sing Group Berhad Annual Report 2018 Part 2 PDFDocumento211 páginasMah Sing Group Berhad Annual Report 2018 Part 2 PDFCheong Wei HaoAinda não há avaliações