Escolar Documentos

Profissional Documentos

Cultura Documentos

Expansion of The Media Industry in India

Enviado por

jhashailenderDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Expansion of The Media Industry in India

Enviado por

jhashailenderDireitos autorais:

Formatos disponíveis

1249

INDUSTRY SPECIFIC

Expansion of the Media Industry in India

Rapid economic growth and FDI has resulted in huge growth of media industry in India. The industry is benefited from the favourable laws and liberation of the market. The growth of media market led to the high competition but still there is scope for new companies to enter and existing companies to expand. This is also creating many opportunities and scope for the consumers, investors and related professionals. Read on

In post-independence era media had huge role to play towards the development of society in India. In 1947 when India attained independence, the country was facing many socio-political-economic challenges. Therefore, at that time medias role towards society was highly critical and challenging. The main goals set by the government for media to perform were to inform and educate the Indian population. During that period print media was flourishing as it contributed a lot in the freedom struggle. However, the reach of this medium was very limited because the literacy rate of India was very low. As opposed to this, boom came in broadcasting in 1980s when television made a grand entry to the media market. The medium was controlled by the government body, Doordarshan, unlike newspapers which have been owned by the private organisations. Since then media market has witnessed massive growth in its every sector.

Dr. Harendra Kumar (The author can be reached at doctor.harendra@gmail.com)

THE CHARTERED ACCOUNTANT

february

2012

117

INDUSTRY SPECIFIC

1250

n the basis of languages, media can be divided into three broad categories: English language media, Hindi language media and regional language media. Recent years have seen a big growth of regional language channels and newspapers over English and Hindi languages media. For example, especially in South India local audience is serviced by local media produced by local companies, like Sun TV, Manorama, etc.

Features of Indian Media Market Before moving on to the analysis of market growth in India, let us see the characteristics of Indian media market. 1. Competition effecting content of programmes: The kind of commercial growth an Indian media market is experiencing is affecting the quality of the content. Commercialisation is overpowering the content of the programmes. Many big companies are competing for advertisers and audience attention. Therefore, media market in India has become more price-oriented than content-oriented. It is also affecting the overall taste of the audience. 2. Private Ownership: Majority of media organisations are owned by the private entrepreneurs. Major companies and families have invested in these media organisations. Although, recent years have seen the small investors investing in media, but their investments are limited to subsidiaries and these are not into the group holding companies. 3. Cross Media Ownership: As we know that for many decades newspapers had strong hold on the media market. Therefore, when government monopoly broke down over broadcasting media and many private entrepreneurs entered this sector, many of them were well established in print media sector. For example Aaj Tak news channel belongs to India Today Group, a leading media company which publishes well known India Today magazine. Similarly, Radio Mirchi is owned by the Entertainment Network India Ltd. (ENIL), which is one of the subsidiaries of The Times Group. This represents the relatively young nature of the Indian media sector. However, we are likely to see increasing specialisation as competition intensifies and the media industry matures. On the other hand, Government is planning to restrict the cross media ownership as part of the Broadcast Services Regulation Bill (which has been debated in Parliament). 4. Transparency in Media Regulation: Two main

divisions of the Government, Ministry of Information & Broadcasting and Telecom Regulatory Authority of India keeps an eye on the media sector. In India, especially the editorial enjoys the freedom of expression. The policies and regulation set by these regulatory bodies can be challenged in court. 5. Foreign Direct Investment: Many foreign companies have been investing in media organisations as a joint venture or as partnership or as a direct investment. In the era of preliberalisation, the role of foreign investment in India was very limited. However, post-liberalisation the 1980s onward and softness of Indian government on foreign investors drastically changed the face of India media industry. Currently nearly 74% of FDI is allowed in telecommunication whereas 100% is allowed in the Internet. If we largely talk about media market then news programmes has 26%, in radio FM has 20% and similarly DTH too has 20% of FDI and cable can have around 49% of FDI. 6. Transparent regulatory policies: In India there are many policies which regulate the working of media to make it more responsible towards society. Especially print media is bound by regulations. In broadcasting sector, Doordarshan and All India Radio have to follow broadcasting codes or guidelines which have been set by the Government. 7. Regional & cultural diversity in media: On the basis of languages, media can be divided into three broad categories: English language media, Hindi language media and regional language media. Recent years have seen a big growth of regional language channels and newspapers over English and Hindi languages media. For example, especially in South India local audience is serviced by local media produced by local companies, like Sun TV, Manorama, etc. These characteristics of Indian media market distinguish it from rest of the world. The kind of investment being put into the media market is creating lots of possibilities and opportunities for further growth. The upswing of the media market has resulted in new trends in media and entertainment sector. Some of these are as follows: (a) Expansion of mobile phones as entertainment channel: Mobile manufacturing companies are incorporating many entertainment modes in mobile set like radio, games, movie players, Internet, etc. These features have made it a mobile medium of communication. This has also led to easy access to information by the consumer.

118

THE CHARTERED ACCOUNTANT

february

2012

1251

INDUSTRY SPECIFIC

(b) Convergence: The expansion of media industry has increased the consumer expectations. The convergence means merging many mediums of mass communication into one. Communication distributors like DTH (direct-to-home), CAS (Conditional Access System) and IPTV (Internet Protocol television) have merged radio, TV and Internet into single signal. Recent examples of convergent service include: Services delivered to TV sets via system like Web TV, Email and World Wide Web access via digital TV decoders and mobile telephones and using Internet for voice telephony. The Share of Different Media Sectors in India

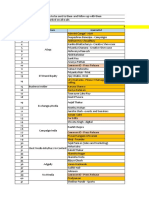

46% and is most dominating sector in media. Following it is print sector with 28% and then film sector with 16%. These three sectors have been dominating the Indian media industry for decades. The other sectors like radio, online/Internet, OOH, animation, gaming & VFX and music have relatively low share in market with 2%, 1%, 2%, 4% and 1% respectively. Indias Place in Global E&M Market

Countries India China Japan US 2005 8,746 41,297 150,975 433,842 2006 10,503 47,245 160,716 454,572 2007 12,401 57,496 166,999 469,096 2008 13,616 69,166 169,298 460,997 2009 14,052 75,815 164,337 428,140

All figures are in USD millions Source: PwC Global E&M outlook 2010

Source: PwC Analysis and Industry Estimates

The above pie chart shows the breakup of the E&M (Entertainment & Media) market in India. The figure clearly shows the television has the greatest share of

The figures indicate the position of Indian media market as compared to other countries. In comparison to countries like China and Japan, the Indian market is quite small. Advertisement as a percentage of the GDP in India is only 0.53% as compared to 1.08% for developed countries like US and 0.90% for Japan. These figures show that there is still a lot of scope for growth in Indian media industry.

THE CHARTERED ACCOUNTANT

february

2012

119

INDUSTRY SPECIFIC

1252

elevision industry is the most dominated sector in media industry and projected to continue to be the major contributor in the industry. It has been estimated that the television sector will grow at a healthy rate of 13.0% cumulatively over the next coming years, from an estimated R307 billion at a CAGR of 15.6% in 2010. The overall television sector is estimated to reach R488 billion by 2014.

The Growth of Media Industry in India The Indian Entertainment and Media market is estimated to grow from estimated R 668.8 billion in 2010 to reach R1040.8 billion in 2014. Let us see the sector wise projected growth of various industries in media markets. a. Television Industry: Television industry is the most dominated sector in media industry and projected to continue to be the major contributor in the industry. It has been estimated that the television sector will grow at a healthy rate of 13.0% cumulatively over the next coming years, from an estimated R307 billion at a Compound Annual Growth Rate (CAGR) of 15.6% in 2010. The overall television sector is estimated to reach R488 billion by 2014. b. The Indian Film Industry: The film industry in India is estimated to grow at CAGR of 12.4%, reaching to R170.5 billion by 2014 from the R114.5 billion, at a CAGR of 20.5%. However, particularly this sector has experienced the downturn in 2009 due to the strike in multiplexes and economic recession. c. Print Media Industry in India: The second most dominating sector in media industry is print media. The sector is projected to grow by 7.4% over the period 2010-2014, reaching to R230.5 billion in 2014. d. Indian Radio Industry: Though the share of radio in media market is small as compared to television, film and print sector yet it has shown the good growth in the market. The industry is estimated to grow at a CAGR of 12.2%, reaching R16 billion in 2014 from the estimated R10 billion in 2010. In advertisement share it is projected that radio advertisement share will grow from 4.2% to 4.3% in the coming years. e. The Animation and Gaming Sector in India: It is worth noticing that many international production houses in the field of animation

are dependent on Indian animation industry. This dependency will help the Indian animation sector to grow at a faster rate. The sector is estimated to grow at a CAGR of 25.2% reaching to R73.4 billion in 2014. The Gaming industry will grow to an estimated R19.4 billion by 2014 from R5.3 billion in 2009. f. OOH: Out of Home advertisement was the worst hit industry in 2009 due to the economic recession faced by the country. However, the industry has rebounded with the use of digital technologies and tools. The estimated size of OOH sector was R12.5 billion in 2009 and its projected growth is at a CAGR of 11.0%, reaching R21 billion in 2014. g. Music Industry: The predictions say that music industry is expected to be the fastest growing segment in E&M industry. It has been estimated that Indian music industry would grow to R26.5 billion in 2014 with a 29% of CAGR. However, this industry has been facing lots of challenges out of which piracy is the biggest threat to the growth of the music industry. The other challenges are acquisition rights and the cost of music royalty. Conclusion Rapid economic growth and FDI has resulted in very big growth of media industry in India. The industry is benefited from the favourable laws and liberation of the market. The growth of media market led to the high competition but still there is scope for new companies to enter and existing companies to expand. This is also creating many opportunities and scope for the consumers, investors and related professionals.

References:

Srinivas, Lakshmi, Media, Culture and Society, New Delhi: SAGE Publication, 2002, Vol. 24 pp. 155-173 V.K. Natraj: Economics Through Journalism in 21st Century Journalism in India: New Delhi: Sage Publication Pvt. Ltd., 2007: Part II, Ch. 8, pp. 123-131 Krushna Singh Padhy: The Press in India-Perspective in development & relevance: New Delhi: Kanishka Publishers, 1997 Robin Jeffery: Indias Newspaper Revolution-Capitalism, Politics & the Indian-Language Press 1977-1999: New York, USA: St. Martins Press,2000 V.S. Gupta, Rajeshwar Dyal: Media and Market Forces Challengers & Opportunities: New Delhi: Concept Publishing Company, 1998 Om Gupta: The Prasar Bharti (Broadcasting Cooperation of India) Act, 1990 in Encyclopaedia of Journalism & Mass Communication, New Delhi: Isha Books, 2006, Ch.11, pp. 250-280 n

120

THE CHARTERED ACCOUNTANT

february

2012

Você também pode gostar

- (2008) The Arts of The Muslim HausaDocumento5 páginas(2008) The Arts of The Muslim HausaAwalludin RamleeAinda não há avaliações

- David W. Ames - Igbo and Hausa Musicians (A Comparative Examination)Documento30 páginasDavid W. Ames - Igbo and Hausa Musicians (A Comparative Examination)OmenigboAinda não há avaliações

- Robes of SokotoDocumento11 páginasRobes of SokotoattahiruAinda não há avaliações

- Decoding Millennials in NigeriaDocumento24 páginasDecoding Millennials in NigeriaDonnie FranklinAinda não há avaliações

- Trafficking Nigeria-ItalyDocumento121 páginasTrafficking Nigeria-ItalypaulmazziottaAinda não há avaliações

- Anathomy of The CrisisDocumento14 páginasAnathomy of The CrisisKat GómezAinda não há avaliações

- 11 History of Cartography s12Documento77 páginas11 History of Cartography s12Jamer CostaAinda não há avaliações

- Media in Northern NigeriaDocumento17 páginasMedia in Northern NigeriawhatsupjasonAinda não há avaliações

- What Is Present What Is Visible The Photo Portraits of The 43 Disappeared Students of Ayotzinapa As Positive Social AgencyDocumento21 páginasWhat Is Present What Is Visible The Photo Portraits of The 43 Disappeared Students of Ayotzinapa As Positive Social AgencyRoberto Cruz ArzabalAinda não há avaliações

- Nigerian Patriarchy PDFDocumento13 páginasNigerian Patriarchy PDFDaniel Obasooto100% (1)

- Arabic Literacy Tradition of NigeriaDocumento15 páginasArabic Literacy Tradition of NigeriaattahiruAinda não há avaliações

- Green Buildings For NigeriaDocumento31 páginasGreen Buildings For NigeriaComprehensiveAinda não há avaliações

- Nolly Silver Screen Issue 04 May 2014Documento16 páginasNolly Silver Screen Issue 04 May 2014NollySilverScreenAinda não há avaliações

- Health and The Holy in African and Afro-American Spirit Possession - 000Documento11 páginasHealth and The Holy in African and Afro-American Spirit Possession - 000HersonAinda não há avaliações

- Hausa Hand-Embroidery and Local Development in Northern NigeriaDocumento12 páginasHausa Hand-Embroidery and Local Development in Northern NigeriamoussaAinda não há avaliações

- Okwui Enwezor Modernity and Post Colonial AmbivalenceDocumento15 páginasOkwui Enwezor Modernity and Post Colonial AmbivalenceMERODENE100% (1)

- When Does A Settler Become A Native?Documento12 páginasWhen Does A Settler Become A Native?Augen BlickAinda não há avaliações

- New African List of Most Influential Africans of 2014Documento44 páginasNew African List of Most Influential Africans of 2014Business Daily ZimbabweAinda não há avaliações

- Dance As Art and AestheticsDocumento13 páginasDance As Art and AestheticsSharlee Eby PeayAinda não há avaliações

- Return - The Photographic Archive and Technologies of Indigenous MemoryDocumento16 páginasReturn - The Photographic Archive and Technologies of Indigenous MemorySbarantAinda não há avaliações

- Kurfi HistoryDocumento61 páginasKurfi HistoryUnisoft Global Concept UGC100% (1)

- History of IgbolandDocumento10 páginasHistory of IgbolandAdediran DolapoAinda não há avaliações

- Uganda Audio Visual Content Strategy 2020 / 2025Documento86 páginasUganda Audio Visual Content Strategy 2020 / 2025Diana Nabukenya KattoAinda não há avaliações

- Muhammad: A Legacy of A Prophet (The Script of The Documentary)Documento61 páginasMuhammad: A Legacy of A Prophet (The Script of The Documentary)Catism100% (3)

- Business PlanDocumento16 páginasBusiness PlanItunu Adeyemo100% (1)

- Internal Migration NigeriaDocumento102 páginasInternal Migration NigeriaMohamed BedrouniAinda não há avaliações

- August MagazineDocumento61 páginasAugust MagazineTHE NEW AFRICA MAGAZINE100% (1)

- India vs. China EconomyDocumento15 páginasIndia vs. China EconomyInder TyagiAinda não há avaliações

- Culture Vulture Issue 05 Luxury - TO VIEWDocumento31 páginasCulture Vulture Issue 05 Luxury - TO VIEWDanz HolandezAinda não há avaliações

- Solar Lighting in Emerging MarketsDocumento80 páginasSolar Lighting in Emerging MarketsInternational Finance Corporation (IFC)Ainda não há avaliações

- Nigeria: Onitsha Urban ProfileDocumento40 páginasNigeria: Onitsha Urban ProfileUnited Nations Human Settlements Programme (UN-HABITAT)Ainda não há avaliações

- Igbo Metaphysics in Chinua AchebeDocumento7 páginasIgbo Metaphysics in Chinua AchebeEsùgbamíWilsonÌrosòOgbèAinda não há avaliações

- Nigeria LivestockDocumento12 páginasNigeria LivestockVivek SharmaAinda não há avaliações

- Cultural Times: The First Global Map of Cultural and Creative IndustriesDocumento120 páginasCultural Times: The First Global Map of Cultural and Creative IndustriesFacundo AlvarezAinda não há avaliações

- Cinema Operator Industry Report May 2014Documento27 páginasCinema Operator Industry Report May 2014Abhishek Kumar Singh100% (1)

- Reconceptualizing The Industrial Revolution: Jeff Horn, Leonard N. Rosenband, and Merritt Roe SmithDocumento367 páginasReconceptualizing The Industrial Revolution: Jeff Horn, Leonard N. Rosenband, and Merritt Roe SmithPacAinda não há avaliações

- Economic Success Story South Korean WayDocumento12 páginasEconomic Success Story South Korean WayadaAinda não há avaliações

- Research Methods For Management PDFDocumento176 páginasResearch Methods For Management PDFVARBAL0% (1)

- Trends in Audiovisual Markets. Regional Perspectives From The South - Television, Cinema, Music. UNESCODocumento364 páginasTrends in Audiovisual Markets. Regional Perspectives From The South - Television, Cinema, Music. UNESCOShalo SmithAinda não há avaliações

- The Forgotten VictimsDocumento18 páginasThe Forgotten VictimsMu'az ObadakiAinda não há avaliações

- Null PDFDocumento241 páginasNull PDFPakdhe GustiAinda não há avaliações

- The Black Box of Nigeria's Politics - Pastor Tunde Bakare (Oct. 2021)Documento34 páginasThe Black Box of Nigeria's Politics - Pastor Tunde Bakare (Oct. 2021)Tunde Bakare100% (1)

- India Poverty Report 2011Documento296 páginasIndia Poverty Report 2011Raghu KvAinda não há avaliações

- Case Study Kano Town NigeriaDocumento80 páginasCase Study Kano Town NigeriacurlyjockeyAinda não há avaliações

- PDFDocumento335 páginasPDFghalib86Ainda não há avaliações

- Fulani Oligarchy and The Death of Bola IgeDocumento17 páginasFulani Oligarchy and The Death of Bola Igeneirotsih100% (3)

- CFR - Africa Task Force WebDocumento174 páginasCFR - Africa Task Force WebMrkva2000 account!100% (1)

- Lobato - Creative Industries and Informal Economies Lessons From NollywoodDocumento18 páginasLobato - Creative Industries and Informal Economies Lessons From NollywoodMoreira FocnaAinda não há avaliações

- Ba Thesis 2010 - Life of Walin Katsina Bello KagaraDocumento82 páginasBa Thesis 2010 - Life of Walin Katsina Bello Kagarabello imam100% (1)

- Galina M. Yemelianova - Radical Islam in The Former Soviet UnionDocumento300 páginasGalina M. Yemelianova - Radical Islam in The Former Soviet UnionluizAinda não há avaliações

- 16 Common Uses of SilverDocumento6 páginas16 Common Uses of SilverborgiamatriceAinda não há avaliações

- Paulo Coelho - ZahirDocumento356 páginasPaulo Coelho - ZahirEchipa Allmountain0% (1)

- Africa in The World:: Historical PerspectivesDocumento110 páginasAfrica in The World:: Historical PerspectivesLebohang MalauAinda não há avaliações

- Samsung Electronics: From National Champion' To Global Leader'Documento2 páginasSamsung Electronics: From National Champion' To Global Leader'With PM MeetingAinda não há avaliações

- MBA Project - Big CinemasDocumento85 páginasMBA Project - Big CinemasSwasthik Shetty67% (6)

- Industrial Ion ModelDocumento22 páginasIndustrial Ion ModelSruti BhaskarAinda não há avaliações

- Brief HistoryDocumento5 páginasBrief History2022-24 KRITIKA SHARMAAinda não há avaliações

- Radio AnalysisDocumento86 páginasRadio AnalysisHemang Aggarwal0% (1)

- GauravDocumento83 páginasGauravDharmesh GuptaAinda não há avaliações

- Entertainment Industry in India: Swot AnalysisDocumento8 páginasEntertainment Industry in India: Swot AnalysisShwetank RanjanAinda não há avaliações

- A&M Trade Media SR No Publications Journalist: OrangeDocumento6 páginasA&M Trade Media SR No Publications Journalist: OrangejhashailenderAinda não há avaliações

- Agri N Commodities Media ListDocumento6 páginasAgri N Commodities Media ListjhashailenderAinda não há avaliações

- Aie Asia PressDocumento4 páginasAie Asia PressjhashailenderAinda não há avaliações

- All India Pin CodeDocumento1.851 páginasAll India Pin CodeS C Gaur82% (11)

- Media Delegates - BangladeshDocumento1 páginaMedia Delegates - BangladeshjhashailenderAinda não há avaliações

- Address List - 152 CompaniesDocumento0 páginaAddress List - 152 CompaniesjhashailenderAinda não há avaliações

- Address List - 152 CompaniesDocumento0 páginaAddress List - 152 CompaniesjhashailenderAinda não há avaliações

- All India Pin CodeDocumento1.851 páginasAll India Pin CodeS C Gaur82% (11)

- All India Pin CodeDocumento1.851 páginasAll India Pin CodeS C Gaur82% (11)

- All India Pin CodeDocumento1.851 páginasAll India Pin CodeS C Gaur82% (11)

- Abcguide April2013Documento83 páginasAbcguide April2013jhashailenderAinda não há avaliações

- Case Studies AfaqsDocumento19 páginasCase Studies AfaqsjhashailenderAinda não há avaliações

- NCF 2005 For School EducationDocumento24 páginasNCF 2005 For School Educationkrishna mouliAinda não há avaliações

- 01 Du Directory 2012Documento62 páginas01 Du Directory 2012jhashailenderAinda não há avaliações

- I Wish You The Strength of All Elements: This Presentation Is Automated, So Please Switch On Loudspeakers and EnjoyDocumento16 páginasI Wish You The Strength of All Elements: This Presentation Is Automated, So Please Switch On Loudspeakers and EnjoyjhashailenderAinda não há avaliações

- 18 States - COB Media ListDocumento29 páginas18 States - COB Media ListjhashailenderAinda não há avaliações

- King Michael PanamaDocumento33 páginasKing Michael PanamaOana HereaAinda não há avaliações

- Foreign Direct Investment in NepalDocumento2 páginasForeign Direct Investment in NepalYOJ InvestmentAinda não há avaliações

- Best PHD Thesis TopicsDocumento5 páginasBest PHD Thesis Topicsphdthesis topicsAinda não há avaliações

- Assignment 2 - HondaDocumento8 páginasAssignment 2 - HondaMabu MabuAinda não há avaliações

- International Business - MBA (GTU)Documento101 páginasInternational Business - MBA (GTU)keyurAinda não há avaliações

- Apollo Case StudyDocumento17 páginasApollo Case Studyankurpatel94Ainda não há avaliações

- Hawera Solomon Article ReviewDocumento7 páginasHawera Solomon Article ReviewHawera SolomonAinda não há avaliações

- "Globalisation and Mauritius". DiscussDocumento11 páginas"Globalisation and Mauritius". DiscussVeenoyAinda não há avaliações

- Comste Report 2010Documento259 páginasComste Report 2010Drea TeranAinda não há avaliações

- Impact of FII On Indian Stock MarketDocumento62 páginasImpact of FII On Indian Stock MarketNikhil Jadhav100% (5)

- India On The Move Case AnalysisDocumento3 páginasIndia On The Move Case Analysis17crush67% (3)

- YP Script in EnglishDocumento26 páginasYP Script in Englishsridharvchinni_21769100% (1)

- Impact of Globalization To International MarketingDocumento30 páginasImpact of Globalization To International MarketingAZam KHan50% (2)

- India's Economic Performance - Globalisation As Its Key DriveDocumento16 páginasIndia's Economic Performance - Globalisation As Its Key DriveludovicoAinda não há avaliações

- Intro To IBDocumento5 páginasIntro To IBaudityaerosAinda não há avaliações

- MA Thesis W Ten HaafDocumento76 páginasMA Thesis W Ten HaafromadoniAinda não há avaliações

- Methods of Retail ExpansionDocumento26 páginasMethods of Retail ExpansionSai Abhishek Tata0% (1)

- Geita Investment Guide PDFDocumento80 páginasGeita Investment Guide PDFDenisAinda não há avaliações

- Theories of International Trade and InvestmentDocumento35 páginasTheories of International Trade and InvestmentMOHAMMAD ASIF BEGAinda não há avaliações

- International Finance Theory and Policy v.1.0 - Flatworld Knowledge - AttributedDocumento497 páginasInternational Finance Theory and Policy v.1.0 - Flatworld Knowledge - AttributedAlfonso J Sintjago100% (2)

- India: Country Profile: Key PointsDocumento9 páginasIndia: Country Profile: Key PointsAlyssa GoAinda não há avaliações

- Foreign Direct InvestmentDocumento10 páginasForeign Direct Investmentashish aroraAinda não há avaliações

- A Study On Mergers and Acquisitions in IndiaDocumento52 páginasA Study On Mergers and Acquisitions in IndiaDarshana DicholkarAinda não há avaliações

- Innovation MckinseyDocumento23 páginasInnovation MckinseyVasco Duarte BarbosaAinda não há avaliações

- FMCG August 2015 PDFDocumento52 páginasFMCG August 2015 PDFAshok SharmaAinda não há avaliações

- FOA 11 The Three Pillars of Philippine Foreign PolicyDocumento18 páginasFOA 11 The Three Pillars of Philippine Foreign Policykeig1214Ainda não há avaliações

- Chapter 6 - Political and Legal Environment Notes MGMT1101Documento11 páginasChapter 6 - Political and Legal Environment Notes MGMT1101NaomiGrahamAinda não há avaliações

- Business&Economics: The Rise of Chinese MultinationalsDocumento8 páginasBusiness&Economics: The Rise of Chinese Multinationalsjorgel_alvaAinda não há avaliações

- Egypt Business Fact SheetDocumento22 páginasEgypt Business Fact SheetFatema Nader BahrAinda não há avaliações

- Centre On Transnational CorporationsDocumento14 páginasCentre On Transnational CorporationsOswaldoMattosAinda não há avaliações

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusNo EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusNota: 3.5 de 5 estrelas3.5/5 (10)

- Preclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1No EverandPreclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Nota: 5 de 5 estrelas5/5 (1)

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresNo EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresNota: 4.5 de 5 estrelas4.5/5 (3)

- Drilling Supervisor: Passbooks Study GuideNo EverandDrilling Supervisor: Passbooks Study GuideAinda não há avaliações

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)No EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Nota: 4 de 5 estrelas4/5 (1)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessNo EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessNota: 4.5 de 5 estrelas4.5/5 (17)

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2No EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2Nota: 3 de 5 estrelas3/5 (1)

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreNo EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreNota: 5 de 5 estrelas5/5 (1)

- CUNY Proficiency Examination (CPE): Passbooks Study GuideNo EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideAinda não há avaliações

- Medical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldNo EverandMedical Terminology For Health Professions 4.0: Ultimate Complete Guide to Pass Various Tests Such as the NCLEX, MCAT, PCAT, PAX, CEN (Nursing), EMT (Paramedics), PANCE (Physician Assistants) And Many Others Test Taken by Students in the Medical FieldNota: 4.5 de 5 estrelas4.5/5 (2)

- ASVAB Flashcards, Fourth Edition: Up-to-date PracticeNo EverandASVAB Flashcards, Fourth Edition: Up-to-date PracticeAinda não há avaliações

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)No Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Ainda não há avaliações

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeNo EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeNota: 3.5 de 5 estrelas3.5/5 (3)

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsNo EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsAinda não há avaliações

- Certified Professional Coder (CPC): Passbooks Study GuideNo EverandCertified Professional Coder (CPC): Passbooks Study GuideNota: 5 de 5 estrelas5/5 (1)

- Pilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CNo EverandPilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CAinda não há avaliações

- PTCE: Pharmacy Technician Certification Exam Premium: 4 Practice Tests + Comprehensive Review + Online PracticeNo EverandPTCE: Pharmacy Technician Certification Exam Premium: 4 Practice Tests + Comprehensive Review + Online PracticeAinda não há avaliações

- NCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsNo EverandNCLEX-RN Exam Prep 2024-2025: 500 NCLEX-RN Test Prep Questions and Answers with ExplanationsAinda não há avaliações

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASNo EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASAinda não há avaliações

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsNo EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsNota: 4.5 de 5 estrelas4.5/5 (77)

- LMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamNo EverandLMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamNota: 5 de 5 estrelas5/5 (1)