Escolar Documentos

Profissional Documentos

Cultura Documentos

A Great Volatility Trade

Enviado por

Baljeet SinghDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A Great Volatility Trade

Enviado por

Baljeet SinghDireitos autorais:

Formatos disponíveis

A Great Volatility Trade

By Len Yates There is a terrific volatility trade available right now. I dont normally comment on current opportunities in this column but this one is simply so good I cant keep my mouth shut. As previously written, volatility trading consists of buying cheap options or selling expensive options. Its called volatility trading because of the way we measure how cheap or how expensive options are using implied volatility. Each option implies, by virtue of its current price, and using the option pricing model backwards, a certain level of volatility for its underlying. We gather up the implied volatilities of all the options of a given asset into an average, and we collect a history of daily average implied volatilities. Consequently, this history can be charted. See the chart below for a six-year history of America Online volatilities. The dashed blue line represents average implied volatility, recorded daily. When this line is low, as it is now, that means options are cheap. The solid red line represents the other kind of volatility called statistical volatility which is how volatile the price of the stock itself has been at times during the past six years.

The extraordinary thing is how low implied volatility is right now, compared with recent history. Implied volatility is around 40% right now, compared to a more normal 60% or so. When options are this cheap (as they are not only in America Online but also in many other top-name tech stocks right now), odds heavily favor the options buyer. How much of a difference does it make? Well, to give you an idea, the America Online at-the-money Jan 02 call LEAP, currently priced at 12.25, would be 17.75 if implied volatility was a more normal 60%! Now, I happen to be of the opinion that the market will repeat a recent pattern of the tech stocks rallying through the winter and into the spring. So Im going to be a LEAP call buyer. If you dont look for such a rally, or if youre unsure whether America Online would participate in such a rally, the pure (non-directional) way to play this would be to buy a straddle in the LEAPs. Either way, I would recommend doing this using LEAPs rather than any of the shorter-term options. Why? For two reasons. One, you need to give this strategy plenty of time to play itself out. Who knows? It might take a couple of months or more. Two, longer term options have higher vega or volatility sensitivity. So when implied volatility goes up again, your options will respond better. When implied volatility returns to ~60%, your options will have expanded to more normal premiums. That would be the time to close the position. Also helping the position would be any significant price movement in the underlying. And it would

be very reasonable to expect this. In the chart, note how often statistical volatility spikes to 80% or higher! My model computes a 100% probability of profit on this trade if implied volatility rises just 10 percentage points (to 50%) within the next three months. Simply a terrific trade!

Copyright 2001 by TradingMarkets.com, Inc.

Você também pode gostar

- Volatility Simplified 1Documento2 páginasVolatility Simplified 1bestnifty100% (2)

- Option Special Report PDFDocumento22 páginasOption Special Report PDFbastian_wolf100% (1)

- ExpiringMonthly - Trading With or Against The Skew 0410Documento4 páginasExpiringMonthly - Trading With or Against The Skew 0410Samoila RemusAinda não há avaliações

- Trading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4No EverandTrading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Nota: 4 de 5 estrelas4/5 (1)

- How To Master Your Investment In 30 Minutes A Day (Preparation)No EverandHow To Master Your Investment In 30 Minutes A Day (Preparation)Ainda não há avaliações

- (Brian Johnson) Option Strategy Risk Return RatiDocumento54 páginas(Brian Johnson) Option Strategy Risk Return RatiKarthik MucheliAinda não há avaliações

- What Makes The VIX Tick PDFDocumento59 páginasWhat Makes The VIX Tick PDFmititeiAinda não há avaliações

- Bullish: Option Strategies For Bullish ViewDocumento10 páginasBullish: Option Strategies For Bullish ViewAshutosh ChauhanAinda não há avaliações

- Selling Naked Puts For Profit and Avoiding AssignmentDocumento7 páginasSelling Naked Puts For Profit and Avoiding AssignmentRed Dot SecurityAinda não há avaliações

- The Sketch GenDocumento8 páginasThe Sketch GenEd williamsonAinda não há avaliações

- Option Greeks and Management of Market RiskDocumento14 páginasOption Greeks and Management of Market RiskSantosh More100% (1)

- Covered Calls Are The Same As Cash-Secured PutsDocumento4 páginasCovered Calls Are The Same As Cash-Secured PutspkkothariAinda não há avaliações

- 2017 04 Ebook Butterfly 4 3 2017 1 PDFDocumento19 páginas2017 04 Ebook Butterfly 4 3 2017 1 PDFGrbayern MunchenAinda não há avaliações

- What Is Double Diagonal Spread - FidelityDocumento8 páginasWhat Is Double Diagonal Spread - FidelityanalystbankAinda não há avaliações

- Option GreeksDocumento2 páginasOption GreeksajjupAinda não há avaliações

- Double Calendar Spreads, How Can We Use Them?Documento6 páginasDouble Calendar Spreads, How Can We Use Them?John Klein120% (2)

- Option Spreads 0307Documento17 páginasOption Spreads 0307sauravkgupta5077Ainda não há avaliações

- Trading Volatility2 Capturing The VRMDocumento9 páginasTrading Volatility2 Capturing The VRMlibra11Ainda não há avaliações

- Options StrategiesDocumento18 páginasOptions StrategiesShuting Teoh0% (1)

- Slingshot StrangleDocumento3 páginasSlingshot Strangleprivatelogic100% (1)

- Three Little Spreads Went To MarketDocumento17 páginasThree Little Spreads Went To MarketMarcioCarvalho100% (1)

- Butterfly + Broken Wing ButterflyDocumento4 páginasButterfly + Broken Wing ButterflyMrityunjay KumarAinda não há avaliações

- Why The Excess VolatilityDocumento4 páginasWhy The Excess VolatilitysandeepvempatiAinda não há avaliações

- Short Condor Spread With Calls - FidelityDocumento7 páginasShort Condor Spread With Calls - Fidelityanalystbank100% (1)

- Bull or Bear, We Don'T Care !: Resource Guide For Trading Without Predicting Market DirectionDocumento7 páginasBull or Bear, We Don'T Care !: Resource Guide For Trading Without Predicting Market DirectionRuler ForGood2Ainda não há avaliações

- Assignment On: Marter'S of Business Economics (MBE)Documento19 páginasAssignment On: Marter'S of Business Economics (MBE)88chauhanAinda não há avaliações

- Ption Reeks: Up Delta, Down DeltaDocumento6 páginasPtion Reeks: Up Delta, Down Delta2luckystarAinda não há avaliações

- Option Profit AcceleratorDocumento129 páginasOption Profit AcceleratorlordAinda não há avaliações

- OI Volatility Volume GreeksDocumento9 páginasOI Volatility Volume Greeksbakchod BojackAinda não há avaliações

- IronbutterplyDocumento3 páginasIronbutterplyCiliaAinda não há avaliações

- Other Hedging Strategies With OptionsDocumento3 páginasOther Hedging Strategies With OptionsAnkush SharmaAinda não há avaliações

- Option Trading "The Option Butterfly Spread": by Larry GainesDocumento37 páginasOption Trading "The Option Butterfly Spread": by Larry GainesHardyx HeartilyAinda não há avaliações

- Options U MastersDocumento30 páginasOptions U MastersHernan DiazAinda não há avaliações

- The Butterfly vs. The Broken Wing ButterflyDocumento2 páginasThe Butterfly vs. The Broken Wing Butterflyjlb99999Ainda não há avaliações

- A Simple Options Trading Strategy Based On Technical IndicatorsDocumento4 páginasA Simple Options Trading Strategy Based On Technical IndicatorsMnvd prasadAinda não há avaliações

- The Greek LettersDocumento18 páginasThe Greek LettersSupreet GuptaAinda não há avaliações

- The VIX Futures Basis - Evidence and Trading StrategiesDocumento41 páginasThe VIX Futures Basis - Evidence and Trading StrategiesPhil MironenkoAinda não há avaliações

- The Alternate Road To InvestingDocumento13 páginasThe Alternate Road To InvestingnatesanviswanathanAinda não há avaliações

- The VXX Trading SystemDocumento19 páginasThe VXX Trading SystemobrocofAinda não há avaliações

- Getting Ready To Trade OptionsDocumento16 páginasGetting Ready To Trade Optionswootwoot345322Ainda não há avaliações

- Sheridan Top 5 Mistakes When Creating Monthly Income Feb10Documento32 páginasSheridan Top 5 Mistakes When Creating Monthly Income Feb10ericotavaresAinda não há avaliações

- 9 Option Strategies CH 11Documento35 páginas9 Option Strategies CH 11RLG631Ainda não há avaliações

- How To Build A Double Calendar SpreadDocumento26 páginasHow To Build A Double Calendar SpreadscriberoneAinda não há avaliações

- Covered Calls and Their Unintended Reversal BetDocumento11 páginasCovered Calls and Their Unintended Reversal BetDeep Value Insight100% (1)

- Strategies For Trading Inverse VolatilityDocumento6 páginasStrategies For Trading Inverse VolatilityLogical InvestAinda não há avaliações

- Advanced Option TraderDocumento1 páginaAdvanced Option TradergauravroongtaAinda não há avaliações

- Disclaimer: Gamma ExposureDocumento8 páginasDisclaimer: Gamma ExposureArsh JosanAinda não há avaliações

- Livevol Database StructureDocumento15 páginasLivevol Database StructureJuan LamadridAinda não há avaliações

- Delta Neutral Vega LongDocumento6 páginasDelta Neutral Vega LongPankajAinda não há avaliações

- Understanding Options Trading: The Australian SharemarketDocumento43 páginasUnderstanding Options Trading: The Australian SharemarketAndrewcaesarAinda não há avaliações

- How To Profit From Theta When Trading SPX Options Business News Minyanville's Wall StreetDocumento4 páginasHow To Profit From Theta When Trading SPX Options Business News Minyanville's Wall Streetkljlkhy9Ainda não há avaliações

- Greeks and Greek RatiosDocumento41 páginasGreeks and Greek RatiosVitorDuarteAinda não há avaliações

- Ryan Road Trip Trade PresentationDocumento32 páginasRyan Road Trip Trade PresentationHernan DiazAinda não há avaliações

- Building A Better Breakout System Using Simple Filters PDFDocumento4 páginasBuilding A Better Breakout System Using Simple Filters PDFKiran KrishnaAinda não há avaliações

- The Delta of An Option or Simply The Option DeltaDocumento14 páginasThe Delta of An Option or Simply The Option DeltaMehul J VachhaniAinda não há avaliações

- Maximizing Gains With Trade ManagementDocumento11 páginasMaximizing Gains With Trade Managementhafis82Ainda não há avaliações

- Assignment Option Pricing ModelDocumento28 páginasAssignment Option Pricing Modeleccentric123Ainda não há avaliações

- Bear Call SpreadDocumento41 páginasBear Call SpreadMadhav PotaganiAinda não há avaliações

- Options for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesNo EverandOptions for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesAinda não há avaliações

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNo EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsAinda não há avaliações

- For Obtaining Import Certificate For The Import of Planting Material (To Be Submitted Only Typed in Duplicate in The Office of DIRECTOR OF Horticulture of The Jammu and Kashmir Govt)Documento2 páginasFor Obtaining Import Certificate For The Import of Planting Material (To Be Submitted Only Typed in Duplicate in The Office of DIRECTOR OF Horticulture of The Jammu and Kashmir Govt)Baljeet SinghAinda não há avaliações

- Design (Open School) : Question PaperDocumento1 páginaDesign (Open School) : Question PaperBaljeet SinghAinda não há avaliações

- Form A3 (To Be Completed For Transfer of Rupees From/to The Account of A Non-Resident Bank Other Than For Transactions With The Public in India)Documento2 páginasForm A3 (To Be Completed For Transfer of Rupees From/to The Account of A Non-Resident Bank Other Than For Transactions With The Public in India)Baljeet Singh0% (1)

- Anf 2CDocumento3 páginasAnf 2CBaljeet SinghAinda não há avaliações

- Anf 5A Application Form For Epcg Authorisation IssueDocumento6 páginasAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghAinda não há avaliações

- 92 1 1 Noticej.e (Electrical) Cat-54Documento241 páginas92 1 1 Noticej.e (Electrical) Cat-54Baljeet SinghAinda não há avaliações

- CTRFDocumento2 páginasCTRFBaljeet SinghAinda não há avaliações

- Application For Allotment: of Ravindra BharathiDocumento1 páginaApplication For Allotment: of Ravindra BharathiBaljeet SinghAinda não há avaliações

- PunjabiDocumento1 páginaPunjabiBaljeet SinghAinda não há avaliações

- Request Form For Revalidation of Redemption / Dividend WarrantDocumento1 páginaRequest Form For Revalidation of Redemption / Dividend WarrantBaljeet SinghAinda não há avaliações

- CCS HAU Recruitment Notification PDFDocumento42 páginasCCS HAU Recruitment Notification PDFBaljeet SinghAinda não há avaliações

- ¿Fu E 13 1 VKSJ 26 NSF (K, ÀDocumento5 páginas¿Fu E 13 1 VKSJ 26 NSF (K, ÀBaljeet SinghAinda não há avaliações

- "Form 6A Application For Inclusion of Name in The Electoral Roll by An Overseas ElectorDocumento4 páginas"Form 6A Application For Inclusion of Name in The Electoral Roll by An Overseas ElectorBaljeet SinghAinda não há avaliações

- ¿Fu E 13 3 VKSJ 26 NSF (K, ÀDocumento5 páginas¿Fu E 13 3 VKSJ 26 NSF (K, ÀBaljeet SinghAinda não há avaliações

- ¿Fu E 13 2 VKSJ 26 NSF (K, ÀDocumento5 páginas¿Fu E 13 2 VKSJ 26 NSF (K, ÀBaljeet SinghAinda não há avaliações

- Iz:I 8D: ¿Fu E 13 4 VKSJ 26 NSF (K, ÀDocumento4 páginasIz:I 8D: ¿Fu E 13 4 VKSJ 26 NSF (K, ÀBaljeet SinghAinda não há avaliações

- Vani - Publications - Revised - June2013 - KN - RAO BOOKS PDFDocumento3 páginasVani - Publications - Revised - June2013 - KN - RAO BOOKS PDFBaljeet Singh50% (2)

- Form6AH PDFDocumento4 páginasForm6AH PDFBaljeet SinghAinda não há avaliações

- Form K.M.V 15 Form of An Application For Renewal of Conductor'S LicenceDocumento1 páginaForm K.M.V 15 Form of An Application For Renewal of Conductor'S LicenceBaljeet SinghAinda não há avaliações

- (To Be Filled in by A Registered Medical Practitioner) : FORM K.M.V.13 Form of Medical Certificate For A ConductorDocumento2 páginas(To Be Filled in by A Registered Medical Practitioner) : FORM K.M.V.13 Form of Medical Certificate For A ConductorBaljeet SinghAinda não há avaliações

- PitchBook SampleDocumento8 páginasPitchBook SampleMopis100% (1)

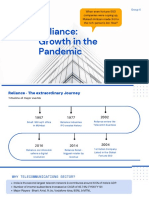

- G4 - D - Growth Strategy of RelianceDocumento18 páginasG4 - D - Growth Strategy of RelianceDeepansh GoyalAinda não há avaliações

- Financial Strategy: Session 2 - Mechanics of Forwards and FuturesDocumento41 páginasFinancial Strategy: Session 2 - Mechanics of Forwards and Futuresrobin robinAinda não há avaliações

- Vendor Data Bank Form CSG-003 Rev 2Documento5 páginasVendor Data Bank Form CSG-003 Rev 2Deepak JainAinda não há avaliações

- Opening A Bank Account Can Seem IntimidatingDocumento9 páginasOpening A Bank Account Can Seem IntimidatingtriratnacomAinda não há avaliações

- IIM A - Indian Railway Turn Around StoryDocumento65 páginasIIM A - Indian Railway Turn Around StorygauravibsAinda não há avaliações

- Week 1FMDocumento52 páginasWeek 1FMchitkarashelly100% (1)

- SEBI As A Capital Market RegulatorDocumento22 páginasSEBI As A Capital Market RegulatorKamta Prasad SahuAinda não há avaliações

- Fundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDocumento10 páginasFundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDonald Cacioppo100% (36)

- Future TerminologyDocumento9 páginasFuture TerminologyavinishAinda não há avaliações

- STMKT Class.1Documento75 páginasSTMKT Class.1Amira El-DeebAinda não há avaliações

- Financial Market, Institutions & Instruments: Project Report 1Documento14 páginasFinancial Market, Institutions & Instruments: Project Report 1Muhammad JawadAinda não há avaliações

- Starhill Global REIT Ending 1Q14 On High NoteDocumento6 páginasStarhill Global REIT Ending 1Q14 On High NoteventriaAinda não há avaliações

- Ey Pe Pulse January 2019Documento25 páginasEy Pe Pulse January 2019Tung NgoAinda não há avaliações

- BMI Indonesia Infrastructure Report Q1 2018Documento83 páginasBMI Indonesia Infrastructure Report Q1 2018Adri UsmanAinda não há avaliações

- Solution Manual - Capital Budgeting Part 2Documento21 páginasSolution Manual - Capital Budgeting Part 2Lab Dema-alaAinda não há avaliações

- Cost of Capital (Fin12)Documento4 páginasCost of Capital (Fin12)MaximusAinda não há avaliações

- Rod'Z Barber Shop: Start Up Business Plan 2020-2022Documento8 páginasRod'Z Barber Shop: Start Up Business Plan 2020-2022Jay Alcain OrpianoAinda não há avaliações

- Master Class On Stock TradingDocumento163 páginasMaster Class On Stock TradingAbbasi Adrien100% (1)

- TSMC 2009 Annual RPTDocumento172 páginasTSMC 2009 Annual RPTpiliskyAinda não há avaliações

- Dual Rate Taxed ValuationDocumento11 páginasDual Rate Taxed ValuationJigesh MehtaAinda não há avaliações

- Sachet Economy of The Philippines - THE CATHOLIC ECONOMISTDocumento4 páginasSachet Economy of The Philippines - THE CATHOLIC ECONOMISTBryan PajaritoAinda não há avaliações

- Minicase 246Documento2 páginasMinicase 246Ngọc Minh Nguyễn100% (1)

- Gawad Kalinga Community Development Foundation IncDocumento33 páginasGawad Kalinga Community Development Foundation IncAiriz Camille CruzAinda não há avaliações

- Teaching Guide: Northern Mindanao Colleges, IncDocumento3 páginasTeaching Guide: Northern Mindanao Colleges, IncBrian Reyes GangcaAinda não há avaliações

- Offering Memorandum: Sustainability Finance Real Economies SICAV-SIFDocumento72 páginasOffering Memorandum: Sustainability Finance Real Economies SICAV-SIFGeorgio RomaniAinda não há avaliações

- For Face2Face With Vivek Bajaj & Vineet JainnDocumento62 páginasFor Face2Face With Vivek Bajaj & Vineet JainnbaljogiAinda não há avaliações

- Tata MotorsDocumento18 páginasTata MotorsManoranjan MallickAinda não há avaliações

- Intermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFDocumento67 páginasIntermediate Accounting 15Th Edition Kieso Solutions Manual Full Chapter PDFprise.attone.itur100% (11)

- Brand ManagementDocumento129 páginasBrand ManagementLatha Devi100% (4)