Escolar Documentos

Profissional Documentos

Cultura Documentos

Document Type Listing

Enviado por

Jayanth MaydipalleTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Document Type Listing

Enviado por

Jayanth MaydipalleDireitos autorais:

Formatos disponíveis

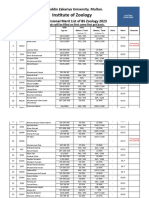

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? REAL FM POSTING YES / NO

DOC TYPE

DESCRIPTION

FUNCTIONAL TEAM(S)

PURPOSE OR TRIGGER

SAP TRANSACTION

DOCUMENT RANGE FROM

DOCUMENT RANGE TO

REVERSING DOC TYPE

AUTH GROUP

DEBIT / CREDIT ENTRIES

GL ACCT CODE ITEM CAT (CONFIG)

DOCUMENT TYPES IN PRODUCTION

AA AB Asset Posting Accounting Document Fixed Assets Various Any asset transaction with the exception of depreciation. Many Fixed Assets transactions codes. SAP invoice documents posted via payroll system in SAP. FBS1, FB08 and auto For auditing of payments in payment program, the payroll program system triggered invoices are required to be separated. Also reverses ZT documents. Also clearing documents for some OIM G/L accounts. Any asset depreciation transaction. AFABN Adjustment Memo postings in SAP. SAP prints paper form FB50, FV50 to send to Treasury. Reverse Document Type for ZA (Advancement Account) Cash replenishment to Advancement Account. FB08 FB50 01 01 0100000000 0100000000 0199999999 0199999999 NO NO No Sometimes None AB AM01 AB01 D - Asset C - Expense 1900000 series

AF AM

Depreciation Posting Adjustment Memo

Fixed Assets Cash Management

03 00

0300000000 0088000000

0399999999 0088999999

NO YES, paper AM document sent to Treasury from SAP with SAP reference #. NO NO

No YES

AF AM

AM01 RV01

D - Expense C - Accum. Dep. D/C - Expense D/C - Revenue D - Vendor C - Expense D - Adv. Acct C - Cash Replenish. Adv. Acct. D - Cash C - Cash or Cash-InTransit D - Customer C - Customer

1900000, 3100000 and 6800000 series Any Expense or Revenue accounts Any Vendor or Expense Account D - 104xxx0 C - 1000001 Cash Account

AZ BA

Advancement Account Invoice Reversal BAI File Replenishment

Accounts Payable Cash Management

17 01

1700000000 0100000000

1799999999 0199999999

YES No

AZ BA

ZA01 AA01

CC

Cash Clearing

Cash Management

Post cash clearings based on file received from Treasury

FB50

01

0100000000

0199999999

NO

No - cash to cash or cash to cash-intransit postings only No

CC

CC01

CD

Customer Clearing

Accounts Receivable

Clear open customer items

F.32

10

1092000000

1099999999

NO

CD

CD01

CK

Vendor Clearing

Grants; Procurement; Accounts Payable Accounts Receivable

Clear open vendor items

F.13, F-44, etc.

10

1092000000

1099999999

YES

No

CK

CK01

DA

Customer Document

Accounts Receivable Customer adjustment document, includes transfer postings/clearing, reversal and write-off transactions. Manual Accounts Receivable write offs

FB08, FBRA, F-30

16

1600000000

1699999999

NO

YES

DA

AR01

DB

Cust Write Off Doc

Accounts Receivable

FB05, FB08, FB75

16

1600000000

1699999999

NO

YES

DB

AR02

DC

GM Federal Billing

Grants

Resource Related Customer invoices posted in SAP for the Grants Federal Billing process.

custom transaction calling VF01

23

2300000000

2399999999

NO

YES, but offset immediately by DD

DC

GM02

1300000, 1300200, 1300300, 1300400, 1300450, 1300452, 1300510 D - Vendor 2100300, 2100400, C - Vendor 2100500, 2100600, 2100700, 2100800 D - Customer (Trade Various Revenue or receivables) Expense Accounts C - Customer (Trade receivables) D - Rev or Expense Various Revenue or C - Customer (Trade Expense Accounts receivables) D - Customer D - 1300510 (recon (Grantor) acct.) C - Grant Revenue C - 4000250 D - Customer (Grantor) C - Grant Revenue D - 1300510 (recon acct.) C - 4000250

DD

GM Offset Fed Billng

Grants

Resource Related Customer invoice offset and clearing posted in SAP for the Grants Federal Billing process.

FB05

23

2300000000

2399999999

NO

YES, but offset immediately by DD

DC

GM02

DF

FSP Customer Invoice

Accounts Receivable

Accounts Receivable Federal Surplus Property customer invoices which are not generated from SAP, but the receivable information is stored and managed in SAP. Accounts Receivable Credit memos.

FB70

18

1800000000

1899999999

NO

YES

DA

AR01

D - Customer (Trade C - 4435720 receivables) C - Revenue D - Revenue D - Any Revenue C - Customer (Trade Account receivables) D - Lock box D - 1399900 clearing C-Customer

DG

Customer Credit Memo

Accounts Receivable

FB75

16

1600000000

1699999999

NO

YES

DA

AR01

DI

Customer Loxkbox Payment w/o Remit

Accounts Receivable

DJ

Trustee Loan Pay/Adj

Accounts Receivable

Accounts Receivable customer payments for the ZFLBMAIN Insurance Lockbox payment process. These types of payments require a unique Revenue Transmittal document, 'Transmittal without Remittance'. The program that automatically creates the Revenue Transmittal document needs a way to identify a Transmittal Without Remittance versus a Transmittal With Remittance (checks attached). This changed when Dpt of Rev became the lockbox bank. This Doc Type now generates a with remittance RT. Accounts Receivable FF68

14

1400000000

1499999999

YES, Related Revenue Transmittal generated in SAP goes to Treas

YES

DI

AR02

13

1300000000

1399999999

NO

NO

DJ

LM02

D - Cash Clearing C - Loan Customer

D - 1001010

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 1 of 9

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE 19 IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? YES REAL FM POSTING YES / NO YES

DOC TYPE DK

DESCRIPTION Loan Disbursement

FUNCTIONAL TEAM(S) Accounts Receivable

PURPOSE OR TRIGGER Accounts Receivable

SAP TRANSACTION FNVD

DOCUMENT RANGE FROM 1900000000

DOCUMENT RANGE TO 1999999999

REVERSING DOC TYPE DK

AUTH GROUP LM01

DEBIT / CREDIT ENTRIES D - Loan receivable expenditure C - Loan Customer D - Cash-in-Transit C - Lockbox Clearing

GL ACCT CODE ITEM CAT (CONFIG) D - 1301***

DL

Lockbox GL Posting

Accounts Receivable

DN

Adj Doc for NSF Checks

Accounts Receivable

DP

Federal Highway Administration (FHWA) Billing Federal Highway Administration (FHWA) Credit Memo Customer Invoice Customer Payment to create Refund of Expenditures Transfer Voucher Payment

Project Systems

DQ

Accounts Receivable

Accounts Receivable customer payments for Insurance Lockbox. When the Lockbox file is posted to SAP, the initial posting (entire deposit amount) is posted to the Bank G/L account and a Lockbox clearing account. This transaction is followed by a second interface transaction using document type DI. Accounts Recivable customer payment NSF Adjustment document bank statement reconciliation in revenue. Journal entry adjusts the Revenue Transmittal information in situations where the lockbox bank has notified the Comptroller Office of bounced checks. Accounts Receivable customer invoice for USDOT FHWA billing twice each week for the federal share of highway project expenditures. Accounts Receivable Credit memos posted in SAP, for PennDOT FHWA billing only. Accounts Receivable - Invoices produced and printed in SAP. Accounts Receivable Customer payments received for which a Refund of Expenditures document is produced (with remittance). Accounts Receivable customer payments where a Revenue Transmittal is not to be generated (Transfer Voucher payments or where an RT was produced outside of SAP). Accounts Receivable customer payments that require a "Transmittal of Revenue without Remittance" be prepared by the sytstem. As of 2/4/03 PUC and Banking Lockbox processes utilize DW docs. The program that automatically creates the Revenue Transmittal document needs a way to identify a Transmittal without Remittance versus a Transmittal with Remittance (checks attached). Accounts Receivable customer invoices that are generated /printed external to SAP Accounts Receivable customer invoice for loans management related Accounts Receivable customer payments received where a Revenue Transmital with remittance is required.

ZFLBMAIN

01

0100000000

0199999999

NO

YES

DL

AR02

C - 1399900

FB50

01

0100000000

0199999999

NO

YES

DN

AR02

D - Revenue D - Any Revenue GL C - Cash in Transit / Lockbox Clearing

FB70

18

1800000000

1899999999

NO

YES

DA

AR01

D - Customer C - Revenue D - Revenue C - Customer (Trade receivables) D - Customer C - Revenue D - Cash in Transit C - Expense

C - Any Revenue Account D - Any Revenue Account C - Any Revenue Account C - Any Expense Account

FB75

16

1600000000

1699999999

NO

YES

DA

AR01

DR DS

Accounts Receivable Accounts Receivable

FB70 F-26; F-28

18 10

1800000000 1092000000

1899999999 1099999999

NO YES, Refund of Expenditures document YES, Reference document from legacy system

YES YES

DA DS

AR01 AR02

DT

Accounts Receivable

F-30

14

1400000000

1499999999

YES

DT

AR02

D - Revenue D - Any Revenue C - Customer (Trade Account receivables) D - Cash in Transit D - 1003000 C - Customer (Trade receivables)

DW

Customer Payment w/o Remit

Accounts Receivable

F-26; F-28

14

1400000000

1499999999

YES, Revenue Transmittal document YES from SAP

DW

ZA01

DX

External Created Invoice

Accounts Receivable

FB70

18

1800000000

1899999999

NO

YES

DA

AR01

DY

Loan Customer Inv

Accounts Receivable

FNM1

18

1800000000

1899999999

NO

YES

DY

LM02

DZ

Customer Payment w/ Remit

Accounts Receivable

F-26; F-28

14

1400000000

1499999999

YES, Revenue Transmittal document YES from SAP YES, this document from SAP if 1st 7 YES pos. of Fund are different

DZ

AR02

EA

Expense Adjustment

General Ledger

EB

Exp Adj - Work Comp

Payroll

Used to transfer expenses between BAs and/or Funds FB50, FV50 and/or expense commitment items. Documents are sent to Treasury only if the first seven positions of the Fund are different. Used to reclass Work Comp (Act 534 and Heart & Lung) FB50, FV50 expenses from a general restricted receipt account back to the employees' agency. Documents are sent to Treasury only if the first seven positions of the Fund are different. Created from nightly job run for program FB50 ZF_OTHE_GM_EXP_TRNS_TO_GMIA which creates GD documents for invoices and VT doc types posted to federal funds. Doc type used for posting directly to a grant for federal billing.

78

7800000000

7899999999

EA

EA01

D - Customer (Trade receivables) C - Revenue D - Customer (loan receivables) C - Revenue D - Cash in Transit C - Customer (Trade receivables) D - Expense CI C - Expense CI

C - Any Revenue Account D - 1300000 C - Loan related revenue GLs D - 1003000

D - 103000 C - 120000 AR Recon acct D - 103000 C - 120000 AR Recon acct

78

7800000000

7899999999

YES, this document from SAP if 1st 7 YES pos. of Fund are different

EB

PY01

D - Expense CI C - Expense CI

GD

GM Delay of Draw

Grants

23

2300000000

2399999999

NO

No statistical based on gl account

GD

GM01

D - Expense CI (real grant) C - Expense CI (z_non-rel grant)

D - 6900999 (real grant) C - 6900999 (z_non-rel grant)

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 2 of 9

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE 23 IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? NO REAL FM POSTING YES / NO No statistical based on gl account

DOC TYPE GL

DESCRIPTION GM LPO-Delay of Draw

FUNCTIONAL TEAM(S) Grants

PURPOSE OR TRIGGER

SAP TRANSACTION

DOCUMENT RANGE FROM 2300000000

DOCUMENT RANGE TO 2399999999

REVERSING DOC TYPE GL

AUTH GROUP GM01

DEBIT / CREDIT ENTRIES D - Expense CI (real grant) C - Expense CI (z_non-rel grant) D - Expense CI (real grant) C - Expense CI (z_non-rel grant)

GL ACCT CODE ITEM CAT (CONFIG) D - 6900999 (real grant) C - 6900999 (z_non-rel grant) D - 6900999 (real grant) C - 6900999 (z_non-rel grant)

GN

GM No Delay of Draw

Grants

Created from nightly job run for program FB50 ZF_OTHE_GM_EXP_TRNS_TO_GMIA which creates GL documents for ZO doc types posted to federal funds to create entry on GMIA. Doc type used for posting directly to a grant for federal billing. Created from nightly job run for program FB50 ZF_OTHE_GM_EXP_TRNS_TO_GMIA which creates GN documents for FI adjustment doc types and cost allocations posted to federal funds to show on GMIA. Doc type used for posting directly to a grant for federal billing. Created from nightly job run for program ZF_OTHE_GM_EXP_TRNS_TO_GMIA which creates GR documents for refund doc types posted to federal funds to show on GMIA. Doc type used for posting directly to a grant for federal billing. Separate document type used for Statutory Transfers which require the Governor's designee's signature and a separate transaction code for Treasury. Reverse Document Type for Accounts Payable (Reverse KR) Used to record payments received from vendors for overcharges/refunds. This transaction is preceded by transaction FB65 using doc type KS or KW. Non-PO invoice entered directly into SAP by the Agency Used to record credit received from vendors to be applied against an existing unpaid or future vendor invoices. Used to record credit offset entry for subrecipient payments posted by Interface or Conversion program where amount is a negative amount (a credit or refund). This FB65 transaction mirrors the FB60 payment transaction made using doc type ZN and is only used to execute F-44 clearing transaction. Used to record credit offset entry for subrecipient payments posted by Interface or Conversion program where actual payment was a postive amount. This FB65 transaction mirrors the FB60 payment transaction made using doc type ZD and is only used to execute F-44 clearing transaction. Vendor Refund of Expenditures - Legacy manual paper Refund documents with remittance. This transaction is followed by transaction F-52 using doc type KC to post Cash-In-Transit entry. Vendor Refund of Expenditures - Legacy manual paper Refund documents without remittance. This transaction is followed by transaction F-52 using doc type KC to post Cash-In-Transit entry. Used to clear vendor account discrepancies due differences between Goods Receipt and Invoice Receipt. Non-PO invoice entered directly into SAP. Vendor Refund of Expenditures (Subrecipient and others) with remittance. User prints the deposit transit slip from SAP via ZF_DEPOSIT transaction and SAP prints paper form to send to Treasury. Vendor Refund of Expenditure transactions are followed by transaction F-52 using doc type KC to post Cash-In-Transit entry. KS also identifies vendor clearing documents. System generated transaction to clear accounts payable document type RN for Correctional Industries Billings to other agencies. Effective 7/1/07 Plant Maint will also use KT to clear Print Shop inventory orders. FB50

23

2300000000

2399999999

NO

No statistical based on gl account

GN

GM01

GR

GM Refunds-No Delay

Grants

23

2300000000

2399999999

NO

No statistical based on gl account

GR

GM01

D - Expense CI (real grant) C - Expense CI (z_non-rel grant) D- Expense CI C- Revenue CI D - Vendor C - Expense D - Cash in Transit C - Vendor D - Expense C - Vendor D - Expense C - Vendor D - Vendor C - Expense

D - 6900999 (real grant) C - 6900999 (z_non-rel grant) D- Expense CI C- Revenue CI Any Vendor or Expense Account D - 1003000 C - Any Vendor Account Any Vendor or Expense Account Any Vendor or Expense Account

GT

Statutory Transfer

General Ledger

FB50, FV50

09

0993000000

0993999999

YES, this document from SAP

YES

GT

GT01

KA KC

Vendor Invoice Reversal Vendor Incoming Payment

Accounts Payable Cash Management

FB08 F-52

17 10

1700000000 1092000000

1799999999 1099999999

NO NO

YES No

KA KC

KR01 KC01

KD KG

Vendor Invoice - Decentralized Vendor Credit Memo

Accounts Payable Accounts Payable

FB60 FB65

19 17

1900000000 1700000000

1999999999 1799999999

YES, ZP clearing document from SAP NO

YES YES

KA KG

KD01 KD01

KH

Vendor Credit Interface

Grants

FB65

17

1700000000

1799999999

Yes, KS clearing document from SAP YES

KH

SA01

KJ

Vendor Credit Offset

Grants

FB65

17

1700000000

1799999999

NO

YES

KJ

SA01

D - Vendor C - Expense

KL

LEG Refund w Remit

Cash Management

FB65

10

1092000000

1099999999

YES, paper RE document sent to Treasury with legacy reference # from agency system. YES, paper RE document sent to Treasury with legacy reference # from agency system. NO

YES

KL

RV04

D - Vendor C - Expense

Any Vendor or Expense Account

KO

LEG Refund wo Remit

Cash Management

FB65

10

1092000000

1099999999

YES

KO

RV04

D - Vendor C - Expense

Any Vendor or Expense Account

KP KR KS

Account Maintenance Vendor Invoice Vend Refund w Remit

Procurement Accounts Payable Cash Management

MR11 FB60 and FBR2 Auto program or FB65 or FV65

48 19 10

4800000000 1900000000 1092000000

4899999999 1999999999 1099999999

NO

KP KA KS

MM04 KR01 RV03 D - Vendor C - Expense D - Vendor C - Expense Any Vendor or Expense Account Any Vendor or Expense Account

YES, ZP clearing document from YES SAP SOMETIMES (1) This document from YES SAP if it clears RN or ZD & KH docs OR (2) Reference document from SAP if refund created; Otherwise, not sent

KT

Interagency Accounts Payable Adjustment

Accounts Receivable

F.51

31

3100000000

3199999999

YES, Reference document from SAP. Revenue line from KT and expense line from RN = Transfer Voucher to Treasury.

KT

KT01

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 3 of 9

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE 19 IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? YES, ZP clearing document from SAP YES, paper RE document sent to Treasury from SAP with SAP reference #. REAL FM POSTING YES / NO YES

DOC TYPE KU

DESCRIPTION Utility Invoices

FUNCTIONAL TEAM(S) Accounts Payable

PURPOSE OR TRIGGER Non-PO utility invoices entered via FB60, Web DynPro, and INTF_0492

SAP TRANSACTION FB60

DOCUMENT RANGE FROM 1900000000

DOCUMENT RANGE TO 1999999999

REVERSING DOC TYPE KA

AUTH GROUP KD01

DEBIT / CREDIT ENTRIES D - Expense C - Vendor D - Vendor C - Expense

GL ACCT CODE ITEM CAT (CONFIG) Any Vendor or Expense Account Any Vednor or Expense Account

KW

Vendor Refund wo Remit

Cash Management

KZ

Vendor Advancement Account Payment PCard Interface

Accounts Payable

Vendor Refund of Expenditures (Subrecipient and others) FB65 or FV65 without remittance. SAP prints paper form to send to Treasury. Vendor Refund of Expenditure transactions are followed by transaction F-52 using doc type KC to post Cash-In-Transit entry. Vendor Payment documents for post with advancement F-58 account payments Automated transaction to distribute Purchasing Card FB50 amounts billed to the correct agency and funding source. To be put in effect 3/1/2003 in conjunction with new PNC file process. Automated transaction to distribute Travel Card amounts FB50 billed to the correct agency and funding source. To be put in effect 2/11/2004 in conjunction with new Travel interface. Used to revalue finished inventory, equipment or supplies to current value. MR21

10

1092000000

1099999999

YES

KW

RV03

15

1500000000

1599999999

YES, this document from SAP

YES

ZK

ZA01

D - Vendor C - Adv Acct D - Expense C - Expense

LB

Cost Allocation

37

3700000000

3799999999

YES, reference document from SAP

LB

LB01

Any Vendor and Advancement GL ending in "4" C - 6395000 D - Various

LT

Travel Card Interface

Travel

30

3000000000

3099999999

YES, reference document from SAP

LT

LT01

D - Expense C - Expense

C - 6395000 D - 6311040

PR

Price Change

Procurement

48

4800000000

4899999999

NO

NO

None

MM01

PS PZ

Project Settlement Vendor Payment Reversal

Commonwealth-wide & Project Systems Accounts Payable

Provide project settlements with their own unique number range for postings to avoid contention with other processes Reversal document type for ZP.

FB50; AUAK; CJ8G; CJ88 FBRA

11 17

1100000000 1700000000

1199999999 1799999999

No NO

No YES

PS PZ

PS01 KR01

D/C - Inventory, Equip, Supplies D/C - RevaluationBudget Inventory Acct D/C - AUC D/C - Final Asset D/C - 6599999 D - Invoices Payable C - Vendor D - Expense C - Vendor D - Expense / Accrued Payble C - Vendor

D/C - 1520000 or 1670000 D/C - 6381112

D/C - AUC D/C - Final Asset D/C - 6599999 Invoices Payable and any Vendor Any Vendor or Expense Account Any Vendor or Expense Account

RE RN

Invoice - Gross Invoice - Net

Procurement Procurement

MRIS Used to record invoices based on Purchase orders. Invoicing Plan invoices. Used to record invoices based on Purchase Orders. Also MIRO and MRRL used to record Purchase Order refunds with and without remittance. RN documents with Bank Code 874 identiied on them will be picked up by a collection program and SAP prints paper form to send to Treasury. This is default doc type for FB50 screen. Used for BAI file FB50 upload and for many other purposes. Used for journal entries prepared to accrue revenues and FB50 expenditures by fund type throughout the year.

51 51 5100000000 5100000000 5199999999 5199999999

YES, ZP clearing document from SAP YES, ZP or KS clearing document from SAP OR Reference document from SAP (if Correctional Industries A/R) NO NO

YES YES

RE RN MM03 MM03

SA SB

G/L Account Document G/L Account Posting

Various Commonwealth-wide & Grants

01 12

0100000000 1200000000

0199999999 1299999999

Sometimes Statistical

SA SB

PY01 ZG02

Various 1300500 or 1300555 Balance Sheet and and offsetting to Revenue Accounts and 4000200 or 4000300 Commitment Items

SC

WBS Element to Internal Order Posting

Commonwealth-wide & Project Systems

Used for journal entries to post Project Systems WBS Element expenditures and adjustments to Internal Orders to capture appropriate federal, state and local shares. Used for journal entries made to correct SAP errors found during the SAP Fund reconciliation when no other entry is appropriate. Reference document is the document number originally sent to Treasury. This doc type also bypasses the Ledger 4, 5, 6 substitution rule that puts 00 in positions 6-7 of the Fund. Transfer payroll expenses from between SAP Funds to agree with either a Treasury only EA or a phone call to Treasury to change the Fund on payroll DSNs (documents) they are unable to process due to an invalid Fund or a Fund without sufficient funds. Reference document is either the paper EA document or the Merge Run ID related to the original ZX document.

FB50

17

1700000000

1799999999

NO

SC

SA01

D - Expense C - Expense

SD

SAP/TABS Reconciliation Entry

General Ledger

FB50

30

3000000000

3099999999

Yes, reference document from SAP or legacy system

YES

SD

SD01

Various

Revenue and Expense commitment items and 1000000

SE

Payroll Expense Adjustment (in SAP only)

General Ledger

FB50

30

3000000000

3099999999

Yes, reference document from SAP or legacy system

YES

SE

SE01

D/C - Expense CI D/C - Cash

Expense commitment items and 1000000

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 4 of 9

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE 14 IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? YES, paper RT document sent to Treasury from SAP with SAP reference #. YES, paper AM document sent to Treasury from SAP with legacy reference #. YES, sent to Treasury via year-end file. REAL FM POSTING YES / NO YES

DOC TYPE SF

DESCRIPTION Fed Rev Dep wo Remit

FUNCTIONAL TEAM(S) Cash Management

PURPOSE OR TRIGGER

SAP TRANSACTION

DOCUMENT RANGE FROM 1400000000

DOCUMENT RANGE TO 1499999999

REVERSING DOC TYPE SF

AUTH GROUP GM01

DEBIT / CREDIT ENTRIES

GL ACCT CODE ITEM CAT (CONFIG)

SAP postings to Federal Revenue without remittance. SAP FB50 prints paper form to send to Treasury.

D - Drawdown D - 1300599 Federal Receivable C - 4xxxxxx C - Federal Revenue D-Exp or Rev C-Exp or Rev D - 104xxxxx (Adv Acct) new fund year C - 104xxxx (Adv Acct) old fund year Various D-6xxxxxx or 4xxxxxx C-6xxxxxx or 4xxxxxx D - 104xxxxx (AA Account new fund year) C - 104xxxx (AA Acount old fund year) Various

SG

NonSAP Adj Memo

Cash Management

Used for agencies that interface Adjustment Memos to SAP. SAP prints paper form to send to Treasury. For use in Interface 0261 to TREAS for FI year-end Advancement Account related documents. Do Not Use This Number Range for any OTHER Doc Type - EVER!

FB50

07

0700000000

0799999999

YES

SG

RV04

SH

Year-End Advancement Account Posting

Cash Management

FB50

60

6000000000

6099999999

NO

SH

AA01

SI

LEG Revenue Document

Cash Management

Legacy paper miscellaneous Revenue document. (AM, DM, PY and TV)

FB50

07

0700000000

0799999999

SJ

NonSAP RevDep w Rem

Cash Management

SK

NonSAP RevDep wo Rem

Cash Management

SL

LEG RT w Remit

Cash Management

Used for agencies that interface Revenue with remittance to SAP. The agency prints the deposit transit slip from their system and SAP prints paper form to send to Treasury. Used for agencies that interface Revenue without remittance to SAP. SAP prints paper form to send to Treasury. Legacy paper Revenue document with remittance.

FB50

07

0700000000

0799999999

YES, paper AM, DM, PY or TV documents sent to Treasury with legacy reference # from agency system. YES, paper RT document sent to Treasury from SAP with legacy reference #. YES, paper RT document sent to Treasury from SAP with legacy reference #. YES, paper RT document sent to Treasury with legacy reference # from agency system. YES, paper AM, PY and TV documents sent to Treasury with legacy reference # from agency system. YES, paper RE document sent to Treasury from SAP with legacy reference #. YES, paper RT document sent to Treasury with legacy reference # from agency system. YES, this document from SAP YES, paper RT document sent to Treasury from SAP with SAP reference #. YES, paper RE document sent to Treasury from SAP with SAP reference #. YES, paper RE document sent to Treasury from SAP with legacy reference #. NO

YES

SI

RV04

YES

SJ

RV04

D - Cash in Transit C - Revenue

D - 1003000, C - Any revenue account D - 1003000, C - Any revenue account D - 1003000, C - Any revenue account Various

FB50

07

0700000000

0799999999

YES

SK

RV04

D - Cash in Transit C - Revenue D - Cash in Transit C - Revenue Various

FB50

14

1400000000

1499999999

YES

SL

RV04

SM

NonSAP Rev Doc

Cash Management

Used for RIS to SAP interface postings and Out of Scope Agency postings of Revenue documents (AMs, PYs and TVs). Used for agencies that interface Refund of Expenditures without remittance to SAP. Agency will send refund number. SAP prints paper form to send to Treasury. Legacy paper Revenue document without remittance.

FB50

07

0700000000

0799999999

YES

SM

RV04

SN

NonSAP Ref wo Remit

Cash Management

08 FB50 FB50

0800000000

0899999999

Yes

SN

RV04

D - Cash in Transit C - Expense D - Cash in Transit C - Revenue D - Expense CI C - Revenue CI D - Cash in Transit C - Revenue

D - 1003000 C - 6xxxxxx D - 1003000, C - Any revenue account D - Expense CI C - Revenue CI D - 1003000, C - Any revenue account D-1003000 C-6xxxxxx

SO

LEG RT wo Remit

Cash Management

14

1400000000

1499999999

YES

SO

RV04

SP SQ

SAP TV Credit Revenue Rev Deposit w Remit

General Ledger Cash Management

SR

NonSAP Rfd wo Remit

Cash Management

Post inter- and intra- agency transfers crediting a Revenue FB50 commitment item. SAP postings for Non-Accounts Receivable Revenue with FB50, FV50 remittance, User prints the deposit transit slip from SAP via ZF_DEPOSIT transaction and SAP prints paper form to send to Treasury. Used for agencies that interface Refund of Expenditures FB50 without remittance to SAP. Agency does not send refund number. SAP prints paper form to send to Treasury. Used for agencies that interface Refund of Expenditures with remittance to SAP. The agency prints the deposit transit slip from their system and SAP prints paper form to send to Treasury. Post adjustments when no file for Treasury or the Revenue Interface System (RIS) is required. Also used for numerous other entries. SAP postings to Non-Accounts Receivable Revenue without remittance. SAP prints paper form to send to Treasury. RIS-SAP interface postings for Revenue. FB50

09 14

0993000000 1400000000

0993999999 1499999999

YES YES

SP SQ

SP01 RV02

08

0800000000

0899999999

No

SR

RV04

D-Cash in Transit C-Expense

SS

NonSAP Ref w Remit

Cash Management

08

0800000000

0899999999

YES

SS

RV04

D-Cash in Transit C-Expense

D-1003000 C-6xxxxxx

SU

Adjustment Document

Various

FB50

01

0100000000

0199999999

Sometimes

SU

SU01

Various

Various

SV

Rev Deposit wo Remit

Cash Management

FB50, FV50

14

1400000000

1499999999

SY

RIS Revenue Posting

Cash Management

FB50

07

0700000000

0799999999

SZ

RIS Refund Posting

Cash Management

RIS-SAP interface postings for Refund of Expenditures.

FB50

08

0800000000

0899999999

YES, paper RT document sent to Treasury from SAP with SAP reference #. YES, RT paper document sent to Treasury with legacy reference # from agency system. YES, RE paper document sent to Treasury with legacy reference # from agency system.

YES

SV

RV02

D - Cash in Transit C - Revenue D - Cash in Transit C - Revenue D - Cash in Transit C - Expense

YES

SY

RV04

YES

SZ

RV04

D - 1003000 C - Any revenue account D - 1003000, C - Any revenue account D - 1003000, C - Any expense account

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 5 of 9

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE VT IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? YES - Last 8 positions of thIs document from legacy system REAL FM POSTING YES / NO YES

DOC TYPE VT

DESCRIPTION Legacy System VT

FUNCTIONAL TEAM(S) General Ledger & Grants

PURPOSE OR TRIGGER Summarized Accounts Payable from various Legacy Systems. File is sent to Treasury from the legacy system.

SAP TRANSACTION Interface or manual FB50

DOCUMENT RANGE FROM A000000000

DOCUMENT RANGE TO Z999999999

REVERSING DOC TYPE None

AUTH GROUP VT01

DEBIT / CREDIT ENTRIES D - Expense or Purchase of Investments C - Non-SAP Invoices Payable D - Expense 638* C - Inventory 16* C - 4200101 OR D - Expense C - Inventory 16* D - Inventory D - Expenditure C - Accrued Payables GR/IR D/C - Expense D/C - Inventory 16*

GL ACCT CODE ITEM CAT (CONFIG) C - 2100200

WA

Goods Issue

Procurement

Used for distribution of materials from one agency to MIGO and MB1A,B,C another or transfer of materials within an agency. Documents are sent to Treasury only if the first seven positions of the Fund are different and there is no revenue commitment item on the document. Used to record receipt of goods or services MIGO (Goods) and ML81 (Services)

49

4900000000

4999999999

YES, this document from SAP if 1st 7 YES pos. of Fund are different and there is no revenue commitment item on the document

None

MM02

WE

Goods Receipt

Procurement

50

5000000000

5099999999

NO

NO

None

MM02

D - Expense 638* C - Inventory 16* C - 4200101 OR D - Expense C - Inventory 16* Balance Sheet and Expense Accounts and Commitment Items

WF

Production Order Costing

Plant Maintenance

WI

Inventory Document

Procurement

Used for recording consumption of materials in the Sign CO12, CO13, CO88, Shop production orders. Used for recording inventory KO88 produced in the Sign Shop production order. Also, used in the settlement process for sign shop production. Documents are sent to Treasury only if the first seven positions of the Fund are different. Adjustment of inventory differences. MI07

49

4900000000

4999999999

YES, this document from SAP if 1st 7 YES pos. of Fund are different

WF

PM01

49

4900000000

4999999999

NO

Statistical

None

MM01

D/C - Inventory D/C - P&L Acct

Balance Sheet and Expense Accounts and Commitment Items D - COGS C - Inventory Any Vendor or Expense Account

WZ ZA

Goods Issue (SCI) Advancement Account Invoice

Procurement Accounts Payable

Commissary Goods Issue Non-PO Invoice for Advancement Accounts. For separating security by document types, reporting and auditing. Used to post payroll expense accruals automatically in FI through accrual program. For GAAP purposes.

MIGO FB60

55 21

5500000000 2100000000

5599999999 2199999999

NO

YES

None AZ

MM02 ZA01

Yes, KZ clearing document from SAP YES

D - 1610000 C - 5104042 D - Expense C - Vendor

ZB

Payroll Accrual

Commonwealth-wide & Payroll / Travel

FB50

12

1200000000

1299999999

NO

Statistical

ZJ

ZG01

D-Expenses (GAAP) GAAP Balance Sheet C-Payables (GAAP) and Expense Accounts and Commitment Items D-Expenses (GAAP) C-Revenues (GAAP) C-Liabilities C-Liabilities (GAAP) D/C-Fund Balance Balance Sheet and GAAP Balance Sheet and GAAP Expense Accounts and Commitment Items

ZC

Upload of CU Info

Commonwealth-wide

Used for year-end upload and reversal of component unit financial information into SAP to properly report in the Commonwealth's CAFR.

FB50

01

0100000000

0199999999

NO

NO

ZC

ZG01

ZD

Vendor Adjustment Invoice

Accounts Payable

ZE ZF

Employee Travel Vendor Invoice Non-SAP Advance Account Replenishment

Accounts Payable & Payroll / Travel General Ledger

Used to record debit offset entry for subrecipient payments FB60 posted by Interface or Conversion program where payment is a positive amount. This FB60 transaction mirrors the FB65 payment transaction made using doc type KJ and is only used to execute F-44 clearing transaction. HR / Travel Invoice postings to pay vendor. auto program in payroll Unique document type used to accumulate amounts to replenish non-SAP Advancement Accounts. FB50

17

1700000000

1799999999

Yes, KS clearing document from SAP YES

ZD

SA01

D - Expense C - Vendor

27 88

2700000000 8800000000

2799999999 8899999999

YES, ZP clearing document from SAP YES, this document from SAP

YES YES

KA None

KR01 ZF01

D - Expense C - Vendor D - Expense C - Out of scope Adv Acct (e.g.,1046100 at DPW) D/C - GAAP Exp/Rev D/C - GAAP Liab. D/C - GRIR Payables (various uses)

Any Employee Vendor or Expense Account D - Expense C - Advancement Acct for agency (e.g.,1046100 at DPW) Balance Sheet and GAAP Balance Sheet and GAAP Income and Expense Accounts and Commitment Items

ZG

GAAP Accrual

Commonwealth-wide

Used for year-end journal entries to accrue revenues and expenditures by fund type for the Commonwealth's GAAP conversion.

FB50

12

1200000000

1299999999

NO

Sometimes statistical

ZJ

ZG02

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 6 of 9

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE 01 IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? NO REAL FM POSTING YES / NO YES, Some statistical

DOC TYPE ZH

DESCRIPTION GAAP Reclass

FUNCTIONAL TEAM(S) Commonwealth-wide

PURPOSE OR TRIGGER

SAP TRANSACTION

DOCUMENT RANGE FROM 0100000000

DOCUMENT RANGE TO 0199999999

REVERSING DOC TYPE ZJ

AUTH GROUP ZG02

DEBIT / CREDIT ENTRIES D/C - Revenues D/C - Expenses D/C - Assets D/C - Liabilities D/C - Fund Balance GAAP or regular GLs D - Expense C - Vendor

GL ACCT CODE ITEM CAT (CONFIG) Balance Sheet and GAAP Balance Sheet, Income and Expense and GAAP Income and Expense Accounts and Commitment Items Any Vendor or Expense Account

Used for year-end journal entries to reclassify GL account FB50 balances within a CoPA fund to properly report the account balances on the Commonwealth's CAFR.

ZI

Vendor Invoice Interface

Accounts Payable

SAP invoice documents posted via an external interface. IDOC interface For auditing of payments in payment program the interface triggered invoices are required to be separated. Used for beginning of year mass reversal of accrual and deferral journal entries upon carryforward of GL balances to new fiscal year. F.80

22

2200000000

2299999999

YES, ZP clearing document from SAP

YES

KA

KD01

ZJ

GAAP Reversal

Commonwealth-wide

01

0100000000

0199999999

NO

YES, Some statistical

ZJ

ZG02

Reversal of ZG and ZH documents

Balance Sheet and GAAP Balance Sheet, Income and Expense and GAAP Income and Expense Accounts and Commitment Items Advancement GL ending in "4" and any Vendor Balance Sheet and Expense Accounts

ZK

Vendor Payment Advancement Account Reversal FI-CO Reconciliation Ledger Transaction Vendor Invoice Offset

Accounts Payable

Reversal document type for KZ (Advancment Account Payment). To identify all reconciliation ledger transactions, which will aid in error correction.

FBRA & FCH8

17

1700000000

1799999999

NO

YES

ZK

ZA01

ZL

Cost Allocation & Commonwealth Wide Grants

KALC

01

0100000000

0199999999

NO

NO

ZL

ZG01

ZN

ZO

Payroll Default Cost Center Correction Payroll & Leave Payout EA

ZP

Payment Posting

Accounts Payable

Used to record debit offset entry for subrecipient payments FB60 posted by Interface or Conversion program where amount is a negative amount (a credit or refund). This FB60 transaction mirrors the FB65 payment transaction made using doc type KH and is only used to execute F-44 clearing transaction. Used for journal entries that will manually correct payroll FB50 posting made to the payroll default cost center and fund. These corrections will be an expense to expense posting. Documents are sent to Treasury only if the first seven positions of the Fund are different. Vendor Payment documents for posting using automated F110 payment program. Interface from FIMS to SAP, primarily to reallocate Payroll charges. Also used to post the clearing of non-SAP payables on a daily basis FB50

17

1700000000

1799999999

NO

YES

ZN

SA01

D - Adv Acct Clearing Account C - Vendor D/C - Expense D/C - FICO Recon Ledger D - Expense C - Vendor

78

7800000000

7899999999

YES, this document from SAP if 1st 7 YES pos. of Fund are different

ZO

ZO01

D - Expense C - Expense

D - Expense C - Expense

20

2000000000

2099999999

YES, this document from SAP

YES

PZ

KR01

D - Vendor Any Vendor and C - Invoices Payable Invoices Payable. D/C - Exp/Rev D/C - Cash or NonSAP Invoices Payable D/C - various D/C - 1000000 or 2100200

ZQ

Interface from FMIS and daily clearing General Ledger / GM of non-SAP payables account

99

9900000000

9999999999

YES, Reference document from YES legacy system or original Payroll doc

ZQ

ZQ01

ZR

Commitment Posting to FI

Commonwealth-wide

Program to post FM Commitments to FI at month-end for FB50 financial statements generated from SPL. Commitments in FI are adjusted for expenditure recognition differences between FM and FI with this program. Treasury interfaces to record payments for out-of-scope agencies FB50 or BAPI interface

01

0100000000

0199999999

No

NO

ZR

ZG01

D - Equity (Enc. by Value type) C - Equity (Res. for Encumbrances) D - Exp / Purchase of Investments C - Treas/Non-SAP Clearing D - Customer C - Cash Clearing Account D/C- HR Doc Split Clear D - Liability C - Vendor

Balance Sheet and Cash Accounts

ZT

Non-SAP Agency

General Ledger

01

0100000000

0199999999

NO

YES

AB

ZG01

ZV

Trustee Payment

Loans

Trustee Payment documents for posting using automated payment program 3rd Party Liability Payments.

F110

20

2000000000

2099999999

YES, this document from SAP

YES

PZ

KR01

ZW

PR Posting 3rd Party

AP / Payroll

Payroll posting PC00_M10_CALC

24

2400000000

2499999999

YES, ZP clearing document from SAP

YES

ZW

KR01

D - Expense or Purchase of Investments C - 1190100 Loans related Customer and Cash Clearing D & C- HR Doc Split Clear (1190030) D - Liability (21*) C - Vendor

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 7 of 9

SAP DOCUMENT TYPE INVENTORY

DOC NUMBER RANGE 25 IS THIS DOC OR A RELATED ONE SENT TO TREASURY FROM SAP OR ANOTHER SYSTEM FOR PAYMENT OR RECEIPT? REAL FM POSTING YES / NO

DOC TYPE ZX

DESCRIPTION Payroll Posting

FUNCTIONAL TEAM(S) Payroll

PURPOSE OR TRIGGER This entry is to record payroll expenses and payroll liabilities as a result of the payroll run. For example: Salaries, Medicare, Social Security, etc.

SAP TRANSACTION Payroll posting PC00_M10_CALC

DOCUMENT RANGE FROM 2500000000

DOCUMENT RANGE TO 2599999999

REVERSING DOC TYPE ZX

AUTH GROUP PY01

DEBIT / CREDIT ENTRIES D - Expense D - HR Doc Split Clear C - Liability C - Payroll Cash Clearing D - Payroll Payable C - Pyrl Emp Payble Auto -----------------D - Pyrl Emp Payble Auto C - Cash-Pyrl Bank Clrng

GL ACCT CODE ITEM CAT (CONFIG) D - Expense (61*) D & C - HR Doc Split Clear (1190010) C - Liability (21*) C - Payroll Cash Clearing (2100150) D - Payroll Payable (2100150) C - Pyrl Emp Payble Auto (2100153) D - Pyrl Emp Payble Auto (2100153) C - Cash-Pyrl Bank Clrng (1000002)

YES, Reference document relates to YES many DSNs, RTs, REs, and AMs from SAP

ZY

Payroll Cash Clearing

Bank Clearing

The Payroll Posting (ZX) does not post directly to the cash Bank Clearing posting account, instead, a payroll cash clearing account is used. ZF_PAYROLL_BANK_ This entry (ZY) is to clear the payroll cash clearing account CLEARING and post to the cash account.

26

2600000000

2699999999

NO

NO

ZY

PY01

8/8/2013

4:45 AM \\vboxsrv\conversion_tmp\scratch_1\162992253.xls.ms_office Page 8 of 9

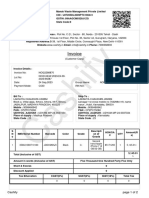

Doc Number Range

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 30 31 37 47 48 49 50 51 60 69 77 78 88 99 VT X1 X2

Year

9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999 9999

From Number

88000000 100000000 200000000 300000000 400000000 500000000 600000000 700000000 800000000 993000000 1092000000 1100000000 1200000000 1300000000 1400000000 1500000000 1600000000 1700000000 1800000000 1900000000 2000000000 2100000000 2200000000 2300000000 2400000000 2500000000 2600000000 2700000000 3000000000 3100000000 3700000000 4700000000 4800000000 4900000000 5000000000 5100000000 6000000000 6900000000 7700000000 7800000000 8800000000 9900000000 A000000000 9100000000 9200000000

To Number

88999999 199999999 299999999 399999999 499999999 599999999 699999999 799999999 899999999 993999999 1099999999 1199999999 1299999999 1399999999 1499999999 1599999999 1699999999 1799999999 1899999999 1999999999 2099999999 2199999999 2299999999 2399999999 2499999999 2599999999 2699999999 2799999999 3099999999 3199999999 3799999999 4799999999 4899999999 4999999999 5099999999 5199999999 6099999999 6999999999 7799999999 7899999999 8899999999 9999999999 Z999999999 9199999999 9299999999

Document Number Ranges taken from PC1 110 - 4/7/2011

Você também pode gostar

- Document Type ListingDocumento9 páginasDocument Type Listinggenfin100% (1)

- Using The SBO SP TransactionNotification Stored ProcedureDocumento25 páginasUsing The SBO SP TransactionNotification Stored ProcedureVeera ManiAinda não há avaliações

- 12 NAW To Be - Bank AccountingDocumento17 páginas12 NAW To Be - Bank AccountingsivasivasapAinda não há avaliações

- Fi MM IntegrationDocumento9 páginasFi MM Integrationvenki1986Ainda não há avaliações

- IT General Ledger AccountingDocumento20 páginasIT General Ledger AccountingPadmanabha NarayanAinda não há avaliações

- Sap Tcode & Ap SopDocumento36 páginasSap Tcode & Ap SopSourav Mamta JangidAinda não há avaliações

- Finance BasisDocumento26 páginasFinance BasisrootaAinda não há avaliações

- FS - 2 Expense Ac in GSTR2 ReportDocumento10 páginasFS - 2 Expense Ac in GSTR2 ReportsapeinsAinda não há avaliações

- Functional Specification - Enhancement: Enhancement ID: Enhancement NameDocumento7 páginasFunctional Specification - Enhancement: Enhancement ID: Enhancement NamesapeinsAinda não há avaliações

- Steps End User Work (Order To Cash)Documento11 páginasSteps End User Work (Order To Cash)rsn_suryaAinda não há avaliações

- 3.4 FunctionalSpecificationDocumento12 páginas3.4 FunctionalSpecificationDinbandhu TripathiAinda não há avaliações

- Aged AR by Aging Bucket Report 0.1 PDFDocumento14 páginasAged AR by Aging Bucket Report 0.1 PDFShanthi SottagariAinda não há avaliações

- Dunning Objects ListsDocumento1 páginaDunning Objects ListsSachin SinghAinda não há avaliações

- FDS0019 GAP0080 O2C GTS Commercial InvoiceDocumento22 páginasFDS0019 GAP0080 O2C GTS Commercial Invoicesomusatish100% (1)

- Functional SpecificationDocumento4 páginasFunctional SpecificationSan SarAinda não há avaliações

- SWI FT MT940 - Understanding FORMAT: Statement Date Bank Account Number Statement NumberDocumento5 páginasSWI FT MT940 - Understanding FORMAT: Statement Date Bank Account Number Statement NumbersrinivasAinda não há avaliações

- SAP FI-Posting Keys For Quick ReferenceDocumento1 páginaSAP FI-Posting Keys For Quick ReferenceilyazsAinda não há avaliações

- OB41Documento1 páginaOB41KrishnaAinda não há avaliações

- Functional Requirement SpecificationDocumento7 páginasFunctional Requirement SpecificationGanesh KumarAinda não há avaliações

- Order To Cash Life CycleDocumento33 páginasOrder To Cash Life CyclepalasmotsiAinda não há avaliações

- Sap123 - Sap SD TablesDocumento3 páginasSap123 - Sap SD Tablessreekanth100% (1)

- PO Receipt of Non Serial Depreciable Item Non ProjectDocumento24 páginasPO Receipt of Non Serial Depreciable Item Non ProjectAlaa Sherif EmamAinda não há avaliações

- Vendor Down PaymentDocumento32 páginasVendor Down PaymentManjunath RaoAinda não há avaliações

- BBP New Format Vendor MasterDocumento21 páginasBBP New Format Vendor Mastersowndarya vangalaAinda não há avaliações

- Hareesh Chava SAP FI/Co Functional Consultant Contact: 09391931463Documento4 páginasHareesh Chava SAP FI/Co Functional Consultant Contact: 09391931463srini reddyAinda não há avaliações

- Useful SAP FI Related Transaction CodesDocumento3 páginasUseful SAP FI Related Transaction Codesdarshanash2009Ainda não há avaliações

- SAP CO Upender ReddyDocumento24 páginasSAP CO Upender ReddysrinivasAinda não há avaliações

- BW Standard Reports ListDocumento3 páginasBW Standard Reports ListDeepu SweetAinda não há avaliações

- Go To SE91 Transaction and Give Message Class Name As J - 1IG - MSGS' Click On Change'Documento4 páginasGo To SE91 Transaction and Give Message Class Name As J - 1IG - MSGS' Click On Change'mayoorAinda não há avaliações

- ERPLO DeemedExport 200614 0653 1304Documento4 páginasERPLO DeemedExport 200614 0653 1304SivaprasadVasireddyAinda não há avaliações

- Ecc ReportsDocumento9 páginasEcc ReportssreekumarAinda não há avaliações

- Sap Fi-16Documento3 páginasSap Fi-16Beema RaoAinda não há avaliações

- MMFIDocumento3 páginasMMFImayoorAinda não há avaliações

- Company Code PlaybookDocumento12 páginasCompany Code Playbookrohitsawarkar28Ainda não há avaliações

- Sap Fi Co ModuleDocumento384 páginasSap Fi Co ModuleAnupam BaliAinda não há avaliações

- Fi-Co Processes in SAPDocumento8 páginasFi-Co Processes in SAPArvind DavanamAinda não há avaliações

- Business Process Blueprint Finance: ProjectDocumento62 páginasBusiness Process Blueprint Finance: ProjectSaravanaRaajaaAinda não há avaliações

- Business Processes Master List Financial Accounting & ControllingDocumento21 páginasBusiness Processes Master List Financial Accounting & ControllingPrathamesh ParkerAinda não há avaliações

- Order To Cash FRDDocumento104 páginasOrder To Cash FRDyoginderAinda não há avaliações

- Sap Fi GL Enduser Step by Step MaterialDocumento99 páginasSap Fi GL Enduser Step by Step MaterialBasem AsaadAinda não há avaliações

- Bank Statements Import and Reconciliation in EBS OracleDocumento2 páginasBank Statements Import and Reconciliation in EBS OracleAshok GiriAinda não há avaliações

- Section 1: Document Information: SCM Report Master Data ZMM - Mat - VenDocumento3 páginasSection 1: Document Information: SCM Report Master Data ZMM - Mat - VenRicky リキAinda não há avaliações

- Idoc Basic Document GokulDocumento29 páginasIdoc Basic Document GokulK.r. KrrishAinda não há avaliações

- FBCJ Cash Journal PostingDocumento13 páginasFBCJ Cash Journal PostingKauam SantosAinda não há avaliações

- Sap Fa TcodeDocumento8 páginasSap Fa TcodeKANG NICKAinda não há avaliações

- FIBK BankReconciliatiaonReport FS FinalDocumento10 páginasFIBK BankReconciliatiaonReport FS FinalAMIT SAWANTAinda não há avaliações

- Creation of G/L Accounts (FS00) : Debtor Bill ReceivableDocumento8 páginasCreation of G/L Accounts (FS00) : Debtor Bill ReceivableSharad IngleAinda não há avaliações

- F-02 General DoumentDocumento9 páginasF-02 General DoumentP RajendraAinda não há avaliações

- 6 NAW To Be - Vendor Invoice Credit MemoDocumento12 páginas6 NAW To Be - Vendor Invoice Credit MemosivasivasapAinda não há avaliações

- G1NTI ITC1 SF02 Incoming Payments and Customer Correspondences v0.1Documento5 páginasG1NTI ITC1 SF02 Incoming Payments and Customer Correspondences v0.1Burzes BatliwallaAinda não há avaliações

- GRIN Goods Receipt SAP Accounting EntriesDocumento3 páginasGRIN Goods Receipt SAP Accounting EntriesMohammed AtifAinda não há avaliações

- BBP - 7 6 12 Withholding Tax Process - ARDocumento12 páginasBBP - 7 6 12 Withholding Tax Process - ARManoj KumarAinda não há avaliações

- Functional Specification: FS - FI - VAT - Profit Center Jan - 18Documento7 páginasFunctional Specification: FS - FI - VAT - Profit Center Jan - 18Anonymous 0SLsR9Ainda não há avaliações

- User Manual FI03: Title: Module NameDocumento35 páginasUser Manual FI03: Title: Module NameAbdelhamid HarakatAinda não há avaliações

- Integration Unit Test Scenario: Project - IT Script 1. Test IDDocumento7 páginasIntegration Unit Test Scenario: Project - IT Script 1. Test IDAnuradha Vadlamani0% (1)

- Technical Specification For ERP-14207Documento8 páginasTechnical Specification For ERP-14207aymenskAinda não há avaliações

- SAP Foreign Currency Revaluation Q & ADocumento9 páginasSAP Foreign Currency Revaluation Q & Aprasad tatikondaAinda não há avaliações

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsAinda não há avaliações

- SAP Document Type ListingSAP Document Type ListingDocumento9 páginasSAP Document Type ListingSAP Document Type Listingkrismmmm100% (1)

- 4 Cookbook Index Table Adoption 20151020Documento19 páginas4 Cookbook Index Table Adoption 20151020Jayanth MaydipalleAinda não há avaliações

- JD - Sap Fico PDFDocumento1 páginaJD - Sap Fico PDFJayanth MaydipalleAinda não há avaliações

- PMDocumento1 páginaPMJayanth MaydipalleAinda não há avaliações

- SAP PM Tables and Related FieldsDocumento8 páginasSAP PM Tables and Related FieldsSunil PeddiAinda não há avaliações

- Innovation DiscoveryDocumento12 páginasInnovation DiscoveryJayanth MaydipalleAinda não há avaliações

- Draft Indian GST LawDocumento190 páginasDraft Indian GST LawpitchiAinda não há avaliações

- ScrapDocumento5 páginasScrapJayanth MaydipalleAinda não há avaliações

- 4 Cookbook Index Table Adoption 20151020Documento19 páginas4 Cookbook Index Table Adoption 20151020Jayanth MaydipalleAinda não há avaliações

- Cookbook VBUK VBUP AdaptionDocumento11 páginasCookbook VBUK VBUP AdaptionserradajaviAinda não há avaliações

- Hosts UmbrellaDocumento1 páginaHosts UmbrellaFabsor SoralAinda não há avaliações

- 7.1.1 MM-J1ID-Excise Master DataDocumento19 páginas7.1.1 MM-J1ID-Excise Master DataJayanth MaydipalleAinda não há avaliações

- Essential Master Data For Cin: Transaction Code: J1IDDocumento2 páginasEssential Master Data For Cin: Transaction Code: J1IDJayanth MaydipalleAinda não há avaliações

- 2 Cookbook VBFA Adoption 20151016Documento8 páginas2 Cookbook VBFA Adoption 20151016Jayanth MaydipalleAinda não há avaliações

- FAQs For DunningDocumento8 páginasFAQs For DunningJayanth MaydipalleAinda não há avaliações

- Excise Invoice Tab Mandetory in MIGODocumento7 páginasExcise Invoice Tab Mandetory in MIGOJayanth MaydipalleAinda não há avaliações

- Excise Frieght-VATDocumento12 páginasExcise Frieght-VATJayanth MaydipalleAinda não há avaliações

- Activating CIN Details in Vendor MasterDocumento9 páginasActivating CIN Details in Vendor Masterabhisek_jajooAinda não há avaliações

- Export 1Documento8 páginasExport 1Jayanth MaydipalleAinda não há avaliações

- Activating CIN Details in Vendor MasterDocumento9 páginasActivating CIN Details in Vendor Masterabhisek_jajooAinda não há avaliações

- Return To Vendor (Excise Material)Documento4 páginasReturn To Vendor (Excise Material)Jayanth MaydipalleAinda não há avaliações

- CIN Financial Accounting FlowsDocumento5 páginasCIN Financial Accounting FlowsJayanth MaydipalleAinda não há avaliações

- Import UserDocumento7 páginasImport UserJayanth MaydipalleAinda não há avaliações

- Important Tables For SAP SDDocumento97 páginasImportant Tables For SAP SDanshuman_jain84Ainda não há avaliações

- Cin Global TemplateDocumento6 páginasCin Global TemplateJayanth MaydipalleAinda não há avaliações

- Import Process-Specify GL AccountsDocumento4 páginasImport Process-Specify GL AccountsJayanth MaydipalleAinda não há avaliações

- Link Between FI &MM SD CONDITION TYPESDocumento1 páginaLink Between FI &MM SD CONDITION TYPESJayanth MaydipalleAinda não há avaliações

- Essential Master Data For Cin: Transaction Code: J1IDDocumento2 páginasEssential Master Data For Cin: Transaction Code: J1IDJayanth MaydipalleAinda não há avaliações

- Sap SD Excise InvoiceDocumento31 páginasSap SD Excise InvoiceGreg ReyAinda não há avaliações

- Service Tax ConfigurationDocumento3 páginasService Tax ConfigurationJayanth MaydipalleAinda não há avaliações

- Nuevo Microsoft Office Excel WorksheetDocumento4 páginasNuevo Microsoft Office Excel WorksheetJayanth MaydipalleAinda não há avaliações

- Special Proceedings RULE 74 - Utulo vs. PasionDocumento2 páginasSpecial Proceedings RULE 74 - Utulo vs. PasionChingkay Valente - Jimenez100% (1)

- C022031601010479 SoadDocumento5 páginasC022031601010479 Soadnitu kumariAinda não há avaliações

- TNPSC Group 1,2,4,8 VAO Preparation 1Documento5 páginasTNPSC Group 1,2,4,8 VAO Preparation 1SakthiAinda não há avaliações

- 1394308827-Impressora de Etiquetas LB-1000 Manual 03 Manual Software BartenderDocumento55 páginas1394308827-Impressora de Etiquetas LB-1000 Manual 03 Manual Software BartenderMILTON LOPESAinda não há avaliações

- Information Assurance Security 11Documento18 páginasInformation Assurance Security 11laloAinda não há avaliações

- InstitutionalismDocumento15 páginasInstitutionalismLowel DalisayAinda não há avaliações

- 2017 IPCC Fall-Winter Newsletter IssueDocumento10 páginas2017 IPCC Fall-Winter Newsletter IssueaprotonAinda não há avaliações

- UtilitarianismDocumento37 páginasUtilitarianismLeiya Lansang100% (2)

- PEER PRESSURE - The Other "Made" Do ItDocumento2 páginasPEER PRESSURE - The Other "Made" Do ItMyrrh PasquinAinda não há avaliações

- The Marriage of King Arthur and Queen GuinevereDocumento12 páginasThe Marriage of King Arthur and Queen GuinevereYamila Sosa RodriguezAinda não há avaliações

- Review of Related LiteratureDocumento3 páginasReview of Related LiteratureEvalyn Diaz100% (3)

- Sample QP 1 Jan2020Documento19 páginasSample QP 1 Jan2020M Rafeeq100% (1)

- GR No. 186417 People vs. Felipe MirandillaDocumento1 páginaGR No. 186417 People vs. Felipe MirandillaNadine GabaoAinda não há avaliações

- CFS Session 1 Choosing The Firm Financial StructureDocumento41 páginasCFS Session 1 Choosing The Firm Financial Structureaudrey gadayAinda não há avaliações

- El Presidente - Film AnalysisDocumento4 páginasEl Presidente - Film AnalysisMary AshleyAinda não há avaliações

- Group 4 Written ReportDocumento21 páginasGroup 4 Written ReportEm Bel100% (1)

- Barandon Vs FerrerDocumento3 páginasBarandon Vs FerrerCorina Jane Antiga100% (1)

- Advincula Vs TeodoroDocumento3 páginasAdvincula Vs TeodoroKeej DalonosAinda não há avaliações

- Government of IndiaDocumento13 páginasGovernment of Indiavikash_kumar_thakurAinda não há avaliações

- The Poetical PolicemanDocumento6 páginasThe Poetical PolicemanYiannis KatsanevakisAinda não há avaliações

- 5953-6th Merit List BS Zool 31-8-2023Documento22 páginas5953-6th Merit List BS Zool 31-8-2023Muhammad AttiqAinda não há avaliações

- Bill Iphone 7fDocumento2 páginasBill Iphone 7fyadawadsbAinda não há avaliações

- MANIPON vs. SANDIGANBAYAN (ART. 210)Documento1 páginaMANIPON vs. SANDIGANBAYAN (ART. 210)Ethan KurbyAinda não há avaliações

- PLJ Volume 52 Number 3 - 01 - Onofre D. Corpuz - Academic Freedom and Higher Education - The Philippine Setting P. 265-277 PDFDocumento13 páginasPLJ Volume 52 Number 3 - 01 - Onofre D. Corpuz - Academic Freedom and Higher Education - The Philippine Setting P. 265-277 PDFKristell FerrerAinda não há avaliações

- Cases 3Documento283 páginasCases 3Tesia MandaloAinda não há avaliações

- Employment in IndiaDocumento51 páginasEmployment in IndiaKartik KhandelwalAinda não há avaliações

- ASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After WDocumento17 páginasASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After Wpranav.kunte3312Ainda não há avaliações

- Business Ethics Session 5Documento9 páginasBusiness Ethics Session 5EliaQazilbashAinda não há avaliações

- 5 6183591383874404675Documento3 páginas5 6183591383874404675Dev BhandariAinda não há avaliações

- UOK-Ph.D. Fee StructureDocumento2 páginasUOK-Ph.D. Fee StructureNeeraj MeenaAinda não há avaliações