Escolar Documentos

Profissional Documentos

Cultura Documentos

End Semester (FA&a) VC

Enviado por

johnbennysTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

End Semester (FA&a) VC

Enviado por

johnbennysDireitos autorais:

Formatos disponíveis

University of Madras Department of Commerce End Semester Examination Aptil/May 2013 Elective: Financial Accounting & Analysis - (BUS

S E 118) Date: 26-04-2013 Time: 3 Hours Maximum Marks: 60

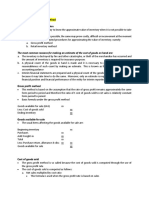

SECTION - A Answer any FOUR questions All questions carry equal marks (4*5 marks = 20 marks) 1. How accounts can be classified? State the rules of double entry system. 2. Explain Break-even Point (BEP). 3 Explain Trial Balance. 4. What are the Limitations of Accounting Ratios? 6. From the following information, prepare a Trial Balance of Mr. Nanda for the year ended 31st March 2011. Particulars / Name of Accounts Capital Account Furniture & Fittings Motor Car Buildings Debtors Creditors Bad debts Opening Stock Purchases Sales Amount Rs. 25,000 1,280 12,500 15,000 7,600 5000 250 6,920 10,950 30,900 Particulars / Name of Accounts Bank (Cr. Balance) Purchase Returns Commission earned Sales Returns Advertisement Interest paid Cash Balance Insurance & Tax Salaries Amount Rs. 5,700 250 750 400 500 236 1,300 2,500 8,164

7. Opening Stock Rs.29,000; Closing Stock Rs.31,000; Sales Rs.3,20,000; GP Ratio is 25% Calculate Stock Turnover Ratio. SECTION - B Answer any FOUR questions All question carry equal marks (4*10 marks = 40 marks) 8. Explain the following: a) Current Ratio b) Liquidity Ratio c) Gross Profit Ratio d) Debt Equity Ratio 9. What do you mean by Marginal Costing and what are its advantages? 10. The following are obtained from a factory Sales (4,000 Units @ Rs.25/ per unit) Variable Cost Fixed Cost Calculate: a) P/V Ratio b) Break even sales c) Margin of Safety Rs. 1,00,000 72,000 16,800

-1-

11. What are the various accounting conventions? 12. Short notes on Debtors turnover ratio, Debt equity ratio, P/V ratio. (or) Rectify the following errors using suspense account where ever necessary, a) The sale book under cost by Rs. 1,000 b) Purchase return book was over cost by Rs. 1,500 c) Cash received from sankar Rs. 2,000 was debited his account d) Purchase of furniture Rs. 500 was entered as purchase e) Discount allowed Rs. 50 has been credited to discount account. 13. From the following Trial Balance and adjustments, prepare final accounts for the year ended 31st December, 2012. Particulars Sundry Debtors Opening Stock (01-01-2011) Cash Balance Bank Overdraft Plant & Machinery Sundry Creditors Trade Expenses Goods Sold Salaries Carriage Outwards Rent Bills Payable Goods Bought Insurance Business Premises Commission Capital Carriage Inwards Total Debit Balances Rs. 32,000 22,000 1,580 17,500 175 2,225 300 900 1,18,870 1,200 34,500 1,000 2,32,250 Credit Balances Rs. 9,000 10,650 1,34,500 7,600 500 70,000 2,32,250

Adjustments: a) The Stock on 31st December 2012 was Rs. 11,000. b) Rent Rs.100 per month for the last quarter was unpaid. c) Depreciate Plant & Machinery by 10% per annum. d) Depreciate Business Premises by 20% per annum. e) Carry forward unexpired Insurance on 31st December 2010 Rs.400.

******

-2-

Você também pode gostar

- CN QBDocumento4 páginasCN QBjohnbennysAinda não há avaliações

- BrandingDocumento46 páginasBrandingjohnbennys100% (1)

- TimeManagementDocumento9 páginasTimeManagementjohnbennysAinda não há avaliações

- Unit-I - EC8702-Adhoc and Wireless Sensor NetworksDocumento37 páginasUnit-I - EC8702-Adhoc and Wireless Sensor NetworksjohnbennysAinda não há avaliações

- G20 Financial InclusionDocumento93 páginasG20 Financial InclusionjohnbennysAinda não há avaliações

- Chapter 3Documento11 páginasChapter 3johnbennysAinda não há avaliações

- Unit 5 CNDocumento13 páginasUnit 5 CNjohnbennysAinda não há avaliações

- EC8551 -COMMUNICATION NETWORKS TWO MARK QUESTIONSDocumento21 páginasEC8551 -COMMUNICATION NETWORKS TWO MARK QUESTIONSjohnbennysAinda não há avaliações

- Rohini College Data Link Layer ProtocolsDocumento7 páginasRohini College Data Link Layer ProtocolsjohnbennysAinda não há avaliações

- Impact Investing Brand Crawford WardleDocumento21 páginasImpact Investing Brand Crawford WardleVipul DesaiAinda não há avaliações

- Corporation of Chennai Revenue Department Property Tax ReceiptDocumento1 páginaCorporation of Chennai Revenue Department Property Tax ReceiptjohnbennysAinda não há avaliações

- Workforce Diversity Walgreens and The Obvious SolutionDocumento3 páginasWorkforce Diversity Walgreens and The Obvious SolutionjohnbennysAinda não há avaliações

- PDFDocumento24 páginasPDFjohnbennysAinda não há avaliações

- Chapter 3Documento11 páginasChapter 3johnbennysAinda não há avaliações

- Financial Inclusion: Ensuring Access to Appropriate Financial ProductsDocumento3 páginasFinancial Inclusion: Ensuring Access to Appropriate Financial ProductsjohnbennysAinda não há avaliações

- BrandingDocumento46 páginasBrandingjohnbennys100% (1)

- Workforce Diversity Walgreens and The Obvious SolutionDocumento3 páginasWorkforce Diversity Walgreens and The Obvious SolutionjohnbennysAinda não há avaliações

- Workforce Diversity Walgreens and The Obvious SolutionDocumento3 páginasWorkforce Diversity Walgreens and The Obvious SolutionjohnbennysAinda não há avaliações

- Ancient History Is The Aggregate of Past EventsDocumento1 páginaAncient History Is The Aggregate of Past EventsjohnbennysAinda não há avaliações

- Workforce Diversity Walgreens and The Obvious SolutionDocumento3 páginasWorkforce Diversity Walgreens and The Obvious SolutionjohnbennysAinda não há avaliações

- Images PDF Files Csp2013Documento93 páginasImages PDF Files Csp2013Amit GuptaAinda não há avaliações

- Ancient History Is The Aggregate of Past EventsDocumento1 páginaAncient History Is The Aggregate of Past EventsjohnbennysAinda não há avaliações

- Ancient History Is The Aggregate of Past EventsDocumento1 páginaAncient History Is The Aggregate of Past EventsjohnbennysAinda não há avaliações

- Vol 2 - 6 - 8Documento26 páginasVol 2 - 6 - 8johnbennysAinda não há avaliações

- Syllabus PHD ManagementDocumento16 páginasSyllabus PHD Managementsachin_taj05100% (1)

- FIIs Investment in Equity and DebtDocumento1 páginaFIIs Investment in Equity and DebtjohnbennysAinda não há avaliações

- 743Documento65 páginas743johnbennysAinda não há avaliações

- I IntroductionDocumento3 páginasI IntroductionjohnbennysAinda não há avaliações

- Consumer Perception+online ShoppingDocumento10 páginasConsumer Perception+online ShoppingRajat Verma0% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- PAH20655 Sek 24Documento14 páginasPAH20655 Sek 24msar 8888Ainda não há avaliações

- Biscuit Industry Comprehensive ReportDocumento9 páginasBiscuit Industry Comprehensive Reportsakthivel vengatasamyAinda não há avaliações

- Torrent Commercial-Application-FormDocumento8 páginasTorrent Commercial-Application-Formnayan patelAinda não há avaliações

- CIMA p1 March 2011 Post Exam GuideDocumento18 páginasCIMA p1 March 2011 Post Exam GuidearkadiiAinda não há avaliações

- The Big Sho (R) T: TalkofthetownDocumento4 páginasThe Big Sho (R) T: Talkofthetownashu soniAinda não há avaliações

- Gold and Silver Club EbookDocumento22 páginasGold and Silver Club Ebookmfaisalidreis100% (1)

- Impact of Organized RetailDocumento6 páginasImpact of Organized RetailPushpak Singh0% (1)

- Monopoly and Market Failure Lesson 2Documento12 páginasMonopoly and Market Failure Lesson 2api-53255207Ainda não há avaliações

- Estimate Inventory Value Using Gross Profit MethodDocumento2 páginasEstimate Inventory Value Using Gross Profit MethodJoanne Rheena BooAinda não há avaliações

- Survey QuestionnaireDocumento2 páginasSurvey QuestionnaireCarla Pabuaya100% (2)

- Consolidated SOFP of Sing and DanceDocumento36 páginasConsolidated SOFP of Sing and DanceVicky Fan67% (3)

- Packaging-Initiating CoverageDocumento27 páginasPackaging-Initiating CoverageRajkumar MathurAinda não há avaliações

- Threat of SubstitutesDocumento3 páginasThreat of SubstitutesKeshav Raj SharmaAinda não há avaliações

- Financial Management Theory Practice 15th Edition Ebook PDFDocumento51 páginasFinancial Management Theory Practice 15th Edition Ebook PDFdon.anderson433100% (35)

- Gourmet BeveragesDocumento30 páginasGourmet BeveragesMahmood SadiqAinda não há avaliações

- Additional Work For Skylight Glazing (Rate Analysis)Documento5 páginasAdditional Work For Skylight Glazing (Rate Analysis)civilsmvdime1965Ainda não há avaliações

- Smartshares Exchange Traded Funds - Other Material InformationDocumento23 páginasSmartshares Exchange Traded Funds - Other Material Informationamy g dalaAinda não há avaliações

- RSI UnlimitedDocumento2 páginasRSI UnlimitedjedilovagAinda não há avaliações

- Chapter 8Documento18 páginasChapter 8Mishu GuptaAinda não há avaliações

- Tutorial 9 Problem SetDocumento6 páginasTutorial 9 Problem SetPeter Jackson0% (1)

- Team Jalali Kobutor Round 01 The PitchersDocumento15 páginasTeam Jalali Kobutor Round 01 The PitchersMd.Sohan SHAHRIARAinda não há avaliações

- CASE STUDY - Rural Buyer BehaviourDocumento6 páginasCASE STUDY - Rural Buyer Behaviourrakeshgopinath499957% (14)

- Task 1: Assume That The Market Is Not Open To Trade. What Is The Equilibrium Price ofDocumento2 páginasTask 1: Assume That The Market Is Not Open To Trade. What Is The Equilibrium Price ofAlzeena KhanAinda não há avaliações

- Present Value of AnnuitiesDocumento2 páginasPresent Value of AnnuitiesJai Prakash100% (1)

- Marketing MixDocumento84 páginasMarketing MixVijay GaneshAinda não há avaliações

- Project On Rural MarketDocumento38 páginasProject On Rural MarketSmita Keluskar100% (1)

- Econ IADocumento7 páginasEcon IAJason TantonoAinda não há avaliações

- The Impact of External Debt On Economic Growth of KenyaDocumento23 páginasThe Impact of External Debt On Economic Growth of KenyaFapohunda Adekunle Stephen100% (1)

- Developing Pricing Strategies and ProgramsDocumento42 páginasDeveloping Pricing Strategies and ProgramsstudentAinda não há avaliações

- Glomac BerhadDocumento11 páginasGlomac BerhadAiman Abdul BaserAinda não há avaliações