Escolar Documentos

Profissional Documentos

Cultura Documentos

Mana Elasticity

Enviado por

debbiewalker87Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mana Elasticity

Enviado por

debbiewalker87Direitos autorais:

Formatos disponíveis

Cooleconomics.

com

mana-elasticity

Cooleconomics.com Elasticity Contents: Demand and steepness Supply and steepness Elasticity introduction price elasticity of demand price elasticity of supply income elasticity of demand cross elasticity of demand DEMAND AND STEEPNESS Why is one demand curve steeper than another? The steepness of a demand curve is a measure of the responsiveness of buyers to a change in price of the product. The steeper a demand curve is, the less responsive buyers are to a change in price. Consider, for example, the hypothetical extreme of a completely vertical demand curve: Price per unit

Demand Curve

Quantity of units These buyers do not change the quantity that they demand when the price changes. An approximate real world example is insulin; a diabetic needs it to survive, and will continue to buy the same quantity even if the price skyrockets. Here are some things that affect steepness of a demand curve: 1. Number of substitutes for the product If a product has few substitutes, then buyers have few options when the price of the product rises; hence they are likely to keep buying the product, though perhaps in slightly lower quantities. Such a product will have a pretty steep demand curve.

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

On the other hand, if a product has many substitutes, then it is easy for buyers to stop buying the product when the products price rises, switching to substitute products; hence a product with many substitutes will have a relatively flat demand curve. 2. Time Suppose gasoline prices skyrocket. Over the short term, you may be forced to buy almost as much gas as at lower prices, since you may need to drive to get to work, etc. Over a longer term, however, you could buy a more fuel efficient vehicle, and reduce your gas consumption by a larger amount. Conclusion: for most (not all) products, more time implies a flatter demand curve.1 SUPPLY AND STEEPNESS Why is one supply curve steeper than another? The steepness of a supply curve is a measure of the responsiveness of sellers to a change in price of the product. The steeper a supply curve is, the less responsive sellers are to a change in price. Consider, for example, the hypothetical extreme of a completely vertical supply curve: Price per unit

Supply Curve

Quantity of units These sellers do not change the quantity that they sell when the price changes. An approximate real world example is harvested bananas; the bananas are already harvested, and sellers will want to sell them all regardless of the price they can get for them (because spoiled unsold bananas do not add to revenue). Time is the most important thing that affects the steepness of a supply curve. Let us define and consider three time periods:

1

Goods which are durablebenefiting the consumer for a few years (such as autos)actually have steeper demand curves given more time. Suppose lawn mower prices skyrocket, for example. Over the short term buyers may delay acquisition of new mowers to replace old ones, hoping that prices will fall back down; this means a very flat demand curve. Over the long term, however, lawn mowers wear out, and buyers must replace them; this means a steeper demand curve.

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

1. The Market Period In the market period, sellers do not have enough time to alter that quantity of product available for sale. The banana example above is a market period example. The supply curve is vertical in the market period. 2. The Short Run In the short run, sellers are able to alter the quantity supplied, but they have at least one fixed factor of production. Suppose a banana farm believes that bananas will fetch a high price next year. This is enough time for the banana farmer to spend a little more money to take extra special care of the banana trees, to ensure a slightly higher banana yield, taking advantage of the higher banana prices. But the banana farmer doesnt have enough time to plant new banana trees that will yield fruit next year. This is a short run example; the trees are the farmers fixed resource. The supply curve is steep, but not vertical, in the short run. 3. The Long Run In the long run, sellers are able to alter the quantity supplied, and they have no fixed factors of production. Suppose a banana farm believes that bananas will fetch a high price in 30 years. This is enough time for the banana farmer to spend a more money planting extra banana trees, to ensure a massively higher banana yield in 30 years, taking great advantage of the higher banana prices. This is a long run example; the trees are the now a variable resource. The supply curve is very flat in the long run; it may even be downward-sloping. (More on this in later notes.) FROM STEEPNESS TO ELASTICITY Sure, steepness is an indicator of the responsiveness of quantity to changes in price, but its quite vague, aint it? Price elasticity is a much more precise measure of this price/quantity relationship. We shall discuss price elasticity, and some other elasticities, in the next section of notes. ELASTICITY General: Elasticity is a ratio of the percentage change in one variable to the percentage change in another variable. We shall discuss four elasticities below: (1) Price elasticity of demand = percentage change in quantity demanded / percentage change in price (2) Price elasticity of supply =

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

percentage change in quantity supplied / percentage change in price (3) Income elasticity of demand = percentage change in quantity demanded / percentage change in income (4) Cross elasticity of demand = percentage change in quantity demanded of good A / percentage change in price of good B More about price elasticity of demand: Example 1: Suppose a 10% price reduction in Coke causes a 5% increase in unit sales. Then the price elasticity of demand of coke is 5% / -10% = -.5 Example 2: Suppose a 2% increase in pretzel prices causes a 10% reduction in unit sales. Then the price elasticity of demand of pretzels is -10% / 2% = -5 From the above examples we can note that: Price elasticity of demand is almost always negative, but sometimes by convention we take the absolute value of the elasticity when expressing it. The closer the price elasticity of demand is to zero, the less responsive is demand to changes in price. Calculating price elasticity of demand using the Arc formula: Example 3: Suppose the following points are on a hypothetical demand curve: Point A: At a price of $10 quantity demanded is 100 Point B: At a price of $20 quantity demanded is 30 We can calculate the price elasticity of demand (Ed) for the segment of the demand curve between points A and B using the Arc formula:2 Ed = Q A QB PA PB (Q A + QB ) / 2 ( PA + PB ) / 2

Another formula which can be used to calculate elasticitythe point formulais discussed a bit later in these notes

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

100 30 10 20 (100 + 30) / 2 (10 + 20) / 2 = -1.615384615386

= 1.076923076923 / -.6666666666

by convention, we eliminate the minus sign: Ed = 1.615384615386 Price Elasticity of Demand: The Point Formula The arc formula, I hope, makes intuitive sense to you. It is of great interest to a firm, if it changes its price by a certain realistic percentage, to know by what percentage quantity demanded will change. But suppose that you want to know the percentage that quantity demanded will change for a very small change in priceindeed, for an infinitesimally small change in price. Can we calculate such an elasticity? Yes, with the point formula. Lets derive (sort of) this formula: Remember, generally, that price elasticity of demand represents percentage change in quantity demanded divided by percentage change in price: Ed = % change in Qd / % change in P How can we express % change in Qd? Well, how about this: % change in Qd = change in Qd / Qd

How can we express % change in P? Well, how about this: % change in P = change in P / P

Lets substitute these expressions into our elasticity equation:

Ed =

change Qd

in

Qd

change in P P

We can rearrange this equation to look like this:

Ed =

change in Qd x change in P

P Qd

5

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

Now, suppose that we want to calculate Ed for an infinitesimally small change in P. Well, thats our friendly derivative from calculus! dQd / dP represents the change in Qd when P changes an extremely small amount. Lets substitute this derivative into the elasticity equation:

Ed =

Qd x P

P Qd

Well, shucks maamthat theres the point elasticity of demand formula! Using the point formula: example 4 Suppose we have a demand equation: Qd = 100 5P Lets calculate the price elasticity of demand at a price of $15 Note: P = $15 Now, plug in P=$15 into the demand equation to get Qd: Qd = 100 5(15) = 25 Now, calculate dQd / dP for our demand equation: dQd / dP = -5 Now, substitute all of our calculations into the point elasticity formula: E d = 5 15 = 3 25 or 3 by convention

Price Elasticity of demand and total revenue Define total revenue (TR) as the total dollar value of a firms sales. For a firm that only produces one product (and sells it at one price per unit), this is equal to price per unit times quantity bought: TR = PQ A firm might want to know how changing its products price per unit affects its total revenue. Well, guess what? The value of the price elasticity of demand tells the firm something about how a price change will affect total revenue!!

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

If Ed is greater than 1, then a higher price results in lower total revenue, and a lower price results in higher total revenue. Dont believe me? Check out example 3: raising the price from $10 to $20 causes total revenue to fall from $1000 to 600; cutting the price from $20 to $10 causes total revenue to rise from $600 to $1000. If Ed is between 0 and 1, then a higher price results in higher total revenue, and a lower price results in lower total revenue. In example 1, Coke revenue will rise if Cokes price is increased; Coke revenue will fall if Cokes price is reduced. Were done with price elasticity of demand; now, on to price elasticity of supply! MORE ABOUT PRICE ELASTICITY OF SUPPLY Example 4: Suppose a 10% price reduction in wheat causes a 5% reduction in wheat supply. Then the price elasticity of supply of wheat is -5% / -10% = .5 Example 5: Suppose a 2% increase in milk prices causes a 10% increase in milk supply. Then the price elasticity of supply of milk is 10% / 2% = 5 From the above examples we can note that: Price elasticity of supply is usually positive The closer the price elasticity of supply is to zero, the less responsive is supply to changes in price. Calculating price elasticity of supply using the Arc formula: Example 3: Suppose the following points are on a hypothetical supply curve: Point A: At a price of $10 quantity supplied is 30 Point B: At a price of $20 quantity supplied is 100 We can calculate the price elasticity of demand (Es) for the segment of the supply curve between points A and B using the Arc formula:3 Es = Q A QB PA PB (Q A + QB ) / 2 ( PA + PB ) / 2

Another formula which can be used to calculate price elasticity of supplythe point formulais virtually the same as the formula for point elasticity of demandjust use Qs instead of Qd in the formula.

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

30 100 10 20 (30 + 100) / 2 (10 + 20) / 2 = 1.615384615386

= -1.076923076923 / -.6666666666

Thats it for price elasticity of supply. Now, on to income elasticity of demand! MORE ABOUT INCOME ELASTICITY OF DEMAND (EI) Example 6: Suppose a 10% income reduction 5% reduction in steak demand. Then the income elasticity of demand of steak is -5% / -10% = .5 Example 7: Suppose a 2% increase in income causes a 10% reduction in ramen noodles demand. Then the income elasticity of demand of ramen noodles is -10% / 2% = -5 From the above examples we can note that: Income elasticity of demand (EI) may be a positive or negative number Define a normal good as one whose demand is positively associated with income. EI is positive for normal goods. (Steak is normal in example 6) Define an inferior good as one whose demand is negatively associated with income. EI is negative for inferior goods. (Ramen noodles are inferior in example 7) Income Elasticity of Demand: The Point Formula Suppose that you want to know the percentage that quantity demanded will change for a very small change in incomeindeed, for an infinitesimally small change in income. Can we calculate such an elasticity? Yes, with the point formula. Lets derive (sort of) this formula: Remember, generally, that income elasticity of demand represents percentage change in quantity demanded divided by percentage change in income (I): EI = % change in Qd / % change in I How can we express % change in Qd? Well, how about this: % change in Qd = change in Qd / Qd

How can we express % change in I? Well, how about this:

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

% change in I

change in I / I

Lets substitute these expressions into our elasticity equation:

Ed =

change Qd

in

Qd

change in I I

We can rearrange this equation to look like this:

Ed =

change in Qd x change in I

I Qd

Now, suppose that we want to calculate EI for an infinitesimally small change in I. Well, thats our friendly derivative from calculus! dQd / dI represents the change in Qd when I changes an extremely small amount. Lets substitute this derivative into the elasticity equation:

Ed =

Qd x I

I Qd

Well, shucks maamthat theres the point income elasticity of demand formula! Using the point formula: example 5 Suppose we have a demand equation: Qd = 75 5P + .02I Lets calculate the price elasticity of demand at an income of $200 and price of $15 Note: I = $200 and P = 15 Now, plug in P=$15 and I= $200 into the demand equation to get Qd: Qd = 75 5(15) + .02(200) = 4 Now, calculate dQd / dI for our demand equation: dQd / dI = .02

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

Cooleconomics.com

mana-elasticity

Now, substitute all of our calculations into the point elasticity formula: E I = .02 200 =1 4

So much for income elasticity of demand. Now, on to cross elasticity of demand! MORE ABOUT CROSS ELASTICITY OF DEMAND (Ec) Example 8: Suppose a 10% increase in Coke prices causes a 5% increase in Pepsi demand. Then the cross elasticity of demand of Coke and Pepsi is 5% / 10% = .5 Example 9: Suppose a 2% increase in hot dog prices causes a 10% reduction in hot dog bun demand. Then the cross elasticity of demand of hot dogs and hot dog buns is -10% / 2% = -5 From the above examples we can note that: Cross elasticity of demand (EC) may be a positive or negative number Define substitute goods as those that serve roughly the same purpose to buyers. EC is positive for substitute goods. (Coke and Pepsi are substitutes in example 8) Define complementary goods as those that are often consumed together. EC is negative for complementary goods. (Hot dogs and hot dog buns are complements in example 9) Cross Elasticity of Demand: The Point Formula Suppose that you want to know the percentage that quantity demanded of one good will change for a very small change in price of another goodindeed, for an infinitesimally small change in price. Can we calculate such an elasticity? Yes, with the point formula. Lets derive (sort of) this formula: Remember, generally, that cross elasticity of demand (Ec) represents percentage change in quantity demanded of good X divided by percentage change in price of good Y: Ec = % change in Qx / % change in Py How can we express % change in Qx? Well, how about this: % change in Qx = change in Qx / Qx

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

10

Cooleconomics.com

mana-elasticity

How can we express % change in Py? Well, how about this: % change in Py = change in Py / Py

Lets substitute these expressions into our elasticity equation:

E xy =

change Qx

in

Qx

change in P y Py

We can rearrange this equation to look like this:

change in Qx E xy = x change in Py

Py Qx

Now, suppose that we want to calculate Ec for an infinitesimally small change in Py. Well, thats our friendly derivative from calculus! dQx / dPy represents the change in Qx when Py changes an extremely small amount. Lets substitute this derivative into the elasticity equation:

EC =

Qx x Py

Py Qx

Well, shucks maamthat theres the point cross elasticity of demand formula!

Example: Suppose we have a demand equation for good X: Qx = 1000 5Px + 2Py Suppose also that Px is currently $10 and Py is currently $15 Now, plug in P=$15 and I= $200 into the demand equation to get Qd: Qx = 1000 5(10) + 2(15) = 980 Now, calculate dQx / dPy for our demand equation:

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

11

Cooleconomics.com

mana-elasticity

dQd / dPy = 2 Now, substitute all of our calculations into the point elasticity formula: EC = 2 15 = .0306 980

Conclusion: Managers find elasticities useful because elasticities provide information on how a change in one thing affects another thing. This information can be very valuable for planning purposes. For example, Intel corporation recently cut prices on its microprocessors; so how many microprocessors should Intel produce this month? Well, if Intel has a good estimate of the price elasticity of demand for its product, then it will have a good idea how much to change production, because it has a sense of how the price change will affect the quantity of microchips that its customers will buy. Those decision makers (such as MBAs) who can calculate, understand, and/or interpret the meaning of a companys elasticities are quite valuable assets to the company and will be well compensated. (Generally, an economist or other specialist will calculate the elasticities and give these values to managers; it is up to the managers to use the information wisely.)

Copyrighted by Michael Francis Williams. Authorized use is encouraged; unauthorized use is prohibited.

12

Você também pode gostar

- Economics for CFA level 1 in just one week: CFA level 1, #4No EverandEconomics for CFA level 1 in just one week: CFA level 1, #4Nota: 4.5 de 5 estrelas4.5/5 (2)

- A level Economics Revision: Cheeky Revision ShortcutsNo EverandA level Economics Revision: Cheeky Revision ShortcutsNota: 3 de 5 estrelas3/5 (1)

- Price Elasticity Week 5Documento38 páginasPrice Elasticity Week 5Katrina LabisAinda não há avaliações

- Elasticity and Its Application: Solutions To Text ProblemsDocumento6 páginasElasticity and Its Application: Solutions To Text ProblemsterrancekuAinda não há avaliações

- Chapter Six Elasticity, Consumer and Producer Surplus: Percentage Change in Quantity Percentage Change in PriceDocumento7 páginasChapter Six Elasticity, Consumer and Producer Surplus: Percentage Change in Quantity Percentage Change in Pricepakibroz5Ainda não há avaliações

- Application of Elasticity of SupplyDocumento14 páginasApplication of Elasticity of Supplykishanlukhi380% (5)

- The Relationship Between The Price of A Good and How Much of It SB Wants To BuyDocumento6 páginasThe Relationship Between The Price of A Good and How Much of It SB Wants To Buy3.Lưu Bảo AnhAinda não há avaliações

- Principles of Microeconomics - Notes - ElasticityDocumento6 páginasPrinciples of Microeconomics - Notes - ElasticityKatherine SauerAinda não há avaliações

- ElasticityDocumento41 páginasElasticityJang Jang OrtencioAinda não há avaliações

- Principles of Macroeconomics 7th Edition Gregory Mankiw Solutions Manual 1Documento36 páginasPrinciples of Macroeconomics 7th Edition Gregory Mankiw Solutions Manual 1cynthiasheltondegsypokmj100% (23)

- 02Documento16 páginas02Paran GuptaAinda não há avaliações

- Be Tutorial 3 - StuDocumento18 páginasBe Tutorial 3 - StuGia LinhAinda não há avaliações

- ELASTICITY of DemandDocumento16 páginasELASTICITY of DemandKyla TorcatosAinda não há avaliações

- ECON 203 SolutionsDocumento6 páginasECON 203 SolutionsRevshin Mae FelizariaAinda não há avaliações

- Price Elasticity of DemandDocumento5 páginasPrice Elasticity of DemandManoj KAinda não há avaliações

- Economics Lecture 3: Micro-Economics of Product MarketsDocumento43 páginasEconomics Lecture 3: Micro-Economics of Product MarketsAnanna AfroseAinda não há avaliações

- Elasticity of DemandDocumento8 páginasElasticity of Demandgyanendra_paudelAinda não há avaliações

- As1 &2Documento29 páginasAs1 &2Emiru ayalewAinda não há avaliações

- Microeconomics Principles and Policy 13th Edition Baumol Solutions Manual DownloadDocumento4 páginasMicroeconomics Principles and Policy 13th Edition Baumol Solutions Manual DownloadGerald Washing100% (19)

- Chap 2 Elasticity and Its Application Part 3Documento48 páginasChap 2 Elasticity and Its Application Part 3The TwitterAinda não há avaliações

- Elasticity EconomicsDocumento14 páginasElasticity EconomicsYiwen LiuAinda não há avaliações

- Micro 5Documento5 páginasMicro 5trinhanhkhoiAinda não há avaliações

- P in Brief, Are As Under:: 0 in Developing Countries of The World, TheDocumento4 páginasP in Brief, Are As Under:: 0 in Developing Countries of The World, TheEmilia Visaya NacuaAinda não há avaliações

- Assessment-01 MEDocumento15 páginasAssessment-01 MEsubodh singhAinda não há avaliações

- Lesson 10 - Module 1 - Supply ElasticityDocumento5 páginasLesson 10 - Module 1 - Supply ElasticityLizlee LaluanAinda não há avaliações

- Objectives For Chapter 4: Elasticity and Its ApplicationDocumento19 páginasObjectives For Chapter 4: Elasticity and Its ApplicationAnonymous BBs1xxk96VAinda não há avaliações

- Elasticity and Its ApplicationDocumento6 páginasElasticity and Its ApplicationSavannah Simone PetrachenkoAinda não há avaliações

- Ch02 PRDocumento17 páginasCh02 PRpks009Ainda não há avaliações

- Entrepreneurial Mind: Business and The Market PlaceDocumento6 páginasEntrepreneurial Mind: Business and The Market PlaceKiefer SachikoAinda não há avaliações

- AGEC 251-ElasticityDocumento45 páginasAGEC 251-ElasticityJoshua Annan. K. OkyereAinda não há avaliações

- Managerial Econo Final Exam Suggestions Q&aDocumento9 páginasManagerial Econo Final Exam Suggestions Q&aShakila Sultana MitiAinda não há avaliações

- Chap 4 ElasticityDocumento14 páginasChap 4 ElasticityLâmViênAinda não há avaliações

- Microeconomics Notes 100 (Mitchell)Documento18 páginasMicroeconomics Notes 100 (Mitchell)sasukeAinda não há avaliações

- Economics For Managers - Notes-2Documento15 páginasEconomics For Managers - Notes-2Phillip Gordon MulesAinda não há avaliações

- Chap 04Documento16 páginasChap 04Syed Hamdan100% (1)

- R12 Topics in Demand and Supply AnalysisDocumento40 páginasR12 Topics in Demand and Supply AnalysisNeeraj KatewaAinda não há avaliações

- CH 04Documento26 páginasCH 04Tanmay PawarAinda não há avaliações

- 02Documento8 páginas02Anubhav JainAinda não há avaliações

- Park 7e SM ch04Documento16 páginasPark 7e SM ch04AndreaAndradeAinda não há avaliações

- Chapter 5 N 6 Questions For ReviewDocumento3 páginasChapter 5 N 6 Questions For ReviewNguyễn Thị ThờiAinda não há avaliações

- Elasticity and ApplicationsDocumento8 páginasElasticity and ApplicationsshubhamAinda não há avaliações

- Chapter Twenty: Elasticity of Demand and SupplyDocumento5 páginasChapter Twenty: Elasticity of Demand and SupplyMya BallinAinda não há avaliações

- Income Elasticity of Demand: InterpretationDocumento10 páginasIncome Elasticity of Demand: Interpretationabhijeet9981Ainda não há avaliações

- Elasticity of Demand and Supply Lecture NotesDocumento5 páginasElasticity of Demand and Supply Lecture NotesNastya CurcubetAinda não há avaliações

- Chapter Two Introduction To EconomicsDocumento36 páginasChapter Two Introduction To Economicsnigusu deguAinda não há avaliações

- BEEB1013 Principles of Economics: Ch. 5: ElasticityDocumento5 páginasBEEB1013 Principles of Economics: Ch. 5: ElasticityNur Izzati HalilAinda não há avaliações

- Answers To Pause-for-Thought Questions: Part B: Business and The MarketDocumento2 páginasAnswers To Pause-for-Thought Questions: Part B: Business and The MarketAliza TariqAinda não há avaliações

- Economics 1Documento4 páginasEconomics 1Meshu QadirAinda não há avaliações

- CONCEPT of ELASTICITYDocumento60 páginasCONCEPT of ELASTICITYBjun Curada LoretoAinda não há avaliações

- Chap 003Documento21 páginasChap 003johnAinda não há avaliações

- Solution Manual For Microeconomics 5th Edition by David BesankoDocumento26 páginasSolution Manual For Microeconomics 5th Edition by David BesankomohsinwazirAinda não há avaliações

- Lecture Note 8: Applying Consumer Theory To Competitive Markets - The United States Sugar ProgramDocumento12 páginasLecture Note 8: Applying Consumer Theory To Competitive Markets - The United States Sugar ProgramThev SightsAinda não há avaliações

- Elasticity and Its ApplicationsDocumento44 páginasElasticity and Its ApplicationsFahadAinda não há avaliações

- Multiple Choice Tutorial: Elasticity of Demand & SupplyDocumento63 páginasMultiple Choice Tutorial: Elasticity of Demand & SupplyZURMAN1Ainda não há avaliações

- ElasticityDocumento7 páginasElasticityeeqanabeellaAinda não há avaliações

- Concept of Elasticty and Its Application (+ Handwritten Notes Too)Documento41 páginasConcept of Elasticty and Its Application (+ Handwritten Notes Too)Aishwarya ChauhanAinda não há avaliações

- Bec Module 3Documento3 páginasBec Module 3cheskaAinda não há avaliações

- GROUPACTIVITYDocumento13 páginasGROUPACTIVITYNeil B. Matu-ogAinda não há avaliações

- Ignou Sovled Assignment Ms09Documento20 páginasIgnou Sovled Assignment Ms09Jugal Maharjan0% (1)

- Elasticity of Supply and Demand SessionDocumento23 páginasElasticity of Supply and Demand SessionCharlizeK0% (1)

- Jesus Paid It All: 1 of 2 Last Updated 6/9/2007Documento2 páginasJesus Paid It All: 1 of 2 Last Updated 6/9/2007debbiewalker87Ainda não há avaliações

- 673 Ass 1 Briefing Feb 2014Documento1 página673 Ass 1 Briefing Feb 2014debbiewalker87Ainda não há avaliações

- Your Love Never Fails (Chord Chart)Documento1 páginaYour Love Never Fails (Chord Chart)debbiewalker87Ainda não há avaliações

- Your Love Never Fails (Chord Chart)Documento1 páginaYour Love Never Fails (Chord Chart)debbiewalker87Ainda não há avaliações

- Jesus Paid It AllDocumento1 páginaJesus Paid It Alldebbiewalker87Ainda não há avaliações

- Your Love Never FailsDocumento1 páginaYour Love Never Failsdebbiewalker87Ainda não há avaliações

- Jesus Paid It All (B) ChartsDocumento4 páginasJesus Paid It All (B) Chartsdebbiewalker87Ainda não há avaliações

- Your Love Never Fails ChordsDocumento2 páginasYour Love Never Fails Chordsdebbiewalker87Ainda não há avaliações

- Your Love Never Fails - ChordsDocumento1 páginaYour Love Never Fails - Chordsdebbiewalker87Ainda não há avaliações

- Jesus Paid It All: Chorus & Turn AroundDocumento1 páginaJesus Paid It All: Chorus & Turn Arounddebbiewalker87Ainda não há avaliações

- Your Love Never FailsDocumento2 páginasYour Love Never Failsdebbiewalker87Ainda não há avaliações

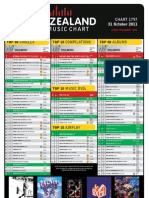

- Chart 1793 03 Oct 2011Documento1 páginaChart 1793 03 Oct 2011debbiewalker87Ainda não há avaliações

- Your Love Never Fails (Chord Chart)Documento1 páginaYour Love Never Fails (Chord Chart)debbiewalker87Ainda não há avaliações

- Jesus Paid It All (B)Documento1 páginaJesus Paid It All (B)debbiewalker87Ainda não há avaliações

- 2013 Course Outline Sem2 Mgt734Documento29 páginas2013 Course Outline Sem2 Mgt734debbiewalker87Ainda não há avaliações

- 3-Hour Medley of Christmas Songs by Halerman444Documento1 página3-Hour Medley of Christmas Songs by Halerman444debbiewalker87Ainda não há avaliações

- Nelson Applied Business Timetable Semester 1 2014Documento2 páginasNelson Applied Business Timetable Semester 1 2014debbiewalker87Ainda não há avaliações

- Lord I Need You BB ChartDocumento1 páginaLord I Need You BB Chartdebbiewalker87Ainda não há avaliações

- Your Grace Finds Me-GDocumento2 páginasYour Grace Finds Me-Gdebbiewalker87Ainda não há avaliações

- 03.king of Heaven GTRDocumento2 páginas03.king of Heaven GTRdebbiewalker87Ainda não há avaliações

- Bachelor of Commerce, Bachelor of Information Technology, Diploma in ViticultureDocumento5 páginasBachelor of Commerce, Bachelor of Information Technology, Diploma in Viticulturedebbiewalker87Ainda não há avaliações

- Radio News ScriptDocumento1 páginaRadio News Scriptdebbiewalker87Ainda não há avaliações

- Chart 1797 31 Oct 2011Documento1 páginaChart 1797 31 Oct 2011debbiewalker87Ainda não há avaliações

- Silent Night Lead SheetDocumento1 páginaSilent Night Lead Sheetdebbiewalker87Ainda não há avaliações

- Intentions Form: Please Complete and Leave Form With Your Office Administrators or PalDocumento1 páginaIntentions Form: Please Complete and Leave Form With Your Office Administrators or Paldebbiewalker87Ainda não há avaliações

- Chart 1791 19 Sept 2011Documento1 páginaChart 1791 19 Sept 2011debbiewalker87Ainda não há avaliações

- Chart 1792 26 Sept 2011Documento1 páginaChart 1792 26 Sept 2011debbiewalker87Ainda não há avaliações

- Chart 1788 29 August 2011Documento1 páginaChart 1788 29 August 2011debbiewalker87Ainda não há avaliações

- Chart 1790 12 Sept 2011Documento1 páginaChart 1790 12 Sept 2011debbiewalker87Ainda não há avaliações

- Chart 1789 05 Sept 2011Documento1 páginaChart 1789 05 Sept 2011debbiewalker87Ainda não há avaliações

- Applied Module 1Documento13 páginasApplied Module 1Joan Mae Angot - VillegasAinda não há avaliações

- Chapter 02 Thinking Like An EconomistDocumento45 páginasChapter 02 Thinking Like An EconomistTiến PhạmAinda não há avaliações

- Review Midterm ExamDocumento12 páginasReview Midterm ExamNgọc Ninh NguyễnAinda não há avaliações

- CH 10Documento38 páginasCH 10Piclang TangAinda não há avaliações

- Demand and Supply Practice PacketDocumento8 páginasDemand and Supply Practice PacketVal Basil100% (1)

- Economics QuizDocumento5 páginasEconomics QuizMohan ManeAinda não há avaliações

- 4UDBE StudyGuide v2 0Documento92 páginas4UDBE StudyGuide v2 0aaaAinda não há avaliações

- Chapter 17 MankiwDocumento9 páginasChapter 17 Mankiwcik siti100% (1)

- Economics Unit 2Documento20 páginasEconomics Unit 2ppriyasonuAinda não há avaliações

- Essentials of Economics 4th Edition Hubbard Test Bank Full Chapter PDFDocumento67 páginasEssentials of Economics 4th Edition Hubbard Test Bank Full Chapter PDFalbertkaylinocwn100% (11)

- 501 Chpt3 AnswersDocumento8 páginas501 Chpt3 AnswersFigen TasAinda não há avaliações

- Parkin 9e TIF ch05Documento34 páginasParkin 9e TIF ch05nbnAinda não há avaliações

- Utility and Indifference Curve WS 2: Published Answer Marks 12 Published Answer Marks 12Documento11 páginasUtility and Indifference Curve WS 2: Published Answer Marks 12 Published Answer Marks 12l PLAY GAMESAinda não há avaliações

- Elasticity of DemandDocumento74 páginasElasticity of DemandShompa Dhali NandiAinda não há avaliações

- 1.3 Explain - Managerial Economics Explained: All Sections No Unread Replies - No RepliesDocumento17 páginas1.3 Explain - Managerial Economics Explained: All Sections No Unread Replies - No RepliesJulian AlbaAinda não há avaliações

- ECONOMICS FORM 5 AND 6 VALIDATEDMODERATED AND ALGNED SYLLABUS MinDocumento43 páginasECONOMICS FORM 5 AND 6 VALIDATEDMODERATED AND ALGNED SYLLABUS MinIsaac Mangochi100% (1)

- Applied Econ - Module 2.1Documento5 páginasApplied Econ - Module 2.1Clarence CaberoAinda não há avaliações

- First Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Documento6 páginasFirst Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Febby Grace Villaceran Sabino0% (1)

- Managerial Economics and Financial Analysis: Unit-IDocumento24 páginasManagerial Economics and Financial Analysis: Unit-IJanu JahnaviAinda não há avaliações

- Chapter 2 Demand (ECO415)Documento28 páginasChapter 2 Demand (ECO415)hurin inaniAinda não há avaliações

- Answer No 1Documento9 páginasAnswer No 1Ra meenAinda não há avaliações

- Math 1526 Consumer and Producer Surplus: ScenarioDocumento10 páginasMath 1526 Consumer and Producer Surplus: ScenarioRavi KaruppusamyAinda não há avaliações

- Elasticities of Demand and SupplyDocumento22 páginasElasticities of Demand and SupplySheilaMarieAnnMagcalasAinda não há avaliações

- Economics 6th Edition Hubbard Test Bank 1Documento172 páginasEconomics 6th Edition Hubbard Test Bank 1kelly100% (42)

- AppliedEconomics - Q3 - Mod4 - Market PricingDocumento28 páginasAppliedEconomics - Q3 - Mod4 - Market PricingRolando Corado Rama Gomez Jr.94% (17)

- ECO162 - ElasticityDocumento38 páginasECO162 - ElasticityNorasyahsah JemsAinda não há avaliações

- Mefa Unit-3Documento20 páginasMefa Unit-3rosieAinda não há avaliações

- Solved Percy Consumes Cakes and Ale His Demand Function For CakesDocumento1 páginaSolved Percy Consumes Cakes and Ale His Demand Function For CakesM Bilal SaleemAinda não há avaliações

- EBD NotesDocumento13 páginasEBD NotesAngel ChakrabortyAinda não há avaliações

- BBA Managerial Economics NotesDocumento148 páginasBBA Managerial Economics NotesFiza IrfanAinda não há avaliações