Escolar Documentos

Profissional Documentos

Cultura Documentos

Building A Thriving and Extended Utilities Value Chain

Enviado por

CognizantTítulo original

Direitos autorais

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Building A Thriving and Extended Utilities Value Chain

Enviado por

CognizantDireitos autorais:

Cognizant 20-20 Insights

Building a Thriving and Extended Utilities Value Chain

To transform from commodity power suppliers to innovative service providers, utilities must lead an emerging ecosystem that facilitates revenue decoupling, renewable energy and energy efficiency portfolio standards.

Executive Summary

The U.S. electric power sector stands at a crossroads, as numerous factors, both internal and external, challenge the traditional operating model. The utilities industry has remained unchanged for years, and for good reason: Business has remained extremely stable, predictable and insulated from most external macroeconomic events. Today, however, utilities face an array of challenges and opportunities amid a rapidly evolving information- and technologydriven environment. New approaches to serving customers by using less energy, cleaner energy and emerging technologies are taking hold, and at the same time, tried-and-true business-asusual approaches have become more expensive, complicated and risky. The challenges are unprecedented. The traditional goals of safety, efficiency and reliability have become even more important to attain, even while new global environmental issues arise, including climate change and national security concerns regarding foreign energy dependence. Meanwhile, future-thinking utilities must also support a growing desire by customers to have greater control over their energy use to reduce costs and decrease their environmental impact. Meeting these demands and turning these challenges into opportunities requires a complete transformation of the traditional electric utility business model. So while delivering safe and reliable electricity will always form the bedrock of operations, the modern utility must now expand its vision and adapt to changing circumstances to deliver energy sustainably to customers and generate value for shareholders.

Traditional Business Imperatives

Traditionally, the utilities business model has revolved around the following four pillars (see Figure 1, next page).

Grid

security and service reliability: An electric grid has often been described as the worlds largest machine. Utilities perform the gargantuan task of managing this complex system every second of the day. service: Serving customers is the foundation of the business, and in this heavily regulated industry, managing high levels of customer service is a tough task. responsibility: With 50% of the nations electricity needs still relying on coal as fuel, utilities have a major role to play in the environmental discussion.

Customer

Environmental

cognizant 20-20 insights | march 2013

Utilities Traditional Business Imperatives

Demand Response

the U.S., responsible for approximately 40% of total emissions (see Figure 2).1

Projected

Reliability/Security

Managing Investments

Customer Satisfaction

Environmental Responsibility

Figure 1

Managing

investments: Utilities are among the most asset-intensive of all businesses, making it critical to maintain asset availability, increase asset productivity and enable a stronger return on investment.

growth in electricity needs. Demand for electricity is projected to grow by about 30% in 2035 over 2005 levels.2 Most states in the U.S. support climate/clean energy policies, and federal action is likely in the near term that will further increase restrictions on fossil-fuel-based electricity generation (see Figure 3, next page). Japans March 2011 nuclear catastrophe raises further questions about the viability of nuclear generation as a sustainable clean generation source. Todays utilities face significant challenges, from reducing dependency on fossil fuel and severely constrained capital expenditures, through heightened security requirements. This means relying on technology to optimize operations (such as the smart grid) and increasing collaboration with fellow utilities and technology providers to identify and develop alternative viable energy sources. declines in production costs for renewable energy technologies. support and uptake of regulatory policies to allow utilities to utilize large-scale energy efficiency as the lowest-cost energy resource. of smart grid technologies that offer utilities and their customers the information and tools to better manage electricity usage. ment of plug-in electric vehicles (PEVs).

Continued Growing

Several significant and persistent trends are influencing and challenging the traditional utilities business model. Some of the most prominent ones include:

Implementation

The

imperative to reduce greenhouse gas (GHG) emissions upwards of 80% by 2050. The electric power sector is the largest single source of global carbon dioxide emissions in

Growing interest and activity in the develop-

Assumed Economy-wide CO2 Reduction Target

Historical emissions

7 2005 = 5,982 mmT CO2 6 5 4 3 2 1 0 1990 2000 2010 2020 2030 2040 2050 2012 = 3% below 2005 (5,803 mmT CO2)

Billion tons CO2

Remainder of U.S. Economy

2020 = 17% below 2005 (4,965 mmT CO2) 2030 = 42% below 2005 (3,470 mmT CO2)

U.S. Electric Sector

2050 = 83% below 2005 (1,017 mmT CO2)

Figure 2

2

80% CO2 reduction by 2050

Increasing

recognition of domestic natural gas as a resource that is less carbon intensive than other fossil fuels for large-scale electricity generation, complementary to renewable energy resources and domestically abundant.

A utility that deals effectively with these trends will be better positioned to succeed in both the short and long terms. Further, such a utility is also more likely to provide better value to its customers and earn stronger returns for investors. The far-reaching impact of these issues makes them more than just a utilities-only problem; solving these challenges will require close collaboration among customers, technologists, researchers and academia, as well as supportive regulatory policies that facilitate revenue decoupling, renewable energy and energy efficiency portfolio standards. The need exists for an ecosystem an extended value chain in which all stakeholders can thrive. Such an ecosystem will further support the ongoing transformation of utilities from simple, regimented, centralized brokers of commodity electric power to complex, diversified, innovative service providers equipped to face the future. This necessary transformation brings into focus the important consideration of how utilities can create an ecosystem that optimizes expenditures, leverages the best skills and technologies and enables the realization of key business imperatives.

Traditionally, utilities have tended to develop business-technology capabilities in-house. Considering todays uncertain economy and the vast challenges they face, utilities need to rethink their core operating assumptions. Given the considerable capital and skills requirements needed to modernize their business, utilities need to question the Solving these viability of relying solely on challenges will require in-house capabilities to build all the new required capa- close collaboration bilities vs. leveraging external among customers, skill sets that are proprietary technologists, in nature. Finding the best solution will be a delicate bal- researchers and ancing act. academia, as well as Before delving into understanding the solution, it is important to understand some of the structural changes happening in the industry that flow directly from the creation of an extended value chain.

supportive regulatory policies that facilitate revenue decoupling, renewable energy and energy efficiency portfolio standards.

The Extended Value Chain

As a form of energy, electricity offers diverse uses and has thus spawned numerous specialty industry sectors, with far-reaching downstream impacts (i.e., GHG emissions). As a result, extracting efficiency from the energy value chain now requires a holistic strategy that connects downstream and upstream sub-functions. Several

Electricity Demand Projection

6,000

Billion kilowatt hours

5,000 4,000 3,000 2,000 1,000 0 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 Historical Projected*

* Electricity demand projections based on expected growth between 2006 and 2035

Figure 3

cognizant 20-20 insights

Utilities Extended Value Chain

Utilities Value Chain

Energy Control Center Interconnection

Extended Value Chain

Upstream

EV and Transportation Infrastructure Energy Management, Demand Curtailment Carbon Cap & Trade

Power Plant/ Substation

Power Plant/ Substation

Interconnection Distribution System Distribution System Distribution System

Downstream

Energy Storage Distributed Generation Clean Tech

Smart Grid

Figure 4

specialized business sectors are expanding the ability and purpose of the traditional value chain, such as:

Reliability: An increase in the reliability of the

electrical system through automatic outage notification, accelerated service restoration and improved grid asset management. benefits: Reduced emissions through enhanced grid efficiency and less need to build new generation, transmission and distribution facilities through increased system load factor and reduced peak demand. information marketplace: Increased commercial benefits by encouraging the development of a new energy information marketplace that will provide the tools and services that consumers need to understand and manage their energy use.

Electronvolt (EV) and transportation infra-

structure: EV, battery switch, charging technology and other EV transportation infrastructure providers. management and demand curtailment: Demand-side management (DSM) and load management solutions.

Environmental

Energy

Energy

Carbon cap and trade: Exchanges, traders, etc. Energy storage: Battery, flow battery, CAES,

flywheel, ultra capacitors.3

Distributed

generation: Individually owned generation and grid integrators.

Clean tech: Solar, bio fuels, fuel cells.

Thus, the traditional value chain with upstream and downstream functions makes the extended value chain a reality (see Figure 4). The smart grid has a key role to play as a valuechain integrator in the extended value chain. The likely benefits of extended value chain integration include:

Structural Changes Enabling the Extended Value Chain

It has never been more dire for our society to focus on extracting as much efficiency as possible from existing electricity infrastructure investments. For most utilities, this means increasing efficiency in generation, on the grid and also at the end-user level, while addressing the challenges posed by these mandates. To remain competitive, utilities must respond to the risks and opportunities presented by diverse and often conflicting objectives, such as the need to address climate change, carbon costs, fuel price volatility, emerging clean technologies, energy efficiency programs, customer expectations and competing third-party energy providers. Responding to

Granular

consumption data: More efficient real-time energy management through the smart grid, as well as the development and use of more energy-efficient appliances, thus reducing peak energy usage by moving less critical activities to non-peak times.

cognizant 20-20 insights

Traditional vs. Forward-Thinking Utilities

Factor Business Model Services Electricity Demand Capacity Cost Utility Objectives Role of Consumer Traditional Utility

Simple, based on steadily increasing electricity sales, typically from an expanding asset base of centralized generation and traditional delivery infrastructure.* Regimented commodized services. Increasing.

Utility That Recognizes the Extended Value Chain

Complex, integrated energy services serving diverse and evolving customer needs with an information-enabled infrastructure. Diversified, innovative service provider. Flattening (on a normalized base) with a potential decline, exception being the deployment of new electric vehicles.** Average cost of new capacity increasing. *** Reliability, environmental quality, service quality, affordability (low bills), returns to shareholders. Active, equipped with technology and incentives to manage energy consumption and generate energy.

Average cost of new capacity stable or declining. Reliability, customer service, affordability (low rates), returns to shareholders.**** Passive

* Although new technologies have been introduced, long equipment lifecycles, standardization and aversion to risk have tended to limit the implementation of innovative transmission and distribution system technology. ** New energy services, such as powering electric vehicles, may increase demand, but the net impact is currently unclear. *** The cost of new capacity will be partially offset as low carbon-generating resources become commercially mature. **** Investor-owned utilities, in addition to managing costs, have the goal of earning market-based returns for shareholders, while publicly owned utilities have the goal of minimizing cost for members.

Figure 5

Investments in Green Technologies

these challenges will require new core competencies and a remake of the industrys value chain. As stated previously, utilities cannot do this all alone. To succeed, they need to recognize and manage the emerging extended value chain. Figure 5 depicts how a utility that recognizes the extended value chain will differ from one that does not. Thus, successful utilities will continue to own customers and their consumption, while new services and products will enable them to efficiently serve customers by successfully evolving and integrating new business capabilities into the extended value chain. This will create a singlechannel delivery mechanism for all customer needs.4 The Skill Set/Specialization Landscape The urgency of the challenges facing the utilities industry has resulted in increased attention from investors and the research community (see Figure 6). A tremendous amount of investment

10,000 9,000 8,000 Millions ($) 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 2001 2002 2003 2004 2005 2006 2007 2008 Year Investment ($M) $714 $899 $1,700 $1,800 $2,500 $3,600 $5,180 $10,000

Figure 6

cognizant 20-20 insights

The Evolving Energy Specialization Industry

EnerNOC: Software and services facilitate Comverge: DSM software. Opower: SaaS company that licenses its

reduced demand and act as an intermediary between customers and utilities.

GE Lightings ESCO: Energy services program. Earth Aid: Home energy management. Better Place: Transportation infrastructure,

battery switch stations. curtailment.

software to utilities, creating reports on energy consumption analysis, with recommendations that customers can use to lower consumption Partners with Honeywell. provider, similar to EnerNOC.

Energy Curtailment Specialists, Inc.: Energy ConsumerPowerLine: Energy management, DSM. EnergyHub: Home energy management, SaaS

platform. stats.

Tendril: Energy management technology Coulomb Technologies: Charging station

Figure 7 provider; has partnered with Ford Motor Co.

Ecobee: Wi-Fi-enabled programmable thermo-

and cutting-edge research has resulted in the rapid development of upstream and downstream technology specializations (see Figure 7). Investments from outside the traditional utilities sector are pivoting around how energy is generated, transmitted and consumed something that any utility can make extensive use of. Figure 8 provides an overview of the specialization landscape that is emerging in the extended industry value chain. This is expected to evolve and mature as additional research is conducted and investments are made.

Regulatory Changes Amid the New Specialization Landscape The regulatory environment may not be able to support the emerging extended value chain; however, it is widely anticipated that regulations will evolve as the industry changes and will encourage energy independence, renewable energy and energy efficiency. These policies, which fall within the purview of state governments and utility regulatory commissions, include:

Clean energy policies: Set an overall direction

to align clean energy goals across different government agencies, state and federal regulators and public service commissions and

Utilities Industry Expansion

Extended Value Chain Elements Electric Vehicles and Transportation Infrastructure Energy Management and Demand Curtailment Energy Storage Electric Vehicles Energy Efficiency Battery Battery Technology Home Energy Management Capacitor Individually Owned Generation Grid Integrators Solar Fuel Cells Bio Fuels

Specialization Landscape

Charging Technology Load Management EV Transportation Infrastructure Load Curtailment Programs Hazardous Waste Management

Distributed Generation

Clean Tech

Smart Grid

Figure 8

cognizant 20-20 insights

drive changes that increase commitment to clean energy resources.

Discovery:

Renewable

portfolio standards: Incentivize compliance both at the consumption and generation stages and reward those parties that deliver results. decoupling: Create an innovative policy framework that removes utilities inherent disincentive for implementing largescale energy efficiency frameworks. net metering: Promote and incentivize distributed generation to facilitate consumer investment in on-site renewable energy generation. rate-making: Encourage long-term right investments by making provisions for premium returns. footprint policies: Set policies that incentivize customers and utilities to reduce their carbon footprints.

Revenue

Effective

In this stage, the ecosystems strategic intent is defined. After understanding the need, a situational analysis of the organizations strengths, weaknesses, opportunities and threats (SWOT analysis) is conducted, and critical industry issues are raised. Finally, an external analysis an assessment of the evolution of the extended value chain is undertaken, noting that the ecosystem will evolve over time. This will give the utility an idea of the role and the degree of influence it has in creating the ecosystem. Any gap that exists between a utilitys strategic intent, the strengths revealed through the SWOT analysis and the capabilities to be built into the extended value chain can be evaluated on the basis of the utilitys ability to deliver against these goals and its impact on the business. Additional aspects to consider include:

Incentive Carbon

>> Developing

A Strategic Framework for Assessing the Extended Value Chain

How can a utility successfully build an ecosystem that uses the best industry elements? An integrated utility is in the best position to nurture this ecosystem and mentor partners to provide the highest levels of customer service. For this to happen, key questions must be considered, including:

an ecosystem hierarchy, including creation of categories, roles and protocols. ponents that must be considered as a part of the utilitys business. the relative importance of the new extended value chain components to the utilitys business.

>> Defining the extended value chain com>> Defining

How can utilities design/build this ecosystem

and weave it into their business strategy?

Formulation:

How

can they monetize their considerable investment to make this ecosystem possible? (Utilities investments in the extended value chain are said to exceed that of other members.) Regulators will play a defining role, without question. policies (with support of regulators) that enable its members to operate without conflicts? value to stakeholders?

This stage involves the production of a clear set of recommendations, with supporting justification and supply strategies for accomplishing them. These findings lead into the prism assessment (see Figure 9, next page). The prism helps utilities assess their unique capabilities, such as ability to deliver, which is the ability to deliver extended value chain benefits. It also ranks external extended value chain members in categories such as participate, guide and mentor in relation to utilities capabilities. This framework serves as a guideline for defining the in-house capabilities to be built, areas for collaboration and capabilities that are core to the utilitys business and should stay in-house.

How does the ecosystem create standards and How can utilities ensure these efforts result in How can utilities develop strong internal capabilities, while leveraging the key capabilities of extended value chain members to maximize value to stakeholders?

Implementation:

We have developed an extended value chain framework that distills ecosystem development into a three-stage activity, comprising discovery, formulation and implementation phases.

This stage is based on the amount of autonomy a utility wants to build into the ecosystem. Accordingly, there are three approaches that can be followed.

cognizant 20-20 insights

Extended Value Chain Prism Model

Ecosystem Member Involvement

St ra te gi

Ecosystem Hierarchy

Mentor

In

te

nt

Guide

Participant

s Pre

ed ent

Low

n* & EV ortatio ge* ora nsp y St g r Ext ne E SM* e Str nde &D ate ted EM dV gic ribution* Dist Imp alue ra Cha ene Op ort G * era an ech tion ce t in Ele an T me o Cle s

as e xam

ples

Tra

h Hi g

Cor eC

om

pet

s ncie

Abi

lity

el to D

iver

Low

Bus

h

ine

Hig

ss

nts

Technology Services Thought Solution

Figure 9

Approach 1: Here, a utility creates an open playground for collaboration and innovation among technology, solution and service providers by extending access to its data within a legal and mutually acceptable commercial framework (see Figure 10). The most important aspect of this ecosystem is controlled and restricted access to data and the safeguarding of the utilitys privacy concerns and business interests. There are regulatory challenges and privacy concerns regarding access to customer consumption data.5 It is important to build openness into the ecosystem that fosters innovation. This means

anyone with an idea can be a part of the ecosystem, comply with the legal and commercial framework, partner with the ecosystem members and build an industry-leading solution. There are several positive upsides to such an ecosystem:

It

offers high incentives for stakeholders, utilities and customers. the ecosystem.

The utility maintains control over and governs Potential exists for large-scale innovation. The utility remains on the front end.

Approach 1: Open Innovation

Customer

Utility

Internet/Paging Network/RF

External Stakeholders

Customer Interaction Channels

Alternate Energy Sources

Access to infrastructure

Smart Utility Meter

Utility

In-Home Display Thermostat

Makes available data

Consumption data Grid data Generation data

Makes available solutions and services

EVs & Transportation Infrastructure

Load Control Modules

Legal Framework Commercial Framework

Fuel Storage

Energy Management

Utility Interaction Channels

Figure 10

cognizant 20-20 insights

Approach 2: Consortium Method

Customer

Utility

Internet/Paging Network/RF

External Stakeholders

Customer Interaction Channels

Alternate Energy Sources

Solution 1 Solution 2 Solution 4

Smart Utility Meter

Solution 3 Utility

In-Home Display Thermostat

Makes available guidance

Load Control Modules

Utility or a utilities services partner collaborates to develop best-of-breed solutions and services.

Makes available expertise

EVs & Transportation Infrastructure

Legal Framework Commercial Framework

Fuel Storage

Energy Management

Utility Interaction Channels

Figure 11

Innovations likely to emerge from this ecosystem include:

approach followed by many industries for risk mitigation when pursuing unchartered waters. The salient features of this ecosystem include:

A charging station service provider can design

locations, rates, etc., based on load, grid topography, etc.

Customers Customers Common

can receive consumption alerts and notifications from a third-party (within the defined customer interaction framework). can receive tailor-made solutions and services for functions such as energy efficiency, load control. interface and standards can be developed for interactions between EVs, appliances and the utility. that can communicate with the utility and the customer to determine the optimal timing for usage (such as a dryer, pool heater, etc.). functions such as energy management, customers can choose from multiple vendors (ie, Google or Cisco), while utilities can use the tools they need to collect and manage data from the smart grid ( la iTunes).

Limited to no data access. Utility involvement and Fewer

investments; the responsibility for formulating problem statements rests with the utility. opportunities for incentives for participants. innovation and

Similarities

Innovations can be developed, such as appliances

with existing one-to-one utility relationships/partnerships except that this model offers a common commercial and legal framework, expanding the opportunity for partners to co-innovate and collaborate for mutual benefit.

Innovations likely to come out of this ecosystem include:

For

Utilities can certify and recommend a certain

brand/type of LED lights, solar panels, charging stations, etc. of an energy efficiency solution provider to deliver their DSM programs. can collaborate to develop and co-brand charging stations, battery switch stations, etc. can collaborate with distributed generation infrastructure providers and integrate their grid and back-end systems.

Utilities can leverage a proprietary algorithm Utilities Utilities

Approach 2: This method is similar to Approach 1 but with a lot less openness (see Figure 11). In fact, Approach 2 is recommended when security and privacy issues are insurmountable. This approach allows for point-to-point interactions between the utility and ecosystem members. The additional layer of controls and governance constrains co-innovation and supports fewer ecosystem members. This may resemble the consortium

cognizant 20-20 insights

Approach 3: Point-to-Point Collaboration

Customer

Utility

Internet/Paging Network/RF

External Stakeholders

Customer Interaction Channels

Legal Framework

Solution 1 Utility

Alternate Energy Sources EVs & Transportation Infrastructure

Smart Utility Meter

In-Home Display Load Control Modules Thermostat

Makes available guidance

Solution 2 Solution 3 Solution 4

Makes available expertise

Fuel Storage

Commercial Framework

Energy Management

Utility Interaction Channels

Figure 12

Approach 3: In this approach, the utility attempts to enhance and fine-tune its strategic procurement process to fit the extended value chain (see Figure 12). This approach is recommended when there are legal and/or commercial challenges to building a multi-party ecosystem. Here, a utility builds a narrow consortium of (typically industry-leading) technology, solution and service providers. It collaborates individually, with or without other partners being involved. This significantly reduces innovation and solely relies on individual collaboration to boost the ecosystem. Salient features of this ecosystem include:

Typically, the utility builds on its strengths and

capabilities core to the business and collaborates with external stakeholders for the rest. ers for specific functions.

Utilities may compete with external stakehold Opportunities

for innovation and incentives exist for fewer participants.

Looking Ahead

The extended value chain concept needs to be woven into a utilitys strategy. To reach unprecedented vistas of operational innovation, utilities must find the right level of partner collaboration with stakeholders whose interests and capabilities are properly aligned. This wave of innovation stands to deliver on all macro-economic expectations and, most importantly, generate superior value to customers and investors.

Access to data and utility problem statements

may not be available to ecosystem members. are significantly higher.

Involvement and investments from the utility

Footnotes

1 2

The Power to Reduce CO2 Emissions, Electric Power Research Institute, 2009. Energy Information Administration, Annual Energy Review and Energy Outlook, U.S. Department of Energy, 2010. Sandia National Laboratories, http://www.sandia.gov/ess/project_map/index.html. Research from Cleantech Group. Sherry Lichtenberg, Ph.D., Smart Grid Data: Must There Be Conflict Between Energy Management and Consumer Privacy? National Regulatory Research Institute, 2010, http://www.nrri.org/pubs/telecommunications/NRRI_smart_grid_privacy_dec10-17.pdf.

3 4 5

cognizant 20-20 insights

10

About the Author

Sanju Nair is a Manager of Consulting, focusing on the power utilities sector within Cognizant Business Consulting. He specializes in customer service, asset management and smart grid. Sanju has over 10 years of industry experience, including operation and maintenance of captive facilities and working with various global leaders. His consulting experience includes designing multiple asset management solutions for network and T&D assets, designing a strategic roadmap for smart grid integration and revamping customer service processes. He can be reached at Sanju.nair2@cognizant.com.

About Cognizant

Cognizant (NASDAQ: CTSH) is a leading provider of information technology, consulting, and business process outsourcing services, dedicated to helping the worlds leading companies build stronger businesses. Headquartered in Teaneck, New Jersey (U.S.), Cognizant combines a passion for client satisfaction, technology innovation, deep industry and business process expertise, and a global, collaborative workforce that embodies the future of work. With over 50 delivery centers worldwide and approximately 156,700 employees as of December 31, 2012, Cognizant is a member of the NASDAQ-100, the S&P 500, the Forbes Global 2000, and the Fortune 500 and is ranked among the top performing and fastest growing companies in the world. Visit us online at www.cognizant.com or follow us on Twitter: Cognizant.

World Headquarters

500 Frank W. Burr Blvd. Teaneck, NJ 07666 USA Phone: +1 201 801 0233 Fax: +1 201 801 0243 Toll Free: +1 888 937 3277 Email: inquiry@cognizant.com

European Headquarters

1 Kingdom Street Paddington Central London W2 6BD Phone: +44 (0) 20 7297 7600 Fax: +44 (0) 20 7121 0102 Email: infouk@cognizant.com

India Operations Headquarters

#5/535, Old Mahabalipuram Road Okkiyam Pettai, Thoraipakkam Chennai, 600 096 India Phone: +91 (0) 44 4209 6000 Fax: +91 (0) 44 4209 6060 Email: inquiryindia@cognizant.com

Copyright 2013, Cognizant. All rights reserved. No part of this document may be reproduced, stored in a retrieval system, transmitted in any form or by any

means, electronic, mechanical, photocopying, recording, or otherwise, without the express written permission from Cognizant. The information contained herein is subject to change without notice. All other trademarks mentioned herein are the property of their respective owners.

Você também pode gostar

- Just Because It's Digital Doesn't Mean It's A SuccessDocumento6 páginasJust Because It's Digital Doesn't Mean It's A SuccessCognizantAinda não há avaliações

- Consumer-Centric Transformation at Anthem: Digital and Then SomeDocumento6 páginasConsumer-Centric Transformation at Anthem: Digital and Then SomeCognizantAinda não há avaliações

- And Now For The Hard WorkDocumento7 páginasAnd Now For The Hard WorkCognizantAinda não há avaliações

- Digital: More About Business Than IT ChangeDocumento6 páginasDigital: More About Business Than IT ChangeCognizantAinda não há avaliações

- How Digital Is Reinventing Levi Strauss & Co.'s IT Business ModelDocumento5 páginasHow Digital Is Reinventing Levi Strauss & Co.'s IT Business ModelCognizantAinda não há avaliações

- Illuminating The Digital Journey AheadDocumento6 páginasIlluminating The Digital Journey AheadCognizantAinda não há avaliações

- Dial Tone Goes DigitalDocumento5 páginasDial Tone Goes DigitalCognizantAinda não há avaliações

- Transparent Pricing: The Future For Healthcare ProvidersDocumento9 páginasTransparent Pricing: The Future For Healthcare ProvidersCognizantAinda não há avaliações

- Strategic IT Transformation Programme Delivers Next-Generation Agile IT Infrastructure With Industry-Leading Resilience For Standard LifeDocumento3 páginasStrategic IT Transformation Programme Delivers Next-Generation Agile IT Infrastructure With Industry-Leading Resilience For Standard LifeCognizantAinda não há avaliações

- Adopting DevOps: Overcoming Three Common Stumbling BlocksDocumento11 páginasAdopting DevOps: Overcoming Three Common Stumbling BlocksCognizantAinda não há avaliações

- Cognizanti Journal Volume 10, Issue 1, 2017Documento52 páginasCognizanti Journal Volume 10, Issue 1, 2017CognizantAinda não há avaliações

- Recoding The Customer ExperienceDocumento12 páginasRecoding The Customer ExperienceCognizantAinda não há avaliações

- Cognitive Computing: The Next Stage in Human/Machine CoevolutionDocumento13 páginasCognitive Computing: The Next Stage in Human/Machine CoevolutionCognizantAinda não há avaliações

- The 2020 Customer ExperienceDocumento14 páginasThe 2020 Customer ExperienceCognizantAinda não há avaliações

- The Future of MoneyDocumento18 páginasThe Future of MoneyCognizantAinda não há avaliações

- Taking Control of The MLR Review ProcessDocumento10 páginasTaking Control of The MLR Review ProcessCognizantAinda não há avaliações

- Analytical Storytelling: From Insight To ActionDocumento16 páginasAnalytical Storytelling: From Insight To ActionCognizant100% (1)

- A Multidimensional View of Critical Web Application Security Risks: A Novel 'Attacker-Defender' PoVDocumento18 páginasA Multidimensional View of Critical Web Application Security Risks: A Novel 'Attacker-Defender' PoVCognizantAinda não há avaliações

- Blockchain: A Potential Game-Changer For Life InsuranceDocumento20 páginasBlockchain: A Potential Game-Changer For Life InsuranceCognizantAinda não há avaliações

- Weighing Telecom Opportunities & Challenges in New Growth Markets South of The BorderDocumento8 páginasWeighing Telecom Opportunities & Challenges in New Growth Markets South of The BorderCognizantAinda não há avaliações

- Aligning Value With Key Capabilities To Drive Retail SuccessDocumento14 páginasAligning Value With Key Capabilities To Drive Retail SuccessCognizantAinda não há avaliações

- An Analytical Approach To Provider and Intermediary Segmentation in The Pharmaceuticals IndustryDocumento7 páginasAn Analytical Approach To Provider and Intermediary Segmentation in The Pharmaceuticals IndustryCognizantAinda não há avaliações

- The Work Ahead: How Data and Digital Mastery Will Usher in An Era of Innovation and CollaborationDocumento24 páginasThe Work Ahead: How Data and Digital Mastery Will Usher in An Era of Innovation and CollaborationCognizantAinda não há avaliações

- Retailers' Disconnect With Shoppers Is Costing ThemDocumento14 páginasRetailers' Disconnect With Shoppers Is Costing ThemCognizantAinda não há avaliações

- Digitizing Field Service Vendor ManagementDocumento10 páginasDigitizing Field Service Vendor ManagementCognizantAinda não há avaliações

- Building A Holistic Capital Management FrameworkDocumento16 páginasBuilding A Holistic Capital Management FrameworkCognizantAinda não há avaliações

- Belgium's SIGEDIS Compliance Program: Doing It The Smart WayDocumento8 páginasBelgium's SIGEDIS Compliance Program: Doing It The Smart WayCognizantAinda não há avaliações

- Preparing For The OECD Common Reporting StandardDocumento7 páginasPreparing For The OECD Common Reporting StandardCognizantAinda não há avaliações

- Preparing For The Regulatory Challenges Wrought by Software As A Medical DeviceDocumento12 páginasPreparing For The Regulatory Challenges Wrought by Software As A Medical DeviceCognizantAinda não há avaliações

- Collective Intelligence: Filling The Insurance Talent GapDocumento14 páginasCollective Intelligence: Filling The Insurance Talent GapCognizantAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- SWOT Analysis For Solar PV-Technology: Dr. Chandani Sharma and Dr. Anamika JainDocumento4 páginasSWOT Analysis For Solar PV-Technology: Dr. Chandani Sharma and Dr. Anamika JainManish VaswaniAinda não há avaliações

- Seminar On Solar Electric Vehicle by Devareddy Srinu (19815A0210)Documento18 páginasSeminar On Solar Electric Vehicle by Devareddy Srinu (19815A0210)yaswanth 9573099277Ainda não há avaliações

- A Pivotal Moment: Sierra Club Foundation Annual Report 2015Documento36 páginasA Pivotal Moment: Sierra Club Foundation Annual Report 2015Mika DeverinAinda não há avaliações

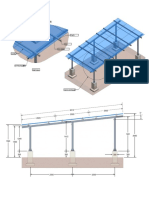

- Mounting PV DesignDocumento1 páginaMounting PV DesignNicolas PEREZAinda não há avaliações

- Energy Consumption & Potential Retrofitting of Highway: Rest and Service Areas (Rsas)Documento53 páginasEnergy Consumption & Potential Retrofitting of Highway: Rest and Service Areas (Rsas)Wan Ahmad FaizFaizalAinda não há avaliações

- Geology & Geothermal ResourcesDocumento40 páginasGeology & Geothermal ResourcesJamhur StAinda não há avaliações

- Ebusco Corporate-Brochure Website EnglishDocumento20 páginasEbusco Corporate-Brochure Website EnglishBowo KusumoAinda não há avaliações

- National Portal For Rooftop Solar - Ministry of New and Renewable EnergyDocumento4 páginasNational Portal For Rooftop Solar - Ministry of New and Renewable EnergykamalmuraAinda não há avaliações

- Andhra PardeshDocumento46 páginasAndhra PardeshSiddharth SharmaAinda não há avaliações

- Su mit Singhani's Resume for Operations Management and Sustainability PositionsDocumento1 páginaSu mit Singhani's Resume for Operations Management and Sustainability PositionsSumit SinghaniAinda não há avaliações

- BrightLeaf Power GeneralBrochure Aug 12Documento2 páginasBrightLeaf Power GeneralBrochure Aug 12Tomas Kern WhiteAinda não há avaliações

- Presentation On State of Power Crisis in BangladeshDocumento10 páginasPresentation On State of Power Crisis in BangladeshrifatAinda não há avaliações

- Yingli CS Cent - Rale-Poggiorsini en 062011-1Documento2 páginasYingli CS Cent - Rale-Poggiorsini en 062011-1ervin custovicAinda não há avaliações

- Siemens - Pictures of The FutureDocumento59 páginasSiemens - Pictures of The FuturehelderfsnAinda não há avaliações

- Low Carbon Energy Transitions in Qatar and The GCCDocumento93 páginasLow Carbon Energy Transitions in Qatar and The GCCLDaggersonAinda não há avaliações

- Republic Act No. 9513: GOVPH (/)Documento29 páginasRepublic Act No. 9513: GOVPH (/)RMC PropertyLawAinda não há avaliações

- Biomass Green Briquette FuelDocumento5 páginasBiomass Green Briquette FuelJoseph ApetuAinda não há avaliações

- Net Zero Energy Buildings Cut Costs and CarbonDocumento5 páginasNet Zero Energy Buildings Cut Costs and CarbonSaleem SayafAinda não há avaliações

- Solar QuestionsDocumento17 páginasSolar Questionsmuhammadshafiq6950% (2)

- Brochure - ADS Global Knowledge AcademyDocumento4 páginasBrochure - ADS Global Knowledge AcademyTanmay BishnoiAinda não há avaliações

- Final Price List Solar SWHS-OS-1214 Wef 30th Dec 2014Documento2 páginasFinal Price List Solar SWHS-OS-1214 Wef 30th Dec 2014AfzalpatelAinda não há avaliações

- Solar Project REPORTDocumento15 páginasSolar Project REPORTismailAinda não há avaliações

- SIP Group 10-Sentha EditedDocumento14 páginasSIP Group 10-Sentha EditedAkshay BAinda não há avaliações

- Solar Crimp ToolsDocumento4 páginasSolar Crimp ToolsCase SalemiAinda não há avaliações

- Tsm-Deg15m 20 (Ii)Documento2 páginasTsm-Deg15m 20 (Ii)Manuel UrdanetaAinda não há avaliações

- Soal Try Out 6 (Bhs. Inggris) UTBKDocumento6 páginasSoal Try Out 6 (Bhs. Inggris) UTBKWahyu Tejo MulyoAinda não há avaliações

- Research Paper Renewable EnergyDocumento9 páginasResearch Paper Renewable EnergyMaíra Prata de AraújoAinda não há avaliações

- Band 9 EssayDocumento5 páginasBand 9 EssayripanAinda não há avaliações

- Pow 3Documento8 páginasPow 3api-268208190Ainda não há avaliações

- The Cost Efficiency of Solar Power: 2006 Project SummaryDocumento1 páginaThe Cost Efficiency of Solar Power: 2006 Project SummaryuhfsteAinda não há avaliações