Escolar Documentos

Profissional Documentos

Cultura Documentos

Portfolio Selection with Two Risky Securities and the Efficient Frontier

Enviado por

David LeeTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Portfolio Selection with Two Risky Securities and the Efficient Frontier

Enviado por

David LeeDireitos autorais:

Formatos disponíveis

Portfolio Selection with Two Risky Securities.

Professor Lasse H. Pedersen

Prof. Lasse H. Pedersen

Outline

Portfolio: expected return and SD Diversification Investment opportunity set Investor preference: risk-return tradeoff Optimal portfolio choice with 2 risky assets

Prof. Lasse H. Pedersen

Portfolio Expected Return and Standard Deviation

The expected return on the portfolio is:

E( Rp ) = i E ( Ri )

With 2 securities, the portfolio variance is:

i =1

2 p

2 = 12 12 + 2 22 + 2 1 2 12 1 2

The standard deviation is:

2 p

3

Prof. Lasse H. Pedersen

Diversification with 2 assets: Example

Suppose we have two assets, US and JP, with: mean US JP 13.6% 15.0% volatility 15.4% 23.0%

and with correlation 27%. If an investor holds 60% in the US and 40% in JP what is the mean and volatility of the portfolio? volatility is another word for standard deviation

Prof. Lasse H. Pedersen 4

Diversification with 2 assets: Example

Portfolio mean: E(Rp) = 0.6*0.136 + 0.4*0.150 = 14.2% Portfolio variance: var(Rp) = (0.6)2*(0.154)2 + (0.4)2*(0.230)2 +2*0.6*0.4*0.27*0.154*0.230 = 0.022 p = 14.7% This portfolio has higher expected return and lower risk than the US market alone!

Prof. Lasse H. Pedersen 5

Risk and Return with Varying Weights

Let be the weight in the US, and 1- the weight in JP. The expected return of the portfolio is: E(rp) = *0.136 + (1-)*0.150 The variance of the portfolio return is: var(rp) = 2*(0.154)2 + (1-)2*(0.230)2 +2**(1-)*0.27*0.154*0.230 What happens when we vary ?

Prof. Lasse H. Pedersen 6

Varying the Portfolio Weights gives: The Investment Opportunity Set

0.152 0.15 0.148 expected return 0.146 0.144 0.142 0.14 0.138 0.136 0.15 US 0.16 0.17 0.18 0.19 0.2 0.21 s tandard deviation 0.22 0.23 0.24 0.25 JP

w 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0

mean 0.150 0.149 0.147 0.146 0.144 0.143 0.142 0.140 0.139 0.137 0.136

volatility 0.230 0.212 0.195 0.179 0.166 0.155 0.147 0.143 0.143 0.146 0.154

Portfolio Terminology

The investment opportunity set consists of all available risk-return combinations. An efficient portfolio is a portfolio that has the highest possible expected return for a given standard deviation The efficient frontier is the set of efficient portfolios. It is the upper portion of the minimum variance frontier starting at the minimum variance portfolio. The minimum variance portfolio (mvp) is the portfolios that provides the lowest variance (standard deviation) among all possible portfolios of risky assets.

Prof. Lasse H. Pedersen

Portfolio Terminology

Mean-s tandard deviation frontier for US and Japan 0.18 0.17 0.16 0.15 Er 0.14 US 0.13 0.12 0.11 0.1 0 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4

Efficient Frontier short US

JP

Minimum Variance short JP Portfolio

Prof. Lasse H. Pedersen

Investment Opportunity Set with Varying Correlations

0 .1 5 2 0.15 0 .1 4 8 e xpec te d re turn 0 .1 4 6 0 .1 4 4 0 .1 4 2 0.14 0 .1 3 8 0 .1 3 6 0 0.05 0.1 0 .1 5 s t a n d a r d d e via t io n US 0.2 0 .2 5 C a s e w it h = -1 C a s e w it h = 0 . 2 7 C a s e w it h = 1

JP

Prof. Lasse H. Pedersen

10

Optimal Portfolio Choice with 2 Risky Assets

Any (mean-variance) investor should choose an efficient portfolio to benefit from diversification. The specific choice depends on the investors risk aversion A more risk-averse investor should choose a portfolio with

lower risk lower expected return

Prof. Lasse H. Pedersen

11

Você também pode gostar

- E Myth RevisitedDocumento11 páginasE Myth RevisitedWil CarloAinda não há avaliações

- FinMan - Risk and Return QuizDocumento3 páginasFinMan - Risk and Return QuizJennifer RasonabeAinda não há avaliações

- Optimal Risky PortfolioDocumento25 páginasOptimal Risky PortfolioAlexandra HsiajsnaksAinda não há avaliações

- Application of Derivatives Tangents and Normals (Calculus) Mathematics E-Book For Public ExamsNo EverandApplication of Derivatives Tangents and Normals (Calculus) Mathematics E-Book For Public ExamsNota: 5 de 5 estrelas5/5 (1)

- Bank GuaranteeDocumento30 páginasBank GuaranteeKaruna ThatsitAinda não há avaliações

- Financial Economics Notes: DiversificationDocumento12 páginasFinancial Economics Notes: DiversificationTheYellowKingAinda não há avaliações

- Optimal Capital Allocation Between Risky and Risk-Free AssetsDocumento20 páginasOptimal Capital Allocation Between Risky and Risk-Free AssetsAlex WanowskiAinda não há avaliações

- International Financial Markets: Costas Arkolakis Teaching Fellow: Federico EspositoDocumento22 páginasInternational Financial Markets: Costas Arkolakis Teaching Fellow: Federico EspositoKajal ChaudharyAinda não há avaliações

- International Portfolio InvestmentsDocumento39 páginasInternational Portfolio InvestmentsAshish SaxenaAinda não há avaliações

- CAPM: The Capital Asset Pricing Model ExplainedDocumento11 páginasCAPM: The Capital Asset Pricing Model Explainedpeter sumAinda não há avaliações

- 2201AFE VW Week 9 Return, Risk and The SMLDocumento50 páginas2201AFE VW Week 9 Return, Risk and The SMLVut BayAinda não há avaliações

- 8 - Portfolio AnalysisDocumento24 páginas8 - Portfolio AnalysisJosh AckmanAinda não há avaliações

- Chapter 1 Introduction To Portfolio Theory: 1.1 Portfolios of Two Risky AssetsDocumento62 páginasChapter 1 Introduction To Portfolio Theory: 1.1 Portfolios of Two Risky AssetsEbenezerMebrateAinda não há avaliações

- 05-Risk Return and CAL - 2014Documento28 páginas05-Risk Return and CAL - 2014strongchong00Ainda não há avaliações

- Minggu 2-4: Analisis Investasi & PortopolioDocumento34 páginasMinggu 2-4: Analisis Investasi & PortopolioFANNY KRISTIANTIAinda não há avaliações

- Return, Risk and The Security Market LineDocumento25 páginasReturn, Risk and The Security Market Linewww_peru9788Ainda não há avaliações

- CH - 5 Capital AllocationDocumento136 páginasCH - 5 Capital AllocationBerhanu ShankoAinda não há avaliações

- Chapter7 Practice QuestionsDocumento7 páginasChapter7 Practice QuestionsNoor TaherAinda não há avaliações

- Financial Economics Bocconi Lecture6Documento22 páginasFinancial Economics Bocconi Lecture6Elisa CarnevaleAinda não há avaliações

- Chapter 11Documento28 páginasChapter 11Khoa LêAinda não há avaliações

- 5 Portfolio TheoryDocumento15 páginas5 Portfolio TheoryUtkarsh BhalodeAinda não há avaliações

- Manajemen KeuanganDocumento12 páginasManajemen Keuangancoba cobaAinda não há avaliações

- Asset Management: Introducing Key Concepts of Portfolio Selection and CAPMDocumento21 páginasAsset Management: Introducing Key Concepts of Portfolio Selection and CAPMAnson LiuAinda não há avaliações

- Optimal+Portfolios+DQ 2008s1Documento2 páginasOptimal+Portfolios+DQ 2008s1permafrostXxAinda não há avaliações

- Portfolio Theory PresentationDocumento50 páginasPortfolio Theory PresentationAkshatAinda não há avaliações

- Return and Risk On Two Assets PortfolioDocumento24 páginasReturn and Risk On Two Assets PortfolioHarsh GuptaAinda não há avaliações

- Risk PreferencesDocumento3 páginasRisk PreferencesCyra AnsariAinda não há avaliações

- Arbitrage Pricing TheoryDocumento15 páginasArbitrage Pricing TheoryYixing ZhangAinda não há avaliações

- ISK Eturn: University of LethbridgeDocumento20 páginasISK Eturn: University of LethbridgeDavid ZhangAinda não há avaliações

- Efficient Portfolios and Capital AllocationDocumento94 páginasEfficient Portfolios and Capital AllocationJose Pinto de AbreuAinda não há avaliações

- Ans 2Documento3 páginasAns 2Varun P ViswanAinda não há avaliações

- MFPMDocumento25 páginasMFPMMadhusmita MishraAinda não há avaliações

- Fnce 220: Business Finance: Topic: Risk & Return RelationshipsDocumento26 páginasFnce 220: Business Finance: Topic: Risk & Return RelationshipsVincent KamemiaAinda não há avaliações

- Risk and Return Portfolio AnalysisDocumento27 páginasRisk and Return Portfolio AnalysisSufyan KhanAinda não há avaliações

- FM423 Practice Exam I SolutionsDocumento10 páginasFM423 Practice Exam I SolutionsruonanAinda não há avaliações

- Chapter 5.pptx Risk and ReturnDocumento25 páginasChapter 5.pptx Risk and ReturnKevin Kivanc IlgarAinda não há avaliações

- Optimal Risky Portfolio (Bodie) PDFDocumento20 páginasOptimal Risky Portfolio (Bodie) PDFjoel_kifAinda não há avaliações

- Ps CAPM SolutionsDocumento14 páginasPs CAPM SolutionsSardar AftabAinda não há avaliações

- CAPM Risk Return ModelDocumento13 páginasCAPM Risk Return ModelJohn W. Paterson IVAinda não há avaliações

- Topic 2: Portfolio Theory, Selection & InvestingDocumento16 páginasTopic 2: Portfolio Theory, Selection & Investing潘超Ainda não há avaliações

- Lecture 4 Risk Aversion and Capital Allocation To Risky AssetsDocumento20 páginasLecture 4 Risk Aversion and Capital Allocation To Risky AssetsLuisLoAinda não há avaliações

- Portfolios of Risky and Risk-Free AssetsDocumento6 páginasPortfolios of Risky and Risk-Free AssetsShrestha SuryaAinda não há avaliações

- Exchange Rates and Monetary Policy UncertaintyDocumento48 páginasExchange Rates and Monetary Policy UncertaintyDudenAinda não há avaliações

- Optimal Risky Portfolios with DiversificationDocumento14 páginasOptimal Risky Portfolios with Diversificationmd mehedi hasanAinda não há avaliações

- Session 3 Notes and FormulaDocumento14 páginasSession 3 Notes and Formulassg2Ainda não há avaliações

- BM410-09 Theory 2 - MPT and Efficient Frontiers 28sep05Documento57 páginasBM410-09 Theory 2 - MPT and Efficient Frontiers 28sep05satishgwAinda não há avaliações

- SAPM - Optimal Risky Portfolio - DistributionDocumento24 páginasSAPM - Optimal Risky Portfolio - DistributionShubham AgrawalAinda não há avaliações

- The Capital Asset Pricing Model: The Risk Return Relation FormalizedDocumento39 páginasThe Capital Asset Pricing Model: The Risk Return Relation Formalizedrohin gargAinda não há avaliações

- Modern Portfolio Theory and Investment Analysis, 7th EditionDocumento6 páginasModern Portfolio Theory and Investment Analysis, 7th EditionAniket GaikwadAinda não há avaliações

- Sem 1 - Capitulo 5 CvitanicDocumento23 páginasSem 1 - Capitulo 5 CvitanicallisonAinda não há avaliações

- FE 445 - Investment Analysis and Portfolio Management: Fall 2020Documento24 páginasFE 445 - Investment Analysis and Portfolio Management: Fall 2020kate ngAinda não há avaliações

- An Introduction To Portfolio Theory: Paul J. AtzbergerDocumento16 páginasAn Introduction To Portfolio Theory: Paul J. AtzbergerSamAinda não há avaliações

- RR Problems SolutionsDocumento5 páginasRR Problems SolutionsShaikh FarazAinda não há avaliações

- Risk and Return NotesDocumento49 páginasRisk and Return NotesAlex TomAinda não há avaliações

- FIN437 Answers To The Recommended Questions Portfolio ManagementDocumento6 páginasFIN437 Answers To The Recommended Questions Portfolio ManagementSenalNaldoAinda não há avaliações

- Money, Banking & Finance: Risk, Return and Portfolio TheoryDocumento39 páginasMoney, Banking & Finance: Risk, Return and Portfolio TheorysarahjohnsonAinda não há avaliações

- Final Assignment: 42106 Financial Risk ManagementDocumento35 páginasFinal Assignment: 42106 Financial Risk ManagementJonatan BordingAinda não há avaliações

- Rational Portfolio DeterminationDocumento9 páginasRational Portfolio DeterminationAlexis RoyerAinda não há avaliações

- Discussion 2Documento4 páginasDiscussion 2Anh Lê Thị LanAinda não há avaliações

- Nike Shareholders Letter 2014Documento6 páginasNike Shareholders Letter 2014David LeeAinda não há avaliações

- PMI-Q2 Earning Press Release FINAL PDFDocumento33 páginasPMI-Q2 Earning Press Release FINAL PDFDavid LeeAinda não há avaliações

- A Year Abroad: D.LeeDocumento49 páginasA Year Abroad: D.LeeDavid LeeAinda não há avaliações

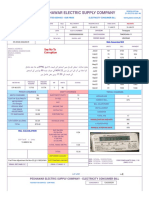

- PESCO ONLINE BILL Jan2023Documento2 páginasPESCO ONLINE BILL Jan2023amjadali482Ainda não há avaliações

- Chapter 2 The New Products ProcessDocumento7 páginasChapter 2 The New Products ProcessmanoAinda não há avaliações

- Leverage Capital Structure and Dividend Policy Practices in Indian CorporateDocumento12 páginasLeverage Capital Structure and Dividend Policy Practices in Indian CorporateDevikaAinda não há avaliações

- Land Use Patterns in CitiesDocumento46 páginasLand Use Patterns in Citiesarnav saikiaAinda não há avaliações

- Logistic Industry Employee PersonalityDocumento10 páginasLogistic Industry Employee Personalityjoel herdianAinda não há avaliações

- Strategic Fit Should Come from Highest LevelsDocumento8 páginasStrategic Fit Should Come from Highest LevelsNhi Nguyễn Thị NgânAinda não há avaliações

- CiDocumento8 páginasCisukrit dobhalAinda não há avaliações

- Invitation To Attend COSH Seminar WorkshopDocumento1 páginaInvitation To Attend COSH Seminar WorkshopOliver Sumbrana100% (1)

- Chapter 1 Differing Perspectives On Quality - Revision1Documento20 páginasChapter 1 Differing Perspectives On Quality - Revision1Moon2803Ainda não há avaliações

- Real Estate Sector Report BangladeshDocumento41 páginasReal Estate Sector Report Bangladeshmars2580Ainda não há avaliações

- The Funding Cost of Chinese Local Government DebtDocumento48 páginasThe Funding Cost of Chinese Local Government Debt袁浩森Ainda não há avaliações

- PitchBook GuideDocumento28 páginasPitchBook GuidePei ZiyanAinda não há avaliações

- Saudi Arabia Report 2018 PDFDocumento9 páginasSaudi Arabia Report 2018 PDFSandy SiregarAinda não há avaliações

- International Public Sector Accounting StandardsDocumento4 páginasInternational Public Sector Accounting Standardsdiana perez100% (1)

- RAA Internal Audit ProfileDocumento3 páginasRAA Internal Audit ProfileArisha NarangAinda não há avaliações

- Business EnterpriseDocumento4 páginasBusiness EnterpriseJhon JhonAinda não há avaliações

- Tiểu luận đã chỉnhDocumento28 páginasTiểu luận đã chỉnhĐức HoàngAinda não há avaliações

- Math 3 - EconomyDocumento3 páginasMath 3 - EconomyJeana Rick GallanoAinda não há avaliações

- Business Advantage Advanced Unit2 Standardisation and DifferentiationDocumento5 páginasBusiness Advantage Advanced Unit2 Standardisation and DifferentiationIgnacio LombardiAinda não há avaliações

- Roborobo Co., LTDDocumento26 páginasRoborobo Co., LTDUnitronik RoboticaAinda não há avaliações

- CIE IGCSE Unit 3.2 - Households - Spending, Borrowing and Saving - Miss PatelDocumento32 páginasCIE IGCSE Unit 3.2 - Households - Spending, Borrowing and Saving - Miss PatelJingyao HanAinda não há avaliações

- May 2006 Examinations: Strategy LevelDocumento32 páginasMay 2006 Examinations: Strategy Levelmagnetbox8Ainda não há avaliações

- Efficient solid waste management in TelanganaDocumento5 páginasEfficient solid waste management in TelanganaManvika UdiAinda não há avaliações

- Agricultural FinanceDocumento22 páginasAgricultural Financeamit100% (3)

- Cost Accounting4&Cost ManagementDocumento10 páginasCost Accounting4&Cost ManagementJericFuentesAinda não há avaliações

- Securities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Documento91 páginasSecurities and Exchange Board of India Final Order: WTM/AB/IVD/ID4/14459/2021-22Pratim MajumderAinda não há avaliações

- Annual Report of Honda AtlasDocumento1 páginaAnnual Report of Honda AtlaskEBAYAinda não há avaliações

- Vendor Selection and Development GuideDocumento20 páginasVendor Selection and Development GuideAsher RamishAinda não há avaliações

- MANAGEMENT Spice JetDocumento21 páginasMANAGEMENT Spice JetAman Kumar ThakurAinda não há avaliações