Escolar Documentos

Profissional Documentos

Cultura Documentos

TRST - Icmd 2009 (B09) PDF

Enviado por

IshidaUryuuTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

TRST - Icmd 2009 (B09) PDF

Enviado por

IshidaUryuuDireitos autorais:

Formatos disponíveis

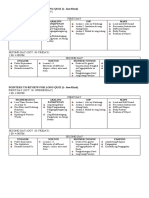

PTTriasSentosaTbk.

Business

PaperPackaging,Polypropylene

FilmandAdhesiveTapes

CompanyStatus

PMDN

Underwriter

PTInterPacificFinancialCorporation,PTPDFCI,PTJardineFlemingNusantaraFinance

Shareholder

2000

PTAdilaksaManunggal

PTKopancaLinggabuana

PTMuliaGahara

SigitHarjojudanto

NoekBrissinaSoehardjo

Public

2001

23.37%

10.99%

10.35%

8.64%

5.17%

41.48%

2005

PTAdilaksaManunggal

PTRejoSariBumi

PTKopancaLinggabuana

Public

PTAdilaksaManunggal

PTKopancaLinggabuana

PTRejoSariBumi

SigitHarjojudanto

NoekBrissinaSoehardjo

Public

2002

23.37%

10.99%

10.37%

8.64%

5.17%

41.46%

2006

17.98%

13.27%

10.99%

57.76%

PTAdilaksaManunggal

PTRejoSariBumi

PTKopancaLinggabuana

Public

PTAdilaksaManunggal

PTKopancaLinggabuana

PTRejoSariBumi

NoekBrissinaSoehardjo

PTGudangGaramTbk

Public

2003

23.37%

10.99%

8.64%

5.17%

1.28%

50.55%

2007

17.94%

13.27%

10.99%

57.80%

PTAdilaksaManunggal

PTRejoSariBumi

PTKopancaLinggabuana

Public

PTAdilaksaManunggal

PTKopancaLinggabuana

PTRejoSariBumi

NoekBrissinaSoehardjo

Public

2004

23.37%

11.00%

8.64%

5.17%

51.82%

2008

17.94%

13.27%

10.99%

57.80%

PTAdilaksaManunggal

PTRejoSariBumi

PTKopancaLinggabuana

Public

PTAdilaksaManunggal

PTRejoSariBumi

PTKopancaLinggabuana

Public

17.98%

13.27%

10.99%

57.76%

2009

17.94%

13.27%

10.99%

57.80%

PTKopancaLinggabuana

PTAdilaksaManunggal

PTRejoSariBumi

Public

28.28%

17.91%

13.27%

40.54%

Management & Number of Employees

Board of Commissioners

Board of Directors

Number of Employees

2000

President Commissioner

Commissioners

Basroni Rizal

Sigid Sumargo Wonowidjojo,

Soeroso Patmodihardjo, Dahryl Irxan

President Director

Directors

Kindarto Kohar

Ir. Albertus Setiawan Tjahjadi, MBA

Yamin Chandra

344

2001

President Commissioner

Commissioners

Basroni Rizal

Sigid Sumargo Wonowidjojo, Dahryl Irxan

President Director

Directors

Kindarto Kohar

Ir. Albertus Setiawan Tjahjadi, MBA, Jamin Chandra

907

2002

President Commissioner

Commissioners

Basroni Rizal

Sigid Sumargo Wonowidjojo, Dahryl Irxan

President Director

Directors

Kindarto Kohar

Ir. Albertus Setiawan Tjahjadi, MBA, Jamin Chandra

779

2003

President Commissioner

Commissioners

Basroni Rizal

Sigid Sumargo Wonowidjojo, Dahryl Irxan

President Director

Directors

Kindarto Kohar

Ir. Albertus Setiawan Tjahjadi, MBA, Jamin Chandra

776

2004

President Commissioner

Commissioners

Basroni Rizal

Dahryl Irxan, Sugiono Wiyono Sugialam,

Johanes Susilo

President Director

Directors

Kindarto Kohar

Yamin Tjandra

Budi Purbowo

YM Budiono

849

2005

President Commissioner

Commissioners

Basroni Rizal

Dahryl Irxan, Sugiono Wiyono Sugialam,

Johanes Susilo

President Director

Directors

Kindarto Kohar

Jamin Tjandra, Budi Purbowo, Jacobus Budiono

911

2006

President Commissioner

Commissioners

Basroni Rizal

Dahryl Irxan

Sugiono Wiyono Sugialam

Johanes Susilo

President Director

Directors

Kindarto Kohar

Jamin Tjandra

Budi Purbowo

YM Budiono

930

2007

President Commissioner

Commissioners

Basroni Rizal

Dahryl Irxan, Sugiono Wiyono Sugialam

Johanes Susilo

President Director

Directors

Kindarto Kohar

Jamin Tjandra, Budi Purbowo, YM Budiono

971

2008

President Commissioner

Commissioners

Basroni Rizal

Dahryl Irxan, Sugiono Wiyono Sugialam,

Johanes Susilo

President Director

Directors

Kindarto Kohar

Jamin Tjandra, Budi Purbowo, YM Budiono

867

2009

President Commissioner

Commissioners

Kindarto Kohar

Dahryl Irxan

Johanes Susilo

President Director

Directors

Sugeng Kurniawan

Jamin Tjandra

Budi Purbowo

Jacobus Budiono Djohari

868

1998

1999

2000

Total Assets

Current Assets

of which

Cash on hand and in banks

Cash and cash equivalents

Time deposits

Trade receivables

Inventories

Pre Paid

Receivable from affiliates

Non-current Assets

of which

Fixed Asset Net

Deffered Tax Assets

Investments

Other Assets

1,518,591

412,127

1,463,000

415,922

1,621,196

482,730

209,952

213,212

183,567

32,785

14,513

Liabilities

Current Liabilities

of which

Bank loans

Short-term debt

Bank borrowings

Trade payables

Taxes payable

Accrued expenses

Payable to affiliates

Current maturities of

long-term debt

Long-term Liabilities

of which

Bank borrowings

Government of Indonesia

Non-Current Liabilities

Minority Interests in Subsidiaries

1,383,972

1,383,046

Shareholders' Equity

Paid-up capital

Paid-up capital

in excess of par value

Revaluation of fixed assets

Retained earnings (accumulated loss)

(million rupiah)

2001

2,002

2,003

2004

2005

1,534,877

553,931

1,522,356

517,419

1,695,870

548,433

1,911,757

538,673

2,104,464

683,574

206,812

117,586

155,938

20,823

28,948

44,948

144,257

1,073,680

75,256

120,346

180,757

153,250

170,048

187,905

224,606

281,196

315,008

328,990

1,004,937

1,147,436

1,373,084

1,420,890

976,772

951,091

1,051,287

1,313,341

1,413,514

138,200

4,173

7,599

1,674

1,547

1,989

1,182,720

1,137,943

1,519,531

1,517,915

1,135,649

1,007,115

856,738

643,325

741,175

538,398

1,032,565

126,918

168,526

1,000,266

174,653

166,638

n.a

2,425

956,177

424,447

n.a

2,762

1,146,494

569,368

534,418

707,961

393,833

193,647

141,643

122,155

200,312

645,681

29,737

35,049

45,486

83,769

85,426

92,945

207,158

207,754

926

44,778

1,617

128,534

213,412

202,777

531,730

577,126

665,619

216,000

954,695

280,800

955,580

280,800

957,970

280,800

134,620

144,000

399,228

216,000

25,600

25,600

25,600

79,882

79,882

79,882

135,880

(139,935)

157,628

424,019

594,013

594,899

597,288

Net Sales

Cost of Good Sold

Gross Profit

Operating Expenses

Operating Profit

Other Income (Expenses)

Profit (Loss) before Taxes

Profit (Loss) after Taxes

427,347

304,203

123,144

22,942

100,202

(189,732)

(89,530)

(62,047)

417,488

351,714

65,774

24,822

40,952

151,972

192,924

145,660

567,194

377,277

189,917

34,256

155,661

(399,612)

(243,951)

(161,465)

764,069

544,428

219,641

46,108

173,533

(162,735)

10,798

297,563

781,636

570,744

210,893

52,301

158,592

90,635

249,227

220,159

793,395

618,248

175,147

57,601

117,546

15,748

133,293

169,994

903,095

762,682

140,412

67,187

73,226

(33,395)

39,831

28,966

1,080,680

915,340

165,341

85,775

79,566

(55,448)

24,118

16,429

Per Share Data (Rp)

Earnings (Loss) per Share

Equity per Share

Dividend per Share

Closing Price

(215)

467

150

506

973

60

850

(75)

47

85

138

185

75

102

308

n.a

170

(1)

0

-

1.68

0.87

11.77

7.01

(1.14)

1.81

-

0.54

0.41

-

0.30

10.28

0.91

0.29

0.23

n.a.

2.11

0.28

(4.09)

(46.09)

0.37

4.22

0.81

0.16

0.10

0.35

2.92

0.29

9.96

51.97

0.32

14.95

0.94

0.33

0.27

n.a.

2.24

0.35

(9.96)

(158.82)

1999

(3.66)

108.20

(2.31)

(335)

2000

10.81

(63.73)

35.86

(211)

Current Ratio (x)

Debt to Equity (x)

Leverage Ratio (x)

Gross Profit Margin (x)

Operating Profit Margin (x)

Net Profit Margin (x)

Inventory Turnover (x)

Total Assets Turnover (x)

ROI (%)

ROE (%)

1

2

3

4

Growth (%)

Indicators

Total Asset

Share Holder's Equity

Net Sales/Revenue

Net Provit

1998

400

101,665

216,000

(9,780)

Financial Ratios

PER (x)

PBV (x)

Dividend Payout (%)

Dividend Yield (%)

400

280,280

144,000

61

340

10

280

10

340

5

205

6

341

3

150

1.67

0.55

n.a

n.a

4.63

0.82

16.52

2.94

19.87

0.60

48.47

1.47

25.64

0.44

51.27

0.88

0.55

2.84

0.74

0.29

0.23

n.a.

3.27

0.50

19.39

74.53

0.80

1.29

0.56

0.27

0.20

0.28

3.72

0.51

14.46

33.08

1.02

0.78

0.44

0.22

0.15

0.21

3.29

0.47

10.02

17.81

1.27

1.00

0.50

0.16

0.08

0.03

2.71

0.47

1.52

3.03

1.20

1.20

0.54

0.15

0.07

0.02

2.78

0.51

0.78

1.72

2001

(5.32)

292.69

34.71

(284)

2,002

(0.82)

66.73

2.30

(26)

2,003

11.40

43.43

1.50

(23)

2004

12.73

0.09

13.83

(83)

2005

10.08

0.25

19.66

(43)

SUMMARY OF FINANCIAL STATEMENT

PT. Trias Sentosa Tbk. (TRST)

2006

(millionrupiah)

2007

2008

TotalAssets

CurrentAssets

ofwhich

Cashandcashequivalents

Tradereceivables

Inventories

NonCurrentAssets

ofwhich

FixedAssetsNet

Investments

OtherAssets

2,020,478

592,558

2,138,991

724,454

2,158,866

723,785

16,696

277,479

281,826

1,427,920

71,005

324,613

307,735

1,414,536

102,801

270,124

316,682

1,435,080

1,422,393

n.a

2,453

1,388,825

n.a

5,903

1,382,187

n.a

6,826

Liabilities

CurrentLiabilities

ofwhich

Shorttermdebt

Tradepayables

NonCurrentLiabilities

1,044,990

559,300

1,157,830

673,338

1,121,478

714,076

195,064

217,284

485,690

189,486

359,168

484,492

312,438

240,647

407,402

975,488

280,800

981,161

280,800

1,037,387

280,800

79,882

614,806

79,882

620,479

79,882

676,705

1,207,058

1,063,266

143,792

98,090

45,702

(18,269)

27,432

25,942

1,496,541

1,305,811

190,730

109,562

81,168

(57,989)

23,179

17,747

1,810,920

1,542,041

268,879

124,179

144,700

(119,694)

25,006

58,025

Shareholders'Equity

Paidupcapital

Paidupcapital

inexcessofparvalue

Retainedearnings(accumulatedloss)

NetSales

CostofGoodsSold

GrossProfit

OperatingExpenses

OperatingProfit

OtherIncome(Expenses)

Profit(Loss)beforeTaxes

Profit(Loss)afterTaxes

PerShareData(Rp)

Earnings(Loss)perShare

EquityperShare

DividendperShare

ClosingPrice

FinancialRatios

PER(x)

PBV(x)

DividendPayout(%)

DividendYield(%)

CurrentRatio(x)

DebttoEquity(x)

LeverageRatio(x)

GrossProfitMargin(x)

OperatingProfitMargin(x)

NetProfitMargin(x)

InventoryTurnover(x)

TotalAssetsTurnover(x)

ROI(%)

ROE(%)

PER=5.46x;PBV=0.46x(June2009)

FinancialYear:December31

PublicAccountant:Purwantono,Sarwoko&Sandjaja

9

347

5

145

6

349

5

174

21

369

n.a

165

15.69

0.42

54.12

1.44

27.53

0.50

79.11

1.43

7.98

0.45

n.a

n.a

1.06

1.07

0.52

0.12

0.04

0.02

3.77

0.60

1.28

2.66

1.08

1.18

0.54

0.13

0.05

0.01

4.24

0.70

0.83

1.81

1.01

1.08

0.52

0.15

0.08

0.03

4.87

0.84

2.69

5.59

Você também pode gostar

- Cement: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaCement: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- PT Ever Shine Tex TBK.: Summary of Financial StatementDocumento2 páginasPT Ever Shine Tex TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- Securities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaSecurities: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- Tobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaTobacco Manufactures: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- Stone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaStone, Clay, Glass and Concrete Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- Indr - Icmd 2009 (B04)Documento4 páginasIndr - Icmd 2009 (B04)IshidaUryuuAinda não há avaliações

- Bima PDFDocumento2 páginasBima PDFIshidaUryuuAinda não há avaliações

- PT Nusantara Inti Corpora TBKDocumento2 páginasPT Nusantara Inti Corpora TBKIshidaUryuuAinda não há avaliações

- Construction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaConstruction: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- PT Kabelindo Murni TBK.: Summary of Financial StatementDocumento2 páginasPT Kabelindo Murni TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaRanking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- PT Kalbe Farma TBK.: Summary of Financial StatementDocumento2 páginasPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- Automotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaAutomotive and Allied Products: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- Adhesive PDFDocumento1 páginaAdhesive PDFIshidaUryuuAinda não há avaliações

- AaliDocumento2 páginasAaliSeprinaldiAinda não há avaliações

- Cables: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)Documento1 páginaCables: Ranking by Total Asset (Million RP) Ranking by Net Profit/Loss (Million RP)IshidaUryuuAinda não há avaliações

- Animal FeedDocumento1 páginaAnimal FeedIshidaUryuuAinda não há avaliações

- PT Multi Bintang Indonesia TBK.: Summary of Financial StatementDocumento2 páginasPT Multi Bintang Indonesia TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- PT Unitex TBK.: Summary of Financial StatementDocumento2 páginasPT Unitex TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- Fasw PDFDocumento2 páginasFasw PDFIshidaUryuuAinda não há avaliações

- Imas PDFDocumento2 páginasImas PDFIshidaUryuuAinda não há avaliações

- PT Indorama Synthetics TBK.: Summary of Financial StatementDocumento2 páginasPT Indorama Synthetics TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- ErtxDocumento2 páginasErtxIshidaUryuuAinda não há avaliações

- PT Betonjaya Manunggal TBK.: Summary of Financial StatementDocumento2 páginasPT Betonjaya Manunggal TBK.: Summary of Financial StatementIshidaUryuuAinda não há avaliações

- BramDocumento2 páginasBramIshidaUryuuAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Lenovo Legion Y920-17IKB LCFC-DS321 NM-B311 R 0.2 SchematicDocumento61 páginasLenovo Legion Y920-17IKB LCFC-DS321 NM-B311 R 0.2 SchematicYetawa GuaviareAinda não há avaliações

- BHMCT 5TH Semester Industrial TrainingDocumento30 páginasBHMCT 5TH Semester Industrial Trainingmahesh kumarAinda não há avaliações

- Handout Round Table On South Asian Ritua PDFDocumento13 páginasHandout Round Table On South Asian Ritua PDFVictor GanAinda não há avaliações

- Construction Safety ChetanDocumento13 páginasConstruction Safety ChetantuAinda não há avaliações

- A Comparative Study On Financial Performance of Private and PublicDocumento17 páginasA Comparative Study On Financial Performance of Private and PublicaskmeeAinda não há avaliações

- English 6: Making A On An InformedDocumento30 páginasEnglish 6: Making A On An InformedEDNALYN TANAinda não há avaliações

- India International SchoolDocumento15 páginasIndia International Schoolazimmuhammed673790Ainda não há avaliações

- Office of The Divisional Forest Officer, Durgapur DivisionDocumento30 páginasOffice of The Divisional Forest Officer, Durgapur Divisionrchowdhury_10Ainda não há avaliações

- Koalatext 4Documento8 páginasKoalatext 4YolandaOrduñaAinda não há avaliações

- Example Research Paper On Maya AngelouDocumento8 páginasExample Research Paper On Maya Angelougw2wr9ss100% (1)

- Capacity Planning FinalizeDocumento85 páginasCapacity Planning FinalizeHansel Ramirez BaruelaAinda não há avaliações

- United States v. Stephen Rosenberg, 4th Cir. (2011)Documento5 páginasUnited States v. Stephen Rosenberg, 4th Cir. (2011)Scribd Government DocsAinda não há avaliações

- Surat At-TaubahDocumento14 páginasSurat At-TaubahAbbasAinda não há avaliações

- Home / Publications / Questions and AnswersDocumento81 páginasHome / Publications / Questions and AnswersMahmoudAinda não há avaliações

- Pointers To Review For Long QuizDocumento1 páginaPointers To Review For Long QuizJoice Ann PolinarAinda não há avaliações

- Advent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaDocumento7 páginasAdvent of Dawn Raids in India - A Case of Aggressive Anti-Trust Regime - Anti-Trust - Competition Law - IndiaNitish GuptaAinda não há avaliações

- CNT A HandbookDocumento276 páginasCNT A Handbookv_singh28Ainda não há avaliações

- School Form 5 (SF 5) Report On Promotion and Level of Proficiency & AchievementDocumento2 páginasSchool Form 5 (SF 5) Report On Promotion and Level of Proficiency & AchievementNeølie Abello LatúrnasAinda não há avaliações

- Substantive Audit Testing - ExpenditureDocumento28 páginasSubstantive Audit Testing - ExpenditureAid BolanioAinda não há avaliações

- Kaatyaayanaaya VidmaheDocumento12 páginasKaatyaayanaaya VidmaheGobu Muniandy100% (1)

- O.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BDocumento3 páginasO.P. Jindal Global University Jindal Global Law School End-Term Examination - Semester BRavvoAinda não há avaliações

- Eugene and John Jilka v. Saline County, Kansas, Agricultural Stabilization and Conservation Committee, Its Review Committee, and United States of America, 330 F.2d 73, 10th Cir. (1964)Documento2 páginasEugene and John Jilka v. Saline County, Kansas, Agricultural Stabilization and Conservation Committee, Its Review Committee, and United States of America, 330 F.2d 73, 10th Cir. (1964)Scribd Government DocsAinda não há avaliações

- Sartre On FreedomDocumento32 páginasSartre On Freedomolmhrs libraryAinda não há avaliações

- True West - April 2016Documento149 páginasTrue West - April 2016Rodrigo Moya100% (4)

- Canovan - Populism For Political Theorists¿Documento13 páginasCanovan - Populism For Political Theorists¿sebatorres7Ainda não há avaliações

- Shailendra Education Society's Arts, Commerce & Science College Shailendra Nagar, Dahisar (E), Mumbai-68Documento3 páginasShailendra Education Society's Arts, Commerce & Science College Shailendra Nagar, Dahisar (E), Mumbai-68rupalAinda não há avaliações

- CHAPTER 6 (2) - Theory of Cost - Lecture in ClassDocumento44 páginasCHAPTER 6 (2) - Theory of Cost - Lecture in ClassMUHAMMAD ZAIM HAMZI MUHAMMAD ZINAinda não há avaliações

- Activities Jan-May 16Documento96 páginasActivities Jan-May 16Raman KapoorAinda não há avaliações

- T Proc Notices Notices 035 K Notice Doc 30556 921021241Documento14 páginasT Proc Notices Notices 035 K Notice Doc 30556 921021241Bwanika MarkAinda não há avaliações

- Steinmann 2016Documento22 páginasSteinmann 2016sofyanAinda não há avaliações